Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Thirstie announced today that it has raised $7 million in Series A funding, and that it’s partnering with Drinkworks to power the e-commerce experience for the cocktail-making machine created by Keurig and Anheuser-Busch.

Co-founder and CEO Devaraj Southworth suggested that this is emblematic of the company’s current direction — rather than building a consumer app for alcohol delivery (which is what Thirstie focused on initially), the company now works with alcohol brands like Dom Perignon, Clos19 and Maker’s Mark to create e-commerce and delivery experiences.

Southworth said this is appealing to brands because “there’s a whole new generation of digital-first, mobile-first consumers and there’s an opportunity to increase revenue.” More important, he said, is “the data opportunity — the data belongs to our brand partners, the data doesn’t belong to a marketplace.”

And while Thirstie is now focused on building an enterprise business, it’s still taking advantage of the network of alcohol retailers that the company created for its consumer app.

Southworth explained said that while Thirstie allows you to order a bottle directly from the Dom Perignon website, it’s actually routing orders “through the network,” so they’re fulfilled by licensed retailers. This means alcohol brands can build a direct relationship with consumers while remaining compliant with the three-tier alcohol distribution system.

And from the Thirstie perspective, this also means building a substantial business without having to invest millions of dollars into marketing a consumer app.

Currently, Thirstie said it supports on-demand delivery in more than 30 cities, and can also ship to any location where shipping alcohol is legal.

Looking ahead, Southworth plans to continue developing Thirstie’s data technology — not just creating dashboards where brands can view their own customer data, but also doing more to aggregate that data to give brands an anonymized, industry-wide view.

“Down the road, there are some very interesting products we can build that can — if the brands are interested — be shared,” he said. “It will be more of a shared marketplace, so all of the brands are going to benefit.”

Thirstie has now raised a total of $12 million, with the new funding coming from Queens Court Capital.

“While some companies have taken capital from industry players to rapidly accelerate the growth of their business, Thirstie realized this could create bias if done too early,” said former Citibank CEO Joe Plumeri (who invested through Queens Court) in a statement. “We admire that Thirstie decided it was more important to scale at a pace that is manageable and allows them to remain independent, and we’re excited to help them achieve their goals.”

Powered by WPeMatico

Electric-vehicle chargers, heads-up displays for soldiers and the Costco of weed were some of our favorites from prestigious startup accelerator Y Combinator’s Winter 2019 Demo Day 1. If you want to take the pulse of Silicon Valley, YC is the place to be. But with more than 200 startups presenting across two stages and two days, it’s tough to keep track.

You can check out our write-ups of all 85 startups that launched on Demo Day 1, and come back later for our full index and picks from Day 2. But now, based on feedback from top investors and TechCrunch’s team, here’s our selection of the top 10 companies from the first half of this Y Combinator batch, and why we picked each.

Looking around corners is one of the most dangerous parts of war for infantry. Ravn builds heads-up displays that let soldiers and law enforcement see around corners thanks to cameras on their gun, drones or elsewhere. The ability to see the enemy while still being behind cover saves lives, and Ravn already has $490,000 in Navy and Air Force contracts. With a CEO who was a Navy Seal who went on to study computer science, plus experts in augmented reality and selling hardware to the Department of Defense, Ravn could deliver the inevitable future of soldier heads-up displays.

Why we picked Ravn: The AR battlefield is inevitable, but right now Microsoft’s HoloLens team is focused on providing mid-fight information, like how many bullets a soldier has in their clip and where their squad mates are. Ravn’s tech was built by a guy who watched the tragic consequences of getting into those shootouts. He wants to help soldiers avoid or win these battles before they get dangerous, and his team includes an expert in selling hardened tech to the U.S. government.

It’s difficult to know if a business’ partners have paid their taxes, filed for bankruptcy or are involved in lawsuits. That leads businesses to write off $120 billion a year in uncollectable bad debt. Middesk does due diligence to sort out good businesses from the bad to provide assurance for B2B deals, loans, investments, acquisitions and more. By giving clients the confidence that they’ll be paid, Middesk could insert itself into a wide array of transactions.

Why we picked Middesk: It’s building the trust layer for the business world that could weave its way into practically every deal. More data means making fewer stupid decisions, and Middesk could put an end to putting faith in questionable partners.

Convictional helps direct-to-consumer companies approach larger retailers more simply. It takes a lot of time for a supplier to build a relationship with a retailer and start selling their products. Convictional wants to speed things up by building a B2B self-service commerce platform that allows retailers to easily approach brands and make orders.

Why we picked Convictional: There’s been an explosion of D2C businesses selling everything from suitcases to shaving kits. But to drive exposure and scale, they need retail partners who’re eager not to be cut out of this growing commerce segment. Playing middleman could put Convictional in a lucrative position, while also making it a nexus of valuable shopping data.

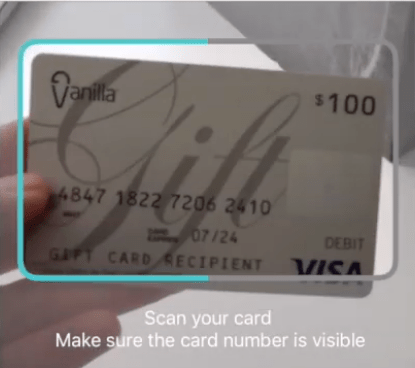

Dyneti has invented a credit card scanner SDK that uses a smartphone’s camera to help prevent fraud by more than 50 percent and improve conversion for businesses by 5 percent. The business was started by a pair of former Uber employees, including CEO Julia Zheng, who launched the fraud analytics teams for Account Security and UberEATS. Dyneti’s service is powered by deep learning and works on any card format. In the two months since it launched, the company has signed contracts with Rappi, Gametime and others.

Why we picked Dyneti: Cybersecurity threats are growing and evolving, yet underequipped businesses are eager to do more business online. Dyneti is one of those fundamental B2B businesses that feels like Stripe — capable of bringing simplicity and trust to a complex problem so companies can focus on their product.

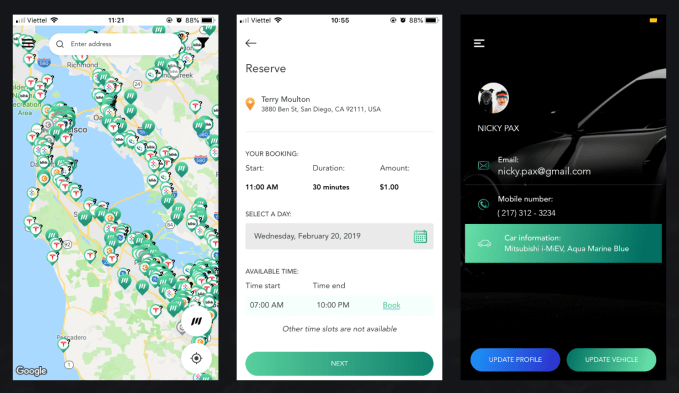

The “Airbnb for electric-vehicle chargers,” ampUp is preparing for a world in which the majority of us drive EVs — it operates a mobile app that connects a network of thousands of EV chargers and drivers. Using the app, an electric-vehicle owner can quickly identify an available and compatible charger, and EV charger owners can earn cash sharing their charger at their own price and their own schedule. The service is currently live in the Bay Area.

Why we picked ampUp: Electric vehicles are inevitable, but reliable charging is one of the leading fears dissuading people from buying. Rather than build out some massive owned network of chargers that will never match the distributed gas station network, ampUp could put an EV charger anywhere there’s someone looking to make a few bucks.

Flockjay operates an online sales academy that teaches job seekers from underrepresented backgrounds the skills and training they need to pursue a career in tech sales. The 12-week bootcamp offers trainees coaching and mentorship. The company has launched its debut cohort with 17 students, 100 percent of whom are already in job interviews and 40 percent of whom have already secured new careers in the tech industry.

Why we picked Flockjay: Unlike coding bootcamps that can require intense prerequisites, killer salespeople can be molded from anyone with hustle. Those from underrepresented backgrounds already know how to expertly sell themselves to attain opportunities others take for granted. Flockjay could provide economic mobility at a crucial juncture when job security is shaky.

Twenty million international contractors work with U.S. companies, but it’s difficult to onboard and train them. Deel handles the contracts, payments and taxes in one interface to eliminate paperwork and wasted time. Deel charges businesses $10 per contractor per month and a 1 percent fee on payouts, which earns it an average of $560 per contractor per year.

Why we picked Deel: The destigmatization of remote work is opening new recruiting opportunities abroad for U.S. businesses. But unless teams can properly integrate these distant staffers, the cost savings of hiring overseas are negated. As the globalization megatrend continues, businesses will need better HR tools.

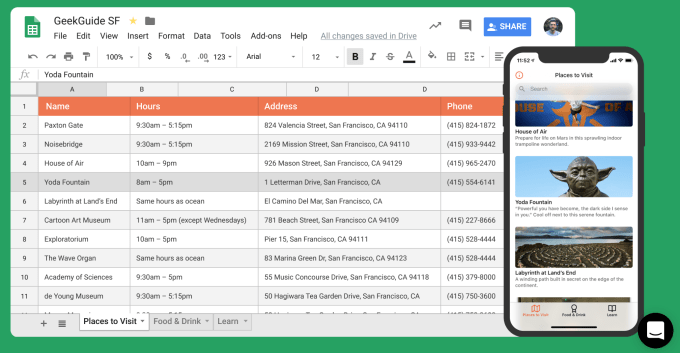

There has been a pretty major trend toward services that make it easier to build web pages or mobile apps. Glide lets customers easily create well-designed mobile apps from Google Sheets pages. This not only makes it easy to build the pages, but simplifies the skills needed to keep information updated on the site.

Why we picked Glide: While desktop website makers is a brutally competitive market, it’s still not easy to make a mobile site if you’re not a coder. Rather than starting from a visual layout tool with which many people would still be unfamiliar, Glide starts with a spreadsheet that almost everyone has used. And as the web begins to feel less personal with all the brands and influencers, Glide could help people make bespoke apps that put intimacy and personality first.

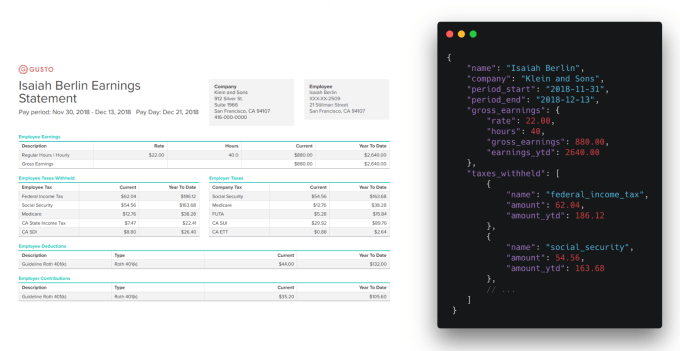

The platform, co-founded by former Uber product manager Minh Tri Pham, turns documents into structured data a computer can understand to accurately automate document processing workflows and take away the need for human data entry. Docucharm’s API can understand various forms of documents (like paystubs, for example) and will extract the necessary information without error. Its customers include tax prep company Tributi and lending business Aspire.

Why we picked Docucharm: Paying high-priced, high-skilled workers to do data entry is a huge waste. And optical character recognition like Docucharm’s will unlock new types of businesses based on data extraction. This startup could be the AI layer underneath it all.

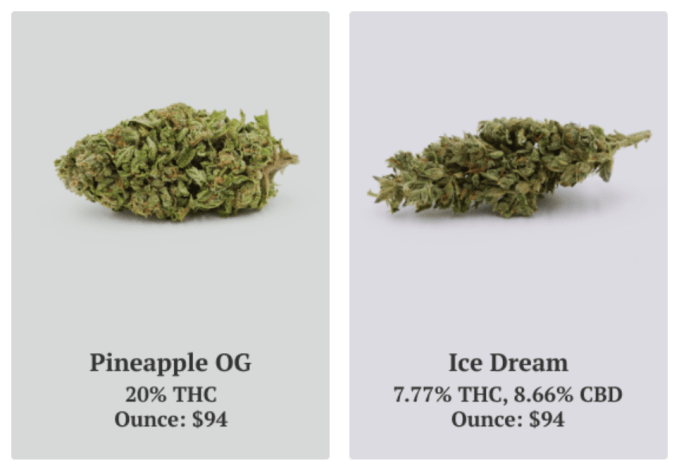

Flower Co provides memberships for cheaper weed sales and delivery. Most dispensaries cater to high-end customers and newbies that want expensive products and tons of hand-holding. In contrast, Flower Co caters to long-time marijuana enthusiasts who want huge quantities at low prices. They’re currently selling $200.000 in marijuana per month to 700 members. They charge $100 a year for membership, and take 10 percent on product sales.

Why we picked Flower Co: Marijuana is the next gold rush, a once-in-a-generation land-grab opportunity. Yet most marijuana merchants have focused on hyper-discerning high-end customers despite the long-standing popularity of smoking big blunts of cheap weed with a bunch of friends. For those who want to make cannabis consumption a lifestyle, and there will be plenty, Flower Co could become their wholesaler.

Atomic Alchemy – Filling the shortage of nuclear medicine

Yourchoice – Omni-gender non-hormonal birth control

Prometheus – Turning CO2 into gas

Lumos – Medical search engine for doctors

Heart Aerospace – Regional electric planes

Boundary Layer Technologies – Super-fast container ships

Additional reporting by Kate Clark, Greg Kumparak and Lucas Matney

Powered by WPeMatico

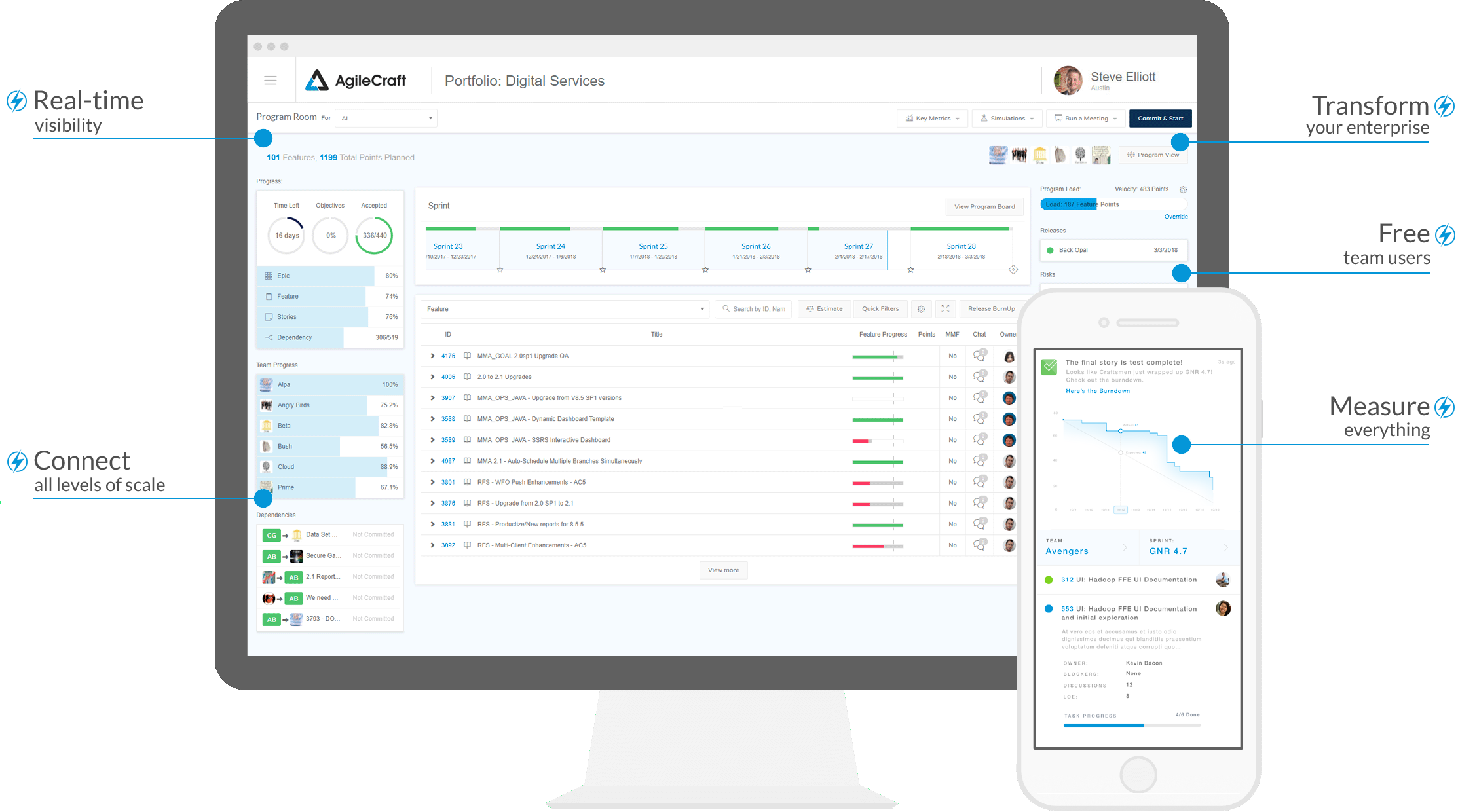

Atlassian today announced that it has acquired AgileCraft, a service that aims to help enterprises plan their strategic projects and workstreams. The service provides business leaders with additional insights into the current status of technical projects and gives them insights into the bottlenecks, risks and dependencies of these projects. Indeed, the focus of AgileCraft is less on technical teams than on the business teams that support them and help them manage the digital transformation of their businesses.

The price total of the acquisition is about $166 million, with $154 million in cash and the remainder in restricted shares.

“Many leaders are still making mission-critical decisions using their instincts and best guesses instead of data,” said Scott Farquhar, Atlassian’s co-founder and co-CEO, in today’s announcement. “As Atlassian tools spread through organizations, technology leaders need better visibility into work performed by their teams. With AgileCraft joining Atlassian, we believe we’re the best company to help executives align the work across their organization – providing an all-encompassing view that connects strategy, work, and outcomes.”

As the name implies, AgileCraft focuses on the Agile methodology, though it also offers a bit of flexibility there with support for frameworks like SAFe, LeSS and Spotify. It supports pulling in data from tools like Atlassian’s Jira, but also Microsoft’s Team Foundation Server, IBM’s RTC and other services.

Atlassian will continue to operate AgileCraft, which had raised about $10.1 million before the acquisition as a standalone service. “We will continue to focus relentlessly on our customers’ success,” writes AgileCraft’s founder and CEO Steve Elliott. “We remain dedicated to pioneering enterprise agility and are thrilled to team up with the outstanding people at Atlassian to help our customers thrive.”

Over the years, Atlassian started embracing users and use cases for its tools that go beyond its core tools for developers. Jira and Confluence are the prime examples for this. Today’s acquisition continues this trend in that AgileCraft aims to bring to the rest of the company many of the methodologies that tech teams use.

“One of the critical roles we play for lots of organizations is in helping drive this kind of digital transformation where we’re really empowering the teams that are building and developing the kind of technology that moves our customers forward,” Atlassian president Jay Simons told me. “AgileCraft basically complements all of that by extending visibility into what teams are using Atlassian products to do up into key stakeholders and leaders in the business that are trying to manage better visibility at a portfolio or program level.”

Simons also stressed that AgileCraft already has very strong integrations into the existing Atlassian tools — and indeed, that was one of the main drivers of the acquisition. He noted that the company plans to improve those and think about additional patterns. “We’ll continue doing what we’re doing,” he said.

Simons also noted that he expects that a lot of Jira customers will now look at AgileCraft as an additional tool in helping the businesses manage their business’s digital transformation.

Atlassian doesn’t typically make a lot of acquisitions. Its pace is close to about one major buy per year. Last year, the company picked up OpsGenie for $295 million. In 2017, it acquired Trello for $425 million, the company’s biggest acquisition to date. Other major products the company has acquired include StatusPage, BlueJimp, HipChat and Bitbucket (all the way back in 2010).

Powered by WPeMatico

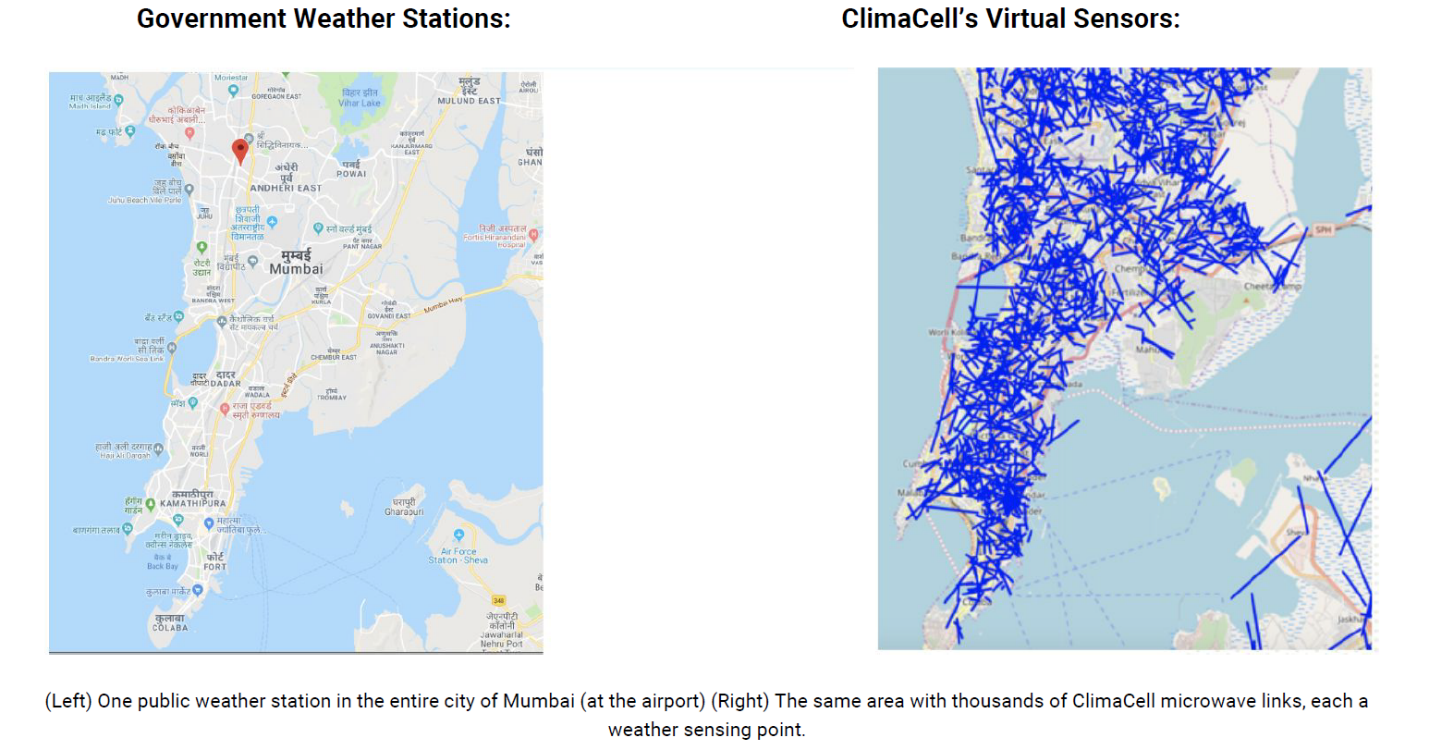

To accurately forecast the weather, you first need lots of data — not just to train your forecasting models but also to generate more precise and granular forecasts. Typically, this has been the domain of government agencies, thanks to their access to this data and the compute power to run the extremely complex models. Anybody can now buy compute power in the cloud, though, and as the Boston and Tel Aviv-based startup ClimaCell is setting out to prove, there are now also plenty of other ways to get climate data thanks to a variety of relatively non-traditional sensors that can help generate more precise local weather predictions.

Now you may say that others, like Dark Sky, for example, are already doing that with their hyperlocal forecasts. But ClimaCell’s approach is very different, and with that has attracted as clients airlines like Delta, JetBlue and United, sports teams like the New England Patriots and agtech companies like Netafim.

“The biggest problem is that to predict the weather, you need to have observations and you need to have models,” ClimaCell CEO Shimon Elkabetz told me. “The entire industry is basically repackaging the data and models of the government [agencies]. And the governments don’t create the relevant infrastructure everywhere in the world. Even in the U.S., there’s room for improvement.”

And that’s where ClimaCell’s main innovation comes in. Instead of relying on government sensors, it’s using the Internet of Things to gather more weather data from far more places than would otherwise be possible. This kind of sensing technology could turn millions of existing connected devices — like cell phones, connected vehicles, street cameras, airplanes and drones — into virtual weather stations. It’s easy enough to see how this would work. If a driver turns on a windshield wiper or fog lights, you know it’s probably raining or foggy. Often, these cars also relay temperature data. If a street camera sees rain, it’s raining.

What’s more complex is that ClimaCell has also developed the technology to gather data from how atmospheric conditions impact the signal propagation between cell phones and their base stations. And to take this one step further — and beyond the ground level — it has also figured out how to gather similar data from satellite-to-ground microwave signals.

“The idea is that everything is sensitive to weather and we can turn everything into a weather sensor,” said Elkabetz. “That’s why we call it the weather of things. It enables us to put in place virtual sensors everywhere.”

Using all this data, ClimaCell is providing its customers, like airlines, ridesharing companies and energy companies, with real-time weather data and forecasts.

Using all of this data the company also recently launched flood alerts for about 500 cities that can provide 24 to 48-hour warnings ahead of major flood events. To do this, the company combined its weather data with its own hydrological model.

For now, most of ClimaCell’s business model focuses on selling its data and predictions to other businesses. The company plans to launch a consumer app in May, though. I got a sneak peek of the app; while I can’t vouch for the forecasts, it’s a very well-designed application that you’ll probably want to look at, no matter whether you’re a weather geek or just want to see if you can get a quick bike ride in before the rain starts.

Why a consumer app? “We want to become the biggest weather technology company in the world,” Elkabetz said. To get to this point, the company has raised a total of $68 million to date from investors that include Clearvision Ventures, JetBlue Technology Ventures, Ford Smart Mobility, Envision Ventures, Canaan Partners, Fontinalis Partners and Square Peg Capital.

Powered by WPeMatico

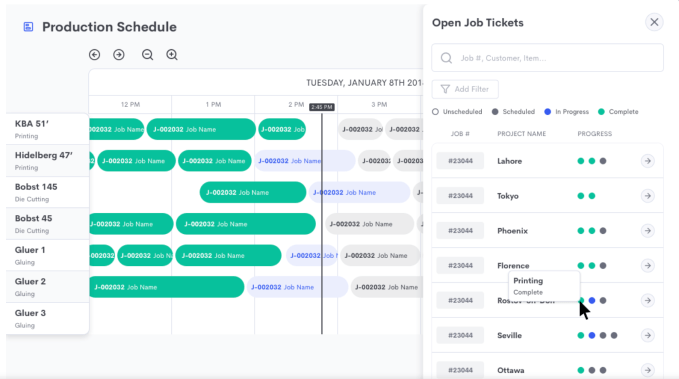

Factory software tools are often out of reach of small manufacturers, forcing them to operate with inefficient manual systems. WorkClout, a member of the Y Combinator Winter 2019 class, wants to change that by offering a more affordable SaaS alternative to traditional manufacturing software solutions.

Company co-founder and CEO Arjun Patel grew up helping out in his Dad’s factory and saw first-hand how difficult it is for small factory owners to automate. He says that traditional floor-management tools are expensive and challenging to implement.

“What motivated me is when my dad was trying to implement a similar system,” Patel said, noting that his father’s system had cost more than $240,000, took over a year to get going and wasn’t really doing what he wanted it to do. That’s when he decided to help.

He teamed up with Bryan Trang, who became the CPO, and Richard Girges, who became the CTO, to build the system that his dad (and others in a similar situation) needed. Specifically, the company developed a cloud software solution that helps manufacturers increase their operational efficiency. “Two things that we do really well is track every action on the factory floor and use that data to make suggestions on how to increase efficiency. We also determine how much work can be done in a given time period, taking finite resources into consideration,” Patel explained.

He said that one of the main problems that small-to-medium sized manufacturers face is a lack of visibility into their businesses. WorkClout looks at orders, activities, labor and resources to determine the best course of action to complete an order in the most cost-effective way.

“WorkClout gives our customers a better way to allocate resources and greater visibility of what’s actually happening on the factory floor. The more data that they have, the more accurate picture they have of what’s going on,” Patel said.

Production Schedule view. Screenshot: WorkClout

The company is still working on the pricing model, but today it charges administrative users like plant management, accounting and sales. Machine operators get access to the data for free. The current rate for paid users starts at $99 per user per month. There is an additional one-time charge for implementation and training.

As for the Y Combinator experience, Patel says that it has helped him focus on what’s important. “It really makes you hone in on building the product and getting customers, then making sure those two things are leading to customer happiness,” he said.

While the company does have to help customers get going today, the goal is to make the product more self-serve over time as they begin to understand the different verticals for which they are developing solutions. The startup launched in December and already has 13 customers, generating $100,000 in annual recurring revenue (ARR), according to Patel.

Powered by WPeMatico

We’ve decided to step back from the breaking news for a minute to conduct a review of seed and early-stage funding trends over the last decade for U.S.-based companies.

I’m fairly certain we can all agree that the environment for startups has changed dramatically in the past 10 years, specifically in two major ways:

What we’ve also seen are recent concerns raised about the decline in seed stage funding by Mark Suster, a partner at UpFront Ventures, as there has not been commensurate growth in early stage funding (Series A and B), to meet this growth in seed-financed companies. This is often expressed as the Series A crunch.

So with venture funding at an all-time high, along with increased growth in supergiant rounds, now seems like an appropriate time to conduct this kind of review.

First, let’s set the stage for our analysis and explain where our data comes from with a few quick facts:

Now, let’s take a look at the trends.

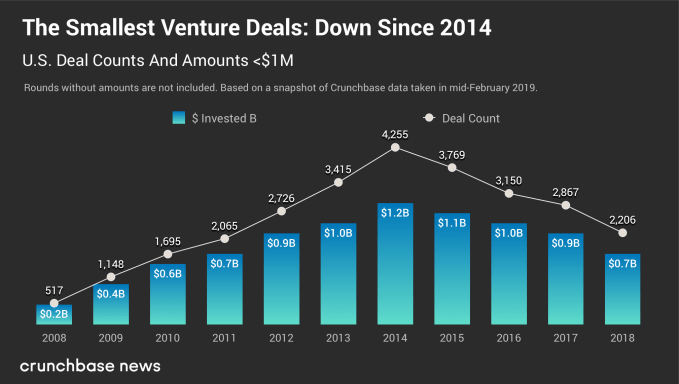

Since 2014 we have seen mostly double-digit declines in less than $1 million rounds each year – a strong pivot from 2008-2014 when we saw double-digit growth.

In 2018 seed funding counts and amounts below $1 million were down from 2015 at 41 and 35 percent respectively. Given that data at this stage can be added long after the round took place, we assess there could be a 20 percentage-point relative increase in 2018 compared to 2017.

If we factor this in, 2018 seed funding counts and amounts below $1 million are down from 2015 at 30 and 23 percent respectively. In other words, seed below $1 million are closer to 2012 and 2017 levels.

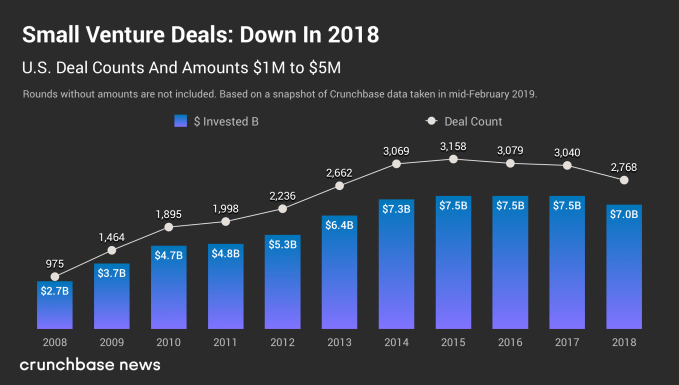

Round from $1 million to $5 million also experienced growth from 2008 through 2015, more than threefold for counts and close to threefold for amounts. Upward growth stalled from 2015. However, we do not see a substantial downward trend in the last three years. Dollars invested are stable at $7.5 billion from 2015 through 2017. Counts and amounts are down in 2018 from the 2015 height by 12 percent for deal count and 6 percent for amounts.

At Crunchbase we are always cautious about reporting downward trends for the most recent year or quarter, as data does flow in after the close of the most recent time period. If the trend is over a greater time period, that is a stronger signal for change in the market. Based on data continuing to be added after the end of a year for the previous year, we assess around 10 percentage point increase relative to 2017. This would make 2018 roughly equivalent to 2017 on rounds and slightly up on amounts.

Why is seed flattening? Seed investors report putting more dollars into fewer deals. Or as they raise more substantial subsequent funds, they are putting more dollars into the same number of transactions. Seed funds need to get enough equity for a meaningful stake, should a startup survive to raise subsequent rounds. Seed funds are investing in fewer startups for more equity.

UpFront Ventures’ Suster (referenced earlier) also talks about larger venture firms becoming less active in seed, as investing at the seed stage can limit their ability down the road to invest in competitive startups who emerge as growing contenders in a specific sector. The growth of more substantial funds in venture allows firms to see deals mature before investing, perhaps paying more to get the equity they want, and allowing startups not growing as quickly to fail or get acquired.

As Fred Wilson from Union Square Ventures notes, “In the first five years of this decade, we saw the seed portion of the market explode. In the last five years of this decade we saw the growth portion of the market explode. But over those last ten years, the middle part, the traditional venture capital market, has not changed much.”

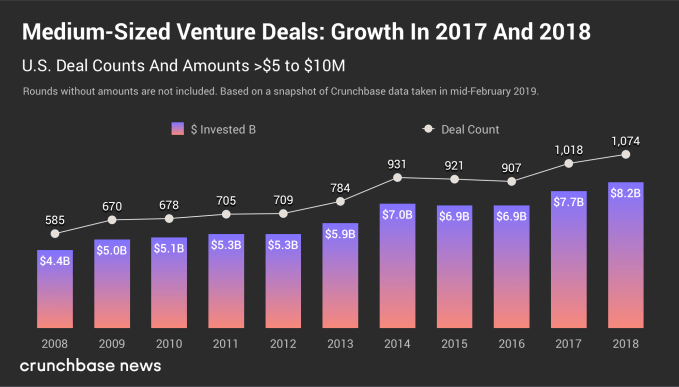

For the middle, Series A and B rounds (which used to be the first institutional money in), the market for $5 million to $10 million rounds has almost doubled, but it has taken from 2008 to 2018. In that same period, growth has been slower than round below $5 million. Growth has continued past 2015. Since 2015, rounds are down slightly for one year, and then continue to grow in 2017 and 2018. Counts are up from 2015 by 17 percent and dollars by 18 percent.

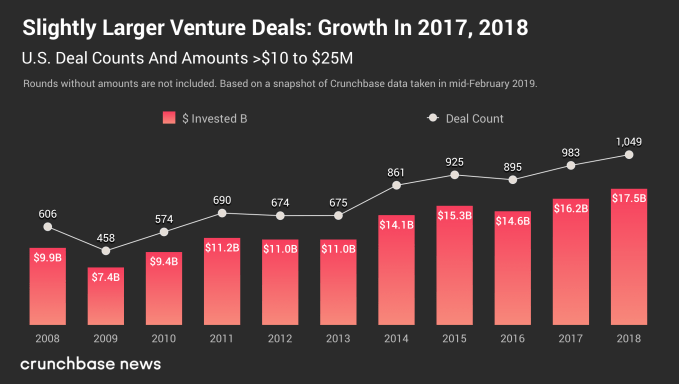

Rounds of $10 million to $25 million have grown over 11 years by 73 percentage points for counts, and 78 percentage points for amounts. This is a slower pace than $5 million to $10 million rounds, but continuing to edge up year over year.

Seed is its own class that is here to stay. Indeed pre-seed, seed and seed extension all seem to have specific dynamics. Of the 600-plus active seed funds who have raised a fund below $100 million, close to half have raised more than one fund. In the last three years in the U.S. we have not seen a slowing of seed funds raised for $100 million and below.

When we take into account the data lag, dollars for below $5 million is projected to be $8.5 billion, close to the height in 2015 of $8.6 billion. Deal counts are down from the height by a fifth, which does mean less seed-funded startups in the U.S. Provided that capital allocation is greater than $5 million continues to grow, less seed funded startups will die before raising a Series A. More companies have a chance to succeed, which is good for seed funds, and ultimately for the whole ecosystem.

Powered by WPeMatico

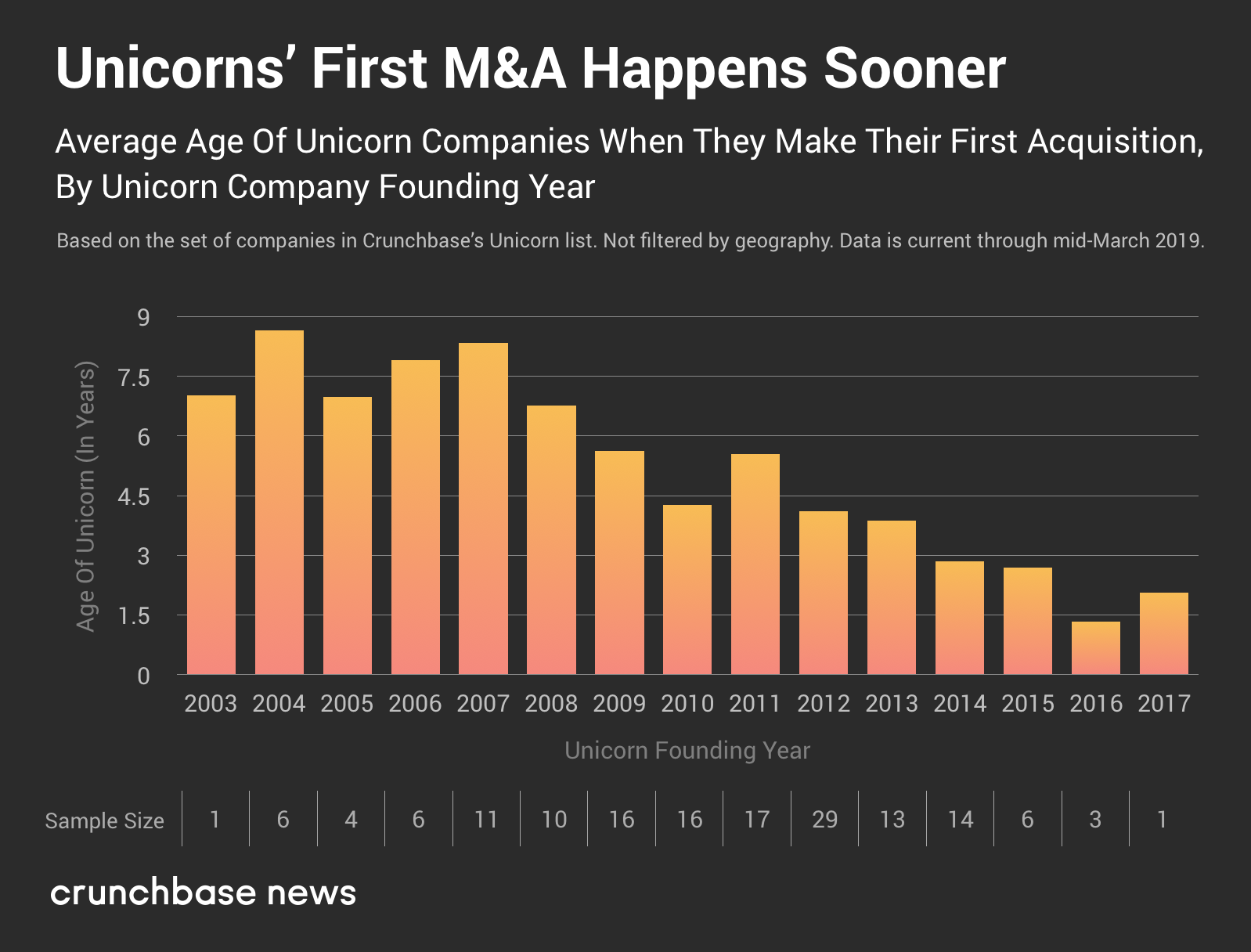

In the name of getting big quick, it seems like some of the most valuable private tech companies are turning to mergers and acquisitions (M&A) as a way to accelerate business growth. So-called “unicorns”—privately-held technology companies which achieve billion-dollar valuations sometime before (or as a direct result of) going public or exiting via M&A—are chomping at the bit to make their first acquisitions, suggesting a mounting pressure on companies to grow even quicker.

Analysis of Crunchbase data indicates that, on average, recently founded unicorn companies are more likely to make their first M&A transactions sooner after founding than their older counterparts. In other words, younger unicorns buy other companies earlier. Here’s the data.

Using M&A data for companies in Crunchbase’s unicorn list, we found out when unicorn companies made their first M&A transactions on average. (We detail a bit more of the methodology in a note at the end.) Companies founded in more recent years were quickest to hit the M&A trail.

Eleven unicorn companies founded in 2007 took an average of roughly 8.33 years before making their first acquisitions. At time of writing, 29 unicorns founded in 2012 have made their first startup purchases, averaging just 4.1 years before doing so.

Note that there’s a bit of a sampling bias here. To an extent, it’s expected that unicorn companies founded in more recent years will have a lower average age of first acquisition, because there are many unicorn companies which haven’t yet made their first M&A deals.

The bulk of all M&A transactions by unicorns (not just the first ones) occur within the first seven years after founding.

We should take recent years’ dramatic reduction in average time until first acquisition with a heftier grain of salt (again, there are plenty of unicorns which haven’t yet gone shopping for startups). Even with that caveat made, averages have steadily trended lower between 2007 and 2012, after remaining steady (across an admittedly small sample set) since the start of the unicorn era.

This suggests that younger unicorns are increasingly using M&A transactions as a way to accelerate their path to massive market power.

It’s a big move for a company to buy another one. There’s all the financial particulars to negotiate, the legal and regulatory hurdles to clear, and the inevitable friction of integrating teams and technology from one entity with another. And that’s when the process is amicable and goes smoothly. The amount of time and resources a company commits to carrying out an M&A strategy is nontrivial, so it’s understandable why a company would put this process off to a later date or eschew it entirely. That high-growth tech companies are pursuing such a time and energy-intense strategy earlier on in the venture life-cycle points to the benefits M&A can bring to startups seeking to scale speedily.

We found this by analyzing the set of acquisitions made by companies in Crunchbase’s list of unicorns, which we used as a proxy for “high-performing private technology companies” as a collective whole. We found the time elapsed between unicorns’ listed founding dates (which, note, have varying levels of precision) and the date of their first-ever acquisitions, regardless of whether the acquirer had achieved unicorn status. We then plotted the resulting data in a couple of ways.

More information about Crunchbase News’s methodology can be found on a dedicated page on this site.

Powered by WPeMatico

With Y Combinator’s Demo Day taking place at Pier 48 in San Francisco next week, its largest batch of companies ever is getting ready to present to an audience of select investors. Having taken Atrium through Demo Day myself, I have first-hand knowledge of the process. When the founders have finished their pitches, the time to talk numbers will closely follow. Chief among the many decisions founders will face during this time is whether to opt for the Pre-Money SAFE or the new Post-Money SAFE, the two standardized legal documents that YC has introduced in recent years.

Both versions are meant to make the process fast, easy and fair for both parties in the early-stage fundraising process. But there are crucial differences between the two that founders should examine carefully.

Essentially, the Pre-Money SAFE is exceptionally favorable to founders because it gets them pre-valuation funding like a convertible note, but debt-free. The Post-Money SAFE sweetens some of the terms for investors, like locking in their percentage ownership in a priced round later on.

Overall, we expect the Post-Money version to become more common, especially if the company is raising a round above $1 million or $2 million, and the investors have more leverage to ask for it in the negotiation.

(Note: This article is aimed at giving founders a general understanding of the changes from Pre-Money SAFEs to Post-Money SAFEs. The information provided is based on my professional experience and opinions, and should not be used without careful consideration and advice by qualified advisors and legal counsel. Also, to learn more and ask questions about Pre and Post-Money SAFEs, join me on April 16th for a webinar where I’ll dive in a bit deeper.)

Today there are two general ways of structuring a startup fundraising round. The first can be called a “priced equity round,” and is characterized by the sale of preferred stock with a fixed valuation.

Powered by WPeMatico

I spent the week at SXSW, Austin’s really, really huge technology, music, comedy and film festival. It’s my first year making the trek down here for the event, which I did to interview sextech entrepreneur Lora DiCarlo founder Lora Haddock, whose robotics innovation reward was infamously revoked at this year’s CES.

“I brush my teeth and I masturbate. It’s all normal,” she said, addressing the stigma surrounding female-focused pleasure tech. Haddock, during our chat, also announced the first-ever government grant for a sextech startup, a $99,637 funding for Lora DiCarlo from the state of Oregon. Lora DiCarlo plans to release its first product, the Osé, this fall.

Here’s what happened while I was wondering confused around Austin.

Uber dominated the news cycle this week; here’s the TL;DR. The ride-hailing company is probably, most likely going to unveil its S-1 next month and it’s tying up some loose ends ahead of its big IPO. Uber wants to raise roughly $1 billion at a valuation of between $5 billion and $10 billion for its autonomous vehicles unit — yes, the same one that was burning through $20 million per month. Waymo, similarly, is looking to raise outside capital for the first time for its AV efforts.

Top TPG dealmaker caught in college admissions scandal

Bill McGlashan, who built his career as a top investor at the private equity firm TPG, was fired (or maybe quit?) says the firm after he was caught up in what the Justice Department said is the largest college admissions scandal it has ever prosecuted. Even worse, McGlashan lead TPG’s social impact strategy under the Rise Fund brand, making the charges particularly damning.

HotelTonight and Slack stakeholder Accel raised $2.525 billion, sources confirm to TechCrunch; $525 million for its fourteenth early-stage fund, $1.5 billion for its fifth growth fund and $500 million for its second Leaders Fund, or a dedicated pool of capital meant to help the firm strengthen its positions on particularly competitive bets. Plus, 137 Ventures announced its fourth fund with $210 million in committed capital. The firm provides liquidity to founders and early employees of “sustainable, fast-growing, private companies.” In essence, 137 Ventures buys shares directly from employees at unicorn tech companies, like Palantir, Flexport and Airbnb.

Last week, we reported Y Combinator president Sam Altman would be stepping down to focus on OpenAI. TechCrunch’s Connie Loizos questions whether he had a positive or negative influence on the accelerator during his presidency. Altman was part of the first YC startup class in 2005 and began working part-time as a YC partner in 2011. He was ultimately made the head of the organization five years ago.

Brian O’Malley’s HotelTonight win

Forerunner Ventures general partner Brian O’Malley went long on HotelTonight and it paid off. For your weekend reading, we thought you might enjoy an oral history from O’Malley about how he stumbled upon HotelTonight and remained connected to the company across its nine-year history.

In an announcement that shocked VC Twitter, Tiger Global announced that Lee Fixel, whom Bill Gurley once said is one of the smartest investors on the scene, is leaving the firm at the end of June. Scott Shleifer and Chase Coleman will continue as co-managers of the portfolios Fixel has overseen, with Shleifer taking over as its head. “Lee has been a driving force behind the expansion of Tiger Global’s private equity investing activities in the United States and India, and he has distinguished himself as a world-class investor across multiple sectors and stages,” the firm stated. And on the hiring front, Canvas Ventures is expanding its team of three general partners to four with the hiring of Mike Ghaffary, a former general partner at Social Capital.

Subscribers to TechCrunch’s premium content can learn which types of startups are most often profitable.

YC demo days are coming up quick. The TechCrunch staff has been meeting with YC startups and documenting their journey through the startup accelerator. I spoke to YourChoice Therapeutics, a startup developing unisex, non-hormonal birth control, and Bottomless, which operates a direct-to-consumer coffee delivery service. TechCrunch’s Lucas Matney wrote about Jetpack Aviation, a YC startup, and its $380,000 flying motorcycle, and Adventurous, an augmented reality scavenger hunt crafted for families. TechCrunch’s Megan Rose Dickey spoke to Ysplit, which wants to make it so you never have to owe anyone money ever again.

This week on Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines, Crunchbase News’ editor-in-chief Alex Wilhelm and TechCrunch’s Connie Loizos discuss Uber’s IPO and Stash’s big round. Listen here.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

When startup founders review a VC term sheet, they are mostly only interested in the pre-money valuation and the board composition. They assume the rest of the language is “standard” and they don’t want to ruffle any feathers with their new VC partner by “nickel and diming the details.” But these details do matter.

VCs are savvy and experienced negotiators, and all of the language included in the term sheet is there because it is important to them. In the vast majority of cases, every benefit and protection a VC gets in a term sheet comes with some sort of loss or sacrifice on the part of the founders – either in transferring some control away from the founders to the VC, shifting risk from the VC to the founders, or providing economic benefits to the VC and away from the founders. And you probably have more leverage to get better terms than you may think. We are in an era of record levels of capital flowing into the venture industry and more and more firms targeting seed stage companies. This competition makes it harder for VCs to dictate terms the way they used to.

But like any negotiating partner, a VC will likely be evaluating how savvy you appear to be in approaching a proposed term sheet when deciding how hard they are going to push on terms. If the VC sees you as naïve or green, they can easily take advantage of that in negotiating beneficial terms for themselves. So what really matters when you are negotiating a term sheet? As a founder, you want to come out of the financing with as much overall control of the company and flexibility in shaping the future of the company as possible and as much of a share in the future economic prosperity of the company as possible. With these principles in mind, let’s take a look at four specific issues in a term sheet that are often overlooked by founders and company counsel:

Powered by WPeMatico