Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

McDonald’s is announcing an agreement to acquire personalization company Dynamic Yield.

The announcement does not include a price, but a source with knowledge of the deal said that it’s more than $300 million. This is the fast food chain’s largest acquisition in 20 years.

Dynamic Yield works with brands across e-commerce, travel, finance and media to create what’s been described as an Amazon-style personalized online experience.

McDonald’s said it will use this technology to create a drive-thru menu that can be tailored to things like the weather, current restaurant traffic and trending menu items. Once you’ve started ordering, the display can also recommend additional items based on what you’ve already chosen.

In fact, the company said it tested this in several U.S. locations in 2018. The plan is to start rolling this out across the United States in 2019, and then to move into international markets. McDonald’s also plans to integrate this technology into other digital products, like self-serve kiosks and the McDonald’s mobile app.

“Technology is a critical element of our Velocity Growth Plan, enhancing the experience for our customers by providing greater convenience on their terms,” said McDonald’s president and CEO Steve Easterbrook in a statement. “With this acquisition, we’re expanding both our ability to increase the role technology and data will play in our future and the speed with which we’ll be able to implement our vision of creating more personalised experiences for our customers.”

The plan that Easterbrook is referring to was first announced in March 2017, with a focus on technology like the McDonald’s mobile app and its Experience of the Future stores.

At the same time, McDonald’s said Dynamic Yield will continue to operate as a standalone company serving existing and future clients, and that it will continue to invest in the core personalization technology.

According to Crunchbase, Dynamic Yield has raised a total of $83.3 million from investors, including Innovation Endeavors, Bessemer Venture Partners and Marker Capital, as well as strategic backers like Naver (which owns the messaging apps Line and Snow), Baidu, The New York Times and Deutsche Telekom.

“We started Dynamic Yield seven years ago with the premise that customer-centric brands must make personalization a core activity,” said Dynamic Yield co-founder and CEO Lior Agmon in a statement. “We’re thrilled to be joining an iconic global brand such as McDonald’s and are excited to innovate in ways that have a real impact on people’s daily lives.”

Powered by WPeMatico

Before people ever use or buy your product, they’ll interact with your brand. What does your company stand for? How is your product different? Branding is an often overlooked, but essential component of communicating your company’s values, connecting with potential customers and, ultimately, driving conversions.

But finding the right brand designer is hard. Depending on your budget, industry and scope, brand designer and brand agency services can vary widely. It’s a niche community, and brand designers who thrive in chaotic, fast-paced startup environments are rare.

We’re demystifying the world of brand design by covering how companies like Intercom approach their brand identity, and asking founders, like you, to nominate a talented brand designer or agency with whom they’ve collaborated. We’ll be publishing more branding articles, guest posts by industry experts and brand designer profiles in the weeks to come, but we need your help. We’re relying on your recommendations to identify which brand designers and agencies to feature.

We’re especially looking for people who have experience in these three categories:

We’re also interested in understanding how much time you’ve worked with a designer or agency, whether you’d recommend them to a friend and examples of their work.

Brand design is just one of our latest initiatives to identify the best service providers for startups. As we develop a shortlist of the top brand designers and agencies in the world, we’ll be asking them about their design philosophy, brand development process, rates and fees, and more. We’ll publish their profiles (along with your recommendations) on Extra Crunch.

We’ll continue updating our database of brand designers on a rolling basis, but in the meantime, help us share this article and nominate a brand designer or agency you know and love.

Any thoughts or questions? Email us at ec_editors@techcrunch.com.

Powered by WPeMatico

Social investing and trading platform eToro announced that it has acquired Danish smart contract infrastructure provider Firmo for an undisclosed purchase price.

Firmo’s platform enables exchanges to execute smart financial contracts across various assets, including crypto derivatives, and across all major blockchains. Firmo founder and CEO Dr. Omri Ross described the company’s mission as “…enabl[ing] our users to trade any asset globally with instant settlement by tokenizing assets and executing all essential trade processes on the blockchain.” Firmo’s only disclosed investment, according to data from Pitchbook, came in the form of a modest pre-seed round from the Copenhagen Fintech Lab accelerator.

Firmo’s mission aligns well with that of eToro — which is equal parts trading platform, social network and educational resource for beginner investors — with the company having long communicated hopes of making the capital markets more open, transparent and accessible to all users and across all assets. By gobbling up Firmo, eToro will be able to accelerate its development of offerings for tokenized assets.

The acquisition represents the latest step in eToro’s broader growth plan, which has ramped up as of late. Earlier in March, the company launched a crypto-only version of its platform in the US, as well as a multi-signature digital wallet where users can store, send and receive cryptocurrencies.

The Firmo deal and eToro’s other expansion activities fit squarely into the company’s belief in the tokenization of assets and the immense, sector-defining opportunity that it creates. Etoro believes that asset tokenization and the movement of financial services onto the blockchain are all but inevitable and the company has employed the long-tailed strategy of investing heavily in related blockchain and crypto technologies despite the ongoing crypto winter.

“Blockchain and the tokenization of assets will play a major role in the future of finance,” said eToro co-founder and CEO Yoni Assia. “We believe that in time all investible assets will be tokenized and that we will see the greatest transfer of wealth ever onto the blockchain.” Assia expressed a similar sentiment in a recent conversation with TechCrunch, stating “We think [the tokenization of assets] is a bigger opportunity than the internet…”

After the acquisition, Firmo will operate as an internal R&D arm within eToro focused on developing blockchain-oriented trade execution and the infrastructure behind the digital representation of tokenized assets.

“The Firmo team has done ground-breaking work in developing practical applications for blockchain technology which will facilitate friction-less global trading,” said Assia.

“The adoption of smart contracts on the blockchain increases trust and transparency in financial services. We are incredibly proud and excited that [Firmo] will be joining the eToro family. We believe that together we have a very bright future and look forward to pursuing our shared goal to become the first truly global service provider allowing people to trade, invest and save.”

Powered by WPeMatico

Ouster has raised $60 million as the San Francisco-based lidar startup opens a new facility that will have the capacity to assemble and ship several thousand sensors a month by the end of 2019.

The new factory, which will have a grand opening ceremony March 28, currently produces hundreds of sensors per month. Ouster says at full capacity, the factory will produce $25 million to $50 million in inventory per month.

Lidar measures distance using laser light to generate highly accurate 3D maps of the world around the car. It’s considered by most in the self-driving car industry a key piece of technology required to safely deploy robotaxis and other autonomous vehicles (although not everyone agrees). However, the sensors are also useful in other industries — and this is where Ouster’s business model is targeted.

Ouster has cast a wider net for customers than some of its rivals. Unlike others vying solely for automotive customers working on the development of autonomous vehicles, Ouster is selling sensors to other industries. Ouster is selling its light detection and ranging radar sensors to robotics, drones, mapping, defense, building security, mining and agriculture companies.

The strategy has appeared to pay off. Ouster says it has 400 customers from 15 industries.

The $60 million in additional funding follows a Series A raise of $27 million announced back in 2017 as Ouster came out of stealth mode. In the years since, the company led by Angus Pacala has grown to more than 100 employees and announced four lidar sensors, with resolutions from 16 to 128 channels, and two product lines, the OS-1 and OS-2. The startup expects to nearly double its headcount in the coming year to support further product line development.

The $60 million in equity and debt funding includes investments from Runway Growth Capital and Silicon Valley Bank, as well as additional funding from Series A participants Cox Enterprises, Constellation Tech Ventures, Fontinalis Partners, Carthona and others.

Ouster said the additional investment has helped to develop Ouster’s product lines, including the launch of the OS-1 128 lidar sensor, and fund the expansion of its production facilities.

The company also announced the appointment of Susan Heystee, senior VP for OEM business at Verizon Connect, to its board of directors.

Waymo, the self-driving car company under Google’s Alphabet, could be a new competitor to the company. Waymo announced this month it will start selling its custom lidar sensors to companies outside of self-driving cars. Waymo will initially target robotics, security and agricultural technology. The sales will help the company scale its autonomous technology faster, making each sensor more affordable through economies of scale, Simon Verghese, head of Waymo’s lidar team, wrote in a Medium post at the time.

Powered by WPeMatico

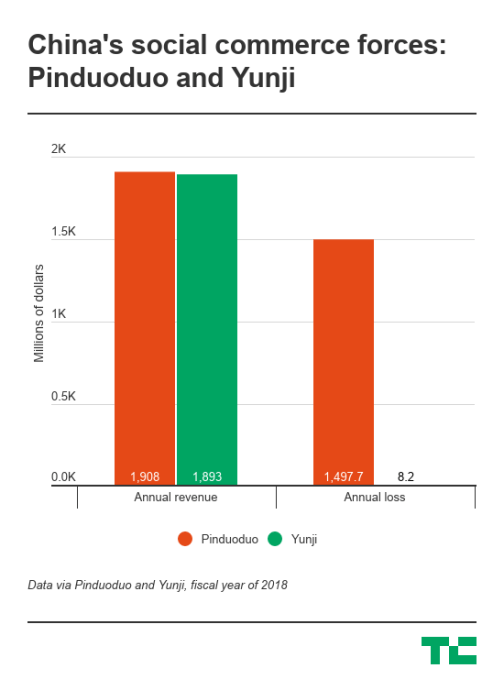

China’s Pinduoduo was all the rage in 2018 as the e-commerce upstart quickly rose to challenge Alibaba and raised $1.63 billion through a Nasdaq listing. Much of its success was attributable to its link to WeChat, China’s messaging leader. Now, another emerging e-commerce player that has leveraged WeChat is gearing up for a listing in the United States.

Yunji, which was founded in 2015 (the same year Pinduoduo launched), is raising up to $200 million according to its prospectus filed with the Securities and Exchange Commission last week. Reuters reported citing sources in September that Yunji planned to raise around $1 billion in the IPO at a valuation of between $7 billion and $10 billion.

Like Pinduoduo, Yunji bills itself as a “social e-commerce” service, which means it takes advantage of social relationships on apps like WeChat to acquire, engage and sell to users. The pair differ, however, in how exactly they make money. Pinduoduo generates the bulk of its revenues — nearly 90 percent in the fourth quarter — from advertising fees collected from merchants. This is akin to Alibaba’s marketplace play of connecting buyers and third-party sellers. Yunji, which was started by e-commerce veteran Xiao Shanglue, focuses on direct sales like Alibaba’s arch-foe JD.com, derived 88 percent of its fourth-quarter revenues from selling to users.

In terms of size, Yunji was about $15 million behind Pinduoduo in revenue last year. It had 23.2 million buyers in 2018, compared to Pinduoduo’s 272.6 million monthly active users. Yunji was, however, much closer to achieving profitability than Pinduoduo, which spent most of its money on sales and marketing. Most of Yunji’s expenses went to fulfillment and logistics.

From inception, Yunji has boasted of its “innovative” membership-based e-commerce model. To join, people typically pay a fee, upon which they gain access to a variety of benefits and discounts as well as the permission to open their own micro-stores. Members then get compensated for successfully selling to others and recruiting new members.

The marketing practice helped Yunji quickly build up a large network of users. As of 2018, Yunji had 7.4 million members who contributed 11.9 percent of its annual revenues and 66.4 percent of annual transactions. But the firm went too far in exploiting the social links it controlled that it started to look like a pyramid scheme, which is banned in China. In 2017, the local government slapped Yunji with a $1.4 million fine for pyramid selling. The firm subsequently apologized and promised to revamp its marketing strategy. For instance, to avoid crossing the red line of awarding salespeople with “material” or “financial” benefits, Yunji resorted to virtual Yun-coins, which are not redeemable for cash and can only be used as coupons for future purchase.

But Yunji is still on the edge. The company warns in its prospectus that China could at any time redefine what constitutes pyramid selling.

“[T]here is no assurance that the competent governmental authorities in China that we communicate with will not change their views, or the other relevant government authorities will share the same view as our PRC legal counsel, or they will find our business model, not in violation of any applicable regulations, given the uncertainties in the interpretation and application of existing PRC laws, regulations and policies relating to our current business model, including, but not limited to, regulations regulating pyramid selling.”

Some of Yunji’s more notable investors include China’s CDH Investments and Huaxing Growth Capital, China Renaissance’s subsidiary focusing on high-growth startups.

Powered by WPeMatico

There’s nothing like a niche language to create a sort of lock-in for a startup, and that’s exactly what’s happened with Gjirafa. Focusing exclusively on Albanian-speaking countries, co-founder and CEO Mergim Cahani started out developing an Albanian language search engine and then literally digitizing the country’s information, from bus timetables to a database of local businesses and venues, and beyond.

Investors were attracted to this “emerging-market approach” and put in a $2 million Series A three years ago to “grow the Balkans’ internet economy” by digitizing and indexing information in Albania and Kosovo, thus making Gjirafa the regional leader in search, e-commerce and online advertising.

Today it claims 3 million monthly unique users across its services and has now raised a Series B round of $6.7 million from Rockaway Capital, which has been backing the company since 2016. The new funding is intended for scaling the current products regionally.

The Series B will allow the company to double their current team (currently at 70 full-time, and about 100 in total with part-time), scale with the existing products regionally and deliver other digital services that aren’t available in the region.

Dušan Zábrodský, investment partner at Rockaway, says: “Mergim Cahani and his team validated our trust and truly succeeded in building a centrepiece of innovation for the whole region. Thanks to this very positive experience we are committed to build up a digital economy in the region and we actively explore new investment opportunities where we can use our knowledge to digitalize traditional industries.”

He says Rockaway group’s investment is long-term and strategic because they think Gjirafa could become an entire platform/network of additional services that will be used throughout the region.

Using the same strategy, Rockaway previously found success in the DACH region, where it built up an online travel group under the Invia Group brand, and in the field of e-commerce through Mall Group, which operates on seven markets in the CEE region. These groups have contributed significantly to Rockaway’s revenues, which crossed the threshold of €2 billion in 2018.

Gjirafa has become the largest e-commerce player in the region, having a leading OTT product: GjirafaVideo and GjirafaStudio, equivalent to Hulu and Netflix; producing its own content it currently has about 1 million minutes of video consumed a day (and growing double-digits on monthly basis) and more than 80 live channels online.

Gjirafa, Inc., is the fastest-growing company in the region, and the growth is impressive at 314 percent CAGR. To put it in perspective: when GDP indicators are normalized for the Balkans region versus the U.S., it has an equivalent revenue growth as Google had between 2001-2004 and continuing on the same path.

Powered by WPeMatico

Infinity Augmented Reality, an Israeli startup, has been acquired by Alibaba, the companies announced this weekend. The deal’s terms were not disclosed. Alibaba and InfinityAR have had a strategic partnership since 2016, when Alibaba Group led InfinityAR’s Series C. Since then, the two have collaborated on augmented reality, computer vision and artificial intelligence projects.

Founded in 2013, the startup’s augmented glasses platform enables developers in a wide range of industries (retail, gaming, medical, etc.) to integrate AR into their apps. InfinityAR’s products include software for ODMs and OEMs and a SDK plug-in for 3D engines.

Alibaba’s foray into virtual reality started three years ago, when it invested in Magic Leap and then announced a new research lab in China to develop ways of incorporating virtual reality into its e-commerce platform.

InfinityAR’s research and development team will begin working out of Alibaba’s Israel Machine Laboratory, part of Alibaba DAMO Academy, the R&D initiative into which it is pouring $15 billion with the goal of eventually serving two billion customers and creating 100 million jobs by 2036. DAMO Academy collaborates with universities around the world, and Alibaba’s Israel Machine Laboratory has a partnership with Tel Aviv University focused on video analysis and machine learning.

In a press statement, the laboratory’s head, Lihi Zelnik-Manor, said “Alibaba is delighted to be working with InfinityAR as one team after three years of partnership. The talented team brings unique knowhow in sensor fusion, computer vision and navigation technologies. We look forward to exploring these leading technologies and offering additional benefits to customers, partners and developers.”

Powered by WPeMatico

One year after a $38 million Series B valued on-demand aviation startup Blade at $140 million, the company has begun taxiing the Bay Area’s elite.

As part of a new pilot program, Blade has given 200 people in San Francisco and Silicon Valley exclusive access to its mobile app, allowing them to book helicopters, private jets and even seaplanes at a moments notice for $200 per seat, at least.

Blade, backed by Lerer Hippeau, Airbus, former Google CEO Eric Schmidt and others, currently flies passengers around the New York City area, where it’s headquartered, offering the region’s wealthy $800 flights to the Hamptons, among other flights at various price points. According to Business Insider, it has worked with Uber in the past to help deep-pocketed Coachella attendees fly to and from the Van Nuys Airport to Palm Springs, renting out six-seat helicopters for more than $4,000 a pop.

Its latest pilot seems to target business travelers, connecting riders to the San Francisco International Airport and Oakland International Airport to Palo Alto, San Jose, Monterey and Napa Valley. The goal is to shorten trips made excruciatingly long due to bad traffic in major cities like New York, Los Angeles and San Francisco. Recently, the startup partnered with American Airlines to better establish its network of helicopters, a big step for the company as it works to integrate with existing transportation infrastructure.

New work with @flybladenow pic.twitter.com/eONvKU3rhM

— Tyler Babin (@Tyler_Babin) March 11, 2019

Blade, led by founder and chief executive officer Rob Wiesenthal, a former Warner Music Group executive, has raised about $50 million in venture capital funding to date. To launch at scale and, ultimately, to compete with the likes of soon-to-be-public transportation behemoth Uber, it will have to land a lot more investment support.

Uber too has lofty plans to develop a consumer aerial ridesharing business, as do several other privately-funded startups. Called UberAIR, Uber will offer short-term shareable flights to commuters as soon as 2023. The company has raised billions of dollars to turn this sci-fi concept into reality.

Then there’s Kitty Hawk, a company launched by former Google vice president and Udacity co-founder Sebastian Thrun, which is developing an aircraft that can take off like a helicopter but fly like a plane for short-term urban transportation purposes. Others in the air taxi or vertical take-off and landing aircraft space, including Volocopter, Lilium and Joby Aviation, have raised tens of millions to eliminate traffic congestion or, rather, to chauffer the rich.

Blade’s next stop is India, the Financial Times reports, where it will conduct a pilot connecting travelers in downtown Mumbai and Pune. The company tells TechCrunch they are currently exploring one additional domestic pilot and one additional international pilot.

Powered by WPeMatico

As I’m sure everyone reading this knows, female-founded businesses receive just over 2 percent of venture capital on an annual basis. Most of those checks are written to early-stage startups. It’s extremely difficult for female founders to garner late-stage support, let alone cash $100 million checks.

Maybe that’s finally changing. This week, not one but two female-founded and led companies, Glossier and Rent The Runway, raised nine-figure rounds and cemented their status as unicorn companies. According to PitchBook data from 2018, there are only about 15 unicorn startups with female founders. Though I’m sure that number has increased in the last year, you get the point: There are hundreds of privately held billion-dollar companies and shockingly few of those have women founders (even fewer have female CEOs)…

Moving on…

I spent a good part of the week at San Francisco’s Pier 48 in a room full of vest-wearing investors. We listened to some 200 YC companies make their 120-second pitch and though it was a bit of a whirlwind, there were definitely some standouts. ICYMI: We wrote about each and every company that pitched on day 1 and day 2. If you’re looking for the inside scoop on the companies that forwent demo day and raised rounds, or were acquired, before hitting the stage, we’ve got that too.

Lyft: This week, Lyft set the terms for its highly-anticipated initial public offering, expected to be completed next week. The company will charge between $62 and $68 per share, raising more than $2 billion at a valuation of ~$23 billion. We previously reported its initial market cap would be around $18.5 billion, but that was before we knew that Lyft’s IPO was already oversubscribed. Here’s a little more background on the Lyft IPO for those interested.

Uber: The global ride-hailing business flew a little more under the radar this week than last week, but still managed to grab a few headlines. The company has decided to sell its stock on the New York Stock Exchange, which is the least surprising IPO development of 2019, considering its key U.S. competitor, Lyft, has been working with the Nasdaq on its IPO. Uber is expected to unveil its S-1 in April.

Ben Silbermann, co-founder and CEO of Pinterest, at TechCrunch Disrupt SF 2017.

Pinterest: Pinterest, the nearly decade-old visual search engine, unveiled its S-1 on Friday, one of the final steps ahead of its NYSE IPO, expected in April. The $12.3 billion company, which will trade under the ticker symbol “PINS,” posted revenue of $755.9 million in the year ending December 31, 2018, up from $472.8 million in 2017. It has roughly doubled its monthly active user count since early 2016, hitting 265 million last year. The company’s net loss, meanwhile, shrank to $62.9 million in 2018 from $130 million in 2017.

Zoom: Not necessarily the buzziest of companies, but its S-1 filing, published Friday, stands out for one important reason: Zoom is profitable! I know, what insanity! Anyway, the startup is going public on the Nasdaq as soon as next month after raising about $150 million in venture capital funding. The full deets are here.

General Catalyst, a well-known venture capital firm, is diving more seriously into the business of funding seed-stage business. The firm, which has investments in Warby Parker, Oscar and Stripe, announced earlier this week its plan to invest at least $25 million each year in nascent teams.

Earlier this week, Opendoor, the SoftBank -backed real estate startup, filed paperwork to raise even more money. According to TechCrunch’s Ingrid Lunden, the business is planning to raise up to $200 million at a valuation of roughly $3.7 billion. It’s possible this is a Series E extension; after all, the company raised its $400 million Series E only six months ago. Backers of OpenDoor include the usual suspects: Andreessen Horowitz, Coatue, General Atlantic, GV, Initialized Capital, Khosla Ventures, NEA and Norwest Venture Partners.

Startup capital

Backstage Capital founder and managing partner Arlan Hamilton, center.

Axios’ Dan Primack and Kia Kokalitcheva published a report this week revealing Backstage Capital hadn’t raised its debut fund in total. Backstage founder Arlan Hamilton was quick to point out that she had been honest about the challenges of fundraising during various speaking engagements, and even on the Gimlet “Startup” podcast, which featured her in its latest season. A Twitter debate ensued and later, Hamilton announced she was stepping down as CEO of Backstage Studio, the operations arm of the venture fund, to focus on raising capital and amplifying founders. TechCrunch’s Megan Rose Dickey has the full story.

This week, TechCrunch’s Connie Loizos revisited a long-held debate: Pro rata rights, or the right of an earlier investor in a company to maintain the percentage that he or she (or their venture firm) owns as that company matures and takes on more funding. Here’s why pro rata rights matter (at least, to VCs).

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about Glossier, Rent The Runway and YC Demo Days. Then, in a special Equity Shot, we unpack the numbers behind the Pinterest and Zoom IPO filings.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

What a Friday. This afternoon (mere hours after we released our regularly scheduled episode no less!), both Pinterest and Zoom dropped their public S-1 filings. So we rolled up our proverbial sleeves and ran through the numbers. If you want to follow along, the Pinterest S-1 is here, and the Zoom document is here.

Got it? Great. Pinterest’s long-awaited IPO filing paints a picture of a company cutting its losses while expanding its revenue. That’s the correct direction for both its top and bottom lines.

As Kate points out, it’s not in the same league as Lyft when it comes to scale, but it’s still quite large.

More than big enough to go public, whether it’s big enough to meet, let alone surpass its final private valuation ($12.3 billion) isn’t clear yet. Peeking through the numbers, Pinterest has been improving margins and accelerating growth, a surprisingly winsome brace of metrics for the decacorn.

Pinterest has raised a boatload of venture capital, about $1.5 billion since it was founded in 2010. Its IPO filing lists both early and late-stage investors, like Bessemer Venture Partners, FirstMark Capital, Andreessen Horowitz, Fidelity and Valiant Capital Partners as key stakeholders. Interestingly, it doesn’t state the percent ownership of each of these entities, which isn’t something we’ve ever seen before.

Next, Zoom’s S-1 filing was more dark horse entrance than Katy Perry album drop, but the firm has a history of rapid growth (over 100 percent, yearly) and more recently, profit. Yes, the enterprise-facing video conferencing unicorn actually makes money!

In 2019, the year in which the market is bated on Uber’s debut, profit almost feels out of place. We know Zoom’s CEO Eric Yuan, which helps. As Kate explains, this isn’t his first time as a founder. Nor is it his first major success. Yuan sold his last company, WebEx, for $3.2 billion to Cisco years ago then vowed never to sell Zoom (he wasn’t thrilled with how that WebEx acquisition turned out).

Should we have been that surprised to see a VC-backed tech company post a profit — no. But that tells you a little something about this bubble we live in, doesn’t it?

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico