Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Direct-to-consumer mattress business Casper has secured a $100 million Series D investment from existing investors Target, NEA, IVP and Norwest Venture Partners.

The fresh infusion of capital values Casper at $1.1 billion, Bloomberg first reported and Casper confirmed.

“We are in the very early chapters of our growth story as demand for Casper products continues to expand across the globe,” Casper chief executive officer and co-founder Philip Krim said in a statement. “Today’s financing accelerates Casper’s vision to become the world’s largest end-to-end sleep company. Our growth will continue to be catalyzed by state-of-the-art sleep products, best-in-class customer experiences, and world-class leadership.”

Casper posted $373 million in net revenue in 2018, according to leaked financials published by The Information this week. In a press release issued today, however, Casper said 2018 revenue topped $400 million. The company, of course, isn’t profitable, with losses reaching $64 million last year, again per The Information. According to Casper’s projections, it will become profitable on an EBITDA basis in 2019 and is expecting revenues of $556 million this year.

Casper has previously raised $240 million in equity funding from celebrity investors Leonardo DiCaprio and 50 Cent, as well as institutional investors, including Lerer Hippeau .

Founded in 2014, the New York business will use the latest investment to expand overseas and open additional brick-and-mortar stores. Competing with other well-funded startups in the business of sleep, like the publicly traded Purple and the VC-backed Leesa Sleep, Casper has taken to physical retail to augment its following. The company opened its first store in New York City in 2018 and has detailed additional plans to open another 200 stores.

An initial public offering is likely the next step for the sleep products retailer, which sells pillows and an $89 sleep-friendly light, in addition to mattresses. Per a recent Reuters report, Casper is in the process of hiring underwriters for its IPO.

Powered by WPeMatico

Every founder wants an eye-catching website or app, but it’s easy to overlook a basic fact: not all your potential visitors will experience your content with their eyes. If you haven’t considered whether a user with differing visual, motor or hearing abilities can easily navigate your software, it’s time to get serious about digital accessibility.

As tempting as it might be to prioritize a stunning visual and mobile experience over an accessible design, accessibility is a legal requirement—not an option—for many businesses.

Just ask high-profile founder Beyoncé Knowles. In January, Beyoncé’s Parkwood Entertainment was hit with a class-action lawsuit that includes “all legally blind individuals in the United States who have attempted to access Beyonce.com.” The lawsuit claims that the site’s lack of visual alternatives make the site inaccessible to blind users like the plaintiff and therefore illegal.

Failing to accommodate people with disabilities not only limits your market (blind people buy concert tickets and merchandise too), it can also bring legal and reputational consequences.

The Americans with Disabilities Act (ADA) requires US businesses that serve the public to provide equal access and accommodations to everyone, whether through a physical building or a digital experience. Just as stores provide ramps as well as stairs, websites need to accommodate people with varying abilities, from movement disorders to visual and auditory impairments. The number of website accessibility lawsuits raised against private companies more than doubled last year. A single plaintiff won $100K in a similar ADA lawsuit in 2017.

While ADA is the enforcing legislation in the United States for the private sector, the Web Content Accessibility Guidelines (WCAG) provide de facto global standards web designers should follow. The guidelines are based on four principles: content must be perceivable, operable, understandable and robust.

If you’re not sure whether your digital content (websites, apps, e-books, etc) is WCAG-compliant, have a certified accessibility consultant conduct an assessment immediately, and contact your legal team should you identify any risks.

However, simple compliance is only the first step. Understanding how accessibility is defined will broaden your understanding of the overall user experience, so you can create better content for all users.

This article is part of Extra Crunch’s exclusive “Startup Law A to Z” series, following previous articles on employment law, customer contracts, intellectual property (IP) and corporate matters. This series is designed to provide founders the information needed to assess legal risks in the areas common to most startups.

Should you identify legal risks facing your startup after reading this or other articles in the series, Extra Crunch resources can help. You can reach out to the Verified Experts of Extra Crunch, who focus on serving companies at your stage, for further guidance in the particular issues at hand.

The Web Content Accessibility Checklist:

A website must present content so that users of different abilities can perceive it. That means providing alternatives for any non-text content, like images or music.

For time-based media (audio and video), captions, content descriptions and sign language are acceptable options.

Powered by WPeMatico

What lies beneath the murky depths? SolarCity co-founder Peter Rive wants to help you and the scientific community find out. He’s just led a $7 million Series A for Sofar Ocean Technologies, a new startup formed from a merger he orchestrated between underwater drone maker OpenROV and sea sensor developer Spoondrift. Together, they’re teaming up their 1080p Trident drone and solar-powered Spotter sensor to let you collect data above and below the surface. They can help you shoot awesome video footage, track waves and weather, spot fishing and diving spots, inspect boats or infrastructure for damage, monitor acquaculture sites or catch smugglers.

Sofar’s Trident drone (left) and Spotter sensor (right)

“Aerial drones give us a different perspective of something we know pretty well. Ocean drones give us a view at something we don’t really know at all,” former Spoondrift and now Sofar CEO Tim Janssen tells me. “The Trident drone was created for field usage by scientists and is now usable by anyone. This is pushing the barrier towards the unknown.”

But while Rive has a soft spot for the ecological potential of DIY ocean exploration, the sea is crowded with competing drones. There are more expensive professional research-focused devices like the Saildrone, DeepTrekker and SeaOtter-2, as well as plenty of consumer-level devices like the $800 Robosea Biki, $1,000 Fathom ONE and $5,000 iBubble. The $1,700 Sofar Trident, which requires a cord to a surface buoy to power its three hours of dive time and two meters per second speed, sits in the middle of the pack, but Sofar co-founder David Lang things Trident can win with simplicity, robustness and durability. The question is whether Sofar can become the DJI of the water, leading the space, or if it will become just another commoditized hardware maker drowning in knock-offs.

From left: Peter Rive (chairman of Sofar), David Lang (co-founder of OpenROV) and Tim Janssen (co-founder and CEO of Sofar)

Spoondrift launched in 2016 and raised $350,000 to build affordable ocean sensors that can produce climate-tracking data. “These buoys (Spotters) are surprisingly easy to deploy, very light and easy to handle, and can be lowered in the water by hand using a line. As a result, you can deploy them in almost any kind of conditions,” says Dr. Aitana Forcén-Vázquez of MetOcean Solutions.

OpenROV (it stands for Remotely Operated Vehicle) started seven years ago and raised $1.3 million in funding from True Ventures and National Geographic, which was also one of its biggest Trident buyers. “Everyone who has a boat should have an underwater drone for hull inspection. Any dock should have its own weather station with wind and weather sensors,” Sofar’s new chairman Rive declares.

Spotter could unlock data about the ocean at scale

Sofar will need to scale to accomplish Rive’s mission to get enough sensors in the sea to give us more data on the progress of climate change and other ecological issues. “We know very little about our oceans since we have so little data, because putting systems in the ocean is extremely expensive. It can cost millions for sensors and for boats,” he tells me. We gave everyone GPS sensors and cameras and got better maps. The ability to put low-cost sensors on citizens’ rooftops unlocked tons of weather forecasting data. That’s more feasible with Spotter, which costs $4,900 compared to $100,000 for some sea sensors.

Sofar hardware owners do not have to share data back to the startup, but Rive says many customers are eager to. They’ve requested better data portability so they can share with fellow researchers. The startup believes it can find ways to monetize that data in the future, which is partly what attracted the funding from Rive and fellow investors True Ventures and David Sacks’ Craft Ventures. The funding will build up that data business and also help Sofar develop safeguards to make sure its Trident drones don’t go where they shouldn’t. That’s obviously important, given London’s Gatwick airport shutdown due to a trespassing drone.

Spotter can relay weather conditions and other climate data to your phone

“The ultimate mission of the company is to connect humanity to the ocean as we’re mostly conservationists at heart,” Rive concludes. “As more commercialization and business opportunities arise, we’ll have to have conversations about whether those are directly benefiting the ocean. It will be important to have our moral compass facing in the right direction to protect the earth.”

Powered by WPeMatico

You know how kings used to have trumpeters heralding their arrival wherever they went? Proxy wants to do that with Bluetooth. The startup lets you instantly unlock office doors and reserve meeting rooms using Bluetooth Low Energy signal. You never even have to pull out your phone or open an app. But Proxy is gearing up to build an entire Bluetooth identity layer for the world that could invisibly hover around its users. That could allow devices around the workplace and beyond to instantly recognize your credentials and preferences to sign you into teleconferences, pay for public transit or ask the barista for your usual.

Today, Proxy emerges from stealth after piloting its keyless, badgeless office entry tech with 50 companies. It’s raised a $13.6 million Series A round led by Kleiner Perkins to turn your phone into your skeleton key. “The door is a forcing function to solve all the hard problems — everything from safety to reliability to the experience to privacy,” says Proxy co-founder and CEO Denis Mars. “If you’re gonna do this, it’s gonna have to work right, and especially if you’re going to do this in the workplace with enterprises where there’s no room to fix it.”

But rather than creepily trying to capitalize on your data, Proxy believes you should own and control it. Each interaction is powered by an encrypted one-time token so you’re not just beaming your unprotected information out into the universe. “I’ve been really worried about how the internet world spills over to the physical world. Cookies are everywhere with no control. What’s the future going to be like? Are we going to be tracked everywhere or is there a better way?” He figured the best path to the destiny he wanted was to build it himself.

Mars and his co-founder Simon Ratner, both Australian, have been best buddies for 10 years. Ratner co-founded a video annotation startup called Omnisio that was acquired by YouTube, while Mars co-founded teleconferencing company Bitplay, which was bought by Jive Software. Ratner ended up joining Jive where the pair began plotting a new startup. “We asked ourselves what we wanted to do with the next 10 or 20 years of our lives. We both had kids and it changed our perspective. What’s meaningful that’s worth working on for a long time?”

They decided to fix a real problem while also addressing their privacy concerns. As he experimented with Internet of Things devices, Mars found every fridge and light bulb wanted you to download an app, set up a profile, enter your password and then hit a button to make something happen. He became convinced this couldn’t scale and we’d need a hands-free way to tell computers who we are. The idea for Proxy emerged. Mars wanted to know, “Can we create this universal signal that anything can pick up?”

Most offices already have infrastructure for badge-based RFID entry. The problem is that employees often forget their badges, waste time fumbling to scan them and don’t get additional value from the system elsewhere.

So rather than re-invent the wheel, Proxy integrates with existing access control systems at offices. It just replaces your cards with an app authorized to constantly emit a Bluetooth Low Energy signal with an encrypted identifier of your identity. The signal is picked up by readers that fit onto the existing fixtures. Employees can then just walk up to a door with their phone within about six feet of the sensor and the door pops open. Meanwhile, their bosses can define who can go where using the same software as before, but the user still owns their credentials.

“Data is valuable, but how does the end user benefit? How do we change all that value being stuck with these big tech companies and instead give it to the user?” Mars asks. “We need to make privacy a thing that’s not exploited.”

Mars believes now’s the time for Proxy because phone battery life is finally getting good enough that people aren’t constantly worried about running out of juice. Proxy’s Bluetooth Low Energy signal doesn’t suck up much, and geofencing can wake up the app in case it shuts down while on a long stint away from the office. Proxy has even considered putting inductive charging into its sensors so you could top up until your phone turns back on and you can unlock the door.

Opening office doors isn’t super exciting, though. What comes next is. Proxy is polishing its features that auto-reserve conference rooms when you walk inside, that sign you into your teleconferencing system when you approach the screen and that personalize workstations when you arrive. It’s also working on better office guest check-in to eliminate the annoying iPad sign-in process in the lobby. Next, Mars is eyeing “Your car, your home, all your devices. All these things are going to ask ‘can I sense you and do something useful for you?’ ”

After demoing at Y Combinator, thousands of companies reached out to Proxy, from hotel chains to corporate conglomerates to theme parks. Proxy charges for its hardware, plus a monthly subscription fee per reader. Employees are eager to ditch their keycards, so Proxy sees 90 percent adoption across all its deployments. Customers only churn if something breaks, and it hasn’t lost a customer in two years, Mars claims.

The status quo of keycards, competitors like Openpath and long-standing incumbents all typically only handle doors, while Proxy wants to build an omni-device identity system. Now Proxy has the cash to challenge them, thanks to the $13.6 million from Kleiner, Y Combinator, Coatue Management and strategic investor WeWork. In fact, Proxy now counts WeWork’s headquarters and Dropbox as clients. “With Proxy, we can give our employees, contractors and visitors a seamless smartphone-enabled access experience they love, while actually bolstering security,” says Christopher Bauer, Dropbox’s physical security systems architect.

The cash will help answer the question of “How do we turn this into a protocol so we don’t have to build the other side for everyone?,” Mars explains. Proxy will build out SDKs that can be integrated into any device, like a smoke detector that could recognize which people are in the vicinity and report that to first responders. Mars thinks hotel rooms that learn your climate, wake-up call and housekeeping preferences would be a no-brainer. Amazon Go-style autonomous retail could also benefit from the tech.

When asked what keeps him up at night, Mars concludes that “the biggest thing that scares me is that this requires us to be the most trustworthy company on the planet. There is no ‘move fast, break things’ here. It’s ‘move fast, do it right, don’t screw it up.’ “

Powered by WPeMatico

In Silicon Valley, investors don’t expect their portfolio companies to be profitable. “Blitzscaling: The Lightning-Fast Path to Building Massively Valuable Companies,” a bible for founders, instead calls for heavy spending on growth to scale in an Amazon -like fashion.

As for Wall Street, it’s shown an affinity for stock in Jeff Bezos’ business, despite the many years it spent navigating a path to profitability, as well as other money-losing endeavors. Why? Because it too is far less concerned with profitability than market opportunity.

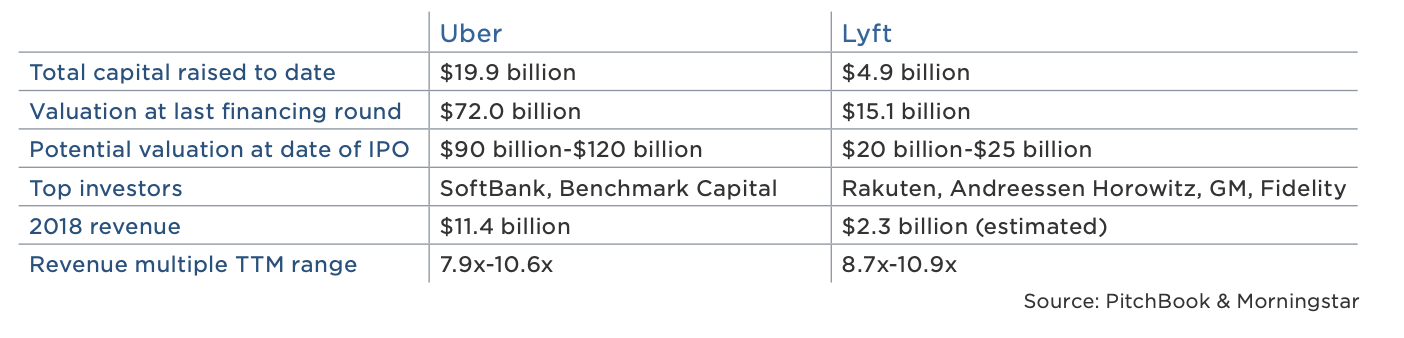

Lyft, a ride-hailing company expected to go public this week, is not profitable. It posted losses of $911 million in 2018, a statistic that will make it the biggest loser amongst U.S. startups to have gone public, according to data collected by The Wall Street Journal. On the other hand, Lyft’s $2.2 billion in 2018 revenue places it atop the list of largest annual revenues for a pre-IPO business, trailing behind only Facebook and Google in that category.

Wall Street, in short, is betting on Lyft’s revenue growth, assuming it will narrow its loses and reach profitability… eventually.

Lyft, losses notwithstanding, is growing rapidly and Wall Street is paying attention. On the second day of its road show, reports emerged that its IPO was already oversubscribed. As a result, Lyft is said to have upped the cost of its stock, with new plans to raise more than $2 billion at a valuation upwards of $25 billion. That represents a revenue multiple of more than 11x, a step up multiple of more than 1.6x from its most recent private valuation of $15.1 billion and, of course, Wall Street’s insatiable desire for unicorns, profitable or not.

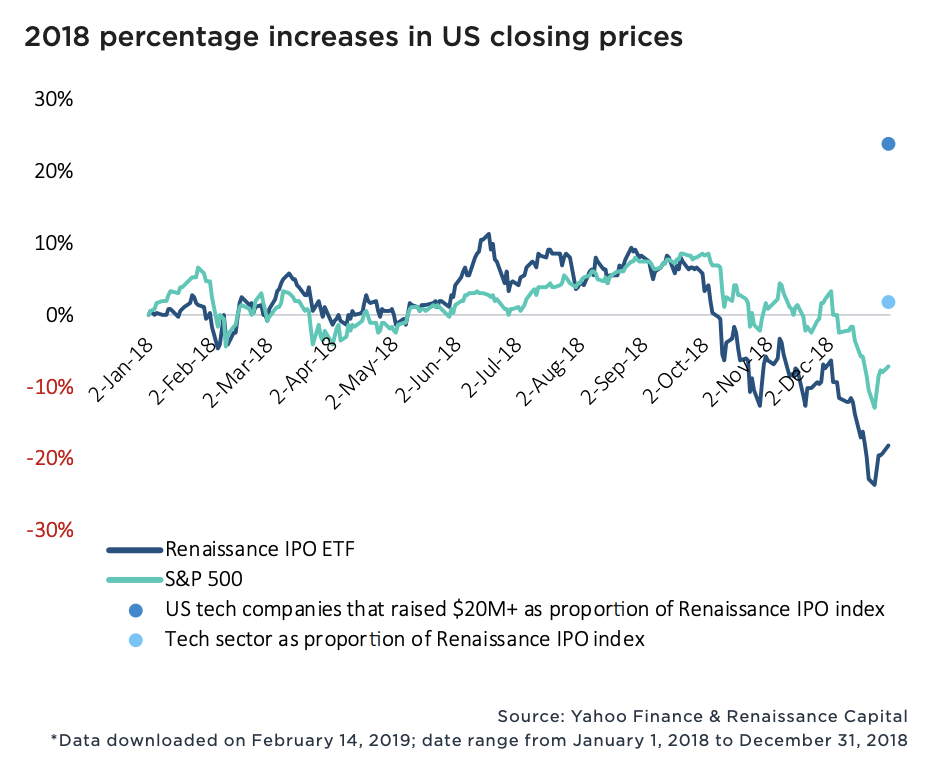

New data from PitchBook exploring the performance of billion-dollar-plus VC exits confirms Wall Street’s leniency toward unprofitable tech companies. Sixty-four percent of the 100+ companies valued at more than $1 billion to complete a VC-backed IPO since 2010 were unprofitable, and in 2018, money-losing startups actually fared better on the stock exchange than money-earning businesses. Moreover, U.S. tech companies that had raised more than $20 million traded up nearly 25 percent of 2018, while the S&P 500 technology sector posted flat returns.

Wall Street is still adapting to the rapid growth of the tech industry; public markets investors, therefore, are willing to deal with negative to minimal cash flows for, well, a very long time.

There’s no doubt Lyft and its much larger competitor, Uber, will go public at monstrous valuations. The two IPOs, set to create a whole bunch of millionaires and return a number of venture capital funds, will provide Silicon Valley a lesson in Wall Street’s tolerance for outsized exits.

Much like a seed-stage investor must bet on a founder’s vision, Wall Street, given a choice of several unprofitable businesses, has to bet on potential market value. Fortunately, this strategy can work quite well. Take Floodgate, for example. The seed fund invested a small amount of capital in Lyft when it was still a quirky idea for ridesharing called Zimride. Now, it boasts shares worth more than $100 million. I’m sure early shareholders in Amazon — which went public as a money-losing company in 1997 — are pretty happy, too.

Ultimately, Wall Street’s appetite for unicorns like Lyft is a result of the shortage of VC-backed IPOs. In 2006, it was the norm for a company to make its stock market debut at 7.9 years old, per PitchBook. In 2018, companies waited until the ripe age of 10.9 years, causing a significant slowdown in big liquidity events and stock sales.

Fund sizes, however, have grown larger and the proliferation of unicorns continues at unforeseen rates. That may mean, eventually, an influx of publicly shared unicorn stock. If that’s the case, might Wall Street start asking more of these startups? At the very least, public market investors, please don’t be swayed by WeWork‘s eventual stock offering and its “community adjusted EBITDA.” Silicon Valley’s pixie dust can’t be that potent.

Powered by WPeMatico

Linear Labs, a startup developing an electric motor for cars, scooters, robots, wind turbines and even HVAC systems, has raised $4.5 million in a seed round led by Science Inc. and Kindred Ventures.

Investors Chris and Crystal Sacca, Ryan Graves of Saltwater Ventures, Dynamic Signal CEO Russ Fradin, Masergy executive chairman and former-CEO Chris MacFarland, as well as Ustream co-founder Gyula Feher also participated in the round.

The four-year-old company was founded by Brad and Fred Hunstable, who say they have invented a lighter, more flexible electric motor. The pair came up with the motor they’ve dubbed the Hunstable Electric Turbine (HET) while working to design a device that could pump clean water and provide power for small communities in underdeveloped regions of the world.

Linear Labs currently has 50 filed patents, 21 of which are issued, with 29 patents pending.

The founders come with a background in entrepreneurship and electrical engineering. Brad Hunstable is former CEO and founder of Ustream, the live-video-streaming service that sold to IBM in 2016 for $150 million. Fred Hunstable, who comes with a background in electrical engineering and nuclear power, led Ebasco and Walker Engineering’s efforts in designing, upgrading and completing electrical infrastructure, environmental and enterprise projects as well as safety and commercial-grade evaluation programs.

The HET uses multiple rotors that can adapt to varying conditions, according to the company. It also produces twice as much torque density and three times the power density than permanent magnet motors. Linear Labs says its motor produces two times the output per given motor size, and minimum 10 percent more range.

The HET design makes it ideally suited for mobility applications such as electric vehicles because it produces high levels of torque without the need for a gearbox. This helps cut production cuts, the company contends.

“The holy grail in electric motors has always been high torque and no gearbox, and the HET achieves both in a smaller, lighter and more efficient package that is more powerful than traditional motors,” Linear Labs CTO Fred Hunstable said in a statement.

The upshot could be electric vehicles with better range and more powerful electric scooters.

The commercialization of the electric motor will result in substantial leaps in terms of energy savings, reliability enhancement, and low-cost manufacturing, according to Babak Fahimi, founding director of the Renewable Energy and Vehicular Technology (REVT) Laboratory at the University of Texas at Dallas.

The company plans to use the seed funding to market its invention to customers. It’s also hiring talent and recently added new people to its leadership team, including John Curry as their president and Jon Hurry as vice president. Curry comes from KLA-Tencor and NanoPhotonics. Hurry has held positions at Tesla and Faraday Future.

Powered by WPeMatico

Innoviz, the Israel-based startup developing solid-state lidar sensors and perception software for autonomous vehicles, has raised $132 million in a Series C funding round that includes major Chinese financial institutions.

The round, which makes Innoviz one of the better capitalized lidar startups, includes China Merchants Capital (SINO-BLR Industrial Investment Fund, L.P.), Shenzhen Capital Group and New Alliance Capital. Israeli institutional investors Harel Insurance Investments and Financial Services and Phoenix Insurance Company also participated.

The Series C round will remain open for a second closing to be announced in the coming months, the company said.

Lidar measures distance using laser light to generate highly accurate 3D maps of the world around the car. It’s considered by most in the self-driving car industry a key piece of technology required to safely deploy robotaxis and other autonomous vehicles. Innoviz is developing solid-state lidar, which proponents of this technology say is more reliable over time because of the lack of moving parts.

Like so many startups with fresh capital, Innoviz plans to use the funds to scale up the company.

For Innoviz, this means increasing production of its lidar sensors and expanding its manufacturing capacity. Innoviz is focused on expanding in important automotive markets, including the U.S., Europe, Japan and China. Innoviz has been pushing into China over the past year through a partnership with the Chinese automotive supplier HiRain Technologies, a global supplier to some of China’s largest automakers.

That company has half of its business coming from China and has won nine of its supplier agreements with different automakers in the country through its HiRain partnership, according to people with knowledge of the company.

The company’s aim is to enable high-volume delivery of its automotive-grade lidar system called InnovizOne. This product can be produced and sold at a 90 percent lower cost than its first-generation system, according to Innoviz.

Innoviz said it also plans to expand its research and development efforts by investing in the buildout of next-generation products and software that will feature more cost reductions and improved performance.

Innoviz’s strategy has been to partner with a number of OEMs and Tier 1 suppliers such as Magna, HARMAN, HiRain Technologies and Aptiv and to package perception software with its lidar sensors and offer it as a complete unit for companies developing autonomous vehicle technology.

Innoviz has locked in several key customers, notably BMW. The automaker picked Innoviz’s tech for series production of autonomous vehicles starting in 2021.

In March, Lyft announced a partnership with Magna to help get its self-driving tech into various automakers, as well as implement the ride-hailing service into future autonomous cars. Innoviz raised $65 million in Series B funding in 2017, from strategic partners and leading auto industry suppliers Delphi Automotive and Magna International, along with other investors.

Powered by WPeMatico

Tribe, which helps brands acquire content from so-called “micro-influencers,” has raised $7.5 million in Series A funding.

The startup was founded in Australia in 2015 by TV and radio host Jules Lund, who told me he was responding to the growing demand for branded content.

“Brands are desperate for content,” Lund said. “When you have a hundred customer profiles and the ability to be hyper personalized and targeted and social, you now need 100 beautiful pieces of content. Creative agencies can’t supply that at the right cost and the right turnaround, and stock images are the antithesis of personalization, because they don’t feature your brand.”

As for how Tribe differs from all the other influencer marketing companies out there, Lund noted that it’s a purely self-serve product, where brands post their requests — either for an “influencer campaign,” where the influencers are creating content and promoting it to their followers, or a “content campaign,” which is just about creating the content — then users submit their work and get paid if the brand decides to use it.

Plus, the brands on the platform aren’t sending free stuff to influencers who may or may not be a good fit. Instead, Tribe is connecting them with influencers who already own (and presumably like) their products.

“Tribe’s role is to simply unlock all of that branded content that sits within people’s iPhones and Samsungs,” Lund said. “The micro-influencers are looking in their pantry or their wardrobe, looking at the apps in their phones, all of these products that they already use.”

Tribe says it’s already working with brands like Unilever, L’Oréal and Marvel and generating more than $250,000 worth of branded content every day. And while the United Kingdom is currently the company’s biggest market, the United States already accounts for 20 percent of the more than 50,000 influencers on the platform.

With the new funding, Tribe is officially launching in the U.S. and opening an office at One World Trade Center in Manhattan, which will be led by CEO Anthony Svirskis. He said the money will also allow Tribe to continue investing in its product.

“With TRIBE we’re finally seeing influencer marketing done right,” said Chris Burch, founder and CEO of investor Burch Creative Capital, in a statement. “The U.S. market has been waiting for a tech platform like this for years and as soon as we heard they were launching stateside, we knew we needed to be a part of it.”

Powered by WPeMatico

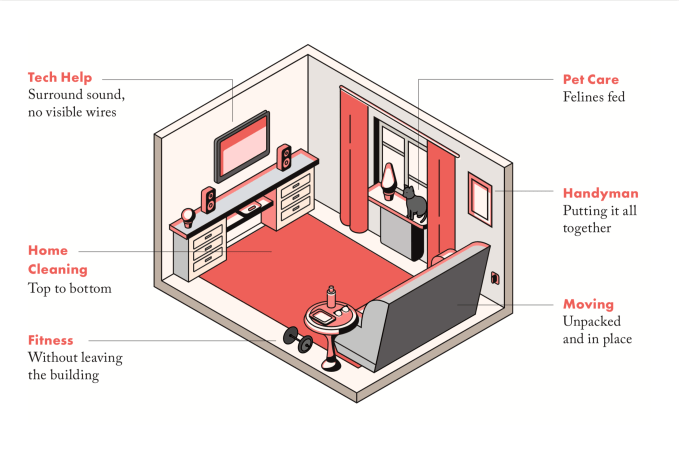

Hello Alfred — the startup that assigns in-home assistants to take care of your recurring chores and tasks — has announced the launch of a new service tier that will provide more properties and residents with access to the company’s underlying technology.

The company, which won the Startup Battlefield competition at our 2014 Disrupt event in San Francisco, looks to unlock valuable time for users by handling the long list of small routine items that add up over the course of a week and still require human oversight.

Hello Alfred partners with building owners to provide residents with dedicated home managers that assist with various errands and on-request services, such as apartment cleaning, grocery delivery, laundry services, prescription refills and more. Users have a direct line of communication with the company’s hospitality team through Hello Alfred’s mobile app, where they can manage tasks and set recurring appointments.

The new platform, “Powered by Alfred,” acts as a fairly similar but more accessible alternative to the company’s current offering. Residents in buildings equipped with “Powered by Alfred” are given access to all of the company’s solutions with the exception of the weekly visits from dedicated home managers currently included in the existing service. By excluding the dedicated in-home service, Hello Alfred is able to offer its new service tier at a lower price point and integrate with more buildings faster.

Property owners using “Powered by Alfred” can customize packages to include the services that best fit the needs of their residents and can upgrade or change service levels at any time. Both residents and building owners using the new platform are also given more control and direct access to Hello Alfred’s proprietary technology, allowing users to control functions that normally fall under the purview of the company’s dedicated home managers.

Additionally, with the launch of the new offering, Hello Alfred will be consolidating its various solutions under one central app, where residents and building managers can handle all inquiries, appointments and payments.

Hello Alfred’s new service tier, “Powered by Alfred,” provides a single, shared access point for resident and property owners to manage inquiries and drive property performance / Hello Alfred Press Kit

The launch of “Powered by Alfred” seems to be a natural evolution for the company, which seeks to make its offering more accessible to all residents of all backgrounds.

Hello Alfred previously employed a consumer-facing business model, in which customers would pay a monthly subscription fee for the array of in-home services and access to the company’s team of hospitality specialists, referred to as Alfreds.

However, around the time of the startup’s Series B round, Hello Alfred adopted the model of partnering directly with property owners to offer its services complimentary to residents. The partnership structure was not only a more conducive model for scaling but also enabled the company to offer the same services to any resident in an Alfred-equipped building, regardless of socioeconomic status.

Hello Alfred quickly built up a sizeable backlog of property owners hoping to integrate the platform into their units, according to the company. However, the task of maintaining dedicated staffing for every unit in every location made it difficult for the Alfred team to satisfy its swelling demand, having to instead focus resources primarily on luxury properties.

With “Powered by Alfred” removing in-home management services, the company has been able to improve accessibility and better satisfy the market’s appetite for its services, now rolling out the offering to non-luxury buildings and properties that previously sat in its pipeline.

Behind the launch of the new platform — which the company has piloted over the course of several months — Hello Alfred has increased its market share by more than 50 percent, with its services now available in more than 150,000 residential properties.

“We want Alfred to be a utility. We want to make “help” a universal utility and make it something anyone can access,” Hello Alfred CEO and co-founder Marcela Sapone told TechCrunch. “We wanted to find a way where we could accelerate growth and get human-focused help into urban buildings to help most urban environments.”

The launch represents the latest step in Hello Alfred’s broader expansion plans, which appear to have ramped up in recent months. Hello Alfred is now active in 16 cities — including Houston, where the company plans to launch next week — with its new offering available across all of its active markets. The startup already boasts an impressive partnership roster that includes more than 20 of the largest property owners in the U.S., and the Alfred team expects its new offering to open up further opportunities for partnerships across different property classes and different stages of a resident’s life cycle.

“As WeWork transformed commercial real estate, Hello Alfred is transforming residential real estate, and redefining what it means to live in a city today,” said Sapone. “This business expansion allows us to not only satisfy increasing demand for our service, but to connect every part of the resident experience — from the moment you sign your lease, until the moment you move to another Hello Alfred building.”

To date, the company has raised just over $63.5 million in venture capital, according to data from PitchBook, from prestigious investment brands that include New Enterprise Associates, Spark Capital, SV Angel, Moderne Ventures, Invesco and others.

Powered by WPeMatico

As we wrote last week in How Salesforce paved the way for the SaaS platform approach, the ability to build extensions, applications and even whole companies on top of the Salesforce platform set the stage and the bar for every SaaS company since. Vlocity certainly recognized that. Targeting five verticals, it built industry-specific CRM solutions on the Salesforce platform, and today announced a $60 million Series C round on a fat unicorn $1 billion valuation.

The round was led by Sutter Hill Ventures and Salesforce Ventures. New investors Bessemer Venture Partners and existing strategic investors Accenture and New York Life also participated. The company has now raised $163 million.

Company co-founder and CEO David Schmaier, whose extensive career includes stints with Siebel Systems and Oracle, says he and his co-founders (three of whom helped launch Veeva) wanted to take the idea of Veeva, which is a life sciences-focused company built on top of Salesforce, and extend that idea across five verticals instead of just one. Those five verticals include communications and media, insurance and financial services, health, energy and utilities and government and nonprofits.

The idea he said was to build a company with a market that was 10x the size of life sciences. “What we’re doing now is building five Veevas at once. If you could buy a product already tailored to the needs of your industry, why wouldn’t you do that?,” Schmaier said.

The theory seems to be working. He says that the company, which was founded in 2014, has already reached $100 million in revenue and expects to double that by the end of this year. Then of course, there is the unicorn valuation. While perhaps not as rare as it once was, reaching the $1 billion level is still a significant milestone for a startup.

In the Salesforce platform story, co-founder and CTO Parker Harris addressed the need for solutions like the ones from Veeva and Vlocity. “…Harris said they couldn’t build one Salesforce for healthcare and another for insurance and a third one for finance. We knew that wouldn’t scale, and so the platform [eventually] just evolved out of this really close relationship with our customers and the needs they had.” In other words, Salesforce made the platform flexible enough for companies like these to fill in the blanks.

“Vlocity is a perfect example of the incredible innovation occurring in the Salesforce ecosystem and how we are working together to provide customers in all industries the technologies they need to attract and serve customers in smarter ways,” Jujhar Singh, EVP and GM for Salesforce Industries said in a statement.

It’s also telling that of the three strategic investors in this round — New York Life, Accenture and Salesforce Ventures — Salesforce is the biggest investor, according to Schmaier.

The company has 150 customers, including investor New York Life, Verizon (which owns this publication), Cigna and the City of New York. It already has 700 employees in 20 countries. With this additional investment, you can expect those numbers to increase.

“What this Series C round allows us to do is to really put the gas on investing in product development, because verticals are all about going deep,” Schmaier said.

Powered by WPeMatico