Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Sure, we just aired a new episode, but things keep happening, and after talking about this crop of IPOs for so long, we can’t help ourselves. (You can follow us on Twitter, here and here, by the way, if Equity isn’t enough for you.)

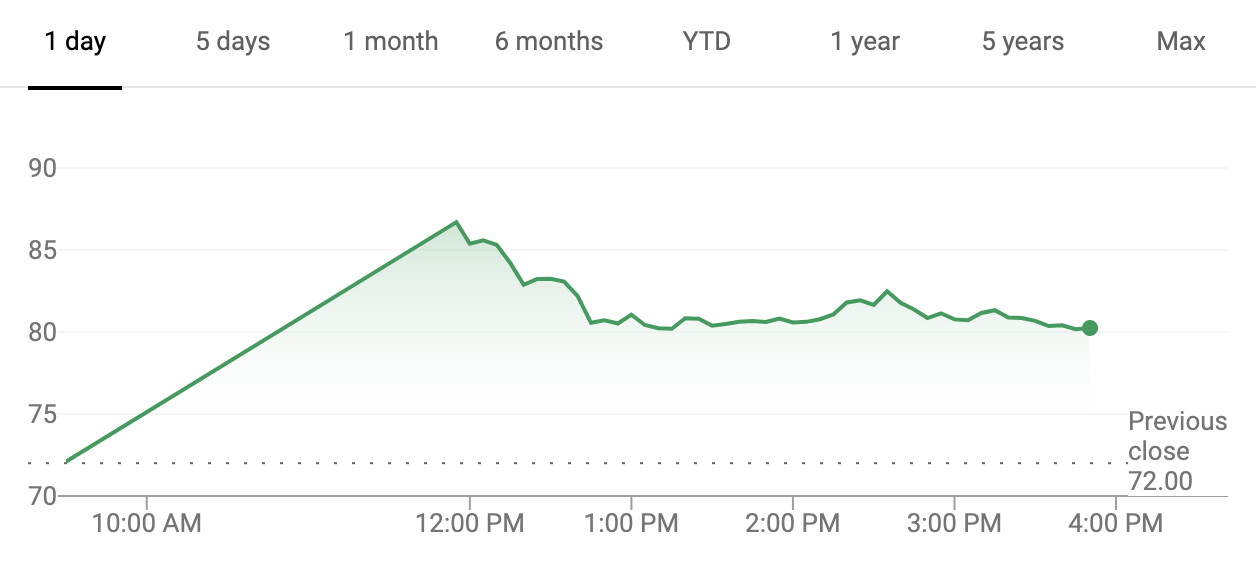

Lyft, as you know, started trading today, closing the loop on a long saga that brought the smaller of the two domestic ride-hailing unicorns to the public markets.

After so much speculation about which of the two would get out the door first, Lyft did, and now we get to see what sort of pricing shenanigans happen next. Does Uber drop rates and punish Lyft? Or does Uber work to cut its losses, lowering its expenses and providing a clearer path toward profitability before its April IPO roadshow kicks off? (Not a path to profitability, mind; Uber and Lyft need to show a path to the direction of profitability first.)

We hit all the bases, going over the company’s pricing path, its varying share figures, final raise metrics and more. If you want the hard stuff, we’ve got a shot for you.

Now that the Lyft IPO has wrapped, we’ll be shifting our focus to Pinterest, Zoom and, of course, Uber. Stay tuned.

OK, now we’re done. Until next Friday. Unless something else happens.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Amid calls for a dozen different global cities to replace Silicon Valley — Austin, Beijing, London, New York — nobody has yet nominated “nowhere.” But it’s now a possibility.

There are two trends to unpack here. The first is startups that are fully, or almost fully, remote, with employees distributed around the world. There’s a growing list of significant companies in this category: Automattic, Buffer, GitLab, Invision, Toptal and Zapier all have from 100 to nearly 1,000 remote employees.

The second trend is nomadic founders with no fixed location. For a generation of founders, moving to Silicon Valley was de rigueur. Later, the emergence of accelerators and investors worldwide allowed a wider range of potential home bases. But now there’s a third wave: a culture of traveling with its own, growing support networks and best practices.

You don’t have to look far to find startup gurus and VCs who strongly advise against being remote, much less a nomad. The basic reasoning is simple: Not having a location doesn’t add anything, so why do it? Startups are fragile, so it’s best to avoid any work practice that could disrupt delicate growth cycles.

Powered by WPeMatico

Pink confetti fell from the ceiling Friday as Lyft co-founders Logan Green and John Zimmer celebrated their company’s IPO. The stock offering was a bona fide success, with shares selling for $87.24 apiece Friday morning — 21 percent higher than Lyft’s initial $72 share price — and closing at $78.29 per share.

Lyft raised roughly $2.3 billion Thursday evening, hours before ringing the opening bell of the Nasdaq on Friday around noon Pacific. The IPO gave Lyft an initial market cap of about $24 billion, representing an 11x revenue multiple and a 1.6x step-up from its most recent private valuation of $15.1 billion.

On Bloomberg TV, Lyft’s co-founders discussed the company’s long-term prospects, including international growth, autonomous vehicle plans, the future of car ownership and insurance.

“We are confident that the business will be very profitable,” Green told Emily Chang. “We are making tremendous progress going after this once-in-a-generation shift where this entire industry, a $1.2 trillion market, could flip from an ownership model to a service model and we are leading the way there.”

The pair opted to host their IPO in Los Angeles, Lyft’s largest market.

“We want to make a point that you can both invest in communities and build a great business,” Zimmer said. “It was fun to ring the bell with several members of our driver community and have many of them participate in our IPO because we gave them a bonus to do so.”

Powered by WPeMatico

1stdibs began pushing the antiques business into the 21st century long ago. Apparently, investors think it can push further and faster with $76 million in new funding. That’s how much the now-18-year-old, New York-based company says it just closed on for its Series D round, led by T. Rowe Price Associates, with participation from earlier backers Index Ventures, Benchmark and Spark Capital.

The company now boasts a valuation of well over $500 million, it tells the WSJ. Other investors in the new round include Sofina Group, Foxhaven Asset Management, and Allen & Company, as well as Michael Zeisser, who is the former chairman of U.S. Investments for Alibaba Group, and Groupe Artémis, which owns the auction house Christie’s.

1stdibs has always been an interesting startup, one that’s both loved by the antiques dealers who use it, and, apparently, feared. When, in 2016, 1stdibs became heavier-handed about enforcing the commissions from each sale on its platform — and on which it relies for revenue — more than 30 dealers reportedly met at a design store in lower Manhattan to grouse about the development, complaining that the company had begun prizing revenue growth over its relationships.

Of course, with venture-capital funding — and the company has now collected $170 million altogether — comes expectations. And despite pushback from dealers, they’ve apparently stuck with the platform. 1stdibs says an average of 50 items sell for more than $5,000 on its platform daily, and that 15 of these are items that sell for more than $10,000. (A quick scan suggests a very wide range of prices, with many vintage items priced at $5,000 or less, but plenty with far richer tags, like a three-carat ruby and diamond ring available right now on the site for a cool $200,000, and a chandelier dating back to roughly 1870 and selling, someone is hoping, for more than $300,000.)

With venture funding comes competition, too. Though 1stdibs may be the doyen of the online antiques market, other, newer companies eyeing its traction have since emerged on the scene, many of which have also since raised venture funding and are also growing fast, including The RealReal, which was founded in 2011 and is reportedly weighing a public offering; and Chairish, founded in 2013, which sells vintage and used decor.

Chairish has raised just $16.7 million from investors to date. The RealReal has raised $288 million.

In fact, a fight for brand recognition in what’s become an increasingly crowded playing field as the U.S. population ages (and more antiques are dispersed into the world) may ultimately lead 1stdibs to follow a growing number of formerly online-only marketplaces now extending their reach into the offline world.

Though the company already has a New York location, in a block-long, late-19th-century warehouse called the Terminal Stores building, CEO David Rosenblatt tells the WSJ that using its new funding, more brick-and-mortar showrooms may be in its future.

Powered by WPeMatico

Political parties, campaigns and brands can’t get an accurate and cost-effective understanding of opinion in small geographic areas, like the constituencies of lawmakers. This is a big problem in political campaigning. And all political campaigning now has a huge online element, as we know. We also know political turbulence is one of the defining themes of our age.

But one thing is clear: All the players want faster, cheaper, more accurate and a more granular understanding of consumers and voters. In the age of AI, survey predictions are influenced as much as so many other machine-learning technology products.

Focaldata is a U.K. startup that thinks it has some of the answers to these quandaries. Their integrated consumer analytics and survey workflow application claims to give customers a more accurate and granular picture of consumers than traditional polling using machine learning. At the same time, they say their workflow software cuts down on the cost and time that market research takes.

The idea is that they employ a new machine learning-based technique (MRP) to generate survey “results.” This new methodology can use more information (such as old survey data or public statistics) than conventional methods, which lets them get accurate predictions in small geographic areas from the same sample sizes.

Founder Justin Ibbett had done MRP manually on his laptop a few times for some existing market research firms and realized how fiddly it was. “I felt a dedicated software application would reduce the complexity whilst making the results more accessible and useful — our early incarnations just delivered a spreadsheet!” he told me.

Much of Focaldata’s business has been in politics. They have worked with the pro-Remain group Best for Britain and the anti-Racism charity Hope not Hate on combating Far Right sentiment. However, most demand is now from large brand owners, such as ABInBev, a recent client.

They now have more than 10 paying clients, including big brands like M&C Saatchi.

Competitors include YouGov, Survation, Dalia Research (a Balderton-backed company) and standard market research agencies like Kantar and Ipsos Mori.

But against traditional agencies, Ibbett says their ML-based data processing engine sets them apart, allowing them to go very granular and get more accurate over time.

The market research market is £5 billion in the U.K. alone (PwC report, 2016) and global market research is a $40 billion market.

The startup has raised a £1.1 million seed round from notable U.K. angels, including Alex Chesterman, founder of Zoopla and Martin Bolland, founder of Alchemy Partners. Previously they raised a small pre-seed round from three other angels, including Xen Lategan (backer of Magic Pony and ex-Google, former CTO of News International).

CTO and co-founder Calvin Dudek was at Google for five years as a product manager, and ran Data Science Innovation at the DWP. Chief Data Scientist Takao Noguchi is a cognitive scientist.

Powered by WPeMatico

Nativo has acquired SimpleReach, a move that Nativo CEO Justin Choi said will pair his company’s distribution system for native ads with SimpleReach’s measurement tools.

“If you can’t measure the impact of something, it’s difficult to scale spend in that area,” Choi told me. “When we say measurement we’re actually talking about connecting content to outcomes.”

To be clear, Nativo already offers measurement tools of its own, but apparently they’re limited to content that the brand or marketer is publishing on their own sites. SimpleReach, on the other hand, can measure sponsored content programs published elsewhere on the web, so Choi said it provides a “complementary measurement technology.”

Both Nativo and SimpleReach are long-standing players (and partners) in the native advertising and content marketing industry. Choi said Nativo has succeeded by “focusing on content,” and on the “mid-funnel” of the customer purchase journey.

“Almost all our relationships involve … the actual brands themselves, because we do solve a unique problem for them,” Choi said. “That middle part of: How you get someone to consider something? How do you create intent?”

The companies aren’t disclosing the financial terms of the acquisition. SimpleReach has raised a total of $24 million from investors, including MK Capital, Atlas Ventures, Village Ventures, High Peak Venture Partners and Spring Mountain Capital.

Choi said the company will continue to support SimpleReach as a separate product while also working to integrate its data into Nativo. Apparently “all the core team members” are joining Nativo, as is an off-site engineering team.

He added that the remaining team members have already been hired elsewhere (Update: It’s WeWork-owned Conductor), so “everyone that wanted a home ended up with a home.”

Updated to remove a reference to the number of SimpleReach employees joining Nativo, which a company spokesperson said was not accurate.

Powered by WPeMatico

If you took the photos and videos out of pornography, could it appeal to a new audience? Caroline Spiegel’s first startup Quinn aims to bring some imagination to adult entertainment. Her older brother, Snapchat CEO Evan Spiegel, spent years trying to convince people his app wasn’t just for sexy texting. Now Caroline is building a website dedicated to sexy text and audio. The 22-year-old college senior tells TechCrunch that on April 13th she’ll launch Quinn, which she describes as “a much less gross, more fun Pornhub for women.”

TechCrunch checked out Quinn’s private beta site, which is pretty bare bones right now. Caroline tells us she’s already raised less than a million dollars for the project. But given her brother’s success spotting the next generation’s behavior patterns and turning them into beloved products, Caroline might find investors are eager to throw cash at Quinn. That’s especially true given she’s taking a contrarian approach. There will be no imagery on Quinn.

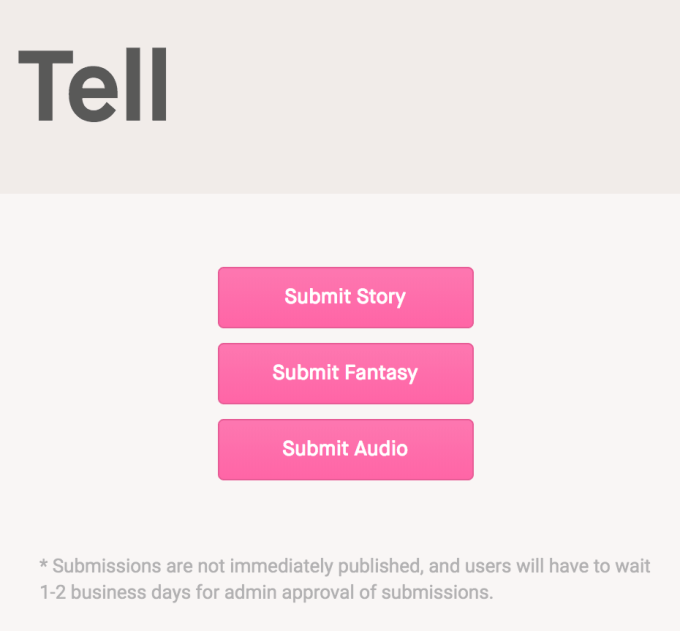

Caroline explains that “There’s no visual content on the site — just audio and written stories. And the whole thing is open source, so people can submit content and fantasies, etc. Everything is vetted by us before it goes on the site.” The computer science major is building Quinn with a three-woman team of her best friends she met while at Stanford, including Greta Meyer, though they plan to relocate to LA after graduation.

The idea for Quinn sprung from a deeply personal need. “I came up with it because I had to leave Stanford my junior year because I was struggling with anorexia and sexual dysfunction that came along with that,” Caroline tells me. “I started to do a lot of research into sexual dysfunction cures. There are about 30 FDA-approved drugs for sexual dysfunction for men but zero for women, and that’s a big bummer.”

She believes there’s still a stigma around women pleasuring themselves, leading to a lack of products offering assistance. Sure, there are plenty of porn sites, but few are explicitly designed for women, and fewer stray outside of visual content. Caroline says photos and videos can create body image pressure, but with text and audio, anyone can imagine themselves in a scene. “Most visual media perpetuates the male gaze … all mainstream porn tells one story … You don’t have to fit one idea of what a woman should look like.”

That concept fits with the startup’s name “Quinn,” which Caroline says one of her best guy friends thought up. “He said this girl he met — his dream girl — was named ‘Quinn.’ ”

Caroline took to Reddit and Tumblr to find Quinn’s first creators. Reddit stuck to text and links for much of its history, fostering the kinky literature and audio communities. And when Tumblr banned porn in December, it left a legion of adult content makers looking for a new home. “Our audio ranges from guided masturbation to overheard sex, and there’s also narrated stories. It’s literally everything. Different strokes for different for folks, know what I mean?” Caroline says with a cheeky laugh.

To establish its brand, Quinn is running social media influencer campaigns where “The basic idea is to make people feel like it’s okay to experience pleasure. It’s hard to make something like masturbation cool, so that’s a little bit of a lofty goal. We’re just trying to make it feel okay, and even more okay than it is for men.”

As for the business model, Caroline’s research found younger women were embarrassed to pay for porn. Instead, Quinn plans to run ads, though there could be commerce opportunities too. And because the site doesn’t bombard users with nude photos or hardcore videos, it might be able to attract sponsors that most porn sites can’t.

Until monetization spins up, Quinn has the sub-$1 million in funding that Caroline won’t reveal the source of, though she confirms it’s not from her brother. “I wouldn’t say that he’s particularly involved other than he’s one of the most important people in my life and I talk to him all the time. He gives me the best advice I can imagine,” the younger sibling says. “He doesn’t have any qualms, he’s very supportive.”

Quinn will need all the morale it can get, as Caroline bluntly admits, “We have a lot of competitors.” There’s the traditional stuff like Pornhub, user-generated content sites like Make Love Not Porn and spontaneous communities like on Reddit. She calls $5 million-funded audio porn startup Dipsea “an exciting competitor,” though she notes that “we sway a little more erotic than they do, but we’re so supportive of their mission.” How friendly.

Quinn’s biggest rival will likely be outdated but institutionalized site Literotica, which SimilarWeb ranks as the 60th most popular adult website, 631st most visited site overall, showing it gets 53 million hits per month. But the fact that Literotica looks like a web 1.0 forum yet has so much traffic signals a massive opportunity for Quinn. With rules prohibiting Quinn from launching native mobile apps, it will have to put all its effort into making its website stand out if it’s going to survive.

But more than competition, Caroline fears that Quinn will have to convince women to give its style of porn a try. “Basically, there’s this idea that for men, masturbation is an innate drive and for women it’s a ‘could do without it, could do with it.’ Quinn is going to have to make a market alongside a product and that terrifies me,” Caroline says, her voice building with enthusiasm. “But that’s what excites me the most about it, because what I’m banking on is if you’ve never had chocolate before, you don’t know. But once you have it, you start craving it. A lot of women haven’t experienced raw, visceral pleasure before, [but once we help them find it] we’ll have momentum.”

Most importantly, Quinn wants all women to feel they have rightful access to whatever they fancy. “It’s not about deserving to feel great. You don’t have to do Pilates to use this. You don’t have to always eat right. There’s no deserving with our product. Our mission is for women to be more in touch with themselves and feel fucking great. It’s all about pleasure and good vibes.”

Powered by WPeMatico

It’s not uncommon to hear CEOs and business leaders talk about focusing on the consumer. But the only way to build for the consumer is to hear what they want, which can be a resource-intensive thing to retrieve.

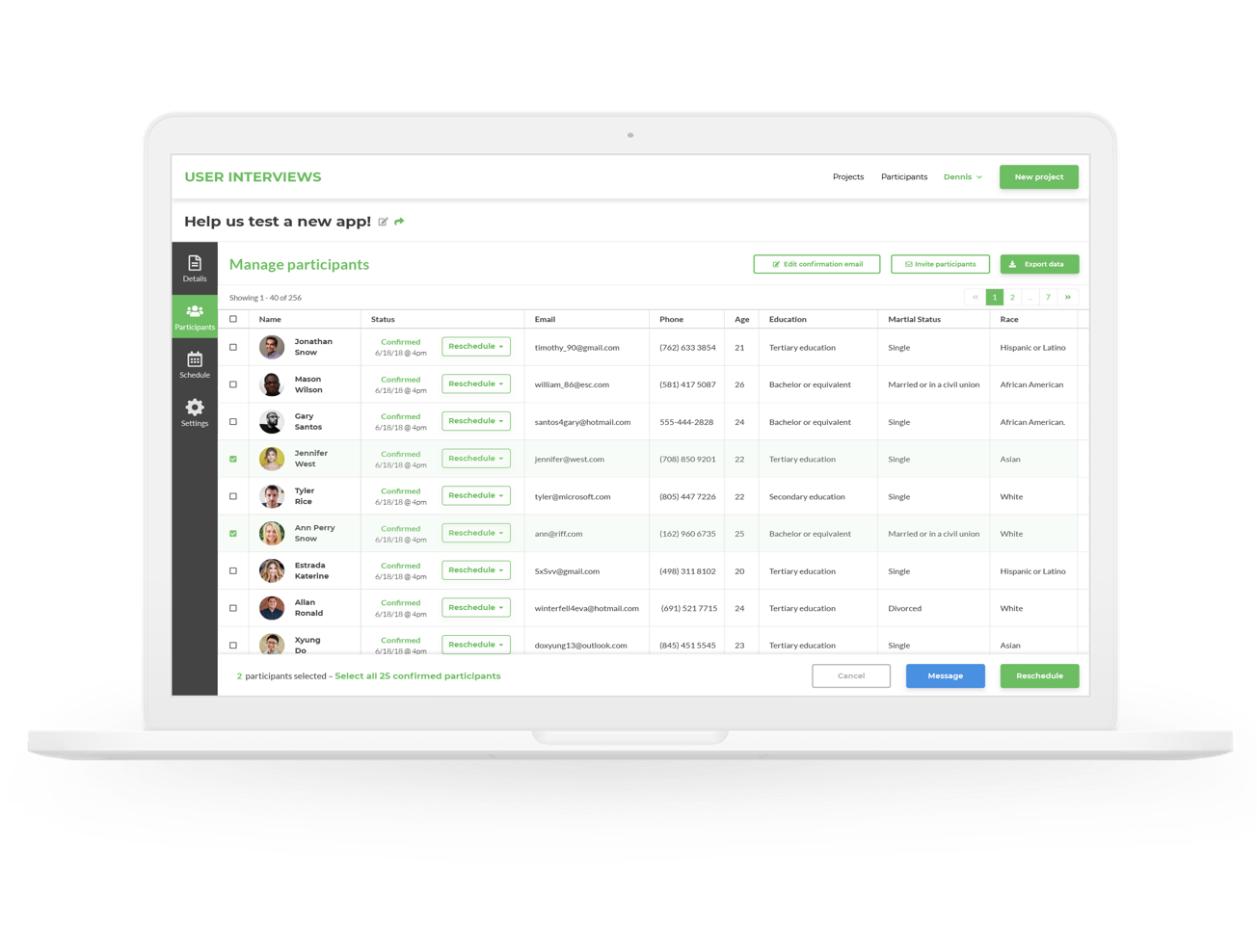

User Interviews, an ERA-backed company out of New York, is looking to lighten that load with a fresh $5 million in seed funding from Accomplice, Las Olas, FJ Labs and ERA.

User Interviews actually started out as Mobile Suites, an amenities logistics platform for hotels. It was a dud, and the team — Basel Fakhoury, Dennis Meng and Bob Saris — decided to do far more user research before determining the next product.

In the process of talking to customers to understand their pain points, they realized just how difficult collecting user feedback could be.

That’s how User Interviews was born. The platform’s first product, called Recruit, offers a network of non-users that can be matched with companies to provide feedback. In fact, User Interviews’ first sales were made by simply responding to Craigslist ads posted by companies looking for non-users from which they could collect feedback. But because the majority of user research is based on existing users, the company also built Research Hub, which is essentially a CRM system for user feedback and research. To be clear, User Interviews doesn’t facilitate the actual interviews with users, but tracks the feedback, facilitates sending emails and ensures that no one from the research team is reaching out to a single user too often.

But because the majority of user research is based on existing users, the company also built Research Hub, which is essentially a CRM system for user feedback and research. To be clear, User Interviews doesn’t facilitate the actual interviews with users, but tracks the feedback, facilitates sending emails and ensures that no one from the research team is reaching out to a single user too often.

With Recruit, User Interviews charges $30/person that it matches with a company for feedback. Research Hub costs starts at $150/month.

“Right now, our greatest challenge is that our clients are the best product people in the world, and we have a huge pipeline of amazing ideas that are very valuable and no one is doing yet that our clients would love,” said CEO and cofounder Basel Fakhoury. “But we have to build it fast enough.”

No mention of what those forthcoming products might be, but the current iteration sure seems attractive enough. User Interviews clients include Eventbrite, Glassdoor, AT&T, DirecTV, Lola, LogMeIn, Thumbtack, Casper, ClassPass, Fandango, NNG, Pinterest, Pandora, Colgate, Uber and REI, to name a few.

Powered by WPeMatico

Betaworks Studios, the brainchild of New York City seed-stage venture capital fund Betaworks, has amassed the support of WeWork, or The We Company, as they now call themselves.

JLL Spark Ventures and the co-working giant have led co-led a $4.4 million investment in the membership-based co-working club described as a supportive community for builders. Launched in 2018, Betaworks Studios offers entrepreneurs, artists, engineers and creatives a place to work on projects and accumulate a network, similar to a WeWork hub.

Betaworks Ventures, which filed today to raise a $75 million sophomore fund, and BBG Ventures have also participated in the funding for Betaworks Studio, which previously raised a pre-seed round led by BBG.

Founded in 2008 by John Borthwick, Betaworks operates an investment fund, an accelerator and builds companies internally with spinouts including Giphy, Digg and Bit.ly. The idea for Betaworks Studios was to expand its resources and network to the greater entrepreneurial community.

Borthwick brought on Daphne Kwon, the former chief financial officer of Goop, to run the studio arm, which charges $2400 per year or $225 per month.

Betaworks says its studio has hosted some 9,000 people for meetings and speaking events. It currently has only one club location in New York City’s Meatpacking District but plans to open additional studios with the fresh cash.

Powered by WPeMatico

DoorDash launched a new initiative today called Kitchens Without Borders, which it says is designed to promote business owners who are immigrants and refugees.

It’s starting out with 10 restaurants in the San Francisco Bay Area: Besharam, Z Zoul Cafe, Onigilly, Los Cilantros, Sabores Del Sur, West Park Farm & Sea, Little Green Cyclo, Afghan Village, D’Maize and Sweet Lime Thai Cuisine.

The entrepreneurs behind each of these businesses is profiled on the Kitchens Without Borders site. Their restaurants will also get promoted within the DoorDash app, and they’ll receive $0 delivery fees for up to six weeks.

A DoorDash spokesperson told me the initial 10 participants were selected from 60 applicants, and that the program will be expanding to include other restaurants across the country in the coming months.

This announcement comes a month after DoorDash announced that it had raised another $400 million in funding. The company also drew criticism earlier this year for its driver compensation practices.

In a blog post, CEO Tony Xu said he has a personal connection to the program:

For one, I’m an immigrant. I moved to this country from China when I was five, and my mom ran a Chinese restaurant with the purpose of creating a better life and fulfilling her dream of becoming a doctor. I worked alongside her as a dishwasher and saw firsthand what it takes to make it in this country. Over the course of 12 years, she eventually saved up enough money to become the doctor that she wanted to be and opened up a medical clinic, which she has now been running for the past 20 years.

Powered by WPeMatico