Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Jeffrey Katzenberg’s upcoming mobile streaming service Quibi has added another notable name to its roster of executive talent. The company announced it has hired Tom Conrad, previously VP of product at Snap (maker of Snapchat), and a co-creator of Pandora, where he served as chief technology officer. At Quibi, Conrad will be chief product officer, which will see him leading product, user research and customer support.

The news of Conrad’s hire was first reported by Variety on Monday, which also noted Conrad had served on Quibi’s board since late 2018 and was officially hired as CPO on March 25. He will report to Quibi CEO Meg Whitman in his new role.

Conrad will play a big part in Quibi’s success (or lack thereof, if it doesn’t fare well!), as a significant aspect to the service is to be the app’s mobile design. Unlike modern streaming services like Netflix, Quibi aims to offer short-form, high-quality video cut into smaller pieces for easy consumption on a smartphone. At this year’s SXSW, Whitman explained the Quibi advantage, noting how the technology it’s using will allow the company to do “full-screen video seamlessly from landscape to portrait.”

At Quibi, Conrad’s understanding of streaming services, thanks to his time at Pandora, and apps favored by young users, thanks to his role at Snap, will surely come into play.

Conrad left Snap in 2018 at a critical time for the popular social app. Its massive redesign had just rolled out, and was destroyed by early user reviews, with the majority giving the update one or two stars when it hit. The design was later rolled back. However, Snap CEO Evan Spiegel was the product decision maker — Conrad was more involved in terms of execution. That experience, however, may have given Conrad insight into what doesn’t work for the young Gen Z crowd, as much as what does.

Conrad left Snap in 2018 at a critical time for the popular social app. Its massive redesign had just rolled out, and was destroyed by early user reviews, with the majority giving the update one or two stars when it hit. The design was later rolled back. However, Snap CEO Evan Spiegel was the product decision maker — Conrad was more involved in terms of execution. That experience, however, may have given Conrad insight into what doesn’t work for the young Gen Z crowd, as much as what does.

The executive also spent a decade at Pandora, as CTO and EVP of Product, which saw him leading the teams that designed, developed and maintained the Pandora apps across platforms — including web, mobile and other consumer electronics devices, as well as automotive. While Quibi is focused on being a mobile streaming app, it’s hard to imagine a streaming service that refuses to ever go cross-platform — especially since the majority of viewing of today’s streaming service viewing takes place on a television. (Even when it’s the streaming service from YouTube.)

With its billion-dollar backing from investors, Quibi has been able to snag several big names for its exec ranks, in addition to its CEO Meg Whitman, and now Conrad.

In March, the company said it landed top CAA agent Jim Toth (married to power producer Reese Witherspoon, by the way). Toth’s clients at CAA included Matthew McConaughey, Robert Downey Jr., Scarlett Johansson, Jamie Foxx, Zoe Saldana, Chris Evans, Salma Hayek, Zooey Deschanel and Neil Patrick Harris.

Quibi also hired former DC and Warner Bros. exec Diane Nelson to run operations. Nelson had served as president of DC Entertainment since 2009, and helped spearhead development of the DC Universe movies and shows.

In addition, the streaming service itself has already been signing big-name talent for its content, including Catherine Hardwicke, Antoine Fuqua, Guillermo del Toro, Sam Raimi and Lena Waithe. It’s also working with Steph Curry’s production company and most recently announced — awkward alert? — a show detailing Snapchat’s founding, focused on Evan Spiegel’s rise.

Image credit: Conrad, via Crunchbase

Powered by WPeMatico

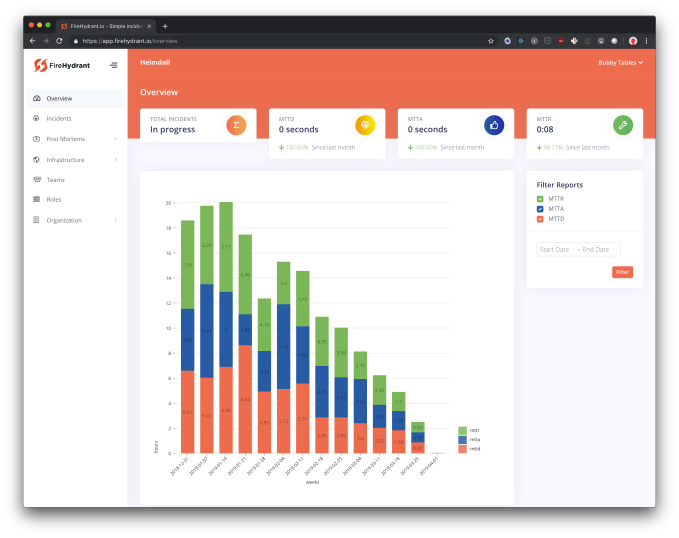

FireHydrant, an NYC startup, wants to help companies recover from IT disasters more quickly, and understand why they happened — with the goal of preventing similar future scenarios from happening again. Today, the fledgling startup announced a $1.5 million seed investment from Work-Bench, a New York City venture capital firm that invests in early-stage enterprise startups.

In addition to the funding, the company announced it was opening registration for its FireHydrant incident management platform. The product has been designed with Google’s Site Reliability Engineering (SRE) methodology in mind, but company co-founder and CEO Bobby Ross says the tool is designed to help anyone understand the cause of a disaster, regardless of what happened, and whether they practice SRE or not.

“I had been involved in several fire fighting scenarios — from production databases being dropped to Kubernetes upgrades gone wrong — and every incident had a common theme: absolute chaos,” Ross wrote in a blog post announcing the new product.

The product has two main purposes, according to Ross. It helps you figure out what’s happening as you attempt to recover from an ongoing disaster scenario, and once you’ve put out the fire, it lets you do a post-mortem to figure out exactly what happened with the hope of making sure that particular disaster doesn’t happen again.

As Ross describes it, a tool like PagerDuty can alert you that there’s a problem, but FireHydrant lets you figure out what specifically is going wrong and how to solve it. He says that the tool works by analyzing change logs, as a change is often the primary culprit of IT incidents. When you have an incident, FireHydrant will surface that suspected change, so you can check it first.

“We’ll say, hey, you had something change recently in this vicinity where you have an alert going off. There is a high likelihood that this change was actually causing your incident. And we actually bubble that up and mark it as a suspect,” Ross explained.

Screenshot: FireHydrant

Like so many startups, the company developed from a pain point the founders were feeling. The three founders were responsible for solving major outages at companies like Namely, DigitalOcean, CoreOS and Paperless Post.

But the actual idea for the company came about almost accidentally. In 2017, Ross was working on a series of videos and needed a way to explain what he was teaching. “I began writing every line of code with live commentary, and soon FireHydrant started to take the shape of what I envisioned as an SRE while at Namely, and I started to want it more than the video series. 40 hours of screencasts recorded later, I decided to stop recording and focus on the product…,” Ross wrote in the blog post.

Today it integrates with PagerDuty, GitHub and Slack, but the company is just getting started with the three founders, all engineers, working on the product and a handful of beta customers. It is planning to hire more engineers to keep building out the product. It’s early days, but if this tool works as described, it could go a long way toward solving the fire-fighting issues that every company faces at some point.

Powered by WPeMatico

Pixeom, a startup that offers a software-defined edge computing platform to enterprises, today announced that it has raised a $15 million funding round from Intel Capital, National Grid Partners and previous investor Samsung Catalyst Fund. The company plans to use the new funding to expand its go-to-market capacity and invest in product development.

If the Pixeom name sounds familiar, that may be because you remember it as a Raspberry Pi-based personal cloud platform. Indeed, that’s the service the company first launched back in 2014. It quickly pivoted to an enterprise model, though. As Pixeom CEO Sam Nagar told me, that pivot came about after a conversation the company had with Samsung about adopting its product for that company’s needs. In addition, it was also hard to find venture funding. The original Pixeom device allowed users to set up their own personal cloud storage and other applications at home. While there is surely a market for these devices, especially among privacy-conscious tech enthusiasts, it’s not massive, especially as users became more comfortable with storing their data in the cloud. “One of the major drivers [for the pivot] was that it was actually very difficult to get VC funding in an industry where the market trends were all skewing towards the cloud,” Nagar told me.

At the time of its launch, Pixeom also based its technology on OpenStack, the massive open-source project that helps enterprises manage their own data centers, which isn’t exactly known as a service that can easily be run on a single machine, let alone a low-powered one. Today, Pixeom uses containers to ship and manage its software on the edge.

What sets Pixeom apart from other edge computing platforms is that it can run on commodity hardware. There’s no need to buy a specific hardware configuration to run the software, unlike Microsoft’s Azure Stack or similar services. That makes it significantly more affordable to get started and allows potential customers to reuse some of their existing hardware investments.

What sets Pixeom apart from other edge computing platforms is that it can run on commodity hardware. There’s no need to buy a specific hardware configuration to run the software, unlike Microsoft’s Azure Stack or similar services. That makes it significantly more affordable to get started and allows potential customers to reuse some of their existing hardware investments.

Pixeom brands this capability as “software-defined edge computing” and there is clearly a market for this kind of service. While the company hasn’t made a lot of waves in the press, more than a dozen Fortune 500 companies now use its services. With that, the company now has revenues in the double-digit millions and its software manages more than a million devices worldwide.

As is so often the case in the enterprise software world, these clients don’t want to be named, but Nagar tells me they include one of the world’s largest fast food chains, for example, which uses the Pixeom platform in its stores.

On the software side, Pixeom is relatively cloud agnostic. One nifty feature of the platform is that it is API-compatible with Google Cloud Platform, AWS and Azure and offers an extensive subset of those platforms’ core storage and compute services, including a set of machine learning tools. Pixeom’s implementation may be different, but for an app, the edge endpoint on a Pixeom machine reacts the same way as its equivalent endpoint on AWS, for example.

Until now, Pixeom mostly financed its expansion — and the salary of its more than 90 employees — from its revenue. It only took a small funding round when it first launched the original device (together with a Kickstarter campaign). Technically, this new funding round is part of this, so depending on how you want to look at this, we’re either talking about a very large seed round or a Series A round.

Powered by WPeMatico

San Diego-based Edgybees today announced the launch of Argus, its API-based developer platform that makes it easy to add augmented reality features to live video feeds.

The service has long used this capability to run its own drone platform for first responders and enterprise customers, which allows its users to tag and track objects and people in emergency situations, for example, to create better situational awareness for first responders.

I first saw a demo of the service a year ago, when the team walked a group of journalists through a simulated emergency, with live drone footage and an overlay of a street map and the location of ambulances and other emergency personnel. It’s clear how these features could be used in other situations as well, given that few companies have the expertise to combine the video footage, GPS data and other information, including geographic information systems, for their own custom projects.

Indeed, that’s what inspired the team to open up its platform. As the Edgybees team told me during an interview at the Ourcrowd Summit last month, it’s impossible for the company to build a new solution for every vertical that could make use of it. So instead of even trying (though it’ll keep refining its existing products), it’s now opening up its platform.

“The potential for augmented reality beyond the entertainment sector is endless, especially as video becomes an essential medium for organizations relying on drone footage or CCTV,” said Adam Kaplan, CEO and co-founder of Edgybees. “As forward-thinking industries look to make sense of all the data at their fingertips, we’re giving developers a way to tailor our offering and set them up for success.”

In the run-up to today’s launch, the company has already worked with organizations like the PGA to use its software to enhance the live coverage of its golf tournaments.

Powered by WPeMatico

There’s no shortage of so-called femtech startups raising money right now, and little wonder why.

Aside from the growing market opportunity — the global fertility services market is expected to reach $31 billion by 2023, says the consultancy Allied Market Research, nearly double where it stood in 2016 — more women are clamoring for information about their reproductive health, and 15-minute doctor visits aren’t doing the trick.

The newest recipient of venture dollars: NextGen Jane, a 4.5-year-old, Oakland, Calif.-based company that’s hoping to use blood wrung from tampons to find early markers of endometriosis and, later, if all goes well, cervical cancer and other disorders.

The company disclosed just today that it has secured $9 million in Series A funding led by Material Impact, a new fund focused on materials technology that we reported on last November. Other participants in the round include Access Industries, Viking Global Investors, Liminal Ventures and numerous notable angels, including PhDs from Harvard Medical School and Stanford University.

Its approach is far more palatable than the option women have long suffered, which is to have a small camera inserted into their pelvic cavity in search of endometrial cells. (Note: Women typically wind up in this position only after enduring bewildering pain that drives them to see their doctors.) The idea with NextGen Jane instead is for a custom-made tampon to be worn for roughly two hours, placed inside a test tube as part of a home kit and sent to a lab for further analysis.

Of course, it needs to work first, and the technology hasn’t been approved by the FDA. In fact, it hasn’t been proven at all.

The funding could, potentially, make the difference. In an interview with Technology Review last month, NextGen CEO and co-founder Ridhi Tariyal said that a clinical trial is designed and ready to go, but that NextGen Jane needed capital to run a trial on roughly 800 women in order to establish the diagnostic efficacy of menstrual blood. With funding, she’d said, it would take the company about two years to collect a meaningful amount of data.

Reproductive specialists seem torn generally on the trend of startups producing home kits aimed at helping women understand their fertility. While they see some value in the information they provide, they also fear that even home kits that have already been proven to accomplish their intended goal, such as measuring anti-Müllerian hormone, or AMH, may confuse women as much as they help them.

NextGen Jane had previously raised $2.3 million in funding. Meanwhile, TechCrunch has been reporting extensively on the broader uptick in femtech investing. You can find a much deeper dive regarding who has raised what lately and why right here.

Powered by WPeMatico

French startup ManoMano is raising a new funding round of $125 million (€110 million). The company operates an e-commerce website and marketplace focused on home improvement and gardening.

ManoMano is part of the great unbundling of general e-commerce platforms. By focusing on a vertical in particular, the company can provide a large product offering, competitive prices and better customer service.

The platform generated $450 million (€400 million) in gross merchandise value last year. France is still its main market, but the company plans to become the dominant home improvement platform in Europe.

According to an interview in JDN, ManoMano plans to take a page out of Amazon’s playbook and expand its Mano Fulfillment service. As the name suggests, ManoMano plans to manage products from third-party retailers and take care of logistics.

More recently, ManoMano launched a B2B service with a few advantages for professional workers.

Eurazeo Growth, Aglaé Ventures and Bpifrance are participating in today’s funding round, with existing investors CM-CIC, Partech Ventures, Piton and General Atlantic also participating.

Powered by WPeMatico

Despite not being Brazilian and having their first exposure to the country only a few years ago, the two co-founders of Escale have managed to raise $22.6 million for their company, which provides customer acquisition services to companies in telecommunications and healthcare across Brazil.

Their secret? A knowledge of search engine optimization technologies honed through side businesses the two ran back in the United States.

The state of online marketing and digital sales was so woefully bad in Brazil that co-founders Matthew Kligerman and Ken Diamond had a green field in front of them on which to build Brazil’s first true online customer acquisition service, according to Diamond.

“We fell in love with Brazil for its warm culture and natural beauty, but as consumers, we had terrible experiences acquiring the most fundamental products and services for our new lives: internet, cell phone plans, health insurance and basic banking needs,” Kligerman said in a statement.

The company’s largest customer, according to Diamond, is NET, the Brazilian cable and telecom operator. NET was the first company to sign on for Escale’s customer acquisition services, but the company’s roster of clients now includes some of Brazil’s largest companies, including Bradesco, Sul America, Claro, GNDI and Amil.

It’s that marquee client list that attracted QED Investors and Invus Opportunities to co-lead the $22.6 million round that Escale just closed. The company’s previous investors, Kaszek Ventures, Rocket Internet’s GFC and Redpoint e.Ventures, also participated in the funding.

Latin America is in the throes of a startup renaissance at the moment, with Brazilian companies like Nubank and iFood and the Colombian company Rappi reaching billion-dollar valuations. Meanwhile investors are committing more capital to the region. SoftBank, for instance, is committing $5 billion to a new Latin American-focused fund.

With the new funding, Escale intends to move deeper into the development of customer acquisition platforms across verticals like consumer finance, insurance and education with comparison shopping sites and informational services (à la Credit Karma in the U.S.).

“With millions of web and cloud voice interactions every month, Escale can transform each of those interactions into data points, and continually improve its proprietary acquisition platform, ‘EscaleOS,’ to create highly-intelligent, customized marketing and sales funnels, helping consumers at the right moment connect with the products and services they need,” says Nicolas Berman, a partner at Kaszek Ventures. “The more consumer interactions they have, the faster Escale’s data flywheel spins.”

Powered by WPeMatico

The internet is often lauded for the potential to increase the impact of a range of primary services in emerging markets, including education, commerce, banking and healthcare. While many of those platforms are now being built, a few are finding that a hybrid approach combining online and offline is advantageous.

That’s exactly what Jio Health, a “full stack” (forgive the phrase) healthcare startup is bringing to consumers in Southeast Asia, starting in Vietnam.

The company started as a U.S.-based venture that worked with healthcare providers around the “Obamacare” initiative, before sensing the opportunity overseas and relocating to Vietnam, the Southeast Asian market of 95 million people and a fast-growing young population.

Today, it operates an online healthcare app and a physical facility in Saigon; it also has licenses for prescriptions and over the counter drug sales. The serviced launched nearly a year ago; already the company has some 130 staff, including 70 caregivers — including doctors — and a tech team of 30.

The idea is to offer services digitally, but also provide a physical location for when it is needed. Therein, the company ensures that “every element of that journey” is controlled and of the required standard; that’s in contrast to services that partner with hospitals or other care centers.

The scope of Jio Health’s services range from pediatrics to primary care, chronic disease management and ancillary services, which will soon cover areas like eye care, dermatology and cancer.

“Our initial research [before moving] found that healthcare in Vietnam was unlike the U.S.,” Raghu Rai, founder and CEO of Jio Health, told TechCrunch in an interview. “Spending is primarily driven by the consumer (out of pocket) and there’s no real digital infrastructure to speak of.”

Rai — a U.S. citizen — said doctors typically “have minutes per patient” and get through “hundreds” of consultations in every morning shift. That gave him an idea to make things more efficient.

“We can probably address north of 80 percent of consumers’ health needs,” he said of Jio Health,” but we also have referral partnerships with certain hospitals.”

Raghu Rai is CEO and founder of Jio Health

The process begins when a consumer downloads the Jio Health app and inputs primary information. A representative is then dispatched to visit the consumer in person, potentially within “hours” of the submission of information, according to Rai.

He believes that Jio Health can save its users money and time by using remote consultancy for many diagnoses. The company also works with health insurance companies for areas like annual checkups, and Rai said that McDonald’s and 7-Eleven are among the corporations that offer Jio Health among the providers for their staff; they’re not exclusive.

This week, Jio Health announced that it has closed a $5 million Series A funding from Southeast Asia’s Monk’s Hill Ventures . Rai said the company plans to use the capital for expansion. In particular, he said, the company is adding new care categories this month — including eye care and dermatology — and it is working toward expanding its brand through marketing.

Further down the line, Rai said the company hopes to expand to Hanoi before the end of this year. While there is interest in moving into other markets within Southeast Asia, that isn’t about to happen soon.

“We have begun to investigate other markets, but at this point feel the market in Vietnam is substantial in itself,” he told TechCrunch. “It’s very plausible that we’d be looking at international expansion plans in 2020… we’re going to be focused on Southeast Asia.”

Powered by WPeMatico

After years of fierce competition as private companies, Uber and Lyft are going public on U.S. markets. Scooter service providers, the transportation trend du jour, raised hundreds of millions of dollars to scatter scooters on city sidewalks (to the chagrin of residents and regulators alike) throughout 2017 and 2018. On the other side of the Pacific, Grab and Go-Jek are raising gobs of cash as they continue to scale upward and outward.

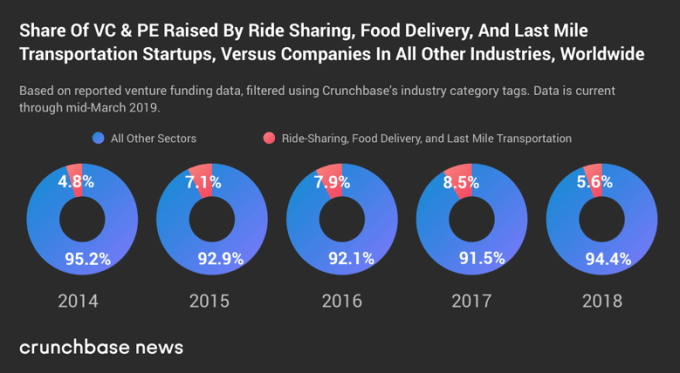

Of all the seed, early and late-stage venture funding raised over the past couple of years, how much of the total went to companies in the ride-hailing, food delivery and last-mile transportation categories (which encompasses bikes and scooters)? Probably not as much as you’d think.

Taken together, companies in these sectors raised less than 10 percent of the total venture dollar volume reported for each of the past five full calendar years.

We’ve charted it out based on yearly totals. Take a peek:

To be sure, we’re still talking about a lot of money here. Companies in these three categories raised more than $22 billion in venture funding rounds (not including private equity) in 2017 and more than $18 billion in 2018.

Ventures in the transportation space loom large in the media, and how could they not? It’s a forbiddingly capital-intensive market to play in, requiring companies to raise massive sums, which make for good headlines.

In its early years, competition between on-demand, point-to-point transportation marketplace companies rewarded brashness and speed with early scale and the long-term structural advantages conferred to first the firms which grew the fastest.

But those advantages may not have been as stiff as first expected. Lyft beat Uber to the public markets, raised its valuation during its IPO roadshow, priced at the top of its extended range and then popped 21 percent when it started trading.

That success means that the red chunks of our above chart weren’t all fool’s bets. Instead, a good chunk of the equity represented is now liquid. Of course, there’s a lot more work to do for literally every other ride-hailing, ridesharing, scooter-renting and other wheels-providing unicorns in the world: They still have to go public.

Powered by WPeMatico

Restaurant sales hit $825 billion last year in the U.S., but with margins averaging at only three to five percent per business, they’re always looking for an edge on efficiency and just generally running things in a smarter way. A startup called Toast, which has built a popular platform for restaurant management, has closed a hefty round of funding to double down on that opportunity to do that.

The company has raised $250 million on a valuation of $2.7 billion, money that it will use to invest in building technology to help restaurants with marketing, recruitment and operational efficiency, as well as start to think about expanding to more territories outside the U.S.

The basics of the funding were flagged earlier today by Prime Unicorn Index and we reached out to the company to confirm. It is being led by TCV and Tiger Global Management, with participation from Bessemer Venture Partners and T. Rowe Price Associates funds and other existing investors.

This Series E is a big bump up for the company: in its previous round in July 2018, the company was valued at $1.4 billion — partly the result of strong growth at the company. While it’s not disclosing revenue numbers or whether it is yet profitable, Toast currently serves tens of thousands of businesses — covering a range of sizes from independent venues to smaller chains — and in the last year tallied up transactions in the tens of billions of dollars, seeing growth of some 148 percent in its revenues, according to CFO Tim Barash.

The restaurant business represents a big opportunity for e-commerce companies, but there have been some notable stumbles where ambitions have not been met with success. Groupon, which spent several years acquiring and organically building a point of sale and restaurant management business, first drastically cut down and then finally called it quits and sold off its efforts, called Breadcrumb, in 2016. Amazon also pulled out of point of sale services (aimed at more than restaurants) and has in certain regions also pulled back on other restaurant efforts like its order management and delivery platform.

Barash said in an interview that he thinks the key to why Toast has steadily grown its business through all that is because a large proportion of its own employees — some 70 percent — have worked in the food service industry themselves.

“I was first a busboy, and then I worked in pizza delivery for years,” he said. “Seventy percent of our employees have worked at restaurants, including those in our product leadership, and that helps us understand the problem.”

Restaurants, as Barash points out, are complicated. “They are essentially manufacturers and retailers at the same time, all in one small physical footprint,” and so the key to building products for them is to understand that and the challenges they face in building and running those businesses.

And that’s before you consider the many other factors that can make restaurants a dicey game, from changing cuisine tastes, to changing eating habits — many get food delivered today — to the precariousness of the commercial real estate market and so much more.

The aim of Toast is to build tools to apply data science and orderly IT processes to address whichever of those variables that can be controlled by the restaurant.

Today, Toast’s products include point of sale services as well as reporting and analytics; display systems for kitchens; online ordering and delivery interfaces; and loyalty programs. It also builds its own hardware, which includes handheld order pads, payment and ordering terminals, self-service kiosks and displays for guests. It also offers links through to a network of some 100 partners, such as Grubhub for takeout food, when a restaurant does not cover those services or functions directly, to help stitch together services to work on its platform.

Tomorrow, the plan is to use the funding to enhance all of those with more advanced features that speak to some of the bigger issues and concerns Barash said its customers are voicing today.

That will include better and more services aimed at guest engagement and retention; better ways to recruit and keep people in an industry that has a high turnover of employees; and of course more tools to address how efficiently a business is operating to make it more profitable. The company has committed some $1 billion in the next five years to R&D to build more hardware and software.

Having access to this kind of tech and platform is a big deal, especially for independently owned places that hope to compete against bigger chains without having to compromise on their core competency: making unique and delicious food.

In the meantime, Barash said that while Toast itself is no stranger to approaches from larger players itself — he declined to say who but said many who have ambitions to do more business with the restaurant industry had approached it over the years — the company’s long-term vision is to grow bigger and remain its own boss.

It’s an ambition that has hit the spot with investors that have an appetite for high-growth businesses.

“At TCV, we invest in companies that have the potential to reshape entire industries. By providing restaurants of all sizes with access to innovative technology, Toast is leveling the playing field and leading the industry’s transition to the cloud,” said David Yuan, general partner at TCV, in a statement, who is joining the board with this round. “Our investment will enable Toast to extend their platform beyond point-of-sale and guest-facing technology, and in doing so, create a powerful SaaS platform with a superlative business model. We’re excited to partner with Toast as they accelerate the growth of the community they serve.”

Powered by WPeMatico