Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

We live in the subscription streaming era of media. Across film, TV, music, and audiobooks, subscription streaming platforms now shape the market. Gaming and podcasting could be next. Where are the startup opportunities in this shift, and in the next shift that will occur?

I sat down with Pär-Jörgen “PJ” Pärson, a partner at European venture firm Northzone, to discuss this at SLUSH this past winter. Pärson – a Swede who now runs Northzone’s office in NYC – led the top early-stage investor in Spotify and led the $35 million Series C in $45/month sports streaming service fuboTV (which has roughly 250,000 subscribers).

In the transcript below, we dive into the core investment thesis that has guided him for 20 years, how he went from running a fish distribution to running a VC firm, his best practices for effective board meetings and VC-entrepreneur relationships, and his assessment of the big social platforms, AR/VR, voice interfaces, blockchain, and the frontier of media. It has been edited for length and clarity.

Eric Peckham:

Northzone isn’t your first VC firm — Back in 1998, you created Cell Ventures, which was more of a holding company or studio model. What was your playbook then?

Powered by WPeMatico

There are a lot of people who never thought they’d see the day venture capitalists would funnel millions into femtech businesses, direct-to-consumer tampon retailers no less. But that’s our new reality and Cora is proof.

San Francisco-based Cora, which develops and sells organic tampons, pads and other personal care products, has just closed a $7.5 million Series A led by Harbinger Ventures. Cora is one of many femtech startups to raise funding this week alone, in what is turning out to be a red-hot year for VC investment in the space.

Femtech, defined as any software, diagnostics, products and services that leverage technology to improve women’s health, has attracted at least $241 million in VC funding so far this year, according to PitchBook. That puts the sector on pace to secure nearly $1 billion in investment by year-end, greatly surpassing last year’s record of $650 million. For more historical context, startups in the space brought in only $62 million in 2012, $225 million in 2014 and $231 million in 2016.

“Investors have realized there is a huge pent-up demand in the market for healthier products for women,” Cora co-founder Molly Hayward tells TechCrunch. “The way in which the VC world is structured, there just has not been a lot of representation. It’s really difficult to understand the value of a product you aren’t ever going to use or to understand a problem you aren’t ever going to have, particularly around period care. This isn’t something we were talking about as a society five years ago.”

The four-year-old startup operates a little differently than your run-of-the-mill D2C company. Like TOMS, the popular footwear brand, Cora donates a month’s supply of products for every month’s supply sold. To date, Cora has donated 5 million pads to girls in India and Kenya and 100,000 products to women in the U.S.

“To me, [Cora] was this incredible, holistic opportunity to change the way that women experience their period,” Hayward said.

Investors must be excited about Cora’s growth. Though she didn’t disclose specific numbers, Hayward says the brand has expanded 400 percent year-over-year, a metric they are expecting to sustain with this new bout of funding. Cora’s products are sold on a subscription basis, with prices ranging from $8 per month for six tampons to $16 per month for 24. For those unfamiliar with the costs of such products, $8 for six tampons comes at quite the premium. A box of 50 Playtex tampons, for example, retails for around $9.

Investors must be excited about Cora’s growth. Though she didn’t disclose specific numbers, Hayward says the brand has expanded 400 percent year-over-year, a metric they are expecting to sustain with this new bout of funding. Cora’s products are sold on a subscription basis, with prices ranging from $8 per month for six tampons to $16 per month for 24. For those unfamiliar with the costs of such products, $8 for six tampons comes at quite the premium. A box of 50 Playtex tampons, for example, retails for around $9.

In Cora’s case, customers are shelling out extra cash for millennial-inspired branding, a soothing unboxing experience and a general ease of access to its products, as well as Cora’s organic, hypoallergenic and compostable materials, which aren’t characteristic of many similar products on the market.

Cora plans to use the capital to put more of its items in Target stores, where it already sells its tampons and pads, and expand its portfolio of products. As part of the funding, Cora has added two more women to its board of directors: Lisa Bougie, the former GM of Stitch Fix, and Andrea Freedman, the former chief financial officer of Method. Its board is now 80 percent female.

Powered by WPeMatico

Cities all over the world have seen an influx of two-wheeled, electric kick scooters on the road over the last couple of years. Scooters from the likes of Bird, Lime, Spin, Uber’s JUMP, Lyft and others are all trying to own the first and the last mile. The first mile is often understood as the distance between a transportation hub and someone’s starting point while the last mile is the distance between a transportation hub and someone’s final destination. These companies want both, and some (Uber, Lyft) also want everything in between.

The rise of electric scooters is often compared to the rise of ride-hailing, but there are some key differences at play. For one, cities are in charge of regulation — not the states. And since these are much smaller vehicles, cities can easily pick them up and throw them in the back of a truck if they become a nuisance. Meanwhile, as part of city regulation, data-sharing is not optional — it’s a requirement in order for companies to receive permission to deploy scooters on city streets.

The startup ecosystem had become accustomed to the ethos of begging for forgiveness, rather than asking for permission. But that’s not the case with electric scooters. These companies have found their entire businesses to be contingent on the continued approval from individual cities all over the world. That inherently creates a number of potential conflicts.

It’s also unclear whether the increase in people riding scooters is indicative of people adopting shared services or simply adopting a new mode of transportation. Some industry insiders wonder if it’s just a matter of time between consumers ditch shared scooters in exchange for their own.

Between city regulators capping the growth of operators, the vast number of companies going after the first and last miles and the threat of the shift from shared to ownership, it’s all going to come down to the survival of the fittest.

Unlike the ride-sharing market, electric scooter operators are entirely dependent upon cities. These cities, rightfully so, have a number of concerns ranging from safety to sidewalk congestion to equal access to transportation.

Powered by WPeMatico

We profiled HyperSciences in February, when the team had just successfully completed a launch milestone for a small business grant with NASA. The last time we checked in, the hypersonic drilling company had raised about $5 million as part of an untraditional Reg A offering. By the end of March, HyperSciences rounded out its first major round with $9.6 million from 3,552 individual investors on SeedInvest in the equity crowdfunding platform’s second largest raise to date.

The heart of HyperSciences’ work is its hypersonic propulsion system that can fire a projectile at five times the speed of sound. At its most simplistic, HyperSciences’ hypersonic engine can fire upward to power suborbital space launches (HyperDrone) and point downward to penetrate deep pockets of geothermal energy, for example (HyperDrill).

Rather than going the normal venture capital route, HyperSciences decided to raise from regular people who believed in its vision. The way the company sees it, traditional VC would have likely forced HyperSciences to narrow its mission.

“Reg A lets everyone who cares about our planned hypersonic future vote with their checkbook,” HyperSciences founder and CEO Mark Russell told TechCrunch. “I think that’s important.” Russell comes from a family-run mining business and is no stranger to the challenges of a public company.

“I’ve learned a lot from running ops in the back offices,” Russell said. “Based on our public company experiences, we do like that the SEC Reg A process has a clear path to taking your company to the public markets as the next step in the process.”

With infusions of $125,000 from NASA’s Small Business Innovation Research grant and $1 million from Shell’s Global’s GameChanger program, HyperSciences is happy to bounce between research grants with a boost from the Reg A’s special form of “mini-IPO” in order to maintain its autonomy for the time being.

Russell explained that the Reg A’s intensive SEC process requires a fair level of maturity from a company — and enough capital to jump through all the hoops. “You’re not typically a seller of t-shirts in Reg A crowd financing,” Russell said.

HyperSciences’ next milestone will come in May when the company will demo its drilling tech in a field test for Shell. The company plans to leverage its new funding for additional future field testing, pushing its existing business plan forward and moving toward sustainability.

“Our investors are more like smart ‘crowd VCs.’ They’re generally are pretty savvy and see that we went through a stringent process to get here,” Russell said. “We’ve provided them with enough information to make a great decision.”

Powered by WPeMatico

Managed by Q, the office management platform based out of New York, has today been acquired by The We Company, formerly known as WeWork.

Financial terms were not disclosed. The WSJ reports that it was a cash and stock deal. Managed by Q, which has 500 employees, will remain as a wholly owned separate entity and CEO Dan Teran will remain following the acquisition to join WeWork leadership.

Upon its latest financing in January, Managed by Q was valued at $249 million, according to PitchBook.

Here’s what Teran had to say in a prepared statement:

We are excited for this incredible opportunity to deepen our commitment to realizing our ambitious vision of building an operating system for the built world. WeWork is uniquely positioned to invest in workplace technology and services, and I look forward to partnering with their team to build more robust products for our clients and create a global platform to help companies push the bounds on our collective potential.

Managed by Q was founded in 2014 with a plan to change the way that offices run. The platform allowed office managers and other decision-makers to handle supply stocking, cleaning, IT support and other non-work related tasks in the office by simply using the Managed by Q dashboard. Managed by Q serves the demand through a combination of in-house operators and third-party vendors and service providers.

Notably, Managed by Q took a different tack than most other logistics companies, employing their operators as W2 workers instead of 1099 contractors. Moreover, Managed by Q offered a stock option plan to operators that gives 5 percent of the company back to those employees.

The company has raised a total of $128.25 million since launch from investors such as GV, RRE and Kapor Capital. Managed by Q currently serves the markets of New York, San Francisco, Los Angeles, Chicago, Boston and Silicon Valley, with plans to aggressively expand following the acquisition, according to the WSJ.

Not only has Managed by Q swiftly matured into a big player in the NY tech scene and Future of Work space, but it has also fostered interesting competition and consolidation within the space. Managed by Q has itself made several acquisitions, including the purchase of NVS (an office space planning and project management service) and Hivy (an internal comms tool to let employees tell office managers what they need).

Powered by WPeMatico

When everyone always tells you “yes,” you can become a monster. Leaders especially need honest feedback to grow. “If you look at rich people like Donald Trump and you neglect them, you get more Donald Trumps,” says Torch co-founder and CEO Cameron Yarbrough about our gruff president. His app wants to make executive coaching (a polite word for therapy) part of even the busiest executive’s schedule. Torch conducts a 360-degree interview with a client and their employees to assess weaknesses, lays out improvement goals and provides one-on-one video chat sessions with trained counselors.

“Essentially we’re trying to help that person develop the capacity to be a more loving human being in the workplace,” Yarbrough explains. That’s crucial in the age of “hustle porn,” where everyone tries to pretend they’re working all the time and constantly “crushing it.” That can leave leaders facing challenges feeling alone and unworthy. Torch wants to provide a private place to reach out for a helping hand or shoulder to cry on.

Now Torch is ready to lead the way to better management for more companies, as it’s just raised a $10 million Series A round led by Norwest Venture Partners, along with Initialized Capital, Y Combinator and West Ventures. It already has 100 clients, including Reddit and Atrium, but the new cash will fuel its go-to market strategy. Rather than trying to democratize access to coaching, Torch is doubling-down on teaching founders, C-suites and other senior executives how to care… or not care too much.

“I came out of a tough family myself and I had to do a ton of therapy and a ton of meditation to emerge and be an effective leader myself,” Yarbrough recalls. “Philosophically, I care about personal growth. It’s just true all the way down to birth for me. What I’m selling is authentic to who I am.”

Torch’s co-founders met when they were in grad school for counseling psychology degrees, practicing group therapy sessions together. Yarbrough went on to practice clinically and start Well Clinic in the Bay Area, while Keegan Walden got his PhD. Yarbrough worked with married couples to resolve troubles, and “the next thing I know I was working with high-profile startup founders, who like anybody have their fair share of conflicts.”

Torch co-founders (from left): Cameron Yarbrough and Keegan Walden

Coaching romantic partners to be upfront about expectations and kind during arguments translated seamlessly to keep co-founders from buckling under stress. As Yarbrough explains, “I was noticing that they were consistently having problems with five different things:

1. Communication – Surfacing problems early with kindness

2. Healthy workplace boundaries – Making sure people don’t step on each others’ toes

3. How to manage conflict in a healthy way – Staying calm and avoiding finger-pointing

4. How to be positively influential – Being motivational without being annoying or pushy

5. How to manage one’s ego, whether that’s insecurity or narcissism – Seeing the team’s win as the first priority

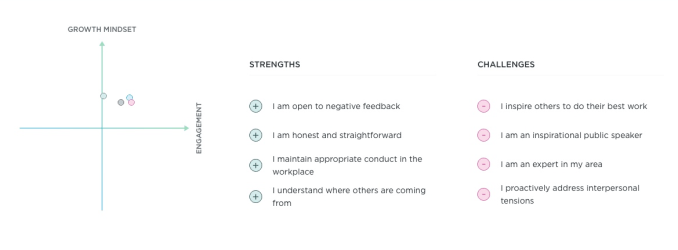

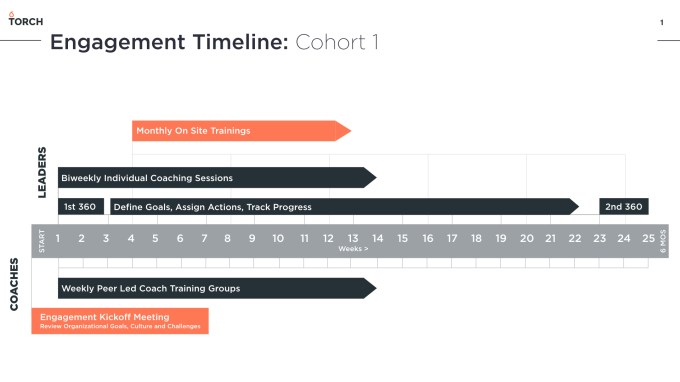

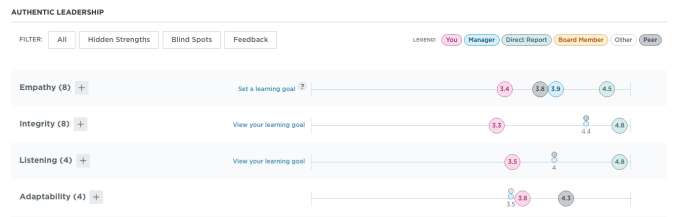

To address those, companies hire Torch to coach one or more of their executives. Torch conducts extensive 360-degree interviews with the exec, as well as their reports, employees and peers. It seeks to score them on empathy, visionary thinking, communication, conflict, management and collaboration, Torch then structures goals and improvement timelines that it tracks with follow-up interviews with the team and quantifiable metrics that can all be tracked by HR through a software dashboard.

To make progress on these fronts, execs do video chat sessions through Torch’s app with coaches trained in these skills. “These are all working people with by nature very tight schedules. They don’t have time to come in for a live session so we come to them in the form of video,” Yarbrough tells me. Rates vary from $500 per month to $1,500 per month for a senior coach in the U.S., Europe, APAC or EMEA, with Torch scoring a significant margin. “We’re B2B only. We’re not focused on being the most affordable solution. We’re focused on being the most effective. And we find that there’s less price sensitivity for senior leaders where the cost of their underperformance is incredibly high to the organization.” Torch’s top source of churn is clients’ going out of business, not ceasing to want its services.

Here are two examples of how big-wigs get better with Torch. “Let’s say we have a client who really just wants to be liked all the time, so much so that they have a hard time getting things done. The feedback from the 360 would come back like ‘I find that Cameron is continually telling me what I want to hear but I don’t know what the expectations are of me and I need him to be more direct,’ ” Yarbrough explains. “The problem is those leaders will eventually fire those people who are failing, but they’ll say they had no idea they weren’t performing because he never told them.” Torch’s coaches can teach them to practice tough-love when necessary and to be more transparent. Meanwhile, a boss who storms around the office and “is super-direct and unkind” could be instructed on how to “develop more empathic attunement.”

Yarbrough specifically designed Torch’s software to not be too prescriptive and leave room for the relationship between the coach and client to unfold. And for privacy, coaches don’t record notes and HR only sees the performance goals and progress, not the content of the video chats. It wants execs to feel comfortable getting real without the worry their personal or trade secrets could leak. “And if someone is bringing in something about trauma or that’s super-sensitive about their personal life, their coach will refer them out to psychotherapists,” Yarbrough assures me.

Torch’s direct competition comes from boutique executive coaching firms around the world, while on the tech side, BetterUp is trying to make coaching scale to every type of employee. But its biggest foe is the stubborn status quo of stiff-upper-lipping it.

The startup world has been plagued by too many tragic suicides, deep depression and paralyzing burnout. It’s easy for founders to judge their own worth not by self-confidence or even the absolute value of their accomplishments, but by their status relative to yesterday. That means one blown deal, employee quitting or product delay can make an executive feel awful. But if they turn to their peers or investors, it could hurt their partnership and fundraising prospects. To keep putting in the work, they need an emotional outlet.

“We ultimately have to create this great software that super-powers human beings. People are not robots yet. They will be someday, but not yet,” Yarbrough concludes with a laugh. IQ alone doesn’t make people succeed. Torch can help them develop the EQ, or emotional intelligence quotient, they need to become a boss that’s looked up to.

Powered by WPeMatico

This morning, Forbes wrote a lengthy profile of Andreessen Horowitz, the now 10-year-old venture firm that its rivals love to hate but nevertheless tend to copy. It’s a great read that revisits some of the firm’s wins and losses and, interestingly, regrets, including the founders’ early predisposition to talk trash about the rest of the venture industry.

As Ben Horowitz tells reporter Alex Konrad, “I kind of regret it, because I feel like I hurt people’s feelings who were perfectly good businesses . . . I went too far.”

The story also suggests that Andreessen Horowitz — whose agency-like model has been widely replicated by other big venture firms — is re-shaping venture capital a second time. It’s doing this, says Forbes, by turning itself into a registered investment advisor.

But the firm isn’t alone is morphing into something very different than it once was, including an RIA. SoftBank is already one. General Catalyst appears to be in the process of registering as one, too. (It recently withdrew its status as a so-called exempt reporting advisor.) Other big firms with a range of un-VC-like products are similarly eyeing the same move.

They don’t have much choice. While VCs have traditionally been able to dabble in new areas through their limited partner agreements with their own investors, they’ve also faced what’s traditionally been a 20 percent cap on these activities, like buying in the public markets, investing in other funds, issuing debt to fund buyouts, and acquiring equity through secondary transactions.

Put another way, 20 percent of their capital could be used to experiment, but the rest had to be funneled into typical venture capital-type deals.

For Andreessen Horowitz, that cap clearly began to grate. An early and enduring believer in cryptocurrencies, marketplaces, and applications, the firm grew particularly frustrated over its inability to invest more of its flagship fund into crypto startups. It raised a separate crypto fund last year so it could move more aggressively on opportunities, but according to Forbes, the constraints that came with creating that separate legal entity gave rise to new aggravations.

By becoming a registered investment advisor, Andreessen Horowitz will no longer have to limit these stakes, including in its general fund — the newest of which it’s expected to announce shortly. It will also have the freedom to invest any percentage of its fund that it wants in larger high-growth companies, to buy shares from founders and early investors, and to trade public stocks, as Forbes notes.

It’s the same reason that SoftBank is a registered investment advisor and other big firms with more assets will invariably be, as well. As longtime startup attorney Barry Kramer observes, “Like the now-giant operating companies that VCs once funded, like Google and Apple and Amazon — each of which used to play in discrete market segments and now overlap — hedge funds, mutual funds, secondary funds, and venture funds that used to play in discrete market segments are starting to overlap, too.”

In fact, the opportunity to shop for secondary stakes alone could drive a venture firm to restructure. “Secondary markets are eating” the public markets, observes Barrett Cohn on the investment bank Scenic Advisement, which helps broker sales between equity buyers and sellers. Cohn has a vested interest in this turnabout, but it’s also hard to argue he’s wrong, considering how long startups remain private, and how much more secondary activity now takes place before companies are acquired, go public, or conk out.

Little wonder the powerful venture capital lobby group — the National Venture Capital Association — has been trying to talk the SEC into changing its definition of what constitutes a venture capital firm. It recognizes that it will lose more and more members if venture firms aren’t afforded more flexibility.

In the meantime, becoming an RIA isn’t without its downsides — a lot of them, notes Bob Raynard, the managing director of the fund administration services company Standish Management in San Francisco.

Though he thinks many firms like Andreessen Horowitz may not have a choice at a certain point (“I think there are a lot of other growth equity and venture firms that should be registered for their own sake”), the new rules to which it will be adapting can “be quite onerous,” beginning with a complete lack of privacy, as well as expenses.

One estimate we found suggests that the median annual compliance costs are eight times higher for RIAs than for exempt registered advisors.

“If [Andreessen Horowitz] is becoming an RIA, its cost structure just went way up,” says Raynard, observing that a compliance officer will have to sign off on everything an employee at the firm does, as well as the investing decisions that its partners’ spouses, children, and even parents make. “As a VC, you don’t have to report your trades,” Raynard notes, but an RIA has to ensure that nothing and no one with a pecuniary interest in the firm creates an expensive misstep.

One could also imagine it creating headaches for limited partners, who typically like to invest in distinct asset classes, whether venture capital or private equity or hedge funds. If Andreessen Horowitz, among other firms, starts to look like an amalgamation of all three, how will it be viewed? In which bucket will it land?

The firm declined to answer that question and others of ours today, saying it’s focused for now on completing the process of registering as an RIA. Raynard pushes back on the idea that its new look might throw off the institutions that have long funded it, however. “I think regulators will view it as a good thing, and I think most LPs would view it as a favorable shift, because of increased outside scrutiny involved.”

Indeed, Raynard thinks that beyond expenses and added layers of management and and an eagle-eyed SEC watching more closely, a bigger trade-off as venture firms become investment firms more broadly could be that it becomes harder to recruit.

Despite widespread interest in working for a brand-name firm, “if you’re a junior-level person and you’re being recruited by a firm that’s a registered investment advisor versus a venture firm where your deals are not being scrutinized and you have some privacy,” says Raynard, “it’s something you’re going to think about.”

Powered by WPeMatico

BuzzFeed and Eko have been working together to create a wide range of interactive videos, which they began launching in the past week or so — starting with this Tasty potato recipe that allows you to customize your ingredients, revealing a bit about your personality in the process.

There’s also an interactive Tarot reading, a video quiz that determines which kind of dog you are and this customizable ramen video.

I spoke with BuzzFeed and Eko executives last week to learn more about how they’re working together, and where it might go next.

These videos — usually brief and based on existing BuzzFeed formats — feel pretty different from previous Eko showcases like “That Moment When,” which is more of a comedic, Choose Your Own Adventure-style story.

Eko’s Chief Creative Officer Alon Benari acknowledged that in the past, the company usually “started from a traditional video and injected interactivity into it.” But while “this is one of the first projects where we did the other path” — namely, taking an interactive format like a quiz and introducing video — the focus is still on “bringing together the best of both worlds.”

“This isn’t a direction change,” added Vice President of Business Development Ivy Sheibar. “We have a full pipeline of what you would consider coming more from traditional video.”

As for BuzzFeed, Chief Marketing Officer Ben Kaufman suggested that this is a natural extension of the publisher’s strategy to experiment with new formats. By offering this kind of interactivity, BuzzFeed can tailor videos to their viewers’ needs and interests (for example, by customizing video recipes based on dietary restrictions) while also “allowing our audience to engage with our videos and create data feedback loops.”

In addition to providing the technical platform to create these videos, Kaufman said Eko’s team shared important insights from years of experience with interactivity.

“One of the things they trained us on was what the meaning of a meaningful choice was — [a choice] where actually as an audience member you would take that to heart and makes you feel like, ‘This video is really made for me,’ ” he said.

Kaufman added that as BuzzFeed and Eko continue rolling out different types of interactive videos, “Our goal in the next few weeks is to crack this, to build a real deep audience connection, see what they are loving and go heavy into scaling that.”

Powered by WPeMatico

Slack and other consumer-grade productivity tools have been taking off in workplaces large and small — and data governance hasn’t caught up.

Whether it’s litigation, compliance with regulations like GDPR or concerns about data breaches, legal teams need to account for new types of employee communication. And that’s hard when work is happening across the latest messaging apps and SaaS products, which make data searchability and accessibility more complex.

Here’s a quick look at the problem, followed by our suggestions for best practices at your company.

The increasing frequency of reported data breaches and expanding jurisdiction of new privacy laws are prompting conversations about dark data and risks at companies of all sizes, even small startups. Data risk discussions necessarily include the risk of a data breach, as well as preservation of data. Just two weeks ago it was reported that Jared Kushner used WhatsApp for official communications and screenshots of those messages for preservation, which commentators say complies with record keeping laws but raises questions about potential admissibility as evidence.

Powered by WPeMatico