Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Today’s startups have a distinct advantage when it comes to launching a company because of the public cloud. You don’t have to build infrastructure or worry about what happens when you scale too quickly. The cloud vendors take care of all that for you.

But last month when Pinterest announced its IPO, the company’s cloud spend raised eyebrows. You see, the company is spending $750 million a year on cloud services, more specifically for AWS. When your business is primarily focused on photos and video, and needs to scale at a regular basis, that bill is going to be high.

That price tag prompted Erica Joy, a Microsoft engineer, to publish this tweet and start a little internal debate here at TechCrunch. Startups, after all, have a dog in this fight, and it’s worth exploring if the cloud is helping feed the startup ecosystem, or sending your bills soaring, as they have with Pinterest.

after discussion with some folks about this article and the generally ridiculous amount of money startups pay for aws, i am wondering if there is an effective, easy to use, open source tool that helps startups reduce aws spend. https://t.co/GBh40b4UOH

— EricaJoy (@EricaJoy) March 25, 2019

For starters, it’s worth pointing out that Ms. Joy works for Microsoft, which just happens to be a primary competitor of Amazon’s in the cloud business. Regardless of her personal feelings on the matter, I’m sure Microsoft would be more than happy to take over that $750 million bill from Amazon. It’s a nice chunk of business; but all that aside, do startups benefit from having access to cloud vendors?

Powered by WPeMatico

Snap is taking a leaf out of the Asian messaging app playbook as its social messaging service enters a new era.

The company unveiled a series of new strategies that are aimed at breathing fresh life into the service that has been ruthlessly cloned by Facebook across Instagram, WhatsApp and even its primary social network. The result? Snap has consistently lost users since going public in 2017. It managed to stop the rot with a flat Q4, but resting on its laurels isn’t going to bring back the good times.

Snap has taken a three-pronged approach: extending its stories feature (and ads) into third-party apps and building out its camera play with an AR platform, but it is the launch of social games that is the most intriguing. The other moves are logical, and they fall in line with existing Snap strategies, but games is an entirely new category for the company.

It isn’t hard to see where Snap found inspiration for social games — Asian messaging companies have long twinned games and chat — but the U.S. company is applying its own twist to the genre.

Powered by WPeMatico

Pressure is steadily mounting on U.S. lawmakers to implement comprehensive cannabis banking reform at the federal level, and that pressure is coming from all directions.

Rapid shifts in public opinion and a rising number of states with legal medical and adult-use cannabis sales have laid bare an obvious need to update our banking laws to meet the age of regulated cannabis markets. And earlier this month, Congress tackled the issue head on in a widely anticipated hearing that had huge implications for the future of banking for America’s legal cannabis industry.

The Secure and Fair Enforcement (SAFE) Banking Act was among the most notable topics discussed during the House Financial Services Committee hearing February 13, which was titled “Challenges and Solutions: Access to Banking Services for Cannabis-Related Businesses.”

The legislation, which would provide safe harbor to banks working with state-legal cannabis businesses, counts a large and diverse group of lawmakers, regulators, law enforcement professionals, financial institutions, businesses interests and trade organizations among its supporters.

House Financial Services Committee member Rep. Ed Perlmutter (D-CO), along with Rep. Denny Heck (D-WA), introduced the SAFE Banking Act in the last Congress, with 95 co-sponsors — including 13 Republicans — signing on. Twenty bipartisan co-sponsors signed onto the companion bill, introduced in the Senate by Jeff Merkley (D-OR). The two bills drew some heavyweight co-sponsors from both sides of the aisle, including Sen. Rand Paul (R-KY), Sen. Elizabeth Warren (D-MA), Sen. Cory Gardner (R-CO), Sen. Kamala Harris (D-CA) and Sen. Cory Booker (D-NJ), and in the House, Rep. Beto O’Rourke (D-TX), Rep. David Joyce (R-OH), Rep. Tulsi Gabbard (D-HI) and Rep. Adam Schiff (D-CA).

And a bipartisan group of 19 state attorneys general came together last year to urge Congress to advance legislation that would allow state-legal cannabis businesses to utilize traditional banking services available to every other legal industry in the United States.

Groups like the Credit Union National Association, the Independent Community of Bankers of America, American Bankers Association and the National Cannabis Industry Association are also vocal advocates for the measure.

As the U.S. cannabis industry continues along its steady growth trajectory, access to banking services is perhaps the most critical challenge facing operators.

And that wasn’t the first attempt in the House to address the cannabis banking problem. In 2014, House lawmakers passed an amendment to an appropriations bill (228-195) that, much like the SAFE Banking Act, would have extended legal protections to financial institutions working with state-regulated cannabis businesses. The measure failed to move through the Senate, however.

But much has changed since 2014. Ten states and Washington, DC, have now legalized cannabis for adult use; 33 states have legalized comprehensive medical cannabis programs; two in three Americans now support legalizing cannabis nationwide for recreational use, according to Gallup polling data; and a majority of older Americans — a formidable voting bloc — now supports legalization. Momentum around cannabis reform is spreading across the globe as well, with cannabis now legally available to adults for recreational use in both Canada and Uruguay, and numerous countries mulling similar reforms.

A brand new multi-billion-dollar industry has risen up in a few short years, and yet, most financial institutions in the U.S. remain reluctant to work with cannabis businesses due to fears of violating federal money laundering laws. That fear has forced the majority of cannabis businesses to operate on a cash-only basis — creating massive security risks, logistical nightmares and regulatory headaches for all parties involved.

As the U.S. cannabis industry continues along its steady growth trajectory, access to banking services is perhaps the most critical challenge facing operators. The recent House Financial Services Subcommittee hearing represents the committee’s first-ever hearing on this issue — a promising first step toward passing the SAFE Banking Act.

Sixty-seven percent of Americans across the political spectrum want Congress to enact legislation allowing financial institutions to do business with legal cannabis operators, according to polling data from think tank Third Way.

With this new Congress, there may finally be progress. Rep. Perlmutter and Rep. Heck plan to re-introduce the SAFE Banking Act in the House, and Sen. Merkley is expected to re-introduce a similar measure in the Senate. Now we need House lawmakers to prioritize this issue and move these measures through the legislature, so they can become the law of the land.

Powered by WPeMatico

Welcome to this week’s transcribed edition of This is Your Life in Silicon Valley. We’re running an experiment for Extra Crunch members that puts This is Your Life in Silicon Valley in words – so you can read from wherever you are.

This is your Life in Silicon Valley was originally started by Sunil Rajaraman and Jascha Kaykas-Wolff in 2018. Rajaraman is a serial entrepreneur and writer (Co-Founded Scripted.com, and is currently an EIR at Foundation Capital), Kaykas-Wolff is the current CMO at Mozilla and ran marketing at BitTorrent. Rajaraman and Kaykas-Wolff started the podcast after a series of blog posts that Sunil wrote for The Bold Italic went viral. The goal of the podcast is to cover issues at the intersection of technology and culture – sharing a different perspective of life in the Bay Area. Their guests include entrepreneurs like Sam Lessin, journalists like Kara Swisher and politicians like Mayor Libby Schaaf and local business owners like David White of Flour + Water.

This week’s edition of This is Your Life in Silicon Valley features Mike Isaac, whose upcoming book about Uber – ‘Super Pumped’ – is sure to generate controversy. Isaac conducted hundreds of interviews for the book, and answers some pointed questions about his research during this podcast. Isaac also talks about press leaks, Facebook hacks and more during this interview.

If you want to hear what Mike would ask Travis Kalanick if he had the opportunity for a sitdown, you don’t want to miss this transcript.

For access to the full transcription, become a member of Extra Crunch. Learn more and try it for free.

Sunil Rajaraman:

Welcome to season three of This is your Life in Silicon Valley, a podcast about the Bay Area, technology, and culture. I’m your host Sunil Rajaraman, and I’m joined by my cohost, Jascha Kaykas-Wolff-Wolff. This is your Life in Silicon Valley is brought to you by The Bold Italic.

Powered by WPeMatico

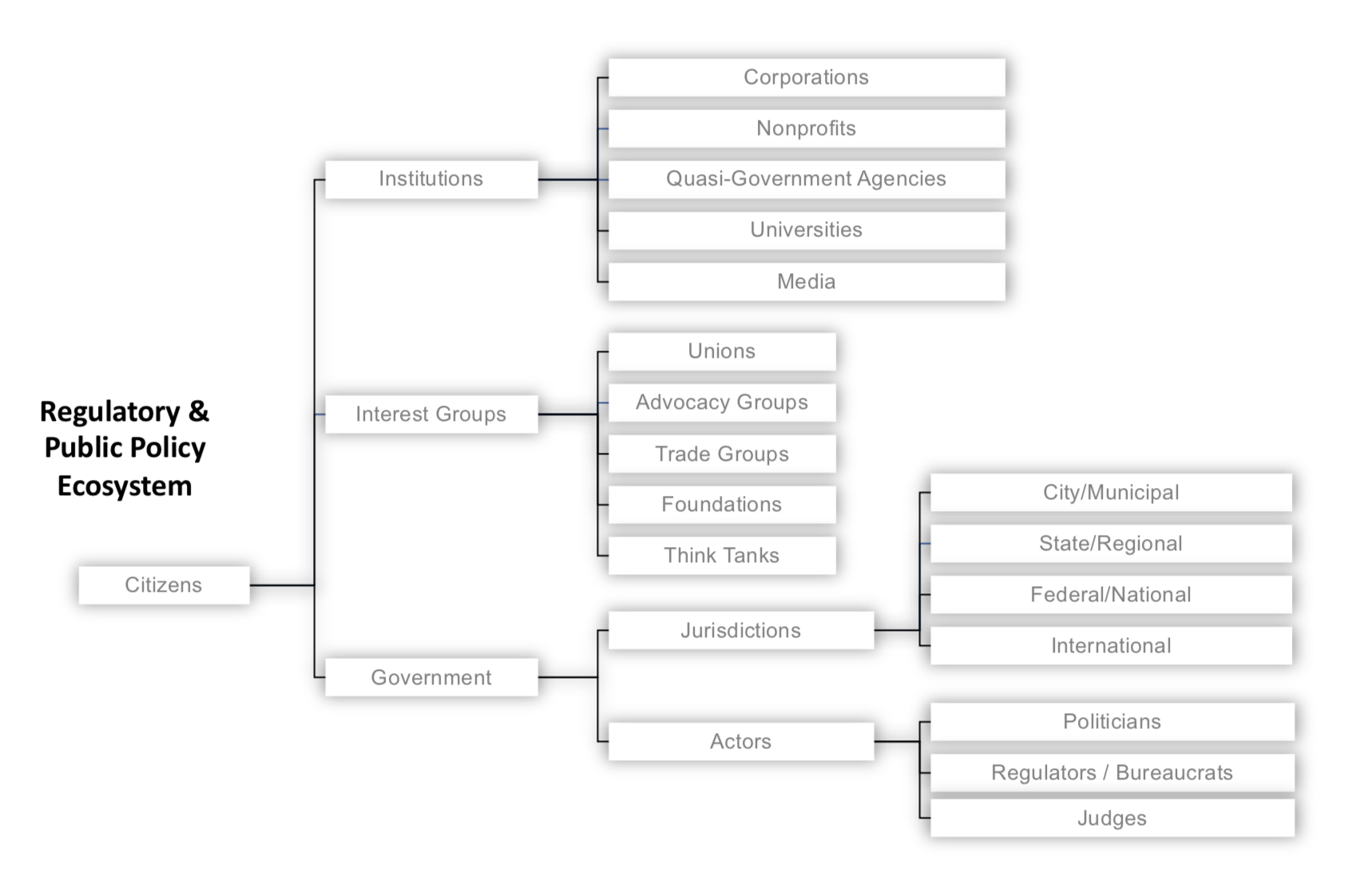

Startups are but one species in a complex regulatory and public policy ecosystem. This ecosystem is larger and more powerfully dynamic than many founders appreciate, with distinct yet overlapping laws at the federal, state and local/city levels, all set against a vast array of public and private interests. Where startup founders see opportunity for disruption in regulated markets, lawyers counsel prudence: regulations exist to promote certain strongly-held public policy objectives which (unlike your startup’s business model) carry the force of law.

Snapshot of the regulatory and public policy ecosystem. Image via Law Office of Daniel McKenzie

Although the canonical “ask forgiveness and not permission” approach taken by Airbnb and Uber circa 2009 might lead founders to conclude it is strategically acceptable to “move fast and break things” (including the law), don’t lose sight of the resulting lawsuits and enforcement actions. If you look closely at Airbnb and Uber today, each have devoted immense resources to building regulatory and policy teams, lobbying, public relations, defending lawsuits, while increasingly looking to work within the law rather than outside it – not to mention, in the case of Uber, a change in leadership as well.

Indeed, more recently, examples of founders and startups running into serious regulatory issues are commonplace: whether in healthcare, where CEO/Co-founder Conrad Parker was forced to resign from Zenefits and later fined approximately $500K; in the securities registration arena, where cryptocurrency startups Airfox and Paragon have each been fined $250K and further could be required to return to investors the millions raised through their respective ICOs; in the social media and privacy realm, where TikTok was recently fined $5.7 million for violating COPPA, or in the antitrust context, where tech giant Google is facing billions in fines from the EU.

Suffice it to say, regulation is not a low-stakes table game. In 2017 alone, according to Duff and Phelps, US financial regulators levied $24.4 billion in penalties against companies and another $621.3 million against individuals. Particularly in today’s highly competitive business landscape, even if your startup can financially absorb the fines for non-compliance, the additional stress and distraction for your team may still inflict serious injury, if not an outright death-blow.

The best way to avoid regulatory setbacks is to first understand relevant regulations and work to develop compliant policies and business practices from the beginning. This article represents a step in that direction, the fifth and final installment in Extra Crunch’s exclusive “Startup Law A to Z” series, following previous articles on corporate matters, intellectual property (IP), customer contracts and employment law.

Given the breadth of activities subject to regulation, however, and the many corresponding regulations across federal, state, and municipal levels, no analysis of any particular regulatory framework would be sufficiently complete here. Instead, the purpose of this article is to provide founders a 30,000-foot view across several dozen applicable laws in key regulatory areas, providing a “lay of the land” such that with some additional navigation and guidance, an optimal course may be charted.

The regulatory areas highlighted here include: (a) Taxes; (b) Securities; (c) Employment; (d) Privacy; (e) Antitrust; (f) Advertising, Commerce and Telecommunications; (g) Intellectual Property; (h) Financial Services and Insurance; and finally (i) Transportation, Health and Safety.

Of course, some regulations may touch on multiple regulatory areas, for example, the “Fair Credit Reporting Act” is a law ultimately about privacy, but it impacts many financial and employment-related services as well. Certain laws may therefore be cross-listed in more than one regulatory area. Also, since we can’t look at every U.S. state and city, this article will focus primarily on the federal and California state laws.

After you focus on the particular regulatory areas that may implicate your business, next reference the short quotations and links to relevant primary and secondary sources below, then work to identify the specific compliance risks you face. This is where other Extra Crunch resources can help. For example, the Verified Experts of Extra Crunch include some of the most experienced and skilled startup lawyers in practice today. Use these profiles to identify attorneys who are focused on serving companies at your particular stage and then seek out any further guidance you need to address the regulatory matters pertinent to your startup.

With that as context, the Startup Law A to Z – Regulatory Compliance checklist is below:

Before diving into further detail, it may be helpful for some readers to note the distinction between a law and a regulation. Simply put, regulations provide more detailed direction on how certain laws should be followed. So regulations are not technically laws, but they carry the force of law (including penalties for violation), since they are adopted by governmental agencies under authority granted by statute. Beyond that, understanding how laws and regulations are actually enacted is helpful to illustrate the extent to which the process is politically driven.

In the U.S., a bill must first pass both legislative branches of government, then, if signed by the executive branch, it will be codified in statute as law (Schoolhouse Rock anyone?). Once codified, the legislative branch will authorize the relevant executive department or agency to determine whether specific regulations are necessary to give the law effect. If so, those executive departments or agencies will determine what further rules are needed, and in turn, work to enforce them.

At the federal level, for example, proposed regulations are developed first through a “Notice of Proposed Rulemaking,” listed in the Federal Register and filed in the corresponding executive agency’s official docket (available at Regulations.gov). This affords the public an opportunity to comment on the regulations. After receiving comments, the filing agency may revise the proposed regulation before final rules are issued, which again will be published in the Federal Register and then filed in the agency’s official docket at Regulations.gov, before they are codified in the Code of Federal Regulations (CFR).

At nearly every step in this process then, institutions, government, and interest groups are working – sometimes at cross purposes – to shape what the law will be and how it will impact your startup.

The Startup Law A to Z – Regulatory Compliance reference guide is below:

Powered by WPeMatico

Tonal is today announcing its Series C financing that it hopes will allow the company to bring its at-home gym to even more homes. The funding round shows investors’ excitement around the new generation of personal exercise equipment that combines on-demand training with smart features. Tonal, like Peloton, offers features previously unavailable outside of gyms, and with this injection of capital, the company expects to build new personal features and invest in marketing and retail experiences.

L Catterton’s Growth Fund led the $45 million Series C round, which included investments from Evolution Media, Shasta Ventures, Mayfield, Sapphire Sport and others. This financing round brings the total amount raised to $90 million.

Tonal is based out of San Francisco and was founded by Aly Orady in 2015. The company launched its strength-training product in 2018. The wall-mounted Tonal uses electromagnetism to simulate and control weight, allowing the slender device to replicate (and replace) a lot of weight-lifting machines.

The Tonal machine costs $2,995, and for $49 a month, Tonal offers members access to personal training sessions, recommended programs and workouts. Since launching, CEO Orady tells TechCrunch there have been virtually no returns. He says their customer care teams proactively work with members to ensure a good experience.

Orady is excited to have L Catterton participating in this financing round, saying their deep network and unparalleled experience building premium fitness brands globally is an incredibly exciting new resource for the company. The Connecticut-based investment firm helped fund Peloton, ThirdLove, ClassPass and The Honest Company.

“As the fitness landscape continues to evolve, we have seen a clear shift toward personalized, content-driven, at-home workout experiences,” said Scott Dahnke, Global co-CEO of L Catterton in a released statement. “Tonal is the first connected fitness brand focused on strength training and represents an opportunity to invest behind an innovative concept with tremendous growth potential. We look forward to leveraging our deep knowledge of consumer behavior and significant experience in the connected fitness space to bring Tonal’s dynamic technology and content platform to more homes across the country.”

Tonal shares a market with Peloton, and Orady says a significant amount of Tonal owners also own Peloton equipment. Yet, feature-by-feature, Peloton and Tonal are different. While they’re both in-home devices that offer on-demand instructors, Peloton targets cardiovascular exercises while Tonal is a strength-training machine. Orady states his customers find the two companies offer complementary experiences.

“The common thread with our members is that they understand the value of investing in their fitness and overall health,” said Aly Orady, “All of our members are looking to take their fitness to the next level with strength training. Tonal offers the ability to strength train at home by providing a comprehensive, challenging full body workout without having to sacrifice quality for convenience.”

This is an enormous market he says the company can rely on for years to come. The majority of Tonal’s customers are between 30 and 55 years old and live in, or adjacent to, the top 10 major metro U.S. markets. There’s an even split, he says, between male and female members.

Tonal is similar to Mirror, another at-home, wall-mounted exercise device that costs $1,495. While Tonal focuses on strength training through resistance, Mirror offers yoga, boxing, Pilates and other exercises and activities with on-demand instruction and real-time stats. Mirror also launched in 2018 and the company has raised $40 million.

Going forward, Tonal expects to expand its software to provide new personalization features to its members. The hope is to build experiences that motivate users while serving up real-time feedback. This includes building new workout categories and additional fitness experiences, even when users travel and don’t have access to their Tonal machine.

The company sees it expanding its retail and marketing presence. Right now, just eight months after the product’s debut, customers have very limited access to try the Tonal machine. It’s only on display at Tonal’s flagship San Francisco store and is coming to a pop-up store in Newport Beach, Calif.

Orady tells TechCrunch the company needs new talent to help the company achieve its mission. Tonal is hiring and looking to hire in hardware, software, design, video production and marketing.

At-home exercise equipment is a massive market, and Tonal offers a unique set of features and advantages that should allow it to stand apart from competitors. This isn’t just another treadmill. Tonal is a strength-training super machine the size of a thick HDTV. Challenges abound, but the company seemingly has a solid plan to utilize its latest round of financing that should allow it to reach more customers and show them why the Tonal machine is worth the cost.

Powered by WPeMatico

Fresh from closing a notable investment from Airbnb, India’s OYO has expanded its footprint into Japan. The move comes through a joint venture with investor SoftBank — which led OYO’s $1 billion round last year through its Vision Fund — which will cover hotel-based accommodation and home rentals.

Financial details around the joint venture were not disclosed. An OYO representative declined to go into details when asked.

OYO started in India, where it initially aggregated budget hotels; it has since expanded into China, Malaysia, Nepal, the U.K., the UAE, Indonesia, the Philippines and — now — Japan. China, in particular, has shown promise, with OYO’s room inventory there reportedly double what it is in India.

The evolution has not just been a geographical one. Its business has moved from a laser focus on the long-tail of budget hotels to a broader “hospitality” play. It now includes managed private homes and, in India, wedding venues, holiday packages and co-working — while its hotel supply is a mixture of franchised and leased. It has also advanced its focus from budget-minded consumers to cover business travelers, too.

The Japanese JV will be led by Prasun Choudhary, whom OYO describes as a founding member of its team. Like OYO business elsewhere in the world, the company is appealing to small and medium hotel franchises and owners. On the consumer side, its prime segment is domestic and international travelers who seek “budget to mid-segment hospitality,” to use part of a statement from OYO founder and CEO Ritesh Agarwal, who is pictured in the image at the top of this post.

Agarwal is a Thiel fellow who started the company in 2011 when aged just 18. His original business, called Oravel, was an Airbnb clone that pivoted to become OYO. Today, that company is valued at $5 billion after raising more than $1.5 billion from investors.

SoftBank has previously struck joint ventures to bring other Vision Fund companies to Japan. Those include WeWork, Chinese ride-hailing firm Didi Chuxing and India’s Paytm, which launched a payment service in the country.

Powered by WPeMatico

French startup OpenClassrooms is announcing a new partnership for a masters-level online program. Students who enroll in this program will access a fully online program about artificial intelligence. Eventually, future graduates will join companies — Microsoft will likely hire some of them.

If you aren’t familiar with OpenClassrooms, the company started with basic massive open online course content for people willing to learn more about a particular topic. The startup then started offering full-fledged diplomas that require six months, a year or more.

OpenClassrooms is accredited to deliver official degrees in France — and the company plans to do the same in the U.S. and the U.K. It’s not 100 percent just you learning by yourself, as you get to talk to a mentor every week to discuss your progress. And it’s been working quite well for the company.

An online path generally costs less than a traditional degree, and you’re more flexible when it comes to hours, days and semesters. The startup is so confident that it guarantees you’ll find a job within six months of graduation.

More recently, OpenClassrooms has been partnering with companies to offer apprenticeship programs. The idea is that you work for a company several days a week and study when you’re not working. It’s a win-win, as some companies struggle to find the right candidates, and some students want to start working right away and don’t want to pay for their studies. And OpenClassrooms gets paid by companies directly. Uber, Deliveroo, Capgemini, BNP Paribas and dozens of others participate in the apprenticeship program.

Microsoft will help OpenClassrooms design a new degree around data science, machine learning and all things artificial intelligence. The company will provide content and projects. OpenClassrooms will recruit 1,000 candidates in France, the U.K. and the U.S. as part of this program.

Powered by WPeMatico

Zaver, a Swedish fintech that has built a payments platform to facilitate peer-to-peer trades and more, has picked up just over $1.2 million in seed funding. Backing the burgeoning startup are VC firms Inventure and Inbox Capital, as well as a number of relatively well-established angel investors.

They include Joen Bonnier (partner at Atomico), Tom Dinkelspiel, Pontus Hagnö, Fabian Hielte (owner of Ernström & C:o and a previous investor in Spotify and iZettle), Bo Mattsson (founder of Cint) and Fredrik Österberg (founder of Evolution Gaming).

Aiming to disrupt the market for P2P payment solutions, Zaver is developing a SaaS and accompanying apps to bring together buyers, sellers and merchants with the promise of “secure payments on your terms.” The fintech startup aims to facilitate trades between peers by enabling the use of flexible payment methods such as direct payments, “buy now, pay later” and installments.

To support this, Zaver’s platform claims to embed “intelligent fraud detection” algorithms in tandem with the automatic creation of “verified digital agreements” between transacting parties.

“The Zaver app is the first platform-independent checkout solution for P2P transactions,” says Amir Marandi, who co-founded Zaver alongside Linus Malmén — both former engineering students at KTH Royal Institute of Technology.

“With Zaver’s intelligent fraud prevention, automated and immediate credit decisions and cryptographically signed digital receipts, peers can do safe payments on their own terms with people they really don’t know that well,” he says. “We try to make P2P trades as safe as possible for all parties involved and offer flexible payment options, without compromising on the user experience.”

In addition, Zaver for Business enables merchants to utilise the platform to increase conversion and reduce transaction costs. “Our mission with this product is to reduce the need of a physical card reader,” adds Marandi.

Zaver’s typical user is described as a young student who wants to sell their iPhone on a classified site in a secure way, or a plumber who wants to buy a used VW Golf today and pay later. Meanwhile, the typical customer of Zaver for Business is a company with omni-channel sales, selling products/services online and offline.

“Our main competitors are not the kind of business you might expect,” explains Marandi. “It’s not the banks, but rather upcoming startups wanting to innovate the payment industry. The most direct competitor today I would say is the credit card industry.”

To that end, Zaver makes money from the transaction fees it charges merchants (which it says are up to 70 percent cheaper than traditional payment services), and on interest charged when someone chooses to pay via installments.

Adds Marandi: “Using automated systems for the entire customer journey we are able to offer individualised interest rates at the point of sale. The system automatically chooses an interest rate for you, based on your creditworthiness.”

Powered by WPeMatico

Less than a decade ago IPOs, acquisitions and global expansion by African startups were more possibility than reality. March saw all three from the continent’s tech scene.

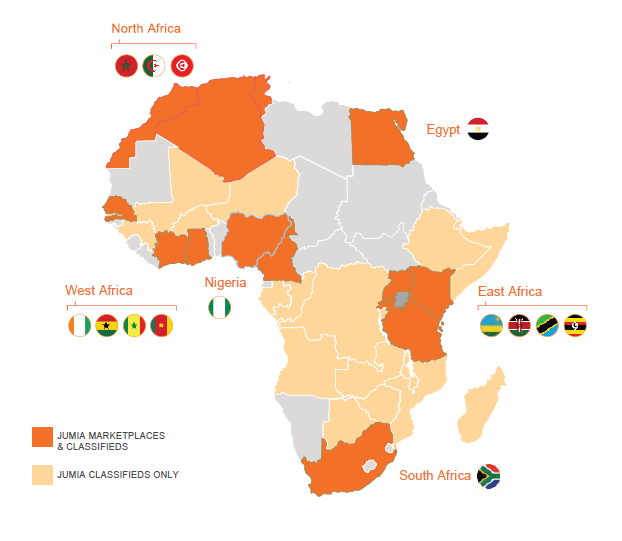

Pan-African e-commerce company Jumia filed for an IPO on the New York Stock Exchange, per SEC documents and confirmation from chief executive Sacha Poignonnec.

In an updated filing, (since the March 12 original) Jumia indicated it will offer 13,500,000 ADR shares, for an offering price of $13 to $16 per share to trade under the ticker symbol “JMIA.” The IPO could raise up to $216 million for Jumia.

Since our first story (and reflected in the latest SEC docs), Mastercard Europe agreed upfront to buy $50 million in Jumia ordinary shares.

With a smooth filing process, Jumia will become the first African startup to list on a major global exchange. The company is incorporated in Germany, but maintains its headquarters in Nigeria, and operates exclusively in Africa, with 4,000 employees on the continent.

The pending IPO creates another milestone for Jumia. The venture became the first African startup unicorn in 2016, achieving a $1 billion valuation after a funding round that included Goldman Sachs, AXA and MTN.

Founded in Lagos in 2012 with Rocket Internet backing, Jumia now operates multiple online verticals in 14 African countries. Goods and services lines include Jumia Food (an online takeout service), Jumia Flights (for travel bookings) and Jumia Deals (for classifieds). Jumia processed more than 13 million packages in 2018, according to company data. The company has started to generate annual revenues over $100 million, but like many burn-rate startups, has done so while racking up big losses.

There’ll be a lot more to cover, analyze and debate pre and post Jumia’s NYSE bell toll — which could happen in coming weeks or months. For example, can Jumia generate a profit; is it really an African startup; will Jumia become an acquisition target for a big outside name or an acquirer of smaller startups in African e-commerce? Stay tuned for continuing TechCrunch coverage.

On the acquisition front, Lagos-based online lending startup OneFi bought Nigerian payment solutions company Amplify for an undisclosed amount.

OneFi is taking over Amplify’s IP, team and client network of more than 1,000 merchants to which Amplify provides payment processing services, OneFi CEO Chijioke Dozie told TechCrunch.

The purchase of Amplify caps off a busy period for OneFi. Over the last seven months the Nigerian venture secured a $5 million lending facility from Lendable, announced a payment partnership with Visa and became one of the first (known) African startups to receive a global credit rating. OneFi is also dropping the name of its signature product, Paylater, and will simply go by OneFi (for now).

Collectively, these moves represent a pivot for OneFi away from operating primarily as a digital lender, toward becoming an online consumer finance platform.

“We’re not a bank but we’re offering more banking services…Customers are now coming to us not just for loans but for cheaper funds transfer, more convenient bill payment, and to know their credit scores,” said Dozie.

OneFi will add payment options for clients on social media apps, including WhatsApp, this quarter — something in which Amplify already holds a specialization and client base. Through its Visa partnership, OneFi will also offer clients virtual Visa wallets on mobile phones and start providing QR code payment options at supermarkets, on public transit and across other POS points in Nigeria.

On the back of the acquisition, OneFi is in the process of raising a round and will look to expand internationally, considering Senegal, Côte d’Ivoire, DRC, Ghana and Egypt and Europe for Diaspora markets.

On African startups expanding globally, FlexClub — a South African venture that matches investors and drivers to cars for ride-hailing services — announced it will expand in Mexico in a partnership with Uber after closing a $1.2 million seed round led by CRE Venture Capital.

The move comes as Africa’s tech-transit space continues to produce unique mobility solutions shaped around local needs.

FlexClub touts itself as a “gig economy investment platform” that is creating new asset classes in emerging markets, according to chief executive and co-founder Tinashe Ruzane.

That asset class, for now, is ride-hail vehicles. FlexClub allows investors to go on the site and purchase a car (ultimately managed and serviced by FlexClub). The startup then connects that car to an Uber driver who uses earnings to pay a weekly rental charge.

Those fees generate monthly fixed-rate interest income for the investor. The driver has the option of buying the car after 12 months, with a descending purchase price over time.

FlexClub’s platform manages the investment, rental income and disbursement of funds across all parties. The startup also handles insurance, maintenance and upkeep of the cars.

Ruzane envisions this as a model to finance multiple asset classes in emerging markets — where lending options are fewer for individuals who may not have credit histories.

“Our goal is to make this completely passive… where investors can invest in different kinds of assets on our platform, login to a dash, and see this is how my five cars in South Africa are doing, my vans in Mexico, my motorbikes in Indonesia — with a diversified portfolio around the world,” he explained.

FlexClub will begin work matching investors to cars and Uber drivers in Mexico in April. The startup sees opportunities to move into other mobility classes, such as Africa’s ride-hail motorcycle taxi and three-wheel tuk-tuk market, CEO Tinashe Ruzane told TechCrunch in this feature.

And finally, francophone Africa will see a boost in funds and support for startups. The Dakar Network Angels group launched last month, making its first investment to cleantech venture Coliba — an Ivorian startup that uses a mobile app to coordinate waste recycling

The deal is part of Dakar Network Angels’ mission of convening experts and capital to bridge the resource gap for startups in French-speaking Africa — or 24 of the continent’s 54 countries.

The organization — which goes by DNA for short — will offer seed fund investments of between $25,000 to $100,000 to early-stage ventures with high growth potential. These rounds will come with the entrepreneurial guidance of DNA’s angel network.

Launched in Senegal, the organization’s founder Marieme Diop — a VC investor at Orange Digital Ventures — named the goal of bridging VC disparities between francophone and non-francophone Africa as the primary driver for DNA. She pointed to funding data by Partech, indicating that 76 percent of investment to African startups goes to three English-speaking countries — Nigeria, Kenya and South Africa.

To gain consideration for DNA investment, startups must gain referral by a member. DNA will take a minority stake (less than 10 percent) in ventures that receive seed funds and provide program mentorship until exits, Diop told TechCrunch.

To become an angel, members must commit to investing a minimum of $10,000 a year (for those coming on as individuals), $20,000 (for corporates) and be on hand to support the portfolio startups, according to DNA’s Corporate Membership Charter.

More Africa Related Stories @TechCrunch

African Tech Around The Net

Powered by WPeMatico