Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

I sat down with Menlo Ventures partner Shawn Carolan this week to talk about his early investment in Uber. Menlo, if you remember, led Uber’s Series B and has made a hefty sum over the year selling shares in the ride-hailing company. I’ll have more on that later; for now, I want to share some of the insights Carolan had on his experience ditching venture capital to become a founder.

Around when Menlo made its first investment in Uber, Carolan began taking a step back from the firm and building Handle, a startup that built tools to help people be more productive. Despite years of hard work, Handle was ultimately a failure. Carolan said he shed a lot of tears over its demise, but used the experience to connect more intimately with founders and to offer them more candid, authentic advice.

“People in the valley are always achievement-oriented; it’s always about the next thing and crushing it and whatever,” Carolan told TechCrunch. “When [Handle] shut down, I had this spreadsheet of all the people who I felt like I disappointed: Seed investors who invested in me, all the people at Menlo and my friends who had tweeted out early stuff. It was a long spreadsheet of like 60 people. And when I started a sabbatical, what I said was I’m going to go connect with everyone and apologize.”

Today, Carolan encourages founders to own their vulnerabilities.

“It’s OK to admit when you’re wrong,” he said. “Now I can see it on [founders’] faces, I can see when they’re scared. And they’re not going to say they’re scared but I know it’s tough. This is one of the toughest things that you’re going to go through. Now I can be there emotionally for these founders and I can say ‘here’s how you do it, here’s how you talk to your team and here’s what you share.’ A lot of founders feel like they have to do this alone and that’s why you have to get comfortable with your vulnerability.”

After Handle shuttered, Carolan returned to Menlo full time and made the firm a boatload of money from Roku’s IPO and now Uber’s. Anyway, thought those were some nice anecdotes that should be shared since most of our feeds are dominated by Silicon Valley hustle porn.

Want more TechCrunch newsletters? Sign up here. Ok, on to other news…

IPO corner

There were so many fund announcements this week; here’s a quick list.

Lots of great new exclusive content for our Extra Crunch subscribers is on the site, including this deep dive into the challenges of transportation startup profits. Plus: When to ditch a nightmare customer, before they kill your startup; The right way to do AI in security; and The definitive Niantic reading guide.

Sinema, that one MoviePass competitor, has run into its fair share of bumps in the road. TechCrunch’s Brian Heater hopped on the phone with the startup’s CEO this week to learn more about those bumps, why its terminating accounts en masse, a class-action lawsuit its battling and more.

Photo by Stephen McCarthy / RISE via Sportsfile

TechCrunch’s Startup Battlefield brings the world’s top early-stage startups together on one stage to compete for non-dilutive prize money, and the attention of media and investors worldwide. Here’s a quick update on some of our BF winners and finalists:

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm, myself and Phil Libin, the founder of Evernote and AllTurtles, chat about the importance of IPOs. Plus, in a special Equity Shot, Alex and I unpack the Uber S-1.

Powered by WPeMatico

Hundreds of billions of dollars in venture capital went into tech startups last year, topping off huge growth this decade. Here at DocSend, we’re seeing the downstream effects in our data: investors who receive DocSend links are reviewing more pitch decks than ever, as more people build companies and try to get a slice of the funding opportunities.

So it stands to reason that making your pitch deck stand out is critical to raising a round. But how do you do that in such a competitive landscape?

After analyzing both successful and failed fundraising pitch decks, we’ve learned that storytelling matters and this hasn’t changed over the last few years. This makes intuitive sense — who doesn’t love a good story?

But does telling a story help founders raise capital successfully? And more importantly, do you fail to fundraise if you don’t tell a story? In this post, I’m going to share some hard evidence.

It follows up on my post over on TechCrunch, looking at three big mistakes we see in failed pitch decks.

Before we start diving into the data, here’s why we know: our document sharing and tracking platform is used every day by thousands of startups to share their decks securely with investors, with visits to pitch decks shared via DocSend having grown 4x from 2017 to 2018. Controlling for DocSend’s growth, we estimate that investors are viewing 35% more decks in 2018 than they did in 2017.

In total, over 100,000 users have shared over 2.2 million links through DocSend since we launched in 2014, and these documents have received over 220 million views; while we’ve grown quickly among sales, business development and customer success teams, startup pitch decks have continued to be a popular use-case. We’ve also been analyzing the pitch data in a collaboration with Harvard Business School since 2015, so we’re experienced at analyzing and interpreting this data.

The old adage “you only get one chance to make a first impression” is true when it comes to pitch decks, and in fact that was the case for our company’s own fundraising process. When I pitched DocSend for our seed round, I knew what we were up against — why will this be a big business? And, why won’t Google build this? Our product was still in private beta, and we had no revenue. However, we had an MVP and those who were using our product, including our potential investors, found the product to be very useful.

Powered by WPeMatico

Fundraising has always been something of a black box. High-flying companies make it seem like a breeze, but most entrepreneurs lose sleep over it. My first startup was called Pursuit.com and although we successfully raised a seed round, it was incredibly tough (we were eventually aqui-hired by Facebook). DocSend is my second startup, and it has taught me a lot about the process — not only because of our own fundraising, but because the product itself reveals big pitching trends in a unique way.

Since 2014, over 100,000 users have shared over 2.2 million links through our document tracking and sharing platform, and these documents have received over 220 million views. Thousands of founders share their funding decks with prospective investors every day, in addition to our product’s other uses for sales, business development and customer success. To get insights about all this activity, we have a long-running partnership with Harvard Business School, where we’ve been analyzing the anonymized fundraising data of startups attempting to raise a Seed or an A round.

We shared our early learnings in a TechCrunch article in 2015, Lessons from a study of perfect pitch decks. In this post, I’ll update our findings based on the last four years of data (and a lot of user growth on our side).

So what differentiates a winning seed round pitch deck from those that fail to raise capital? While both successful and failed pitch decks are about the same length, an average of 18 pages, how the content is structured is vastly different. And while investors spend the same amount of time on both, 3.7 minutes on average, where they spend time tells us a lot about what successful pitches and failed pitches have in common. Below, I detail three mistakes that you want to avoid.

If you want to check out more details on what you should do in your deck, read my follow-up article “Data tells us that investors love a good story“ over on Extra Crunch.

It’s very tempting, especially for technical founders, to start pitch decks with how incredible their product is, how much time they’ve spent building it, their unique tech stack, and how convinced they are that they have just the right MVP for launch. But guess what?

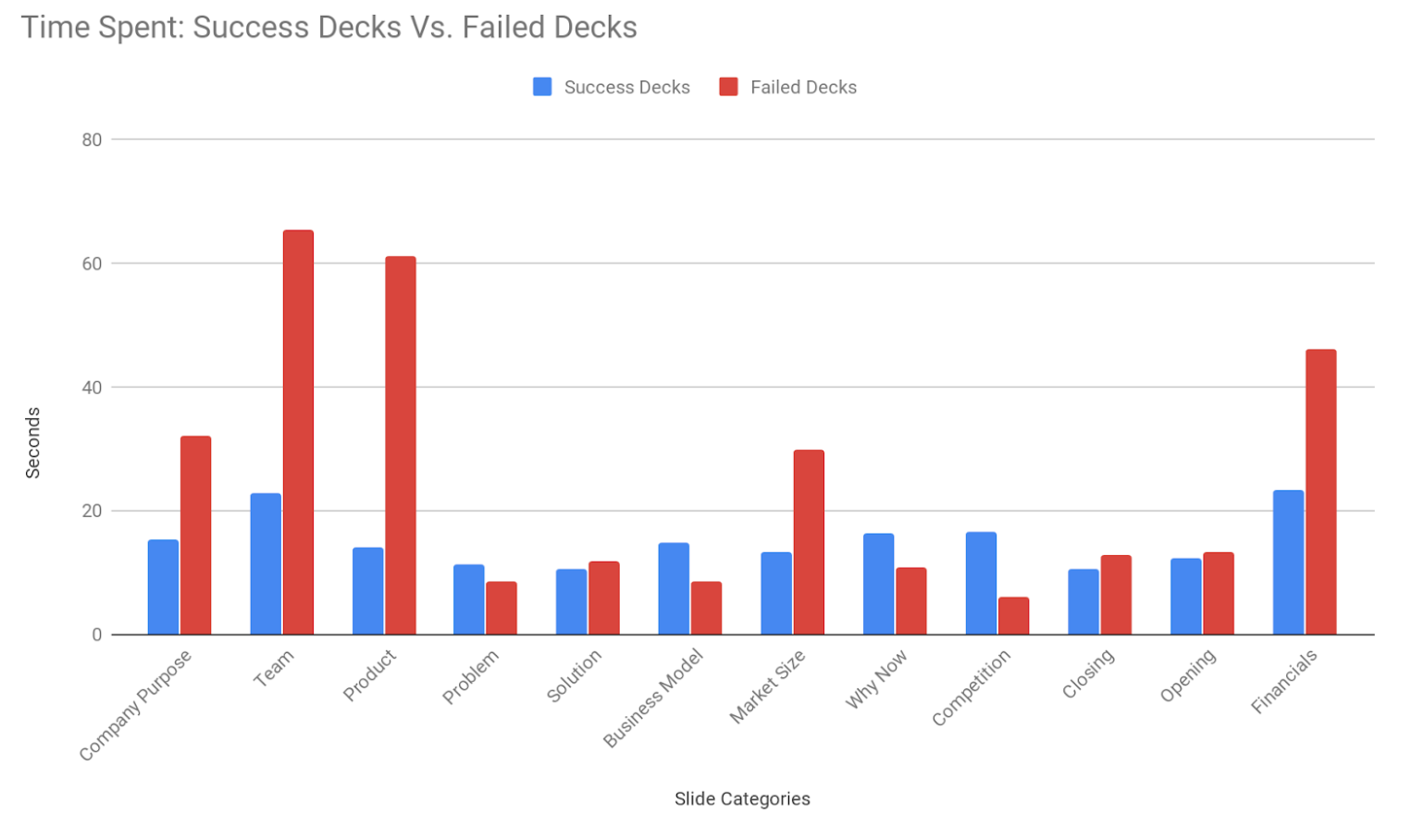

You might think that’s a good thing. More time on my product slides, right? No. Data tells us that they are probably digging into the details trying to map your product‘s value to the current market needs and they are not coming away with a clear connection between the two.

Your target investors are also not your target customer. Showing screenshots and product details are just confusing for them. What are they looking at? Why does this matter? Most products are capable of being built; the question they are trying to answer is why is this product going to create a big business?

Image via DocSend

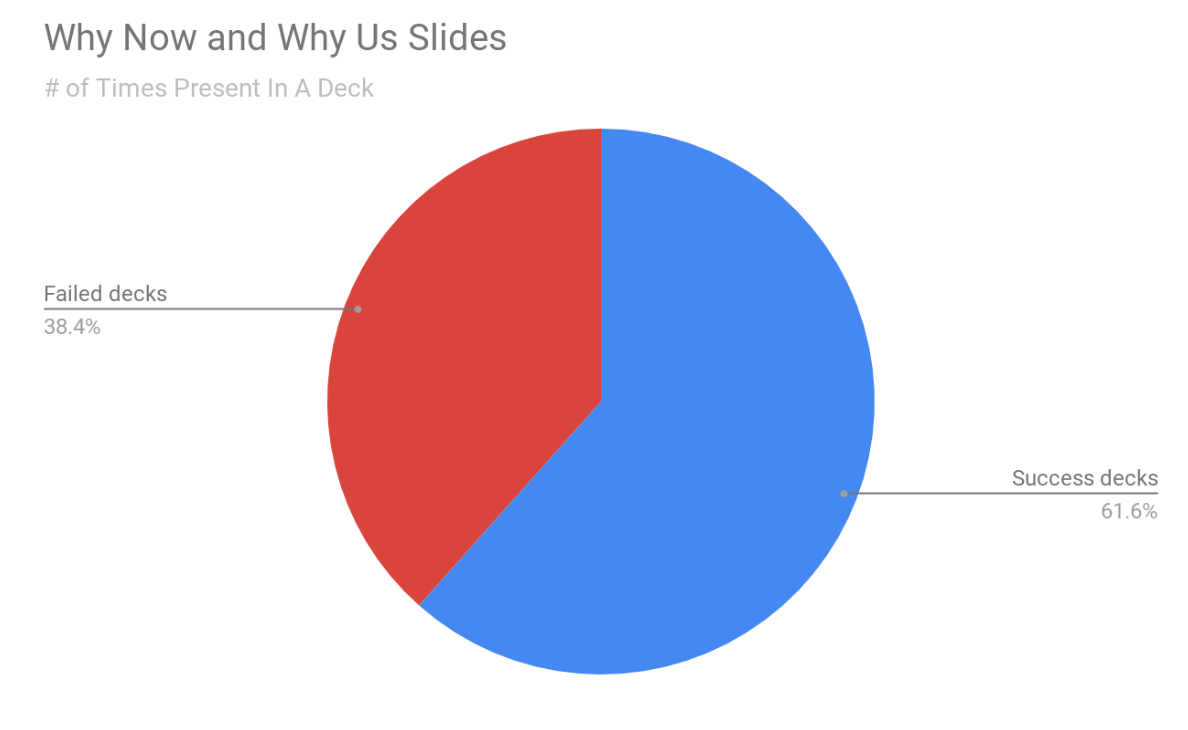

By now Simon Sinek has beaten this one into our collective brains with his start with the why Ted Talk and yet what we see in our data is that in failed decks, the “why now” and “why you” question has been left to the end. Successful pitches start with their company purpose, followed by why this team, and why the timing is right for this particular product.

In successful decks, investors spend 27 seconds on an average on “why now” and “why you” slides but in failed decks, they spend 62 seconds on these slides. We read this as investors are spending more time researching your team and your capabilities than they do with successful pitch decks. More time spent on these pages means that investors are not as convinced about this venture as the entrepreneur would like them to be. Entrepreneurs should focus on making their “why” slides part of a seamless narrative that leaves the investors wondering why this isn’t already a huge business.

Image via DocSend

Everyone loves a good story and investors are no exception to this rule. All successful pitch decks tell a compelling story and follow a similar narrative thread. They start with the company purpose, the big problem they are trying to solve, why now is the right time, and why they are the right team to solve it. Failed pitch decks start with the product, followed by business model, and competitive landscape. Successful decks cover these too but they invariably follow a narrative that makes intuitive sense while in failed decks there is no compelling narrative.

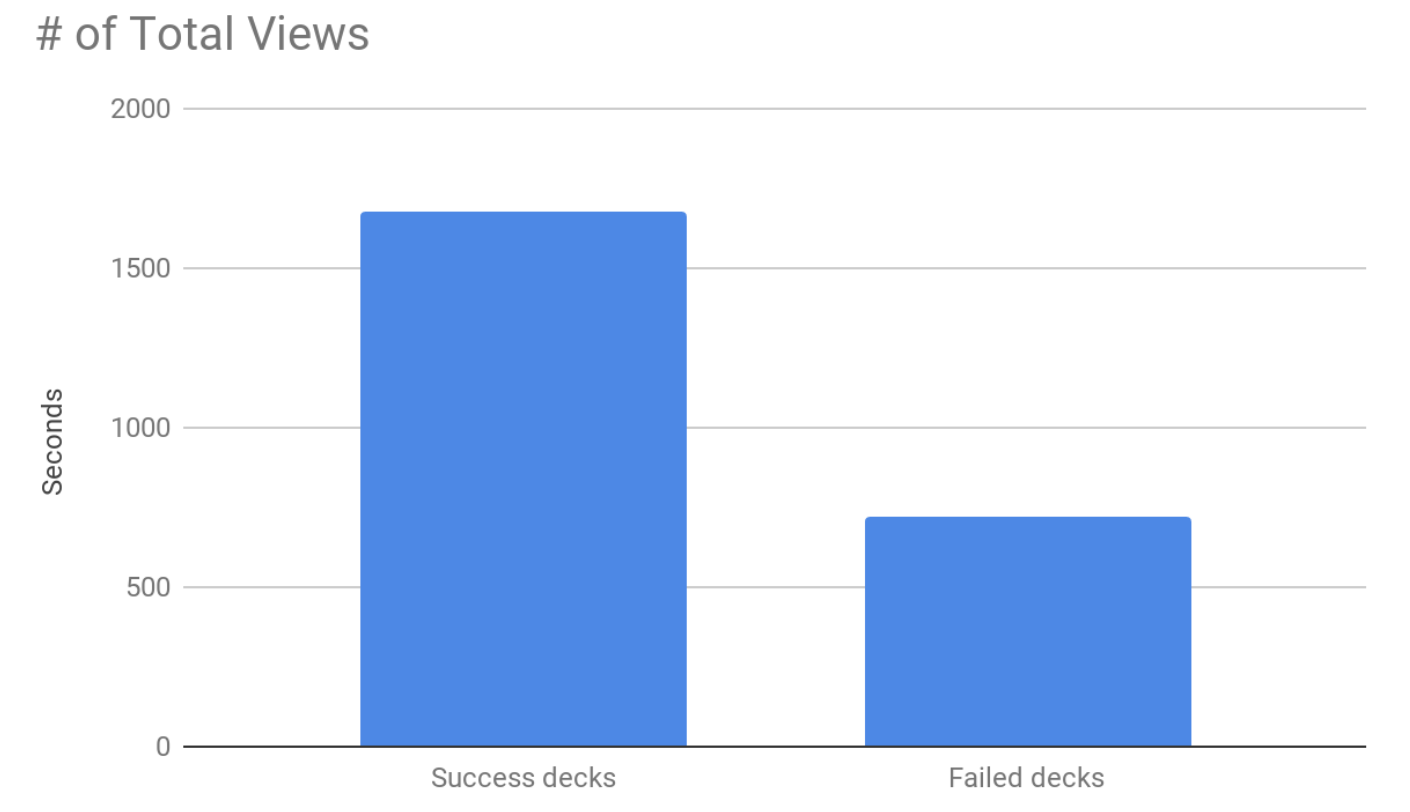

Successful decks also get more repeat visits, they are visited 2.3 times more than failed decks and are forwarded along more often than failed pitch decks.

Image via DocSend

In the early days, entrepreneurs spend most of their time conceiving and building their minimum viable product (MVP). Naturally, they feel compelled to pitch this to investors. Although unintuitive, data suggests that you should restrain yourself from talking about your product before you have painted a narrative about the business opportunity: why now and why you. Once investors are convinced of those key points, by all means, go through all the product details and roadmaps. Just don’t lead with your product.

This is the first of a series of articles about fundraising. My followup article now available on Extra Crunch reveals what our data shows you should do with your deck. In future installments, I’ll be sharing more about the difference between Seed, Series A, and Series B rounds as well as how fundraising challenges change as your company grows. For the next post, I’ll be writing about why some pitch decks raise way more money than others. In the meantime, have questions about the best way to raise money? Check out our blog or reach out to us on Twitter at: @rheddleston or @docsend.

Powered by WPeMatico

What is Niantic? If they recognize the name, most people would rightly tell you it’s a company that makes mobile games, like Pokémon GO, or Ingress, or Harry Potter: Wizards Unite.

But no one at Niantic really seems to box it up as a mobile gaming company. Making these games is a big part of what the company does, yes, but the games are part of a bigger picture: they are a springboard, a place to figure out the constraints of what they can do with augmented reality today, and to figure out how to build the tech that moves it forward. Niantic wants to wrap their learnings back into a platform upon which others can build their own AR products, be it games or something else. And they want to be ready for whatever comes after smartphones.

Niantic is a bet on augmented reality becoming more and more a part of our lives; when that happens, they want to be the company that powers it.

This is Part 3 of our EC-1 series on Niantic, looking at its past, present, and potential future. You can find Part 1 here and Part 2 here. The reading time for this article is 24 minutes (6,050 words)

After the absurd launch of Pokémon GO, everyone wanted a piece of the AR pie. Niantic got more pitches than they could take on, I’m told, as rights holders big and small reached out to see if the company might build something with their IP or franchise.

But Niantic couldn’t build it all. From art, to audio, to even just thinking up new gameplay mechanics, each game or project they took on would require a mountain of resources. What if they focused on letting these other companies build these sorts of things themselves?

That’s the idea behind Niantic’s Real World Platform. This platform is a key part of Niantic’s game plan moving forward, with the company having as many people working on the platform as it has on its marquee money maker, Pokémon GO.

There are tons of pieces that go into making things like GO or Ingress, and Niantic has spent the better part of the last decade figuring out how to make them all fit together. They’ve built the core engine that powers the games and, after a bumpy start with Pokémon GO’s launch, figured out how to scale it to hundreds of millions of users around the world. They’ve put considerable work into figuring out how to detect cheaters and spoofers and give them the boot. They’ve built a social layer, with systems like friendships and trade. They’ve already amassed that real-world location data that proved so challenging back when it was building Field Trip, with all of those real-world points of interest that now serve as portals and Pokéstops.

Niantic could help other companies with real-world events, too. That might seem funny after the mess that was the first Pokémon GO Fest (as detailed in Part II). But Niantic turned around, went back to the same city the next year, and pulled it off. That experience — that battle-testing — is valuable. Meanwhile, the company has pulled off countless huge Ingress events, and a number of Pokémon GO side events called “Safari Zones.” CTO Phil Keslin confirmed to me that event management is planned as part of the platform offering.

As Niantic builds new tech — like, say, more advanced AR or faster ways to sync AR experiences between devices — it’ll all get rolled into the platform. With each problem they solve, the platform offering would grow.

But first they need to prove that there’s a platform to stand on.

Niantic’s platform, as it exists today, is the result of years of building their own games. It’s the collection of tools they’ve built and rebuilt along the way, and that already powers Ingress Prime and Pokémon GO. But to prove itself as a platform company, Niantic needs to show that they can do it again. That they can take these engines, these tools, and, working with another team, use them for something new.

Powered by WPeMatico

Quiz Khalifa aka Host Malone aka Trap Trebek aka HQ Trivia’s Scott Rogowsky has been pushed out of the live mobile gaming startup. The two split due to disagreements about Rogowsky attempting to take a second full-time job hosting sports streaming service DAZN’s baseball show ChangeUp while moving to only hosting HQ on weekends, TMZ first reported. HQ wanted someone committed to their show.

Now HQ co-founder and CEO Rus Yusupov confirms to TechCrunch that Rogowsky will no longer host HQ Trivia. He tells me that the company ran a SurveyMonkey survey of its top players and they voted that former guest host Matt Richards rated higher than Rogowsky. Yusupov says HQ is excited to have Richards as its new prime time host. It’s also putting out offers to more celebrity guests to host for a few shows, a few weeks or even a whole season of one of its time slots.

HQ Trivia’s new host Matt Richards

The departure could still shake HQ’s brand since Rogowsky had become the de facto face of the company. But he was also prone to talking a lot on the air and promoting himself, sometimes in ways that felt distracting from the game. Rogowsky has also been using HQ’s brand to further his stand-up comedy career, splashing its logo on advertising for his shows like this one below at a casino where “The centerpiece is a live trivia competition,” he told WPTV5.

[Update: Rogowsky has since commented on his departure via tweetstorm. He thanked the team and viewers for their support but didn’t mention the startup’s founders, confirmed his ChangeUp gig led to leaving HQ, and threw a dig at the company noting “I wasn’t given the courtesy of a farewell show.”]

Sadly, it won’t be possible for me to continue hosting HQ concurrently as I had hoped, and because I wasn’t given the courtesy of a farewell show, please allow me to use this thread to say all the things I would have said on my final broadcast. (2/5)

— Scott Rogowsky (@ScottRogowsky) April 12, 2019

Rogowsky also issued TechCrunch this statement:

“Nothing in my decade-plus entertainment career has meant more to me personally and professionally than my involvement with HQ. I am tremendously grateful to the talented team of engineers, writers, animators and producers at Intermedia Labs who helped me grow the show into the international phenomenon it became, and above all, I will forever be thankful for the millions of HQties around the world who will always hold a special place in my heart. While the decision to leave HQ was a difficult one, I am delighted to begin this next chapter in my career with the amazing people at MLB and DAZN. If you miss me on HQ, you can now get three hours of me every weeknight watching ChangeUp on DAZN.”

TechCrunch had predicted that Rogowsky might depart if he wasn’t properly compensated with equity in HQ Trivia that would only vest and earn him money if he stuck around. The damage to HQ could worsen if he’s scooped up by Facebook, Snapchat or another tech company to build out their own live video gaming shows.

Rogowsky used HQ Trivia branding to promote his own in-person comedy and trivia shows

HQ Trivia provided this statement on Rogowsky’s exit:

We continue to build an incredible company at HQ Trivia, from drawing hundreds of thousands of players to the platform daily, to increasing the size of the prize, to attracting strong talent. We’ve come a long way since Scott Rogowsky’s first trivia game and we’re grateful for everything he’s done for the platform. This is a team that creates products for talent to really shine—we’re just getting started at HQ Trivia, and as he makes his next move, wanted to take a minute to thank him for being part of our journey.

Yusupov tells me he’s excited about exploring new hosts, noting that Richards is a person of color who brings more diversity to HQ’s lineup. Richards is a stand-up comic who has appeared on CBS’ 2 Broke Girls, Nickelodeon’s School of Rock and was a voice-over host for game show Trivial Takedown on FUSE. Yusupov says the team feels jazzed about the new creative opportunities beyond Rogowsky, though the CEO says he appreciates all that its former host contributed.

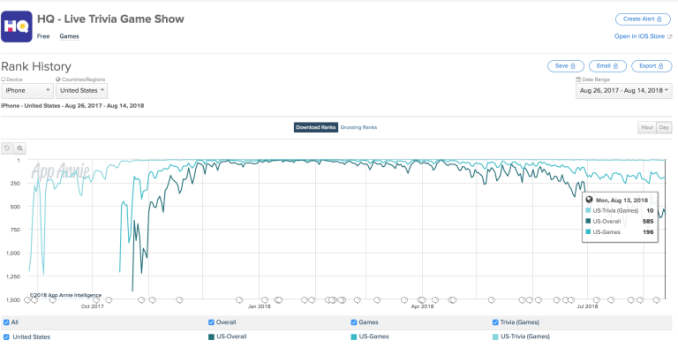

Richards will have the tall task of trying to revive HQ’s popularity. It climbed the app store charts to become the No. 3 top game and No. 6 overall app in January 2018, and peaked at 2.38 million concurrent players in March 2018. But it’s been on a steady decline since, falling to the No. 585 overall app in August, and it dropped out of the top 1,500 last month, according to App Annie. HQ Trivia was installed more than 160,000 times last month on iOS and Android, with approximately $200,000 in in-app purchase revenue, according to Sensor Tower. But that’s just 8 percent as many downloads as the 1.97 million new installs HQ got in March 2018.

Exhaustion with the game format, so many winners splitting jackpots to just a few dollars per victor and laggy streams have all driven away players. The introduction of a new Wheel of Fortune-style HQ Words game in August hasn’t stopped the decline. And the tragic death of HQ co-founder and former CEO Colin Kroll may have impeded efforts to turn things around. There’s a ton of pressure on the company after it raised $23 million, including a $15 million round at a $100 million valuation.

Even if HQ Trivia fades from the zeitgeist, it and Rogowsky will have inspired a new wave of innovation in what it means to play with our phones.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

It’s time for another Equity Shot, a quick-take episode centered around a breaking news event. This time, as you already guessed, Kate Clark and I sat down to dig into the Uber S-1. It’s a huge, complex document, but we did our best to summarize what’s inside.

First, we talked through yearly results, looking back a half-decade into Uber’s revenue growth. In the filing, Uber reported 2018 revenues of $11.27 billion, net income of $997 million and adjusted EBITDA losses of $1.85 million. We highlighted those numbers, talked about operating losses and the company’s gyrating net results that included the positive impacts of various divestitures.

Yes, this S-1 required a bit more unpacking than most. We apologize for the frantic scrolling, we were pouring through the document live and we were a bit excited. This is an IPO that’s been talked about for years and will be easily one of the largest floats of all time.

Anyway, an S-1 brings insights to more than just a company’s financials, so we spent time highlighting key stakeholders, or, in other words, the people are are going to get really really really rich off Uber’s IPO. That includes Uber co-founder and chief executive officer Travis Kalanick, famous venture capital firms like the SoftBank Vision Fund and Benchmark, and more.

The IPO, remember, is expected to sell $10 billion in stock (primary and secondary) and value the company at $100 billion or more.

If 30 minutes digging through the S-1 wasn’t enough for you, don’t fret, we’ll be following the Uber IPO for weeks — probably months — to come.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

As Uber gears up for its highly anticipated public debut, the company is setting aside some dough for drivers that have logged some serious rides on the platform as a reward for sticking with the service. The company follows Lyft, which also rewarded drivers with one-time cash bonuses during its public offering.

The company is setting aside a number of shares of common stock at the initial IPO price that drivers who earn this “appreciation award” will be able to purchase.

Drivers will get $100, $500, $1,000 or $10,000 for completing 2,500, 5,000, 10,000 or 20,000 lifetime trips, respectively. The caveat being that drivers will need to have also completed at least one ride in 2019 as of April 7 and be “in good standing.” We’ve reached out to Uber about what exactly that means.

Uber’s “driver appreciation awards” are pretty identical to what Lyft did for its public offering, which awarded drivers with 10,000 and 20,000 rides with $1,000 and $10,000 respectively. The key difference being Uber has some nice smaller cash bonuses for less-prolific drivers. Uber detailed that for drivers outside of the United States, the appreciation award “may be adjusted on a region-by-region basis to account for differences in average hourly earnings by region.”

Powered by WPeMatico

PagerDuty debuted on the New York Stock Exchange today, and as we type, shares of the nine-year-old, San Francisco-based incident response software company are trading at nearly $39.

That’s up more than 60 percent above their IPO range of $24 per share, which was itself adjusted from the range of $21 to $23 that had been expected earlier and gives the company a valuation of close to $3 billion. That’s an awful lot for a company whose software helps technical teams at 11,000 companies spot problems with applications and respond to incidents. Though it’s growing quickly — revenue was up 48 percent last year — it still pulled in just $117.8 million in 2018. Meanwhile, its net loss widened last year, to $40.7 million from $38.1 million in 2017.

Certainly, its performance has to make the company’s investors — who last assigned the company a valuation of $1.3 billion back in September — very happy. Some of the VCs poised to win big if PagerDuty’s shares continue flying high include Andreessen Horowitz, which owned 18.4 percent of PagerDuty’s shares sailing into the IPO; Accel, which owned 12.3 percent; and Bessemer, which owned 12.2 percent. Other winners include Baseline Ventures (6.7 percent) and Harrison Metal (5.3 percent).

It’s also exciting for CEO Jennifer Tejada, a proven operator who was brought in to lead PagerDuty in 2016 and now becomes part of a small — but growing — club of women CEOs to take their tech companies public, including Katrina Lake of Stitch Fix and Julia Hartz of Eventbrite.

We talked with Tejada earlier today about the company’s big day. In addition to crediting company co-founders (and shareholders) Andrew Miklas and Baskar Puvanathasan, both of whom have since left the company, Tejada thanked PagerDuty co-founder Alex Solomon, who remains the company’s CTO. She also told us a little bit about what today has been like, and how the IPO changes things — and doesn’t. Our chat has been edited for length.

TC: First and foremost, how are you feeling?

JT: It’s been an incredible day. It’s been an incredible several months. You have to enjoy it when it’s going well.

TC: How does the vision for the company change now that it’s public? Have you been thinking ahead to possible acquisitions?

JT: The vision doesn’t change. We intend to do exactly what we’ve been doing, which is to provide the best real-time operations platform available to companies as they undergo digital transformation to meet the growing demands of their customers. We think we’re [facing] an early and very large opportunity that will be available to us for a long time. So our job continues to be to build great products, stay close to our customers, expand regionally and continue doing what has allowed us to be a successful private company.

TC: You and I had talked about the challenges of retaining employees in San Francisco when we sat down together in November. It’s a battle for every local company. How do you keep employees beyond the lock-up period? How do you ensure they stay focused on performance and not your share price?

JT: I think that mindset of, ‘It’s all over when you go public,’ is kind of a Silicon Valley fable. If you look at the most successful SaaS companies on the planet, they’ve gained 10x, 20x, 30x their value post their IPO. I also think what employees look for ahead of their financial success is career success. Am I being developed and recognized and can I build my career at this company? And we’ve worked really hard to create those career opportunities for our employees who [I think see, as I do] the IPO like a racing boat pushing off the dock, across the starting line, and into the open ocean, where the next adventure awaits.

In the meantime, we’ve already lessened our reliance on [overheated job markets] by opening offices in Toronto and Atlanta and Seattle and London and Sydney, even while we’re still hiring in San Francisco and Seattle.

TC: Obviously, Lyft’s shares have been up and down, owing to short sellers. Have you been monitoring short interest? Are you at all concerned about investors driving the price sky high, then selling it on the way down?

JT: I haven’t even looked at the stock price in the last several hours . . . There are a lot of things outside of my control, and the free market is one of them.

TC: PagerDuty is rare in that is doesn’t have a dual-class structure, which can greatly empower leaders over everyone else associated with a company. Presumably, this is a great relief to your investors; I just wonder whether it was ever a consideration?

JT: I’m a little bit of a traditionalist. I’ve been around long enough to know how checks and balances work, and a single-class structure made sense for PagerDuty. Also, dual-class structures tend to emerge more when you have deeply involved founders, and though Alex is still very much a part of the business, PagerDuty’s other two founders have worked outside of the business for some time.

TC: You have plenty of operating experience, including previously running Keynote Systems, but you’ve never taken a company public. Were there ways in which you found the roadshow experience surprising?

JT: I was surprised by how fun it was! [Laughs.] When you have a great story, and a great partner helping you tell it — in my case that’s [PagerDuty CFO] Howard Wilson, who I’ve worked with for 10 years — it’s great. We had a great reception from investors. I loved our IPO team; our Top were both led by women and whenever I had a question, they [had the answer]. I also had this cocoon of experience surrounding me thanks to our board. If anyone tells you that [in this position] they are super comfortable, they’re either lying or [clueless] but I was very lucky. I also have a whole bunch of buddies who are CEOs [and other executives] in SaaS and I’ve been shaking them down for advice for months, so I felt well-prepared.

TC: What was some of the advice you received from those friends about how your life is about to change?

JT: Some of it was about the need to keep people focused and not get distracted, to remind everyone that this is a milestone, not the goal. [Some centered on] surrounding yourself with a great team and the importance of great investor relations, a function you don’t have as a private company but that can create huge value and provide support and understanding of the market.

One CEO said to just make sure you keep having fun, to try and stay “you,” to find joy in the same things as before. There will be stressful moments and tough questions — that’s true of any company that’s scaling — but I heard a lot of advice about just taking care of myself, including on the roadshow. In fact, there were a lot of really supportive notes and private tweets that, in a job that can feel lonely, made me feel not alone, and I’m very appreciative of that.

TC: People call IPOs just another funding event, but that’s kind of baloney, isn’t it? If you had to list the most meaningful moments in your life on a scale from 1 to 10, 1 being the most important, where might today fall? Would today be up there on that list?

JT: When I think of most meaningful moments, I think of the day my daughter was born, and my wedding. Another day that was very meaningful to me was when I approved our pledge to donate one percent [of PagerDuty’s equity, one percent of its product and one percent of employees’ time] to social impact. We did it a lot later in the game than some companies; our equity was already valuable. But we knew that it was going to create meaningful impact over time.

But yes, it is a gratifying day, especially for the co-founders who were pulling the idea together for PagerDuty a couple of years before they even launched it, and for employees who’ve been with the company for nearly as long and who turned down safer and higher-paying jobs along the way. Seeing their joy today — that is a memory that will be in my top 10 for sure.

Powered by WPeMatico

TechCrunch Include is partnering with Salesforce Ventures to host this month’s Include Office Hours on April 30th. From 2:00pm – 4:00pm, Salesforce Ventures investors Matt Garratt, Phoebe Peronto, Spencer Chavez, and Claudine Emeott will meet with founders one on one, for 20 minutes, to offer guidance, advice and product feedback. You can apply here.

TechCrunch launched the Include program in 2014 to connect underserved and underrepresented founders in tech to our vast network and facilitate opportunities. The Include Office Hours program is one such initiative. TechCrunch partners with a VC firm a few times a year to give diverse founders a unique opportunity to meet privately with investors to get advice on building and developing their startups.

Underserved and underrepresented founders are invited to apply. Diverse founders include, but are not limited to, female founders, veterans, Latino/a, Black, LGBTQ and founders with disabilities.

Salesforce Ventures will be hosting office hours on April 30th from 2:00pm – 4:00pm. Salesforce Ventures is interested in meeting with founders from the following categories: B2B SaaS & Enterprise Technology Startups across multiple sectors including retail, fintech, digital health, manufacturing, impact (education, sustainability, diversity & inclusion) in addition to AI/ML, developer tools and blockchain. Founded in 2009, the firm’s portfolio consists of 300+ investments in more than 20 countries. Companies in the Salesforce Ventures portfolio typically receive funding, access to one of the world’s largest cloud systems and guidance from the company’s execs. Connect with Salesforce Ventures here.

Let’s meet the investors:

Matt Garratt, Managing Partner, Salesforce Ventures

Matt Garratt is the managing partner of Salesforce Ventures. Matt has completed investments in leading enterprise SaaS companies, including companies such as DocuSign, MuleSoft and Twilio. Prior to joining Salesforce Ventures, he was a vice president at Battery Ventures, where he invested in early-stage enterprise software and GreenIT companies. Matt was also a vice president of Plymouth Ventures, a late-stage investment fund based in Ann Arbor, Michigan. He has also worked for GE in their corporate strategy group and has spent time in Africa monitoring energy and infrastructure investments for E+Co, a public-purpose investment.

Matt Garratt is the managing partner of Salesforce Ventures. Matt has completed investments in leading enterprise SaaS companies, including companies such as DocuSign, MuleSoft and Twilio. Prior to joining Salesforce Ventures, he was a vice president at Battery Ventures, where he invested in early-stage enterprise software and GreenIT companies. Matt was also a vice president of Plymouth Ventures, a late-stage investment fund based in Ann Arbor, Michigan. He has also worked for GE in their corporate strategy group and has spent time in Africa monitoring energy and infrastructure investments for E+Co, a public-purpose investment.

Phoebe Peronto, Principal, Salesforce Ventures

Phoebe Peronto is a principal at Salesforce Ventures, where she focuses on investing in enterprise SaaS companies in various industry sectors, including retail/commerce, developer tools and emerging technologies (AI/ML, blockchain). She joined Salesforce by way of the investing team at GV, and operational roles at both Google Inc. and Rocket Internet. Phoebe holds a dual degree from UC Berkeley in Political Science and Business Administration and graduated with high distinction as a George Baker Scholar from Harvard Business School. Based in San Francisco, Phoebe has become one of those crazy obsessed coffee people.

Spencer Chavez, Principal, Salesforce Ventures

Spencer Chavez is a principal at Salesforce Ventures, where he is responsible for both sourcing and executing investments in enterprise software companies, with a recent focus on companies in the fintech, AI/ML and digital health spaces. Prior to joining Salesforce Ventures, Spencer was on the investment team at JMI Equity, where he focused on making growth equity investments in enterprise software companies. Earlier in his career, Spencer worked in the investment banking divisions at both Citigroup and Needham & Company, where he helped advise the firms’ technology clients on M&A and capital-raising initiatives. Spencer graduated from Santa Clara University with a B.S. in Commerce, majoring in finance and minoring in economics.

Claudine Emeott, Senior Director of Impact Investing, Salesforce

Claudine Emeott leads the Salesforce Impact Fund and is looking to invest in mission-driven enterprise technology companies in education, sustainability, diversity + inclusion, and enabling technology for the social sector. Prior to Salesforce, Claudine led impact investing at Kiva, developing a new funding model for social enterprises and spearheading a new impact framework. Before moving to the Bay Area, Claudine spent the first half of her career in economic development consulting and has lived in Beijing, Chicago and Kathmandu. Claudine holds a B.A. from Harvard and a master’s from MIT.

If you are a partner/managing director of a firm and are interested in supporting underserved and underrepresented founders, email neesha@techcrunch.com.

Powered by WPeMatico

The SoftBank Vision Fund has been screaming from the venture headlines the last few months, driven by eye-popping rounds (and valuations!) into some of the most notable startups around the world. Yet, SoftBank isn’t the only player rapidly buying up the cap tables of top startups. Indeed, another firm, more than a century old, has been fighting for that late-stage equity crown.

… Who the what?

When our fintech contributor Gregg Schoenberg interviewed Charles Plowden, the firm’s joint senior partner, about the firm’s prodigious investing, we realized that we have never gone in-depth on one of the most influential investors in Silicon Valley. So here goes.

Baillie Gifford is a 110-year-old asset management firm based out of Edinburgh, Scotland, and has long had a penchant for pre-IPO tech companies. The firm was an early investor into some of the world’s most valuable private and public tech companies, boasting a roster of portfolio companies that includes unicorns from nearly all generations in modern tech, including everything from Amazon, Google and Salesforce to Tesla, Airbnb, Spotify, newly public Lyft, Palantir and even SpaceX.

Baillie Gifford’s reach stretches way beyond the 280/101 corridor. The firm has an extensive history of investing across geographies, with one of its first and most successful investments coming from an early entry into Chinese e-commerce titan Alibaba. More recently, Baillie Gifford even held a stake in recently IPO’d Chinese electric autonomous vehicle manufacturer NIO, and one the firm’s largest current holdings is South African internet conglomerate Naspers — which itself is an active investor and developer of emerging market tech infrastructure.

The firm’s low profile belies its aggressive capital deployment strategy. According to data from PitchBook, Baillie Gifford was involved in roughly 20 deals in 2018 and was involved as a lead or participant in transactions worth over $21 billion in aggregate total deal size — beating out behemoth Tiger Global, which tallied roughly $13.25 billion on the same metric.

The firm has about $2 billion focused on private companies, so while it is aggressive in getting into later-stage rounds, it is not nearly operating at the scale of say the Vision Fund or Tiger Global. While the asset manager primarily focuses on public-equity investing, the firm has participated in investment rounds as early as Series A, according to PitchBook and Crunchbase data.

Overall, the firm manages $221 billion in assets under management as of January 2019.

As one of the earliest asset managers to invest in pre-IPO tech companies, Baillie Gifford has sourced investments through its longstanding reputation as an investor. The firm first began really diving into private tech investing in the wake of the dot-com bubble. The firm doubled down on the tech sector at a time when few others were investing and sifted through the blood bath to find cheap entryways into companies that are now amongst the world’s largest.

Today, however, the landscape is undoubtedly much different. Tech companies now make up four of the top five largest companies in the world by market cap, and seven out of the top 10. Now, everyone wants a piece of the pie and there seem to be more checks being thrown at founders than most can even fit in their wallets.

With more capital at their fingertips than ever before, founders are opting to keep their startups private for longer in order to avoid the stress of having to deal with short-term public market investors who are more often than not looking for the first opportunity to cash out. So why, amongst so much choice, do companies continue to partner with Baillie Gifford?

Plowden has some insights on that front in our interview, but the summary is that Baillie Gifford just sees itself as a partner. Unlike its peers and most investment managers, Baillie Gifford has no outside shareholder owners to report to. As a partnership, wholly owned and run by just 44 partners, the firm doesn’t face the organizational constraints that beset most firms that manage billions and billions in assets.

The result? In short, Baillie Gifford has quietly been making a killing, and probably drinking some good Scotch along the way, as well.

Powered by WPeMatico