Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

EAT Club, the lunch delivery service that counts companies like Facebook, Postmates and others as customers, has acquired meal delivery service Taro. Financial terms of the deal were not disclosed.

Taro’s business model worked by shipping pre-made meals directly to consumers. With the acquisition, however, Taro will no longer serve customers directly. Instead, it will be folded into EAT Club’s corporate program that enables employees to select their individually packed lunch.

“EAT Club is the only food delivery service for businesses that treats eating in the workplace as a personalized culinary experience,” Taro co-founder and CEO Krishna Mehra said in a statement. “When we set out to expand our reach and distribution beyond family dinners, EAT Club emerged as a natural partner with its unique approach of delivering employees individualized selection within a collaborative atmosphere. EAT Club is making it possible for thousands of new workers to experience Taro’s food and flavors, and we are proud to join forces with them in increasing workplace satisfaction.”

What attracted EAT Club to Taro was its emphasis on healthy, authentic meals, and its approach to managing food production and distribution, EAT Club CEO Doug Leeds told TechCrunch.

“They’ve built some really interesting things we want to keep competitively secret on the equipment side,” Leeds said. “From top to bottom, we were pretty excited about what we were seeing at Taro. We’re going to take their people, tech, recipes and food production processes, and apply them to our existing customers.”

Leeds, the former CEO of IAC Publishing, joined EAT Club last year. Despite his short tenure, this marks the second acquisition under his leadership. Last year, EAT Club acquired lunch box delivery service Farm Hill.

EAT Club has served more than 17 million meals to employees to date, which comes out to about 25,000 meals a day. Given the amount of energy required for that level of production, EAT Club has implemented what it’s calling a Zero Carbon Initiative. Through the initiative, EAT Club will offset its carbon footprint by matching its electricity usage with renewable energy generation. EAT Club also plans to make all of its packaging either recyclable or compostable and support landfill recapture programs.

“By far, the biggest carbon impact of our business is in the delivery — the transportation aspect,” Leeds said. “But we wanted to go further than that. In our production, it was in all of the energy we used to cook food. We wanted to see what is the actual carbon footprint of the entire operation.”

On the employee-side, EAT Club plans to provide stronger commuter benefits and is looking to move its Los Angeles-based office to a location closer to the metro line, Leeds said. To date, EAT Club has raised more than $46 million from investors like August Capital, Trinity Ventures and Sodexo Ventures.

Powered by WPeMatico

Airbase is a startup with a plan to change the way you think about accounting around spending. Instead of multiple workflows, it wants to create a simpler one involving, well, Airbase. It’s a bold move for any startup to take on something as entrenched as financials, but it’s giving it a shot, and today the company launched with a $7 million Series A investment.

First Round Capital was lead investor. Maynard Webb, Village Global, BoxGroup and Quiet Capital also participated. The deal closed at the end of November last year. This is the first external funding for the company, which company founder and CEO Thejo Kote had bootstrapped previously with $300,000 of his own money.

“At a high level, Airbase is the first all-in-one spend management system. It replaces a number of different systems that companies use to manage how they spend money,” Kote told TechCrunch.

He knows of what he speaks. Prior to starting this company, Kote co-founded Automatic, a startup that he sold to SiriusXM for more than $100 million in 2017. As a founder, he saw just how difficult it was to track the vast variety of spending inside a company, from supplies to subscriptions to food and drink.

“Think about the hundreds of things that companies spend money on, and the way in which the management of that happens is a pretty broken process today,” he said. For starters, it usually involves some sort of approval request in a tool like Slack, Jira or Google forms.

Once approved, the person requesting the expense will put that on a company credit card, then have to submit expense reports at the end of each month using a tool like Expensify. If you purchase from a vendor, then that involves an invoice and that has to be processed and paid. Finally it would need to be reconciled and accounted for in accounting software. Each step of this process ends up being time-consuming and costly for an organization.

Kote’s idea was to take this process and streamline it by removing the friction, which he saw as being related to the disparate systems in place to get the work done. He believed by creating a single workflow on a unified, single platform he could create a smoother system for everyone involved.

He is putting that single system between the bank and the accounting system, including a virtual Airbase Visa card that can take the place of physical cards if desired. Request for spending happens inside Airbase instead of an external tool. When the virtual card gets charged, bookkeeping and reconciliation gets handled in Airbase and pushed to your accounting package of choice.

Airbase workflow. Diagram: Airbase

This could be a difficult proposition for companies with existing systems in place, but could be attractive to startups and small companies whose accounting systems have not yet hardened. Perhaps that’s why most of Airbase’s customers are startups or SMBs with between 50 and 1000 employees, such as Gusto, Netlify and Segment.

Bill Trenchard, general partner at lead investor First Round Capital, says he has seen very little innovation in this space and that’s what drew him to Airbase. “Airbase has taken a bold step forward to create an entirely new paradigm. It delivers a real solution to the biggest problems finance teams face as their companies grow,” Trenchard said in a statement.

The company was founded in 2017 and has 22 employees. It has a sales office in San Francisco, but other employees are spread across four countries.

Powered by WPeMatico

I’m excited to announce that The Europas Awards for European Tech Startups is really shaping up! The awards will be held on 27 June 2019, in London, U.K. on the front lawn of the Geffrye Museum in Hoxton, London — creating a fantastic and fun garden party atmosphere in the heart of London’s tech startup scene.

TechCrunch is once more the exclusive media sponsor of the awards and conference, alongside new “tech, culture & society” event creator The Pathfounder.

Here’s how to enter and be considered for the awards.

You can nominate a startup, accelerator or venture investor that you think deserves to be recognized for their achievements in the last 12 months.

*** The deadline for nominations is 1 May 2019 ***

For the 2019 awards, we’ve overhauled the categories to a set that we believe better reflects the range of innovation, diversity and ambition we see in the European startups being built and launched today. There are now 20 categories, including new additions to cover AgTech / FoodTech, SpaceTech, GovTech and Mobility Tech.

Attendees, nominees and winners will get discounts to TechCrunch Disrupt in Berlin, later this year.

The Europas “Diversity Pass”

We’d like to encourage more diversity in tech! That’s why, for the upcoming invitation-only “Pathfounder” event held on the afternoon before The Europas Awards, we’ve reserved a tranche of free tickets to ensure that we include more women and people of colour who are “pre-seed” or “seed-stage” tech startup founders. If you are a women founder or person of colour founder, apply here for a chance to be considered for one of the limited free diversity passes to the event.

The Pathfounder event will feature premium content and invitees, designed be a “fast download” into the London tech scene for European founders looking to raise money or re-locate to London.

The Europas Awards

The Europas Awards results are based on voting by expert judges and the industry itself.

But key to it is that there are no “off-limits areas” at The Europas, so attendees can mingle easily with VIPs.

The complete list of categories is here:

Timeline of The Europas Awards deadlines:

* 6 March 2019 – Submissions open

* 1 May 2019 – Submissions close

* 10 May 2019 – Public voting begins

* 18 June 2019 – Public voting ends

* 27 June 2019 – Awards Bash

Amazing networking

We’re also shaking up the awards dinner itself. Instead of a sit-down gala dinner, we’ve taken feedback for more opportunities to network. Our awards ceremony this year will be in the setting of a garden lawn party, where you’ll be able to meet and mingle more easily, with free-flowing drinks and a wide-selection of street food (including vegetarian/vegan). The ceremony itself will last approximately 75 minutes, with the rest of the time dedicated to networking. If you’d like to talk about sponsoring or exhibiting, please contact dianne@thepathfounder.com

Instead of thousands and thousands of people, think of a great summer event with the most interesting and useful people in the industry, including key investors and leading entrepreneurs.

The Europas Awards have been going for the last 10 years, and we’re the only independent and editorially driven event to recognise the European tech startup scene. The winners have been featured in Reuters, Bloomberg, VentureBeat, Forbes, Tech.eu, The Memo, Smart Company, CNET, many others — and of course, TechCrunch.

• No secret VIP rooms, which means you get to interact with the speakers

• Key founders and investors attending

• Journalists from major tech titles, newspapers and business broadcasters

Meet the first set of our 20 judges:

Brent Hoberman

Executive Chairman and Co-Founder

Founders Factory

Videesha Böckle

Founding Partner

signals Venture Capital

Bindi Karia

Innovation Expert + Advisor, Investor

Bindi Ventures

Christian Hernandez Gallardo

Co-Founder and Venture Partner at White Star Capital

Powered by WPeMatico

Varsha Rao, Airbnb’s former head of global operations and, most recently, the chief operating officer at Clover Health, has joined Nurx as its chief executive officer.

Rao replaces Hans Gangeskar, Nurx’s co-founder and CEO since 2014, who will stay on as a board member.

Nurx, which sells birth control, PrEP, the once-daily pill that reduces the risk of getting HIV, and an HPV testing kit direct to consumer, has grown 250 percent in the last year, doubled its employee headcount and attracted 200,000 customers. Rao tells TechCrunch the startup realized they needed talent in the C-suite that had experienced this kind of growth.

“The company has made some really great progress in bringing on strong leaders and that’s one of the things that got me excited about joining,” Rao told TechCrunch. Nurx recently hired Jonathan Czaja, Stitch Fix’s former vice president of operations, as COO, and Dave Fong, who previously oversaw corporate pharmacy services at Safeway, as vice president of pharmacy.

Rao, for her part, joined Clover Health, a Medicare Advantage startup backed by Alphabet, in late 2017 after three years at Airbnb.

“After being at Airbnb, a really mission-driven company, I couldn’t go back to something that wasn’t equally or more so and healthcare really inspired me,” Rao said. “In terms of accessibility, I feel like [Nurx] is super important. We are really fortunate to live in a place where can access birth control and it can be more easily found but there are lots of parts of the country where physical access is challenging and costs can be a factor. To be able to break down barriers of access both physically and from an economic standpoint is hugely meaningful to me.”

Nurx, a graduate of Y Combinator, has raised about $42 million in venture capital funding from Kleiner Perkins, Union Square Ventures, Lowercase Capital and others. It launched in 2015 to facilitate women’s access to birth control across the U.S. with a HIPAA-compliant web platform and mobile application that delivers contraceptives directly to customers’ doorsteps.

Today, the telehealth startup is available to customers in 24 states and counts Chelsea Clinton as a board member.

Powered by WPeMatico

Kindbody, a startup that lures millennial women into its pop-up fertility clinics with feminist messaging and attractive branding, has raised a $15 million Series A in a round co-led by RRE Ventures and Perceptive Advisors.

The New York-based company was founded last year by Gina Bartasi, a fertility industry vet who previously launched Progyny, a fertility benefit solution for employers, and FertilityAuthority.com, an information platform and social network for people struggling with fertility.

“We want to increase accessibility,” Bartasi told TechCrunch. “For too long, IVF and fertility treatments were for the 1 percent. We want to make fertility treatment affordable and accessible and available to all regardless of ethnicity and social economic status.”

Kindbody operates a fleet of vans — mobile clinics, rather — where women receive a free blood test for the anti-Müllerian hormone (AMH), which helps assess their ovarian egg reserve but cannot conclusively determine a woman’s fertility. Depending on the results of the test, Kindbody advises women to visit its brick-and-mortar clinic in Manhattan, where they can receive a full fertility assessment for $250. Ultimately, the mobile clinics serve as a marketing strategy for Kindbody’s core service: egg freezing.

Kindbody charges patients $6,000 per egg-freezing cycle, a price that doesn’t include the cost of necessary medications but is still significantly less than market averages.

Bartasi said the mobile clinics have been “wildly popular,” attracting hoards of women to its brick-and-mortar clinic. As a result, Kindbody plans to launch a “fertility bus” this spring, where the company will conduct full fertility assessments, including the test for AMH, a pelvic ultrasound and a full consultation with a fertility specialist.

In other words, Kindbody will offer all components of the egg-freezing process on a bus aside from the actual retrieval, which occurs in Kindbody’s lab. The bus will travel around New York City before heading west to San Francisco, where it plans to park on the campuses of large employers, catering to tech employees curious about their fertility.

“Our mission at Kindbody is to bring care directly to the patient instead of asking the patient to come to visit us and inconvenience them,” Bartasi said.

A sneak peek of Kindbody’s “fertility bus,” which is still in the works

Kindbody, which has raised $22 million to date from Green D Ventures, Trailmix Ventures, Winklevoss Capital, Chelsea Clinton, Clover Health co-founder Vivek Garipalli and others, also provides women support getting pregnant with in vitro fertilisation (IVF) and intrauterine insemination (IUI).

With the latest investment, Kindbody will open a second brick-and-mortar clinic in Manhattan and its first permanent clinic in San Francisco. Additionally, Bartasi says they are in the process of closing an acquisition in Los Angeles that will result in Kindbody’s first permanent clinic in the city. Soon, the company will expand to include mental health, nutrition and gynecological services.

In an interview with The Verge last year, Bartasi said she’s taken inspiration from SoulCycle and DryBar, companies whose millennial-focused branding strategies and prolific social media presences have helped them accumulate customers. Kindbody, in that vein, notifies its followers of new pop-up clinics through its Instagram page.

In the article, The Verge called Kindbody “the SoulCycle of fertility” and questioned its branding strategy and its claim that egg freezing “freezes time.” After all, there is limited research confirming the efficacy of egg freezing.

“The technology that allows for egg-freezing has only been widely used in the last five to six years,” Bartasi explained. “The majority of women who froze their eggs haven’t used them yet. It’s not like you freeze your eggs in February and meet Mr. Right in June.”

Though Kindbody touts a mission of providing fertility treatments to the 99 percent, there’s no getting around the sky-high costs of the services, and one might argue that companies like Kindbody are capitalizing off women’s fear of infertility. Providing free AMH tests, which often falsely lead women to believe they aren’t as fertile as they’d hoped, might encourage more women to seek a full-fertility assessment and ultimately, to pay $6,000 to freeze their eggs, when in reality they are just as fertile as the average woman and not the ideal candidate for the difficult and uncomfortable process.

Bartasi said Kindbody makes all the options clear to its patients. She added that when she does hear accusations that services like Kindbody capitalize on fear of infertility, they tend to come from legacy programs and male fertility doctors: “They are a little rattled by some of the new entrants that look like the patients,” she said. “We are women designing for women. For far too long women’s health has been solved for by men.”

Kindbody’s pricing scheme may itself instill fear in incumbent fertility clinics. The startup’s egg-freezing services are much cheaper than market averages; its IVF services, however, are not. Not including the costs of medications necessary to successfully harvest eggs from the ovaries, the average cost of an egg-freezing procedure costs approximately $10,000, compared to Kindbody’s $6,000. Its IVF services are on par with other options in the market, costing $10,000 to $12,000 — not including medications — for one cycle of IVF.

Kindbody is able to charge less for egg freezing because they’ve cut out operational inefficiencies, i.e. they are a tech-enabled platform while many fertility clinics around the U.S. are still handing out hoards of paperwork and using fax machines. Bartasi admits, however, that this means Kindbody is making less money per patient than some of these legacy clinics.

“What is a reasonable profit margin for fertility doctors today?” Bartasi said. “Historically, margins have been very, very high, driven by a high retail price. But are these really high retail prices sustainable long term? If you’re charging 22,000 for IVF, how long is that sustainable? Our profit margins are healthy.”

Bartasi isn’t the only entrepreneur to catch on to the opportunity here, as I’ve noted. A whole bunch of women’s health startups have launched and secured funding recently.

Tia, for example, opened a clinic and launched an app that provides health advice and period tracking for women. Extend Fertility, which like Kindbody, helps women preserve their fertility through egg freezing, banked a $15 million round. And a startup called NextGen Jane, which is trying to detect endometriosis with “smart tampons,” announced a $9 million Series A a few weeks ago.

Powered by WPeMatico

Cytora, a U.K. startup that developed an AI-powered solution for commercial insurance underwriting, has raised £25 million in a Series B round. Leading the investment is EQT Ventures, with participation from existing investors Cambridge Innovation Capital, Parkwalk and a number of unnamed angel investors.

A spin-out of the University of Cambridge, Cytora was founded in 2014 by Richard Hartley, Aeneas Wiener, Joshua Wallace and Andrzej Czapiewski — although both Wallace and Czapiewski have since departed.

Its first product launched in late 2016 to a number of large insurance customers, with the aim of applying AI to commercial insurance supported by various public and proprietary data. This includes property construction features, company financials and local weather, combined with an insurance company’s own internal risk data.

“Commercial insurance underwriting is inaccurate and inefficient,” says Cytora co-founder and CEO Richard Hartley. “It’s inaccurate because underwriting decisions are made using sparse and outdated information. It’s inefficient because the underwriting process is so manual. Unlike buying car or travel insurance, which can be purchased in minutes, buying business insurance can take up to seven days. This means operating costs for insurers are extremely high and customer experience isn’t good leading to a lack of trust.”

To illustrate how inefficient commercial insurance can be, Hartley says that for every £1 of premium that businesses pay to insurers, only 60 pence is set aside to pay total claims. The other 40 pence evaporates as the “frictional cost of delivering insurance.”

Powered by AI, Hartley claims that Cytora is able to distill the seven-day underwriting process down to 30 seconds via its API. This enables insurers to underwrite programmatically and build workflows that provide faster and more accurate decisions.

“Our APIs are powered by a risk engine which learns the subtle patterns of good and bad risks over time,” he explains. “This gives insurers a better understanding of the underlying risk of each business and helps them set a more accurate price. Both customers and insurers benefit.”

Typical Cytora customers are commercial insurers that are digitally transforming their underwriting process. Users of the software are either underwriters within insurance companies who are underwriting large commercial risks (i.e. an average insurance premium ~£500k and above) or business customers of insurance companies who are buying insurance direct online with an average premium of £1,000-£5,000.

“For the latter, our customers have built quotation workflows on top of Cytora’s APIs, enabling business owners to buy policies online in less than a minute without having to fill in a form,” says Hartley. “We require only a business name and postcode to issue a quote, which revolutionises the customer experience.”

To that end, Cytora generates revenue by charging a yearly ARR license fee, which increases based on usage and per line of business. The company says today’s Series B funding will be used to accelerate the expansion of its product suite and for scaling into new geographies.

Powered by WPeMatico

If you’re hoping to create a unicorn on a budget, look to the European technology sector for inspiration. Despite the well-documented increase in available funding for tech companies across the continent, startups are reaching unicorn status with much lower totals of venture capital than U.S. rivals. In fact, this level of “capital efficiency” is one major attraction for international investors weary of the “burn rate” of many U.S. companies aspiring to valuations of $1 billion+.

It costs a staggering 50-100 percent more in the U.S. to create a company valued at $1 billion than in Europe. For U.S. tech companies that achieved unicorn status in 2018, the median amount of funding required was more than $125 million, whereas their contemporaries in Europe required a lesser total of $80 million. For 2017, the gap was even wider; U.S. companies again required just over $100 million, the smaller pool of Europeans slightly above $50 million.

| Region | Year | Median funding required prior to reaching a valuation of $1B |

| U.S. | 2017 | $107 million |

| Europe | 2017 | $53.15 million |

| U.S. | 2018 | $125.38 million |

| Europe | 2018 | $80.8 million |

The median funding secured prior to (not including) the round in which tech companies in the U.S. and Europe achieved a $1 billion valuation during 2017/18 (Data source: PitchBook)

A key reason for this greater efficiency in scaling is because European companies have had to make do with less. Europe has historically had a much smaller pool of “late-stage growth” funding (typically rounds of $30-75 million), and even today it is far easier to raise $20 million for a European tech company than $50 million, while that does not hold true in the U.S. to anywhere near the same degree.

This dearth of late-stage money has forced European tech companies to scale more efficiently, with lower overheads and a focus on profitability at an earlier stage, rather than the aggressive growth patterns often witnessed in the U.S. But this “enforced prudence” has come at a price.

Greater capital efficiency has arguably resulted in fewer European tech companies achieving unicorn status, with Europe lagging far behind the number created each year in the U.S. In 2018, the U.S. birthed 53 unicorns; Europe, only 10. So how much funding is required to close the gap?

Let’s assume (safely) product innovation and quality is available both in the U.S. and Europe, and let’s assume (less safely) there are many more quality European companies built to “unicorn potential” that are currently unable to raise enough to fuel scale to the point where they achieve $1 billion valuations. To plug this funding gap, we estimate Europe would require a multi-year capital pool of $10-20 billion in additional late-stage capital.

That math is based on a large number, up to 40, of companies a year missing out on becoming unicorns because of a lack of available funding, alongside the assumption that each unicorn needs more than $100 million in funding in total.

The extremely good news is that it is not $100 billion. Due to the inherent efficiency of risk capital, $10-20 billion can go an awfully long way. Arguably, there is no other industry or sector that can yield such a high return on committed money within a reasonably short few years.

No, Europe is still a trickier market to scale than the U.S. Not only does Europe have to compete with the ready availability of capital in the U.S., but different regulatory environments, language barriers and a brain drain of talent attracted to Silicon Valley all combine to create impediments for European tech companies scaling in an interconnected world.

Funding, however, stands as the simplest of limiting factors to address. Especially when an analysis of the stats shows that whilst European tech companies are “saving” a lot of money, this directly contributes to far fewer of them being worth the mythical $1 billion+. A marginal uplift in capital would produce a disproportionately higher number of unicorns.

Powered by WPeMatico

KZen is about to release ZenGo, a mobile app to manage your cryptocurrencies securely and more easily. There are already countless crypto wallets out there, but the startup thinks they’re all either too complicated or too insecure.

If you own cryptocurrencies, chances are they’re sitting on an exchange, such as Coinbase or Binance. If somebody manages to log in to your account, nothing is stopping them from sending those assets to other wallets and stealing everything.

Worse, if somebody hacks an exchange, they could potentially divert cryptocurrencies from that exchange’s wallets. In other words, leaving your cryptocurrencies on an exchange means you give your assets to that exchange and hope they properly take care of them.

On the other end of the spectrum, you can manage your private keys yourself and rely on a hardware wallet from Ledger and Trezor. The learning curve is too hard for many people. And if you don’t follow instructions properly, you might end up losing access to your wallet or accidentally sharing private keys.

Enough about other wallets, let’s talk about ZenGo. Former TechCrunch editor Ouriel Ohayon and his team think the perfect wallet app involves a smartphone you own paired with ZenGo’s servers.

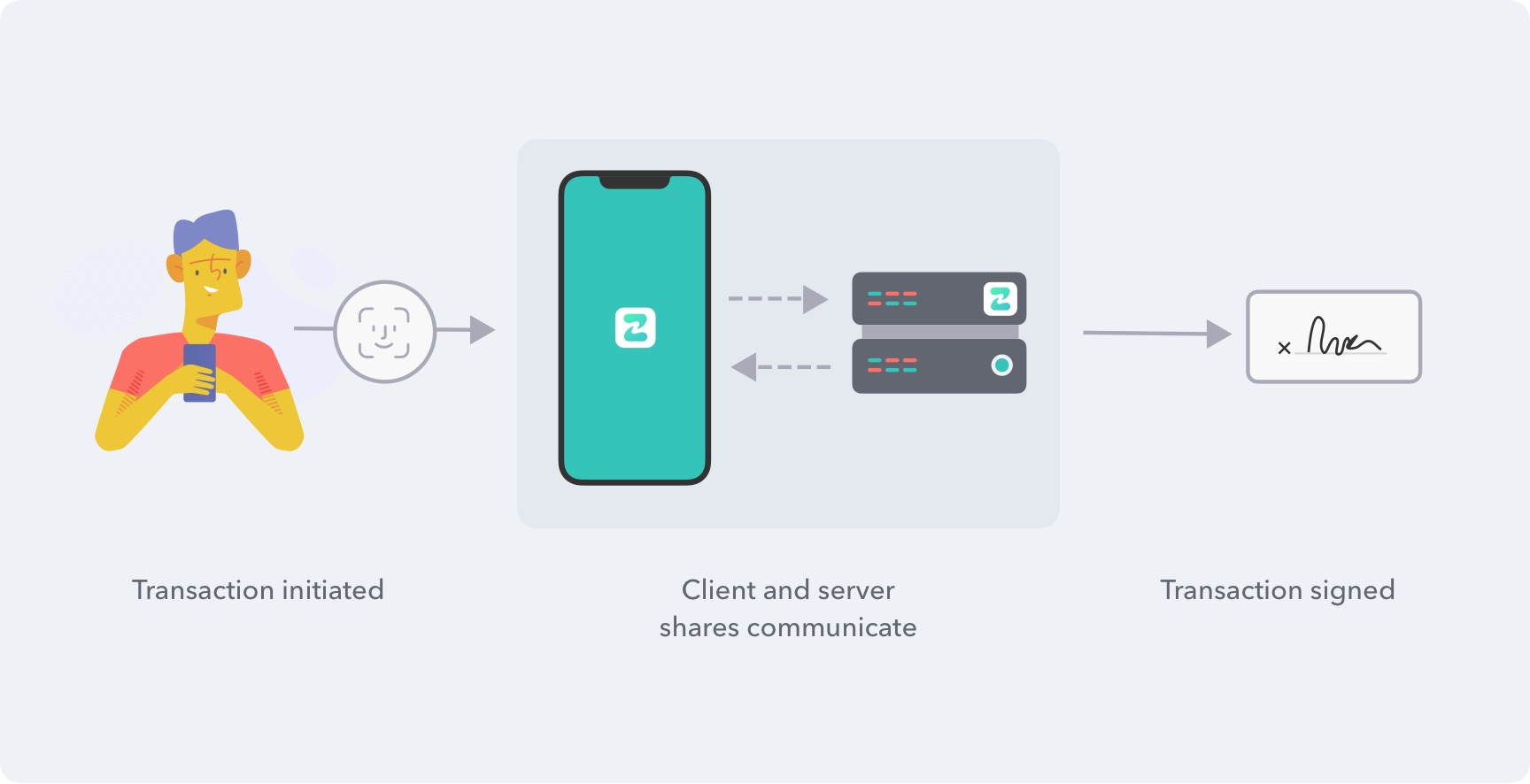

The company uses threshold signatures, which means that you need both ZenGo’s servers and your smartphone to initiate a transaction. If you lose your device, you can recover your funds. But the startup can’t access your cryptocurrencies on its own.

Behind the scene, ZenGo still uses a public key and private secrets, but everything is completely transparent for the end user.

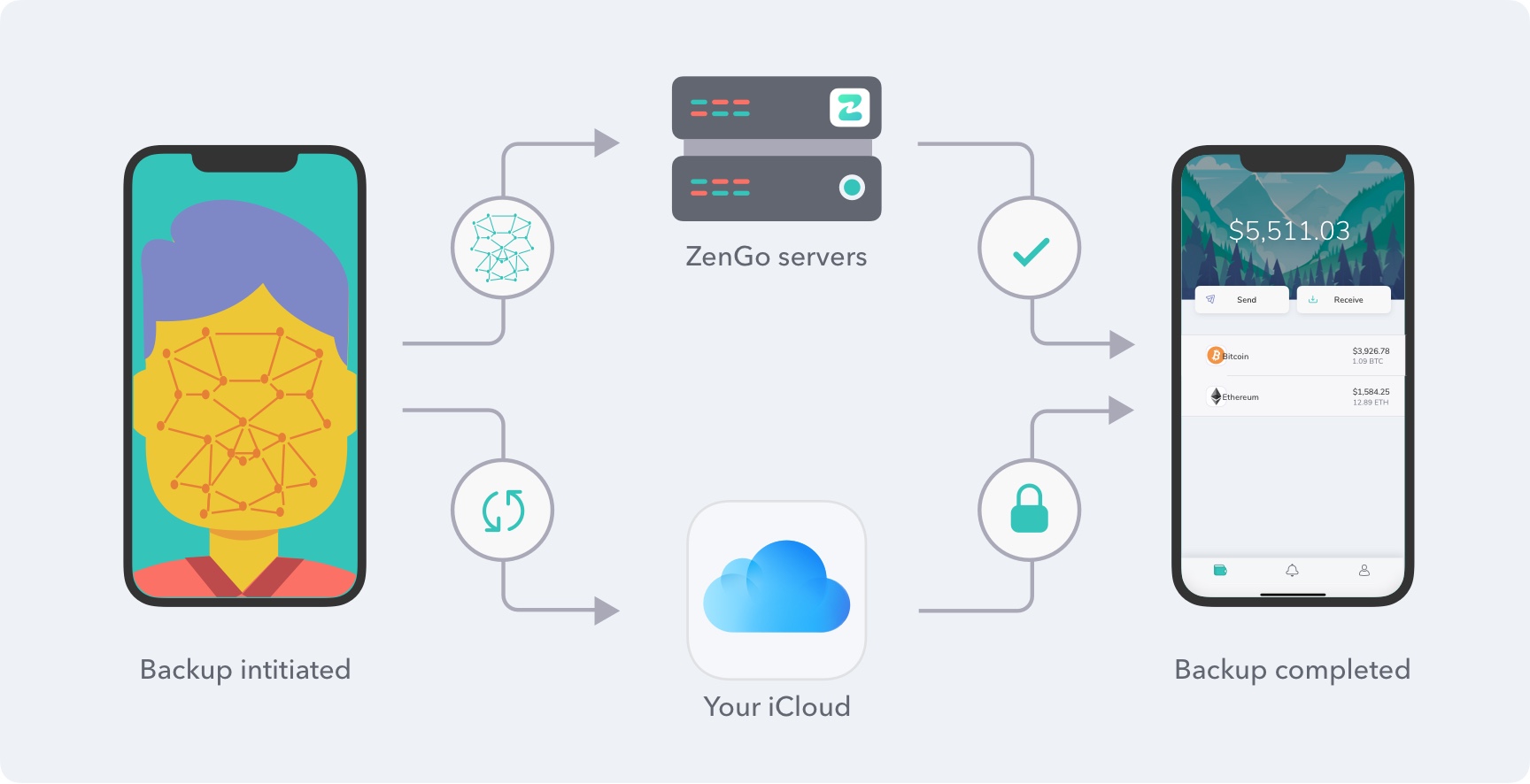

When you set up your wallet, two private secrets are generated separately and stored in multiple ways — one part is on your smartphone, the other is on the servers. You need both parts to sign a transaction. If you back up your device part to ZenGo’s servers, you can recover all parts in case you lose your device, for instance.

ZenGo can’t directly access the second part on its own because it is encrypted using a decryption code that is stored on your iCloud account. But accessing your iCloud is not enough — if you want to recover your wallet, you need to prove your identity.

That’s why the company stores a 3D biometric face map to let you restore your wallet on a new device. The company partners with ZoOm so that you can create a face map from any smartphone with a selfie camera.

The security model has been open-sourced and I hope many security experts will try to find vulnerabilities. That’s the only way you can know for sure that it’s a secure system.

All of this sounds complicated, but most users won’t even realize what’s happening. I tried the app and it’s a well-designed mobile app. Right now, it only supports Bitcoin and Ethereum, but more assets are on the way. The company tracks your public addresses to notify you when you receive funds.

The app isn’t available just yet. It should launch as a beta this week and arrive in the stores pretty soon.

Powered by WPeMatico

Move over, Flexport. There is another player looking to make waves in the huge and messy business of freight logistics. Zencargo — a London startup that has built a platform that uses machine learning and other new technology to rethink how large shipping companies and their customers manage and move cargo, or freight forwarding as it’s known in the industry — has closed a Series A round of funding of about $19 million.

Zencargo’s co-founder and head of growth Richard Fattal said in an interview that the new funds will be used to continue building its software, specifically to develop more tools for the manufacturers and others who use its platform to predict and manage how cargo is moved around the world.

The Series A brings the total raised by Zencargo to $20 million. This latest round was led by HV Holtzbrinck Ventures . Tom Stafford, managing partner at DST Global; Pentland Ventures; and previous investors Samos, LocalGlobe and Picus Capital also participated in the round.

Zencargo is not disclosing its valuation, nor its current revenues, but Fattal said that in the last 12 months it has seen its growth grow six times over. The company (for now) also does not explicitly name clients, but Fattal notes that they include large e-commerce companies, retailers and manufacturers, including several of the largest businesses in Europe. (One of them at least appears to be Amazon: Zencargo provides integrated services to ship goods to Amazon fulfillment centers.)

Shipping — be it by land, air or sea — is one of the cornerstones of the global economy. While we are increasingly hearing a mantra to “buy local,” the reality of how the mass-market world of trade works is that components for things are not often made in the same place where the ultimate item is assembled, and our on-demand digital culture has created an expectation and competitive market for more than what we can source in our backyards.

For companies like Zencargo, that creates a two-fold opportunity: to ship finished goods — be it clothes, food or anything — to meet those consumer demands wherever they are; and to ship components for those goods — be it electronics, textiles or flour — to produce those goods elsewhere, wherever that business happens to be.

Ironically, while we have seen a lot of technology applied to other aspects of the economics equation — we can browse an app anytime and anywhere to buy something, for example — the logistics of getting the basics to the right place are now only just catching up.

Alex Hersham, another of Zencargo’s co-founders who is also the CEO (the third co-founder is Jan Riethmayer, the CTO), estimates that there is some $1.1 trillion “left on the table” from all of the inefficiencies in the supply chain related to things not being in stock when needed, or overstocked, and other inventory mistakes.

Fattal notes that Zencargo is not only trying to replace things like physical paperwork, faxes and silos of information variously held by shipping companies and the businesses that use them — but the whole understanding and efficiency (or lack thereof) that underlies how everything moves, and in turn the kinds of businesses that can be built as a result.

“Global trade is an enormous market, one of the last to be disrupted by technology,” Fattal said. “We want not just to be a better freight forwarder but we want people to think differently about commerce. Given a choice, where is it best to situate a supplier? Or how much stock do I order? How do I move this cargo from one place to another? When you have a lot of variability in the supply chain, these are difficult tasks to manage, but by unlocking the data in the supply chain you can really change the whole decision making process.”

Zencargo is just getting started on that. Flexport, one of its biggest startup competitors, in February raised $1 billion at a $3.2 billion valuation led by SoftBank to double down on its own freight forwarding business, platform and operations. But as Christian Saller, a partner at HV Holtzbrinck Ventures describes it, there is still a lot of opportunity out there and room for more than one disruptor.

“It’s such a big market that is so broken,” he said. “Right now it’s not about winner-take-all.”

Powered by WPeMatico

Most work involving computers is highly repetitive, which is why companies regularly have developers write code to automate repetitive tasks. But that process is not very scalable. Ideally, individuals across an entire business would be able to create automated tasks, not just developers. This problem has created a new category called process automation. Startups in this space are all about making companies more efficient.

Most of the existing tools on the market are code-based and complicated, which tends to make it tough for non-technical people to automate anything. Ideally, you would allow them to train software robots to handle repetitive and mundane tasks.

This is the aim of Leapwork, which today announces a Series A investment of $10 million, from London’s DN Capital and e.ventures out of Berlin. The company already has many clients, from tier-one banks and global healthcare firms to aerospace and software companies, and now plans to expand in the U.S. Its customers typically already have a lot of experience with tools such as Tricentis, MicroFocus, UiPath and BluePrism, but employ Leapwork when code-based tools prove limiting.

Founded in 2015 and launched in April 2017, Leapwork has an entirely visual system, backed by a modern tech stack. Instead of using developer time, staff automate tasks themselves, without writing any code, with a simple user interface that is likened to learning PowerPoint or Excel. Leapwork estimates it can save 75 percent of an employee’s time.

Christian Brink Frederiksen, Leapwork’s CEO and co-founder said: “About half of our business comes from the U.S. and this investment will enable us to serve those customers better, as well as reaching new ones.”

Leapwork has found traction in the areas of software testing, data migration and robotic process automation in finance and healthcare. Based in Copenhagen, Denmark, Leapwork has offices in London, U.K., San Francisco, USA, Minsk, Belarus, and Gurugram, India.

Thomas Rubens, of DN Capital, said: “From the outset we were impressed by Leapwork’s product, which we believe will change the automation landscape. Every company has repetitive tasks that could be automated and few have the developer resource to make it happen.”

The founders began in June 2015 in Copenhagen, Denmark, after having worked for almost two decades in enterprise software and business-critical IT. They launched their first pilot in July 2016 and, after working with Global2000 pilot customers in the U.S. and Europe, went live with the Leapwork automation platform in March 2017.

Prior to this funding the company was bootstrapped by the founders, as both had previous successful exits.

Powered by WPeMatico