Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Africa has made its global IPO debut. Pan-African e-commerce company Jumia—a $1 billion-valued company—began trading live on the NYSE last week.

The stock offering made Jumia the first upstart operating in Africa to list on a major global exchange.

This raises expectations for unicorns and IPOs to create the continent’s first wave of startup moguls. But unlike other markets, big public listings and nine-figure valuations could remain rare in Africa.

The rise of venture arms and startup acquisitions will factor more prominently than IPOs in creating Africa’s early startup successes.

I’ll break down why. First, a quick briefer.

Not everyone may be aware, but yes, Africa has a booming tech scene. When measured by monetary values, it’s minuscule by Shenzen or Silicon Valley standards.

Powered by WPeMatico

When Zoom hit the public markets Thursday, its IPO pop, a whopping 81 percent, floored everyone, including its own chief executive officer, Eric Yuan.

Yuan became a billionaire this week when his video conferencing business went public. He told Bloomberg that he actually wished his stock hadn’t soared quite so high. I’m guessing his modesty and laser focus attracted Wall Street to his stock; well, that, and the fact that his business is actually profitable. He is, this week proved, not your average tech CEO.

I chatted with him briefly on listing day. Here’s what he had to say.

“I think the future is so bright and the stock price will follow our execution. Our philosophy remains the same even now that we’ve become a public company. The philosophy, first of all, is you have to focus on execution, but how do you do that? For me as a CEO, my number one role is to make sure Zoom customers are happy. Our market is growing and if our customers are happy they are going to pay for our service. I don’t think anything will change after the IPO. We will probably have a much better brand because we are a public company now, it’s a new milestone.”

“The dream is coming true,” he added.

For the most part, it sounded like Yuan just wants to get back to work.

Want more TechCrunch newsletters? Sign up here. Otherwise, on to other news…

You thought I was done with IPO talk? No, definitely not:

While I’m on the subject of Uber, the company’s autonomous vehicles unit did, in fact, raise $1 billion, a piece of news that had been previously reported but was confirmed this week. With funding from Toyota, Denso and SoftBank’s Vision Fund, Uber will spin-out its self-driving car unit, called Uber’s Advanced Technologies Group. The deal values ATG at $7.25 billion.

The TechCrunch staff traveled to Berkeley this week for a day-long conference on robotics and artificial intelligence. The highlight? Boston Dynamics CEO Marc Raibert debuted the production version of their buzzworthy electric robot. As we noted last year, the company plans to produce around 100 models of the robot in 2019. Raibert said the company is aiming to start production in July or August. There are robots coming off the assembly line now, but they are betas being used for testing, and the company is still doing redesigns. Pricing details will be announced this summer.

#TCRobotics pic.twitter.com/Vf4kUWH0fR

— Lucas Matney (@lucasmtny) April 19, 2019

Digital health investment is down

Despite notable rounds for digital health businesses like Ro, known for its direct-to-consumer erectile dysfunction medications, investment in the digital health space is actually down, reports TechCrunch’s Jonathan Shieber. Venture investors, private equity and corporations funneled $2 billion into digital health startups in the first quarter of 2019, down 19 percent from the nearly $2.5 billion invested a year ago. There were also 38 fewer deals done in the first quarter this year than last year, when investors backed 187 early-stage digital health companies, according to data from Mercom Capital Group.

Byton loses co-founder and former CEO, reported $500M Series C to close this summer

Lyric raises $160M from VCs, Airbnb

Brex, the credit card for startups, raises $100M debt round

Ro, a D2C online pharmacy, reaches $500M valuation

Logistics startup Zencargo gets $20M to take on the business of freight forwarding

Co-Star raises $5M to bring its astrology app to Android

Y Combinator grad Fuzzbuzz lands $2.7M seed round to deliver fuzzing as a service

Hundreds of billions of dollars in venture capital went into tech startups last year, topping off huge growth this decade. VCs are reviewing more pitch decks than ever, as more people build companies and try to get a slice of the funding opportunities. So how do you do that in such a competitive landscape? Storytelling. Read contributor’s Russ Heddleston’s latest for Extra Crunch: Data tells us that investors love a good story.

Plus: The different playbook of D2C brands

And finally, for the first of a new series on VC-backed exits aptly called The Exit. TechCrunch’s Lucas Matney spoke to Bessemer Venture Partners’ Adam Fisher about Dynamic Yield’s $300M exit to McDonald’s.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about rounds for Brex, Ro and Kindbody, plus special guest Danny Crichton joined us to discuss the latest in the chip and sensor world.

Powered by WPeMatico

Fastly, the content delivery network that’s raised $219 million in financing from investors (according to Crunchbase), is ready for its close up in the public markets.

The eight-year-old company is one of several businesses that improve the download time and delivery of different websites to internet browsers and it has just filed for an IPO.

Media companies like The New York Times use Fastly to cache their homepages, media and articles on Fastly’s servers so that when somebody wants to browse the Times online, Fastly’s servers can send it directly to the browser. In some cases, Fastly serves up to 90 percent of browser requests.

E-commerce companies like Stripe and Ticketmaster are also big users of the service. They appreciate Fastly because its network of servers enable faster load times — sometimes as quickly as 20 or 30 milliseconds, according to the company.

The company raised its last round of financing roughly nine months ago, a $40 million investment that Fastly said would be the last before a public offering.

True to its word, the company is hoping public markets have the appetite to feast on yet another “unicorn” business.

While Fastly lacks the sizzle of companies like Zoom, Pinterest or Lyft, its technology enables a huge portion of the activities in which consumers engage online, and it could be a bellwether for competitors like Cloudflare, which recently raised $150 million and was also exploring a public listing.

The company’s public filing has a placeholder amount of $100 million, but given the amount of funding the company has received, it’s far more likely to seek closer to $1 billion when it finally prices its shares.

Fastly reported revenue of roughly $145 million in 2018, compared to $105 million in 2017, and its losses declined year on year to $29 million, down from $31 million in the year-ago period. So its losses are shrinking, its revenue is growing (albeit slowly) and its cost of revenues are rising from $46 million to around $65 million over the same period.

That’s not a great number for the company, but it’s offset by the amount of money that the company’s getting from its customers. Fastly breaks out that number in its dollar-based net expansion rate figure, which grew 132 percent in 2018.

It’s an encouraging number, but as the company notes in its prospectus, it’s got an increasing number of challenges from new and legacy vendors in the content delivery network space.

The market for cloud computing platforms, particularly enterprise-grade products, “is highly fragmented, competitive and constantly evolving,” the company said in its prospectus. “With the introduction of new technologies and market entrants, we expect that the competitive environment in which we compete will remain intense going forward. Legacy CDNs, such as Akamai, Limelight, EdgeCast (part of Verizon Digital Media), Level3, and Imperva, and small business-focused CDNs, such as Cloudflare, InStart, StackPath, and Section.io, offer products that compete with ours. We also compete with cloud providers who are starting to offer compute functionality at the edge like Amazon’s CloudFront, AWS Lambda, and Google Cloud Platform.”

Powered by WPeMatico

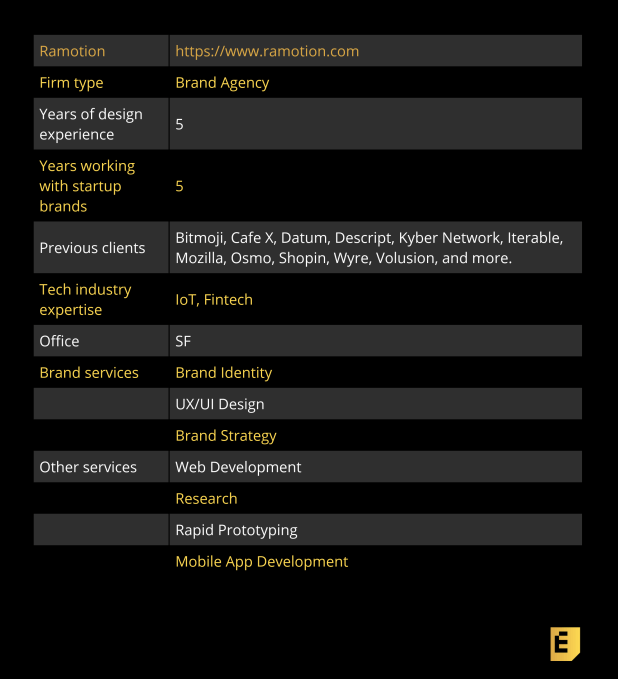

Ramotion is a remote branding and product design agency that has worked with Bay Area tech startups since 2014. While they typically do branding for funded, fast-growing startups, Ramotion has helped companies ranging from Bitmoji’s early brand identity to Mozilla’s rebrand. We spoke to Ramotion’s CEO Denis Pakhaliuk about their iterative approach, his favorite branding projects and more.

“We are a big fan of starting small: designing a small package, releasing it and then iterating on top of that. So, founders need to be focused on what’s really necessary right now for their next round of investment or product releases.”

“I think some founders think they need everything, but they actually need an MVP and product design. The same goes for brand identity. They need to have some key elements like colors, typeface and the logo. There is no need to do everything in the beginning, because the logo and brand identity becomes meaningful after it’s used. It’ll eventually improve.”

“They’re the reason we have such an amazing logo today.” Kevin Sproles, Austin, founder & CEO at Volusion

Below, you’ll find the rest of the founder reviews, the full interview and more details like pricing and fee structures. This profile is part of our ongoing series covering startup brand designers and agencies with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already.

Yvonne Leow: Can you tell me about your journey and how you came to create Ramotion?

Denis Pakhaliuk: Yeah, I started as a CG designer more than 10 years ago. I was doing computer graphics, CG modeling, digitalization of architectural design and automotive design. I was initially very focused on German cars and industrial design. Once iPhone 3G came out, I switched to doing UI design for mobile apps, which was a very hot topic at the time.

From that point I met a guy who just said, “Hey, I’m thinking of building an agency,” and so we decided to do it together. It started with a few people and now we have up to 30. We focus on different products, from small companies to more established brands, like Salesforce, among others. So yeah, it’s been a fun journey.

Yvonne Leow: At what point did Ramotion start working with startups?

Powered by WPeMatico

Editors Note: This article is part of a series that explores the world of growth marketing for founders. If you’ve worked with an amazing growth marketing agency, nominate them to be featured in our shortlist of top growth marketing agencies in tech.

Startups often set themselves back a year by hiring the wrong growth marketer.

This post shares a framework my marketing agency uses to source and vet high-potential growth candidates.

With it, early-stage startups can identify and attract a great first growth hire.

It’ll also help you avoid unintentionally hiring candidates who lack broad competency. Some marketers master 1-2 channels, but aren’t experts at much else. When hiring your first growth marketer, you should aim for a generalist.

This post covers two key areas:

One interesting way to find great marketers is to look for great potential founders.

Let me explain. Privately, most great marketers admit that their motive for getting hired was to gain a couple years’ experience they could use to start their own company.

Don’t let that scare you. Leverage it: You can sidestep the competitive landscape for marketing talent by recruiting past founders whose startups have recently failed.

Why do this? Because great founders and great growth marketers are often one and the same. They’re multi-disciplinary executors, they take ownership and they’re passionate about product.

You see, a marketing role with sufficient autonomy mimics the role of a founder: In both, you hustle to acquire users and optimize your product to retain them. You’re working across growth, brand, product and data.

As a result, struggling founders wanting a break from the startup roller coaster often find transitioning to a growth marketing role to be a natural segue.

How do we find these high-potential candidates?

To find past founders, you could theoretically monitor the alumni lists of incubators like Y Combinator and Techstars to see which companies never succeeded. Then you can reach out to their first-time founders.

You can also identify future founders: Browse Product Hunt and Indie Hackers for old projects that showed great marketing skill but didn’t succeed.

There are thousands of promising founders who’ve left a mark on the web. Their failure is not necessarily indicative of incompetence. My agency’s co-founders and directors, including myself, all failed at founding past companies.

To get potential founders interested in the day-to-day of your marketing role, offer them both breadth and autonomy:

Remember, recreate the experience of being a founder.

Further, vet their enthusiasm for your product, market and its product-channel fit:

The latter is a little-understood but critically important requirement: Hire marketers who are interested in the channels your company actually needs.

Let’s illustrate this with a comparison between two hypothetical companies:

Broadly speaking, the enterprise app will most likely succeed through the following customer acquisition channels: sales, offline networking, Facebook desktop ads and Google Search.

In contrast, the e-commerce company will most likely succeed through Instagram ads, Facebook mobile ads, Pinterest ads and Google Shopping ads.

We can narrow it even further: In practice, most companies only get one or two of their potential channels to work profitably and at scale.

Meaning, most companies have to develop deep expertise in just a couple of channels.

There are enterprise marketers who can run cold outreach campaigns on autopilot. But, many have neither the expertise nor the interest to run, say, Pinterest ads. So if you’ve determined Pinterest is a high-leverage ad channel for your business, you’d be mistaken to assume that an enterprise marketer’s cold outreach skills seamlessly translate to Pinterest ads.

Some channels take a year or longer to master. And mastering one channel doesn’t necessarily make you any better at the next. Pinterest, for example, relies on creative design. Cold email outreach relies on copywriting and account-based marketing.

(How do you identify which ad channels are most likely to work for your company? Read my Extra Crunch article for a breakdown.)

To summarize: To attract the right marketers, identify those who are interested in not only your product but also how your product is sold.

The founder-first approach I’ve shared is just one of many ways my agency recruits great marketers. The point is to remind you that great candidates are sometimes a small career pivot away from being your perfect hire. You don’t have to look in the typical places when your budget is tight and you want to hire someone with high, senior potential.

This is especially relevant for early-stage, bootstrapping startups.

If you have the foresight to recognize these high-potential candidates, you can hopefully hire both better and cheaper. Plus, you empower someone to level up their career.

Speaking of which, here are other ways to hire talent whose potential hasn’t been fully realized:

If you don’t yet have a growth candidate to vet, you can stop reading here. Bookmark this and return when you do!

Now that you have a candidate, how do you assess whether they’re legitimately talented?

At Bell Curve, we ask our most promising leads to incrementally complete three projects:

We allow a week to complete these projects. And we pay them market wage.

Here’s what we’re looking for when we assess their work.

First — putting their work aside — we assess the dynamics of working with them. Are they:

If they follow our instructions and do a decent job, they’re competent. If they hit our deadline, they’re probably reliable. If they ask good questions, they’re communicative.

And if we like talking to them, they’re kind.

A level higher, we use these projects to assess their ability to contribute to the company:

If you don’t have the in-house expertise to assess their growth skills, you can pay an experienced marketer to assess their work. It’ll cost you a couple hundred bucks, and give you peace of mind. Look on Upwork for someone, or ask a marketer at a friend’s company.

Powered by WPeMatico

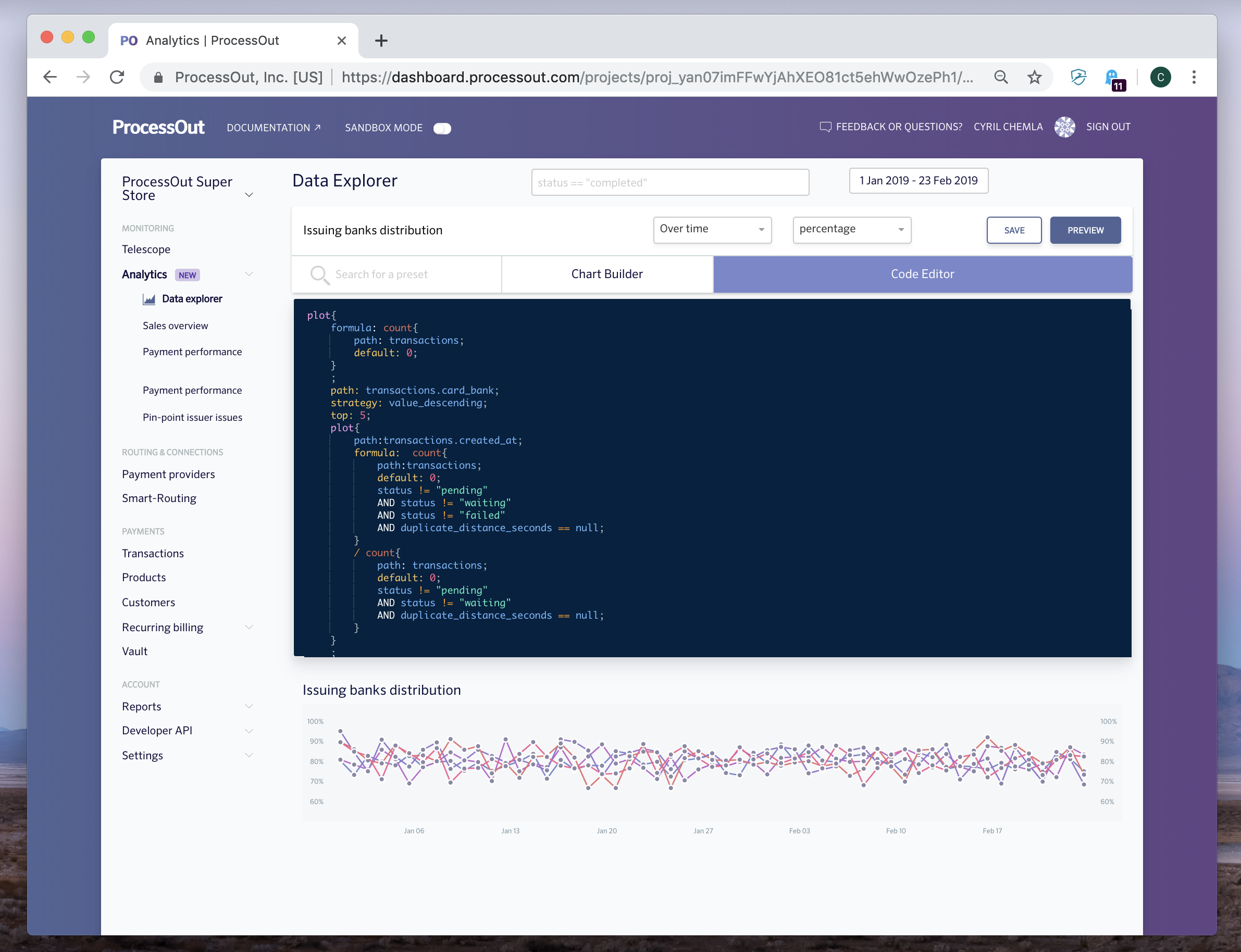

ProcessOut has grown quite a lot since I first covered the startup. The company now has a ton of small and big clients, from Glovo to Vente-Privée and Dashlane. The company has become an expert on payment providers and payment analytics.

The core of the product remains the same. Clients sign up to get an overview on the performance of their payment systems. After setting up ProcessOut Telescope, you can monitor payments with expensive fees, failed payments and disappointing payment service providers.

And this product is quite successful. Back in October 2018, the company had monitored $7 billion in transactions since its inception — last month, that number grew to $13 billion.

The company is adding new features to make it easier to get insights from your payment data. You can now customize your data visualization dashboards with a custom scripting language called ProcessOut Lang. This way, if you have an internal payment team, they can spot issues more easily.

ProcessOut can also help you when it comes to generating reports. The company can match transactions on your bank account with transactions on different payment providers.

If you’re a smaller company and can’t optimize your payment module yourself, ProcessOut also builds a smart-routing checkout widget. When a customer pays something, the startup automatically matches card information with the best payment service provider for that transaction in particular.

Some providers are quite good at accepting all legit transactions, such as Stripe or Braintree. But they are also more expensive than more traditional payment service providers. ProcessOut can predict if a payment service provider is going to reject this customer before handing the transaction to that partner. It leads to lower fees and a lower rejection rate.

The company recently added support for more payment service providers in Latin America, such as Truevo, AllPago and Mercadopago. And ProcessOut now routes more transactions in one day compared to the entire month of October 2018.

As you can see, the startup is scaling nicely. It will be interesting to keep an eye on it.

Powered by WPeMatico

Uber has confirmed it will spin out its self-driving car business after the unit closed $1 billion in funding from Toyota, auto-parts maker Denso and SoftBank’s Vision Fund.

The development has been speculated for some time — as far back as October — and it serves to both remove a deeply unprofitable unit from the main Uber business, helping Uber scale back some of its losses, while giving Uber’s Advanced Technologies Group (known as Uber ATG) more freedom to focus on the tough challenge of bringing autonomous vehicles to market.

The deal values Uber ATG at $7.25 billion, the companies announced. In terms of the exact mechanics of the investment, Toyota and Denso are providing $667 million, with the Vision Fund throwing in the remaining $333 million.

The deal is expected to close in Q3, and it gives investors a new take on Uber’s imminent IPO, which comes with Uber ATG. The company posted a $1.85 billion loss for 2018, but R&D efforts on “moonshots” like autonomous cars and flying vehicles dragged the numbers down by accounting for more than $450 million in spending. Moving those particularly capital-intensive R&D plays into a new entity will help bring the core Uber numbers down to earth, but clearly there’s still a lot of work to reach break-even or profitability.

Still, those crazy numbers haven’t dampened the mood. Uber is still seen as a once-in-a-generation company, and it is tipped to raise around $10 billion from the IPO, giving it a reported valuation of $90 billion-$100 billion.

Like the spin-out itself, the identity of the investors is not a surprise.

The Vision Fund (and parent SoftBank) have backed Uber since a January 2018 investment deal closed, while Toyota put $500 million into the ride-hailing firm last August. Toyota and Uber are working to bring autonomous Sienna vehicles to Uber’s service by 2021 while, in further proof of their collaborative relationship, SoftBank and Toyota are jointly developing services in their native Japan, which will be powered by self-driving vehicles.

The duo also backed Grab — the Southeast Asian ride-hailing company in which Uber owns around 23 percent — perhaps more aggressively. SoftBank has been an investor since 2014, and last year Toyota invested $1 billion into Grab, which it said was the highest investment it has made in ride hailing.

“Leveraging the strengths of Uber ATG’s autonomous vehicle technology and service network and the Toyota Group’s vehicle control system technology, mass-production capability, and advanced safety support systems, such as Toyota Guardian, will enable us to commercialize safer, lower cost automated ridesharing vehicles and services,” said Shigeki Tomoyama, the executive VP who leads Toyota’s “connected company” division, said in a statement.

Here’s Uber CEO Dara Khosrowshahi’s shorter take on Twitter:

Excited to announce Toyota, Denso and the SoftBank Vision Fund are making a $1B investment in @UberATG, as we work together towards the future of mobility. pic.twitter.com/JdqhLkV7uU

— dara khosrowshahi (@dkhos) April 19, 2019

Powered by WPeMatico

Five years after Dropbox acquired their startup Zulip, Waseem Daher, Jeff Arnold and Jessica McKellar have gained traction for their third business together: Pilot.

Pilot helps startups and small businesses manage their back office. Chief executive officer Daher admits it may seem a little boring, but the market opportunity is undeniably huge. To tackle the market, Pilot is today announcing a $40 million Series B led by Index Ventures with participation from Stripe, the online payment processing system.

The round values Pilot, which has raised about $60 million to date, at $355 million.

“It’s a massive industry that has sucked in the past,” Daher told TechCrunch. “People want a really high-quality solution to the bookkeeping problem. The market really wants this to exist and we’ve assembled a world-class team that’s capable of knocking this out of the park.”

San Francisco-based Pilot launched in 2017, more than a decade after the three founders met in MIT’s student computing group. It’s not surprising they’ve garnered attention from venture capitalists, given that their first two companies resulted in notable acquisitions.

Pilot has taken on a massively overlooked but strategic segment — bookkeeping,” Index’s Mark Goldberg told TechCrunch via email. “While dry on the surface, the opportunity is enormous given that an estimated $60 billion is spent on bookkeeping and accounting in the U.S. alone. It’s a service industry that can finally be automated with technology and this is the perfect team to take this on — third-time founders with a perfect combo of financial acumen and engineering.”

The trio of founders’ first project, Linux upgrade software called Ksplice, sold to Oracle in 2011. Their next business, Zulip, exited to Dropbox before it even had the chance to publicly launch.

It was actually upon building Ksplice that Daher and team realized their dire need for tech-enabled bookkeeping solutions.

“We built something internally like this as a byproduct of just running [Ksplice],” Daher explained. “When Oracle was acquiring our company, we met with their finance people and we described this system to them and they were blown away.”

It took a few years for the team to refocus their efforts on streamlining back-office processes for startups, opting to build business chat software in Zulip first.

Pilot’s software integrates with other financial services products to bring the bookkeeping process into the 21st century. Its platform, for example, works seamlessly on top of QuickBooks so customers aren’t wasting precious time updating and managing the accounting application.

“It’s better than the slow, painful process of doing it yourself and it’s better than hiring a third-party bookkeeper,” Daher said. “If you care at all about having the work be high-quality, you have to have software do it. People aren’t good at these mechanical, repetitive, formula-driven tasks.”

Currently, Pilot handles bookkeeping for more than $100 million per month in financial transactions but hopes to use the infusion of venture funding to accelerate customer adoption. The company also plans to launch a tax prep offering that they say will make the tax prep experience “easy and seamless.”

“It’s our first foray into Pilot’s larger mission, which is taking care of running your companies entire back office so you can focus on your business,” Daher said.

As for whether the team will sell to another big acquirer, it’s unlikely.

“The opportunity for Pilot is so large and so substantive, I think it would be a mistake for this to be anything other than a large and enduring public company,” Daher said. “This is the company that we’re going to do this with.”

Powered by WPeMatico

If you’re a SaaS business, you’re likely overwhelmed with data and an ever-growing list of acronyms that purport to unlock secret keys to your success. But like most things, tracking with you do has very little impact on what you actually do.

It’s really important to find one, or a very small number, of key indicators to track and then base your activities against those. It’s arguable that SaaS businesses are becoming TOO data driven — at the expense of focussing on the core business and the reason they exist.

In this article, we’ll look at focusing on metrics that matter, metrics that help form activities, not just measure them in retrospect.

Most of the metrics we track, such as revenue growth, are lagging indicators. But growth is a result, not an activity you can drive. Just saying you want to grow an extra 10% doesn’t mean anything towards actually achieving it.

Since growth funnels are generally looked at from top to bottom, and in a historical context — a good exercise can be the other way around — go bottom-up, starting with the end result (the growth goal) and figure out what each stage needs to contribute to achieve it.

You can do this by looking at leading indicators. These are metrics that you can influence — and that as you act, and see them increase or decrease, you can be relatively certain of the knock-on effects on the rest of the business. For example — if you run a project management product, the number of tasks created is likely to be a good leading indicator for the growth of the business — more tasks created on the platform equals more revenue.

Powered by WPeMatico

Uber and Lyft instituted new safety features and policies this week.

The move follows the death of Samantha Josephson, a student at the University of South Carolina, who was kidnapped and murdered in late March. She was found dead after getting into a vehicle that she believed to be her Uber ride. The murder, which has garnered nationwide media attention, seems to have spurred action by the ridesharing behemoths.

In response, Uber is launching the Campus Safety Initiative, which includes new features in the app. Currently, the features are in testing, and they remind riders to check the license plate, make and model of the car, as well as the driver’s name and picture, before ever entering into a vehicle. The test is running in South Carolina, in partnership with the University of South Carolina, with plans to roll out nationwide.

Lyft, which went public on March 29, has implemented continuous background checks for drivers this week. (Uber has had this in place since last year.) Lyft also enhanced its identity verification process for drivers, which combines driver’s license verification and photographic identity verification to prevent driver identity fraud on the platform.

Uber, prepping to debut on the public market, is taking the safety precautions seriously. The new system reminds riders about checking their ride three separate times: the first is a banner at the bottom of the app once the ride has been ordered, the second is a warning to check license plate, car details and photo, and the third is an actual push notification before the driver arrives reminding riders to check once more.

Alongside the reminder system, Uber is also working to build out dedicated pickup zones in the Five Points district of Columbia, with plans to roll out dedicated pickup zones at other U.S. universities.

That said, Uber has also warned investors ahead of its IPO about a forthcoming safety report on the company, which could be damaging to the brand. The report is supposed to be released sometime this year, and will give the public its first comprehensive look at the scale of safety incidents and issues that occur on the platform.

“The public responses to this transparency report or similar public reporting of safety incidents claimed to have occurred on our platform … may result in negative media coverage and increased regulatory scrutiny and could adversely affect our reputation with platform users,” said Uber in its April 14 IPO paperwork.

Indeed, the issue of safety on platforms like Uber and Lyft, or really any app that asks you to be alone with total strangers, goes well beyond any single incident. A CNN investigation found that 103 Uber drivers had been accused of sexual assault or abuse in the last four years.

Powered by WPeMatico