Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Astound, a company selling automated employee help desk services, has raised a new round of $15.5 million from investors led by the Los Angeles investment firm March Capital Partners.

Previous investors Vertex Ventures, Pelion Venture Partners, Moment Ventures and the Slack Fund also participated in the funding, which brings Astound’s total capital raised to $27 million.

The company’s software integrates with ServiceNow, BMC, Jira, Cherwell and Workday, among others.

For co-founder and chief product officer Dan Turchin, the company is the culmination of decades of work spent developing tools for human resources and employee services. It’s the seventh company that Turchin has been involved in around applying technology to help employees, he says. Most recently, Turchin worked at ServiceNow, which he left in 2014 to launch Astound .

Astound said it would use the financing to increase its product development and sales and marketing efforts, according to a statement.

Taking information from structured and unstructured data sources across different information silos within a business and offering it up to employees via automated messages (it’s a chatbot) frees human resources and help desk staff to engage at a higher level with employees, companies like Astound say.

Automation is certainly coming to businesses, whether employees like it or not. A study from McKinsey indicates that 70 percent of companies will bring in at least one automation technology by 2030. And those technologies could contribute up to $120 billion in increased economic value, according to the McKinsey study cited by Astound.

Powered by WPeMatico

Mfine, an India-based startup aiming to broaden access to doctors and healthcare by using the internet, has pulled in a $17.2 million Series B funding round for growth.

The company is led by four co-founders from Myntra, the fashion commerce startup acquired by Flipkart in 2014. They include CEO Prasad Kompalli and Ashutosh Lawania who started the business in 2017 and were later joined by Ajit Narayanan and Arjun Choudhary, Myntra’s former CTO and head of growth, respectively.

The round is led by Japan’s SBI Investment with participation from sibling fund SBI Ven Capital and another Japanese investor, Beenext. Existing Mfine backers Stellaris Venture Partners and Prime Venture Partners also returned to follow-on. Mfine has now raised nearly $23 million to date.

“In India, at a macro-level, good doctors are far and few and distributed very unevenly,” Kompalli said in an interview with TechCrunch. “We asked ‘Can we build a platform that is a very large hospital on the cloud?,’ that’s the fundamental premise.”

There’s already plenty of money in Indian healthtech platforms — Practo, for one, has raised more than $180 million from investors like Tencent — but Mfine differentiates itself with a focus on partnerships with hospitals and clinics, while others have offered more daily health communities that include remote sessions with doctors and healthcare professionals who are recruited independently of their day job.

“We are entering a different phase of what is called healthtech… the problems that are going to be solved will be much deeper in nature,” Kompalli said in an interview with TechCrunch.

Mfine makes its money as a digital extension of its healthcare partners, essentially. That means it takes a cut of spending from consumers. The company claims to work with more than 500 doctors from 100 “top” hospitals, while there’s a big focus on tech. In particular, it says that an AI-powered “virtual doctor” can help in areas that include summarising diagnostic reports, narrowing down symptoms, providing care advice and helping with preventative care. There are also other services, including medicine delivery from partner pharmacies.

To date, Mfine said that its platform has helped with more than 100,000 consultations across 800 towns in India during the last 15 months. It claims it is seeing around 20,000 consultations per month. Beyond helping increase the utilization of GPs — Mfine claims it can boost their productivity 3 to 4X — the service can also help hospitals and centers increase their revenue, a precious commodity for many.

Going forward, Kompalli said the company is increasing its efforts with corporate companies, where it can help cover employee healthcare needs, and developing its insurance-style subscription service. Over the coming few years, that channel should account for around half of all revenue, he added.

A more immediate goal is to expand its offline work beyond Hyderabad and Bangalore, the two cities where it currently operates.

“This round is a real endorsement from global investors that the model is working,” he added.

Powered by WPeMatico

The market for voice apps has opened up — Amazon Alexa’s platform alone has more than 80,000 skills as of earlier this year — and there’s little sign of that growth slowing now that smart speakers have hit critical mass in the U.S. To capitalize on this trend, Voiceflow, a startup making it easier for product teams to build voice applications for Alexa and Google Assistant, has raised $3 million in seed funding.

The round was led by True Ventures, and includes participation from Product Hunt founder Ryan Hoover, Eventbrite founder Kevin Hartz and InVision founder Clark Valberg. The company has previously raised $500,000 in pre-seed funding.

Explains Voiceflow CEO and co-founder Braden Ream, the idea for a collaborative platform for building voice apps came from direct experience as a voice app developer.

The team — which also includes Tyler Han, Michael Hood and Andrew Lawrence — had decided to build a voice application offering interactive children’s stories for Alexa, called Storyflow.

But as the team began to build out its library of these choose-your-own-adventure stories, they realized the process wasn’t scaling fast enough to serve their user base — they simply couldn’t build the storyboards with all their branches fast enough.

“At some point, we had the idea to just do a drag-and-drop,” says Ream. “I wished I could build the flow chart, the scripting and the actual coding — I wished this was all one step. That led us to build a really early iteration of what is now Voiceflow. It was sort of an internal tool,” he continues. “And being the nerds that we are, we kept making the platform better by adding logic, variables and modularity.”

The original plan was to make Storyflow’s platform a “YouTube of voice” so anyone could build their stories easily.

But when the Storyflow community got ahold of what the team had built, they very quickly wanted to use it to build their own voice apps — not just interactive stories.

“That’s when the light bulb went off for us,” notes Ream. “This could easily be the central platform for building voice apps, and not necessarily interactive children’s stories. The pivot was very easy,” he says. “All we had to do was change our name from Storyflow to Voiceflow.”

The platform officially launched in November, and today has more than 7,500 customers who have published some 250 voice apps using its tools.

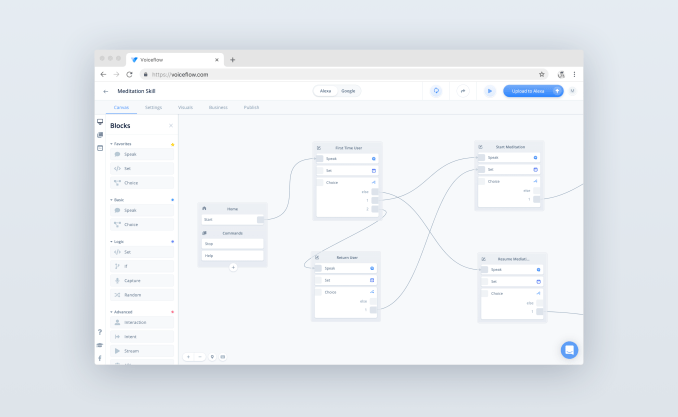

Voiceflow is designed to be non-technical for those who don’t know how to code. For example, its two basic block types are “speak” and “choice.” Its blocks are organized on the screen through drag-and-drop, as users design the flow of their app. For more technical users, an advanced section allows you to add logic and variables — but it’s still entirely visual.

For enterprise customers, there’s also an API block in Voiceflow that allows the customer to integrate the business’s own API into their voice app.

What’s also interesting about the product is its collaborative features. While Voiceflow is free for individuals, its business model is focused on allowing teams to work together to build voice apps. Priced at $29 per month in its paid workspaces, voice agencies that have a larger staff — including linguists, voice user interface designers and developers, for example — can all work together on one board, share projects and hand off assets more easily.

With the seed funding, Voiceflow plans to grow the team by hiring more engineers and continue to develop the platform.

Longer-term, the company wants to help people design better, more human-sounding voice apps through its platform.

“The problem right now is you have documentation and best practices by Google. Then you have the exact same on the Alexa side, but there’s no coherent industry standard. And there’s certainly no tangible base of examples, or easy way to put these into practice,” Ream explains. “If we can help spawn another 10,000 voice user interface designers — we can help train them and give them a platform that’s accessible, where they can collaborate with each other — I think you’re going to see a tremendous uplift in the quality of conversations.”

On this front, Voiceflow has started a program called Voiceflow University, which today includes video tutorials but will later become a more standardized training course.

In addition to the videos, Voiceflow networks with its community directly on Facebook, where more than 2,500 developers, linguists, educators, designers and entrepreneurs actively discuss the voice app design and development process.

This interaction between Voiceflow and its user base was one of the key selling points for True Ventures’ Tony Conrad.

“After I left the [pitch] meeting and I started digging around a little bit, the thing that blew me away was the engagement of the community of developers. That’s unlike anybody else. The single biggest differentiator of this platform is actually Braden and the team’s engagement with the community,” Conrad says. “It reminds me of early WordPress.”

Voiceflow also recently worked with another visual design tool, Invocable, which has shut down, to allow its users to transition to Voiceflow’s platform.

There is, perhaps, a cautionary tale in there — Invocable, in its farewell blog post, points out that people continue to use smart speakers mainly for things like music, news, reminders and simple commands. It also says that Natural Language Processing and Natural Language Understanding haven’t developed to the point where they can support higher-quality voice apps. That day will likely come to pass, but there’s a bit of a timing issue when it comes to betting on the right platform to support the voice app development market in the meantime, ahead of widespread consumer adoption.

Toronto-based Voiceflow is a team of 12 today and looking to grow.

Powered by WPeMatico

When Chive Media Group spun out its out-of-home TV business last year, co-founder and CEO Leo Resig said the structure should help the new company, called Atmosphere, raise venture capital.

Looks like those fundraising efforts were successful, with Atmosphere announcing that it has raised $10 million in Series A funding led by S3 Ventures, with participation from Capstar Capital.

“I have yet to meet someone who enjoys watching closed-captioning or talking heads at their favorite establishments,” said S3 Ventures partner Charlie Plauche in a statement. (Plauche is joining Atmosphere’s board of directors.) “Yet, that is the best option most businesses have to entertain patrons. That all changes with Atmosphere, who offers engaging content to viewers of all ages with no audio needed.”

Chive Media Group is known for its namesake website, theChive, which focuses on funny and viral content. Chive co-founders (and brothers) Leo and John Resig told me that when the company decided to move into video, it didn’t have the money to create a big production arm.

“We stuck to our roots of what we do best: Seek out and curate and package existing content,” John said. As a result, the company was able to license “a pretty large IP library of short-form, mostly amateur viral videos,” which it then offered to bars and other out-of-home locations as Chive TV.

Chive TV still exists, but it’s now just one of the channels that Atmosphere offers, with Leo noting that Atmosphere now includes more polished videos from partners like Red Bull and GoPro.

“Everyone’s creating content these days,” John added. “We’re a shiny new distribution vessel for a lot of that content.”

In general, Leo argued that Atmosphere content is better tailored than regular TV to the needs of (say) a restaurant or a doctor’s office.

“It’s ambient TV,” he said. “It’s not episodic, it’s not character-driven, you can pick it up and leave it without missing a touchdown.”

Plus, as Plauche mentioned, it’s designed to be watchable without audio.

The company says Chive TV is already streamed in 4,300 bars, restaurants, gyms and other locations. And it’s adding around 450 venues every month.

At the same time, the Resigs said Atmosphere has been building up a technology backend, with the analytics and ad serving that you get with online video.

Until now, Chive and Atmosphere have been giving the content away for free while monetizing with ads, but Leo said they’ll soon start charging a monthly subscription fee of around $10 or $20, which he suggested is “not a lot of money for what the venues are getting,” particularly compared to their cable bill. There’s an additional product that venues can pay for to insert their own messages and house ads.

The Resigs actually hold the same title at both companies, but Leo (CEO) suggested that he’ll be spending more time on Atmosphere, while John (president) said he’ll be “straddling” the two organizations.

Leo said Atmosphere has around 20 employees — with another 20 who are currently splitting their work between Chive Media and Atmosphere, but will ultimately go work for one of the two organizations.

Powered by WPeMatico

Blueshift is a startup founded by tech industry veterans who saw first-hand how difficult cross-channel marketing was. They decided to launch a company and build a cross-channel marketing platform from the ground up that uses AI and machine learning to make sense of the growing amount of customer data. Today, the startup announced a $15 million Series B round to keep it going.

The round was led by SoftBank Ventures Asia, a fund focused on AI startups like Blueshift . Previous investors Storm Ventures and Nexus Venture Partners also participated. Today’s investment brings the total raised to $30 million, according to the company.

Company co-founder and CEO Vijay Chittoor says the marketing landscape is changing, and he believes that requires a new approach to allow marketers to take advantage of the multiple channels where they could be engaging with customers from a single tool.

“If you thought about the world of customer engagement at Walmart or Groupon [or any other retailer] 10 years ago, it was primarily an email problem. Today, we as customers, we’re interacting with these brands on not just email, but also on mobile notifications, Facebook custom audiences and WeChat [and across multiple other channels],” he explained.

He says that this has created a lot more data, which it turns out is a double-edged sword for marketing pros. “I think on one end, it’s exciting for a marketer or a CMO to have more data and more channels. It gives them more ways to connect. But at the same time, it’s also more challenging because now you have to make sense of a thousand times more data. And you have to use it intelligently on not just one channel like email, but you’re now trying to make sense of data across 15 different channels,” Chittoor said.

This a crowded field, with big players like Adobe, Salesforce and Oracle, among others, offering similar cross-channel, AI-fueled solutions. In addition, startups are attracting huge chunks of money to attack this problem, including Klayvio pulling in $150 million a couple of weeks ago and Iterable, which landed $50 million last month.

He says his company’s differentiator is the AI piece, and it is this piece that the company’s lead investor in this round has been focusing on in its investments. The company plans to use this round to continue building out its marketing platform and show marketers how to communicate intelligently across channels wherever the consumer happens to be. Customers include LendingTree, Udacity and BBC.

Powered by WPeMatico

Series B rounds used to be about establishing a product-market fit, but for some startups the whole process seems to be accelerating. Harness, the startup founded by AppDynamics co-founder and CEO Jyoti Bansal is one of those companies that is putting the pedal the metal with his second startup, taking his learnings and a $60 million round to build the company much more quickly.

Harness already has an eye-popping half billion dollar valuation. It’s not terribly often I hear valuations in a Series B discussion. More typically CEOs want to talk growth rates, but Bansal volunteered the information, excited by the startup’s rapid development.

The round was led by IVP, GV (formerly Google Ventures) and ServiceNow Ventures. Existing investors Big Labs, Menlo Ventures and Unusual Ventures also participated. Today’s investment brings the total raised to $80 million, according to Crunchbase data.

Bansal obviously made a fair bit of money when he sold AppDynamics to Cisco in 2017 for $3.7 billion and he could have rested after his great success. Instead he turned his attention almost immediately to a new challenge, helping companies move to a new continuous delivery model more rapidly by offering Continuous Delivery as a Service.

As companies move to containers and the cloud, they face challenges implementing new software delivery models. As is often the case, large web scale companies like Facebook, Google and Netflix have the resources to deliver these kinds of solutions quickly, but it’s much more difficult for most other companies.

Bansal saw an opportunity here to package continuous delivery approaches as a service. “Our approach in the market is Continuous Delivery as a Service, and instead of you trying to engineer this, you get this platform that can solve this problem and bring you the best tooling that a Google or Facebook or Netflix would have,” Basal explained.

The approach has gained traction quickly. The company has grown from 25 employees at launch in 2017 to 100 today. It boasts 50 enterprise customers including Home Depot, Santander Bank and McAfee.

He says that the continuous delivery piece could just be a starting point, and the money from the round will be plowed back into engineering efforts to expand the platform and solve other problems DevOps teams face with a modern software delivery approach.

Bansal admits that it’s unusual to have this kind of traction this early, and he says that his growth is much faster than it was at AppDynamics at the same stage, but he believes the opportunity here is huge as companies look for more efficient ways to deliver software. “I’m a little bit surprised. I thought this was a big problem when I started, but it’s an even bigger problem than I thought and how much pain was out there and how ready the market was to look at a very different way of solving this problem,” he said.

Powered by WPeMatico

Ruthless copying is common in tech. Just ask Snapchat. However, it’s typically more conceptual than literal. But car API startup Smartcar claims that its competitor Otonomo copy-and-pasted Smartcar’s API documentation, allegedly plagiarizing it extensively to the point of including the original’s typos and randomly generated strings of code. It’s published a series of side-by-side screenshots detailing the supposed theft of its intellectual property.

Smartcar CEO Sahas Katta says “We do have evidence of several of their employees systemically using our product with behavior indicating they wanted to copy our product in both form and function.” Now a spokesperson for the startup tells me “We’ve filed a cease-and-desist letter, delivered to Otonomo this morning, that contains documented aspects of different breaches and violations.”

The accusations are troubling given Otonomo is not some inconsequential upstart. The Israel-based company has raised over $50 million since its founding in 2015, and its investors include auto parts giant Aptiv (formerly Delphi) and prestigious VC firm Bessemer Ventures Partners. Otonomo CMO Lisa Joy provided this statement in response to the allegations, noting it will investigate but is confident it acted with integrity:

Otonomo prides itself on providing a completely unique offering backed by our own intellectual property and patents. We take Smartcar’s questions seriously and are conducting an investigation, but we remain confident that our rigorous standards of integrity remain uncompromised. If our investigation reveals any issues, we will immediately take the necessary steps to address them.

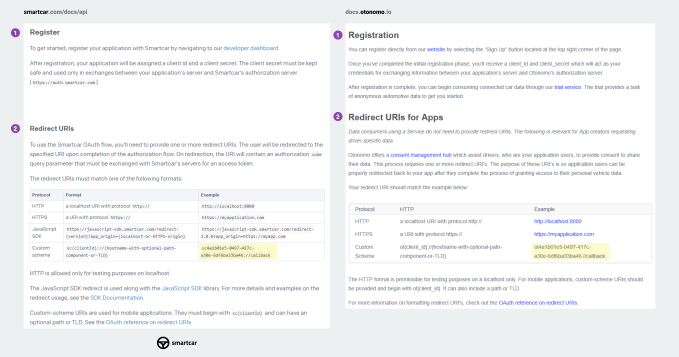

Both startups are trying to build an API layer that connects data from cars with app developers so they can build products that can locate, unlock, or harness data from vehicles. The 20-person Mountain View-based Smartcar has raised $12 million from Andreessen Horowitz and NEA. A major deciding factor in who’ll win this market is which platform offers the best documentation that makes it easiest for developers to integrate the APIs.

“A few days ago, we came across Otonomo’s publicly available API documentation. As we read through it, we quickly realized that something was off. It looked familiar. Oddly familiar. That’s because we wrote it” Smartcar explains in its blog post. “We didn’t just find a few vague similarities to Smartcar’s documentation. Otonomo’s docs are a systematically written rip-off of ours – from the overall structure, right down to code samples and even typos.”

The screenshot above comparing API documentation from Smartcar on the left and Otonomo on the right appears to show Otonomo used nearly identical formatting and the exact same randomly generated sample identifier (highlighted) as Smartcar. Further examples flag seemingly identical code strings and snippets.

Smartcar founder and CEO Sahas Katta

Otonomo has pulled down their docs.otonomo.io documentation website, but TechCrunch has reviewed an Archive.org Wayback Machine showing this Otonomo site as of April 5, 2019 featured sections that are identical to the documentation Smartcar published in August 2018. That includes Smartcar’s typo “it will returned here”, and its randomly generated sample code placeholder “”4a1b01e5-0497-417c-a30e-6df6ba33ba46” which both appear in the Wayback Machine copy of Otonomo’s docs. The typo was fixed in this version of Otonomo’s docs that’s still publicly available, but that code string remains.

“It would be a one in a quintillion chance of them happening to land on the same randomly generated string” Smartcar’s Katta tells TechCrunch.

Yet curiously, Otonomo’s CMO told TechCrunch that “The materials that [Smartcar] put on their post are all publicly accessible documentation, It’s all public domain content.” But that’s not true, Katta argues, given the definition of ‘public domain’ is content belonging to the public that’s uncopyrightable. “I would sure hope not, considering . . . we have proper copyright notices at the bottom. Our product is our intellectual property. Just like Twilio’s API documentation or Stripe’s, it is published and publicly available — and it is proprietary.”

Otonomo’s Lisa Joy noted that her startup is currently fundraising for its Series C, which reportedly already includes $10 million from South Korean energy and telecom holdings giant SK. “We’re in the middle of raising a round right now. That round is not done” she told me. But if Otonomo gets a reputation for allegedly copying its API docs, that could hurt its standing with developers and potentially endanger that funding round.

Powered by WPeMatico

Twitter shut down Dom Hoffman’s app Vine, giving away the short-form video goldmine to China’s TikTok. Now a year and half since Hoffman announced he’d reimagine the app as V2 then scrapped that name, his follow-up to Vine called Byte has finally sent out the first 100 invites to its closed beta. Byte will let users record or upload short, looped vertical videos to what’s currently a reverse-chronological feed.

the byte beta we’ve been running with friends and family *feels* exactly like the vine friends and family beta, down to the weird but appealing randomness of the videos. that’ll change as we expand, but it’s a pretty good sign pic.twitter.com/rBbQrNtTJ7

— dom hofmann (@dhof) April 22, 2019

It will be a long uphill climb for Byte given TikTok’s massive popularity. But if it differentiates by focusing less on lip syncing and teen non-sense so it’s less alienating to an older audience, there might be room for a homegrown competitor in short-form video entertainment.

It will be a long uphill climb for Byte given TikTok’s massive popularity. But if it differentiates by focusing less on lip syncing and teen non-sense so it’s less alienating to an older audience, there might be room for a homegrown competitor in short-form video entertainment.

Hoffman tells TechCrunch that he’s emboldened by the off-the-cuff nature of the beta community, which he believes proves the app is compelling even before lots of creative and funny video makers join. He says his top priority is doing right by creators so they’ll be lined up to give Byte a shot when it officially launches even if they could get more views elsewhere.

For now, Hoffman plans to keep running beta tests, adding and subtracting features for a trial by fire to see what works and what’s unnecessary. The current version is just camera recordings with no uploads, and just a feed with Likes and comments but no account following. Upcoming iterations from his seven-person team will test video uploads and profiles.

One reassuring point is that Hoffman is well aware that TikTok’s epic rise has changed the landscape. He admits that Byte can’t win with the exact same playbook Vine did when it faced an open field, and it must bring something unique. Hoffman tells me he’s a big fan of TikTok, and sees it as one evolutionary step past Vine, but not in the same direction as his new app

Does the world need Vine back if TikTok already has over 500 million active users? We’ll soon find out of Hoffman can take a Byte of that market.

Powered by WPeMatico

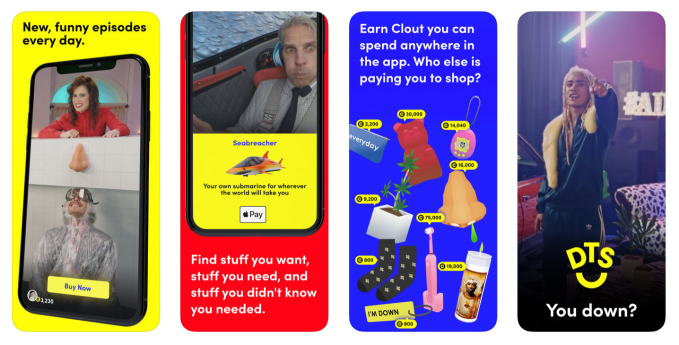

Cyrus Summerlin and Max Hellerstein, who previously created the Push for Pizza app (which allowed users to order a pizza with the push of a button), are officially launching their new startup today, Down to Shop.

The app bills itself as both a modern reinvention of QVC and “the funnest way to shop.” It allows users to watch funny videos featuring products that can be purchased directly from the app.

In an email, Hellerstein said the pair created Down to Shop out of dissatisfaction with existing advertising and e-commerce. Summerlin described it as “a hypermedia commerce platform.”

“We’ve created a self-aware, fun and entertaining, interactive environment that gets customers to engage with brands like never before — because they want to,” Summerlin said. “What a concept!”

To do this, Down to Shop says it has recruited a creative team of Upright Citizens Brigade alums and Instagram influencers to star in its shows, which are written, filmed and edited in the startup’s Los Angeles studios. The content is built around four-week seasons, with daily episodes across five shows each season.

You can download the iOS app now, then swipe through different videos and games. Judging from the videos available at launch, the app is holding true to its promise of “content first, advertising second,” with laid-back, tongue-in-cheek shows that also happen to feature promoted products.

By playing games and watching videos, you also earn Clout, the in-app currency that be used to make purchases. As for the products available to purchase, the company says it’s already working with more than 60 brands, including Sustain Condoms, Dirty Lemon (water) and Pretty Litter (cat litter).

Down to Shop’s investors include Greycroft, Lerer Hippeau and Firstmark. The startup isn’t disclosing the size of its funding, but according a regulatory filing, it raised $5.9 million last fall.

Powered by WPeMatico

In a foodie’s ideal world, we’d all eat healthy, minimally processed cuisine sourced from artisanal farmers, bakers and chefs.

In the real world, however, most of us derive the lion’s share of calories from edibles supplied by a handful of giant food conglomerates. As such, the ingredients and processing techniques they favor have an outsized impact on our daily diets.

With this in mind, Crunchbase News decided to take a look at corporate food VCs and the startups they are backing to see what their dealmaking might say about our snacking future. We put together a list of venture funds operated by some of the larger food and beverage producers, covering literally everything from soup to nuts (plus lunch meat and soda, too!).

Like their corporate backers, startups funded by “Big Food” are a diverse bunch. Recent funding recipients are pursuing endeavors ranging from alternative protein to biospectral imaging to fermented fungus. But if one were to pinpoint an overarching trend, it might be a shift away from cost savings to consumer-friendliness.

“You think of food-tech and ag-tech 1.0, these were technologies that were primarily beneficial to the producers,” said Rob LeClerc, founding partner at AgFunder, an agrifood investor network. “This new generation of companies are really more focused on what does the consumer want.”

And what does the consumer want? This particular consumer would currently like a zero calorie hot fudge sundae. More broadly, however, the general trends LeClerc sees call for food that is healthier, tastier, nutrient-dense, satiating, ethically sourced and less environmentally impactful.

Below, we look at some of the trends in more detail, including funded companies, active investors and the up-and-coming edibles.

Mass-market foods may get better but also weirder. This is particularly true for one of the more consistently hot areas of food-tech investment: alternative protein.

Demand for protein-rich foods, combined with ethical concerns about consuming animal products, has, for a number of years, led investors to startups offering meaty tasting tidbits sourced from the plant world.

But lately, corporate food giants have been looking farther beyond soy and peas. Lab-grown meat, once an oddball endeavor good for headlines about $1,000 meatballs, has been attracting serious cash. Since last year, at least two companies in the space have closed rounds backed by Tyson Ventures, the VC arm of the largest U.S. meat producer. They include pricey meatball maker Memphis Meats (actually based in California), which raised $20 million, and Israel-based Future Meat Technologies, a biotech startup working on animal-free meat, which secured $2 million.

Much of the early enthusiasm for new products stems from disillusionment with the existing ingredients we overeat.

If you cringe at the notion of lab-grown cell meat, then there’s always the option of getting your protein through microbes in volcanic springs. That’s the general aim of Sustainable Bioproducts, a startup that raised $33 million in Series A funding from backers including ADM and Danone Manifesto Ventures. The Chicago company’s technology for making edible protein emerged out of research into extremophile organisms in Yellowstone National Park’s volcanic springs.

Meanwhile, if you hanker for real dairy milk but don’t want to trouble cows, another startup, Perfect Day, is working on a solution. Per the company website: “Instead of having cows do all the work, we use microflora and age-old fermentation techniques to make the very same dairy protein that cows make.” Toward that end, the Berkeley company closed a $35 million Series B in February, with backing from ADM.

Perfect Day isn’t the only fermentation play raising major funding.

Corporate food-tech investors have long been interested in the processing technologies that turn an obscure microbe or under-appreciated crop into a high-demand ingredient. And lately, LeClerc said, they’ve been particularly keen on startups finding new ways to apply the age-old technology known as fermentation.

Most of us know fermentation as the process that turns a yucky mix of grain, yeast and water into the popular beverage known as beer. More broadly, however, fermentation is a metabolic process that produces chemical changes in organic substrates through the action of enzymes. That is, take a substance, add something it reacts with and voilà, you have a new substance.

Several of the most heavily funded, buzz-generating companies in the food space are applying fermentation, LeClerc said. Besides Perfect Day, examples he points to include the unicorn Ginkgo Bioworks, Geltor (another alt-protein startup) and mushroom-focused MycoTechnology.

Colorado-based MycoTechnology has been a particularly attractive investor target of late. The company has raised $83 million from a mix of corporate and traditional VCs, including a $30 million Series C in January that included Tyson and Kellogg’s venture arm, Eighteen94 Capital . Founded six years ago, the company is pursuing a range of applications for its fermented fungi, including flavor enhancers, protein supplements and preservatives.

Besides adding strange new ingredients to our grocery shelves, corporate food-tech investors are also putting money into technologies and platforms aimed at boosting the security and efficiency of existing supply chains.

Just like new foods, much of the food safety tech sounds odd, too. Silicon Valley-based ImpactVision, a seed-funded startup backed by Campbell Soup VC arm Acre Venture Partners, wants to employ hyper-spectral imaging to perceive information about contamination, food quality and ripeness.

Boston-based Spoiler Alert, another Acre portfolio company, develops software and analytics for food companies to manage unsold inventory. And Pensa Systems, which uses AI-powered autonomous drones to track in-store inventory, raised a Series A round this year with backing from the venture arm of Anheuser-Busch InBev.

We highlighted a few trends in corporate food-tech investment, but there are others that merit attention, as well. Probiotics plays, including the maker of the GoodBelly drink line, are generating investor interest. New ingredients other than proteins are also attracting capital, such as UCAN, a startup developing energy snacks based on a novel, slow-digesting carbohydrate. And the list goes on.

Much of the early enthusiasm for new products stems from disillusionment with the existing ingredients we overeat. But LeClerc noted that new products aren’t always better in the long run — they just might seem so at first.

“The question in the back of our head is: Are we ever creating margarine 2.0,” he said. “Just because it’s a plant product doesn’t mean it’s actually better for you.”

Powered by WPeMatico