Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Coursera, an online learning startup that offers free and paid short courses, skills certifications and complete degrees in partnership with universities and businesses, has raised another $103 million to scale out its business into new geographies, subject areas and products — a Series E led by a strategic investor, the Australian online recruitment and course directory provider SEEK Group, with participation from Future Fund and NEA.

Coursera currently offers 3,200 courses and 310 specializations, with partners including Columbia University, Johns Hopkins and the University of Michigan. Some 40 million people have now taken online classes through the startup — a significant jump on the 26 million figure Coursera noted when it last raised money, in 2017 (a $64 million Series D).

Also jumping is Coursera’s valuation, which had been around $800 million and is now “well over” $1 billion, according to a source close to the company.

Coursera’s growth is coming at a key time in the e-learning sector.

Online education has, overall, become an increasingly viable alternative and complement to in-person learning — bolstered by improvements in technology and methodology, demand for skills that hasn’t been met by more traditional channels and the economic challenges posed by higher education for a large number of people.

On one side, there have been some significant consolidations that speak to the opportunity. Just two weeks ago, 2U (which, like Coursera, works with universities to build online degree programs) acquired Trilogy — which provides training and bootcamps primarily for tech skills — for $750 million.

On the other, there have been some significant stumbles. Udacity, another online education startup valued at $1 billion, recently laid off 20 percent of its staff as part of a wider restructuring, with the aim of curbing costs while still expanding its business focused on “nano degrees.”

Coursera’s aim, said CEO Jeff Maggioncalda (who joined the company in 2017), is to steer a course that offers a range of learning alternatives as diverse as the mass market it’s hoping to continue targeting.

“We long ago realised that having a range of learning options, from open, free courses to masters degrees and everything in between such as microcredentials, bachelor’s degrees and certifications, is the way to go,” Maggioncalda said. “We look at that as our product portfolio.”

Coursera had its start by opening up the world of university learning to a wider population by putting courses online; it has more recently moved into working with companies and other organizations to build courses for them and to build courses to help train people in specific vocational areas, such as this program it developed with Google for IT certifications last year, and the health vertical that it introduced in January of this year. That is something it plans to continue developing, too.

“Beyond the nobility of providing great access to higher education to a world of people who otherwise wouldn’t have it, there is another imperative,” Maggioncalda said. “The future of work and learning are converging, and companies are realising that there are a lot of jobs that are getting automated, so finding an inexpensive but high-quality way to retrain is turning out to be a historic challenge. We need to get better at making high-quality education accessible.”

The SEEK investment is coming at a timely moment as a complement to this mission. Maggioncalda notes that Coursera is going to start working more directly on developing what you might think of as the next step after you learn something on its platform, which will be getting a job.

“This investment reflects our commitment to online education, which is enabling the up-skilling and re-skilling of people and is aligned to our purpose of helping people live fulfilling working lives,” said SEEK co-founder and CEO Andrew Bassat in a statement.

He noted that to date, some 190 million people have posted resumes on SEEK, with some 900,000 organizations using the platform to recruit for job openings. “It’s not coincidental that we think they’re a great investment partner,” he said.

But the first steps, Maggioncalda noted, will be working with the companies that are already turning to Coursera to build training programs.

“We absolutely see an opportunity to expand what we are doing with them,” he said. “If we are teaching skills to students, it’s not too hard to imagine us saying to that company or related employers, ‘we can introduce you to people with these skills.’ And you can imagine us doing this with others courses that we teach.” That could mean, for example, offering help with job placement for those paying Coursera to get their master’s or bachelor’s degrees.

That in itself could prove to be an interesting way of luring more students as online learning starts to get more competitive itself — not unlike how universities today are partly evaluated by students based on how helpful it will be to leverage those names when looking for jobs.

Other areas where we may see Coursera developing ahead is in its efforts to add a more diverse range of types of courses to its offering. The Trilogy acquisition by 2U highlights a rising demand for “bootcamps” to learn specific skills to enhance one’s work prospects. The growth of Triplebyte (itself also recently raising money) highlights how there is yet another bridge to be built between education and job hunting, in the form of “tests” to help screen and place the right people with the right job opportunities. And Lambda School has had a strong run so far in its model of offering nine-month, very career focused online training sessions in a variety of coding areas.

“It reinforces that people learning different skills need different environments,” Maggioncalda said. Given the right business model, cyberspace has no boundary, and the same might be said for online education.

Powered by WPeMatico

Artificial intelligence and other tech for automating some of the more repetitive aspects of human jobs continues to be a growing category of software, and today a company that builds tools to address this need for salespeople has raised a tidy sum to grow its business.

SalesLoft, an Atlanta-based startup that has built a platform for salespeople to help them engage with their clients — providing communications tools, supporting data and finally analytics to “coach” salespeople to improve their processes — has raised $70 million in a Series D round of funding led by Insight Partners with participation from HarbourVest.

Kyle Porter, SalesLoft’s co-founder and CEO, would not disclose the amount of funding in an interview, but he did confirm that it is more than double its valuation from the previous round — a $50 million Series C that included LinkedIn among the investors (more on that below) — but less than $1 billion. That round was just over a year ago and would have valued the firm at $250 million. That would put SalesLoft’s current valuation at more than $500 million, and a source close to the company notes that it’s around $600 million.

While there are a number of CRM and sales tools out in the market today, Porter believes that many of the big ones might better be described as “dumb databases or repositories” of information rather than natively aimed at helping source and utilise data more effectively.

“They are not focused on improving how to connect buyers to sales teams in sincere ways,” he said. “And anytime a company like Salesforce has moved into tangential areas like these, they haven’t built from the ground up, but through acquisitions. It’s just hard to move giant aircraft carriers.”

SalesLoft is not the only one that has spotted this opportunity, of course. There are dozens of others that are either competing on single or all aspects of the same services that SalesLoft provides, including the likes of Clari, Chorus.ai, Gong, Conversica, Afiniti and not least Outreach — which is seen as a direct competitor on sales engagement and itself raised $114 million on a $1.1 billion valuation earlier this month.

One of the notable distinctions for SalesLoft is that one of its strategic investors is LinkedIn, which participated in its Series C. Before Microsoft acquired it, LinkedIn was seen as a potential competitor to Salesforce, and many thought that Microsoft’s acquisition was made squarely to help it compete against the CRM giant.

These days, Porter said that his company and LinkedIn have a tight integration by way of LinkedIn’s Sales Navigator product, which SalesLoft users can access and utilise directly within SalesLoft, and they have a hotline to be apprised of and help shape LinkedIn’s API developments. SalesLoft is also increasingly building links into Microsoft Dynamics, the company’s CRM business.

“We are seeing the highest usage in our LinkedIn integration among all the other integrations we provide,” Porter told me. “Our customers find that it’s the third most important behind email and phone calls.” Email, for all its cons, remains the first.

The fact that this is a crowded area of the market does speak to the opportunity and need for something effective, however, and the fact that SalesLoft has grown revenues 100 percent in each of the last two years, according to Porter, makes it a particularly attractive horse to bet on.

“So many software companies build a product to meet a market need and then focus purely on selling. SalesLoft is different. This team is continually innovating, pushing the boundaries, and changing the face of sales,” said Jeff Horing, co-founder and MD of Insight Venture Partners, in a statement. “This is one reason the company’s customers are so devoted to them. We are privileged to partner with this innovative company on their mission to improve selling experiences all over the world.”

Going forward, Porter said that in addition to expanding its footprint globally — recent openings include a new office in London — the company is going to go big on more AI and “intelligence” tools. The company already offers something it calls its “coaching network,” which is not human but AI-based and analyses calls as they happen to provide pointers and feedback after the fact (similar to others like Gong and Chorus, I should note).

“We want to give people a better way to deliver an authentic but ultimately human way to sell,” he said.

Powered by WPeMatico

The competition is intense for great tech talent, and it’s even harder to find the most qualified people who are also the right fit for your company

This article shares some practical processes that you can add to your human resources function in order to accelerate the programmer pipeline, based on the years I have spent as a hiring focused software engineer at growing startups and now running my own recruiting firm.

Our recruiting strategy is surprisingly simple, and boils down to optimizing various segments of the sourcing funnel: awareness, pageviews, and application submits.

What ties these tactics together, though, is you, your company, what you’re offering, and how you approach the people you want to hire. If you want to build a strong, diverse team, you need to develop a thoughtful, empathetic and proactive approach before you can optimize.

In the article’s appendix, I also provide our company’s 2019 checklist process — eighteen steps that we delegate to manage our sourcing process.

Powered by WPeMatico

Last week, at TechCrunch’s robotics event at UC Berkeley, we sat down with four VCs who are making a range of bets on robotics companies, from drone technologies to robots whose immediate applications aren’t yet clear. Featuring Peter Barrett of Playground Global, Helen Liang of FoundersX Ventures, Eric Migicovsky of Y Combinator and Andy Wheeler of GV (pictured above), we covered a lot of terrain (no pun intended), including whether last-mile delivery robots make sense and how much robots should be expected to do without human intervention.

We also discussed climate change and how it factors into their bets, and why the many private enterprises focused on creating fully automated vehicles may need to do much more to empower the cities in which they plan to operate. You can find excerpts of our talk below. And for access to the full transcript, become a member of Extra Crunch. Learn more and try it for free.

TC: How do you think about investing in the here and now, versus the future (which is complicated for VCs, given that venture funds need to produce returns within a ten-year window, typically):

PB: One of the challenges with investing in robotics is that robotics companies do tend to take a lot longer to mature than your average enterprise SaaS company. There are some classes of investments that we know the technology works; it’s just a question of commercializing it and bringing it to market, and Canvas [a Playground-backed company that makes autonomous warehouse carts and was just acquired by Amazon] did an extraordinary job of finding a market that existed and had technology in hand that would solve that problem.

There’s other stuff like the amazing work that the folks are doing at Agility [Robotics] with a biped that can operate for many hours in unstructured human environments that today is really, candidly, a research robot, and to reach its long-term aspirations, there’s a whole other set of technologies that we’ll need to develop as the company matures.

We think about blending the stuff that’s very impactful but is going to take a long time because it’s fundamentally a new science and technology that needs to be created, [with] immediate applications of technologies that are proven today, that we’re deploying against real markets.

AW: As for whether we try to build a portfolio where there are exits at different stages, generally, when I’m looking to invest in a robotics thing, I understand that the timeframes can be fairly long, and so what we’re looking for are things that really are going to be very large opportunities — that can generate billion-dollar-plus exits.

TC: A growing number of small last-mile delivery robots has attracted funding. Helen, your firm is an investor in one of these startups, Robby. What’s the appeal?

HL: We look at where we see a pain point in the market. During our team meetings on Fridays, we always use DoorDash. It feels awkward when we order a $100 meal, and the delivery person has driven a long way. We’ll give him a $15, but it’s still [tricky for that person] in terms of economics. If you have a central station for the food delivery, and robots can handle that last-mile delivery, we think that’s a more cost-effective approach.

Robby has partnered with PepsiCo [to delivering snacks to students attending the University of the Pacific in Stockton, Ca.] that makes it more like a vending machine, and we think that’s an interesting market, too. We’ll see how fast adoption will happen.

EM: YC is an investor in Robby as well, and we think of this as kind of the perfect example of how hackers can get into a fairly complex industry. When you look at some robotics and specifically autonomous vehicles, you see extremely large investments going into some of the some of the big players, but then at the same time, you see groups and hackers that are able to use off-the-shelf technology to solve real problems that affect businesses or people, and build services or products that that are valuable. We’ve seen this over and over.

You don’t have to be looking for a large VC investment to compete in the space. It is possible to stay frugal stay nimble and build something on a small scale to demonstrate that you found a problem that people are willing to pay money to solve. Then, if you’re interested, [you can] pursue larger VC investment or not. It’s kind of open right now.

TC: VCs we’ve talked with in the past have suggested that in robotics, they often see cool ideas for which there isn’t necessarily a market or big market need. Is this also your experience?

PB: This is a common pattern where there was some mechanism, some capability of the robot, some feat of dexterity or something [and founders think, ‘That’s really cool, I’m going to make a company out of it.’ But we think about it in terms of, what do you want from the robots? What’s the outcome that everybody agrees is worthwhile? And then, how do you find and build companies to achieve those goals?

One thing we’re struggling with right now is that there’s no real hardware or software platforms. You think about 10 years hence [and] the kinds of things we’ll be investing in, [and it’s] robotics applications that are aggregates of neural networks and some explicit software bound together in some form that can be delivered, so a large enterprise can use an application and not have everybody start from first principles. Because right now, when you built a robotics application, you make all the hardware, you make all the software. All the intellectual and actual capital [money] gets dissipated, building and rebuilding those same things. So robotics applications over time will be investable, much more like the way we invest in software, and that will allow smaller units of creativity to produce useful products.

TC: Andy, how long do you think it’s going to take until we get there?

AW: I think I think we’re making we’re making steady progress on that front. To your earlier question, this space has a lot of folks that are building technology a bit in search of a problem. That’s a common thing in startups generally. I would encourage everybody who’s looking to build a startup in the space is to really find a burning business problem. In the course of solving those [problems], people will build these platforms that Peter was talking about, and we’ll eventually get there in terms of [founders] just having to focus on the application layer.

TC: There are so many buckets: delivery robots, self-driving trucks. Both relate in ways to the overarching problem for our age, which is climate change. How much do you factor climate change into the investing decisions that you make?

PB: When we look at applications and robotics in agricultural, a lot of [our questions are] around how do you deal with a minimum carbon footprint, [and] how you replace workers who are missing. And dealing with climate change will be increasingly be a central thought in what we want from our robots. [After all] what we want from them is the ability to maintain or improve the lifestyles we have without further unwinding the environment.

TC: We talked backstage, and you think we are over-indexing on autonomy as the answer.

PB: When we think about autonomy, it’s not clear how autonomy helps cities. . . There are absolutely applications for autonomy, [including] on a farm or in a logistics environment. I think we still really don’t know how to do Level 5 [which is complete automation, requiring zero human assistance]. And I don’t think we know whether it’s exponentially hard or asymptotically. I think it’s decades before there’s any significant Level 5.

[In the meantime, if] we cared about safety, we’d install roundabouts or lower the blood alcohol limit and not try and make a sentient vehicle that drives on the road the way we do, right?

I’d much rather see having the city collaborate with the vehicles and instrument the city to collaborate with clever vehicles for the benefit of everybody who lives there. But that’s not Level 5 autonomy as the way we think of it

EM: It’s slightly interesting that autonomous vehicles, specifically the individual passenger car, evolved in America, because it’s one of the countries that has the least public transport per capita. And that that’s one of the things that the industry has to acknowledge — that there are other options that can be blended into the transport solutions for cities.

It seems like it might be happening because it’s something that an individual can take somewhat control over. You can’t own a bus, but you can own or [rent] a self-driving car.

PB: Or [an electric] scooter or a bike, right. The future of mobility is going to be a blending of all of these things. But not taking advantage of a logistics platform in a city means you’re kind of doing it the hard way, trying to make a robot to have all the human priors required to drive safely. And it’s just not clear that we know how to do that yet.

TC: Andy, GV is a big investor in Uber. What what’s your thinking? Does the city need to be a kind of central brain in order for these private enterprises to work effectively?

AW: I don’t think it’s a strict requirement at all. We’ve seen success with with self-driving trials where the city is not super involved from an infrastructure perspective, I do think it makes it a lot easier if that’s the case, though.

Powered by WPeMatico

Pinterest is a great place to find digital art but a terrible place to sell it. The fact that anything online is infinitely copyable makes it tough for artists to establish a sense of scarcity necessary for their work to be perceived as valuable. Yash Nelapati saw this struggle up close as Pinterest’s first employee. Now he has started MakersPlace, where creators can generate a blockchain fingerprint for each of their artworks that proves who made it and lets it be sold as part of a limited edition.

Similar to Etsy, MakersPlace allows artists to sell their creations while the startup takes a 15 percent cut. Collectors receive a non-fungible cryptocurrency token connoting ownership of a limited-edition digital print of the artwork that they can store in their own crypto wallet or in one on MakersPlace. The MakersPlace site officially launches today after a year of beta testing.

“At Pinterest, we noticed that there are millions of digital creators that are spending countless hours creating digital artwork, but they struggle with basic things like attribution,” says MakersPlace co-founder Dannie Chu, who spent six years leading growth engineering at Pinterest. “Their work is getting printed, copied, shared and ultimately they make very little money from it being put online. If you can’t create a sustainable model for digital creators to create, you’re not going to have art.”

If software is eating art, Uncork Capital wants a seat at the dinner table. It has led a $2 million seed round for MakersPlace, joined by Draper Dragon Fund and Abstract Ventures, plus angels from Pinterest, Facebook, Zillow and Coinbase. They see the crypto-tokenized digital photo of a rose that sold for $1 million last year as just the start of a thriving blockchain art market. “That was a light-bulb moment for us. People are actually valuing digital creations like physical creations,” says Chu.

Hiscox estimates there were $4.64 billion in online art sales (though mostly of traditional offline art) in 2018, compared to Art Basel‘s estimate of $67.4 billion in total art sales for the year. MakersPlace could be well-positioned as more art is sold online and more of it becomes truly digital. “MakersPlace has already partnered with thousands of incredible digital artists selling their unique artwork, a testament to the easy-to-use platform they’ve built,” said Uncork Managing Partner Jeff Clavier. “They’ve also created a seamless and fun, one-stop-shop for discovering and collecting digital artwork.”

The startup’s technology is designed so artists fingerprinting their work don’t need extensive blockchain experience. They just upload it to MakersPlace before sharing it elsewhere, verify their identity through an integration with Civic where they take a photo holding their driver’s license, and an Ethereum-based token is generated with the creator’s name, the art’s name, its impression and edition number and the date. An Ethereum token name, ID, contract ID and creator’s ID are all assigned so there’s a permanent record of authorship.

Art collectors can browse MakersPlace’s categories for animation, photography, drawings, pixel art and 3D creations; explore recent and popular uploads; or search by specific artist or art piece. They can buy art with a credit card or with Ether; use, display or distribute it for non-commercial purchases; or resell it on the secondary market. MakersPlace assumes no ownership of the art it hosts.

One major concern is that artists unaware of MakersPlace might have their works fraudulently fingerprinted and attributed to a thief. Chu says that “We use a mix of website, email and identity verification services to do this (we use civic.com). This is a strong deterrent to uploading and establishing attribution for stolen digital creations.” But you could still imagine the headache for less-tech-savvy artists if their creative identity gets hijacked.

One major concern is that artists unaware of MakersPlace might have their works fraudulently fingerprinted and attributed to a thief. Chu says that “We use a mix of website, email and identity verification services to do this (we use civic.com). This is a strong deterrent to uploading and establishing attribution for stolen digital creations.” But you could still imagine the headache for less-tech-savvy artists if their creative identity gets hijacked.

There’s plenty of other blockchain entrants into the art world, from Blockchain Art Collective‘s NFC stickers for registering physical art to artist tipping platform ArtByte. Many startups are trying to solve the art attribution problem, including Monegraph, KnownOrigin, Bitmark, CodexProtocol, Artory and more. MakersPlace will have to hope its talent, Silicon Valley funding and focus on digital works will differentiate it from the pack.

As we move to a culture where so many of the things that represent our identity, from photographs to music, have become endlessly replicable, the concept of possession has lost its meaning. Yet we’re still hoarders deep down, scared of not having enough. “Collecting is an innate human behavior, but as people become more urban, mobile and minimalist, physical keepsakes have become less appealing,” Nelapati concludes. “Our mission is to create a platform that incentivizes creators by giving them ownership over the work they produce.”

[Featured Image: bunny style by Chocotoy]

Powered by WPeMatico

Last year the Gosu.ai startup, which has developed an AI assistant to help gamers play smarter and improve their skills, raised $1.9 million. Using machine learning, it analyzes matches and makes personal recommendations, and allows gamers to be taught by a virtual assistant.

Because they have this virtual assistant they can now do some interesting research. For the first time ever, we can actually peer over the shoulder of a gamer and find out what makes them good or not. The findings are fascinating.

Gosu.ai surveyed nearly 5,000 gamers playing Dota 2 to understand which factors separate successful and less-successful gamers.

They found that although only 4 percent of respondents to the survey were women, it turned out that those women that responded had a 44 percent higher win rate on average than the men.

Does this suggest women are better gamers than men? This isn’t a scientific study, but it is a tantalizing idea…

The study also found that the higher your skills in foreign languages, the slower your skills improve. They also found that people without a university degree, people who don’t travel and people who play sports increase their game ratings faster. Similarly, having a job also slows growth. Well, duh.

Gosu.ai’s main competitors are Mobalytics, Dojo Madness and MoreMMR. But the main difference is that these competitors make analytics of raw statistics, and find the generalized weak spots in comparison with other players, giving general recommendations. Gosu.ai analyzes the specific actions of each player, down to the movement of their mouse, to cater direct recommendations for the player. So it’s more like a virtual assistant than a training platform.

The startup is funded by Runa Capital, Ventech and Sistema_VC. Previously, the startup was backed by Gagarin Capital.

Powered by WPeMatico

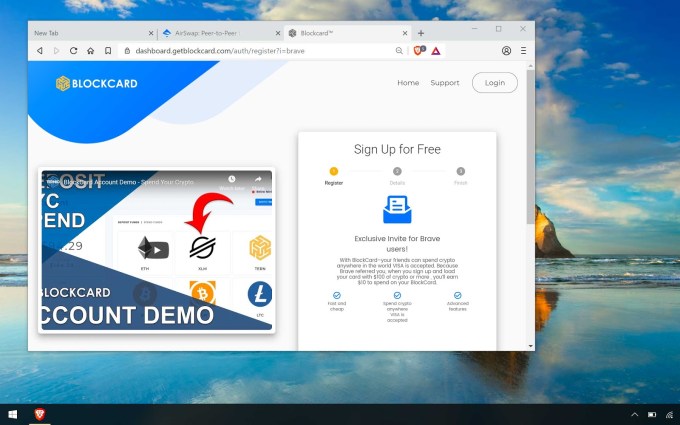

With the latest desktop version of the Brave browser, users can now opt-in to the Brave Ads program.

Brave is an ad-blocking web browser startup led by Brendan Eich, creator of the JavaScript programming language and former Mozilla CEO. He’s long maintained that the vision is “bigger than an ad blocker,” with a goal of finding new ways to compensate online publishers.

Brave Ads are a crucial part of that vision. The company says users who choose to participate in the program will receive 70 percent of the revenue generated by the ads they see. Their rewards will take the form of Basic Attention Tokens (BAT), a cryptocurrency that the users can, in turn, share with the creators of the content that they’re watching.

Eich told me that the browser is set by default to donate a user’s BAT at the end of the month to their most-visited sites, but the company also plans to let users exchange BAT for rewards like hotel rooms and restaurant vouchers (through the TAP Network created by the startup Hooch). They should also, eventually, be able to cash out with regular “fiat currency” through exchanges like Coinbase and Uphold.

Brave has been testing ads since January, and Eich said that more than 40 percent of desktop users have been opting in. Certainly, some Brave users may simply want to use the browser for its ad-blocking capabilities, but he suggested that the more “ecologically minded ones” will want to participate, rather than getting a “free ride.”

“A lot of users don’t want to cash out [when they receive BAT],” he added. “It’s not a huge amount of value for most people, so they may prefer to just use it to give back. And that’s the real idea: A browser with the user steering it is replacing the ad tech complex.”

The ads are also supposed to protect user privacy. There is a degree of targeting, but Eich said all the data and “decision-making” happens on the device, so Brave and the advertiser never get access to it. (Brave does aggregate anonymized, high-level data so that advertisers can see who viewed their campaigns.)

The ads appear in the browser and don’t replace a previously blocked ad. Brave says the ads are coming from partners like Vice, Home Chef, ConsenSys, Ternio BlockCard, MyCrypto and eToro.

The company also has plans to work with publishers that want to run ads when their site is viewed on the browser, with the revenue then split between Brave, the publisher and the user.

Powered by WPeMatico

Aaron Patzer launched Mint to help consumers organize their finances. Now he’s raised $5.2 million from investors to launch Vital to bring that consumer-focused mindset to emergency rooms and hospitals to help them organize patient flow.

Patzer co-founded the company with his brother-in-law Justin Schrager, a doctor of emergency medicine at Emory University Hospital. The serial entrepreneur invested a million dollars and two years of peer-reviewed academic study and technical research and development to create Vital, according to a company statement.

Investors in the seed round include First Round Capital and DFJ, Bragiel Brothers, Meridian Street Capital, Refactor Capital and SV Angel. Alongside angel investors Vivek Garipalli, the chief executive of CloverHealth and Nat Turner and Zach Weinberg, the founders of Flatiron Health, these investors are hoping that Patzer can repeat in the healthcare industry the magic he brought to financial services.

“The HITECH* Act was well-intentioned, but now hospitals rely on outdated, slow, and inefficient software – and nowhere is it more painful than in the emergency room,” said Patzer, in a statement. “Doctors and nurses often put more time into paperwork and data entry than patient care. Vital uses smart, easy tech to reverse that, cutting wait times in half, reducing provider burnout and saving hospitals millions of dollars.”

Vital isn’t so much replacing the current system of electronic health records as providing a software integration layer that makes those systems easier to use, according to the company.

It’s basically a two-sided application with a survey for incoming patients. An admitting nurse begins the record and as a next step a patient receives a text to add details like height, weight, recent surgeries, medications and allergies, just as they would on a paper form. Patients can also submit a photo of themselves and their insurance card to expedite the process.

The information is then fed back into a tracking board that doctors and nurses use to prioritize care. A triage nurse then reviews the data and affirms that it is correct by taking vital signs and assessing patients.

All of that data is fed into an algorithm that analyzes the available information to predict a course of treatment and help staff in the emergency room prioritize who needs care first.

Vital’s selling the service to emergency rooms with a starting sticker price of $10,000 per month.

“Vital successfully built software with a modern, no-training-required interface, while also meeting HIPAA compliance. It’s what people expect from consumer software, but rarely see in healthcare,” says First Round investor Josh Kopelman, who’s taking a seat on the company’s board of directors. “Turning massive amounts of complex and regulated data into clean, easy products is what Mint.com did for money, and we’re proud to back a solution that’ll do the same in life and death situations.”

In some ways, Vital looks like the patient-facing admissions side of a coin that companies like Qventus have raised tens of millions of dollars to solve at the systems level.

Powered by WPeMatico

Managed by Q, the office management platform recently acquired by WeWork, has today announced the launch of Task Management.

The feature comes to Managed by Q by way of Hivy, a startup acquired by MBQ back in 2017, that focuses on connecting a company’s employees to the office manager that handles their requests.

Pre-Hivy, collecting requests and tracking projects across a large number of employees was a tedious, fragmented process. Hivy created a dashboard that organizes all those requests in a single place.

Since the acquisition, Managed by Q and Hivy have been working to integrate their respective platforms. Where Managed by Q connects office managers to the right vendor or MBQ operator to handle the job, the new Task Management system will connect office managers with the employees making the requests in the first place, essentially putting the entire pipeline in a single place.

Obviously, the path to full integration was a long one.

“What I think matters most,” said Hivy co-founder Pauline Tordeur, speaking about the process of intertwining two separate products, “is that we knew why we were doing this and what the future would look like when we integrate. Having this vision and outlook from the very beginning is important.”

The timing is interesting in that this is the first product announcement Managed by Q has made since it was acquired by WeWork.

“It’s hard to describe the feeling,” said Managed by Q co-founder and CEO Dan Teran of being acquired by The We Company. “There is a perception of WeWork from the outside, but since I’ve been spending a lot of time getting to learn the business firsthand, I think there is just so much potential.”

He noted that Managed by Q is indeed setting out to integrate with WeWork in a way that’s similar to the process Q just finished with Hivy.

“We set out to build the operating system for space, and one of the biggest things we missed is the space itself,” said Teran. “That’s actually the hardest part for most people. So now that becomes another ingredient we can deliver to our customers.”

Powered by WPeMatico

Embrace, an LA-based startup that offers a mobile-first application performance management platform, today announced that it has raised a $4.5 million funding round led by Pritzker Group Venture Capital. This brings the company’s total funding to $7 million. New investors Greycroft, Miramar Ventures and Vy Captial also participated in this round, as did previous investors Eniac Ventures, The Chernin Group, Techstars Ventures, Tikhon Bernstam of Parse and others.

Current Embrace customers include the likes of Home Depot, Headspace, OkCupid, Boxed, Thrive Market and TuneIn. These companies use the service to get a better view of how their apps perform on their users’ devices.

As Embrace CEO and co-founder Eric Futoran, who also co-founded entertainment company Scopely, argues, too many similar services mostly focus on crashes, yet those only constitute a small number of the actual user experience issues in most apps. “To a large extent, crashes are solved,” he told me. “The crash percentages are often 99.8 percent crash-free and yet users are still complaining.”

That’s because there are plenty of other issues beyond code exceptions, which many tools focus on almost exclusively, that can force an app to close (think memory issues or the OS shutting down the app because it uses too many CPU cycles). “To users, that looks like a crash. Your app closed. But in no way, that’s a crash from a technical perspective,” Futoran noted.

Raising this new round, Futoran told me, was pretty easy. Indeed, Pritzker approached the company. “It was not fundraising,” he said. “They sat us down and said, ‘we want to fund you guys,’ which I find pretty unusual. So I’ve been calling it a pre-emptive round.” He also noted that having Pritzker involved should help open up the mid-west market for Embrace, which is mostly focusing on enterprise customers (though Futoran’s definition of “enterprise” includes the likes of digital-first companies like Headspace).

“We saw many organizations trust Embrace’s seamless and innovative optimization platform to quickly identify and resolve any user-impacting issues within their apps, and we’re optimistic about the future of the company in this growing market,” said Gabe Greenbaum, an LA-based partner for Pritzker Group Venture Capital. “We look forward to this next stage in the company’s growth journey and are honored to partner with Eric and Fredric to help them achieve their vision.”

The company plans to use the new funding to increase its go-to-market capabilities, and grow its team to build out its technology.

Powered by WPeMatico