Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

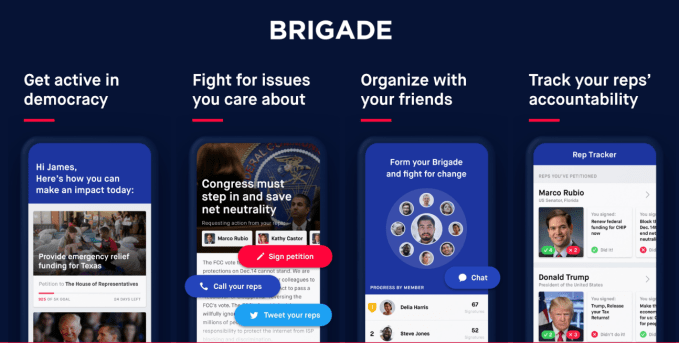

Causes grew to a jaw-dropping 200 million users as one of the first 10 Facebook platform apps. Started by Facebook co-founder Sean Parker, it was meant to turn a generation into activists and philanthropists. Causes acquired Votizen to augment shallow clicktivism with a way to remind friends to vote. But after Facebook went mobile and the web platform waned, Parker arranged Causes’ sale to his newer civic tech effort Brigade, for which he’d led a $9.3 million Series A and later fed more money. Brigade’s ballot guide was used by 250,000 people in the 2016 election, leading to 5 million Get Out The Vote messages sent, but the startup’s apps for connecting with campaigns or debating political issues never went viral like Causes.

Now both Causes’ and Brigade’s stories are coming to an end. In February, we caught wind of Brigade selling off its high-grade engineering team to Pinterest in an acqui-hire while it sought a home for its IP. Today, Brigade announces its technology and data have been acquired by politician-tracking service Countable. Terms of the deal were not disclosed, but it’s unlikely that Brigade’s Series A investors earned a return.

“While we didn’t reach the ultimate mountaintop, I think we moved the entire civic tech space forward,” Brigade CEO Matt Mahan tells me. “Countable offers a unique opportunity to bring greater scale to some of our best ideas, and our previous work will in turn accelerate their already impressive progress.”

Brigade’s features

Countable lets people view summaries of upcoming legislation, contact their representatives about their opinion and track the officials’ votes. “Brigade was founded with the non-partisan mission to reinvent how Americans participate in politics. When they decided to bring their journey to a close, Matt and Brigade’s leadership team sought a mission-aligned company to acquire their technology, and a responsible place to point any members of their community who were eager to remain civically active and engaged,” says Countable CEO Bart Myers, whose tech has powered 35 million civic actions. “They approached Countable — an obvious fit for our commitment to lowering barriers to civic entry and empowering meaningful action, and we’re excited to provide a home for their technology moving forward.”

Brigade CEO Matt Mahan

Mahan admits that a potentially fatal wrong turn for Brigade was pivoting its product to “debates” in 2016. “We quickly learned that this level of openness resulted in less substantive discussion, more personal attacks and fewer participants willing to add their voices: the opposite of our goals. By removing too many barriers, debates empowered the loudest and most aggressive voices in the room,” he tells me. The startup course-corrected to focus on making real political impact with petitions and tools for contacting representatives.

By 2018, Mahan realized that “after two election cycles Brigade had not achieved the user scale we know is required to fundamentally transform our politics . . . For a company set up to be a civic moonshot, this was simply not good enough.” Parker’s team did not provide TechCrunch a statement or commentary on Brigade’s decline. The startup’s San Francisco-based engineering team was too pricey for civic tech companies to afford, but those that could pay the steep price didn’t need Brigade’s IP. So after approaching a half-dozen potential acquirers, Mahan split the company, selling the team to Pinterest and the tech to Countable. The cash and stock deal will make Brigade investors shareholders in Countable, and Mahan is taking an advisory role.

To further their contribution to the democracy innovation community, Countable has agreed to open-source Brigade’s voter matching software. This allows apps to tie a user to their official voting record to offer personalized features, like reminders of upcoming elections, petitions for local issues and ways to contact their elected officials. Seth Flaxman, the CEO of civic tech software developer Democracy Works, which built TurboVote, says, “This is extremely difficult technology to build and can help TurboVote determine which of our 6 million users needs more help registering to vote. They are passing the baton, making it possible for nonprofits like ours to build off their progress.”

Countable

But there was one more loose end to tie up. Causes sucked in a ton of Facebook user data in the early days of the platform before restrictions were put in place (too late to stop Cambridge Analytica). So Mahan tells me, “Brigade proactively reached out to Facebook and worked with them and a third-party consultant to conduct a comprehensive review to identify and delete user data that was not essential for providing the existing app experience. In all, we deleted billions of rows of data that ethically we felt should not be transferred.”

As one of the most well-funded civic tech startups, Brigade’s breakup could cast a shadow on the space that includes MoveOn and Change.org. Consumer-focused apps for improving democracy are tough to monetize. It may fall to more sustainable democracy-focused startups like grassroots mass-texting app Hustle or nonprofits like Avaaz to arm the public with the equipment and knowledge necessary to participate in the political process. Given the deep polarization and animosity between nations’ political parties around the world, we need all the tools to amplify truth and civility we can get.

Powered by WPeMatico

Rappi represents a new era for Latin American technology startups.

Based in Bogotá, Colombia, the on-demand delivery startup has taken the region by storm, attracting a record amount of venture capital funding in mere months. Today marks the beginning of a new round of explosive growth as SoftBank, the Japanese telecom giant and prolific Silicon Valley tech investor, has confirmed a $1 billion investment in the business.

The king-sized financing comes two months after SoftBank announced its Innovation Fund, a new pool of capital committed to spending billions on the growing tech ecosystem in Central and South America.

VC funding in Latin America catapulted to new heights in 2018. Startups located across Argentina, Brazil, Chile, Colombia and more have secured nearly $2.5 billion since the beginning of 2018, according to PitchBook, up from less than $1 billion invested in 2017.

SoftBank plans to transfer the Rappi investment to the Innovation Fund “upon the fund’s establishment,” according to a press release. For now, the SoftBank Group and affiliated Vision Fund will each invest $500 million in the company. Jeffrey Housenbold, a managing director at SoftBank responsible for investments in Brandless, Opendoor and DoorDash, will join Rappi’s board of directors.

“SoftBank’s vision of accelerating the technology revolution deeply resonated with our mission of improving how people live through digital payments and a super-app for everything consumers need,” Rappi co-founder Sebastian Mejia said in a statement. “We will continue to focus on building innovations for couriers, restaurants, retailers and start-ups that translate into new sources of growth.”

Mejia, Simón Borrero and Felipe Villamarin launched Rappi in 2015, graduating from the Y Combinator startup accelerator the following year. It didn’t take long for the business to capture the attention of American VCs, including the likes of Andreessen Horowitz, DST Global and Sequoia Capital .

The latest round, the largest ever for a Latin American tech startup, brings Rappi’s total raised to date to a whopping $1.2 billion. The company was valued at more than $1 billion last year with a $200 million financing.

Rappi is among few venture-backed “unicorns” based in Latin America. São Paulo-based Nubank, a fast-growing fintech startup, garnered a $4 billion valuation last year with a $180 million investment.

Rappi didn’t immediately respond to a request for comment.

Powered by WPeMatico

Spot.IM announced today that it has raised $25 million in Series D funding.

We’ve written about the company’s commenting platform before, but CEO Nadav Shoval said it’s now building a broader “community platform.”

That means going beyond commenting and moderation to also include community pages and other ways to highlight and monetize user-generated content. The company’s customers include Hearst, Refinery29, Fox News and our corporate siblings at Engadget and AOL.com.

Shoval argued that these tools are particularly important as digital media business models are struggling — regardless of whether those publishers are focused on advertising, subscriptions or other models, the key is to focus on loyal readers and viewers rather than “random users that come in and disappear.”

Spot.IM can make a big difference in this area by keeping users engaged, and by providing data to help publishers understand their behavior and value. In fact, Shoval said that for some publishers, a Spot.IM user will provide five times as much lifetime revenue as a non-Spot.IM user.

“We do believe it’s about better understanding: Who are our users, what do they want and how can we provide them with more value?” he added.

The company has now raised a total of $63 million, according to Crunchbase. The new funding was led by previous investor Insight Venture Partners with participation from Norma Investments (representing businessman Roman Abramovich), AltaIR Capital, Cerca and WGI Group (founded by Noah Goodhart, Jonah Goodhart and Mike Walrath).

Spot.IM is also announcing that it has appointed tech and media executive Itzik Ben-Bassat as president and as a member of its board of directors.

Powered by WPeMatico

Jude Gomila, who previously sold his mobile advertising company Heyzap to RNTS Media, is taking on a new challenge — building a “knowledge base” that can fill in Wikipedia’s blind spots, particularly when it comes to emerging technologies and startups.

While Gomila is officially launching Golden today, it’s already full of content about things like the latest batch of Y Combinator startups and morphogenetic engineering. And it’s already raised $5 million from Andreessen Horowitz, Gigafund, Founders Fund, SV Angel, Liquid 2 Ventures/Joe Montana, plus a long list of individual angel investors including Gomila’s Heyzap co-founder, Immad Akhund.

To state the obvious: Wikipedia is an incredibly useful website, but Gomila pointed out that notable companies and technologies like SV Angel, Benchling, Lisk and Urbit don’t currently have entries. Part of the problem is what he called Wikipedia’s “arbitrary notability threshold,” where pages are deleted for not being notable enough. (This is also what happened years ago to the Wikipedia page about yours truly — which I swear I didn’t write myself.)

Perhaps that threshold made sense when Wikipedia was just getting started and the infrastructure costs were higher, but Gomila said it doesn’t make sense now. In determining what should be included in Golden, he said the “more fundamental” question is about existence: “Does this company exist? Does Anthony Ha exist?” If so, there’s a good chance that it should have a page on Golden, at least eventually.

In his blog post outlining his vision for the site, Gomila wrote:

We live in an age of extreme niches, an age when validation and completeness is more important than notability. Our encyclopedia on Golden doesn’t have limited shelf space — we eventually want to map everything that exists. Special relativity was not notable to the general public the moment Einstein released his seminal paper, but certainly was later on — could this have been the kind of topic to be removed from the world’s canon if it was discovered today?

Gomila said he’s also bringing some new technologies and fresh approaches to the problem. Some of this is pretty straightforward, like allowing users to embed videos, academic papers and other multimedia content onto Golden pages.

At the same time, he’s hoping to make it much easier to write and edit Golden pages. You do so in a WYSIWYG editor that doesn’t require you to know any HTML, and the site will help you with automated suggestions, for example pulling out author and title information when you’re adding a link to another site.

Gomila said that this will allow users to work much more quickly, so that “one hour spent on Golden is effectively 100 hours on other platforms.”

There’s also an emphasis on transparency, which includes features like “high resolution citations” (citations that make it extra clear which statement you’re trying to provide evidence for) and the fact that Golden account names are tied to your real identity — in other words, you’re supposed to edit pages under your own name. Gomila said the site backs this up with bot detection and “various protection mechanisms” designed to ensure that users aren’t pretending to be someone they’re not.

“I’m sure there will always be trolls up to their usual tricks, but they will be on the losing side,” he told me.

If you think someone has added incorrect or misleading information to a page, you can flag it as an issue. Gomila suggested AI could also play a more editorial role by pointing out when someone is using language that’s biased or seems too close to marketing-speak.

“AI can have bias and humans can have bias,” he acknowledged, but he’s hoping that both elements working together can help Golden get closer to the truth. He added that “rather than us editorially changing things, our team will act like normal users” who can edit and flag issues.

Golden is available to users for free, without advertising. Gomila said his initial plan for making money is charging investment funds and large companies for a more sophisticated query tool.

Powered by WPeMatico

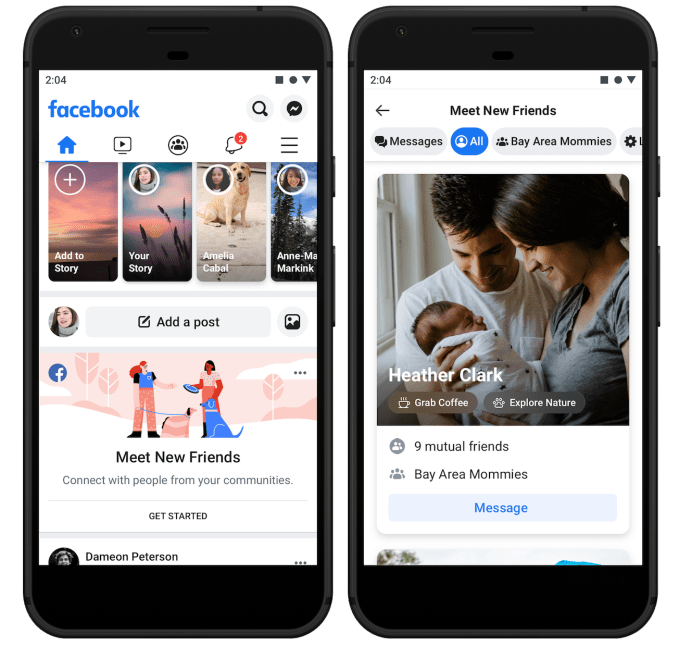

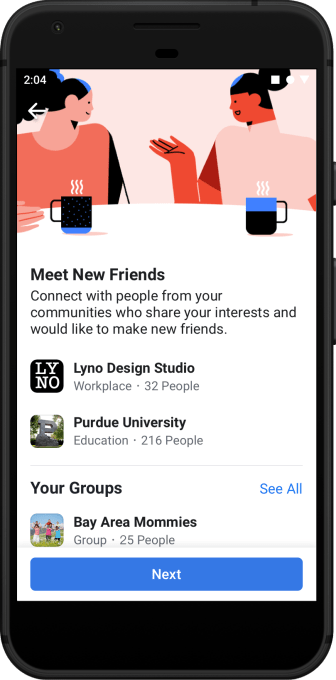

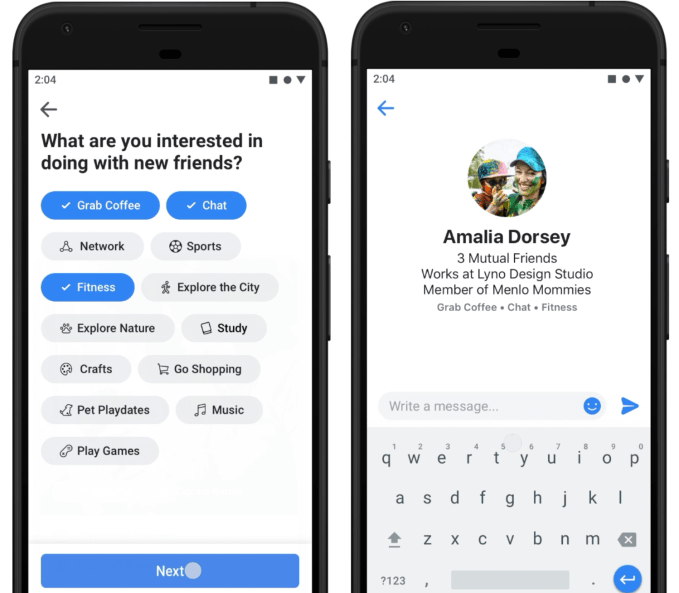

Facebook’s social graph is aging, full of long-lost acquaintances and hometown friends you don’t care much about seeing in the News Feed any more. But Facebook is now testing a pivot away from its core identity of connecting you with existing friends so it can revitalize the social graph and keep people coming back. Facebook’s “Meet New Friends” lets you browse people from shared communities such as your school, workplace or city who’ve also opted in to the feature. Announced today at Facebook’s F8 conference, Meet New Friends now in testing in a few markets before it’s rolled out more widely soon.

Meet New Friends could give people fresh pals to follow in their News Feed, or help recently registered users grow their network until they have access to enough content to keep them busy. And eventually, Facebook could layer on monetization features similar to dating apps where users pay to be shown more prominently to potential connections.

Fidji Simo, the head of Facebook’s main app, tells me Meet New Friends was based on emerging behaviors the company had spotted. “Developing relationships with people they didn’t already know is very different from the core use case of Facebook,” but she notes, “We’ve already seen that naturally happen in Groups, and Meet New Friends will make that a bit easier.”

Fidji Simo, the head of Facebook’s main app, tells me Meet New Friends was based on emerging behaviors the company had spotted. “Developing relationships with people they didn’t already know is very different from the core use case of Facebook,” but she notes, “We’ve already seen that naturally happen in Groups, and Meet New Friends will make that a bit easier.”

When users open Meet New Friends, they pick the communities through which they’re open to meeting new friends. For now they choose between schools, employers and locations, but Facebook will eventually add Groups too. In that sense it works a bit like Facebook Dating, which rolls out to 14 new countries today and opens to dating friends with its new Secret Crush feature.

Algorithms will sort potential connections by who is most relevant, such as those with mutual friends or shared interests, but you won’t get “matched” where both users have to state their interest in the other. Instead, users can just browse profiles, and then either send people a friend request (which might feel a bit out of the blue), or send them a single text-only message to a recipient’s dedicated Meet New Friends chat inbox. They can’t message that same person again until they respond (to prevent spamming), and the text-only limitation ensures no unsavory photos get blasted around. If they do reply, the thread moves to Facebook Messenger.

Meet New Friends will pit Facebook against a range of other apps, from local-focused Meetup and Nextdoor to verticalized apps like Hey Vina for women only to dating-affiliated apps like Bumble BFF. But Facebook benefits from its ubiquity, so users can try Meet New Friends without feeling embarrassed by downloading an app just to make them less lonely.

For years, the mildly creepy People You May Know feature has been a cornerstone of Facebook’s growth strategy. But it’s still just about recreating your offline social graph online. As Facebook strives to become more meaningful to people’s lives, fostering new friendships could give people a fuzzy feeling about the giant corporation.

Click below to check out all of TechCrunch’s Facebook conference coverage from today:

Powered by WPeMatico

With news that the We Company (formerly known as WeWork) has officially filed to go public confidentially with the SEC today, there’s a big question on everyone’s mind: Is this the next massive startup win or a house of cards waiting to be toppled by the glare of the public markets?

No company I follow has as much polarized opinion as the We Company. And while the company will have to reveal at least some of its hand in its official S-1, my guess is that the polarization around the company will not be alleviated until well after it goes public, if ever.

The challenge with understanding its business is how much the details of each of its leases, real estate markets and tenants matter to its bottom line. We already know the top line numbers: the company had revenue of $1.8 billion in 2018, and a net loss of $1.9 billion that year. That led to the received opinion that the company has an extraordinarily weak business. As Crunchbase News editor Alex Wilhelm put it:

Powered by WPeMatico

Mobile marketing company ManyChat has raised $18 million in Series A funding.

The startup, co-founded by CEO Mikael Yang, is currently focused on Facebook Messenger. It offers tools for creating a bot on Messenger while also supporting live human chatting (ManyChat says its approach is a “smart blend of automation and personal outreach”), and additional options like advertising to get more users to engage with your messaging channels.

ManyChat is just one of several startups hoping to build a business around Facebook Messenger bots, but this sounds like a product that businesses are actually using. The company says more than 1 million accounts have been created on the platform, with customers coming from e-commerce, traditional retail, gyms, beauty salons restaurants and more.

Those customers have collectively enlisted 350 million Messenger subscribers, and there are 7 billion messages sent on the platform each month. Plus, with an average open rate of 80 percent, these messages are actually being read.

The funding was led by Bessemer Venture Capital, with participation from Flint Capital. Bessemer’s Ethan Kurzweil is joining the board of directors, while the firm’s Alex Ferrara also becomes a board observer.

“ManyChat is at the forefront of a major shift in how businesses market to customers,” Kurzweil said in the funding announcement. “It’s not a matter of ‘if’ but ‘when’ email lists and static forms get replaced with a more personalized and conversational approach to customer engagement.”

He added that the company’s work with Messenger is “only the beginning”: “With Instagram, WhatsApp, RCS, and others on the horizon, there’s endless potential to scale.”

Powered by WPeMatico

Menlo Ventures was founded in 1976 but it took 35 years for the venture capital firm to hit the jackpot.

Since the dot-com boom, Menlo Ventures has teetered between good and great. A prolific Silicon Valley investor, it’s never quite reached the heights of Accel or Andreessen Horowitz (a16z), or established the level of name recognition as Benchmark or Sequoia, firms that struck gold with bets on Facebook, Instagram and Snap.

But where others missed the boat entirely on one of the most valuable tech startups of all time, Menlo Ventures gnawed its way into an early deal at the last possible moment.

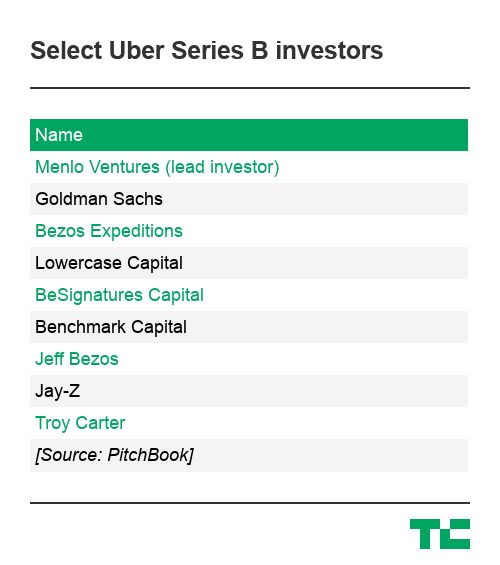

In 2011, the firm led a $32 million Series B funding in a fledgling on-demand car service called Uber, agreeing to value the startup at a colossal $322 million after the company’s first-choice investor, a16z, failed to accept Uber’s sky-high terms. Menlo would go on to invest a total of $66.5 million in the company on expected total returns of up to $3.1 billion.

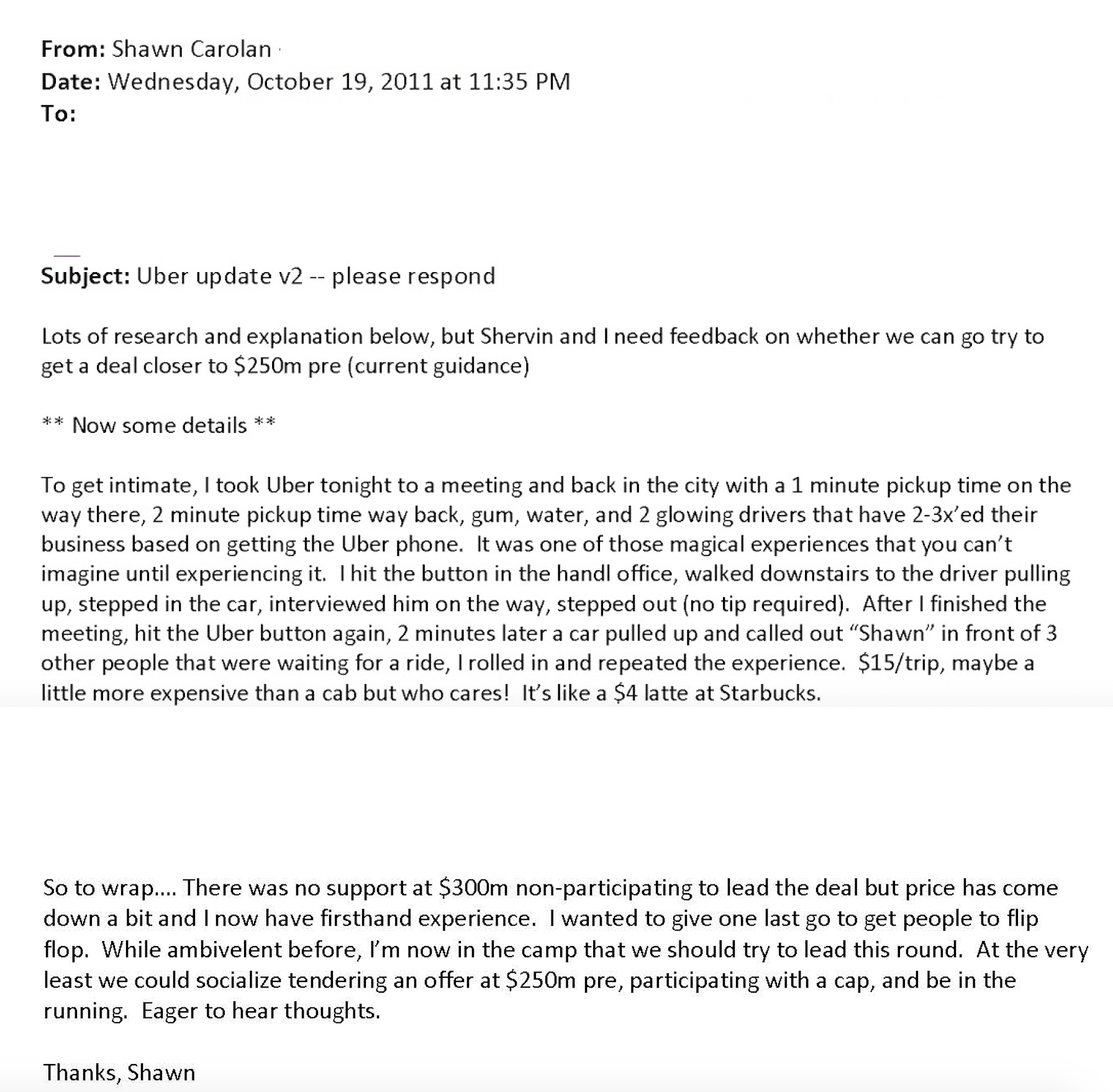

“I wouldn’t have dared to dream quite this big,” Menlo Ventures partner Shawn Carolan told TechCrunch. Carolan and embattled investor Shervin Pishevar, the former Menlo Ventures partner and founder of Sherpa Capital accused of sexual misconduct, secured Menlo a spot on Uber’s cap table years ago when several firms were vying for a stake.

The pair, according to discussions with insiders, are polar opposites, representatives of the diverging approaches to deal-making in Silicon Valley. While Pishevar, described to TechCrunch as “overpowering” and “self-promotional,” developed a lasting relationship with Uber co-founder and former chief executive officer Travis Kalanick crucial to the deal, Carolan, a reserved Midwesterner, crunched the numbers and worked to convince his firm that Uber, a young startup with a hot-headed leader, was worth their time and money.

Now, as Uber preps for an imminent initial public offering, the firm wants to shine a light on Carolan, an under-the-radar investor known more for his humility than his portfolio.

Menlo Ventures partner Shawn Carolan’s last-ditch effort to convince his firm to invest in Uber in late 2011.

As Uber approaches its IPO, a slew of investors that were in the right place at the right time await a payday of unforeseen scale.

Uber dropped its IPO prospectus in early April. Next week, it’s expected to debut on the New York Stock Exchange at a valuation between $80 billion and $100 billion, up from its most recent private valuation of $72 billion. The IPO will be amidst the largest liquidity events for a U.S. VC-backed technology company in history, on par with Facebook’s 2012 public offering that valued the social media empire at $104 billion.

In addition to Menlo Ventures, the Japanese telecom giant SoftBank, Benchmark, Uber co-founders Travis Kalanick and Garrett Camp, Saudi Arabia’s Public Investment Fund and GV, the investment arm of Alphabet, own stakes in Uber worth billions.

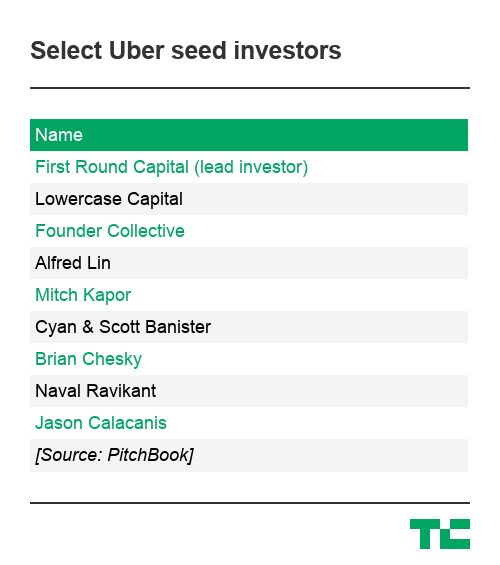

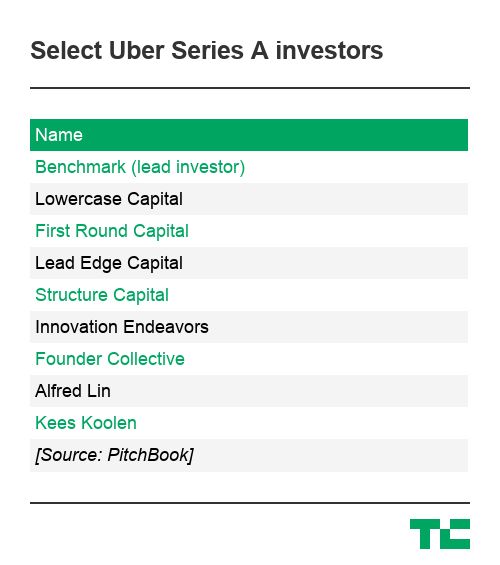

Seed backers like Chris Sacca of Lowercase Capital and Rob Hayes of First Round Capital, who invested in “UberCab” before it had anything to show for itself, will also earn tremendous payouts.

Menlo has already raked in hundreds of millions in profits from its Uber investment, as have several other investors that sold their shares on the secondary market. In 2018, Menlo earned $973 million when a group of investors led by SoftBank purchased nearly half of its Uber stock. The deal represented a 93x return on shares the firm had paid $10.5 million for years prior, according to the firm’s calculations.

Since that transaction, Menlo has expanded its Uber stake through the sale of its portfolio company Jump Bikes to Uber in 2018. The firm had invested $7.5 million in Jump, a provider of a dockless bicycle system, only months before it was acquired by Uber for $200 million. Menlo, as a result, banked another $50 million in Uber stock.

Today, it owns a 2.3 percent stake in Uber worth between $1.85 billion and $2.1 billion, depending on how Uber prices its IPO.

Uber founding CEO Travis Kalanick.

The story of Menlo Ventures’ investment in Uber dates back to 2005 when Carolan first met Travis Kalanick, Uber’s founder and former chief executive. The notorious entrepreneur was fundraising for an earlier company, a peer-to-peer file-sharing startup called Red Swoosh. Menlo didn’t invest, but Kalanick left a lasting impression.

Years later, Benchmark general partner Matt Cohler called Pishevar on his cell phone to let him know Uber had begun raising its Series B. Pishevar didn’t know Kalanick yet but had been introduced to his fast-growing car-sharing business by AngelList founder and Uber backer Naval Ravikant in 2010.

Pishevar was a garish type who would two years later leave Menlo to launch his own firm Sherpa Capital, a backer of Slack, Airbnb, Robinhood, Hyperloop One and more. Carolan was restrained, focused more on metrics than relationships. Together, the pair worked their way onto Uber’s cap table with Pishever serving as the lead investor externally and internally, both men receiving credit as leads.

Venture capitalists often brag about the skill required to land the best deals, but most of the time, it comes down to luck and timing. Menlo, in this case, got really lucky.

A recent feature on Andreessen Horowitz in Forbes detailed the firm’s biggest misstep: losing Uber. Hours before they were set to sign a term sheet, the firm shifted, offering Uber a lower valuation than what had been promised. Kalanick, known already at that point for his disdain for investors, walked. Little did the Menlo team know they were being used as a “stalking horse for leverage,” according to Forbes’ reporting. So when a16z tried to cheapen the deal, Uber turned immediately to its second-choice, Menlo Ventures.

A16z declined to provide additional details for this story.

“Whenever you have a company of this caliber that has that kind of growth rate, there’s a lot of people that are vying for the opportunity to invest,” Carolan said. “Frankly, there’s never been a company like Uber.”

With a sense of urgency, Pishevar hopped on a plane to Dublin, Ireland at Kalanick’s request. The CEO was speaking at a technology conference called Web Summit. It was there that the term sheets were signed over pints at the Shelbourne Hotel, and a close friendship between Pishevar and Kalanick would begin to blossom. Pishevar, according to The New York Times, later introduced the ride-hail chief to the club scene and Los Angeles celebrity culture. Until Kalanick’s final days as CEO, Pishevar would fiercely defend the founder’s dog-eat-dog style of management. To this day, the two are close friends.

Meanwhile, Carolan was heads down, benchmarking Uber against other tech companies, completing a thorough unit economics analysis and hoping his colleagues wouldn’t be disappointed by the Uber investment, a point of contention among certain Menlo staffers who viewed Uber as a limo dispatch company with an app, not the next billion-dollar business.

“There were a lot of things you had to believe back then and at that moment in time, Uber didn’t paint that picture, [Carolan] was the one who painted that picture,” Mark Siegel, a managing director at Menlo since 1996, told TechCrunch. “And he pounded the table pretty hard.”

After all, Uber was only active in four markets at the time of Menlo’s initial investment: San Francisco, Seattle, Chicago and New York City. Rider bookings were growing fast but were just $1 million per month, with close to zero net revenue after paying drivers. Carolan himself was unconvinced of the business’s longevity until his first ride in an Uber turned him.

Uber declined to confirm early booking figures.

“We had a lot of heartburn over the valuation,” Carolan said. “But it’s the ones you don’t chase, like YouTube, which I kind of dismissed as a lousy business and didn’t chase it. When you see something like Uber that has that type of repeated retention and essentially zero customer acquisition, it’s kind of like, okay, this is just a magical experience that’s going to sell itself.”

Carolan’s commitment was recognized internally but while Uber gained momentum, so did Pishevar. His involvement in Uber brought him notoriety, while Carolan’s role slipped through the cracks. Even when accusations of sexual misconduct against Pishevar surfaced in 2017, his name was often preceded by “early Uber investor.”

Pishevar was accused of sexually harassing multiple women, including Uber’s very own former head of global expansion, Austin Geidt. The Bloomberg expose highlighting allegations against him came just one month after a report he had been arrested in London for rape. Charges for the reported London incident were later dropped and Pishevar, through his lawyer, has said the other claims were part of a “smear campaign” against him.

Menlo Ventures sought to distance itself from the scandal, naturally, claiming in a series of tweets they had no knowledge of inappropriate behavior during his tenure at the firm.

A Chicago native, Shawn Carolan joined Menlo Ventures in 2002 as a 28-year-old fresh out of Stanford’s business school. His wife and high school sweetheart, Jennifer Carolan, would make a career as a venture capitalist, too, co-founding Reach Capital, an edtech-focused VC fund coincidentally located next door to Menlo’s San Francisco outpost.

Menlo Ventures partner Shawn Carolan.

In 2009, the Menlo team realized they had overcompensated on enterprise and made the call to pioneer a reinvigorated consumer tech strategy spearheaded largely by Carolan.

In 2011, to bolster the new effort, Carolan hired Pishevar, a rookie VC they hoped would bring a fresh perspective to a firm of engineering geeks. Immediately, Pishevar sourced Square, Jack Dorsey’s hot new payments startup. The team rallied behind him but ultimately, Square went with Kleiner Perkins’s Mary Meeker instead. Later, Pishevar would bring in Pinterest and Snap, mere months after the ephemeral messaging app had launched but the Menlo team passed, according to a source with knowledge of the deals.

In Pishevar’s first six months at Menlo, he invested in Tumblr, Warby Parker, Machine Zone and Uber.

Carolan, for his part, has returned more capital in a single year than any partner in its history, the firm said. In a 12-month period between 2017 to 2018, Roku’s IPO and the Uber stock sale brought in some $2 billion in returns for Menlo, capital that was used to fuel its latest fund, a $500 million vehicle focused on Series B and C-stage startups.

In addition to accumulating a 35.3 percent pre-IPO stake in the digital streaming business Roku, which the firm celebrated with boxes of popcorn implanted with several thousand dollars in cash bonuses for the administrative team, Carolan was the first institutional investor in Siri, the personal assistant application Apple paid a little more than $200 million for in 2010. More recently, he invested in Chime, a mobile banking platform valued at $1.5 billion in March.

Pishevar, since leaving Menlo, has continued to ink deals with high-flying unicorns, including Uber, in which Sherpa invested an additional $200 million. However, since resigning from Sherpa Capital following the sexual misconduct scandal in 2017, he’s kept a much lower profile. Most recently, he signed on as an investor and board member at Bolt Mobility, an electric scooter business in Florida. A 2018 Florida business filing listed him as the company’s sole officer, though the Bolt team recently told BuzzFeed Pishevar was strictly an investor. The Sherpa Capital team, for their part, have relaunched as ACME Capital.

Bolt has not responded to a request for comment.

Menlo remained one of the largest institutional backers in Uber for years, a position that, while lucrative, proved tricky when Uber began to unravel internally.

When Pishevar left Menlo Ventures to build Sherpa Capital in 2013, Carolan assumed the Menlo board observer seat for the next 21 months. Pishevar, now a close friend to Kalanick, stayed on the board as an observer until 2015.

Eventually, Carolan would take a step back from Menlo to focus on his productivity startup, Handle. But when Handle failed to become the rocket ship Carolan had dreamed of, he returned to investing at Menlo full-time with a newfound empathy for founders.

Little did he know he would play a role in the high-profile ouster of one of the most notable tech founders of all time.

In July 2016, talks of Kalanick’s resignation led by Benchmark general partner and Uber board member Bill Gurley began. Menlo had given up its board observer seat by then, but was part of a consortium of four key early Uber investors (Benchmark, First Round Capital and Lowercase Capital) that controlled the preferred share vote, which was needed to make impactful decisions; for example, approving new board seats or remove a founding CEO.

In 2017, it became abundantly clear that Uber would never achieve profitability nor complete its highly anticipated IPO with Kalanick at the helm. Susan Fowler had published her infamous blog post, executives were quitting, remarks on Uber’s toxic culture could be found just about anywhere and the #DeleteUber campaign had turned social media against the ride-hail company.

Shervin Pishevar (right) looks on as he gives a press conference during the Web Summit at Parque das Nacoes, in Lisbon on November 10, 2016. (PATRICIA DE MELO MOREIRA/AFP/Getty Images)

Uber was going to implode if the board didn’t act. Benchmark’s Gurley took center stage, calling on Kalanick to resign. Pishevar remained a Kalanick confidant and later when Benchmark sued Kalanick, he published a bizarre open letter in an eleventh-hour attempt to sway the public to rally behind the ousted CEO. Carolan, reluctant to be perceived as anything other than founder friendly, turned against the founder and advocated alongside Gurley for Kalanick’s removal.

“I imagine he wouldn’t be particularly happy with me for having done that but you gotta do what you gotta do sometimes,” Carolan said. “Ultimately, our job is to help that company achieve its mission. It’s not an allegiance to any one person at the company.”

Finally, Kalanick gave up the Uber C-suite in June 2017 and former Expedia Group CEO Dara Khosrowshahi stepped in as his replacement. Sixteen months later, Uber would file confidentially for a 2019 IPO.

Menlo Ventures leaped into cutting-edge consumer investing at a time when its reputation in The Valley was unremarkable. For years, decades even, the firm shielded itself from PR and declined to take the spotlight as the Andreessen Horowitzes of the world touted their successes.

Today, the firm is more accepting of attention, leveraging its Uber position to attract entrepreneurs and foster new unicorns, like the more recent portfolio additions Chime and Carta.

“It has clearly benefited us in terms of the overall perception of the firm and credibility,” Siegel said, admitting he was one of the Menlo partners dubious of its 2011 Uber investment. “There’s no doubt it has been a huge positive.”

In the years since Uber came along, Menlo has made key additions to its team, marking the beginning of a new era for the timeworn investor. In 2015, it hired Steve Sloane, who became the firm’s youngest partner to date when he was promoted earlier this year. Naomi Ionita, the firm’s only female partner, joined in early 2018. And Grace Ge, a fresh recruit from RRE Ventures in New York, started this week as a senior associate on the venture team. Another yet-to-be-announced hire will begin in June.

Uber, despite narrowly avoiding a complete implosion in 2017, has changed the game for many investors. The returns it will generate in the next several months will refresh the coffers of many venture capital funds. Money tied to Uber will flow toward the next generation of founders for years to come, and the investors responsible for its landmark success will boast about it for the remainder of their careers.

Even if Uber doesn’t turn out to be the Wall Street darling its investors hope — Lyft has struggled to accumulate value on the public markets — the company has indisputably transformed the Silicon Valley playbook for hypergrowth and execution in the gig-economy ecosystem.

Powered by WPeMatico

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. Last week, TechCrunch’s Anthony Ha gave us his recap of the TED2019 conference and offered key takeaways from the most interesting talks and provocative ideas shared at the event.

Under the theme, “Bigger Than Us,” the conference featured talks, Q&As and presentations from a wide array of high-profile speakers, including an appearance from Twitter CEO Jack Dorsey, which was the talk of the week. Anthony dives deeper into the questions raised in his onstage interview that kept popping up: How has social media warped our democracy? How can the big online platforms fight back against abuse and misinformation? And what is the internet good for, anyway?

“…So I would suggest that probably five years ago, the way that we wrote about a lot of these tech companies was too positive and they weren’t as good as we made them sound. Now the pendulum has swung all the way in the other direction, where they’re probably not as bad we make them sound…

…At TED, you’d see the more traditional TED talks about, “Let’s talk about the magic of finding community in the internet.” There were several versions of that talk this year. Some of them very good, but now you have to have that conversation with the acknowledgement that there’s much that is terrible on the internet.”

Image via Ryan Lash / TED

Anthony also digs into what really differentiates the TED conference from other tech events, what types of people did and should attend the event, and even how he managed to get kicked out of the theater for typing too loud.

For access to the full transcription and the call audio, and for the opportunity to participate in future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Powered by WPeMatico

WeWork, the co-working giant now known as The We Company, has submitted confidential documents to the U.S. Securities and Exchange Commission for an initial public offering, the company confirmed in a press release Monday.

According to The New York Times, the business initially filed IPO paperwork in December.

WeWork, valued at $47 billion in January, has raised $8.4 billion in a combination of debt and equity funding since it was founded by Adam Neumann and Miguel McKelvey in 2010. WeWork is among several tech unicorns with hundreds of millions, billions actually, in backing from the SoftBank Vision Fund. Recently, the Japanese telecom giant eyed a majority stake in the company worth $16 billion, but cooled their jets at the last minute.

WeWork doubled its revenue from $886 million in 2017 to roughly $1.8 billion in 2018, with net losses hitting a staggering $1.9 billion. These aren’t attractive metrics for a pre-IPO business; then again, Uber’s currently completing a closely watched IPO roadshow despite shrinking growth. Here’s more from Crunchbase News on WeWork’s top line financials:

On the bright side, per Axios, WeWork established a 90 percent occupancy rate in 2018, with total membership rising 116 percent to 401,000.

WeWork is often referenced as the perfect example of Silicon Valley’s tendency to inflate valuations. WeWork, a real estate business, burns through cash rapidly and will undoubtedly have to work hard to convince public markets investors of its longevity, as well as its status as a tech company.

WeWork is backed by SoftBank, Benchmark, T. Rowe Price, Fidelity, Goldman Sachs and several others.

Powered by WPeMatico