Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

As tech has grown, policy debates have become an important pastime. Today’s tech industry aspires to replace human drivers with self-driving cars, secretaries with AI assistants, permanent jobs with gigs — and as a result, the human impact of tech has become an everyday conversation.

No other idea is as emblematic of this as Universal Basic Income, a policy that would distribute a monthly sum to every adult regardless of their income or employment status.

The conversation is widespread. Mark Zuckerberg and Elon Musk have said that UBI may be desirable or necessary. Y-Combinator Research and Facebook co-founder Chris Hughes are running basic income studies. Tech-friendly presidential hopefuls Bernie Sanders and Andrew Yang support the issue.

But should the average tech entrepreneur or investor support UBI? The answer is not entirely clear.

The good news is that the tech industry is deeply familiar with risk, which is an important component of arguments for UBI. The bad news: risk isn’t the whole story, and both positive and negative evidence for the policy are currently thin.

Image via H. Armstrong Roberts/ClassicStock/Getty Images

Entrepreneurs understand the risk component of UBI because it’s the same risk they take in starting companies. Many entrepreneurs start with savings or seed funding that reduce their downside risk — and it’s not hard for them to imagine that others lack these resources. A UBI could solve the issue.

Powered by WPeMatico

Asto, the Santander-owned “upstart” developing financial tools for freelancers and SMEs, is adding invoice financing to its bookkeeping app.

The new offering, which potentially opens up so-called “micro-financing” to a much broader business market, comes hot on the heels of Santander Group acquiring Albert, an invoicing and expenses app for freelancers and micro-businesses. Albert’s functionality has now been integrated into Asto, with Albert co-founder Ivo Weevers becoming Asto’s chief product and design officer.

In a call, Weevers described Asto’s mission as wanting to create a “full stack of financial services for self-employed people [and other micro businesses].” Financial services for SMEs is a “huge, fast-growing market,” he says, adding that “Asto is innovating on the bookkeeping side, [while] other players on the market are working on the bank account side.”

“A lot of people are struggling with trying to understand and get access to finances that might help them in growing their business or overcoming certain periods of their business where extra cash would be really handy,” he tells me.

“What we’re doing now is providing a comprehensive solution where we help people with their daily tasks around bookkeeping and understanding where they are financially, but also connecting dots seamlessly with a financial solution. This is what this new micro-financing solution is all about.”

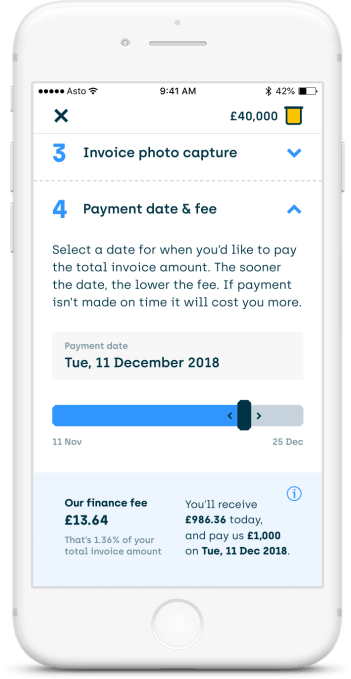

In a demo I’m given of the new invoice financing feature, it all feels relatively painless. After signing up to Asto and applying for the micro-finance option, you’re given an estimated pot of credit from which to drawn down on per invoice financed.

In a demo I’m given of the new invoice financing feature, it all feels relatively painless. After signing up to Asto and applying for the micro-finance option, you’re given an estimated pot of credit from which to drawn down on per invoice financed.

Invoices can be issued simply within the mobile app (or uploaded to it), which in itself is quite a time saver. Anyone who freelances knows that writing invoices and tracking them is a pain. Even more so is waiting to be paid.

Next to each invoice is a finance button. Clicking on it initiates the micro loan, with clear signposting on how much you’ll need to pay back and when. The time frame is based on the payment terms of your issued invoice with a bit of extra leeway if needed.

“Micro-financing used to be accessible only for the larger SMEs, people with financial knowledge and the time to go into a branch and talk to an account manager and wait for a few weeks to get a decision,” explains Weevers.

“One of the innovate steps we are trying to do here is we are making this option available for the smaller end of the SME market, which is by far the biggest and by far the most unserved. By doing it on mobile, which is their favourite device, and also doing it in a matter of minutes rather than having to wait for weeks,” he adds.

Meanwhile, I’m told that the credit itself is provided by Asto via owner Santander. Noteworthy is that the invoice financing feature doesn’t for the time being use transaction data pulled in from bank accounts you have linked to the app. Instead, Asto is using a range of other data points and info you provide when first applying for the micro-financing option.

Powered by WPeMatico

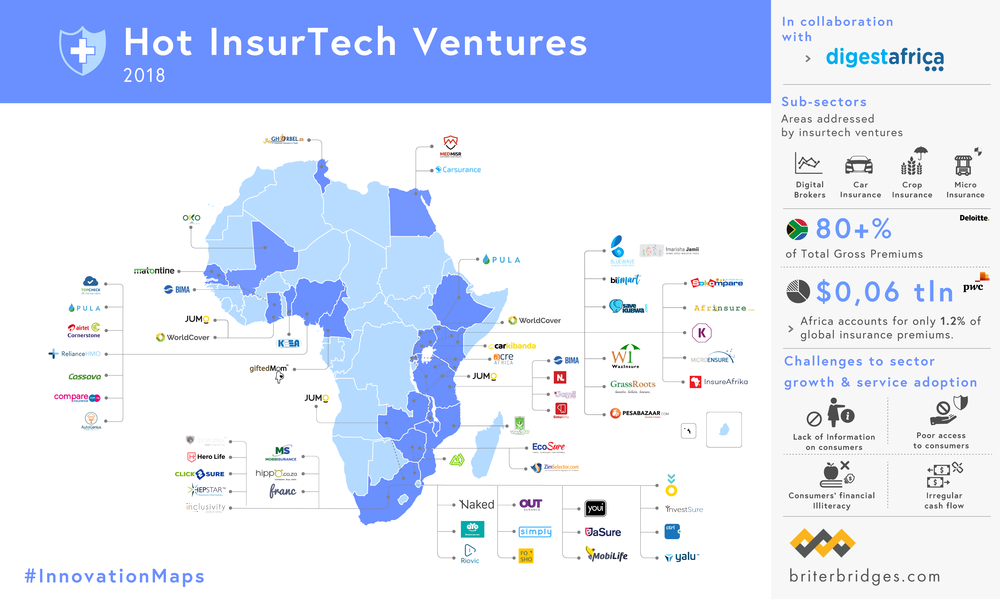

WorldCover, a New York and Africa-based climate insurance provider to smallholder farmers, has raised a $6 million Series A round led by MS&AD Ventures.

Y Combinator, Western Technology Investment and EchoVC also participated in the round.

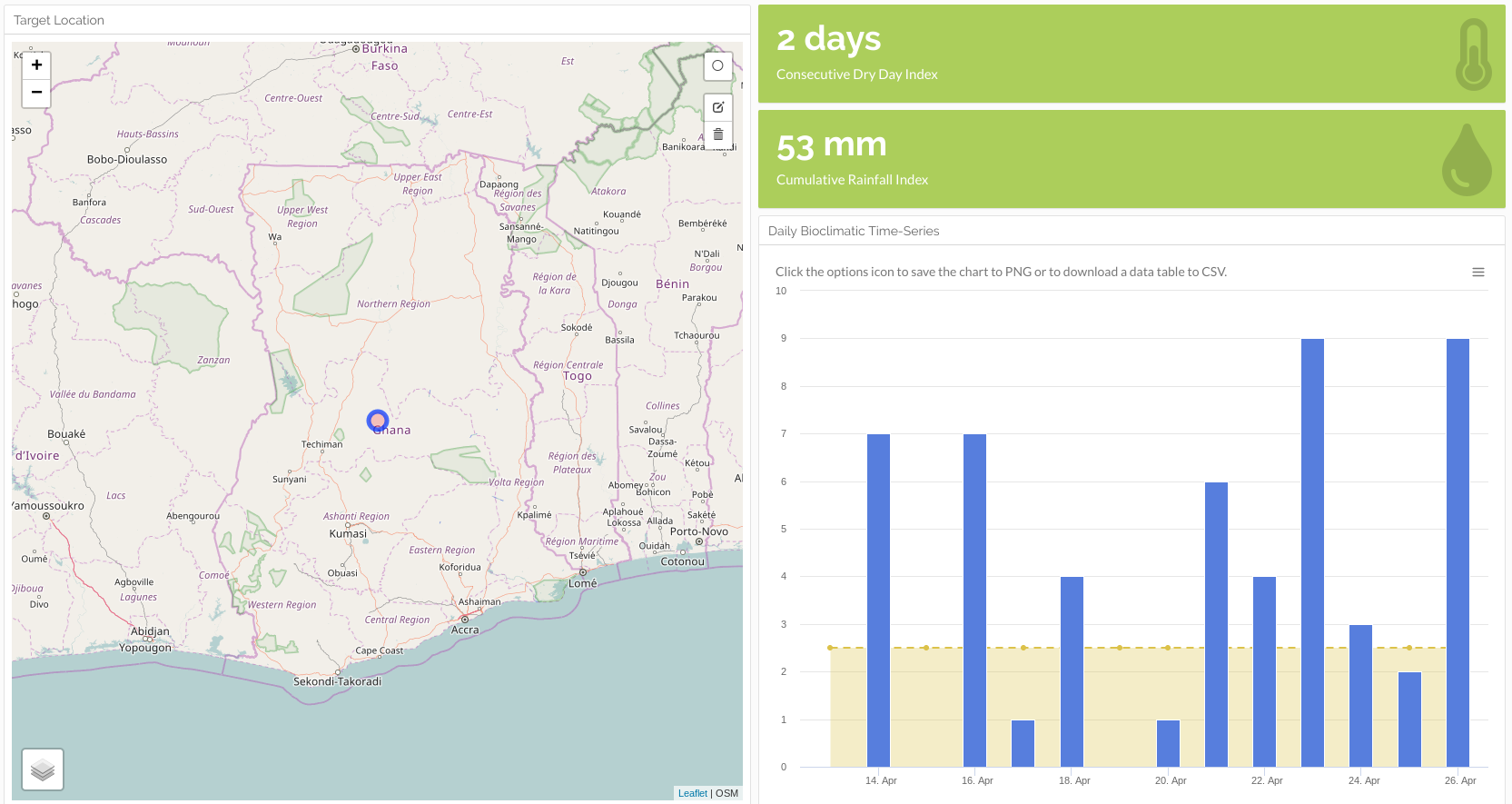

WorldCover’s platform uses satellite imagery, on-ground sensors, mobile phones and data analytics to create insurance options for farmers whose crop yields are affected adversely by weather events — primarily lack of rain.

The startup currently operates in Ghana, Uganda and Kenya . With the new funding, WorldCover aims to expand its insurance offerings to more emerging market countries.

“We’re looking at India, Mexico, Brazil, Indonesia. India could be first on an 18-month timeline for a launch,” WorldCover co-founder and chief executive Chris Sheehan said in an interview.

The company has served more than 30,000 farmers across its Africa operations. Smallholder farmers are those earning all or nearly all of their income from agriculture, farming on 10-20 acres of land and earning around $500 to $5,000, according to Sheehan.

Farmers connect to WorldCover by creating an account on its USSD mobile app. From there they can input their region and crop type and determine how much insurance they would like to buy and use mobile money to purchase a plan. WorldCover works with payments providers such as M-Pesa in Kenya and MTN Mobile Money in Ghana.

The service works on a sliding scale, where a customer can receive anywhere from 5x to 15x the amount of premium they have paid. If there is an adverse weather event, namely lack of rain, the farmer can file a claim via mobile phone. WorldCover then uses its data-analytics metrics to assess it, and, if approved, the farmer will receive an insurance payment via mobile money.

Common crops farmed by WorldCover clients include maize, rice and peanuts. It looks to add coffee, cocoa and cashews to its coverage list.

For the moment, WorldCover only insures for events such as rainfall risk, but in the future it will look to include other weather events, such as tropical storms, in its insurance programs and platform data analytics.

For the moment, WorldCover only insures for events such as rainfall risk, but in the future it will look to include other weather events, such as tropical storms, in its insurance programs and platform data analytics.

The startup’s founder clarified that WorldCover’s model does not assess or provide insurance payouts specifically for climate change, though it does directly connect to the company’s business.

“We insure for adverse weather events that we believe climate change factors are exacerbating,” Sheehan explained. WorldCover also resells the risk of its policyholders to global reinsurers, such as Swiss Re and Nephila.

On the potential market size for WorldCover’s business, he highlights a 2018 Lloyd’s study that identified $163 billion of assets at risk, including agriculture, in emerging markets from negative, climate change-related events.

“That’s what WorldCover wants to go after…These are the kind of micro-systemic risks we think we can model and then create a micro product for a smallholder farmer that they can understand and will give them protection,” he said.

With the round, the startup will look to possibilities to update its platform to offer farming advice to smallholder farmers, in addition to insurance coverage.

WorldCover investor and EchoVC founder Eghosa Omoigui believes the startup’s insurance offerings can actually help farmers improve yield. “Weather-risk drives a lot of decisions with these farmers on what to plant, when to plant, and how much to plant,” he said. “With the crop insurance option, the farmer says, ‘Instead of one hector, I can now plant two or three, because I’m covered.’ ”

Insurance technology is another sector in Africa’s tech landscape filling up with venture-backed startups. Other insurance startups focusing on agriculture include Accion Venture Lab-backed Pula and South Africa based Mobbisurance.

With its new round and plans for global expansion, WorldCover joins a growing list of startups that have developed business models in Africa before raising rounds toward entering new markets abroad.

In 2018, Nigerian payment startup Paga announced plans to move into Asia and Latin America after raising $10 million. In 2019, South African tech-transit startup FlexClub partnered with Uber Mexico after a seed raise. And Lagos-based fintech startup TeamAPT announced in Q1 it was looking to expand globally after a $5 million Series A round.

Powered by WPeMatico

You probably haven’t heard of Checkout, a digital payments processing company that was founded in 2012 in London. Apparently, however, investors have been keeping tabs on the low-flying company and like what they see. Today, Checkout announced that it has raised $230 million in Series A funding at a valuation just shy of $2 billion co-led by Insight Partners and DST Global, with participation from GIC, the Singaporean sovereign-wealth fund, Blossom Capital, Endeavor Catalyst and other, unnamed strategic investors.

It’s the first institutional round for the company; it’s also one of the biggest Series A rounds ever for a European company.

What’s so special about Checkout that investors felt compelled to write such big checks? In a sea filled with fintech startups, it’s hard to know at first glance what differentiates it — or whether investors merely spy a huge opportunity, particularly given the company’s recent revenue numbers.

Checkout helps businesses — including Samsung, Adidas, Deliveroo and Virgin, among others — to accept a range of payment types across their online stores around the world. According to the WSJ, the fees from these services are adding up, too. It says Checkout’s European business generated $46.8 million in gross revenue and $6.7 million in profit in 2017, information it dug up through Companies House, the United Kingdom’s registrar of companies.

Checkout also plays into two huge trends that seem to be lifting all boats — the ongoing boom in online shopping, and the growing number of businesses using online payments. Little wonder that investors poured into payments startups last year more than four times what they invested in them in 2017 ($22 billion, according to Dow Jones VentureSource data cited by the WSJ).

Little wonder, too, that payments startups that have gone public are faring well, including the global payments company Adyen, which IPO’d on the Euronext in June of last year and has mostly seen its shares move in one direction since. Indeed, the company, valued at $2.3 billion by investors in 2015, is now valued at nearly $21 billion.

Though Checkout’s Series A is stunning for its size, according to Dealroom data, it isn’t the largest for a European company. Among other giant rounds, the U.K.-based biotech company Immunocore closed on $320 million in Series A funding in 2015. In 2017, another U.K. fintech, OakNorth, a digital bank that focuses on loans for small and medium enterprises, raised $200 million in Series A funding. (It has gone on to raise roughly $850 million altogether.)

More recently, TradePlus24, a two-year-old, Zurich, Switzerland-based fintech company that insures against default the accounts receivables of small and mid-size businesses, also raised a healthy amount: $120 million in Series A funding. Its backers include Credit Suisse and the insurance broker Kessler.

Powered by WPeMatico

The microbiome testing service uBiome has placed its founders and co-chief executives, Jessica Richman and Zac Apte, on administrative leave following an FBI raid on the company’s offices last week.

The company’s board of directors have named John Rakow, currently the company’s general counsel, as its interim chairman and chief executive, the company said in a statement.

Directors of the company are also conducting an independent investigation into the company’s billing practices, which is being overseen by a special committee of the board.

It was only last week that the FBI went to the company’s headquarters to search for documents related to an ongoing investigation. What’s at issue is the way that the company was billing insurers for the microbiome tests it was performing on customers.

“As interim CEO of uBiome, I want all of our stakeholders to know that we intend to cooperate fully with government authorities and private payors to satisfactorily resolve the questions that have been raised, and we will take any corrective actions that are needed to ensure we can become a stronger company better able to serve patients and healthcare providers,” Rakow said in a statement.

”My confidence is based on the significant clinical evidence and medical literature that demonstrates the utility and value of uBiome’s products as important tools for patients, health care providers and our commercial partners.” added Mr. Rakow.

It’s been a rough few weeks for consumer companies working on developing microbiome testing services and treatments based on those diagnosis. In addition to the FBI raid, the Seattle-based company, Arivale, was forced to shut down its “consumer program” after raising more than $50 million from investors, including Maveron, Polaris Partners and ARCH Venture Partners.

UBiome is backed by investors including Andreessen Horowitz, OS Fund, 8VC, Y Combinator, DNA Capital, Crunchfund, StartX, Kapor Capital, Starlight Ventures and 500 Startups.

Powered by WPeMatico

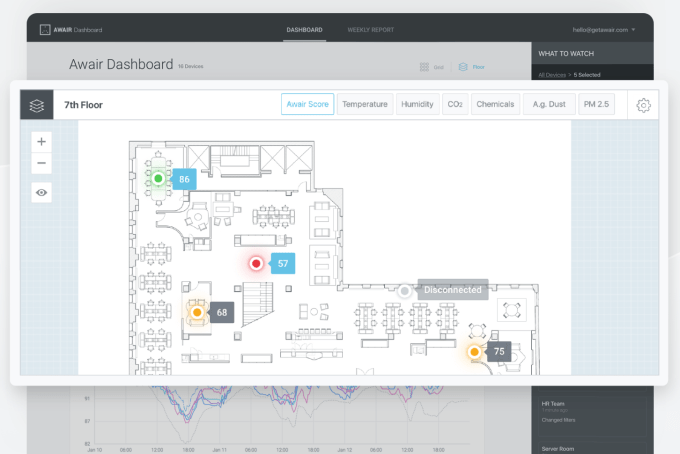

Monitoring a space is about a lot more than security cameras. Awair is trying to help businesses and consumers more deeply understand the environments in which they live and work.

Awair has raised a $10 million Series B led by The Westly Group with participation from iRobot, Altos Ventures, Emerson Electric and Nuovo Capital. The company has raised more than $21 million to date.

The company has been plugging along with air-quality monitors that look like they belong in the MoMa. Awair’s $199 monitor senses things like particulate matter, temperature, humidity, and CO² levels. They’ve built out their product line with a couple other devices, but they’re largely targeting air-conscious consumers that might have allergies of another ailments and “design moms” who are looking to get some well-designed tech into their home.

The information all plugs into an app that helps consumers understand what’s happening in their home and get tips for how they can improve air quality.

As the company looks to make venture-worthy returns, it’s been scaling beyond the consumer IoT space into the world of enterprise IoT with its Omni product that Await has been selling to large real estate firms, offices and hospitals, aiming to give companies more insight into what life is like in every corner of their physical spaces.

The devices measure the same things their consumer products do, but also can track ambient light and noise in space, and pipe all of that data into a dashboard that can help businesses automate how they push their existing building infrastructure like their HVAC systems to respond to changes in the environment.

While Awair has been selling consumer IoT devices since 2015, its business product is about 18 months old, and a big part of this fundraise is to bring a sales staff onboard to keep the pace of enterprise expansion, which has been faster growing than the consumer business.

The company says they have more than 300 enterprise customers on the platform, including WeWork, Airbnb, Harvard and The Crown Estate.

Powered by WPeMatico

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Josh Constine and Frederic Lardinois discuss major announcements that came out of Facebook’s F8 conference and dig into how Facebook is trying to redefine itself for the future.

Though touted as a developer-focused conference, Facebook spent much of F8 discussing privacy upgrades, how the company is improving its social impact, and a series of new initiatives on the consumer and enterprise side. Josh and Frederic discuss which announcements seem to make the most strategic sense, and which may create attractive (or unattractive) opportunities for new startups and investment.

“This F8 was aspirational for Facebook. Instead of being about what Facebook is, and accelerating the growth of it, this F8 was about Facebook, and what Facebook wants to be in the future.

That’s not the newsfeed, that’s not pages, that’s not profiles. That’s marketplace, that’s Watch, that’s Groups. With that change, Facebook is finally going to start to decouple itself from the products that have dragged down its brand over the last few years through a series of nonstop scandals.”

(Photo by Justin Sullivan/Getty Images)

Josh and Frederic dive deeper into Facebook’s plans around its redesign, Messenger, Dating, Marketplace, WhatsApp, VR, smart home hardware and more. The two also dig into the biggest news, or lack thereof, on the developer side, including Facebook’s Ax and BoTorch initiatives.

For access to the full transcription and the call audio, and for the opportunity to participate in future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Powered by WPeMatico

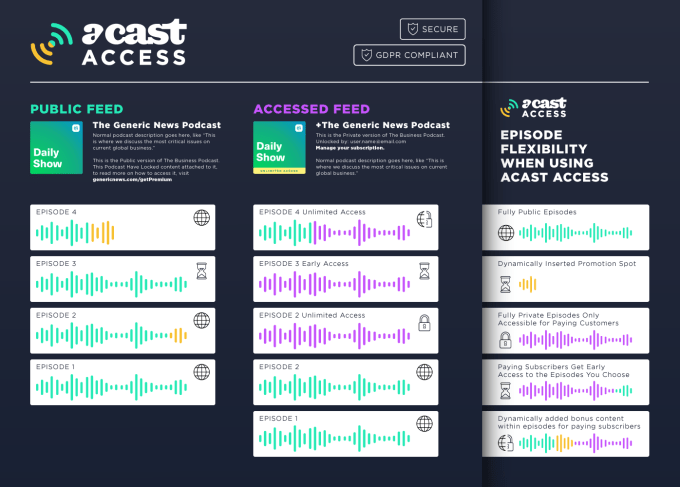

Podcast monetization company Acast is launching a new way for publishers to put their podcasts behind a paywall.

Until now, podcasts have not been well-suited to subscription paywalls, due to the fact that they’re distributed via RSS feeds that can be accessed by any podcast player. So instead we’ve seen workarounds like Substack building a web-based audio player and TechCrunch releasing all our podcasts free while putting transcripts behind the Extra Crunch paywall.

And then there’s Luminary, the subscription podcast app that’s faced serious backlash for including unaffiliated podcasts in a way that some podcasters suspect it was re-hosting their audio files. (The company says it wasn’t doing that.)

With Acast Access, on the other hand, publishers should be able to create versions of their podcasts that are only available to subscribers, but are still accessible from any app.

Chief Product Officer Johan Billgren said that Acast works with a publisher to create two different podcast feeds — the public feed, which is available to everyone for free, and the “accessed-RSS” feed, which should include all the public content but also extra episodes, episodes released early or episodes with bonus content inserted.

Billgren demonstrated the listener process for me, showing how a subscriber could log onto a publisher’s site, visit the podcast page and then click a button that will allow them to subscribe to the paid version of the podcast, choosing the podcast app of their choice. Once you’ve subscribed, you should be able to download and play episodes anytime you want, without any additional login.

Behind the scenes, Billgren said Acast is checking anonymized user data against the publisher’s API to confirm that you really do have permission to access the feed. And apparently it can still cut you off after you cancel your subscription.

Initial Acast Access partners include the Financial Times and The Economist. While it makes sense to launch with larger publishers who can incorporate this into their existing subscription paywalls, Billgren said Acast will also be making this available to smaller partners in the comings months — they’ll be able to release podcasts behind Acast’s own subscription paywall. (The company has already been experimenting with paid content through its Acast+ app.)

“Basically, we want to reach the point where it’s a natural thing to say, ‘This is the public version [of a podcast], press the link to get access to the accessed version,’ ” he said.

Powered by WPeMatico

We’ve captured much of Niantic’s ongoing story in the first three parts of our EC-1, from its beginnings as an “entrepreneurial lab” within Google, to its spin-out as an independent company and the launch of Pokémon GO, to its ongoing focus on becoming a platform for others to build augmented reality products upon.

It’s not an origin story that serves as an easily replicable blueprint — but if we zoom out a bit, what’s to be learned?

A few key themes stuck with me as I researched Niantic’s story so far. Some of them – like the challenges involved with moving millions of users around the real world – are unique to this new augmented reality that Niantic is helping to create. Others – like that scaling is damned hard – are well-understood startup norms, but interesting to see from the perspective of an experienced team dealing with a product launch that went from zero to 100 real quick.

The reading time for this article is 21 minutes (5,125 words).

Everything Niantic has built so far is an evolution of what the team had built before it. Each major step on Niantic’s path has a clear footprint that precedes it; a chunk of DNA that proved advantageous, and is carried along into the next thing.

Looking back, it’s a cycle we can see play out on repeat: build a thing, identify what works about it, trim the extra bits, then build a new thing from that foundation.

Powered by WPeMatico

Ticketing startup SeatGeek has a new CTO.

Brian Murphy previously held the same position at Tumblr (which, like TechCrunch, is owned by Verizon Media) and has also served as vice president of engineering at The New York Times and senior director of technology at Condé Nast.

“Brian is an incredible leader and team-builder who has overseen engineering teams for some remarkable companies,” said SeatGeek co-founder and CEO Jack Groetzinger in a statement. “He is a perfect fit for this role at SeatGeek and embodies the values we hold – he loves building great products, is humble yet aggressive in how he approaches opportunities, and is focused on creating experiences live event fans will love.”

Murphy told me his career started in consulting, but he’s been attracted to technology roles in media companies because he was “drawn to all the smart creative folks who want to use their technology in that medium.”

As for SeatGeek, Murphy described it as a “very consumer-oriented, very mobile-focused” company that’s now moving into the enterprise business by working with teams and venues to sell tickets. He also said he’ll be working on international expansion and helping SeatGeek build a broader live event experience.

“You’ve sort of started to see it with partnerships with Lyft and Snapchat and Spotify,” he said.”There’s definitely an opportunity how we bring our Starbucks-esque experience to the stadium.”

Murphy added that he’ll be “very, very busy with recruiting.”

Meanwhile, SeatGeek’s outgoing CTO Eric Waller isn’t leaving the company — instead, he’s becoming chief product officer.

Powered by WPeMatico