Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

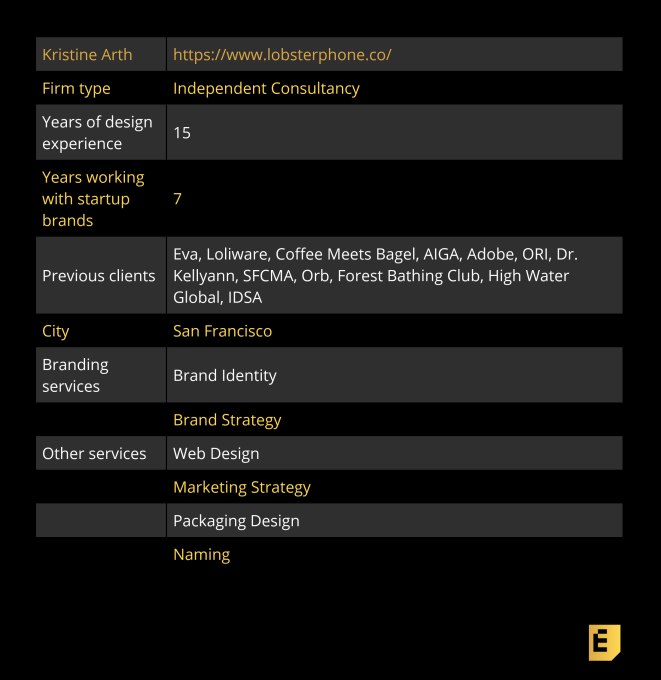

After spending a decade working at international design and branding agencies, Kristine Arth launched her own independent branding agency called Lobster Phone last April. Since then, she’s launched 22 brands under her unofficial tagline “I don’t sleep.” Lobster Phone, however, is all about creating iconic brands with bold personality, which Kristine passionately delivers to her clients. We spoke to Kristine about her branding philosophy, the story behind the name Lobster Phone, and why she loves working with founders.

“My specialty is people, honestly. I don’t find that I focus in any category, field, or particular segment of an industry is my focus. My specialty is working with people and understanding their background because entrepreneurs have a very different outlook on life. They will climb that mountain at all costs, and I feel very similarly. My sign is Capricorn, I’m a goat. So I will always climb to the top of that mountain. I feel very in line with entrepreneurs in that way because I want to help them do their best work.”

“Kristine is what every person dreams of in a design partner to give your brand a soul and heart.” Julián Ríos Cantú, México City, Mexico, Co-founder and CEO, Eva Tech

“Entrepreneurs will come to me and say, “I want a logo, I want a campaign, I want this.” And I will say, you need a brand, you need strategy, you need a foundational promise to sell to your clients. And with that foundational brand strategy and a flexible brand, we’ll get what you want. The common mistake is to come with a solution versus coming in with the problem.”

Below, you’ll find the rest of the founder reviews, the full interview, and more details like pricing and fee structures. This profile is part of our ongoing series covering startup brand designers and agencies with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already.

Yvonne Leow: Can you tell me a little bit about yourself and how you got into branding?

Kristine Arth: I originally thought I was going to be a ceramist. I went to school at Columbia in Chicago, and studied ceramics for about half a semester before I discovered the computer lab, and was like “Oh my God, everything is happening so fast there, this is amazing. It’s for me.” So I quickly moved into graphic design and never looked back. I started in advertising and marketing, and worked in Chicago for about 10 years at Leo Burnett, Wunderman, and then moved out to San Francisco to start fresh. Fuseproject, a top industrial design and branding agency, reached out to me, had me come in for an interview and the rest is history.

Powered by WPeMatico

Founded in late 2013, OnePlus did the impossible, coming seemingly out of nowhere to take on some of the biggest players in mobile. The company has made a name by embracing a fawning fan base and offering premium smartphone features at budget pricing, even as the likes of Samsung and Apple routinely crack the $1,000 barrier on their own flagships.

OnePlus’ history is awash with clever promotions and fan service, all while exceeding expectations in markets like the U.S., where fellow Chinese smartphone makers have run afoul of U.S. regulations. The company’s measured approach to embracing new features has won a devoted fan base among Android users.

Over the past year, however, the company has looked to bleeding-edge technology as a way forward. OnePlus was one of the first to embrace In-Display fingerprint sensors with last year’s 6T, and has promised to be among the first to offer 5G on its handsets later this year.

CEO Pete Lau formed the company with fellow Oppo employee Carl Pei. The pair have turned the company into arguably the most exciting smartphone manufacturer in the past decade. OnePlus has big plans on the horizon, too, including further expansion into the Indian market and the arrival of its first TV set in the coming year.

At Disrupt SF (which runs October 2 to October 4), Lau will discuss OnePlus’ rapid accent and its plans for the future.

Tickets are available here.

Powered by WPeMatico

Sitting silently with your eyes closed isn’t fun, but it’s good for you… so you probably don’t meditate as often as you’d like. In that sense, it’s quite similar to exercise. But people do show up when prodded by the urgency and peer pressure of scheduled group cycling or aerobics classes. What’s still in the way is actually hauling your lazy butt to the gym, hence the rise of Peloton’s in-home stationary bike with attached screen streaming live and on-demand classes. My butt is particularly lazy, but I’ve done 80 Peloton rides in four months. The model works.

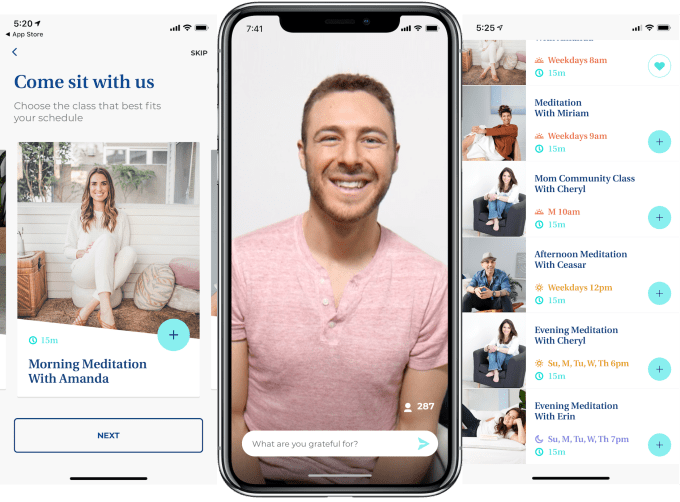

Now that model is coming to mindfulness with the launch of Journey LIVE, a subscription iOS app offering live 15-minute group meditation classes. With sessions starting most waking hours, instructors that interact with you directly and a sense of herd mentality, you feel compelled to dedicate the time to clearing your thoughts. By video and voice, the teachers introduce different meditation theories and practices, guide you through and answer questions you can type in. Each day, Journey also provides a newly recorded on-demand session in case you need a class on your own schedule.

” ‘I tried Headspace’ or ‘I tried Calm .’ With a lot of the current meditation apps, people go on but they drop off very quickly,” says Journey founder and CEO Stephen Sokoler. “It means that there’s an interest in meditating and having a better life but people fall off because meditating alone is hard, it’s confusing, it’s boring. Meditating with a live teacher who can connect with you and say your name, who makes you feel seen and heard makes a huge difference.”

Journey subscriptions start at $19.99 per month after a week-long free trial. That feels a bit steep, but prices drop to $7.99 if paid annually with the launch discount, or you can dive in with a $399 lifetime pass. The challenge will be keeping users from abandoning meditation and then their subscription without resorting to growth hacking and annoying notifications that are antithetical to the whole concept. Journey has now raised a $2.4 million seed round led by Canaan and joined by Brooklyn Bridge Ventures, Betaworks and more to get the company rolling.

Journey subscriptions start at $19.99 per month after a week-long free trial. That feels a bit steep, but prices drop to $7.99 if paid annually with the launch discount, or you can dive in with a $399 lifetime pass. The challenge will be keeping users from abandoning meditation and then their subscription without resorting to growth hacking and annoying notifications that are antithetical to the whole concept. Journey has now raised a $2.4 million seed round led by Canaan and joined by Brooklyn Bridge Ventures, Betaworks and more to get the company rolling.

Sokoler’s own journey could set an example of the possibilities of sticking with it. “Meditation changed my life. I was fortunate enough to move to Australia, find a book on Buddhism, and then I had the willpower to start practicing meditation every day,” he tells me. “I lost 85 pounds. People ask me how I lost the weight and they expect me to say a diet like keto or Atkins, but it was because of the program I was in.” Suddenly able to sit quietly with himself, Sokoler didn’t need food to stay occupied or feel at ease.

The founder saw the need for new sources of happiness while working in employee rewards and recognition for 12 years. He built up a company that makes mementos for commemorating big business deals. Meditation proved to him the value of developing inner quiet, whether to inspire happiness, calm, focus or deeper connections to other people and the world. Yet the popular meditation apps ignored thousands of years of tradition when meditation would be taught in groups that give a naturally ethereal activity more structure. He founded Journey in 2015 to bring meditation to corporate environments, but now is hoping to democratize access with the launch of Journey LIVE.

“You could think of it as a real-life meditation community or studio in the palm of your hand,” Sokoler explains. Instructors greet you when you join a session in the Journey app and can give you a shout-out for practicing multiple days in a row. They help you concentrate on your breath while giving enough instruction to keep you from falling asleep. You can see or hide a list of screen names of other participants that make you feel less isolated and encourage you not to quit.

Finding a market amidst the popular on-demand meditation apps will be an uphill climb for Journey LIVE. While classes recorded a long time ago might not be as engaging, they’re convenient and can dig deep into certain styles and intentions. Calm and Headspace run around $12.99 per month, making them cheaper than Journey LIVE and potentially easier to scale.

But Sokoler says his app’s beta testing saw better retention than competitors. “If you’ve ever been to the New York Public Library, there’s so many books versus going to a local curated bookstore where something is right there for you. This is much more approachable, much more accessible,” Sokoler tells me. “There’s a paradox of choice, and having so many options makes it hard for people to stick with it and come back every single day.”

With our phones and Netflix erasing the downtime we used to rely on to give our brain a break or reflect on our day, life is starting to feel claustrophobic. We’re tense, anxious and easily overwhelmed. Meditation could be the antidote. Unlike with cycling or weightlifting, you don’t need some expensive Peloton bike or Tonal home gym. What you need is consistency, and an impetus to slow down for 15 minutes you could easily squander. We’re a tribal species, and Journey LIVE group classes could use camaraderie to lure us into the satisfying void of nirvana.

Powered by WPeMatico

Most of the strategy discussions and news coverage in the media and entertainment industry is concerned with the unfolding corporate mega-mergers and the political implications of social media platforms.

These are important conversations, but they’re largely a story of twentieth-century media (and broader society) finally responding to the dominance Web 2.0 companies have achieved.

To entrepreneurs and VCs, the more pressing focus is on what the next generation of companies to transform entertainment will look like. Like other sectors, the underlying force is advances in artificial intelligence and computing power.

In this context, that results in a merging of gaming and linear storytelling into new interactive media. To highlight the opportunities here, I asked nine top VCs to share where they are putting their money.

Here are the media investment theses of: Cyan Banister (Founders Fund), Alex Taussig (Lightspeed), Matt Hartman (betaworks), Stephanie Zhan (Sequoia), Jordan Fudge (Sinai), Christian Dorffer (Sweet Capital), Charles Hudson (Precursor), MG Siegler (GV), and Eric Hippeau (Lerer Hippeau).

“In 2018 I was obsessed with the idea of how you can bring AI and entertainment together. Having made early investments in Brud, A.I. Foundation, Artie and Fable, it became clear that the missing piece behind most AR experiences was a lack of memory.

Powered by WPeMatico

Carta, a seven-year-old, San Francisco-based startup, is the newest unicorn in tech. The company, which largely helps private company investors, founders, and employees manage their equity and ownership, tells TechCrunch it has raised $300 million in a Series E round at a $1.7 billion valuation, led by Andreessen Horowitz. Firm co-founder Marc Andreessen is also joining the board.

The round has been a poorly kept secret. The outlet The Information reported more than a month ago the details that Carta is sharing today. In fact, that leak has given people in the industry who understand Carta’s business time to quietly ask of its valuation whether it isn’t high for a company that does what it does.

Unsurprisingly, Carta argues that it is not, that it has evolved considerably from the outset — which is true. Though it launched as a way for venture-backed companies to mange equity, issue securities, and track their cap tables, by 2014, Carta, formerly known as eShares, had moved beyond replacing paper records and into selling as a monthly service appraisals of the fair market value of private companies’ common stock in order to determine their strike price. It calls this “409A-as-a-service.”

Carta has continued tacking on more services. Among the most notable was the launch last year of a fund administration product designed to help venture capital firms not only manage their portfolio stakes more easily but to more seamlessly work with their own investors or limited partners. Toward this end, Carta now provides portfolio analytics, including deal IRRs and cash management, it helps VCs distribute their quarterly investor reports and it integrates with third-party tax and payroll providers.

Carta has so many pieces in place that in a call on Friday, founder and CEO Henry Ward told us Carta is taking what may be its biggest step yet and becoming the first real “private stock market for companies.” Its massive new funding round is “about act three,” he said. “Now that you have this network of companies and investors all on one platform and the ability to transfer securities, you can build liquidity on top of it.” It’s this vision that enticed Andreessen to jump aboard, he suggested.

There’s unquestionably a need for a kind of private stock market. Private funding has been outpacing IPO funding for years, and it shows no sign of stopping. It’s largely why the SEC is trying to better enable people who are not accredited investors to access private company shares. Most of the U.S. has missed out on the wealth creation happening before companies go public or sell to other companies.

It’s also true that Carta has its hooks into a meaningful number of startups and venture firms at this point. The company says more than 700,000 shareholders are on its platform, that it works with more than 11,000 companies and that its fund administration product now serves 143 venture firms.

Still, some longtime industry observers wonder if Carta isn’t mashing together a lot of disparate, moderately lucrative businesses and positioning it as the next-big platform company, and the view resonates. For one thing, Carta likes to talk about assets managed, though it’s really talking about how much in assets the startups and VCs that use its platform control, which is $575 billion altogether. Carta — which now employs nearly 600 employees across seven offices — says its own annual revenue run rate is currently $55 million.

Relatedly, while Ward says Carta’s primary revenue right now is its software subscription business — another revenue stream is the money it’s paid by the venture firms that use it as a fund administrator — people who question Carta’s fundraising note the people-intensive nature of the kind of work that Carta has been systemizing. Yes, there’s a sophisticated software component, but Carta is more Accenture than Salesforce, and services businesses are valued very differently.

There’s also the question of growth. Ward points to the roughly 450 startups that are garnering venture funding each month right now — all potential customers for Carta. But plenty of companies are also quietly going out of business all the time, a process that will accelerate whenever this very long funding boom finally slows.

This newest business conveys the impression that big things are coming, though it doesn’t sound exactly like a private stock market as Ward describes it, either. Primarily, it won’t provide the relative transparency that stock markets do. We don’t think that’s the case, anyway. Ward was somewhat dismissive of questions we asked about how Carta’s newest business will be fundamentally different than that of secondary players in the market that are already making it possible for shareholders to value and transact shares.

Indeed, though Carta says it’s changing how assets are acquired, valued and transacted, Ward also did not respond to several simple follow-up queries sent to him on Friday about the mechanics of this new business, dubbed CartaX. Instead, he thanked us for our efforts to understand and articulate Carta’s business. Meanwhile, his press team told us it was limited in what it can say about how CartaX operates for now.

Carta has savvy investors. In addition to Andreessen Horowitz, this newest round includes Lightspeed Venture Partners, Goldman Sachs Principal Strategic Investments, Tiger Global, Thrive Capital and earlier backers Tribe Capital, Menlo Ventures and Meritech Capital.

No doubt that in valuing the company, they took into account that Solium — a Canada-based software-as-a-service for stock administration, financial reporting and compliance that was publicly traded — sold for $900 million in cash earlier this year to Morgan Stanley. That’s roughly double Carta’s total funding so far of $447 million.

More likely, they were viewing the company based on its potential as a kind of more liquid market, ambitious as that might seem today. Consider that the parent company to both the NYSE and the Chicago Stock Exchange currently has a market cap of roughly $45 billion. Then again, that company operates 12 exchanges and marketplaces altogether, and it enjoyed more than $6 billion in revenue last year by transacting more than a $100 billion dollars in volume on the NYSE alone on a daily basis.

Perhaps most important to them, Carta is now as well-positioned as anyone to capture and cater to the growing number of privately held companies looking to provide more of their employees liquidity and to cash out early investors. Add to the mix a mega-round and a star board member, and the company may well get to where Ward and his investors want it to go.

We’ll be watching to see.

[Correction: We’d originally misstated the market cap of Intercontinental Exchange, owner of the NYSE and Chicago Stock Exchange, among other marketplaces; we cited its annual revenue instead.]

Powered by WPeMatico

India has a new unicorn after BigBasket, a startup that delivers groceries and perishables across the country, raised $150 million for its fight against rivals Walmart’s Flipkart, Amazon and hyperlocal startups Swiggy and Dunzo.

The new financing round — a Series F — was led by Mirae Asset-Naver Asia Growth Fund, the U.K.’s CDC Group and Alibaba, BigBasket said on Monday. The closing of the round has officially helped the seven-year-old startup surpass $1 billion valuation, co-founder Vipul Parekh, who heads marketing and finances for the company, told TechCrunch in an interview. Chinese giant Alibaba, which also led the Series E round in BigBasket last year, is the largest investor in the company, with about 30% stake, a person familiar with the matter said.

The company, which offers more than 20,000 products from 1,000 brands in more than two dozen cities, will deploy the fresh capital into expanding its supply-chain network, adding more cold storage centers and distribution centers to serve customers faster, Parekh said. The company also plans to add about 3,000 vending machines that offer daily eatable items, such as vegetables, snacks and cold drinks in residential apartments and offices by next month, he added.

Infusion of $150 million for BigBasket, which raised $300 million last year, comes at a time when both Walmart’s Flipkart and Amazon are increasingly expanding their grocery businesses in India.

Amazon Retail India, which operates Amazon Pantry and Prime Now services and has a presence in mire than 100 cities, is reportedly planning to expand its business in India. Flipkart Group CEO Kalyan Krishnamurthy said in an interview with the Economic Times last month that the e-commerce giant may pilot a fresh foods business soon. Last week, Flipkart was said to be in talks to acquire grocery chain Namdhari’s Fresh.

Parekh largely brushed off the challenge his company faces from Flipkart and Amazon at this stage, saying that “it is a very large market, and it is unlikely to be dominated by one single company for the simple reason of its complex nature.” Flipkart and Amazon may eventually get serious about this space, but so far their play with groceries is mostly an additional differentiation checkpoint, he said.

“The success in this business requires having the ability to build and manage a very complex supply chain across multiple categories such as vegetables, meat and beauty products among others. Our focus has been on building the supply chain, and also ensuring that we are able to deliver a very large assortment of products to consumers,” he added. He said BigBasket today offers the largest catalog and fastest delivery among any of its rivals.

Besides, BigBasket, which is increasingly growing its subscription business to supply milk and other daily eatables, is also inching closer to becoming financially stronger. Parekh said BigBasket expects to become operationally profitable in six to eight months. “The idea is that business by itself does not consume cash. If we use cash, it will be for investment in new businesses or scaling of existing businesses,” he said.

India’s retail market, valued at mire than $900 billion, is increasingly attracting the attention of VC funds. Since 2014, online retailers alone have participated in more than 163 financing rounds, clocking over $1.38 billion, analytics firm Tracxn told TechCrunch. More than 882 players are operational in the market, the firm said.

The challenge for BigBasket remains fighting a growing army of rivals, including hyperlocal delivery startups including Grofers, which raised $60 million earlier this year, unicorn Swiggy and Google-backed Dunzo, which is increasingly becoming a verb in urban Indian cities.

Powered by WPeMatico

Health coaching app developer Noom announced today that it has raised $58 million led by Sequoia Capital.

Other participants include Aglaé Ventures, the tech investment arm of French holding company Groupe Arnault, WhatsApp co-founder and former CEO Jan Koum, DoorDash co-founder and CEO Tony Xu, Oscar Health co-founder Josh Kushner, SB Project co-founder Scooter Braun and returning investor Samsung Ventures.

Headquartered in New York City with offices in Seoul and Tokyo, Noom is best known for its direct-to-consumer weight loss app, but it also develops enterprise products, including an app focused on diabetes and hypertension. Noom’s consumer app competes for users with Under Armour’s MyFitnessPal and Weight Watchers, but its closest rival is probably nutrition and weight loss app Rise because both offer personalized programs and coaching for a subscription fee.

Noom aims to set itself apart by focusing on long-term lifestyle and behavior changes, in addition to calorie, nutrition and exercise tracking. Users get access to 1:1 coaching and fitness programs personalized by an algorithm based on how they answer a questionnaire.

The company will use its new funding to hire more people for product development. In a press statement, Koum said he invested in Noom because it “has many of the same traits that helped WhatsApp disrupt the communications industry. Noom is so far ahead of the competition when it comes to technology, execution and brand recognition that it will be difficult for any company to catch up.”

Powered by WPeMatico

SendBird, a startup that enables developers to add messaging to their apps with a couple of lines of code, announced a secondary Series B investment of $50 million today. This additional funding comes on top of the $52 million, the company raised in February.

The new money was led by Tiger Global Management, with significant participation from Iconiq, the firm that led the initial Series B round. Today’s investment brings the total raised to more than $120 million, according to Crunchbase data.

This is a huge investment for a Series B-level company, and what appears to be driving such a large influx of cash is a fast-growing market with tremendous demand for user-to-user messaging inside apps. By offering this as an API service, developers can drop the capability into their apps without having to build it from scratch. It’s a similar value proposition as Twilio for communications or Stripe for payments.

As SendBird CEO John Kim told us in the first part of the Series B investment in February, his company is aiming to make it simple for developers to add in-app messaging:

We are a very flexible, fully customizable, white label messaging capability. We come with a fully managed infrastructure. So basically, you can log into any mobile applications or websites out there, and use our messaging capability.

Kim says today’s additional money comes at a time when his company is accelerating its go-to-market strategy. “Starting from marketing and sales, we are building the go-to-market engine to scale our global presence by hiring leaders in key areas of the business and building teams around those leaders. To accelerate this process, we’re working with our new investors for Series B, who have made many investments in our target markets and built strong connections there,” Kim told TechCrunch.

Founded in South Korea in 2013, SendBird has 98 employees, with headquarters in San Mateo, Calif. It was a member of the Y Combinator Winter 2016 class.

Powered by WPeMatico

Greetings from Seattle, the land of Amazon, Microsoft, two of the world’s richest men and some startups.

I’m always surprised the Seattle startup ecosystem hasn’t grown to compete with the likes of Silicon Valley — or at least Boston and New York City — since the dot-com boom. Today, it’s the strongest it’s been due to the successes of companies like the newly minted unicorn Outreach, trucking business Convoy and, of course, the dog walking startup Rover. But the city still lags behind, failing to adopt the culture of entrepreneurship that defines San Francisco.

I spent a lot of time wondering why it hasn’t reached its full potential. Is it because Microsoft and Amazon pay their employees so well they don’t have the same urge to build something from the ground up? Is it a lack of access to capital? Is the city not attracting top talent? If you have thoughts, send them my way.

“We think part of the issue is a lack of capital and a lack of help,” Rover and Pioneer Square Labs co-founder Greg Gottesman told TechCrunch earlier this year. “If we can provide a little bit of both of those things, we can really put Seattle where it deserves to be, should be and will be.”

Despite its shortcomings, there is still some action in the city I want to highlight this week. A same-day delivery business, Dolly, is on the rise. The startup told me on Thursday it had raised a $7.5 million round from Unlock Venture Partners, Maveron and Jeff Wilke, the chief executive officer of Amazon Worldwide Consumer. Maveron, if you remember, is the VC fund co-founded by Starbucks founder Howard Schultz.

In other Seattle news, Madrona Venture Group, a well-regarded fund, raised an additional $100 million this week. Typically, Madrona focuses on companies based in the Pacific Northwest, but this fund will deploy capital throughout the entire U.S. Hmmm, that’s not necessarily a good sign for Seattle founders, but great progress for the ecosystem nonetheless.

If you’re interested in learning more about Seattle tech, I’ve covered it a bit because it’s my hometown! Start with this story, which dives deep into a Seattle accelerator that’s working hard to encourage entrepreneurship in the city. Alright, on to other news.

Want more TechCrunch newsletters? Sign up here.

WeWork: The co-working giant now known as The We Company submitted confidential IPO documents to the SEC, the company confirmed in a press release Monday. Is this the next massive startup win or a house of cards waiting to be toppled by the glare of the public markets? TechCrunch’s Danny Crichton investigates.

Slack: The business is in its final steps toward a much-anticipated direct listing, with one source telling TechCrunch the listing will be complete within 45 days. The WSJ reported this week that Slack will make an online presentation to potential shareholders on May 13. This week, we dug deep into Slack’s S-1 and decided to evaluate just how well the tech press, us included, did in covering the company. For the most part, the tech press did decently well, except for one curious, $162 million gap.

Uber: Finally! That ride-hailing company is going public next week. That latest news? Uber co-founder Travis Kalanick won’t be ringing the opening bell. Uber would not be where it is today without Kalanick, but him being there would surely be a reminder of Uber’s rocky past.

Beyond Meat: Shares of the company surged up 135 percent in their market opener last week, valuing the company as high as $3.52 billion. Volatility was so high on the company’s stock that the Nasdaq had to pause trading of “BYND” shares.

Ofo has run into its fair share of issues, laying off hundreds of workers, shutting down its international division and more. Now, you can buy a piece of the startup’s history.

Now you can buy a piece of startup history… Ofo bikes for ~$60 https://t.co/LLJbDOXm0C

— Jon Russell (@jonrussell) April 29, 2019

In other micro-mobility news, Lyft’s head of scooter & bikes Liam O’Connor, who was hired to help transportation company Lyft build its bike and scooter operations, has left after seven months with the newly-public company. TechCrunch’s Ingrid Lunden has the scoop. Plus, Bird, the electric scooter unicorn doing its best to overcome regulatory barriers, has made its way back to San Francisco. Bird is using its business license in San Francisco to introduce monthly personal rentals in the city. The program enables people to rent a scooter for $24.99 a month with no cap on the number of rides. We’ll how that goes.

For some reason, people are giving Magic Leap more money. The company has secured another $280 million in a deal with Japan’s largest mobile operator, Docomo. Do you know what that means? The developer fo AR/VR headsets has raised a total of $2.6 billion. We’re just as confused as you.

Brand new venture capital funds:

Unshackled Ventures raised $20 million.

Exclusive: @UnshackledVC has a new $20M pre-seed fund to invest only in immigrants. Why? Because immigrants are “inherently more entrepreneurial:” https://t.co/ZLiZ1UczJV

— Kate Clark (@KateClarkTweets) May 2, 2019

Jungle Ventures closed on $175 million.

And Toyota AI Ventures launched a $100 million fund.

I have the inside story on Menlo Ventures early Uber stake and TechCrunch’s Connie Loizos goes deep with early Uber backer Bradley Tusk.

This week, we offer TechCrunch Extra Crunch subscribers exclusive tips on building extraordinary teams. Plus, the final piece in TechCrunch’s Greg Kumparak’s series on Niantic, the fast-growing developer of Pokemon Go. If you recall, we’ve captured much of Niantic’s ongoing story in the first three parts of our EC-1, from its beginnings as an “entrepreneurial lab” within Google, to its spin-out as an independent company and the launch of Pokémon GO, to its ongoing focus on becoming a platform for others to build augmented reality products upon.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and TechCrunch’s Danny Crichton chat about updates at the Vision Fund, Cheddar’s big exit and more of this week’s headlines.

Powered by WPeMatico

There’s a seemingly insatiable demand for Theranos content. John Carreyrou’s best-selling book, “Bad Blood,” has already inspired an HBO documentary, The Inventor; an ABC podcast called The Dropout, a prestige limited series starring SNL’s Kate McKinnon, was just announced; and Jennifer Lawrence is reportedly going to star in the feature film version of this tawdry “true crime meets tech” tale. That’s before getting started on the various and sundry cover stories and think pieces about her fraud.

I think it’s fair to say the Theranos story has been sufficiently well-documented, and I’m worried that this negative perception may be reinforced now that uBiome founder Jessica Richman has been placed on administrative leave. While it’s hard to pass on a chance to stoke startup schadenfreude, perhaps we could focus less on these rare, unrepresentative and dispiriting examples? Instead, Hollywood could put the spotlight on women who pioneered the bleeding edge of tech and actually produced billion-dollar successes. Here are a few candidates ready for their close-ups:

Judith Faulkner, founder and chief executive officer, Epic Systems

In the late 1970s, the picture of a working woman in Wisconsin was likely Laverne or Shirley. Little did anyone know that in the basement of a Victorian manse in Madison, the future of healthcare was being coded by Judith Faulkner, the founder and CEO of what would become Epic Systems. Epic is arguably the most impactful startup in the history of health software, and Faulkner was building medical scheduling software before most people could even picture a PC. Her efforts established the Electronic Medical Records market as we know it and today. Her company manages records for more than 200 million people, employs nearly 10,000 and generates around $2.7 billion per year in revenue — not bad for a math graduate who never raised any venture capital.

One might argue that the origins of medical software are too tepid to make for exciting TV, but something tells me the kind of CEO who hires Disney alums to design her corporate campus and dresses up like a wizard to address her employees might make for a compelling subject.

SANTA BARBARA, CA – FEBRUARY 09: Lynda Weinman speaks onstage (Photo by Rebecca Sapp/Getty Images for SBIFF)

Lynda Weinman might have the most esoteric path to becoming a billion-dollar entrepreneur in history. After getting a humanities degree from Evergreen College, where she was classmates with “Simpsons” creator Matt Groenig, Lynda opened a pair of punk rock fashion boutiques on LA’s Sunset Strip.

After those folded in the early 1980s, she taught herself enough computer graphics to become a freelance animator on movies like “Bill & Ted’s Excellent Adventure,” which in turn led to her becoming a teacher at the prestigious Art Center College of Design. Her academic pedigree provided the launching pad to write an influential textbook; that, in turn, gave her the star power to strike out on her own as one of the first web celebrities.

Keep in mind; this dramatic arc only covers the time before she started the eponymous Lynda.com, and bootstrapped it to a $1.5 billion exit in edtech — an industry most VCs and entrepreneurs fear to tread. In terms of material for a memoir, Hannah Horvath has nothing on Lynda Weinman.

FRAMINGHAM, MA – MAY 30: Shira Goodman, former chief executive at Staples, poses for a portrait in Framingham, MA on May 30, 2017 (Photo by Suzanne Kreiter/The Boston Globe via Getty Images)

Shira Goodman has arguably done more for online shopping in the U.S. than anyone not named Bezos. She didn’t found Staples, but she did start and scale its “delivery business,” as she humbly calls it, to the point where it became the fourth largest e-commerce company in the U.S.

At a time when more nimble startups were disrupting big-box retailers, Shira did what few of her contemporaries could do — rapidly shifted a multi-billion-dollar legacy company in an ancient industry into the future, and eventually became CEO of the entire enterprise. She did this while also raising three children and supporting her husband when he decided to change careers and go to Rabbinical school. Sitcoms have been premised on less, and since two versions of “The Office” have captivated audiences, perhaps it’s time to provide the perspective from the CEO of Dunder-Mifflin HQ?

Helen Greiner, co-founder, iRobot

From C. A. Rotwang in “Metropolis” to Tony Stark in the Marvel movies, there have been plenty of cinematic explorations of robot builders, but the story of iRobot co-founder Helen Greiner might be more interesting than anything yet committed to celluloid. As a recent grad from MIT, Greiner spent a substantial chunk of the 1990s applying her mechanical genius to everything from a mechatronic dinosaur for Disney to a store cleaning robot with the potential for mass destruction for SC Johnson.

Far from an ivory-tower academic, Grenier helped the government deploy search and rescue efforts at Ground Zero after 9/11 and cave-clearing ‘bots in Afghanistan, and the bomb-disposing Packbot she developed has saved the lives of thousands of service members. Grenier, at age 38, took her company public and made the Jetson’s vision of a robot housekeeper a reality in the form of the Roomba.

CAMBRIDGE, MA – MARCH 15: Kelsey Wirth, who has a grassroots organization called Mothers Out Front: Mobilizing For A Livable Climate (Photo by Essdras M Suarez/The Boston Globe via Getty Images)

While the original startup bros were inflating the tech bubble in the late 1990s, Kelsey Wirth was pioneering 3D printing, which at the time was as fantastical as anything Theranos promised. Wirth’s story as the co-founder of Align Technology is especially compelling in the way it shares some surface similarities with Holmes’ narrative. Prominent skeptics of Invisalign cast doubts on the company in its early days, noting that the startup’s PR had outstripped its clinical validation. Wirth had to solve seemingly intractable technical challenges, including scanning misaligned incisors, developing algorithms to overcome underbites, pioneering new manufacturing process, convincing the FDA to clear the product and then selling it across the country — armed only with an English lit degree and an MBA. Despite the long odds of curing crossbites with software, Wirth started what has become a publicly traded business that is currently worth more than 20 billion dollars.

Most of these founders faced setbacks, including external obstacles and those of their own making. There were layoffs, bad deals and few of these stories had perfectly happy endings. Still, while a contemporary startup can earn plaudits for simply repackaging CBD and pushing it on Facebook, these entrepreneurs demonstrated a level of ambition rarely seen among modern upstarts.

The sensational focus on Elizabeth Holmes’ misdeeds steal focus from a group of landmark female entrepreneurs and waste a tremendous opportunity to inspire the next generation with heroic tales instead of fables of fabrication. None of these accounts have the black and white morality of the Theranos debacle, but these founders cleared hurdles both scientific and social. They flipped the script and made history; surely Hollywood can find some drama in that.

Thanks to Parul Singh, Elizabeth Condon and Alyssa Rosenzweig for reviewing drafts of this post.

Powered by WPeMatico