Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

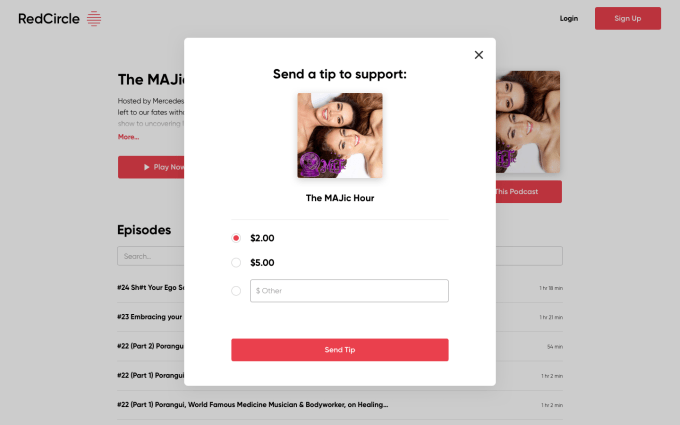

A group of former Uber employees unveiled their podcasting startup RedCircle last week, and now they’re already launching new features — specifically the ability for listeners to make small tip payments to podcasters.

RedCircle has created a web-based podcast player of its own, but CEO Michael Kadin (previously an engineering manager at Uber) said the mission isn’t to compete with other podcast apps. Instead the team aims to create the tools podcasters need to build a real business.

In fact, RedCircle is already offering some of those tools — like hosting and analytics — for free, and it also launched a cross-promotion marketplace where those podcasters can team up to try to grow each others’ audiences.

As for the new tipping feature, it appears as a button on the RedCircle player, allowing users to pay $2, $5 or a custom amount with just a few clicks (you’ll also need to enter your credit card info, of course). The startup can also automatically insert a tipping link into a podcast’s show notes, so listeners will find out about it regardless of the player they use.

Co-founder Jeremy Lermitte (a former Uber product manager) added that tipping provides a way for fans to compensate a podcaster for an episode they particularly enjoyed without making the long-term commitment of, say, signing up for a Patreon subscription.

“This allows you to engage at your own pace,” Lermitte said.

Podcasters can and do accept one-time payments via PayPal or Venmo, but Kadin said RedCircle offers more data about who’s making the payments, while also providing a 1099 form for taxes and “all the other things you want to turn this into a real thing, versus something casual.”

“The first thing podcasters say they need is to grow their audience,” he added. “The second thing is to make money from it. Now we’re working on both of those problems. Just give us another week and a half and we’ll make even more progress.”

RedCircle has raised a $1.5 million seed round led by Roy Bahat at Bloomberg Beta .

Powered by WPeMatico

Lora DiCarlo, a startup coupling robotics and sexual health, has $2 million to shove in the Consumer Electronics Show’s face.

The same day the company was set to announce their fundraise, The Consumer Technology Association, the event producer behind CES, decided to re-award the Bend, Oregon-based Lora DiCarlo with the innovation award it had revoked from the company ahead of this year’s big event.

In January, the CTA nullified the award it had granted the business, which is building a hands-free device that uses biomimicry and robotics to help people achieve a blended orgasm by simultaneously stimulating the G spot and the clitoris. Called Osé, the device uses micro-robotic technology to mimic the sensation of a human mouth, tongue and fingers in order to produce a blended orgasm for people with vaginas.

Lora DiCarlo’s debut product, Osé, set to release this fall. The company says the device is currently undergoing changes and may look different upon release.

“CTA did not handle this award properly,” CTA senior vice president of marketing and communications Jean Foster said in a statement released today. “This prompted some important conversations internally and with external advisors and we look forward to taking these learnings to continue to improve the show.”

Lora DiCarlo had applied for the CES Innovation Award back in September. In early October, the CTA notified the company of its award. Fast-forward to October 31, 2018 and CES Projects senior manager Brandon Moffett informed the company they had been disqualified. The press storm that followed only boosted Lora DiCarlo’s reputation, put Haddock at the top of the speakers’ circuit and proved, once again, that sexuality is still taboo at CES and that the gadget show has failed to adapt to the times.

In its original letter to Lora DiCarlo, obtained by TechCrunch, the CTA called the startup’s product “immoral, obscene, indecent, profane or not in keeping with the CTA’s image” and that it did “not fit into any of [its] existing product categories and should not have been accepted” to the awards program. CTA later apologized for the mishap before ultimately re-awarding the prize.

At the request of the CTA, Haddock and her team have been working with the organization to create a more inclusive show and better incorporate both sextech companies and women’s health businesses.

“We were a catalyst to a huge, resounding amount of support from a very large community of people who have been quietly thinking this is something that needs to happen,” Haddock told TechCrunch. “For us, it was all about timing.”

Lora DiCarlo plans to use its infusion of funding, provided by new and existing investors led by the Oregon Opportunity Zone Limited Partnership, to hire ahead of the release of its first product. Pre-orders for the Osé, which will retail for $290, will open this summer with an expected official release this fall.

Haddock said four other devices are in the pipeline, one specifically for clitoral stimulation, another for clitoral and vaginal stimulation, one for anywhere on the body and the other, she said, is a different approach to the way people with vulvas masturbate.

“We are aiming for that hands-free, human experience,” Haddock said. “We wanted to make something really interesting and very different and beautiful.”

Next year, Haddock says they plan to integrate their products with virtual reality, a step that will require a larger boost of capital.

Haddock and her employees don’t plan to quiet down any time soon. With their newfound fame, the team will continue supporting the expanding sextech industry and gender equity within tech generally.

“We’ve realized our social mission is so important,” Haddock said. “Gender equality, at its source, is about sex. We absolutely demonize sex and sexuality … When you talk about removing sexual stigmas, you are also talking about removing gender stigmas and creating gender equity.”

Powered by WPeMatico

Who would have thought Rent the Runway would emerge as a competitor to The Wing and all traditional brick-and-mortar retail?

Its newest store, complete with co-working space, shows it’s more than just a designer gown rental service. Shortly after landing a $125 million investment at a $1 billion valuation, Rent the Runway (RTR) has replanted roots in San Francisco, opening an 8,300 square foot West Coast flagship in the city’s Union Square neighborhood.

Located on 228 Grant Avenue, the store is RTR’s fifth and largest location yet. In addition to 3,000 pieces of merchandise curated daily, the store includes stylists, a coffee cart, space for evening programming and networking events, desk space for co-working, a beauty bar and some 20 dressing rooms.

“Think of it like your gym or your Starbucks; it’s part of what you do on a daily basis,” RTR chief operating officer Maureen Sullivan told TechCrunch.

RTR was founded in 2009 by Jenn Hyman and Jenny Fleiss as a website for renting expensive, designer dresses. Since then it’s expanded to become a fashion rental marketplace equipped with accessories, casual pieces and its bread and butter: formal wear.

The company’s core product, RTR Reserve, lets customers rent one piece of clothing for four to eight days with prices starting at $30 per garment. RTR Update, at $89 per month, gives customers access to up to four pieces of clothing per month. And finally, RTR Unlimited charges users $159 for unlimited swaps every month, meaning you get up to four pieces at a time but can visit a store daily and swap the pieces out, if you wanted.

Its new space is essentially The Wing with an enormous closet of designer clothing available to rent. RTR even used the same all-female design team that crafted The Wing’s spaces to create its newest spot, which mimics The Wing’s airy, West Elm-like vibe.

Of course, RTR isn’t trying to compete with co-working spaces or salons or coffee shops; rather, the team recognizes that sometimes women need to find beautiful clothes and get shit done simultaneously.

“Our subscriber is a busy working woman,” Sullivan said. “Sometimes she may want to come in and work.”

The new store was built for the 21st century tech-enabled consumer. A “physical manifestation of the shared closet,” the store’s technology allows customers to return rented items within a few seconds, check out with their RTR Pass on their phone and pick up orders without having to wait in line.

RTR currently operates physical stores in Chicago, New York, Woodland Hills, Calif. and Washington, DC. Sullivan says San Francisco is the company’s third largest market behind New York and DC.

RTR opened its first standalone location in San Francisco last year and quickly realized the space was too small for its expanding crowd of subscribers. While the service was intended to be all-digital, data collected by RTR indicated users wanted to try on clothes before they rented. With that in mind, RTR will continue to open additional stores and “experiment with its physical presence” in other ways, too.

“Data is at the heart of our company,” Sullivan said. “We aren’t a typical direct-to-consumer brand.”

RTR has raised a total of $521 million in debt and equity funding from Franklin Templeton Investments, T. Rowe Price, Female Founders Fund and others.

Powered by WPeMatico

One of China’s most ambitious artificial intelligence startups, Megvii, more commonly known for its facial recognition brand Face++, announced Wednesday that it has raised $750 million in a Series E funding round.

Founded by three graduates from the prestigious Tsinghua University in China, the eight-year-old company specializes in applying its computer vision solutions to a range of use cases such as public security and mobile payment. It competes with its fast-growing Chinese peers, including the world’s most valuable AI startup, SenseTime — also funded by Alibaba — and Sequoia-backed Yitu.

Bloomberg reported in January that Megvii was mulling to raise up to $1 billion through an initial public offering in Hong Kong. The new capital injection lifts the company’s valuation to just north of $4 billion as it gears up for its IPO later this year, sources told Reuters.

China is on track to overtake the United States in AI on various fronts. Buoyed by a handful of mega-rounds, Chinese AI startups accounted for 48 percent of all AI fundings in 2017, surpassing those in the U.S. for the first time, shows data collected by CB Insights. An analysis released in March by the Allen Institute for Artificial Intelligence found that China is rapidly closing in on the U.S. by the amount of AI research papers published and the influence thereof.

A critical caveat to China’s flourishing AI landscape is, as The New York Times and other publications have pointed out, the government’s use of the technology. While facial recognition has helped the police trace missing children and capture suspects, there have been concerns around its use as a surveillance tool.

Megvii’s new funding round arrives just days after a Human Rights Watch report listed it as a technology provider to the Integrated Joint Operations Platform, a police app allegedly used to collect detailed data from a largely Muslim minority group in China’s far west province of Xinjiang. Megvii denied any links to the IJOP database per a Bloomberg report.

Kai-Fu Lee, a world-renowned AI expert and investor who was Google’s former China head, warned that any country in the world has the capacity to abuse AI, adding that China also uses the technology to transform retail, education and urban traffic among other sectors.

Megvii has attracted a rank of big-name investors in and outside China to date. Participants in its Series E include Bank of China Group Investment Limited, the central bank’s wholly owned subsidiary focused on investments, and ICBC Asset Management (Global), the offshore investment subsidiary of the Industrial and Commercial Bank of China.

Foreign backers in the round include a wholly owned subsidiary of the Abu Dhabi Investment Authority, one of the world’s largest sovereign wealth funds, and Australian investment bank Macquarie Group.

Megvii says its fresh proceeds will go toward the commercialization of its AI services, recruitment and global expansion.

China has been exporting its advanced AI technologies to countries around the world. Megvii, according to a report by the South China Morning Post from last June, was in talks to bring its software to Thailand and Malaysia. Last year, Yitu opened its first overseas office in Singapore to deploy its intelligence solutions to partners in Southeast Asia. In a similar fashion, SenseTime landed in Japan by opening an autonomous driving test park this January.

“Megvii is a global AI technology leader and innovator with cutting-edge technologies, a scalable business model and a proven track record of monetization,” read a statement from Andrew Downe, Asia regional head of commodities and global markets at Macquarie Group. “We believe the commercialization of artificial intelligence is a long-term focus and is of great importance.”

Powered by WPeMatico

SoFi is one of the leading fintech startups to emerge from San Francisco and breach the financial markets. Originally started as a way to better finance student debt, it has since expanded to include products targeted at personal loans and home loans.

Today, the company announced a new exchange-traded fund (ETF) product focused on the gig economy. GIGE, which trades on Nasdaq, is an actively managed fund advised by Toroso Investments that allows investors to capitalize on this hot sector of the economy. Toroso offers a range of services around creating and managing ETFs.

The company also announced the creation of an ETF focused on high-growth stocks. That ETF, which trades as SFYF on the NYSE, is designed to identify and capture the growth of the top 50 of the 1,000 largest publicly traded issues.

It has formerly used that growth focus to create two ETFs, targeting 500 high-growth companies under the trading name SFY and a product it called “SoFi Next 500 ETF,” which trades under SFYX, both of which have no management fees.

SoFi’s SFYF fund is composed specifically of public companies that show the strongest growth on three key metrics: top-line revenue growth, net income growth and forward-looking consensus estimates of net income growth.

For its GIGE fund, SoFi defines the “gig economy” as a group of companies that “embrace and support the workforce in which employment is based around short-term engagements that allow for flexibility and personal freedom and temporary contracts.”

SoFi’s new funds add value to investors primarily through providing 1) access to industry disruptors at 2) an earlier-stage point in their growth cycle.

In recent years, more and more investors have been trying to get a piece of the hottest tech companies earlier with a growing number of traditional institutional investors now dipping their toes into startup and tech investing.

Furthermore, a number of platforms and funds were launched to support the high-demand for access to some of the top public and private companies and major disruptive trends, including funds focused on themes such as artificial intelligence, big data, cybersecurity or the next manufacturing revolution.

SoFi argues that its GIGE fund offers compelling value due to the speed at which it offers investors access to new equity issues, as the fund is structured so that most post-IPO companies can join the GIGE within 31 days of IPO, relative to the 60-90 days traditional passive funds that often have to wait to add a newly IPO’d company.

Additionally, because SoFi’s GIGE fund is actively managed, SoFi is also offering fund investors access to experienced asset managers and an alternative to algorithmic, machine-led passive funds that have increasingly dominated the capital markets.

“Our members are excited by high-growth and gig economy companies because these companies are in many cases part of their lives,” said SoFi CEO Anthony Noto in a press release. “We’re giving our members a way to get started investing by buying what they know and investing in themselves.”

The announcement is the company’s latest step in its attempt to further establish itself under the new guard of CEO Anthony Noto, formerly of Goldman Sachs, who replaced former head Michael Cagney in 2018, as the company looks to move further away from dark clouds in its past established by lawsuits, sexual harassment claims, FTC penalties and chunky rounds of layoffs. In the past week, the company also announced that CMO and former COO, Joanne Bradford, will be leaving the company at the end of May, though the split was reportedly long-planned and amicable.

The launch of SoFi’s new investment products also comes just weeks after the company was reportedly in discussions to raise $500 million from the Qatar Investment Authority.

To date, SoFi has raised roughly $2 billion in venture capital, according to data from Crunchbase, with backing from a number of Silicon Valley and Wall Street heavy hitters, including SoftBank, Silver Lake Partners, Morgan Stanley, Founders Fund and a host of others.

Already at a valuation of nearly $4.5 billion, according to PitchBook, SoFi appears well on its way to an eventual IPO. Noto, however, noted in a recent interview with Yahoo Finance that “an IPO is not a priority at this point” for SoFi as the company remains focused on executing on a high-quality sustainable growth path.

Powered by WPeMatico

HeyJobs, a three-year-old Berlin startup that helps large employers scale recruitment, has raised $12 million in Series A funding.

The round is led by Notion Capital, with participation from existing investors Creathor Ventures, Rocket Internet’s GFC and newly re-branded Heartcore Capital.

Founded in 2016 and launched the following year, HeyJobs aims to tackle the recruitment problem European employers are facing due to steep declines in available workforce as the so-called the “boomer” generation nears retirement (this is seeing Germany alone losing 500,000 workers annually, apparently).

The HeyJobs platform leverages machine learning in an attempt to make high-skilled recruitment more scalable. It promises to match talent with job profiles and draw in the best candidates via targeted marketing and a “personalized application and assessment flow.”

“We use a fully automated technological approach to help candidates find jobs and companies find employees,” says HeyJobs co-founder and CEO Marius Luther.

“For example, we deploy multiple machine learning algorithms to find the right potential candidates for a specific role (asking ‘who are the most likely candidates for an intensive care nurse role in East London?’). Our technology then makes sure candidates see the job proposal on channels such as Facebook, Instagram, job platforms and across the web.”

In addition, Luther says that HeyJobs’ personalized assessment ensures that the company only delivers to employers high-quality, hireable candidates, something he dubs as “predictable hiring” at scale.

“Our clients are typically the talent acquisition teams of employers with high-volume recruitment needs,” he explains. “In Germany, 8/10 largest employers (by headcount) are our clients. Typical industries would be logistics (i.e. DPD, UPS), retail (i.e. Vodafone) and hospitality (i.e. h-hotels, Five Guys). However our real customer is the non-academic job seeker who is looking for a job that will help him/her live a more fulfilling life — be it by being paid more, switching to better employment conditions or finding a job closer to home.”

To that end, HeyJobs says it is now serving more than 500 enterprise clients, including United Parcel Service, PayPal, Five Guys, Vodafone and Securitas. The company generates revenue via a range of business models, from subscription to per-hire success fees.

“The cost per hire is typically a fraction of what clients would pay job boards on a per-post basis or what they would pay to staffing firms on a per-hire basis,” adds the HeyJobs CEO.

Powered by WPeMatico

Indian edtech startup CollegeDekho, which helps students connect with prospective colleges and keep track of exams, has raised $8 million in a Series B round.

The new financing round for the four-year-old Gurgaon-based startup was led by its parent company GirnarSoft Education and London-based private equity investor Man Capital, which also participated in the startup’s Series A round last year.

Ruchir Arora, founder and CEO of CollegeDekho, told TechCrunch in an interview that the startup will use the capital to expand its presence in more schools and also begin connecting students with international educational institutions. The startup, which has raised $13 million to date, will also ramp up its research and development efforts.

CollegeDekho, Hindi for search for college, maintains a website that helps students identify the right career choices for them. The website has a chatbot that answers some of the questions students have while logging their responses, and other activities such as the kind of colleges they are searching for, their preferred location and budget.

Arora said the startup, which also has about 3,000 call center representatives and counselors, builds profiles of students to make college recommendations. He said each month the site observes more than five million sessions from students. Last year, more than 8,000 students used CollegeDekho to take admission in a college.

Parents in India, a country of 1.3 billion people with not the best literacy record, see education as an upward mobility for their children. Each year, more than six to seven million students go to a college. But because of a range of factors that can include cultural stigma, many students end up choosing the wrong path and thus don’t excel in college. Indeed, many students ultimately don’t pursue the subject they are best suited for, Arora said, and that’s where CollegeDekho aims to make an impact.

Most high school students in India often gravitate toward engineering or medical college, as a result of which, each year India produces many engineers and doctors who struggle for years to find a job. Arora said his startup looks at more than 2,000 career paths a student could pursue.

What works in favor of Arora is that the country will continue to turn out millions of students each year who will be looking to go to a college soon. It also helps that CollegeDekho is operationally profitable, Arora said, adding that it generates about $3.2 million in revenue in a year. Any additional cash the startup raises will go into its expansion, he said.

CollegeDekho charges a nominal fee from students, and also takes a cut when they join a college. More than 36,000 educational institutes are listed on CollegeDekho. The startup also works with more than 400 colleges to conduct an exam for direct admission, and there too it earns a cut.

India’s education market, estimated to grow to $5.7 billion by next year, has emerged as a lucrative opportunity for startups and VCs alike. Bangalore-based Byju’s, which helps millions of students in India prepare for competitive exams, raised $540 million from Naspers and others late last year. Unacademy, which like Byju’s offers online tutoring to students, has raised more than $38.5 million to date.

A legion of other education startups today are vying for the attention of students in the nation. Noida-based AskIITians, not too far from the offices of CollegeDekho, aims to help school-going students prepare for medical and engineering exams. Extramarks, also based in Noida, operates in the same space as AskIITians. Reliance Industries, owned and controlled by India’s richest man, Mukesh Ambani, bought a 38.5% stake in the startup three years ago.

Powered by WPeMatico

In 2019, it’s estimated that every minute there are 150 new websites coming online. While many of these won’t be long-term ventures, a large percentage will eventually find themselves looking to organic search engine traffic to grow their reach.

This invariably leads people to the task of keyword research; uncovering the search terms most likely to result in prospective customers.

With increased competition it’s imperative you don’t just focus on the traditional sources of keyword inspiration that every other business uses.

In the past year alone I’ve personally helped hundreds of business owners grow search engine traffic to their websites. This responsibility drives me to succeed in one key area: Finding relevant search terms to target that their competitors have likely missed.

In this article, I will highlight some of the most overlooked ideas and sources of data to reveal words and phrases relevant to your business that are high in intent but lacking in competition.

If you can find the keywords your audience are searching for, but your competitors haven’t found, you can leverage a huge advantage to increase traffic and engagement on your content.

Google is constantly improving their ability to understand searcher intent. That is, they know what people are looking for and the results that will satisfy those searches.

When it comes to any industry that offers products or services, one of the most common search queries is often some variation of “best [industry] [services / products]”.

Powered by WPeMatico

As medical devices move to networked technologies, securing those devices becomes increasingly important.

Regulators, seemingly late to the threat that unsecured medical devices posed, only began requiring protections for medical devices like pacemakers and insulin pumps two years ago, and since then new technology companies have leapt into the breach to begin providing security services for the healthcare industry.

Most recently, MedCrypt, a graduate from the most recent batch of Y Combinator companies, raised $5.3 million in a new round of funding, from investors led by Section 32, the investment firm founded by former Google Ventures partner Bill Maris.

Joining Maris’ firm were previous investors Eniac Ventures and Y Combinator itself.

“Internet-connected medical technology is entering the market at light speed, calling for devices to be secure by design, which leads to a heightened level of patient safety at all times,” said MedCrypt chief executive Mike Kijewski in a statement.

Securing patient data has been a longtime requirement for health technology companies, but both patient records and hospital networks are dangerously vulnerable to cyberattacks.

In 2018, more than 6 million patient records in the U.S. were exposed thanks to network intrusions and cyberattacks, according to the publication Health IT Security. And those were just in the 10 largest security breaches.

The healthcare industry has only managed to achieve 72% compliance with the HIPAA Security Rule for protecting patient data, according to an April report from CynergisTek.

Investors have recognized the problem and are investing more into companies focused on the healthcare market specifically. MedCrypt’s competition for these security dollars include companies like Medigate, which raised $15 million earlier this year.

While Medigate focuses on network security, MedCrypt is focused on securing devices themselves. Both security functions are critical, according to investors.

“With regulators appropriately taking a hard look at medical device security and the sheer growth in the number of devices being added to already complex clinical networks,” there is a significant opportunity for companies tackling medical device security, according to a statement from Dr. Jonathan Root, who has led several IT-enabled healthcare investments for USVP.

Powered by WPeMatico

Shape Security has been helping big companies stay safe from fraudulent activities like password reuse and bot traffic on their publicly facing websites and apps. The company now wants to help smaller companies have that same type of protection, and today it announced a new cloud service called Connect aimed at that market.

“We’re an enterprise-focused company that protects the majority of large U.S. banks, the majority of the largest airlines, similar kinds of profiles with major retailers, hotel chains, government agencies and so on. We specifically protect them against automated fraud and abuse on their consumer-facing applications — their websites and their mobile apps,” Shuman Ghosemajumder, Shape Security CTO explained.

The company has taken that same type of protection and packaged it for smaller businesses. “What we’re doing with the new product, which is called Connect, is automating those aspects which we have provided with the high-end [product], and are making it easier to deploy and run,” Ghosemajumder said.

He said that they get protection against the same kind of high-end, automated fraud that the large enterprise customers get, as well as protection against DDoS attacks, scraping and so on.

The company is best known for stopping the act of credential stuffing, a sophisticated kind of strike where attackers continually try to get onto a website or app using stolen usernames and passwords. In addition, they tend to use a variety of computers and IP addresses to mask the attack. In fact, Sumit Agarwal, who is co-founder and chief operating officer at Shape, coined the term when he was working at the Department of Defense in a previous position before he helped launch the company.

A product like Connect can help expand Shape’s market by moving beyond the large enterprises that have been its primary target up until now. While it provides a similar level of service, it delivers it in a way that makes it easier for these smaller organizations to consume, while still enabling them to take advantage of the advanced security techniques that would typically be out of their reach.

Shape Security was founded in 2011, but spent several years developing the core product before emerging from Stealth in 2014. It currently has 300 employees and has raised $132 million, according to Crunchbase data. The most recent round was $26 million in November.

Powered by WPeMatico