Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to Startups Weekly, a newsletter published every Saturday that dives into the week’s noteworthy venture capital deals, funds and trends. Before I dive into this week’s topic, let’s catch up a bit. Last week, I wrote about the sudden uptick in beverage startup rounds. Before that, I noted an alternative to venture capital fundraising called revenue-based financing. Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets.

Here’s what I’ve been thinking about this week: Unicorn scarcity, or lack thereof. I’ve written about this concept before, as has my Equity co-host, Crunchbase News editor-in-chief Alex Wilhelm. I apologize if the two of us are broken records, but I think we’re equally perplexed by the pace at which companies are garnering $1 billion valuations.

Here’s the latest data, according to Crunchbase: “2018 outstripped all previous years in terms of the number of unicorns created and venture dollars invested. Indeed, 151 new unicorns joined the list in 2018 (compared to 96 in 2017), and investors poured more than $135 billion into those companies, a 52% increase year-over-year and the biggest sum invested in unicorns in any one year since unicorns became a thing.”

2019 has already coined 42 new unicorns, like Glossier, Calm and Hims, a number that grows each and every week. For context, a total of 19 companies joined the unicorn club in 2013 when Aileen Lee, an established investor, coined the term. Today, there are some 450 companies around the globe that qualify as unicorns, representing a cumulative valuation of $1.6 trillion.

We’ve clung to this fantastical terminology for so many years because it helps us classify startups, singling out those that boast valuations so high, they’ve gained entry to a special, elite club. In 2019, however, $100 million-plus rounds are the norm and billion-dollar-plus funds are standard. Unicorns aren’t rare anymore; it’s time to rethink the unicorn framework.

Petition to stop using the term “unicorn” unless the company is valued at more than $1 billion *and* profitable.

— Kate Clark (@KateClarkTweets) May 22, 2019

Last week, I suggested we only refer to profitable companies with a valuation larger than $1 billion as unicorns. Understandably, not everyone was too keen on that idea. Why? Because startups in different sectors face barriers of varying proportions. A SaaS company, for example, is likely to achieve profitability a lot quicker than a moonshot bet on autonomous vehicles or virtual reality. Refusing startups that aren’t yet profitable access to the unicorn club would unfairly favor certain industries.

So what can we do? Perhaps we increase the valuation minimum necessary to be called a unicorn to $10 billion? Initialized Capital’s Garry Tan’s idea was to require a startup have 50% annual growth to be considered a unicorn, though that would be near-impossible to get them to disclose…

While I’m here, let me share a few of the other eclectic responses I received following the above tweet. Joseph Flaherty said we should call profitable billion-dollar companies Pegasus “since [they’ve] taken flight.” Reagan Pollack thinks profitable startups oughta be referred to as leprechauns. Hmmmm.

The suggestions didn’t stop there. Though I’m not so sure adopting monikers like Pegasus and leprechaun will really solve the unicorn overpopulation problem. Let me know what you think. Onto other news.

Image by Rafael Henrique/SOPA Images/LightRocket via Getty Images

CrowdStrike has set its IPO terms. The company has inked plans to sell 18 million shares at between $19 and $23 apiece. At a midpoint price, CrowdStrike will raise $378 million at a valuation north of $4 billion.

Slack inches closer to direct listing. The company released updated first-quarter financials on Friday, posting revenues of $134.8 million on losses of $31.8 million. That represents a 67% increase in revenues from the same period last year when the company lost $24.8 million on $80.9 million in revenue.

Online lender SoFi has quietly raised $500M led by Qatar

Groupon co-founder Eric Lefkofsky just-raised another $200M for his new company Tempus

Less than 1 year after launching, Brex eyes $2B valuation

Password manager Dashlane raises $110M Series D

Enterprise cybersecurity startup BlueVoyant raises $82.5M at a $430M valuation

Talkspace picks up $50M Series D

TaniGroup raises $10M to help Indonesia’s farmers grow

Stripe and Precursor lead $4.5M seed into media CRM startup Pico

Maveron, a venture capital fund co-founded by Starbucks mastermind Howard Schultz, has closed on another $180 million to invest in early-stage consumer startups. The capital represents the firm’s seventh fundraise and largest since 2000. To keep the fund from reaching mammoth proportions, the firm’s general partners said they turned away more than $70 million amid high demand for the effort. There’s more where that came from, here’s a quick look at the other VCs to announce funds this week:

This week, I penned a deep dive on Slack, formerly known as Tiny Speck, for our premium subscription service Extra Crunch. The story kicks off in 2009 when Stewart Butterfield began building a startup called Tiny Speck that would later come out with Glitch, an online game that was neither fun nor successful. The story ends in 2019, weeks before Slack is set to begin trading on the NYSE. Come for the history lesson, stay for the investor drama. Here are the other standout EC pieces of the week.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I debate whether the tech press is too negative or too positive in its coverage of tech startups. Plus, we dive into Brex’s upcoming round, SoFi’s massive raise and CrowdStrike’s imminent IPO.

Powered by WPeMatico

When serial entrepreneur Eric Lefkofsky grows a company, he puts the pedal to the metal. When in 2011 his last company, the Chicago-based coupons site Groupon, raised $950 million from investors, it was the largest amount raised by a startup, ever. It was just over three years old at the time, and it went public later that same year.

Lefkofsky seems to be stealing a page from the same playbook for his newest company, Tempus. The Chicago-based genomic testing and data analysis company was founded a little more than three years ago, yet it has already hired nearly 700 employees and raised more than $500 million — including through a new $200 million round that values the company at $3.1 billion.

According to the Chicago Tribune, that new valuation makes it — as Groupon once was — one of Chicago’s most highly valued privately held companies.

So why all the fuss? As the Tribune explains it, Tempus has built a platform to collect, structure and analyze the clinical data that’s often unorganized in electronic medical record systems. The company also generates genomic data by sequencing patient DNA and other information in its lab.

The goal is to help doctors create customized treatments for each individual patient, Lefkofsky tells the paper.

So far, it has partnered with numerous cancer treatment centers that are apparently giving Tempus human data from which to learn. Tempus is also generating data “in vitro,” as is another company we featured recently called Insitro, a drug development startup founded by famed AI researcher Daphne Koller. With Insitro, it is working on a liver disease treatment owing to a tie-up with Gilead, which has amassed related human data over the years from which Insitro can use to learn. As a complementary data source, Insitro, like Tempus, is trying to learn what the disease does in a “dish,” then determine if it can use what it observes using machine learning to predict what it sees in people.

Tempus hasn’t come up with any cancer-related cures yet, but Lefkofsky already says that Tempus wants to expand into diabetes and depression, too.

In the meantime, he tells Crain’s Chicago Business that Tempus is already generating “significant” revenue. “Our oldest partners, have, in most cases, now expanded to different subgroups (of cancer). What we’re doing is working.”

Investors in the latest round include Baillie Gifford; Revolution Growth; New Enterprise Associates; funds and accounts managed by T. Rowe Price; Novo Holdings; and the investment management company Franklin Templeton.

Powered by WPeMatico

Jumia may be the first startup you’ve heard of from Africa. But the e-commerce venture that recently listed on the NYSE is definitely not the first or last word in African tech.

The continent has an expansive digital innovation scene, the components of which are intersecting rapidly across Africa’s 54 countries and 1.2 billion people.

When measured by monetary values, Africa’s tech ecosystem is tiny by Shenzen or Silicon Valley standards.

But when you look at volumes and year over year expansion in VC, startup formation, and tech hubs, it’s one of the fastest growing tech markets in the world. In 2017, the continent also saw the largest global increase in internet users—20 percent.

If you’re a VC or founder in London, Bangalore, or San Francisco, you’ll likely interact with some part of Africa’s tech landscape for the first time—or more—in the near future.

That’s why TechCrunch put together this Extra-Crunch deep-dive on Africa’s technology sector.

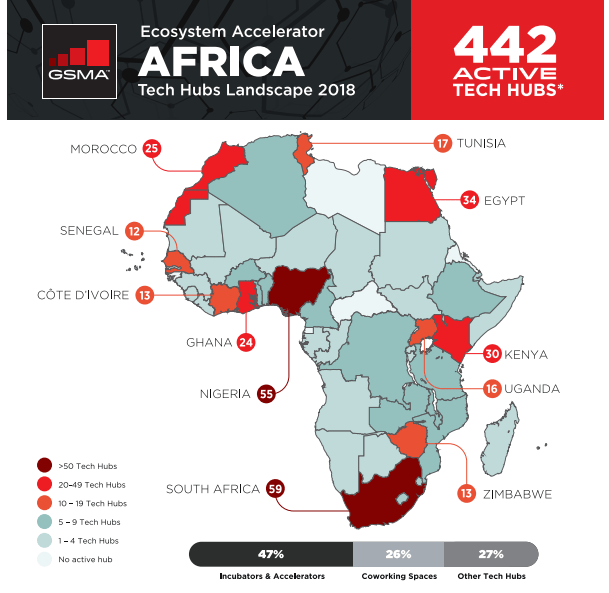

A foundation for African tech is the continent’s 442 active hubs, accelerators, and incubators (as tallied by GSMA). These spaces have become focal points for startup formation, digital skills building, events, and IT activity on the continent.

Prominent tech hubs in Africa include CcHub in Nigeria, Pan-African incubator MEST, and Kenya’s iHub, with over 200 resident members. More of these organizations are receiving funds from DFIs, such as the World Bank, and aid agencies, including France’s $76 million African tech fund.

Prominent tech hubs in Africa include CcHub in Nigeria, Pan-African incubator MEST, and Kenya’s iHub, with over 200 resident members. More of these organizations are receiving funds from DFIs, such as the World Bank, and aid agencies, including France’s $76 million African tech fund.

Blue-chip companies such as Google and Microsoft are also providing money and support. In 2018 Facebook opened its own Hub_NG in Lagos with partner CcHub, to foster startups using AI and machine learning.

Powered by WPeMatico

After a decade in the peculiar world of venture capital, Andreessen Horowitz managing director Scott Kupor has seen it all when it comes to the dos and don’ts for dealing with Valley VCs and company building. In his new book Secrets of Sand Hill Road (available on June 3), Scott offers up an updated guide on what VCs actually do, how they think and how founders should engage with them.

TechCrunch’s Silicon Valley editor Connie Loizos will be sitting down with Scott for an exclusive conversation on Tuesday, June 4 at 11:00 am PT. Scott, Connie and Extra Crunch members will be digging into the key takeaways from Scott’s book, his experience in the Valley and the opportunities that excite him most today.

Tune in to join the conversation and for the opportunity to ask Scott and Connie any and all things venture.

To listen to this and all future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Powered by WPeMatico

According to the startups at Factory Berlin, it’s not just another co-working space. After all, the company took its name from Andy Warhol’s famous factory in New York City, and it describes itself as “Europe’s largest club for startups.”

Late last year, we toured Factory Berlin’s five-story, 14,000-square-meter location in Görlitzer Park. Yes, it’s a building where startups can rent workspace, but as part of the tour, we had a chance to talk to several entrepreneurs, and everyone described it as a real community.

“Being part of the community, to us, means not isolating ourselves from the outer world,” said Code University founder Tom Bachem. “Or especially in Berlin, from the great startup ecosystem that we have — but instead, really deeply integrating into it.”

Similarly, Neel Popat of Donut pointed to the Factory’s blockchain events and showcases as a major benefit, while Kip Carter of New School said his team has used the Factory messaging app to find experts who can work with New School’s kids.

And |Pipe| founder and CEO Simon Hossell said it’s been a great base for entrepreneurs who aren’t from Berlin: “It’s the fact that you know although you may be a stranger or a foreigner in a new city, there’s always a group of people — like-minded, smart, intelligent individuals around you that are always there to help and encourage.”

Powered by WPeMatico

For a cybersecurity company, Bugcrowd relies much more on people than it does on technology.

For as long as humans are writing software, developers and programmers are going to make mistakes, said Casey Ellis, the company’s founder and chief technology officer in an interview TechCrunch from his San Francisco headquarters.

“Cybersecurity is fundamentally a people problem,” he said. “Humans are actually the root of the problem,” he said. And when humans made coding mistakes that turn into bugs or vulnerabilities that be exploited, that’s where Bugcrowd comes in — by trying to mitigate the fallout before they can be maliciously exploited.

Founded in 2011, Bugcrowd is one of the largest bug bounty and vulnerability disclosure companies on the internet today. The company relies on bug finders, hackers, and security researchers to find and privately report security flaws that could damage systems or putting user data at risk.

Bugcrowd acts as an intermediary by passing the bug to the companies to get fixed — potentially helping them to dodge a future security headache like a leak or a breach — in return for payout to the finder.

The greater the vulnerability, the higher the payout.

“The space we’re in is brokering conversations between different groups of people that don’t necessarily have a good history of getting along but desperately need to talk to each other,” said Ellis.

Powered by WPeMatico

Foursquare just made its first acquisition. The location tech company has acquired Placed from Snap Inc. on the heels of a fresh $150 million investment led by The Raine Group. The terms of the deal were not disclosed. Placed founder and CEO David Shim will become president of Foursquare.

Placed is the biggest competitor to Foursquare’s Attribution product, which allows brands to track the physical impact (foot traffic to store) of a digital campaign or ad. Up until now, Placed and Attribution by Foursquare combined have measured more than $3 billion in ad-to-store visits.

Placed launched in 2011 and raised $13.4 million (according to Crunchbase) before being acquired by Snap Inc. in 2017.

As part of the deal with Foursquare, the company’s Attribution product will henceforth be known as Placed powered by Foursquare. The acquisition also means that Placed powered by Foursquare will have more than 450 measureable media partners, including Twitter, Snap, Pandora and Waze. Moreover, more than 50% of the Fortune 100 are partnered with Placed or Foursquare.

It’s also worth noting that this latest investment of $150 million is the biggest financing round for Foursquare ever, and comes following a $33 million Series F last year.

Here’s what Foursquare CEO Jeff Glueck had to say about the financing in a prepared statement:

This is one of the largest investments ever in the location tech space. The investment will fund our acquisition and also capitalize us for our increased R&D and expansion plans, allowing us to focus on our mission to build the world’s most trusted, independent location technology platform.

That last bit, about an independent location technology platform, is important here. Foursquare is 10 years old and has transformed from a consumer-facing location check-in app — a game, really — into a location analytics and development platform.

Indeed, when Glueck paints his vision for the company, he lists five key areas of focus:

You’ll notice that its consumer apps, Foursquare and Swarm, are at the bottom of the list. But that’s because Foursquare’s real technological and strategic advantage isn’t in building the best social platform. In fact, Glueck said that more than 90% of the company’s revenue came from the enterprise side of the business. Foursquare’s advantage is in the accuracy of its technology, as afforded by the decade of data that has come from Foursquare, Swarm and the users who have expressly verified their location.

The Pilgrim SDK fits into that top item on the list: developer tools. The Pilgrim SDK allows developers to embed location-smart experiences and notifications into their apps and services. But it also expands Foursquare’s access to data from beyond its own apps to the greater ecosystem, yielding the data it needs to power analytics tools for brands and publishers.

With this acquisition, Placed will be able to leverage Foursquare’s existing map of 105 million places of interest across 190 countries, as well as tap into the measured U.S. audience of more than 100 million monthly devices:

Foursquare and Placed share a similar philosophy of building against a truth set of real consumer responses. Getting real people to confirm the name of their location is the only way to know if your technology is accurate or not. Placed has leveraged over 135 million survey responses in its first-party Placed survey apps, all from consumers opted-in to its rewards app. Foursquare expands the truth set for machine learning exponentially by adding in our over 13 billion consumer confirmations.

The hope is that Foursquare is accurate enough to become the de facto location analytics and services company for measuring ad spend. With enough scale, that may allow the company to break into the walled gardens where most of that ad spend is going: Facebook and Google.

Of course, to win as the “world’s most trusted, independent location technology platform,” consumers have to trust the platform. After all, one’s location may be the most sensitive piece of data about them. Foursquare has taken steps to be clear about what its technology is capable of. In fact, at SXSW this year, Foursquare offered a limited run of a product called Hypertrending, which was essentially an anonymized view of real-time location data showing activity in the Austin area.

Here’s what executive chairman and co-founder Dennis Crowley had to say at the time:

We feel the general trend with internet and technology companies these days has been to keep giving users a more and more personalized (albeit opaquely personalized) view of the world, while the companies that create these feeds keep the broad “God View” to themselves. Hypertrending is one example of how we can take Foursquare’s aggregate view of the world and make it available to the users who make it what it is. This is what we mean when we talk about “transparency” – we want to be honest, in public, about what our technology can do, how it works, and the specific design decisions we made in creating it.

With regards to today’s acquisition of Placed, Jeff Glueck had this to say:

Both companies also share a commitment to privacy and consumers being in control. Our Foursquare credo of “data as a privilege” only deepens as our company expands. We believe location should only be shared when consumers can see real value and visible benefits driven by location. We remain dedicated to elevating the industry through respect for transparency, user control, and instituting layers of privacy safeguards.

This new financing brings Foursquare’s total funding to $390.4 million.

Powered by WPeMatico

Let’s rewind a decade. It’s 2009. Vancouver, Canada.

Stewart Butterfield, known already for his part in building Flickr, a photo-sharing service acquired by Yahoo in 2005, decided to try his hand — again — at building a game. Flickr had been a failed attempt at a game called Game Neverending followed by a big pivot. This time, Butterfield would make it work.

To make his dreams a reality, he joined forces with Flickr’s original chief software architect Cal Henderson, as well as former Flickr employees Eric Costello and Serguei Mourachov, who like himself, had served some time at Yahoo after the acquisition. Together, they would build Tiny Speck, the company behind an artful, non-combat massively multiplayer online game.

Years later, Butterfield would pull off a pivot more massive than his last. Slack, born from the ashes of his fantastical game, would lead a shift toward online productivity tools that fundamentally change the way people work.

In mid-2009, former TechCrunch reporter-turned-venture-capitalist M.G. Siegler wrote one of the first stories on Butterfield’s mysterious startup plans.

“So what is Tiny Speck all about?” Siegler wrote. “That is still not entirely clear. The word on the street has been that it’s some kind of new social gaming endeavor, but all they’ll say on the site is ‘we are working on something huge and fun and we need help.’”

Maybe I make a terrible boss, but at least I know it. Work with me: http://tinyspeck.com/jobs/cptl/

— Stewart Butterfield (@stewart) July 10, 2009

Siegler would go on to invest in Slack as a general partner at GV, the venture capital arm of Alphabet .

“Clearly this is a creative project,” Siegler added. “It almost sounds like they’re making an animated movie. As awesome as that would be, with people like Henderson on board, you can bet there’s impressive engineering going on to turn this all into a game of some sort (if that is in fact what this is all about).”

After months of speculation, Tiny Speck unveiled its project: Glitch, an online game set inside the brains of 11 giants. It would be free with in-game purchases available and eventually, a paid subscription for power users.

Powered by WPeMatico

Chinese tech giant Alibaba is doubling down on India’s burgeoning video market, looking to fight back local rival ByteDance, Google and Disney to gain its foothold in the nation. The company said today that it is pumping $100 million into Vmate, a three-year-old social video app owned by subsidiary UC Web.

Vmate was launched as a video streaming and short-video-sharing app in 2016. But in the years since, it has added features such as video downloads and 3-dimensional face emojis to expand its use cases. It has amassed 30 million users globally, and will use the capital to scale its business in India, the company told TechCrunch. Alibaba Group did not respond to TechCrunch’s questions about its ownership of the app.

The move comes as Alibaba revives its attempts to take on the growing social video apps market, something on which it has missed out completely in China. Vmate could potentially help it fill the gap in India. Many of the features Vmate offers are similar to those offered by ByteDance’s TikTok, which currently has more than 120 million active users in India. ByteDance, with a valuation of about $75 billion, has grown its business without taking money from either Alibaba or Tencent, the latter of which has launched its own TikTok-like apps with limited success.

Alibaba remains one of the biggest global investors in India’s e-commerce and food-tech markets. It has heavily invested in Paytm, BigBasket, Zomato and Snapdeal. It was also supposedly planning to launch a video streaming service in India last year — a rumor that was fueled after it acquired a majority stake in TicketNew, a Chennai-based online ticketing service.

UC Web, a subsidiary of Alibaba Group, also counts India as one of its biggest markets. The browser maker has attempted to become a super app in India in recent years by including news and videos. In the last two years, it has been in talks with several bloggers and small publishers to host their articles directly on its platform, many people involved in the project told TechCrunch.

UC Web’s eponymous browser rose to stardom in the days of feature phones, but has since lost the lion’s share to Google Chrome as smartphones become more ubiquitous. Chrome ships as the default browser on most Android smartphones.

The major investment by Alibaba Group also serves as a testament to the growing popularity of video apps in India. Once cautious about each megabyte they spent on the internet, thrifty Indians have become heavy video consumers online as mobile data gets significantly cheaper in the country. Video apps are increasingly climbing up the charts on Google Play Store.

In an event for marketers late last year, YouTube said that India was the only nation where it had more unique users than its parent company Google. The video juggernaut had about 250 million active users in India at the end of 2017. The service, used by more than 2 billion users worldwide, has not revealed its India-specific user base since.

T-Series, the largest record label in India, became the first YouTube channel this week to claim more than 100 million subscribers. What’s even more noteworthy is that T-Series took 10 years to get to its first 10 million subscribers. The additional 90 million subscribers signed up to its channel in the last two years. Also fighting for users’ attention is Hotstar, which is owned by Disney. Earlier this month, it set a new global record for most simultaneous views on a live-streaming event.

Powered by WPeMatico

Entering into the world of Anthemis is a bit like stepping into the frame of a Wes Anderson film. Eclectic, offbeat people situated in colorful interiors? Check. A muse in the form of a renowned British-Venezuelan economist? Check. A design-forward media platform to provoke deep thought? Check. An annual summer retreat ensconced in the French Alps? Bien sûr.

Sitting atop this most unusual fintech(ish) VC is its ponytailed founder and chairman Sean Park, whose difficult-to-place accent and Philosophy professor aura belie his extensive fixed income capital markets experience. He’s joined by founder and CEO Amy Nauiokas, who in addition to being one of Fintech’s most prominent female investors also owns a high-minded film and television production company.

When Arman Tabatabai and I recently sat down with Park and Nauiokas in their New York office, the firm’s leaders were in an upbeat mood, having blown past the temporary perception-setback associated with the abrupt resignation last year of Anthemis’ former CEO Nadeem Shaikh (for more on this, read TechCrunch writer Steve O’Hear’s coverage of the situation).

And as the conversation below demonstrates, Park and Nauiokas are well poised to bring the quirk into everything they touch, which these days runs the gamut from backing companies involved in sustainable finance, advancing their home-grown media platform and preparing a soon-to-be-announced initiative elevating female entrepreneurs.

Gregg Schoenberg: With the two of you now at the helm, how does Anthemis present itself today?

Sean Park: I’ll step back and say that when Amy and I were working at big financial institutions in the noughties, we saw that the industry was going to change and that existing business models were running into their natural diminishing returns.

We tried to bring some new ideas to the organizations we were working in, but we each had epiphany moments when we realized that big organizations weren’t built to do disruptive transformation — for bad reasons, but also good reasons, too.

GS: Let’s fast forward to today, where you have several strong Fintech VCs out there. But unlike others, Anthemis puts weirdness at the heart of its model.

Yes, you’ve backed some big names like Betterment and eToro, but you’ve done other things that are farther afield. What’s the underlying thesis that supports that?

Amy Nauiokas: Whatever we do at Anthemis has to be a non-zero-sum game. It has to be for good, not for evil. So that means that we aren’t looking in any place where you see predatory opportunities to make money.

Powered by WPeMatico