Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

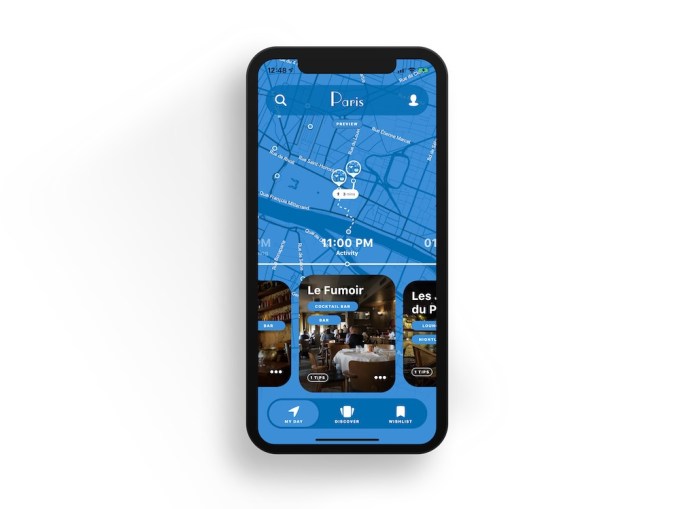

Welcome is a new app that CEO Matthew Rosenberg said is designed for a more spontaneous approach to traveling.

“What we’re going after is these millennials [and] Gen Z travelers who feel comfortable going in the moment,” Rosenberg told me. “Eighty-five percent of people aren’t even looking at activities before they arrive.”

So instead of asking travelers to create their own itineraries by browsing through a list of recommendations and reviews, Welcome builds the itinerary for them. When you’re planning to visit a destination, or when you’ve arrived and you’re wondering what to do, you can open Welcome and browse through a list of potential locations and activities, indicating which ones interest you. You also can browse recommendations from local experts, or ask for tips from your friends.

Welcome then uses your responses to create a schedule for you, consisting both of places you’ve explicitly said you want to visit and of things that would probably be of interest. The itineraries are also based on location, with different travel options like taking an Uber or Lyft, mass transit or walking.

Most intriguingly, the itineraries adjust in real time — if one of the items on the list doesn’t interest you, you can swipe to skip it, and Welcome will automatically fill in the gap with new activities. Or if you find a great spot where you want want to spend the whole afternoon, the app will once again adjust. Rosenberg said it’s even pulling in weather data, so “if we were going to send you to a park in the afternoon, and at lunch it starts raining, we can replace it with a museum.”

He acknowledged that this approach might be less suited for travelers who like to plan everything in advance — but even then, he noted, “The truth is, for all the planning that happens, most people’s plans tend to fall apart in the moment. Something always changes, some alley you want to go down, some boat you want to take, some sort of adventure that if you didn’t take it, you’d regret. That’s what we’ve really tried to embrace.”

Rosenberg added that the app could eventually introduce new ways for users to more explicitly filter the results based on their preferences — say, if they’re particularly interested in theater or museums, or if they’re on a tight budget.

Welcome says it already offers recommendations in more than 250 cities worldwide.

It’s a free app, and Rosenberg said the focus is on growth, not monetization. While he plans to make money by driving purchases and transactions, he said Welcome will never be advertising-driven. “Everything we show you is authentic. No one’s paying us to send you to some mediocre restaurant.”

The startup was founded by Rosenberg (who previously founded video app Cameo) and Peter Gerard, and has raised $1.2 million in seed funding led by 3 Rodeo.

“What we use today in travel is rooted in this old-school style of thinking,” Rosenberg said. “What I mean by that is, most travel sites put a bunch of pins on a map, but it’s still up to you to look around and figure out what to do. I don’t think anyone’s really thought: How can we take advantage not only of the mobile device, but really the data that’s out there right now … No one’s really built tools for our generation.”

Powered by WPeMatico

Workhorse Group, the electric vehicle company that grabbed headlines last month over a proposed deal to buy General Motors’ Lordstown, Ohio factory, has raised $25 million from a group of unnamed investors.

The money will not go toward the factory. Instead, it will be used for the more pressing matter of keeping the company running. Under terms of the deal, investors will receive preferred stock and warrants to buy shares. An annual dividend will be paid out in shares of Workhorse stock.

The Cincinnati-based company is small, with fewer than 100 employees. Its biggest problem isn’t ideas or even product pipeline; it’s capital.

Workhorse has struggled financially at various points since its founding in 1998. The company reported just $364,000 in revenue in the first quarter, down from $560,000 in the same period last year. As of March 30, 2019, the company had cash, cash equivalents and short-term investments of $2.8 million, compared to $1.5 million as of December 31, 2018.

Workhorse borrowed $35 million from hedge fund Marathon Asset Management earlier this year.

Workhorse, which was once owned by Navistar and sold in 2013 to AMP Holding, has a customer pipeline for its electric trucks that includes UPS. It’s also hoping to win a contract with the United States Postal Service.

But it needs capital to scale up. The funding gives Workhorse the capital to deliver on its existing backlog and produce its N-GEN delivery van, according to CEO Duane Hughes.

“We now have all necessary pieces in place to bridge Workhorse into full-scale N-GEN production and are looking forward to commencing the manufacturing process, in earnest, during the fourth quarter of this year,” Hughes said in a statement.

Meanwhile, GM has been in talks since early 2019 to sell its Lordstown vehicle factory in Ohio to Workhorse Group. GM’s Lordstown factory stopped producing the automaker’s Chevrolet Cruze in March; without any new vehicles slated for the factory, workers were laid off.

Under the potential Lordstown deal, a new entity led by Workhorse founder Steve Burns would acquire the facility. Workhorse would hold a minority interest in the new entity. This new entity would allow Workhorse to seek new equity without diluting existing shareholder value.

Workhorse would build a commercial electric pickup at the plant if the deal goes through, Hughes has said.

Powered by WPeMatico

Lilium, the ambitious Munich-based startup developing an all-electric vertical take-off and landing (VTOL) device, has announced that London is to be its new software engineering base, flying in the face of Brexit, you may well say. This, says the company, will create “hundreds of high-end software engineering roles” in the U.K. capital city over the next five years.

Alongside designing and manufacturing a new type of jet, Lilium plans to launch a fully vertical “air taxi” service by 2025, which will require consumer-facing “hailing” apps and sophisticated software for fleet management, including maintenance, and scheduling flights on-demand. That system also will need to integrate with existing air traffic control regulations and systems, all of which isn’t trivial, to say the least.

The announcement comes in the slipstream of Lilium unveiling a new five-seater prototype and a maiden flight last month. This saw the full-scale, full-weight prototype successfully take off and land, following extensive ground testing.

Meanwhile, the German startup is disclosing a trio of new senior hires, including the appointment of Carlos Morgado, former chief technology officer (CTO) at Just Eat, to lead the development of the new London software engineering team as VP, Digital Technology.

In addition, Lilium has appointed Anja Maassen van den Brink as chief people officer (CPO), and Luca Benassi as chief development engineer. Maassen van den Brink joins Lilium from VodafoneZiggo. Benassi is said to bring more than 20 years of experience in the aerospace sector, having worked at NASA, Boeing and, most recently, Airbus, where he was a senior expert and head of Acoustics and Vibration.

Commenting on the choice of London as a base for the engineering team, Remo Gerber, chief commercial officer (CCO), comments: “Achieving our aims will require us to build one of the world’s most innovative and high-performing software engineering teams. While we recognize that talent is global, London offers us access to a rich talent pool and an environment that’s well-suited to delivering the extraordinary.”

Of course, how rich that talent pool will remain after Brexit is yet to be seen. But for now it’s clear that Lilium believes that long-term London has more upsides than downsides, regardless of the current Brexit impasse.

Powered by WPeMatico

Just a few months ago, Innoviz became one of the better capitalized lidar startups when it announced it had raised $132 million in a Series C funding round. But that wouldn’t be the end of it.

The company kept the funding doors propped open and ultimately captured another $38 million from investors. The round has closed at $170 million, Innoviz said Monday.

Initial investors in the Series C round included China Merchants Capital, Shenzhen Capital Group, New Alliance Capital, Israeli institutional investors Harel Insurance Investments and Financial Services and Phoenix Insurance Company. The newest investors, and those responsible for the fresh injection of $38 million, were not named.

The close of the Series C round brings Innoviz’s total funding to $252 million.

The lidar industry is brimming with startups — about 70 according to industry experts — that see an opportunity to sell their tech to companies developing autonomous vehicles. Lidar measures distance using laser light to generate highly accurate 3D maps of the world around the car. It’s considered by most in the self-driving car industry a key piece of technology required to safely deploy robotaxis and other autonomous vehicles.

Innoviz is aiming for this very space with its solid-state lidar sensors and perception software for autonomous vehicles. The company contends that solid-state lidar technology is more reliable over time because of the lack of moving parts.

Innoviz says that its perception software is what helps it stand out in a sea of lidar startups. The perception software identifies, classifies, segments and tracks objects to give autonomous vehicles a better understanding of the 3D driving scene.

The company plans to use the funding, in part, to further develop the perception software piece. That includes bringing on two computer vision experts, Dr. Raja Giryes and Or Shimshi, as “strategic collaborators.”

The funding will also be used to help Innoviz scale up and eventually mass produce its products. Its automotive-grade lidar product called InnovizOne is entering series production in 2021 for global automakers. The company has an existing solid-state lidar (InnovizPro) that is available now.

Innoviz’s strategy has been to partner with a number of OEMs and Tier 1 suppliers, such as Magna, HARMAN, HiRain Technologies and Aptiv, and to package perception software with its lidar sensors and offer it as a complete unit for companies developing autonomous vehicle technology.

Innoviz has locked in several key customers, notably BMW. The automaker picked Innoviz’s tech for series production of autonomous vehicles starting in 2021.

Powered by WPeMatico

A number of promising women’s health tech companies have popped up in the last few years, from fertility apps to ovulation bracelets — even Apple has jumped into the subject with the addition of period tracking built into the latest edition of the watch. But there hasn’t been much in the way of innovation in women’s sexual health for decades.

In-vitro fertilization (IVF) is now a 40-year-old invention and even the top pharmaceutical companies have spent a pittance on research and development. Subjects like polycystic ovarian syndrome, endometriosis and menopause have taken a backseat to other, more fatal concerns. Fertility is itself oftentimes a mysterious black box as well, though a full 10% of the female population in the United States has difficulty getting or staying pregnant.

That’s all starting to change as startups are now bringing in millions in venture capital to gather and treat women’s health. While it’s early days (no unicorns just yet) interest in the subject has been jumping steadily higher each year.

To shine a better light on the importance of tech’s role in spurring more innovation for women’s fertility, we asked five VCs passionate about the space for their investment strategies, including Sarah Cone (Social Impact Capital), Vanessa Larco (NEA), Anu Duggal (Female Founders Fund), Jess Lee (Sequoia) and Nancy Brown (Oak HC/FT).

Sarah Cone, Social Impact Capital

We’re interested in companies that create large data sets in women’s health and fertility, enabling personalized medicine, clinical trial virtualization, better patient outcomes, and the application of modern AI/ML techniques to generate hypotheses that discover new targets and molecules.

Powered by WPeMatico

It takes a lot of trust to allow a company to come in and install a mystery box on their network to monitor for threats. It’s like inviting in a security guard to sit in your living room to make sure nobody breaks in.

Yet that’s exactly what Darktrace does. (The box, not the security guard.)

The Cambridge U.K.-founded company, now with a second headquarters in San Francisco, assumes that any network can be breached. Instead of looking at the perimeter of a network, Darktrace uses artificial intelligence (AI) and machine learning to scan and identify security weaknesses and malicious traffic inside a company’s network.

Traditional network monitoring typically uses signature-based threat detection of matching against known malicious files, but can be easily modified to evade detection. Instead, Darktrace builds up a profile of the network to understand what the baseline “normal” looks like so it can spot and identify potential issues, like large amounts of data exfiltration or suspect devices.

But how do you win over those who see a sea of meaningless buzzwords? How can you differentiate between the smoke and mirrors and the real deal?

“No one wants the black box making decisions without them knowing what it’s doing,” said Nicole Eagan, Darktrace’s co-founder and chief executive, in a call with TechCrunch.

“So, let them have visibility,” she said.

Darktrace’s founders have roots in the U.K. and U.S. intelligence, where they took what they knew of the cybersecurity threats to the private sector to where the new battleground opened up. In the past half-decade of its existence, the company has gained major clients on its roster — from telcos to banks, tech giants and car makers — supported by 900 staff in over 40 offices around the world.

About a quarter of its customers are in financial services, said Eagan. But it takes a lot for the heavily regulated companies to trust a mystery device on a company’s network where the data and security, like financial services, is highly regulated.

Powered by WPeMatico

Vectra, a seven-year-old company that helps customers detect intrusions at the network level, whether in the cloud or on premises, announced a $100 million Series E funding round today led by TCV. Existing investors, including Khosla Ventures and Accel, also participated in the round, which brings the total raised to more than $200 million, according to the company.

As company CEO Hitesh Sheth explained, there are two primary types of intrusion detection. The first is end point detection and the second is his company’s area of coverage, network detection and response, or NDR. He says that by adding a layer of artificial intelligence, it improves the overall results.

“One of the keys to our success has been applying AI to network traffic, the networking side of NDR, to look for the signal in the noise. And we can do this across the entire infrastructure, from the data center to the cloud all the way into end user traffic including IoT,” he explained.

He said that as companies move their data to the cloud, they are looking for ways to ensure the security of their most valuable data assets, and he says his company’s NDR solution can provide that. In fact, securing the cloud side of the equation is one of the primary investment focuses for this round.

Tim McAdam, from lead investor TCV, says that the AI piece is a real differentiator for Vectra and one that attracted his firm to invest in the company. He said that while he realized that AI is an overused term these days, after talking to 30 customers he heard over and over again that Vectra’s AI-driven solution was a differentiator over competing products. “All of them have decided to standardize on the Vectra Cognito because to a person, they spoke of the efficacy and the reduction of their threat vectors as a result of standardizing on Vectra,” McAdam told TechCrunch.

The company was founded in 2012 and currently has 240 employees. That is expected to double in a year to 18 months with this funding.

Powered by WPeMatico

On the heels of Google buying analytics startup Looker last week for $2.6 billion, Salesforce today announced a huge piece of news in a bid to step up its own work in data visualization and (more generally) tools to help enterprises make sense of the sea of data that they use and amass: Salesforce is buying Tableau for $15.7 billion in an all-stock deal.

The latter is publicly traded and this deal will involve shares of Tableau Class A and Class B common stock getting exchanged for 1.103 shares of Salesforce common stock, the company said, and so the $15.7 billion figure is the enterprise value of the transaction, based on the average price of Salesforce’s shares as of June 7, 2019.

This is a huge jump on Tableau’s last market cap: it was valued at $10.79 billion at close of trading Friday, according to figures on Google Finance. (Also: trading has halted on its stock in light of this news.)

The two boards have already approved the deal, Salesforce notes. The two companies’ management teams will be hosting a conference call at 8am Eastern and I’ll listen in to that as well to get more details.

This is a huge deal for Salesforce as it continues to diversify beyond CRM software and into deeper layers of analytics.

The company reportedly worked hard to — but ultimately missed out on — buying LinkedIn (which Microsoft picked up instead), and while there isn’t a whole lot in common between LinkedIn and Tableau, this deal will also help Salesforce extend its engagement (and data intelligence) for the customers that Salesforce already has — something that LinkedIn would have also helped it to do.

This also looks like a move designed to help bulk up against Google’s move to buy Looker, announced last week, although I’d argue that analytics is a big enough area that all major tech companies that are courting enterprises are getting their ducks in a row in terms of squaring up to stronger strategies (and products) in this area. It’s unclear whether (and if) the two deals were made in response to each other, although it seems that Salesforce has been eyeing up Tableau for years.

“We are bringing together the world’s #1 CRM with the #1 analytics platform. Tableau helps people see and understand data, and Salesforce helps people engage and understand customers. It’s truly the best of both worlds for our customers–bringing together two critical platforms that every customer needs to understand their world,” said Marc Benioff, chairman and co-CEO, Salesforce, in a statement. “I’m thrilled to welcome Adam and his team to Salesforce.”

Tableau has about 86,000 business customers, including Charles Schwab, Verizon (which owns TC), Schneider Electric, Southwest and Netflix. Salesforce said Tableau will operate independently and under its own brand post-acquisition. It will also remain headquartered in Seattle, Wash., headed by CEO Adam Selipsky along with others on the current leadership team.

Indeed, later during the call, Benioff let it drop that Seattle would become Salesforce’s official second headquarters with the closing of this deal.

That’s not to say, though, that the two will not be working together.

On the contrary, Salesforce is already talking up the possibilities of expanding what the company is already doing with its Einstein platform (launched back in 2016, Einstein is the home of all of Salesforce’s AI-based initiatives); and with “Customer 360,” which is the company’s product and take on omnichannel sales and marketing. The latter is an obvious and complementary product home, given that one huge aspect of Tableau’s service is to provide “big picture” insights.

“Joining forces with Salesforce will enhance our ability to help people everywhere see and understand data,” said Selipsky. “As part of the world’s #1 CRM company, Tableau’s intuitive and powerful analytics will enable millions more people to discover actionable insights across their entire organizations. I’m delighted that our companies share very similar cultures and a relentless focus on customer success. I look forward to working together in support of our customers and communities.”

“Salesforce’s incredible success has always been based on anticipating the needs of our customers and providing them the solutions they need to grow their businesses,” said Keith Block, co-CEO, Salesforce. “Data is the foundation of every digital transformation, and the addition of Tableau will accelerate our ability to deliver customer success by enabling a truly unified and powerful view across all of a customer’s data.”

Powered by WPeMatico

Hello and welcome back to Startups Weekly, a newsletter published every Saturday that dives into the week’s noteworthy venture capital deals, funds and trends. Before I dive into this week’s topic, let’s catch up a bit. Last week, I wrote about the proliferation of billion-dollar companies. Before that, I noted the uptick in beverage startup rounds. Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets.

Now, time for some quick notes on Peloton’s confirmed initial public offering. The fitness unicorn, which sells a high-tech exercise bike and affiliated subscription to original fitness content, confidentially filed to go public earlier this week. Unfortunately, there’s no S-1 to pore through yet; all I can do for now is speculate a bit about Peloton’s long-term potential.

What I know:

A bullish perspective: Peloton, an early player in the fitness tech space, has garnered a cult following since its founding in 2012. There is something to be said about being an early-player in a burgeoning industry — tech-enabled personal fitness equipment, that is — and Peloton has certainly proven its bike to be genre-defining technology. Plus, Peloton is actually profitable and we all know that’s rare for a Silicon Valley company. (Peloton is actually New York-based but you get the idea.)

A bearish perspective: The market for fitness tech is heating up, largely as a result of Peloton’s own success. That means increased competition. Peloton has not proven itself to be a nimble business in the slightest. As Darrell noted in his piece, in its seven years of operation, “Peloton has put out exactly two pieces of hardware, and seems unlikely to ramp that pace. The cost of their equipment makes frequent upgrade cycles unlikely, and there’s a limited field in terms of other hardware types to even consider making. If hardware innovation is your measure for success, Peloton hasn’t really shown that it’s doing enough in this category to fend of legacy players or new entrants.”

TL;DR: Peloton, unlike any other company before it, sits evenly at the intersection of fitness, software, hardware and media. One wonders how Wall Street will value a company so varied. Will Peloton be yet another example of an over-valued venture-backed unicorn that flounders once public? Or will it mature in time to triumphantly navigate the uncertain public company waters? Let me know what you think. And If you want more Peloton deets, read Darrell’s full story: Weighing Peloton’s opportunity and risks ahead of IPO.

Anyways…

Public company corner

In addition to Peloton’s IPO announcement, CrowdStrike boosted its IPO expectations. Aside from those two updates, IPO land was pretty quiet this week. Let’s check in with some recently public businesses instead.

Uber: The ride-hailing giant has let go of two key managers: its chief operating officer and chief marketing officer. All of this comes just a few weeks after it went public. On the brightside, Uber traded above its IPO price for the first time this week. The bump didn’t last long but now that the investment banks behind its IPO are allowed to share their bullish perspective publicly, things may improve. Or not.

Zoom: The video communications business posted its first earnings report this week. As you might have guessed, things are looking great for Zoom. In short, it beat estimates with revenues of $122 million in the last quarter. That’s growth of 109% year-over-year. Not bad Zoom, not bad at all.

We cover a lot of startup and big tech news here at TechCrunch. Sometimes, the really great features writers put a lot of time and energy into fall between the cracks. With that said, I just want to take a moment this week to highlight a few of the great stories published on our site recently:

A peek inside Sequoia Capital’s low-flying, wide-reaching scout program by Connie Loizos

How to calculate your event ROI by Sarah Shewey

Why four security companies just sold for $1.5B by Ron Miller

In case you missed it, Bird is in negotiations to acquire Scoot, a smaller scooter upstart with licenses to operate in the coveted market of San Francisco. Scoot was last valued at around $71 million, having raised about $47 million in equity funding to date from Scout Ventures, Vision Ridge Partners, angel investor Joanne Wilson and more. Bird, of course, is a whole lot larger, valued at $2.3 billion recently.

On top of this deal, there was no shortage of scooter news this week. Bird, for example, unveiled the Bird Cruiser, an electric vehicle that is essentially a blend between a bicycle and a moped. Here’s more on the booming scooter industry.

Thumbtack is raising up to $120M on a flat valuation

Depop, a shopping app for millennials, bags $62M

Fitness startup Mirror nears $300M valuation with fresh funding

Step raises $22.5M led by Stripe to build no-fee banking services for teens

Possible Finance lands $10.5M to provide kinder short-term loans

Voatz raises $7M for its mobile voting technology

Flexible housing startup raises $2.5M

Legacy, a sperm testing and freezing service, raises $1.5M

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I discuss how a future without the SoftBank Vision Fund would look, Peloton’s IPO and data-driven investing.

Powered by WPeMatico

Financial troubles have forced Maker Media, the company behind crafting publication MAKE: magazine as well as the science and art festival Maker Faire, to lay off its entire staff of 22 and pause all operations. TechCrunch was tipped off to Maker Media’s unfortunate situation which was then confirmed by the company’s founder and CEO Dale Dougherty.

For 15 years, MAKE: guided adults and children through step-by-step do-it-yourself crafting and science projects, and it was central to the maker movement. Since 2006, Maker Faire’s 200 owned and licensed events per year in over 40 countries let attendees wander amidst giant, inspiring art and engineering installations.

“Maker Media Inc ceased operations this week and let go of all of its employees — about 22 employees” Dougherty tells TechCrunch. “I started this 15 years ago and it’s always been a struggle as a business to make this work. Print publishing is not a great business for anybody, but it works…barely. Events are hard . . . there was a drop off in corporate sponsorship.” Microsoft and Autodesk failed to sponsor this year’s flagship Bay Area Maker Faire.

But Dougherty is still desperately trying to resuscitate the company in some capacity, if only to keep MAKE:’s online archive running and continue allowing third-party organizers to license the Maker Faire name to throw affiliated events. Rather than bankruptcy, Maker Media is working through an alternative Assignment for Benefit of Creditors process.

“We’re trying to keep the servers running” Dougherty tells me. “I hope to be able to get control of the assets of the company and restart it. We’re not necessarily going to do everything we did in the past but I’m committed to keeping the print magazine going and the Maker Faire licensing program.” The fate of those hopes will depend on negotiations with banks and financiers over the next few weeks. For now the sites remain online.

The CEO says staffers understood the challenges facing the company following layoffs in 2016, and then at least 8 more employees being let go in March according to the SF Chronicle. They’ve been paid their owed wages and PTO, but did not receive any severance or two-week notice.

“It started as a venture-backed company but we realized it wasn’t a venture-backed opportunity” Dougherty admits, as his company had raised $10 million from Obvious Ventures, Raine Ventures, and Floodgate. “The company wasn’t that interesting to its investors anymore. It was failing as a business but not as a mission. Should it be a non-profit or something like that? Some of our best successes for instance are in education.”

The situation is especially sad because the public was still enthusiastic about Maker Media’s products Dougherty said that despite rain, Maker Faire’s big Bay Area event last week met its ticket sales target. 1.45 million people attended its events in 2016. MAKE: magazine had 125,000 paid subscribers and the company had racked up over one million YouTube subscribers. But high production costs in expensive cities and a proliferation of free DIY project content online had strained Maker Media.

“It works for people but it doesn’t necessarily work as a business today, at least under my oversight” Dougherty concluded. For now the company is stuck in limbo.

Regardless of the outcome of revival efforts, Maker Media has helped inspire a generation of engineers and artists, brought families together around crafting, and given shape to a culture of tinkerers. The memory of its events and weekends spent building will live on as inspiration for tomorrow’s inventors.

Powered by WPeMatico