Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

The quest to create a social auditorium in virtual reality has eaten many VC dollars over the years. While plenty of contenders have emerged, it’s likely Against Gravity’s href=”https://rec.net/”> Rec Room has been the most creative in its approach to capturing a niche market while plotting how to build a sustainable business based on users in VR headsets talking to one another.

The Seattle startup has told TechCrunch exclusively that it has bagged $24 million over two rounds of funding. The studio’s Series A was led by Sequoia and their Series B, which just recently closed, was led by Index Ventures . Against Gravity has a bevy of top investors that also participated in the rounds, including First Round Capital, Maveron, Anorak Ventures, Acequia Capital, Betaworks and DAG Ventures.

The company didn’t break down the specific details of the rounds. Against Gravity was authorized to raise up to $15.4 in its Series B at up to a $126 million post-money valuation, according to Delaware stock authorization docs we got from PitchBook. The company didn’t comment on the valuation.

Rec Room is hardly a household name compared to some major console titles, but among virtual reality users, the title has been a standby known for the diversity of gameplay available inside its walls and its wide support for hardware. Users are able to create experiences or “rooms” that can be accessed by other users. They don’t need any coding knowledge to build these spaces, as creation all happens within the game and can be done by multiple users simultaneously.

Rec Room is also about to surpass one million rooms created by users on the platform. The company says these environments include “sports games, shooters, adventure quests, nightclubs, club houses, and escape rooms.”

While companies like Linden Labs, the creator of Second Life, have focused their VR efforts on realistic but unvarying user-created environments, Against Gravity has seemingly one-upped their strategy by focusing on dynamic gameplay modes where the emphasis is on user interactions as opposed to graphic fidelity.

The Seattle startup, which was founded in 2016, now has 35 employees building out and maintaining Rec Room. The company is playable on a variety of platforms, and is about to add iOS support to its roster, an expansion that could bring a lot more users onto the VR-centric platform.

Rec Room’s content isn’t monetized too aggressively at the moment. CEO Nick Fajt thinks some of the user-generated experiences are going to offer an interesting opportunity down the road, prompting users to spend in-game tokens on more than just upgrades to the platform’s Playmobil-like avatars.

“I think a direction that we’re actually excited about is that we want to let the users creating some of this content charge tokens to play them,” Fajt tells TechCrunch. “I think that’s one that we’re kind of on the cusp of doing and we’re hoping to get that out later this year.”

For Against Gravity, timing has always been a key consideration for expansion, especially inside the slow-growing VR market, which has only recently seemed to hit a stride. I chatted with Fajt back in 2017, and he told me that the key for VR startups surviving was staying lean and biding their time until standalone mobile headsets with positional tracking and motion controllers were released. Facebook’s Oculus Quest headset, which came out less than a month ago, is perhaps the first clear device to fit that vision.

One of Facebook’s head AR/VR executives shared earlier this week that more than $5 million in Quest content had been sold in the company’s store in the first two weeks after the device’s launch. That’s a major development for an industry that hasn’t seen many smash hits, but for free-to-play game makers like Against Gravity, which has now raised $29 million to date, there’s plenty of maturation in the VR market that still needs to happen.

Powered by WPeMatico

Background noise on calls could be a thing of the past if Krisp has anything to do with it. The app, now available on Windows and Macs after a long beta, uses machine learning to silence the bustle of a home, shared office or coffee shop so your voice and the voices of others comes through clearly.

I first encountered Krisp in prototype form when we were visiting UC Berkeley’s Skydeck accelerator, which ended up plugging $500,000 into the startup alongside a $1.5 million round from Sierra Ventures and Shanda Group.

Like so many apps and services these days, Krisp uses machine learning. But unlike many of them, it uses the technology in a fairly straightforward, easily understandable way.

The machine learning model the company has created is trained to recognize the voice of a person talking into a microphone. By definition pretty much everything else is just noise — so the model just sort of subtracts it from the waveform, leaving your audio clean even if there’s a middle school soccer team invading the cafe where you’re running the call from.

It can also mute sound coming the other direction — that is, the noise on your friend’s side. So if they’re in a noisy street and you’re safe at home, you can apply the smart noise reduction to them as well.

Because it changes the audio signal before it gets to any apps or services, it’s compatible with pretty much everything: Skype, Messenger, Slack, whatever. You could even use it to record podcasts when there’s a leaf blower outside. A mobile version is on the way for release later this year.

It works — I’ve tested it, as have thousands of other users during the beta. But now comes the moment of truth: will anyone pay for it?

The new, official release of the app will let you mute the noise you hear on the line — that is, the noise coming from the microphones of people you talk to — for free, forever. But clearing the noise on your own line, like the baby crying next to you, after a two-week trial period, will cost you $20 per month, or $120 per year, or as low as $5 per month for group licenses. You can collect free time by referring people to the app, but eventually you’ll probably have to shell out.

Not that there’s anything wrong with that: A straightforward pay-as-you-go business model is refreshing in an age of intrusive data collection, pushy “freemium” platforms and services that lack any way to make money whatsoever.

Powered by WPeMatico

RealityEngines.AI, a research startup that wants to help enterprises make better use of AI, even when they only have incomplete data, today announced that it has raised a $5.25 million seed funding round. The round was led by former Google CEO and Chairman Eric Schmidt and Google founding board member Ram Shriram. Khosla Ventures, Paul Buchheit, Deepchand Nishar, Elad Gil, Keval Desai, Don Burnette and others also participated in this round.

The fact that the service was able to raise from this rather prominent group of investors clearly shows that its overall thesis resonates. The company, which doesn’t have a product yet, tells me that it specifically wants to help enterprises make better use of the smaller and noisier data sets they have and provide them with state-of-the-art machine learning and AI systems that they can quickly take into production. It also aims to provide its customers with systems that can explain their predictions and are free of various forms of bias, something that’s hard to do when the system is essentially a black box.

As RealityEngines CEO Bindu Reddy, who was previously the head of products for Google Apps, told me, the company plans to use the funding to build out its research and development team. The company, after all, is tackling some of the most fundamental and hardest problems in machine learning right now — and that costs money. Some, like working with smaller data sets, already have some available solutions like generative adversarial networks that can augment existing data sets and that RealityEngines expects to innovate on.

Reddy is also betting on reinforcement learning as one of the core machine learning techniques for the platform.

Once it has its product in place, the plan is to make it available as a pay-as-you-go managed service that will make machine learning more accessible to large enterprise, but also to small and medium businesses, which also increasingly need access to these tools to remain competitive.

Powered by WPeMatico

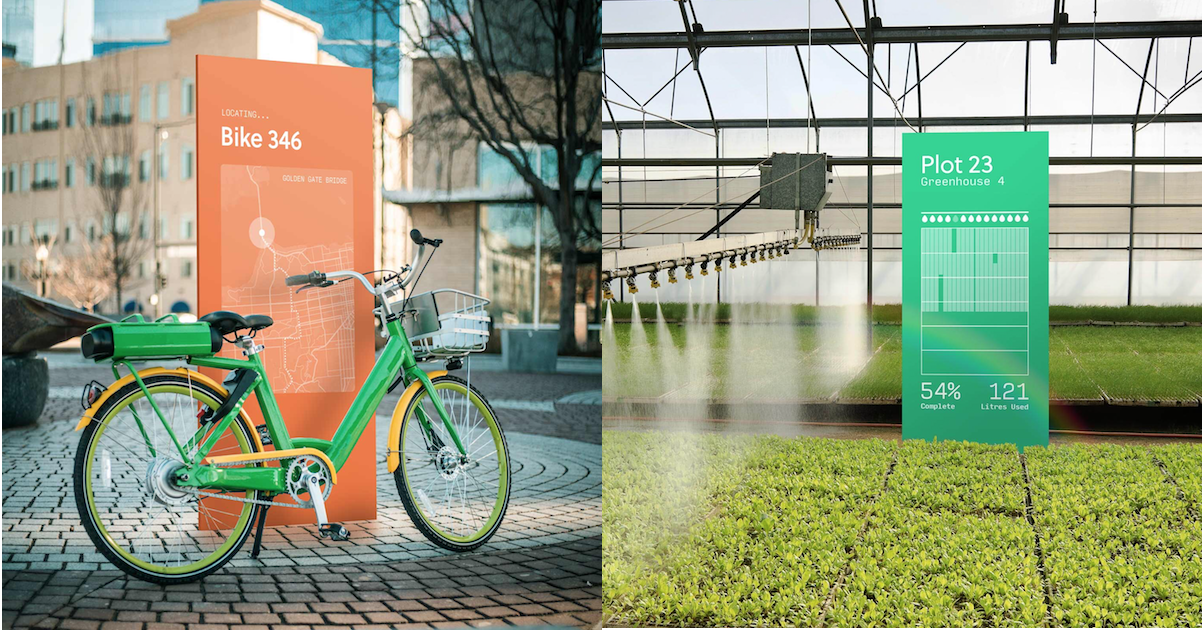

With 200X the range of Wi-Fi at 1/1000th of the cost of a cellular modem, Helium’s “LongFi” wireless network debuts today. Its transmitters can help track stolen scooters, find missing dogs via IoT collars and collect data from infrastructure sensors. The catch is that Helium’s tiny, extremely low-power, low-data transmission chips rely on connecting to P2P Helium Hotspots people can now buy for $495. Operating those hotspots earns owners a cryptocurrency token Helium promises will be valuable in the future…

The potential of a new wireless standard has allowed Helium to raise $51 million over the past few years from GV, Khosla Ventures and Marc Benioff, including a new $15 million Series C round co-led by Union Square Ventures and Multicoin Capital. That’s in part because one of Helium’s co-founders is Napster inventor Shawn Fanning. Investors are betting that he can change the tech world again, this time with a wireless protocol that like Wi-Fi and Bluetooth before it could unlock unique business opportunities.

Helium already has some big partners lined up, including Lime, which will test it for tracking its lost and stolen scooters and bikes when they’re brought indoors, obscuring other connectivity, or their battery is pulled, out deactivating GPS. “It’s an ultra low-cost version of a LoJack” Helium CEO Amir Haleem says.

InvisiLeash will partner with it to build more trackable pet collars. Agulus will pull data from irrigation valves and pumps for its agriculture tech business. Nestle will track when it’s time to refill water in its ReadyRefresh coolers at offices, and Stay Alfred will use it to track occupancy status and air quality in buildings. Haleem also imagines the tech being useful for tracking wildfires or radiation.

Haleem met Fanning playing video games in the 2000s. They teamed up with Fanning and Sproutling baby monitor (sold to Mattel) founder Chris Bruce in 2013 to start work on Helium. They foresaw a version of Tile’s trackers that could function anywhere while replacing expensive cell connections for devices that don’t need high bandwith. Helium’s 5 kilobit per second connections will compete with SigFox, another lower-power IoT protocol, though Haleem claims its more centralized infrastructure costs are prohibitive. It’s also facing off against Nodle, which piggybacks on devices’ Bluetooth hardware. Lucky for Helium, on-demand rental bikes and scooters that are perfect for its network have reached mainstream popularity just as Helium launches six years after its start.

Helium says it already pre-sold 80% of its Helium Hotspots for its first market in Austin, Texas. People connect them to their Wi-Fi and put it in their window so the devices can pull in data from Helium’s IoT sensors over its open-source LongFi protocol. The hotspots then encrypt and send the data to the company’s cloud that clients can plug into to track and collect info from their devices. The Helium Hotspots only require as much energy as a 12-watt LED light bulb to run, but that $495 price tag is steep. The lack of a concrete return on investment could deter later adopters from buying the expensive device.

Only 150-200 hotspots are necessary to blanket a city in connectivity, Haleem tells me. But because they need to be distributed across the landscape, so a client can’t just fill their warehouse with the hotspots, and the upfront price is expensive for individuals, Helium might need to sign up some retail chains as partners for deployment. As Haleem admits, “The hard part is the education.” Making hotspot buyers understand the potential (and risks) while demonstrating the opportunities for clients will require a ton of outreach and slick marketing.

Without enough Helium Hotspots, the Helium network won’t function. That means this startup will have to simultaneously win at telecom technology, enterprise sales and cryptocurrency for the network to pan out. As if one of those wasn’t hard enough.

Powered by WPeMatico

Adjust is announcing that it has raised $227 million in new funding.

The company, founded in Berlin back in 2012, has created a variety of ad measurement and anti-fraud tools — CEO Christian Henschel said the goal is to “make marketing simpler, smarter and safer.” Adjust says it’s now being used in more than 25,000 mobile apps for customers like NBCUniversal, Zynga, Robinhood, Pinterest and Procter & Gamble.

It’s been nearly four years since the company raised its previous round of $15 million. Henschel (pictured above with his co-founder and CTO Paul Müller) told me the company was already profitable back then, and it’s continued to be profitable while growing revenue by an average of 80 percent every year. So it raised more money (a lot more), he said, “because we saw the opportunity … to grow our business even further.”

Henschel pointed to three broad areas where Adjust is planning to invest and grow. First, there’s combating fraud, where he said the company was “very early,” first launching its mobile fraud prevention suite in 2016. It expanded its offerings earlier this year with the acquisition of Unbotify.

Second, he said Adjust will continue to invest in automation and aggregation — an area where it made another recent acquisition, namely the data aggregation company Acquired.io.

“We’re giving our customers the ability to get rid of the repetitive and boring tasks and really focus them back on thigns that human beings are very good at — that is creativity,” Henschel said.

Lastly, the company (which already has 350 employees in 15 offices worldwide) will continue to invest in customer service and geographic expansion, particularly in Asia.

Speaking of acquisitions, Adjust says it’s also partnered with Japanese marketing agency Adways and acquired Adways’ attribution tool PartyTrack. So naturally, you might assume that this new capital means even more deals are in the works, but Henschel said, “Acquisitions are always tough — it’s hard to find the right companies, and even harder to integrate them.”

In other words, he’s open to acquiring more companies, but he said, “We don’t have any plans right now.”

This new round brings Adjust’s total funding to $250 million. It was led by Eurazeo Growth, Highland Europe, Morgan Stanley Alternative Investment Partners and Sofina.

“Adjust reached profitability just three years after its creation, and has seen extraordinary growth since then,” said Eurazeo Growth’s Yann du Rusquec in a statement. “The company is ideally positioned to further expand its product and footprint throughout 2019 and beyond, cementing its position as one of the most successful global tech champions to come out of Europe.”

Powered by WPeMatico

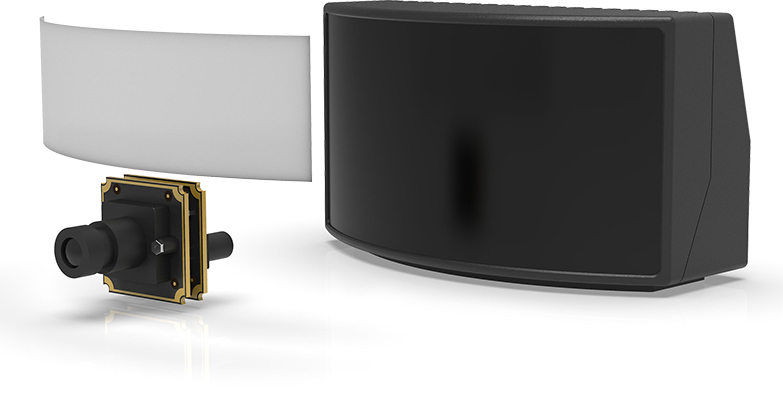

Lidar is a critical part of many autonomous cars and robotic systems, but the technology is also evolving quickly. A new company called Sense Photonics just emerged from stealth mode today with a $26M A round, touting a whole new approach that allows for an ultra-wide field of view and (literally) flexible installation.

Still in prototype phase but clearly enough to attract eight figures of investment, Sense Photonics’ lidar doesn’t look dramatically different from others at first, but the changes are both under the hood and, in a way, on both sides of it.

Early popular lidar systems like those from Velodyne use a spinning module that emit and detect infrared laser pulses, finding the range of the surroundings by measuring the light’s time of flight. Subsequent ones have replaced the spinning unit with something less mechanical, like a DLP-type mirror or even metamaterials-based beam steering.

All these systems are “scanning” systems in that they sweep a beam, column, or spot of light across the scene in some structured fashion — faster than we can perceive, but still piece by piece. Few companies, however, have managed to implement what’s called “flash” lidar, which illuminates the whole scene with one giant, well, flash.

That’s what Sense has created, and it claims to have avoided the usual shortcomings of such systems — namely limited resolution and range. Not only that, but by separating the laser emitting part and the sensor that measures the pulses, Sense’s lidar could be simpler to install without redesigning the whole car around it.

I talked with CEO and co-founder Scott Burroughs, a veteran engineer of laser systems, about what makes Sense’s lidar a different animal from the competition.

“It starts with the laser emitter,” he said. “We have some secret sauce that lets us build a massive array of lasers — literally thousands and thousands, spread apart for better thermal performance and eye safety.”

These tiny laser elements are stuck on a flexible backing, meaning the array can be curved — providing a vastly improved field of view. Lidar units (except for the 360-degree ones) tend to be around 120 degrees horizontally, since that’s what you can reliably get from a sensor and emitter on a flat plane, and perhaps 50 or 60 degrees vertically.

These tiny laser elements are stuck on a flexible backing, meaning the array can be curved — providing a vastly improved field of view. Lidar units (except for the 360-degree ones) tend to be around 120 degrees horizontally, since that’s what you can reliably get from a sensor and emitter on a flat plane, and perhaps 50 or 60 degrees vertically.

“We can go as high as 90 degrees for vert which i think is unprecedented, and as high as 180 degrees for horizontal,” said Burroughs proudly. “And that’s something auto makers we’ve talked to have been very excited about.”

Here it is worth mentioning that lidar systems have also begun to bifurcate into long-range, forward-facing lidar (like those from Luminar and Lumotive) for detecting things like obstacles or people 200 meters down the road, and more short-range, wider-field lidar for more immediate situational awareness — a dog behind the vehicle as it backs up, or a car pulling out of a parking spot just a few meters away. Sense’s devices are very much geared toward the second use case.

Particularly because of the second interesting innovation they’ve included: the sensor, normally part and parcel with the lidar unit, can exist totally separately from the emitter, and is little more than a specialized camera. That means that while the emitter can be integrated into a curved surface like the headlight assembly, while the tiny detectors can be stuck in places where there are already traditional cameras: side mirrors, bumpers, and so on.

The camera-like architecture is more than convenient for placement; it also fundamentally affects the way the system reconstructs the image of its surroundings. Because the sensor they use is so close to an ordinary RGB camera’s, images from the former can be matched to the latter very easily.

Most lidars output a 3D point cloud, the result of the beam finding millions of points with different ranges. This is a very different form of “image” than a traditional camera, and it can take some work to convert or compare the depths and shapes of a point cloud to a 2D RGB image. Sense’s unit not only outputs a 2D depth map natively, but that data can be synced with a twin camera so the visible light image matches pixel for pixel to the depth map. It saves on computing time and therefore on delay — always a good thing for autonomous platforms.

The benefits of Sense’s system are manifest, but of course right now the company is still working on getting the first units to production. To that end it has of course raised the $26 million A round, “co-led by Acadia Woods and Congruent Ventures, with participation from a number of other investors, including Prelude Ventures, Samsung Ventures and Shell Ventures,” as the press release puts it.

Cash on hand is always good. But it has also partnered with Infineon and others, including an unnamed tier-1 automotive company, which is no doubt helping shape the first commercial Sense Photonics product. The details will have to wait until later this year when that offering solidifies, and production should start a few months after that — no hard timeline yet, but expect this all before the end of the year.

“We are very appreciative of this strong vote of investor confidence in our team and our technology,” Burroughs said in the press release. “The demand we’ve encountered – even while operating in stealth mode – has been extraordinary.”

Powered by WPeMatico

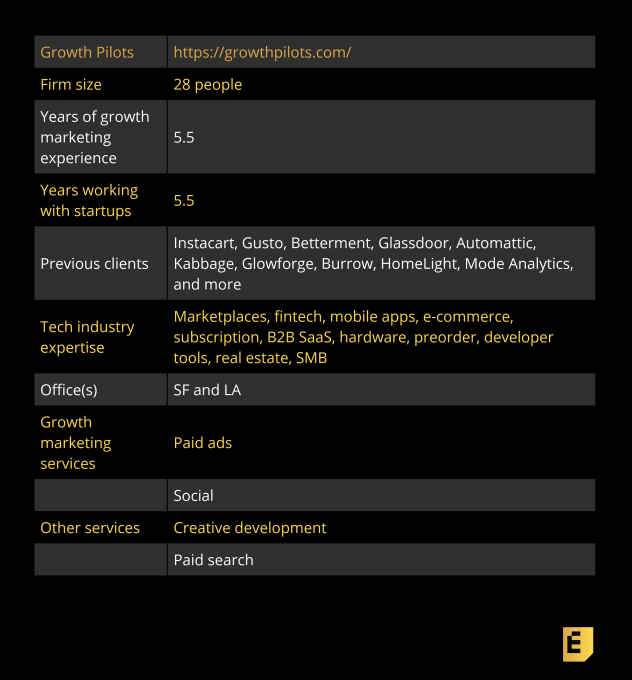

Growth Pilots is one of the more exclusive performance marketing agencies in San Francisco, but they know how to help high-growth startups excel at paid marketing. CEO and founder Soso Sazesh credits his personal experiences as an entrepreneur along with his team’s deep understanding of high-growth company needs and challenges as to what sets Growth Pilots apart. Whether you’re a founder of a seed or Series D stage startup, learn more about Growth Pilots’ approach to growth and partnerships.

“I think a lot of times, especially at the early stage, founders don’t have a lot of time so they’re willing to find the path of least resistance to get their paid acquisition channels up and running. If things are not properly set up and managed, this can lead to a false negative in terms of writing off a channel’s effectiveness or scalability. It’s worth talking to an expert, even if it’s just for advice, to ensure you don’t fall into this trap.”

“They have good business acumen, move fast and work as an extension to your internal team.” Guillaume McIntyre, SF, Head of Acquisition Marketing, Instacart

“Something we pride ourselves on is working with relatively few clients at a time so we can really focus all of our team’s efforts and energy on doing the highest quality work. Each of our team members works on a maximum of two to three accounts, and therefore they’re able to get very invested in each client’s business and integrated into their team. We really try to simulate the internal team dynamics as much as possible and pairing that with our external capabilities and expertise.”

Below, you’ll find the rest of the founder reviews, the full interview, and more details like pricing and fee structures. This profile is part of our ongoing series covering startup growth marketing agencies with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already.

Yvonne Leow: Tell me a little bit about your background and how you got into growth.

Soso Sazesh: I grew up in northern Minnesota where there is no tech industry whatsoever and then after high school, I came out to Silicon Valley and got exposed to the epicenter of the technology industry. I became very interested in startups and hustled to find startup internships so I could get experience and learn how they operated.

After a couple of startup internships, I got accepted to UC Berkeley and that gave me even more exposure to the startup ecosystem with all of the startup events and resources that UC Berkeley had to offer. I worked on a couple of startup projects while I was at UC Berkeley, and I taught myself scrappy product management and how to get software built using contract developers.

Powered by WPeMatico

As studies show that early diagnosis and preventative therapies can help prevent the onset of Alzheimer’s, startups that are working to diagnose the disease earlier are gaining more attention and funding.

That’s a boon to companies like Neurotrack, which closed on $21 million in new financing led by the company’s previous investor, Khosla Ventures, with participation from new investors Dai-ichi Life and SOMPO Holdings.

Last year, the Japanese life insurance company Dai-ichi Life partnered with Neurotrack to roll out a cognitive assessment tool to the company’s customers in Japan.

And earlier this year, the Japanese health insurer SOMPO conducted a 16-week pilot with Neurotrack, where more than 550 of SOMPO’s employees took Neurotrack’s test and followed the Memory Health Program for four months. Neurotrack and SOMPO are now working to deepen and extend their partnership.

“As the global crisis around Alzheimer’s continues to grow, the private sector is joining government and nonprofits to address the problem in their markets. In Japan, for example, traditional insurance companies are developing novel solutions that incorporate Neurotrack’s products to advance better memory health among its population,” said Elli Kaplan, Neurotrack co-founder and CEO. “These partnerships are innovative models that we hope to replicate in other markets, enabling traditional insurance companies to create new markets while helping to address the Alzheimer’s crisis. And now they’re also investing in our company, so these companies have two ways of doing well by doing good.”

Neurodegenerative disorders are becoming a more serious issue for the island nation — and the rest of the world. In fact, over the weekend the G20 first raised the possibility that aging populations could be a global risk.

“Most of the G20 nations already experience or will experience ageing,” Bank of Japan governor Haruhiko Kuroda, told reporters from Agence France Presse. “We need to discuss problems that arise with societal ageing and how to deal with them.”

In the U.S., the estimated cost of caring for Americans with Alzheimer’s and other dementias was an estimated $277 billion in 2018, according to a study cited by WebMD. Roughly $186 billion of those costs are borne by Medicare and Medicaid, with another $60 billion in payments coming out-of-pocket. That number could top $1.1 trillion by 2050, according to the same report.

Neurotrack uses cognitive assessments that follow eye movements using the camera on a computer or mobile phone to create a baseline for cognitive functions. The company then uses a combination of brain training and diet, exercise and sleep adjustments to try to improve cognitive function and health.

Its technology is one of several different approaches startups are taking to try to provide early diagnoses and potential preventative measures against the disease.

MyndYou, another company tackling neurodegenerative diagnostics, uses an app to monitor movement among its users. The company assesses that data to determine whether there may be any issues related to cognitive function. It recently partnered with the Japanese company Mizuho to test its efficacy among Japan’s aging population.

Then there’s Altoida, another startup that launched recently to tackle the cognitive assessment market. It uses augmented reality and a series of memory tests to assess brain function and attempt to detect neurodegeneration.

Neurotrack’s technology, based on research from Emory University, has managed to attract more than just Japanese corporations. Previous investors like Sozo Ventures, Rethink Impact, AME Cloud Partners and Salesforce founder Marc Benioff have also thrown cash behind the company.

To date, the company has raised more than $50 million, including $6.8 million in grants from the National Institutes of Health and National Institute of Aging.

The company said its new investment will be used to develop new partnerships in additional global markets and continue research and development.

“One can now feel empowered to test for potential memory decline, given that Neurotrack’s Memory Health Program can help stave off cognitive decline. This fully integrated platform enables users to assess the state of their memory, reduce future risk for decline, and monitor progress in order to take better control of one’s memory health. We combine these tools with deep analytics to further target and personalize, creating a very powerful precision medicine solution,” said Kaplan. “Just as when you go on a diet, you use a scale to provide evidence that you’re losing weight. Neurotrack now has the equivalent of both a scale to measure and the Memory Health Program for cognitive health. This is a game-changer for dementia risk.”

Japan has national efforts targeting a reduction in the onset of dementia in 6% of people in their 70s by 2025 (the country has the world’s largest population of the elderly, with more than 20% of the country over the age of 65). Roughly 13 million people are expected to develop Alzheimer’s in Japan by 2025.

Part of the company’s success in fundraising comes from the results of a preliminary study that showed improved cognitive functions for people diagnosed with some decline in cognitive function after a year of using Neurotrack’s Memory Health Program. The company claims it has the the first fully integrated, clinically validated platform that can assess a person’s cognition through its cognitive assessment — which can predict conversion from healthy to mild cognitive impairment (MCI) or MCI to Alzheimer’s disease within three years at 89% accuracy, and within six years at 100% accuracy.

While that kind of assessment is good, Alzheimer’s symptoms can begin to appear as early as 25 years before the onset of the disease. So there’s still work to be done.

“Neurotrack has built an incredible integrative platform that is transforming our battle with Alzheimer’s,” said Jenny Abramson, founder and managing partner of Rethink Impact. “Elli’s two decades of experience in the private sector and in government are helping her scale this solution to the millions of people suffering from cognitive decline around the world. We couldn’t be more excited to continue to support Neurotrack, given both the financial opportunity and the impact they are already having on this critical disease.”

Powered by WPeMatico

As grocery shopping moves online, one piece of the puzzle hasn’t been directly addressed: fresh fruits and vegetables. That also happens to be a category in which there is a ton of food waste, with a good deal of fruits and veggies never making it out of the grocery store to begin with.

Misfits Market has raised $16.5 million in Series A to handle just that.

Greenoaks Capital led the round, but Misfits isn’t disclosing other participants in the financing. Other Greenoaks Capital investments include Deliveroo, OYO, Clover Health, Brex and Discord.

Misfits Market offers a subscription box of “ugly” fruits and veggies, the ones with blemishes or odd shapes that make a grocery shopper think twice before checking out, each week.

Misfits sources these fruits and veggies straight from farms. This means that the extra time spent shipping them to a grocery store, and then sitting on shelves, is eliminated from the equation with Misfits.

The company currently operates in all zip codes in Pennsylvania, New York, New Jersey, Connecticut, Delaware, Massachusetts, Vermont, New Hampshire, Rhode Island, Maine and Ohio, with plans to expand into Washington, D.C., Maryland, Virginia, West Virginia, North Carolina, South Carolina, Georgia and Florida.

Currently, Misfits Market offers two different box options. The smaller box, called The Mischief, includes 10 to 12 pounds of fruits and veggies each week for $23.75 à la carte, or less than $20 as a weekly subscription. The Madness, Misfits’ bigger box, includes 18 to 20 pounds of fresh fruits and veggies for $42.50 as a one-time purchase, or for $34 as a subscription.

Users can pause their weekly subscription or cancel at any time.

CEO and founder Abhi Ramesh said the idea for Misfits Market started when he visited a farm a few years ago. The farmer was collecting apples that he said weren’t of the grade he could sell to grocery stores or farmers’ markets, and that they’d either be given away to neighbors or thrown away.

“That was my sort of romanticized light bulb moment,” said Ramesh.

He was fascinated and started interviewing farmers in the north east and asking them how much of their produce ended up going to waste because it wasn’t pretty enough for grocery stores. The answer was consistently between 20% and 40%.

Ramesh says there is an opportunity down the line to expand beyond fruits and veggies, but that for now the company is laser-focused on that category.

Since launching in 2018, Misfits has sent out 5 million pounds of produce that would have gone to waste otherwise.

Powered by WPeMatico

Andreessen Horowitz <3 Latin American startups.

Latin America is the only region outside of the U.S. where the venture firm is routinely investing capital, and it just made another commitment, doubling down on its early-stage support for the point-of-sale lending startup ADDI.

ADDI picked up $12.5 million in new financing in April of this year as the company looks to expand its lending services online.

For an American audience, the closest corollary to what ADDI is up to is likely Affirm, the point-of-sale lender that’s raised a ton of cash and come in for some (valid) criticism for its basic business model.

Like Affirm, ADDI lets its borrowers apply for credit at the moment of purchase. The company likens its service to the layaway and credit plans that already exist in Colombia — but involve pretty onerous requirements to use. Company co-founder Santiago Suarez and Andreessen Horowitz general partner Angela Strange both commented on how, in some cases, Colombian shoppers have to have three people vouch for a borrower before a store will issue credit or agree to a layaway plan.

The difference between an ADDI loan — or any loan — and layaway is that an installment payment plan doesn’t charge interest (and even with the fees that installment plans do charge, they are often still cheaper than taking out a loan).

But financial products are coming for consumers in Latin America whether those buyers like it or not — and for the most part, it seems they do like it.

Historically, only the wealthiest clientele in Latin America received anything resembling the kinds of financial products that are more widely available in the United States, according to Strange. And the investment in ADDI is just part of her firm’s thesis in trying to make more services more broadly available in a region where a technological transformation is creating unprecedented opportunities for challengers.

That assessment is what drew Santiago Suarez back to Latin America only two years ago. A former executive at Lending Club who previously had worked as the head of New Product Development and Emerging Services at J.P. Morgan, Suarez saw the tremendous growth happening in Latin America and returned to Colombia to see if he could bring some much needed services to his home country.

Suarez partnered with his childhood friend, Elmer Ortega, who was working as the chief technology officer of the local hedge fund where he had previously been employed as a derivatives trader before learning how to code.

Together, the two men, who had known each other since they were five years old, set out to transform how credit was offered in retail shops. It’s an industry that Suarez had known well since his parents had owned stores.

“In the U.S. there are all of these gaps that fintech companies are filling,” says Suarez. “But the gaps in Latin America are bigger.”

Suarez and Ortega incorporated the company in September 2018, around the same time they raised $2.3 million from the regional investment firm, Monashees, Andreessen and Village Global . They then raised another $1.5 million in an internal round of financing before closing the most recent funding.

The company offers loans at annual percentage rates ranging from 19.99% to 28.90%. The company started with a digital solution for brick and mortar retailers because 90% of retail in Colombia still happens offline.

Although it’s in its early days, the company has already originated 10,000 borrowers and typically loans out roughly $500 since it launched on February 22, according to Suarez. He declined to comment on the company’s default rate on loans.

Now with 40 employees on staff, the company is looking to bring its lending tool to more e-commerce and physical retailers, according to Suarez. And despite the threat of cyclical political turmoil, Suarez says there’s no better time to be investing in Colombia.

“It’s the most stable country outside of Chile… Way more stable than Brazil, way more stable than Argentina and way more stable than Mexico,” Suarez says. “What we’re looking at is more than cyclical instability… those things go beyond that. Nubank was able to build a multibillion business in the worst political and economic crisis in Brazil’s history. I think Colombia is an incredibly attractive space with a deep talent pool.”

Powered by WPeMatico