Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to Startups Weekly, a newsletter published every Saturday that dives into the week’s noteworthy venture capital deals, funds and trends. Before I dive into this week’s topic, let’s catch up a bit. Last week, I wrote about Peloton’s upcoming initial public offering. Before that, I noted the proliferation of billion-dollar companies.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

Now I know this newsletter is supposed to be about startups, but we’re shifting our focus to Big Tech today. Bear with me.

I spent the better part of the week in Scottsdale, Ariz. where temperatures outside soared past 100 and temperatures inside were icy cold. Both because Recode + Vox cranked the AC to ungodly levels but also because every panel, it seemed, veered into a debate around the “techlash” and antitrust.

If you aren’t familiar, the Financial Times defines the techlash as “the growing public animosity toward large Silicon Valley platform technology companies.” Code Conference has in the past been an event that underscores innovation in tech. This year, amid growing tensions between tech’s business practices and the greater good, things felt a little different.

The conference began with Peter Kafka grilling YouTube’s CEO Susan Wojcicki. Unfortunately for her, CodeCon took place the week after an enormous controversy struck YouTube. You can read about that here. Wojcicki wasn’t up to the task of addressing the scandal, at least not honestly. She apologized to the LGBTQ community for YouTube’s actions but was unable to confront the larger issue at hand: YouTube has failed to take necessary action toward eliminating hate speech on its platform, much like other social media hubs.

From there, The Verge’s Casey Newton asked Instagram head Adam Mosseri and Facebook vice president of consumer hardware Andrew Bosworth point blank if Facebook should be broken up. Unsurprisingly, neither of the two men are fond of the idea.

“Personally, if we split [Facebook and Instagram] it might make my life easier but I think it’s a terrible idea,” Mosseri, who was named CEO of Instagram last fall, said. “If you split us up, it would just make it exponentially more difficult to keep people safe. There are more people working on safety and integrity issues at Facebook than all the people that work at Instagram.”

Bosworth, who manages VR projects at Facebook, had this to say: “You take Instagram and Facebook apart, you have the same attack surfaces. They now aren’t able to share and combine data … So this isn’t circular logic. This is an economy of scale.”

Wojcicki, when asked whether YouTube should separate from Google, had a less nuanced and frankly shockingly ill-prepared response:

This is the actual answer YouTube’s CEO gave @pkafka when asked what it would mean if the company was spun off from Google due to antitrust: “I don’t know. I’ve been really busy this week working with all these other concerns… I don’t know. We would figure it out.” #CodeCon

— Alex Heath (@alexeheath) June 10, 2019

There’s more where that came from, but this newsletter isn’t about big tech! It’s about startups! Here’s all the startup news you missed this week.

IPO Corner

CrowdStrike’s IPO went really well: After pricing its IPO at $34 per share Tuesday evening and raising $612 million in the process (a whole lot more than the planned $378 million), the company’s stock popped 90% Wednesday morning with an initial share price of $63.50. A bona fide success, CrowdStrike boasted an initial market cap of $11.4 billion, nearly four times that of its last private valuation, at market close Wednesday. I chatted with CrowdStrike CEO George Kurtz on listing day. You can read our full conversation here.

Fiverr climbs: The marketplace had a good first day on the NYSE. The company priced its IPO at $21 per share Wednesday night, raising around $111 million. It then started trading Thursday morning at $26 apiece, with shares climbing for most of the day and closing at $39.90 — up 90% from the IPO price. Again, not bad. Read TechCrunch’s Anthony Ha’s conversation with Fiverr CEO Micha Kaufman here.

Get ready for … Slack’s highly-anticipated direct listing next week (June 20). Catch up on direct listings here and learn more about Slack’s journey to the public markets here.

Bird confirmed its acquisition of Scoot

As is usually the case with these things, parties from both Bird and Scoot declined to tell us any details about the deal, so we went and found the details ourselves! First, The Wall Street Journal’s Katie Roof reported the (mostly stock) deal was valued at roughly $25 million. We confirmed with our sources that it was indeed less than $25 million and came after Scoot struggled to raise additional capital from venture capital investors.

It’s a mostly stock deal so value is largely contingent on what happens to Bird from here https://t.co/dcTL9ovmeL

— Katie Roof (@Katie_Roof) June 13, 2019

While we’re on the subject of M&A, Epic Games, the creator of Fortnite, acquired Houseparty, a video chatting mobile app, this week. The deal comes shortly after Epic Games raised a whopping $1.25 billion. Founded in 2015, Houseparty is a social network that delivers video chat across a number of different platforms, including iOS, Android and macOS. Like Fortnite, the offering tends to skew younger. Specifically, the app caters toward teen users, providing a more private and safer space than other, broader platforms.

Symphony, a messaging app, gets $165M at a $1.4B valuation

BetterUp raises $103M to fast-track employee development

Neurobehavioral health company BlackThorn pulls in $76M from GV

Against Gravity, maker of the VR hit ‘Rec Room,’ nabs $24M

Simpo secures $4.5M seed round to help drive software adoption

If you’ve been unsure whether to sign up for TechCrunch’s awesome new subscription service, now is the time. Through next Friday, it’s only $2 a month for two months. Seems like a no-brainer. Sign up here. Here are some of my personal favorite EC pieces of the week:

Silicon Valley’s founder fetish infantilizes public companies

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I debate dual-class stock, discuss my takeaways from #CodeCon and review the biggest rounds of the week. You can subscribe to Equity here or wherever else you listen to podcasts.

Powered by WPeMatico

Every time I see a “the future of work is remote” article, I think to myself: “How backwards! How retro! How quaint!” That future is now, for many of us. I’ve been a fully remote developer-turned-CTO for a full decade. So I’m always baffled by people still wrestling with whether remote work is viable for their company. That jury rendered its verdict a long time ago.

One reason companies still struggle with it is that remote work amplifies the negative effects of bad practices. If everyone’s in one place, you can dither, handwave, vacillate, micromanage, and turn your workplace into an endless wasteland of unclear uncertainty, punctuated by ad-hoc last-second crisis meetings — and your employees will probably still conspire against your counterproduction to get something done, albeit much less than what they’re capable of.

If they’re remote, though, progress via conspiracy and adhocracy is no longer an option. If they’re remote, you need decisive confidence, clear direction, iterative targets, independent responsibilities, asynchronous communications, and cheerful chatter. Let me go over each of those:

Decisive confidence. Suppose Vivek in Delhi, Diego in Rio, and Miles in Berlin are all on a project. (An example I’m drawing from my real life.) It’s late your time. You have to make a decision about the direction of their work. If you sleep on it, you’re writing off multiple developer-days of productivity.

Sometimes they have enough responsibilities to have other things to work on. (More on that below.) Sometimes you don’t have to make the decision because they have enough responsibility to do so themselves. (More on that below.) But sometimes you have to make the business-level decision based on scant information. In cases like this, remember the military maxim: “Any decision is better than no decision.”

Powered by WPeMatico

Three years ago, I met with a founder who had raised a massive seed round at a valuation that was at least five times the market rate. I asked what firm made the investment.

She said it was not a traditional venture firm, but rather a strategic investor that not only had no ties to her space but also had no prior investment experience. The strategic investor, she said, was looking to “get their hands dirty” and “get in on the ground floor.”

Over the next 2 years, I kept a close eye on the founder. Although she had enough capital to pivot her business focus multiple times, she seemed to be at odds, serving the needs of her strategic investor and her customer base.

Ultimately, when the business needed more capital to survive, the strategic investor didn’t agree with the founder’s focus, opted not to prop it up, and the business had to shut down.

Sadly, this is not an uncommon story as examples abound of strategic investors influencing startup direction and management decisions to the point of harm for the startup. Corporate strategics, not to be confused with dedicated funds focused on financial returns like a traditional venture investor like Google Ventures, often care less about return on investment, and more about a startup’s focus, and sector specificity. If corporate imperatives change, the strategic may cease to be the right partner or could push the startup in a challenging direction.

And yet, fortunately, as the disruptive power of technology is being unleashed on nearly every major industry, strategic investors are now getting smarter, both in terms of how they invest and how they partner with entrepreneurs.

From making strong acquisitive plays (i.e. GM’s purchase of Cruise Automation or Toyota’s early-stage investment in Uber) to building dedicated funds, to executing commercial agreements in tandem with capital investment, strategics are getting savvier, and by extension, becoming better partners. In some instances, they may be the best partner.

Negotiating a term sheet with a strategic investor necessitates a different set of considerations. Namely: the preference for a strategic to facilitate commercial milestones for the startup, a cautious approach to avoid the “over-valuation” trap, an acute focus on information rights, and the limitation of non-compete provisions.

Powered by WPeMatico

We’re excited to announce a special promotion for Extra Crunch. Starting today, new users signing up for Extra Crunch will get a trial rate of $2 for the first 2 months. After the trial period ends, you’ll be moved over to our monthly plan for $15 per month. This offer ends on June 21, so be sure to take advantage of it before it expires.

Claim this offer by heading here.

Extra Crunch is our membership program that launched back in February. It features original research and reporting, including unicorn deep dives, startup resources and recommendations, and more. As a subscriber, we’ll remove all banner ads and video pre rolls from the site for you. If you’re interested in attending our events like Disrupt SF, you can also save 20% on tickets by being an Extra Crunch subscriber. Membership also gets you access to our weekly conference calls with TechCrunch writers.

Here are a few articles our subscribers have loved so far:

We’ve already received tremendous feedback and positive reactions from our loyal readers, and we’d love to see you join, too. It’s a great way to support the journalism you love while also getting a deeper dive into the topics you already enjoy on TechCrunch. Sign up here or click the banner below.

Powered by WPeMatico

The TechCrunch Hackathon is shaping up to be a huge battle royale, but we still have room for a few more creative coders, hackers and outright webmonsters to join us at Disrupt San Francisco 2019 on October 2-4 for a chance to win $10,000.

It won’t cost you a thing to come and play in the hackathon sandbox. If you have the vision, the chops and the stamina to face off against some of the world’s best devs, then stop what you’re doing and apply to compete right here.

Here’s what you need to know about the Disrupt SF 2019 Hackathon. Teams can consist of a maximum of 6 people. Don’t have a team? No problem, you can find a team member on our Devpost host site prior to the event.

Besides the $10,000 grand prize, sponsors will also offer prizes (including cold, hard cash, people) to the teams that build a great product using their platform. It won’t be easy. You’ll have roughly 24 high-pressure hours to deliver the goods using their APIs, data sets and other tools.

We’ll announce this year’s sponsors and challenges over the next few weeks, but the sponsored contests, prizes and winners from last year’s hackathon can give you an idea of what to expect.

When the dev clock runs out, it’s pencils down and time to submit your work. On the afternoon of day two, judges review all completed projects — kind of like a flashback to your science fair days. They’ll pick 10 finalists to deliver a two-minute project pitch on the Extra Crunch Stage.

The sponsors will announce their winners, and then TechCrunch will announce one grand prize winner for the best overall hack — and that team will take home a cool, $10,000 cash prize. Check out all the details and the agenda on the Hackathon website.

We’ll keep you fed, watered and highly caffeinated throughout the event — at no cost to you. Plus, you receive free Expo Only passes for the first two days of Disrupt. And if you have any energy left, you can enjoy your free Innovator pass to catch all of the content during day three of Disrupt SF. Sweet!

The entire experience is exhausting and exhilarating, grueling and gratifying. You’ll flex your mighty skills in front of influential people and build something awesome that can make a difference in this world.

The TC Hackathon takes place at Disrupt San Francisco 2019 on October 2-4. Join the battle royale and show us what you can do. Apply to the Hackathon right here.

Is your company interested in sponsoring the Hackathon at Disrupt San Francisco 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

This is it. The final call for all the mobility and transportation startuppers who want to save a solid Benjamin on their ticket to the TC Sessions: Mobility 2019 conference in San Jose, Calif. on July 10. The early-bird ticket price disappears tonight, June 14 at 11:59 p.m. (PT). Beat that deadline and buy a ticket — or pay full freight.

Get ready to experience a full day devoted to the revolution that’s taking place within the mobility and transportation industries. More than 1,000 people — the greatest minds, biggest names and influential thinkers, makers and investors — will attend a day packed with interviews, panel discussions, fireside chats, demos and workshops.

Along with TechCrunch editors, speakers will question assumptions and examine complex technological and regulatory issues. They’ll discuss capital investment concerns and look at the ethics and human factors in a future of autonomous cars, delivery robots and flying taxis.

Here’s a small sample of the programming that’s on tap. The event agenda can help you plan your day, although you may have to clone yourself to catch it all.

Building Business and Autonomy: Co-founder and CTO Jesse Levinson will be on hand to talk about Zoox, an independent autonomous vehicle company. Its cars can navigate tricky San Francisco streets — including the notoriously iconic Lombard Street. We’ll hear how Zoox plans to navigate the challenging road to business success.

The Future of Freight: The trucking industry is in serious trouble, and startups and OEMs are scrambling to come up with a solution. Volvo’s Jenny Elfsberg and Stefan Seltz-Axmacher of Starsky Robotics will join us to debate whether autonomous trucks are the fix we need or if another near-term technology can pave the way to a more efficient and profitable industry.

Will Venture Capital Drive the Future of Mobility? Michael Granoff of Maniv Mobility, Ted Serbinski of Techstars and Bain Capital’s Sarah Smith will debate the uncertain future of mobility tech and whether VC dollars are enough to push the industry forward.

Today’s the last day you can save $100 on your pass to the TC Sessions: Mobility 2019 conference in San Jose, Calif. on July 10. Buy your ticket by 11:59 p.m. (PT) tonight, June 14 or kiss that early bird — and $100 — goodbye.

Is your company interested in sponsoring or exhibiting at TC Sessions: Mobility? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

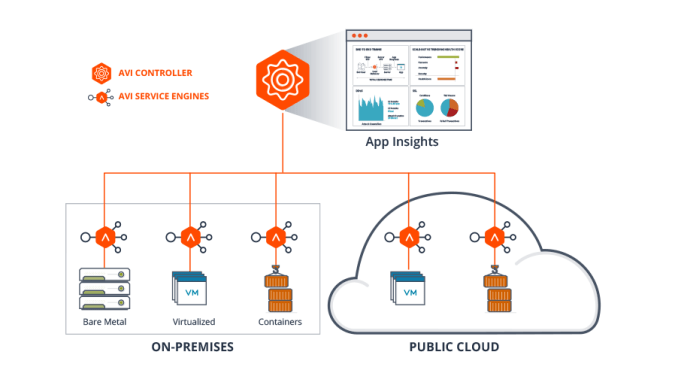

VMware has been trying to reinvent itself from a company that helps you build and manage virtual machines in your data center to one that helps you manage your virtual machines wherever they live, whether that’s on prem or the public cloud. Today, the company announced it was buying Avi Networks, a six-year-old startup that helps companies balance application delivery in the cloud or on prem in an acquisition that sounds like a pretty good match. The companies did not reveal the purchase price.

Avi claims to be the modern alternative to load balancing appliances designed for another age when applications didn’t change much and lived on prem in the company data center. As companies move more workloads to public clouds like AWS, Azure and Google Cloud Platform, Avi is providing a more modern load-balancing tool, that not only balances software resource requirements based on location or need, but also tracks the data behind these requirements.

Diagram: Avi Networks

VMware has been trying to find ways to help companies manage their infrastructure, whether it is in the cloud or on prem, in a consistent way, and Avi is another step in helping them do that on the monitoring and load-balancing side of things, at least.

Tom Gillis, senior vice president and general manager for the networking and security business unit at VMware sees, this acquisition as fitting nicely into that vision. “This acquisition will further advance our Virtual Cloud Network vision, where a software-defined distributed network architecture spans all infrastructure and ties all pieces together with the automation and programmability found in the public cloud. Combining Avi Networks with VMware NSX will further enable organizations to respond to new opportunities and threats, create new business models, and deliver services to all applications and data, wherever they are located,” Gillis explained in a statement.

In a blog post, Avi’s co-founders expressed a similar sentiment, seeing a company where it would fit well moving forward. “The decision to join forces with VMware represents a perfect alignment of vision, products, technology, go-to-market, and culture. We will continue to deliver on our mission to help our customers modernize application services by accelerating multi-cloud deployments with automation and self-service,” they wrote. Whether that’s the case, time will tell.

Among Avi’s customers, which will now become part of VMware, are Deutsche Bank, Telegraph Media Group, Hulu and Cisco. The company was founded in 2012 and raised $115 million, according to Crunchbase data. Investors included Greylock, Lightspeed Venture Partners and Menlo Ventures, among others.

Powered by WPeMatico

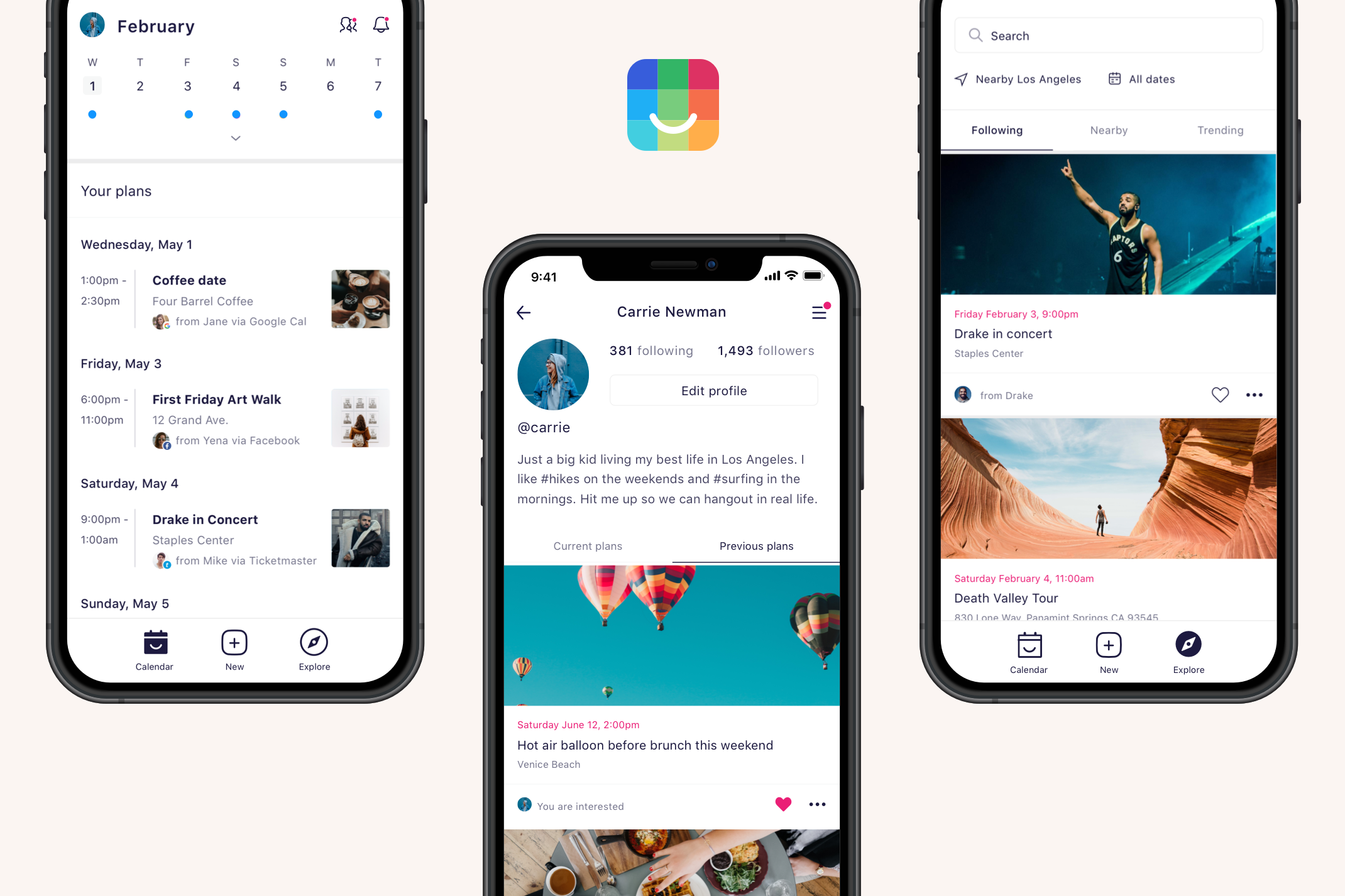

Why is there no app where you can follow party animals, concert snobs or conference butterflies for their curated suggestions of events? That’s the next phase of social calendar app IRL that’s launching today on iOS to help you make and discuss plans with friends or discover nearby happenings to fill out your schedule.

The calendar, a historically dorky utility, seems like a strange way to start the next big social network. Many people, especially teens, either don’t use apps like Google Calendar, keep them professional or merely input plans made elsewhere. But by baking in an Explore tab of event recommendations and the option to follow curators, headliners and venues, IRL could make calendars communal like Instagram did to cameras.

“There’s Twitter for ‘follow my updates,’ there’s SoundCloud for ‘follow my music,’ but there’s no ‘follow my events’ ” IRL CEO Abe Shafi tells me of his plan to turbocharge his calendar app. “They’re arguably the best product that’s been built for organizing what you’re doing, but no one has Superhuman’d or Slack’d the calendar. Let’s build a super f*cking dope calendar!” he says with unbridled excitement. He’ll need that passion to persevere as IRL tries to steal a major use case from SMS, messaging apps and Facebook .

Finding a new opportunity for a social network has attracted a new $8 million Series A funding round for IRL led by Goodwater Capital and joined by Founders Fund and Kleiner Perkins. That builds on its $3 million seed from Founders Fund and Floodgate, whose partner Mike Maples is joining IRL’s board. The startup has also pulled in some entertainment and event CEOs as strategic investors, including Warner Bros. president Greg Silverman, Lionsgate Films president Joe Drake and ClassPass CEO Fritz Lanman to help it recruit calendar influencers users can follow.

In Shafi, investors found a consummate extrovert who can empathize with event-goers. He dropped out of Berkeley to build out his recruitment software startup getTalent before selling it to HR platform Dice, where he became VP of product. He started to become disillusioned by tech’s impact on society and almost left the industry before some time at Burning Man rekindled his fever for events.

IRL CEO Abe Shafi

Shafi teamed up with PayPal’s first board member Scott Banister and early social network founder Greg Tseng. Shafi’s first attempt Gather pissed off a ton of people with spammy invites in 2017. By 2018, he’d restarted as IRL, with a focus on building a minimalist calendar where it was easy to create events and invite friends. Evite and Facebook Events were too heavy for making less formal get-togethers with close friends. He wisely chose to geofence his app and launch state by state to maximize density so people would have more pals to plan with.

IRL is now in 14 states, with a modest 1.3 million monthly active users and 175,000 dailies, plus 3 million people on the waitlist. “Fifty percent of all teens in Texas have downloaded IRL. I wanted to focus on the central states, not Silicon Valley,” Shafi explains. Users log in with a phone number or Google, two-way sync their Google Calendar if they have one, and can then manage their existing schedule and create mini-events. The stickiest feature is the ability to group chat with everyone invited so you can hammer out plans. Even users without the app can chime in via text or email. And unlike Facebook, where your mom or boss are liable to see your RSVPs, your calendar and what you’re doing on IRL is always private unless you explicitly share it.

The problem is that most of this could be handled with SMS and a more popular calendar. That’s why IRL is doubling-down on event discovery through influencers, which you can’t do anywhere else at scale. With the new version of the app launching today, you’ll be recommended performers, locations and curators to follow. You’ll see their suggestions in the Explore tab that also includes sub-tabs of Nearby and Trending happenings. There’s also a college-specific feed for users that auth in with their school email address. Curators and event companies like TechCrunch can get their own IRL.com/… URL people can follow more easily than some janky list of events of gallery of flyers on their website. Since pretty much every promoter wants more attendees, IRL’s had little resistance to it indexing all the events from Meetup.com and whatever it can find.

IRL is concentrating on growth for now, but Shafi believes all the intent data about what people want to do could be valuable for directing people to certain restaurants, bars, theaters or festivals, though he vows that “we’re never going to sell your data to advertisers.” For now, IRL is earning money from affiliate fees when people buy tickets or make reservations. Event affiliate margins are infamously slim, but Shafi says IRL can bargain for higher fees as it gains sway over more people’s calendars.

Unfortunately, without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”

Unfortunately, without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”

Yet the biggest challenge will be rearranging how people organize their lives. A lot of us are too scatterbrained, lazy or instinctive to make all our plans days or weeks ahead of time and put them on a calendar. The beauty of mobile is that we can communicate on the fly to meet up. “Solving for spontaneity isn’t our focus so far,” Shafi admits. But that’s how so much of our social lives come together.

My biggest problem isn’t finding events to fill my calendar, but knowing which friends are free now to hang out and attend one with me. There are plenty of calendar, event discovery and offline hangout apps. IRL will have to prove they deserve to be united. At least Shafi says it’s a problem worth trying to solve. “I know for a fact that the product of a calendar will outlive me.” He just wants to make it more social first.

Powered by WPeMatico

Target Circle and TapHeaven announced they’re merging into a single company under the Target Circle brand.

TapHeaven co-founder and CEO Chris Hoyt, who is becoming chief growth officer at the combined organization, said the two companies have been “trying to solve the same problem” — namely, eliminating many of the inefficiencies in the mobile advertising business.

Hoyt said that for Target Circle, that meant trying to “unify this fragmented ecosystem into a single dashboard for contracts, invoices and offers.” And for TapHeaven, that meant a focus on automation, resulting in the launch of what the company calls a “command center” for user acquisition, where advertisers can optimize their ad campaigns “at the source level, by country” while getting high-quality traffic without fraud.

The companies also complement each other geographically — Target Circle is headquartered in Oslo, Norway, while TapHeaven is headquartered in San Francisco.

According to Hoyt, they first came across each other because they were talking to the same mobile studio about supporting the launch of a new game, and it became clear they “both had the same vision for our businesses, the same future with a unified dashboard wrapped in automation and machine learning to simplify and help the ecosystem perform for these advertisers.”

Target Circle founder and CEO Heiko Hildebrandt will continue to serve as chief executive for the combined companies — in the announcement, he said TapHeaven allows the company to “strengthen and expand its technology in the automation of advertising and fraud prevention and resolution.” Meanwhile, TapHeaven executives Brian Krebs and Jeremy Jones will become CIO and chief of user experience, respectively.

The financial terms of the deal were not disclosed. Moving forward, Hoyt said Target Circle will continue to support its existing products while focusing on the new UA Command Center as “the future of our business.” He also suggested that the platform could help advertisers move away from Facebook and Google, allowing them to get the performance they need from other ad networks.

“What impact this is going to have on the market is really lifting up the rest of the ecosystem,” he said. “I feel like Facebook and Google have had their day, a little bit … With the serious things that are going on with these companies, advertisers are desperate for the answers to where [else] can they spend their money and diversify their portfolio.”

Powered by WPeMatico

FlyCleaners, a New York startup offering on-demand laundry pickup and delivery, has laid off “a large number” of its employees, co-founder and CEO David Salama told TechCrunch.

This confirms a story earlier this week in Crain’s New York reporting that FlyCleaners filed a notification with the Department of Labor outlining plans to close its Long Island City plant and lay off 116 employees.

As Salama explained when we profiled him several years ago, FlyCleaners customers can use the mobile app whenever they want someone to pick up their laundry — the startup handles pickup and return, while the actual cleaning is handled by local businesses.

In an email about the layoffs, Salama told me that the company (which raised a $2 million round led by Zelkova Ventures back in 2013) created its own team for pickup and delivery because “when we started FlyCleaners six years ago, the last-mile logistics industry was simply not where we needed it to be in order to effectively service our customers.” More recently, however, the company has been testing partnerships with other logistics companies as a way to “supplement” its own team.

“Recently, it became clear to us that the cost of our internal team was just too large to bear and it was starting to hamper our ability to execute strategically and to sustain and grow our business,” Salama continued. “And so, that [led] to the painful decision to lay off a large number of employees and to proceed as a more asset-light organization.”

He added, “We don’t anticipate that this change will materially decrease the service we offer our customers. If anything, by partnering with larger-scale logistics providers, our service should be more efficient and resilient than it currently is.”

But if partners are handling pickups, delivery and the laundry, what does FlyCleaners bring to the table? When I asked what the company will focus on moving forward, Salama said, “I prefer to be discreet about it[,] but I’m comfortable saying that our plan is to leverage our technology to create the best customer experience possible.”

He also said that the startup is working with its logistics partners to find new positions for laid-off employees.

Powered by WPeMatico