Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Youper, a mental health app with a chatbot it calls an “emotional health assistant,” has raised $3 million in seed funding from Goodwater Capital. The funds will be used to accelerate development of Youper’s artificial intelligence-based capabilities and grow its user base.

Based in San Francisco, Youper was co-founded in 2016 by Dr. Jose Hamilton. For a decade, Hamilton worked as a psychiatrist in clinical settings, seeing more than 3,000 patients. While talking to them, he realized that a handful of barriers kept many people from seeking help earlier, even if they had dealt with anxiety or depression for years.

“The first one is fear, taking care of yourself, talking about your mental health, understanding your mental health,” he tells TechCrunch. “Seeing a therapist or psychiatrist is super intimidating. That’s why all of my patients used to say the same things. The second barrier is cost, of course. Psychiatrists and therapists are super expensive.”

Hamilton teamed up with co-founders Diego Couto, the startup’s chief product and growth officer, and Thiago Marafon, its CTO, to create an app that would make mental healthcare less intimidating and more accessible. They originally created an app that did not have a conversational interface. Instead, Hamilton says it took a similar approach to Calm and Headspace. But that resulted in a very low user engagement rate and, after a year, the team realized Youper needed to provide a more personalized experience, matching users to the right psychological techniques, including cognitive behavioral techniques and mindfulness, for their needs.

Youper is part of a growing roster of apps that use AI-based chatbots to help users improve their emotional health, including Woebot, Wysa and X2’s Tess. Hamilton says Youper wants to differentiate with its focus on personalization, combining mental health research and user data to match the right psychological techniques with users.

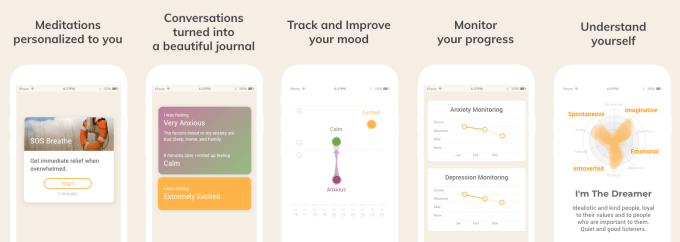

Screenshots from Youper, an app for emotional well-being.

The startup claims Youper has been downloaded more than one million times so far. Most of its users are young adults, and there are more women than men who use Youper.

“I think that’s because women are facing new challenges in our society by conquering new spaces and assuming new roles, and that poses an emotional toll. Another reason is that women are more tuned into self-care than men,” he says. “Sometimes I feel that we men wait for too long suffering in silence.”

For users who have never consulted with a provider, Youper provides a gentle introduction to the types of questions and exercises they might experience in therapy. The questions and exercises given by Youper’s chatbot are meant to help users achieve a better understanding of their emotions, thoughts and behavior.

Youper’s chatbot asks users to focus on their thoughts and identify how they are feeling from a menu of descriptive words. Then a scale lets them rate the strength of that emotion from “slightly” to “extremely.” More questions help them narrow down what is causing those feelings and track their mood. Users are also given options for mindfulness exercises and journaling prompts.

Hamilton says that the average time users spend during each session with its chatbot is about seven minutes, with 80% reporting a reduction in negative moods after one conversation. The startup also claims that after 30 days, a quarter of people who signed up for Youper are still active users.

Youper is currently free, though the company may test a freemium model in the future with premium features. It uses anonymized user data in its own research to improve Youper, but keeps it private and does not share or sell user data or information.

Of course, an app is not a replacement for seeing a therapist or psychiatrist, but Youper presents a much lower barrier to entry for people who worried about the stigma of seeing a professional. Hamilton says he hopes using Youper will encourage more people to seek medical treatment sooner if they need it by making them more comfortable with the idea of discussing their emotional health.

“On average, it takes 10 years for someone to finally talk to a health provider. This could become 10 minutes with an app like Youper,” Hamilton says. “Having an app with a super low barrier to entry, no stigma, something that is about emotional health and taking care of yourself, shows that you don’t need to be afraid.”

Powered by WPeMatico

Knowledge is the fuel of business. Every decision requires a full understanding of the data underlying it, and that means reaching out not only to an organization’s own staff for insight, but also to experts in the wider world. Management consultants, research agencies, and data providers make hundreds of billions of dollars per year attempting to answer key questions for business executives.

Sometimes they are successful, but many times, finding the right expert can be vexing. For the most important decisions, having multiple experts or even hundreds of experts provide their opinion might be critical to success.

Germain Chastel and Sascha Eder know the problem well. Former McKinsey consultants, they worked with some of the top technology companies in the Valley attempting to answer their questions — but oftentimes struggled to do so given the unique problems that confront those organizations. “We realized it was really hard to find experts who could teach them something and had the insights that were relevant,” Chastel explained.

In early 2017, the two left McKinsey and eventually joined forces with Anuja Ketan, and together the trio formed NewtonX. NewtonX is a “knowledge access platform” which attempts to intelligently answer questions posed to it by business clients. Clients answer a carefully calibrated series of questions to properly vet and scope a query, and then NewtonX farms it out to it network of experts for insight.

That rapid-response network has now gotten the attention of Two Sigma Ventures, the venture wing of the high-flying algorithmic-trading hedge fund, which led a $12 million Series A round into New York City-based NewtonX. That’s a follow up to a $3 million seed round co-led by Third Prime Capital and Xfund last year.

Today, the company offers two main product lines. First is what it calls Expert Calls, which are similar to the traditional expert network offering of companies like GLG. Here, a client answers a series of structured questions to determine a single expert to talk to and get feedback from.

The more interesting product to me, and the one representing 70% of the startup’s revenue right now, is Expert Surveys. With this product, the goal is to ask a business question to a wider number of experts who might provide a variety of responses. So, for instance, NewtonX could potentially answer a query such as how CIOs at large Fortune 500 companies are budgeting for cybersecurity this year.

Where NewtonX gets interesting is that it doesn’t want to just casually facilitate these calls and surveys, but instead, the startup wants to build out a true knowledge graph that can better answer questions faster with each activity on the platform. As the platform gets smarter about knowledge, the idea is that on-boarding a new client or initiating a new survey or question will be faster since the platform will already know many of the nuances of that particular field of business.

Over the two and a half years since the company’s founding, it has found wide support among businesses. It counts Microsoft, 23&Me, and Gartner as public clients, and also has a list of 20 corporates already on the platform. Chastel told me that nine of the top ten management consulting firms have also used NewtonX services, and many top research firms have also used the product.

The NewtonX team. Courtesy of NewtonX

Early revenues has allowed the company to expand early. It has 32 employees at its offices near Grand Central, and Chastel noted to me that a majority of employees and a majority of managers are women. He said that the firm’s technology to identify experts on the web is also the basis for their own recruiting efforts.

With the new funding, the company intends to grow to 100 head count locally, and also expand out is client success and expert success teams.

Powered by WPeMatico

Optimizely, a platform that offers tools for A/B testing and personalization on the web and in mobile apps, today announced that it has raised a total of $105 million. This includes a $50 million Series D round led by Goldman Sachs Private Capital, with the participation of Accenture Ventures, as well as a $55 million line of credit from Bridge Bank.

Goldman Sachs’s Michael Kondoleon will join Optimizely’s board of directors as a board member.

“We’re excited to reach this milestone because these investments cement our leadership position in the market,” Optimizely CEO Jay Larson told me. “We can invest more in products to put an even bigger gap between Optimizely and our competition. We can expand geographically. And we will continue to grow our team of world-class digital optimization experts. This is a big day for Optimizely and a big day for the experimentation and personalization industry.”

The company notes that about a quarter of the Fortune 100 currently use its services. The company says it now handles more than 6 billion events a day and that its customers have tripled their investments in digital experience optimization in the last two years. Current customers include the likes of Gap, Visa, IBM, StubHub, Metromile, Lending Club and Sonos.

The company notes that about a quarter of the Fortune 100 currently use its services. The company says it now handles more than 6 billion events a day and that its customers have tripled their investments in digital experience optimization in the last two years. Current customers include the likes of Gap, Visa, IBM, StubHub, Metromile, Lending Club and Sonos.

In total, Optimizely has now raised more than $200 million, excluding the line of credit. The additional $55 million from Bridge Bank is a bit unusual, but not completely out of the ordinary for companies at this stage. “Bridge Bank is proud to continue working with Optimizely, a global leader at the forefront of the digital experience optimization market,” said Mike Lederman, senior vice president and western region director of Bridge Bank’s technology banking group. “Optimizely is on a path of substantial growth and the additional capital will help them continue to build market-leading products that are used by an increasing number of top global brands.”

As is pretty much standard for companies at this stage, Optimizely will use the new funding to drive growth.

Powered by WPeMatico

A couple of years ago, London-based startup Zego realised gig-economy workers would need insurance, and went on to raise a very healthy £6 million in Series A funding, led by Balderton Capital. Its first products were pay-as-you-go scooter and car insurance for food delivery workers.

It’s now announced a $42 million raise in one of the largest funding rounds for a European insurtech startup, in a Series B investment led by pan-European investment firm Target Global, specialists in the fintech and mobility space, with other backers including TransferWise founder Taavet Hinrikus. The proceeds will be used to for Zego’s expansion across Europe and to increase the workforce from 75 to 150.

The raise takes the firm to a total of $51 million in funding, with new investors Latitude joining existing backers Balderton Capital and Tom Stafford of DST Global. The investment comes as the company claims a whopping 900% growth over the past 12 months.

Zego caters to the new mobility services, such as ride-hailing, ridesharing, car rental and scooter sharing, and offers a range of policies from minute-by-minute insurance to annual cover, providing more flexibility than traditional insurers, with pricing based on usage data from vehicles.

This means it’s become popular with scooter and car delivery drivers, plus van and taxi fleets. The firm currently insures one-third of the U.K.’s food delivery market, largely through partnerships with Deliveroo, Just Eat and Uber Eats.

Sten Saar, CEO and co-founder of Zego, said: “When we built Zego from scratch three years ago, our mission was to transform the insurance sector by creating products which truly reflected the rapidly changing world of transport… The world is becoming more urbanized and because of this, we are moving from traditional ownership of vehicles to shared ‘usership’. This means that the rigid model of insurance that has existed for hundreds of years is no longer fit for purpose.”

Ben Kaminski, partner of lead investors Target Global, said: “With the growth of new mobility services, Zego identified a major gap in the insurance market and created a unique business model to fill it, which the incumbents will find very difficult to replicate. The potential of this company is almost limitless, and I fully expect to see its U.K. success mirrored across Europe and beyond in the coming years.”

Powered by WPeMatico

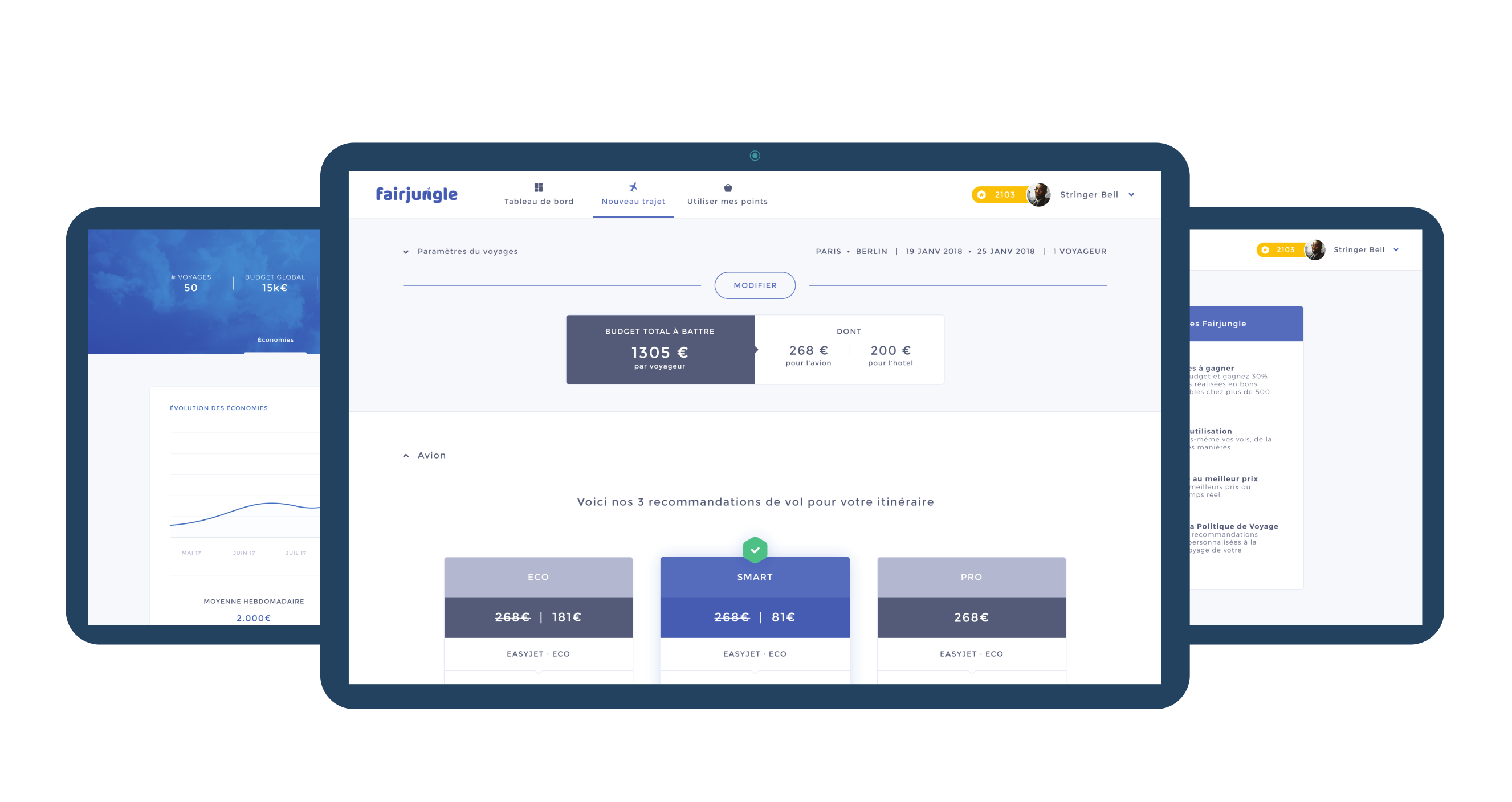

French startup Fairjungle wants to make it easier to book a flight or a hotel room for corporate purposes. The company just raised a $2 million funding round (€1.8 million) from Thibaud Elzière, Eduardo Ronzano, Bertrand Mabille and Whitestones Ventures.

If you work for a big company, chances are you book corporate flights through GBT, CWT or BCD Travel. And let’s be honest, the web interface usually sucks. It’s often hard to compare flights, change dates or even get a fair price.

Fairjungle is betting on a modern user experience and a software-as-a-service business model to change this industry. The idea is to make it feel more like you’re using a flight comparison service instead of a travel agency with a website.

“The value proposition [of legacy competitors] was historically around finding the best travel options for the business traveler, which has become obsolete today when you have tools like Skyscanner and Google Flights,” co-founder and CEO Saad Berrada told me.

In order to modernize that industry, the startup is leveraging the inventory of Skyscanner, Booking.com, Amadeus, Travelfusion and Hotelbeds. This way, you can book flights on 400 airlines and reserve hotel rooms in one million hotels.

After searching for a flight or a hotel room, you can book directly from Fairjungle. This way, employees don’t have to download invoices and file expense reports on a separate platform every time they travel. Companies can set up different rules to keep costs down. For instance, a flight that is unusually expensive requires approval from a manager.

Instead of charging per transaction, Fairjungle has opted for a SaaS model with a subscription of €5 per monthly active user.

Fairjungle currently focuses on small and mid-sized companies. The company has attracted 20 clients so far, including OVH. And it expects to generate $3.4 million (€3 million) in gross bookings by the end of the year.

Powered by WPeMatico

Get ready for summer in the city, TechCrunch -style. We just released a fresh batch of tickets to the 14th Annual TechCrunch Summer Party. Available on a first-come, first-served basis, tickets to our popular event sell out quickly, and they’ll be gone before you know it. Don’t wait — buy your ticket today.

Join us for TechCrunch’s fabulous summer fete at Park Chalet — San Francisco’s coastal beer garden — where you can enjoy ocean views, refreshing drinks and delicious appetizers. It’s a wonderful way to relax and celebrate the entrepreneurial spirit with more than 1,000 members of the startup community.

It’s also a wonderful way to meet your next investor, co-founder or — who knows? You’ll find startup magic in between the drinks, the games, the food and the fun. Opportunity happens at TechCrunch parties.

Check out the party particulars:

Come and join the summer fun. Connect with community and opportunity. As always, you’ll have a chance to win great door prizes — like TechCrunch swag, Amazon Echos and tickets to Disrupt San Francisco 2019.

Tickets sell out quickly, so don’t wait. Buy your 14th Annual Summer Party ticket today.

Did you try to buy a ticket and come up empty? We release tickets to the Summer Party on a rolling basis. Sign up here, and we’ll let you know when the next batch goes on sale.

Is your company interested in sponsoring or exhibiting at the TechCrunch 14th Annual Summer Party? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Just about anyone can come up with a good idea. Fewer people can execute on that idea and turn it into a prototype or MVP. But there is still one final challenge for most entrepreneurs that can prove challenging.

How do you secure that initial seed capital and take your idea to the next level?

At Disrupt SF in October, Redpoint’s Annie Kadavy, DocSend’s Russ Heddleston and Precursor’s Charles Hudson will sit down together and chat it out on the Extra Crunch stage.

Kadavy, Heddleston and Hudson can offer a unique perspective on the process of early-stage fundraising.

Kadavy joined Redpoint in 2018 after a four-year stint at Charles River Ventures, where she sourced or led deals with ClassPass, Cratejoy, DoorDash, Lauren & Wolf and Patreon. She’s also spent time within firms like Bain & Company, Warby Parker and Uber Freight. She understands the importance of operational experience, and knows better than most how to take a company from point A to point B.

Heddleston, co-founder and CEO of DocSend, has a completely different perspective. DocSend is used to securely send and track documents, and one of the most prevalent documents on the platform happens to be pitch decks. Heddleston can tell us about what characteristics get (and keep) the attention of investors, as well as what turns them off.

Hudson, managing partner at Precursor Ventures, has been on both sides of the conference room table. He founded Bionic Panda Games, which was acquired by Zynga in 2010. He moved on to SoftTech VC (now Uncork Capital), where he spent eight years working on seed-stage investments in the consumer internet space. At Precursor Ventures, he’s continuing to invest in early-stage companies that are tackling problems in new markets.

These three each have their own perspective on how to get the attention of investors and how to turn a conversation into a cap table.

“How to Raise Your First Dollars” is but one of many panels that will take place on the Extra Crunch stage at Disrupt SF. The Extra Crunch stage, much like Extra Crunch on the web, is meant to serve as a resource for aspiring entrepreneurs and VCs, offering practical, step-by-step advice on how to get to where you’re going.

We’re thrilled to have Kadavy, Heddleston and Hudson join us at the show.

Disrupt SF runs October 2 – October 4 at the Moscone Center in SF. Tickets to Disrupt SF are available here.

Powered by WPeMatico

MobiKwik, a mobile wallet app in India that has expanded to add several financial services in recent years, said today it plans to enter international markets as it approaches profitability with the local operation. The company is kick-starting its overseas ambitions with cross-border mobile top-ups support.

The 10-year-old firm said it has partnered with DT One, a Singapore-headquartered payments network, to enable international mobile recharge (topping up credit to a mobile account), rewards and airtime credit services in more than 150 nations across some 550 mobile operators. The feature is now live on the app.

The feature is aimed at Indians living overseas and immigrants in India, Upasana Taku, co-founder of MobiKwik told TechCrunch in an interview. Millions of Indians go overseas to pursue education or look for a job. Currently, there is no convenient way for them to either help — or receive help from — their families and friends in India when they need to top up their phones.

Similarly, millions of people come to India in search of a job. The new functionality from MobiKwik will allow their families and friends to top up their mobile credit as well. Taku said there is no processing fee for customers, as MobiKwik is absorbing all the overhead expenses.

For MobiKwik, mobile recharge is just the entry point to assess interest from users, Taku added. “This is the first service we are launching. We will eventually add other essential services as well. Mobile recharge will offer us good data points and will help us understand different markets,” she added.

MobiKwik is also studying different regulatory frameworks in overseas markets and holding conversations with stakeholders, she added.

The announcement comes at a time when MobiKwik is inching closer to profitability, a feat unheard of for a mobile wallet app provider in India. The firm, which claims to have grown its revenue by 100% in the last two years, expects to be profitable by this year and go public by 2022. (Interestingly, MobiKwik was looking to raise a big round at $1 billion valuation two years ago — which never happened.)

In the last year, the firm has expanded to offer financial services such as loans, insurance and investment advice. MobiKwik competes with a handful of payment services in India, including Paytm, PhonePe and Google Pay that either support, or fully work on top of a government-backed payment infrastructure called UPI. In April, UPI apps were used to carry out 782 million transactions, according to official figures.

The big numbers have attracted major investors, too. With $285.6 million in funding, India emerged as Asia’s top fintech market in the quarter that ended in March this year.

Powered by WPeMatico

You’d be hard-pressed to find a tech company that said it wished it had waited longer to implement on diversity and inclusion efforts. The examples of tech companies “doing it right” in this industry are few and far between, but that doesn’t mean it’s not worth trying. And for those that want to try, there’s a clear playbook to follow.

Where tech companies seem to go wrong is around implementing one-off initiatives such as unconscious bias training, employee resource groups or hiring a head of diversity and inclusion. Alone, these initiatives are not effective. But implementing those together, along with other initiatives, can create lasting change inside tech companies.

More than 10 years ago, Freada Kapor Klein, co-founder of Kapor Capital and the Kapor Center for Social Impact, published her groundbreaking book, “Giving Notice,” about the hidden biases people face in the workplace. In it, Kapor Klein laid out five key strategies as part of a comprehensive approach to addressing inclusion within tech companies. In order for it to be effective, companies must implement every single initiative.

This approach, which is applicable to this day, entails instituting policies practices and principles; implementing formal and informal problem-solving procedures; devising customized training based on organizational needs; ask more specific questions on employee surveys and break down data demographically; and ensure accountability from the top.

Powered by WPeMatico

Cleo, the London-based “digital assistant” that wants to replace your banking apps, has quietly taken venture debt from U.S.-based TriplePoint Capital, according to a regulatory filing.

The amount remains undisclosed, though I understand from sources that the figure is somewhere in the region of mid-“single-digit” millions and will bridge the gap before a larger Series B round later this year. Cleo declined to comment on the fundraising.

However, sources tell me the need to raise debt financing is partly related to Cleo Plus, the startup’s stealthy premium offering that is currently being tested and set to launch more widely soon. The new product offers Cleo users a range of perks, including rewards and an optional £100 cash advance as an alternative to using your bank’s overdraft facility. The credit facility is, for the time bring at least, being financed from the startup’s own balance sheet, hence the need for additional capital.

The new funding also relates to Cleo’s U.S. launch, which began tentatively around a year ago. This has been more successful than was expected, seeing Cleo add 650,000 active U.S. users to date. The U.S. currently makes up more than 90% of new users now, too. Overall, the fintech claims 1.3 million users have signed up to the Cleo chatbot and app, with 350,000 active in the U.K.

Accessible via Facebook Messenger and the company’s iOS app, Cleo is an AI-powered chatbot that gives you insights into your spending across multiple accounts and credit cards, broken down by transaction, category or merchant. In addition, Cleo lets you take a number of actions based on the financial data it has gleaned. This includes choosing to put money aside for a rainy day or specific goal, sending money to your Facebook Messenger contacts, donating to charity and setting spending alerts and more.

Meanwhile, alongside TriplePoint, Cleo is backed by some of the biggest VC names in the London tech scene — including Balderton Capital, Entrepreneur First, Moonfruit co-founders Wendy Tan White and Joe White, Skype founder Niklas Zennström, Wonga founder Errol Damelin, TransferWise founder Taavet Hinrikus and LocalGlobe.

Powered by WPeMatico