Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Slack’s public debut is happening Thursday on the NYSE and the company has set a reference price of $26 per share for its direct listing, according to WSJ, which would value the company at around $15.7 billion.

The company’s stock is expected to pop at open, according to the WSJ’s sources. Slack is pursuing a direct listing, eschewing the typical IPO process in favor of putting its current stock on to the NYSE without doing an additional raise or bringing on underwriter banking partners.

This isn’t a first for the technology industry, as Spotify did the same thing about this time last year, but it is still an outlier in terms of common practice for startups looking to the public markets for their liquidity event.

Slack, launched in 2013 by Flickr co-founder Stewart Butterfield, was initially built as a side project to support team communication for Butterfield’s game company Tiny Speck. In the intervening years, it has risen to become one of the most recognized enterprise communication tools currently available.

Update: Slack’s pricing and symbol, ‘WORK’ are now officially confirmed.

Powered by WPeMatico

From the venue and the flashy event website, Waterloo, Ontario’s True North conference (in its second year) doesn’t seem all that distinct from a laundry list of other major tech events that take place each year across North America. But from the moment its main stage programming kicked off on the first day, it was clear this wasn’t your typical gathering place for the tech industry faithful.

The main stage track kicked off with Communitech CEO Iain Klugman. The event is produced by Communitech, an entrepreneurial support and resource organization founded in 1997 to foster the Waterloo region’s technology industry. Communitech sprung out of BlackBerry and the University of Waterloo and the world-class innovation community that surrounds both.

Klugman, a former communications executive and current board member at a number of Communitech-fostered startups and academic institutions, sounded a cautionary and urgent note that continued throughout the day.

Tech conferences, in general, tend to dwell on optimism and enthusiasm, with brief forays into dark alleys of negative consequences. Not this one.

Communitech CEO Iain Klugman speaking at True North 2019 in Waterloo.

Klugman’s talk touched on opportunity, but it was the opportunity to discuss among a group of peers with influence in the technology industry how they should undertake together “to set things right.” Last year’s event had a similar outcome, resulting in the “Tech for Good Declaration,” which True North describes as “the Canadian tech industry’s living document,” and includes a number of principles designed to help guide technology development with community good in mind.

Rather than changing focus for year two, True North’s organizers seem to have doubled down: Klugman’s opening talk included references to surveillance capitalism and breaches of trust, and included this cheerful analogy: “Technology is like fuel. It can warm our homes or it can burn them to the ground, so we decide which one it will do.”

As a whole, the event is about the “tough choices” faced by the collective “we” of the tech industry, according to Klugman.

True North’s official keynote perfectly took the baton from the intro, as New York Times columnist and longtime political commentator Thomas Friedman took the stage. Friedman, a somewhat controversial figure owing to some of his past political stances, launched into a talk informed by his most recent book, “Thank You for Being Late,” and talked about what we’re seeing now in human history as a moment of intersection of three different forces accelerating in a “nonlinear manner” all at once, including technological development outpacing humanity’s ability to adapt to those changes.

NYT columnist and author Thomas Friedman at True North 2019 in Waterloo.

Friedman’s talk ended with him positing that humans spend most of their time today in the essentially “god-less” realm of “cyberspace,” a realm “where we’re all connected but no one’s in charge,” while at the same time we’ve achieved better than ever ability to act with god-like power to control and manipulate our environment. He chided the essential disconnect of powerful forces that act with supreme mastery over technology but with no grounding in sociopolitical understanding (specifically naming Mark Zuckerberg) and those who have the inverse problem (the U.S. Congress, in Friedman’s view).

Overall, Friedman’s views are grounded in what he describes as a place of optimism. But the takeaway is more that humanity is currently at a state where it’s overwhelmed on a number of fronts and out of its depth in terms of having a capacity to cope.

In the afternoon, Robert Mazur (longtime undercover agent and the subject of biopic “The Infiltrator”) discussed his experience tracking down and prosecuting money launderers operating more or less with the blessing of large financial institutions, precisely because their systems were designed around incentive systems that encouraged them but didn’t have protections in place to prevent bad actors from taking advantage. Mazur further elaborated that current telecom industry structure actually makes it even easier than ever to launder large sums relatively unchecked. In essence, it was a warning to be mindful of how the products you build can be exploited by the most malicious actors.

Former Information and Privacy Commissioner for Ontario and creator of the concept of “Privacy by Design” Ann Cavoukian came next, decrying the current state of data “centralized in huge honeypots of information,” including Google (her example).

Former Ontario Information and Privacy Commissioner Ann Cavoukian.

This centralization, she noted is a huge risk in terms of presenting opportunities for tracking, misuse, leaks and more. It’s “taking away our agency as individuals,” she said, and the solution is moving to true decentralization of data.

“Privacy […] is freedom, and is about you making decisions relating to your personal information; not the state, not corporations — you,” she said. “It’s not about secrecy, it’s about control [and] privacy is a necessary condition for societal well-being.”

Cavoukian wrapped her talk by noting the sheer volume of privacy breaches that have leaked consumer information to date, and about the importance of encryption in keeping this safe. Overall, her talk was a blueprint for tech companies looking to incorporate data privacy and good stewardship into the DNA of their products from day one.

Kelsey Leonard, Tribal Co-Lead on the Mid-Atlantic Regional Planning Body of the U.S. National Ocean Council, provided a talk on the implications of digital rights and the continued digital divide as it pertains to Indigenous communities globally. Leonard pointed out that Indigenous nations in North America are the least connected in the world, something she noted continues the ongoing colonialism, and even can potentially contribute to “ongoing genocide of Indigenous peoples.”

Kelsey Leonard, advocate for Indigenous Data Governance and Sovereignty, speaks at True North 2019 in Waterloo.

Indigenous people are also systematically disenfranchised from data ownership and data control, by virtue of their being left out of advanced STEM education and formalized degrees, she said. Leonard also noted that platforms contain reinforcement of what she calls “digital colonialism,” in that Indigenous names are often flagged as fake by algorithms designed to enforce real-name policies, and Indigenous languages are often mistranslated (specifically as Estonian, she said).

This worsens existing Indigenous language and culture erasure. Leonard said a language is lost every two weeks on average, according to recent research. What’s required then is to add protection measures specific to digital platforms to help counter this institutional digital colonization and enforce Indigenous Sovereign Data.

To close day one, Recode founder and legendary Silicon Valley reporter Kara Swisher summarized a lot of her recent work as a New York Times columnist. Basically, that means she called on the industry to stop messing around and start fixing stuff.

Kara Swisher speaks at the True North 2019 conference in Waterloo, Ontario.

Swisher said we’re coming to a “reckoning” for tech in terms of media coverage, and the overwhelmingly positive coverage it’s received over the past many years. She emphasized that we’re only at the beginning of the impact technology will have on society, and laid out a number of current areas of innovation and investment that will continue to upset societal norms, including autonomous driving, artificial intelligence and more.

Regarding media specifically, Swisher noted that she marked a significant shift when BuzzFeed started A/B testing to amplify and extend the attention-capture possible around specific “news” items, citing the famous Katy Perry Left Shark incident of 2015. This, combined with our “continuous partial attention,” which is tied to our inability to totally disengage from our smartphones, is combining to have effects on how we think and work in the world, Swisher said.

She added that, today, many of her new big concerns are around AI, and that “everything that can be digitized will be digitized.” Not only that, she continued, but “almost everything can be,” which will be massively disruptive to peoples’ lives, with effects including a future where most people will have a very high number of different jobs over the course of their lives, requiring continuous education and retraining. “We have to think really hard about what good AI is and what problematic AI is,” she said.

Thompson Reuters Foundation CEO Antonio Zappulla at True North 2019 in Waterloo discussed using technology to help fight human trafficking.

Across other stages, too, the themes of technology’s dangers and how to avert it prevailed across programming. Take Some Risk founder Duane Brown gave a talk on opting out of the always-connected lifestyle and becoming “digitally exhausted.” MedStack founder and CEO Balaji Gopalan talked about the risks inherent in dealing with private patient data in healthcare. Other topics included sustainable energy for Africa, using big data to counter human trafficking and ensuring we steer away from encouraging consumerization in this generation of connected kids.

The event’s central theme was the deceptively simple (and frankly over-uttered) phrase “tech for good,” but the programming and content revealed a level of sophistication and sincerity on the topic that exceeds the low bar often found in tech industry marketing materials and staged events. Overall, it felt introspective, contrite and contemplative — a self-reflection from a community genuine about shoring up its ethical shortcomings. In other words, refreshing.

Powered by WPeMatico

Four-day work week. Open-plan offices. Work-life balance. Remote work. There are endless ways to set up your team and company for success. And there’s evidence for and against all of these scenarios.

Take remote work for instance. Owl Labs reports that 44% of global companies don’t allow it. While Gallup reports that 43% of all Americans work remotely at least some of the time.

So what’s the right answer? Well that depends on what your goals are. But no matter what, the important thing is to make a decision and stick with it.

Because no matter what decision you’re making – personal, professional, big or small – it’s important to commit 100%. And when that decision is likely to impact your company’s culture for years to come, you better hope to get it right.

So when Buffer’s co-founder and CEO, Joel Gascoigne, decided to close down one of their offices, I gave him one key piece of advice. Commit to either placing the entire team in the remaining office or establish a 100% remote workforce. Both scenarios can work, but a mix of the two will only set you up to fail.

When everyone is remote, that becomes one of the defining characteristics of a company’s culture. People have no option but to get their work done and collaborate virtually. And an entirely remote culture can both draw in candidates attracted to this way of working and remove those who know they won’t be able to thrive working remotely.

Powered by WPeMatico

Early-stage startup founders, we’re looking at you. Are you ready to launch your company and show the world what you’ve got? There’s no better launching pad than Startup Battlefield, and the next battle goes down at Disrupt San Francisco 2019 — in the city that gave birth to startup dreams.

There’s no time to waste. The application deadline expires on June 25th at 11:59 p.m. (PT). Apply to compete in the Startup Battlefield today.

Because Disrupt San Francisco 2019 is our flagship event, it’s appropriate that Startup Battlefield comes with a flagship prize. We’re talking a $100,000 equity-free cash infusion to the winner’s bottom line. But there’s more on the line than a wad of cash. Here’s how Startup Battlefield works and the benefits all participants receive.

First off, applying to and participating in Startup Battlefield is free. However, the selection process is extremely competitive. Discerning TechCrunch editors vet every application and choose approximately 15-20 startups to compete. All participating teams receive free, extensive pitch coaching from our Battlefield-tested editorial team.

When you step onto the Disrupt Main Stage, you’ll have six minutes to pitch and present a live demo to a panel of expert VCs and tech leaders — and then respond to their questions.

Teams that make it through to the final round repeat the process to a second set of judges, and it’s from that elite cohort that one standout startup will earn the title, hoist the Disrupt Cup and claim the $100,000 prize.

It all goes down live in front of an audience of thousands, and we live-stream the entire event to the world on TechCrunch.com, YouTube, Facebook and Twitter — and make it available later on-demand.

Whether you win the whole shebang or not, you still win. All competing teams receive intense media and investor attention and exhibit for free in Startup Alley for all three days of the show. You also receive invitations to VIP events, free passes to future TechCrunch events and complimentary subscriptions to our new editorial offering, Extra Crunch.

It’s time. You’re ready to launch. Apply to the Startup Battlefield, and join us at Disrupt San Francisco 2019 on October 2-4. And remember, the application deadline expires on June 25th at 11:59 p.m. (PT).

Not quite ready to battle it out on the Main Stage? Why not apply for our TC Top Picks program? It’s a select group, and if we pick your startup, you’ll receive a free Startup Alley Exhibitor Package, VIP treatment and plenty of media and investor exposure.

Powered by WPeMatico

Pretty much everything about making a self-driving car is difficult, but among the most difficult parts is making sure the vehicles know what pedestrians are doing — and what they’re about to do. Humanising Autonomy specializes in this, and hopes to become a ubiquitous part of people-focused computer vision systems worldwide.

The company has raised a $5.3 million seed round from an international group of investors on the strength of its AI system, which it claims outperforms humans and works on images from practically any camera you might find in a car these days.

HA’s tech is a set of machine learning modules trained to identify different pedestrian behaviors — is this person about to step into the street? Are they paying attention? Have they made eye contact with the driver? Are they on the phone? Things like that.

The company credits the robustness of its models to two main things. First, the variety of its data sources.

“Since day one we collected data from any type of source — CCTV cameras, dash cams of all resolutions, but also autonomous vehicle sensors,” said co-founder and CEO Maya Pindeus. “We’ve also built data partnerships and collaborated with different institutions, so we’ve been able to build a robust data set across different cities with different camera types, different resolutions and so on. That’s really benefited the system, so it works in nighttime, rainy Michigan situations, etc.”

Notably their models rely only on RGB data, forgoing any depth information that might come from lidar, another common sensor type. But Pindeus said that type of data isn’t by any means incompatible, it just isn’t as plentiful or relevant as real-world, visual-light footage.

In particular, HA was careful to acquire and analyze footage of accidents, because these are especially informative cases of failure of AVs or human drivers to read pedestrian intentions, or vice versa.

The second advantage Pindeus claimed is the modular nature of the models the company has created. There isn’t one single “what is that pedestrian doing” model, but a set of them that can be individually selected and tuned according to the autonomous agent’s or hardware’s needs.

“For instance, if you want to know if someone is distracted as they’re crossing the street. There’s a lot of things that we do as humans to tell if someone is distracted,” she said. “We have all these different modules that kind of come together to predict whether someone’s distracted, at risk, etc. This allows us to tune it to different environments, for instance London and Tokyo — people behave differently in different environments.”

“For instance, if you want to know if someone is distracted as they’re crossing the street. There’s a lot of things that we do as humans to tell if someone is distracted,” she said. “We have all these different modules that kind of come together to predict whether someone’s distracted, at risk, etc. This allows us to tune it to different environments, for instance London and Tokyo — people behave differently in different environments.”

“The other thing is processing requirements; Autonomous vehicles have a very strong GPU requirement,” she continued. “But because we build in these modules, we can adapt it to different processing requirements. Our software will run on a standard GPU when we integrate with level 4 or 5 vehicles, but then we work with aftermarket, retrofitting applications that don’t have as much power available, but the models still work with that. So we can also work across levels of automation.”

The idea is that it makes little sense to aim only for the top levels of autonomy when really there are almost no such cars on the road, and mass deployment may not happen for years. In the meantime, however, there are plenty of opportunities in the sensing stack for a system that can simply tell the driver that there’s a danger behind the car, or activate automatic emergency braking a second earlier than existing systems.

While there are lots of papers published about detecting pedestrian behavior or predicting what a person in an image is going to do, there are few companies working specifically on that task. A full-stack sensing company focusing on lidar and RGB cameras needs to complete dozens or hundreds of tasks, depending on how you define them: object characterizations and tracking, watching for signs, monitoring nearby and distant cars and so on. It may be simpler for them and for manufacturers to license HA’s functioning and highly specific solution rather than build their own or rely on more generalized object tracking.

“There are also opportunities adjacent to autonomous vehicles,” pointed out Pindeus. Warehouses and manufacturing facilities use robots and other autonomous machines that would work better if they knew what workers around them were doing. Here the modular nature of the HA system works in its favor again — retraining only the parts that need to be retrained is a smaller task than building a new system from scratch.

Currently the company is working with mobility providers in Europe, the U.S. and Japan, including Daimler Mercedes Benz and Airbus. It’s got a few case studies in the works to show how its system can help in a variety of situations, from warning vehicles and pedestrians about each other at popular pedestrian crossings to improving path planning by autonomous vehicles on the road. The system can also look over reams of past footage and produce risk assessments of an area or time of day given the number and behaviors of pedestrians there.

The $5 million seed round, led by Anthemis, with Japan’s Global Brain, Germany’s Amplifier and SV’s Synapse Partners, will mostly be dedicated to commercializing the product, Pindeus said.

“The tech is ready, now it’s about getting it into as many stacks as possible, and strengthening those tier 1 relationships,” she said.

Obviously it’s a rich field to enter, but still quite a new one. The tech may be ready to deploy, but the industry won’t stand still, so you can be sure that Humanising Autonomy will move with it.

Powered by WPeMatico

Seventy-two hours to save. That’s how much time remains on super-early-bird pricing for passes to Disrupt San Francisco 2019, which takes place October 2-4. If you plan to attend TechCrunch’s flagship event dedicated to bold, early-stage startuppers — and why wouldn’t you — you have until June 21 at 11:59 p.m. (PT) to score the best price. Depending on the type of pass you buy, you can save serious cheddar — up to $1,800. Choose the budget-friendly payment plan option during checkout and you can pay for your pass over time. It’s all geared to be as easy on the purse strings as possible, so buy your pass now and save.

Moscone North Convention Center will be home to more than 10,000 attendees from around the world — including startups, exhibitors and media outlets — for three jam-packed days of programming across 14 categories. It’s where you’ll find both the present and future of technology under one roof.

Every Disrupt event features an amazing lineup of speakers. We’re talking interviews and panel discussions with some of the world’s most influential names in tech and investing — and that tradition continues at Disrupt SF 2019. Here’s just one example of the presentations you’ll experience.

Cybersecurity ranks as a major concern that affects everyone — consumers, businesses and governments. We’re thrilled that Jeanette Manfra, homeland security assistant director and a senior executive at the department’s Cybersecurity and Infrastructure Security Agency (CISA), will grace the stage. One of the government’s most experienced cybersecurity civil servants, Manfra currently leads the effort to protect and strengthen our nation’s vital infrastructure, including the power grid and water supplies. We can’t wait to hear what she has to say about the government’s cybersecurity efforts.

Experience Startup Alley’s ocean of opportunity. You’ll find hundreds of outstanding early-stage startups pushing tech boundaries and creating the future today. You’ll also find the TC Top Picks — a hand-picked cadre of companies representing these categories: AI/Machine Learning, Biotech/Healthtech, Blockchain, Fintech, Mobility, Privacy/Security, Retail/E-commerce, Robotics/IoT/Hardware, SaaS and Social Impact & Education. If that describes your early-stage startup, apply to be a TC Top Pick. If you make the cut, you get to exhibit in Startup Alley for free. You also get three complimentary passes and VIP treatment with plenty of VC and media exposure — including a live interview with a TechCrunch editor on the Showcase Stage.

Disrupt SF 2019 takes place October 2-4, and your chance to snag the best price on passes disappears in just three short days. Be bold. Buy your pass now — before the June 21 11:59 p.m. (PT) deadline — and save big.

Is your company interested in sponsoring or exhibiting at Disrupt SF 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Text IQ, a machine learning system that parses and understands sensitive corporate data, has raised $12.6 million in Series A funding led by FirstMark Capital, with participation from Sierra Ventures.

Text IQ started as co-founder Apoorv Agarwal’s Columbia thesis project titled “Social Network Extraction From Text.” The algorithm he built was able to read a novel, like Jane Austen’s “Emma,” for example, and understand the social hierarchy and interactions between characters.

This people-centric approach to parsing unstructured data eventually became the kernel of Text IQ, which helps corporations find what they’re looking for in a sea of unstructured, and highly sensitive, data.

The platform started as a tool used by corporate legal teams. Lawyers often have to manually look through troves of documents and conversations (text messages, emails, Slack, etc.) to find specific evidence or information. Even using search, these teams spend loads of time and resources looking through the search results, which usually aren’t as accurate as they should be.

“The status quo for this is to use search terms and hire hundreds of humans, if not thousands, to look for things that match their search terms,” said Agarwal. “It’s super expensive, and it can take months to go through millions of documents. And it’s still risky, because they could be missing sensitive information. Compared to the status quo, Text IQ is not only cheaper and faster but, most interestingly, it’s much more accurate.”

Following success with legal teams, Text IQ expanded into HR/compliance, giving companies the ability to retrieve sensitive information about internal compliance issues without a manual search. Because Text IQ understands who a person is relative to the rest of the organization, and learns that organization’s “language,” it can more thoroughly extract what’s relevant to the inquiry from all that unstructured data in Slack, email, etc.

More recently, in the wake of GDPR, Text IQ has expanded its product suite to work in the privacy realm. When a company is asked by a customer to get access to all their data, or to be forgotten, the process can take an enormous amount of resources. Even then, bits of data might fall through the cracks.

For example, if a customer emailed Customer Service years ago, that might not come up in the company’s manual search efforts to find all of that customer’s data. But because Text IQ understands this unstructured data with a person-centric approach, that email wouldn’t slip by its system, according to Agarwal.

Given the sensitivity of the data, Text IQ functions behind a corporation’s firewall, meaning that Text IQ simply provides the software to parse the data rather than taking on any liability for the data itself. In other words, the technology comes to the data, and not the other way around.

Text IQ operates on a tiered subscription model, and offers the product for a fraction of the value they provide in savings when clients switch over from a manual search. The company declined to share any further details on pricing.

Former Apple and Oracle General Counsel Dan Cooperman, former Verizon General Counsel Randal Milch, former Baxter International Global General Counsel Marla Persky and former Nationwide Insurance Chief Legal and Governance Officer Patricia Hatler are on the advisory board for Text IQ.

The company has plans to go on a hiring spree following the new funding, looking to fill positions in R&D, engineering, product development, finance and sales. Co-founder and COO Omar Haroun added that the company achieved profitability in its first quarter entering the market and has been profitable for eight consecutive quarters.

Powered by WPeMatico

Postman, a five-year-old startup that is attempting to simplify development, tests and management of APIs through its platform, has raised $50 million in a new round to scale its business.

The Series B for the startup, which began its journey in India, was led by CRV and included participation from existing investor Nexus Venture Partners . The startup, with offices in India and San Francisco, closed its Series A financing round four years ago and has raised $58 million to date.

Postman offers a development environment which a developer or a firm could use to build, publish, document, design, monitor, test and debug their APIs. Postman, like some other startups such as RapidAPI, also maintains a marketplace to offer APIs for quick integration with other popular services.

The startup was co-founded by Abhinav Asthana, a former intern at Yahoo . Asthana was frustrated with how APIs were an afterthought for many developers, as they usually got around to building them in the eleventh hour. Additionally, developers were relying on their own workflows and there was no organized platform that could be used by many, he explained in an interview with TechCrunch.

Even big software firms have not looked into this space yet, and many have instead become a customer of Postman. “We are solving a fundamental problem for the technology landscape. Big companies tend to be slower as they have many other things on their plate,” said Asthana.

Five years later, Postman has grown significantly. More than 7 million users and 300,000 companies, including Microsoft, Twitter, Best Buy, AMC Theaters, PayPal, Shopify, BigCommerce and DocuSign today use Postman’s platform.

The modern software development relies heavily on APIs as more businesses begin to talk with one another. According to research firm Gartner, more than 65% of global infrastructure service providers’ revenue will be generated through services enabled by APIs by 2023, up from 15% in 2018.

Asthana said Postman intends to use the fresh capital to scale its startup, products and grow its team. “We are scaling rapidly across all dimensions. There are many use cases that we still want to address over the coming months. We will also experiment with sales and invest in improving user experience,” he added.

Postman offers some of its services in limited capacity for free to users. For the rest, it charges between $8 to $18 per user to its customers. That’s how the company generates revenue. Asthana declined to share the financial performance of the startup, but said its customer base was “growing phenomenally.”

Postman said CRV general partner Devdutt Yellurkar has joined its board of directors.

Powered by WPeMatico

Slack, the popular workplace messaging company, is expected to list on the New York Stock Exchange on Thursday in the second major direct listing in the U.S. after Spotify introduced the concept to investors in April of last year.

At this point, plenty of industry observers think it makes sound sense for Slack to embrace the direct listing approach, wherein a company places its stock on a public exchange without raising any money or using underwriters. Though the company warned last week that its operating losses are widening as it chases new customers, it has $800 million on its balance sheet, meaning it doesn’t need to raise more right now.

Slack also doesn’t need underwriters who typically discount a company’s shares in order to ensure that they appreciate in value when they begin trading. It’s a known brand in the tech world, and that universe is broadening by the day. Put another way, Slack doesn’t need to be “sold” for investors to want to snap up its shares.

Still, we wondered about some of the thinking that has gone into preparing Slack for its move into the world of publicly traded companies, so we talked with a couple of people who are familiar with what’s happening behind the scenes to find out more. They asked not to be named, but here’s what we learned:

1) Unlike with the popular streaming music platform Spotify, which has more than 100 million premium subscribers and roughly twice as many active monthly users, Slack wasn’t as well-known to Wall Street as Silicon Valley might imagine. In fact, we’re told the bankers that were selected to advise Slack on its offering — Morgan Stanley, Goldman Sachs and Allen & Co., which are the same three that advised Spotify — had to provide more education to analysts and institutional investors this time around.

2) There will (hopefully) be enough shares to go around, while also not a glut of them. The big concern in a direct offering — which does not feature a lock-up period — is that too many people will dump their shares on the market, crushing the company’s share price, or else that too few will part with their holdings, turning the buying and selling of the company’s shares into a financial game of chicken. We’ll see what happens here, but we’re told the banks have spent the last six months trying to ensure that many — but not all — of the company’s institutional shareholders will be selling some of their stakes at the offering, Also worth noting is that unlike with Spotify, some Slack employees have restricted stock units that will vest upon its public listing and so be part of the supply of shares on its first day.

3) In establishing guidance around how Spotify’s shares should be valued, the banks advising the company looked almost entirely to its private market trades, of which there were many. There has been less secondary activity with Slack’s shares, so the banks are likely to rely on these sales but also to use other inputs. We’ll learn soon enough what they settle on, but based on the latest prices at which its shares have traded in the private market, Slack’s presumed valued right now is at $16.7 billion, or 36 times trailing 12-month sales.

4) You might imagine that banks hate direct listings because of the rich underwriting fees they aren’t collecting, and they probably do. Still, even with a direct listing, they get paid pretty well, thanks to both advisory fees and also because investors often trade through the banks named as advisers in the prospectus. There are also fewer mouths to feed on a deal with a direct listing. In Slack’s case — as happened with Spotify — Morgan Stanley, Goldman Sachs and Allen & Co. will reportedly reap almost all of the spoils — or a reported 90% of the $22 million in fees earmarked for all the advisers involved in the deal. In a traditional IPO, a longer number of banks that promise research coverage are given shares to sell, which eats into lead underwriters’ allotment.

5) One risk that Slack shouldn’t necessarily run into but that may have adversely impacted Uber’s IPO is its investor base. According to Slack’s S-1, its biggest outside shareholders include Accel (it owns 24% sailing into the offering), Andreessen Horowitz (13.3%), Social Capital (10.2%) and SoftBank (7.3 %). Why it matters: Slack doesn’t have to worry about less traditional private company backers like mutual funds not wanting to buy up its shares because they’re too busy trying to offload some.

6) Direct listings may well become a more popular product for consumer companies because companies can avoid further dilution, and there’s no lock-up on their shares, creating a shorter path to liquidity for the company and its employees and its investors. Still, Slack is probably anomalous as an enterprise company with a high enough profile to pull one off. The listings are really for companies that don’t need money any time soon and whose shares are already of interest to investors, who don’t need inducements to pay attention.

7) This is the second direct listing of a highly valued privately held company and, for the second time, it’s happening on the NYSE, with the same market maker, Citadel Securities, charged with ensuring orderly trading; the same bank, Morgan Stanley, selected to advise Citadel; and even the same law firms that worked on Spotify’s direct listing pulled back into service.

It’s nice if you’re part of this particular club, and no one can blame Slack for not wanting to reinvent the wheel. But one wonders how nervous it makes Nasdaq, as well as other banks and law firms, to be shut out of this process a second time.

Powered by WPeMatico

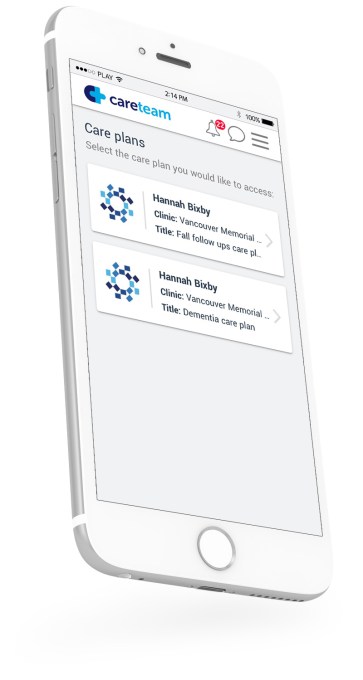

How best to untangle the Gordian knot that is navigating your own healthcare? It’s a tricky question, and one that seems to have become only more complicated as technology improves, in many regards — systems don’t necessarily speak to one another, and it’s still hard for an ordinary patient without specialist knowledge to make sense of everything. Careteam is a Canadian startup hoping to address that, looking to replicate the kind of advances made possible by technology in industries like e-commerce and enterprise software.

Careteam co-founder and CEO Dr. Alexandra Greenhill has experienced the frustration of being a tech-savvy person in a world of healthcare that can seem technologically inept — both as a practicing GP and as someone who depends on the healthcare system as a patient and a relative of patients with more sophisticated medical needs.

“I spent more than 15 years innovating within the healthcare system,” Greenhill told me in an interview. “I computerized hospitals, helped doctors adopt electronic medical records and other types of innovation practices. And then for the last eight years, I’ve been in tech, trying to figure out how to build the kind of technology we need in health, and especially digital health.”

All that experience led Greenhill to the realization that while there were many companies building specific solutions for real, but relatively narrow problems, that didn’t reflect how most people experienced care. Greenhill and her team of three other co-founders (Jeremy P. Smith, Robert I. Atwell and Kevin Lysyk) had all had unfortunate, but eye-opening experiences with family members in need of treatment for major diseases.

“You step in and you discover that cancer care, palliative care, post-surgical care — there’s so many things that would have gone wrong if we didn’t have the expertise ourselves,” Greenhill said. “But in the meantime, you end up being sort of pulled into multiple directions and saying ‘this makes no sense.’ You know, I can purchase stuff online in my private life; I can use all kinds of tools in the business world, and yet it’s back to paper and voice in health, which matters most.”

Careteam CEO and founder Dr. Alexandra Greenhill

What Careteam provides is collaboration for care — true collaboration, designed to span patients, their doctors and other healthcare pros, their families and anyone who matters to them in the course of pursuing their care. It provides the ability to communicate instantly, build care plans that integrate all aspects of their tailored health plans, receive custom-configurable notifications and measure progress toward specific goals set by patient and healthcare providers.

Part of the reason this process has become opaque or difficult is precisely due to innovation: Greenhill takes issue with the prevailing narrative that the healthcare industry is somehow allergic to innovation.

“There’s this sort of perception that healthcare doesn’t innovate, but it’s also almost insulting to the healthcare system, because we have innovated — we save people from cancer, where we couldn’t,” she noted. “We cure HIV, in some cases, and we prevent it from being transmitted to unborn babies of mothers with full-blown AIDS and things that in my working lifetime were impossibilities; it was science fiction to help someone with HIV. And, and we’ve managed to do all of that, and it’s a success story. We’ve created complexity, we’ve created people who live with 12 conditions for many, many years and take complicated drug regiments.”

In addition to advances in treatment, Greenhill notes that she and her team couldn’t have build Careteam five years ago, because cloud storage wasn’t secure and everything had to be done on a site-specific instance, and that would’ve been cost-prohibitive to build. In other words, technology has been applied to, and vastly improved, healthcare overall, regardless of the general perception of the industry as an innovation laggard.

In addition to advances in treatment, Greenhill notes that she and her team couldn’t have build Careteam five years ago, because cloud storage wasn’t secure and everything had to be done on a site-specific instance, and that would’ve been cost-prohibitive to build. In other words, technology has been applied to, and vastly improved, healthcare overall, regardless of the general perception of the industry as an innovation laggard.

That’s why Greenhill’s startup doesn’t shy away from complexity — they embrace it. Careteam is designed not to try to normalize and standardize the varied and highly specialized landscape of healthcare solutions and providers through anything like a one-size-fits-all API. Instead, the company’s tech development is cleverly designed to be flexible when it comes to integrations.

“We collectively spent $1.9 billion in Canada, to try and digitize the healthcare system, create standards and create some exchange between data,” Greenhill said. “The NHS tried the same, big U.S. hospital systems have created their own little sort of islands, including Kaiser and Mayo and others. And the conclusion of all of that is standardization in healthcare just doesn’t seem to catch on.”

Careteam’s approach has been instead to integrate specific clinics, and let practitioners and patients derive benefits and help spur the adoption of the platform to their companion organizations and clinics. It’s a sort of rhizomatic approach that starts with a node central to a patient’s care and spreads through the healthcare professionals and members of the patient’s support network that the product helps. And integration is made possible without technical demands on the part of partners thanks to the work of CTO Lysyk, according to Greenhill.

The Vancouver-based startup is working with the Centre for Aging + Brain Health in Toronto, Ontario in a validation program announced last year, and also raised an initial round of funding in January led by BCF Ventures with participation from Right Side Capital, Globalive Capital, Atrium Ventures, and angels Barney Pell and Ajay Agarwal .

Powered by WPeMatico