Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Two of the highest-flying now-public enterprise companies of the year — Slack and Zoom — are different in many ways, besides the fact that one is focused on workplace messaging while the other is centered around video conferencing.

Slack began life as a very different startup, while Zoom founder Eric Yuan knew from the outset that he wanted to take on his former employer, WebEx. Slack raised a lot of money from many sources before hitting the public market — roughly $1.4 billion over 10 rounds. Zoom raised just $160 million across five rounds, including a $100 million Series D round funded entirely by Sequoia. The two also approached their public offerings differently. Slack chose a direct listing that didn’t raise new money for the company; Zoom chose a traditional IPO, raising half a billion dollars in funding for its coffers just ahead of its first day of trading.

Still, the two companies also have much in common. Both took on incumbents (WebEx and email, respectively). Both are rooted in workplace collaboration and, as such, have some of the same competitors, including Microsoft Teams. Another shared quality, notes Zoom investor Gordon Ritter of Emergence Capital Partners: both are “powered by viral end-user adoption, which is not the case for every SaaS company.” (Slack largely grows within a company, starting with one team; Zoom grows internally and externally, given the nature of video conferencing across companies.)

What the two may also have in common: potentially fewer days at the top of the heap than some of their predecessors. The reason, as says longtime VC Greg Gretsch, who co-founded Jackson Square Ventures in 2011, is the “intensity of new competition is on a completely different level today from what it was 15 or 20 years ago.”

Ritter, who co-founded Emergence in 2002 and has backed Box, Yammer and Veeva Systems, where he remains board chair, echoes the sentiment. The “cycle time of incumbents having their day in the sun is getting shorter and shorter,” he notes.

It’s happening broadly to Fortune 500 companies, whose average lifespan is now less than 20 years, compared with 60 years in the 1950s. But now, even still fast-growing companies like Zoom and Slack, which “have amazing futures,” says Ritter, will likely have startups nipping at their heels very soon.

Craig Hanson, a general partner and co-founder of NextWorld Capital in San Francisco, explains it this way: “In the current environment, with all the entrepreneurs and capital looking for the next great idea, each startup success story immediately blooms an entire field of new startups chasing after them.”

It’s almost possible to time it, says Hanson. “Once a startup raises a big growth round or has an impressive exit, in two to three quarters, you’ll see rounds of funding for similar new companies. This happens in both consumer and enterprise tech. VCs may regret missing out on the first company that just raised big and hope that there’s room for another one, or some great IPO or acquisition may spark a newfound passion for a space they overlooked before or that they thought was too hard until someone proved them wrong.”

Consider the many failed video conferencing startups to precede Zoom, including long-forgotten outfits like TeamSlide, LiveMeeting and Vyew. Indeed, Eric Yuan’s startup was anything but a sure thing, But once a space has been validated by the kind of success that Zoom enjoys, it makes it easier for other founders to raise money. This might partly explain why, in April, a nearly five-year-old, Boston-based startup named Owl Labs landed $15 million in Series B funding for its video conference camera with 360-degree capabilities. Another web conferencing startup, Highfive, based in Redwood City, Calif., drummed up $32 million last year, including from Lightspeed Venture Partners and Andreessen Horowitz.

“It’s easier to explain what they want to do [if they can say] ‘We’re like Twilio for ____,’” says Hanson, adding that as recently as 2016, “you’d have maybe two to three startups going after a space and chasing the incumbents. Now there will be 10 startups, and the incumbents were themselves startups just a handful of years earlier.”

The trend isn’t limited to recently public companies, says Gretsch. In his view, “success for many companies and sectors is declared long before the first IPO, and with that perceived success comes a wave of me-too competitors.”

It goes “hand in hand with the explosion of seed rounds over the last 10 years, which itself has been largely driven by how little it really costs for a company to get a finished product into customers hands,” he says.

In fact, Gretsch isn’t so sure the trend is a new one. Nevertheless, because the sheer number of startups that receive funding is now “off the charts,” it’s changing the game for consumer and enterprise companies alike.

“Any company that’s enjoying success has to remain paranoid and not ever settle for resting on their laurels,” says Gretsch. Today, it just happens to be “more true than it was 23 years ago, when [famed Intel CEO] Andy Grove used it for the title of his book.”

That famous best-seller? “Only the Paranoid Survive.”

Powered by WPeMatico

What would a $100,000 cash infusion do for your early-stage startup? Don’t just imagine it. Apply to compete in Startup Battlefield at Disrupt San Francisco 2019 on October 2-4.

Our premier pitch competition has launched hundreds of startups on an exponential success trajectory, attracts massive media and investor attention and, yeah, it offers a fat $100K prize — equity free. But listen up founders, the application deadline expires on June 25th at 11:59 p.m. (PT). Don’t miss your shot at TC fame and fortune. Fill out an application to Startup Battlefield today.

You literally have nothing to lose. Any early-stage startup — from any country, in any vertical — is eligible, and it doesn’t cost anything to apply or to compete. TechCrunch doesn’t charge any fees or take any equity, either. We’re nice that way.

You’ll have plenty of time to prepare and plenty of sage advice from expert TechCrunch editors. Yup, all competing teams receive extensive, free pitch coaching. You’ll be rarin’ to go when you step on the Disrupt Main stage to deliver your six-minute pitch and live demo to a panel of top VC and tech judges.

We expect more than 10,000 attendees at our flagship Disrupt SF event, and the wildly popular Startup Battlefield always draws a huge audience. We’re talking thousands of spectators, including hundreds of media outlets, investors and tech influencers. These are the very people who could potentially take your company — whether you win the Battle or not — to the next level and beyond. Not to mention the international live stream to get the entire world’s attention.

Want more perks? We’ve got ’em. Battlefield startups get up to four free conference passes, access to TC’s investor-startup matching program and can exhibit for free in Startup Alley for all three days of Disrupt. Plus, you receive backstage access, invitations to VIP events and free passes to all future TechCrunch events.

Then there’s the Startup Battlefield alumni community — 857 companies strong and counting. Your startup will join an awesome group that includes Fitbit, Vurb, Dropbox, Get Around, Cloudflare, Mint and more. Alumni companies have collectively raised $8.9 billion and produced 110 successful IPOs or acquisitions.

Startup Battlefield takes place at Disrupt San Francisco 2019 on October 2-4, and your shot at $100,000 ends when the application deadline expires on June 25th at 11:59 p.m. (PT). Don’t miss all the opportunity. Apply right here, and we’ll see you in San Francisco!

Powered by WPeMatico

Welcome to this week’s transcribed edition of This is Your Life in Silicon Valley. We’re running an experiment for Extra Crunch members that puts This is Your Life in Silicon Valley in words – so you can read from wherever you are.

This is your Life in Silicon Valley was originally started by Sunil Rajaraman and Jascha Kaykas-Wolff in 2018. Rajaraman is a serial entrepreneur and writer (Co-Founded Scripted.com, and is currently an EIR at Foundation Capital), Kaykas-Wolff is the current CMO at Mozilla and ran marketing at BitTorrent. Rajaraman and Kaykas-Wolff started the podcast after a series of blog posts that Sunil wrote for The Bold Italic went viral.

The goal of the podcast is to cover issues at the intersection of technology and culture – sharing a different perspective of life in the Bay Area. Their guests include entrepreneurs like Sam Lessin, journalists like Kara Swisher and Mike Isaac, politicians like Mayor Libby Schaaf and local business owners like David White of Flour + Water.

This week’s edition of This is Your Life in Silicon Valley features Lisa Fetterman – the Founder/CEO of Nomiku (a Y Combinator alum). Lisa talks extensively about why Silicon Valley does not care about female founders, and proposes a solution to the problem.

If you are interested in diving deep into the diversity problem in technology, this episode is for you.

For access to the full transcription, become a member of Extra Crunch. Learn more and try it for free.

Rajaraman: Welcome to season three of This is Your Life in Silicon Valley. A podcast about the Bay Area, technology and culture. I’m your host Sunil Rajaraman and I’m joined by my co-host Jascha Kaykas-Wolff.

Kaykas-Wolff: So, now I got a straw poll for you. Are you ready?

Rajaraman: I’m ready.

Powered by WPeMatico

This is it, the final day the super-early-bird is hanging out at TechCrunch dispensing serious savings on passes to Disrupt San Francisco 2019. Once the clock ticks onto 11:59 p.m. (PT) tonight, the bird flies off to parts unknown. The known part? Ticket prices go up.

Disrupt events provide outstanding ROI at any price. But seriously folks, why pay more? Prices start at $145 and, depending on the pass you buy, you can save up to $1,800. Buy your pass today — before the deadline hits.

One more thing about money. We, like most startuppers, are seriously budget-conscious, so we’ve created a payment plan option that lets you spread your payments over time. Simply select that option during checkout.

On to the main event. San Francisco — the home of the startup culture and spirit, and TC’s flagship Disrupt conference. More than 10,000 attendees — founders, investors, engineers, makers designers, students and 400 media outlets — will settle in for three jam-packed wild and woolly days of startup goodness.

The TechCrunch Hackathon is back in full force, with 800 participants raring to build something new out of nothing in 24 hours. They’ll compete to create working solutions to real-world challenges put forth by an array of sponsors. Each challenge offers its own cash and prizes, and TechCrunch will also award one team a $10,000 cash prize for the best overall hack.

Don’t miss the Startup Battlefield, with its hefty $100,000 cash prize. If you think your early-stage startup has what it takes to step onto the Main Stage and compete against some of the best, get moving now and apply. The deadline expires on June 25th at 11:59 p.m. (PT). Apply right now!

There’s more than one way to step into the Disrupt spotlight. Apply to be in our TC Top Picks program. Up to five early-stage startups will be selected to represent each of these categories: AI/Machine Learning, Biotech/Healthtech, Blockchain, Fintech, Mobility, Privacy/Security, Retail/E-commerce, Robotics/IoT/Hardware, SaaS and Social Impact & Education.

If selected, you’ll receive a free Startup Alley Exhibitor Package and an interview with a TechCrunch editor on the Showcase Stage.

There’s so much more to Disrupt — a heady lineup of speakers, Q&A Sessions, workshops, demos, world-class networking and CrunchMatch to help make connecting easier than ever. What are you waiting for?

The clock is ticking on super-early-bird savings to Disrupt San Francisco 2019 on October 2-4. The deadline expires tonight at precisely 11:59 p.m. (PT). Be kind to your bottom line and buy your pass to Disrupt right now.

Is your company interested in sponsoring or exhibiting at Disrupt San Francisco 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Nowports, a developer of software and services to track freight shipments from ports to destinations across Latin America, has aims to become the regional answer to Flexport’s billion-dollar digital shipping business.

Almost 54 million containers are imported and exported from Latin America each year, and nearly half of them are either delayed or lost due to mismanagement.

Nowports is pitching shippers on its digital management software to keep track of each container, and has signed on a number of leading venture capital firms to fulfill its mission.

The Monterrey, Mexico-based company raised $5.3 million in its seed round of financing. The round was led by Base10 and Monashees, with participation from Y Combinator and additional investors like Broadhaven, Soma Capital, Partech, Tekton and Paul Buchheit.

“In Nowports we saw a very strong combination: well prepared and ambitious team using technology to help thousands of customers to improve their importing and exporting processes. By adding efficiency, reliability, and transparency to change a multi-billion dollar industry, Nowports has been able to attract many clients that saw significant improvements in their daily routines by using the solution” said Caio Bolognesi, general partner from Monashees, in a statement.

The company said it would use the money to expand into new markets, grow its team and integrate with more companies involved in the (very fragmented) Latin American logistics industry. It’s a market that needs a range of better logistics technologies.

“Even though over 90% of the world’s trade is carried by sea, the most cost-effective way to move goods en masse, there has yet to be a solution that’s able to connect suppliers, customs brokers, carriers and transportation companies to provide an efficient and reliable service,” said Maximiliano Casal, founder and chief executive of Nowports, in a statement. “This is why we launched Nowports, combining our 10 years of industry expertise to fill this void and are currently working with over 40 customers in the region and growing.”

The company now has offices in Chile and Uruguay, and is planning to expand to Brazil, Colombia and Peru.

“With platforms, algorithms with AI and integrations, our platform allows companies to take control of their shipments and plan and predict the best timing to move the freight based on the needs of their own company,” said Alfonso De Los Rios, founder and CTO of Nowports.

As the company looks to expand, it has a strategic road map it can follow in the growth of Flexport, the Silicon Valley startup that has become a billion-dollar business by applying technology to the outdated shipping industry.

The two co-founders of Nowports met at a program at Stanford University, with De Los Rios hailing from a family with deep ties to the shipping industry. He and Casal linked up and the two began plotting a way to make the deeply inefficient industry more modern and transparent. To familiarize himself with the market for which he’d be developing a technology, Casal worked in a freight forwarder in Kansas City that had been operating for more than 30 years.

In all, freight providers are getting paid nearly $40 billion per year to move freight into Latin America.

“Alfonso and Max are the ideal founders we look to invest in as they are industry experts and passionate about evolving the industry using technology and automation,” said Adeyemi Ajao, general partner from Base10. “We are proud to be investors in Nowports alongside our friends at Monashees and look forward to watching the company’s continued growth.”

Powered by WPeMatico

The robotaxi’s blowin’ its horn and zooming autonomously down the home stretch. At 11:59 p.m. (PT) on June 21 — that’s tonight, people — we hit the brakes on early-bird pricing for TC Sessions: Mobility 2019. Don’t miss your chance to join us in San Jose, Calif. on July 10 and save a smooth $100. Get your ticket now.

Innovations across multiple technologies — AI, robotics, electric batteries, digital platforms and manufacturing — are transforming mobility and transportation. Join the leading experts, technologists, founders and investors as they discuss the promise, hype and challenges within this nascent revolution.

More than 1,000 attendees are expected for a program-packed day of speakers, panel discussions, workshops and demos. How packed? Here’s the day’s agenda, plus a sample of just some of the presentations we have lined up:

This TC Session is a stellar networking opportunity, and you’ll have extra help cutting through the noise to make the right connections. We’re talking CrunchMatch, TechCrunch’s free business match-making platform. Easily search for like-minded attendees, send and schedule meetings and make the most of your limited time. Learn how CrunchMatch works here.

Don’t miss your chance to connect with the leading minds and makers of your community at TC Sessions: Mobility 2019 on July 10, in San Jose, Calif. And don’t miss your chance to save $100. Buy your early-bird ticket now before the clock runs out tonight at 11:59 p.m. (PT).

Is your company interested in sponsoring or exhibiting at TC Sessions: Mobility? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

The private space industry is seeing a revolution driven by cube satellites, which are affordable, lightweight satellites that are much easier than traditional satellites to design, build and launch. It’s paving the way for new businesses like Wyvern, an Alberta-based startup that provides a very specific service that wouldn’t even have been possible to offer a decade ago: Relatively low-cost access to hyperspectral imaging taken from low-Earth orbit, which is a method for capturing image data of Earth across many more bands than we’re able to see with our eyes or traditional optics.

Wyvern’s founding team, including CEO Chris Robson, CTO Kristen Cote, CSO Callie Lissinna and VP of Engineering/COO Kurtis Broda, had experience building satellites through their schooling, including working on building the first-ever satellite in space designed and built in Alberta, Ex-Alta 1. They’ve also developed their own proprietary optical technology to develop the kind of imagery that will best serve the needs of the clients they’re pursuing. Their first target market, for instance, are farmers, who will be able to log into the commercial version of their product and get up-to-date hyperspectral imaging data of their fields, which can help them optimize yield, detect changes in soil makeup (which will tell them if they have too little nitrogen) or even help them spot invasive plants and insects.

“We’re doing all sorts of things that directly affect the bottom line of farmers,” explained Robson in an interview. “If you can detect them, and you can quantify them, and the farmers can make decisions on how to act and ultimately how to increase the bottom line. A lot of those things you can’t do with multi-spectral [imaging] right now, for example, you can’t speciate with multi-spectral, so you can’t detect invasive species.”

Multi-spectral imaging, in contrast to hyperspectral imaging, measures light on average in between three to 15 bands, while hyperspectral can manage as many as hundreds of adjoining or neighboring bands, which is why it can do more specialist things like identifying the species of animals on the ground in an observed area from a satellite’s perspective.

Hyperspectral imaging is already a proven technology in use around the world for exactly these purposes, but the main way it’s captured is via drone airplanes, which Robson says is much more costly and less efficient than using CubeSats in orbit.

“Drone airplanes are really expensive, and with us, we’re able to provide it for 10 times less than a lot of these drones currently in use,” he said.

Wyvern’s business model will focus on owning and operating the satellites; providing access to the data, it caters to customers in a way that’s easy for anyone to access and use.

“Our key differentiator is the fact that we allow access to actual actionable information,” Robson said. “Which means that if you want to order imagery, you do it through a web browser, instead of calling somebody up and waiting one to three days to get a price on it, and to find out whether they could even do what you’re asking.”

Robson says that it’s only even become possible and affordable to do this because of advances in optics (“Our optical system allows us to basically put what should be a big satellite into the form factor of a small one without breaking the laws of physics,” Robson told me), small satellites, data storage and monitoring stations, and privatized launches making space accessible through hitching a ride on a launch alongside other clients.

Wyvern will also occupy its own, underserved niche providing this highly specialized info, first to agricultural clients, and then expanding to five other verticals, including forestry, water quality monitoring, environmental monitoring and defense. This isn’t something other more generalist satellite imaging providers like Planet Labs will likely be interested in pursuing, Robson said, because it’s an entirely different kind of business with entirely different equipment, clientele and needs. Eventually, Wyvern hopes to be able to open more broadly access to the data it’s gathering.

“You have the right to access [information regarding] the health of the Earth regardless of who you are, what government you’re under, what country you’re a part of or where you are in the world,” he said. “You have the right to see how other humans are treating the Earth, and to see how you’re treating the Earth and how your country is behaving. But you also have the right to take care of the Earth, because we’re super predators. We’re the most intelligent species. We are; we have the responsibility of being stewards of the Earth. And part of that, though, is being able to add almost omniscience of what’s going on in the Earth in the same way that we understand what’s going on in our bodies. That’s what we want for people.”

Right now, Wyvern is very early on the trajectory of making this happen — they’re working on their first round of funding, and have been speaking to potential customers and getting their initial product validation work finalized. But with actual experience building and launching satellites, and a demonstrated appetite for what they want to build, it seems like they’re off to a promising start.

Powered by WPeMatico

As the gaming market continues to boom, billions of dollars are being invested in new games and new streaming platforms vying to own a piece of the action. Most of the value is accruing to the large incumbents in a space, however, and the entrance of Google and other big tech companies makes it difficult to identify where there are compelling opportunities for entrepreneurs to build new empires.

TechCrunch media analyst Eric Peckham recently sat down with Paul Murphy, Partner at European venture firm Northzone, to discuss Paul’s view of the market and where he is focusing his dollars. Below is the transcript of the conversation (edited for length and clarity):

Eric Peckham: You co-founded the hit mobile game Dots before moving to London and joining Northzone last year. Are you still bullish on investment opportunities in mobile gaming or do you think the market has changed?

Paul Murphy: I’m bullish on mobile gaming–the market is bigger than it has ever been. There’s a whole generation of people that have been trained to play games on mobile phones. So those are things that are very positive.

The challenge is you don’t really have a rising tide moment anymore. The winners have won. And so it’s very, very difficult for someone to enter with new content and build a business that’s as big as Supercell or King, regardless of how good their content is. So while the prize for winning in mobile gaming content big, the likelihood is smaller.

Where I’m spending most of my time is not on content, it’s on components within mobile gaming. We’re looking at infrastructure: different platforms that enable mobile gaming, like Bunch which we invested in.

Their product allows you to do live video and audio on top of mobile games. So we don’t have to take any content risk. We’re betting that this great product will fit into a large inventory ecosystem.

Peckham: New mobile game studios that are launching all seem to fall under the sphere of influence of these bigger companies. They get a strategic investment from Supercell or another company. To your point, it’s tough for a small startup to compete entirely on its own.

Murphy: It’s possible in mobile gaming still but it’s really, really hard now. At the same time, what you’ve seen is the odds of winning are lower. It is hard to reach the same scale when it costs you $5.00 to acquire a user today, whereas when Candy Crush launched, it was $0.05 per user. So it’s almost impossible to achieve King-like scale today.

Therefore, you’re looking at similar content risk with reduced upside, which makes that equation less attractive for venture capital. But it might be perfectly fine for an established company because they don’t need to do the marketing, they have the audience already.

The big gaming companies all struggle with the challenge of how to create the next hit IP. They have this machine that can bring any great game to market efficiently, with a large audience they can cross promote from and capital they can invest to build a big brand quickly. For them, the biggest challenge is getting the best content.

So it’s natural to me that the pendulum has swung towards strategic investors in mobile gaming content. Epic has a fund that they set up with Improbable, Supercell is making direct investments, Tencent has been making investments for years. Even from a content perspective, you’re probably going to see Apple, Google, and Amazon making more content investments in mobile gaming.

Image via Getty Images / aurielaki

Peckham: Does this same market dynamic apply to PC games and console games? Do you see a certain area within gaming where there’s still opportunity for independent startups to create the game itself and find success at a venture scale?

Murphy: The reason we made our investment in Klang Games, which is building an MMO called Seed that people will primarily play through PC, is that while there is content risk–you’re never going to get rid of the possibility that the IP doesn’t fly–if it works, it will be massive…an Earth-shattering level of success. If their vision comes to life, it will be very, very big.

So that one has all the risks that you’d have in any other game studio but the upside is exponentially larger, so the bet makes sense to us. And it so happens that it’s going to be on PC first, where there’s certainly a lot of competition but it’s not as saturated and the monetization methods are healthier than in mobile gaming. In PC, you don’t have to do free-to-play tactics that interfere with the gameplay.

Powered by WPeMatico

African fintech has taken center stage for the Catalyst Fund, a JP Morgan Chase and Bill & Melinda Gates Foundation-backed accelerator that provides mentorship and non-equity funding to emerging markets startups.

The organization announced its 2019 startup cohort and three out of the four finance ventures — Chipper Cash, Salutat and Turaco — have an Africa focus (Brazil-based venture Diin, was the fourth).

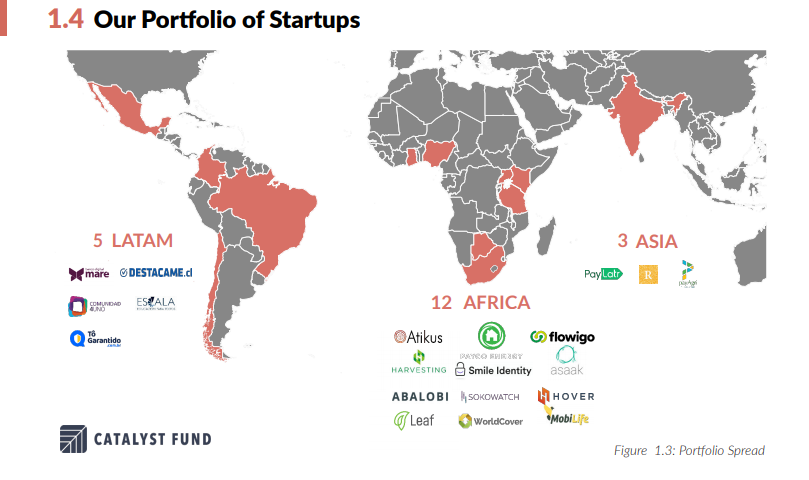

Catalyst Fund, which is managed by global tech consulting firm BFA, also released its latest evaluation report, which showed 60% of the organization’s portfolio startups are located in Africa.

The new additions to the fund’s program will gain $50,000 to $60,000 in non-equity venture building support (as Catalyst Fund dubs it) and six months of technical assistance. The funds and support are aimed at moving the ventures to the next phase of catalyzing business models, generating revenue and connecting to global VCs.

“We really tailor the kind of help we give to companies so they can reach market fit and proof points that investors want to see to enable the next phase of growth,” BFA Deputy Director Maelis Carraro told TechCrunch.

Catalyst Fund’s 2019 startup cohort also gained exposure to the fund’s Circle of Investors — a network of impact and commercial backers who can make decisions on investing in and accelerating particular companies.

Catalyst Fund’s 2019 startup cohort also gained exposure to the fund’s Circle of Investors — a network of impact and commercial backers who can make decisions on investing in and accelerating particular companies.

Next Big Thing and Deciens Capital recently joined the group of 40 investors that includes Techstars and the Mastercard Foundation.

The tenor for support for Catalyst Fund’s newest cohort of startups lasts through 2019. The ventures will also attend the big SOCAP 2019 tech conference in San Francisco, where Catalyst organizes workshops and meetings with its Circle of Investors.

Founded in 2016, the Catalyst Fund’s mandate includes supporting fintech startups that are developing solutions for low-income individuals in emerging markets. The organization has accelerated 20 ventures in Africa, Asia and Latin America that have raised $25.7 million in follow-on capital, according to its latest report.

With the Bill & Melinda Gates Foundation and JP Morgan Chase as the lead backers, Catalyst Fund partners also include Rockefeller Philanthropy Advisors and Accion.

JP Morgan Chase’s interest in supporting Catalyst Fund connects to a firm-wide commitment of the global bank to financial inclusion, according to JP Morgan’s Head of Community Innovation Colleen Briggs — who is also a day-to-day Catalyst Fund manager.

JP Morgan recently launched a $125 million, five-year commitment to improve global financial health, she explained. “For us there is a true market opportunity…we genuinely believe that financial inclusion is the foundation for the economy,” Briggs said.

“If we don’t get the social issues right it undermines the resiliency of the communities and the markets where we’re trying to operate.”

That Catalyst Fund’s cohorts have shifted toward Africa focused ventures speaks to the thesis for fintech on the continent.

By a number of estimates, Africa’s 1.2 billion people represent the largest share of the world’s unbanked and underbanked population.

An improving smartphone and mobile-connectivity profile for Africa (see GSMA) turns this scenario into an opportunity for mobile-based financial products.

Hundreds of startups are descending on Africa’s fintech space, looking to offer scalable solutions for the continent’s financial needs. By stats offered by Briter Bridges and a 2018 WeeTracker survey, fintech now receives the bulk of VC capital and deal-flow to African startups.

Ventures such as Catalyst Fund cohort member Chipper Cash — co-founded by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled — are looking to grow across Africa first before considering any global moves.

The company plans to introduce its no-fee, P2P, cross-border mobile-money payments products beyond current operations in Ghana and Kenya to Rwanda, Tanzania and Uganda within the next 12 months.

Ventures looking to join companies like Chipper Cash as a Catalyst Fund-supported startup can seek a referral from Catalyst’s Circle of Investors — who make a recommendations on new candidates. Catalyst Fund aims to choose 30 startups for its cohort over the next three years, according to program director David del Ser.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Sadly, Equity co-host Alex Wilhelm is out this week, but for good reason: He’s getting married this weekend. Fortunately, we had the esteemed TechCrunch editor Danny Crichton step in to discuss Slack’s direct listing, Facebook’s new cryptocurrency, the scooter cash desert, startup founder salaries and more with Equity co-host Kate Clark.

We began this week’s episode with the latest Slack news. The enterprise communications business was said to price its shares at $26 apiece Wednesday afternoon, valuing the company at around $15.7 billion. We taped this episode on Wednesday, the day before Slack’s direct listing. It’s now Friday. We’ll be back next week to unpack Slack’s initial performance on the public markets.

Then, we turned to Facebook’s new cryptocurrency, Libra, which will let you buy things or send money to people with nearly zero fees using interoperable third-party wallet apps or Facebook’s own Calibra wallet that will be built into WhatsApp, Messenger and its own app. As Kate mentioned in the podcast, if you’re curious at all about Libra, read TechCrunch’s Josh Constine’s deep dive here. And, of course, listen to the latest episode to learn more about the role VCs have played in the development of the token and what it means for crypto startups.

Next up on the agenda was scooters, because we can’t seem to tape a single episode of Equity without mentioning VC’s favorite sector. The news wasn’t great this week, however. We’re hearing that Lime, a scooter startup that has raised hundreds of millions in venture capital funding, is having a tough time landing fresh funding. That’s a big problem, because hardware is a tough and expensive business, and if Lime — and Bird for that matter — aren’t able to secure additional capital, well, it’s goodbye scooters.

Finally, Danny and Kate chatted about startup founder salaries. There’s not much written on this topic and comprehensive founder salary data is hard to come by. Fortunately, TechCrunch’s Ron Miller did a little digging to find out just how much VC-backed entrepreneurs are being paid these days. The results are surprising.

As usual, we’ll be back next week. Thanks for listening!

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico