Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Sales teams have long turned to tech solutions to help improve how they source leads, develop relationships and close deals. Now, one of the startups that helps out at a key point in that trajectory is announcing a round of growth funding to help fuel its own rapid growth. Showpad, a sales enablement platform that lets salespeople source and organise relevant content and other collateral that they use in their deals, has raised a Series D of $70 million.

The funding, which brings the total raised by Showpad to $160 million, is coming in the form of debt and equity. The equity part is co-led by Dawn Capital and Insight Partners, with existing investors Hummingbird Ventures, and Korelya Capital also participating. Silicon Valley Bank is providing debt financing. This is one of the first big investments out of Dawn’s Opportunities Fund that we wrote about last week.

The company is not disclosing its valuation but Pieterjan Bouten, the CEO who co-founded the company with Louis Jonckheere (currently CPO) and Peter Minne (CTO), confirmed that it has doubled since last year, and is seven times the valuation it had when it raised a $50 million Series C in 2016. The company is growing 90% year-on-year at the moment in terms of revenues.

And as a point of reference, another sales enablement player, Seismic, last December raised a Series E of $100 million at a $1 billion valuation.

Founded in Ghent, Belgium, Showpad today operates across two main headquarters, its original European base and Chicago. The latter was the homebase of LearnCore, a company that Showpad acquired last year that focuses on sales coaching and training. This became a strategic acquisition to expand Showpad’s primary product, a platform that acts as a kind of content management system for sales collateral. (Today, while Chicago is where Showpad builds its go-to market efforts and professional services, Ghent focuses on engineering and product, he said.) As it happens, Chicago is also the headquarters of Seismic.

As Bouten described in an interview, Showpad is part of what he considers to be the fourth pillar of the technology marketing stack: storage (the cloud services where you keep all your data), CRM, marketing automation and sales enablement, where Showpad sits.

While the first three are key to helping to manage a salesperson’s activities and work, the fourth is a crucial one for helping to make sure a salesperson can do his or her job more effectively.

Traditionally a lot of the content that salespeople used — presentations, white papers, other materials — to help make their cases and close their deals would be managed offline and directly by individual salespeople. Showpad has taken some of that process and made it digital, which means that now teams of salespeople can more effectively share materials amongst each other; and interestingly the material and its link to successful sales becomes part of how Showpad “learns” what works and what doesn’t.

That, in turn, helps build Showpad’s own artificial intelligence algorithms, to help suggest the best materials for a particular sales effort either to someone else in that team, or to other salespeople using the platform.

“To date there has been enormous innovation in automating the marketing and sales workflow. However, in the end, sales comes down to one person selling to another,” said Norman Fiore, General Partner at Dawn Capital and member of the Showpad Board, in a statement. “Historically, this has been an offline process that has been wildly inconsistent and opaque. Showpad’s suite of products succeeds in bringing this process online for the first time with data-rich feedback loops on the effectiveness of teams, managers, salespeople and even individual pieces of sales content.”

This is a crowded area of the market with a number of standalone companies building sales enablement solutions, but also other companies within the sales stack also adding on enablement as a value-added service.

For now, though, Bouten notes that these are more strategic partners than competitors. For example, Salesforce and Microsoft are partners, and, he adds, “We integrate with Salesloft to make sure sure emails that are sent out are using the right content. We become the single source of truth but also are being used for outreach.”

Today, the company has around 1,200 enterprise customers, including Johnson & Johnson, GE Healthcare, Bridgestone, Honeywell, and Merck. The plan going forward will be to continue building out the services that it offers around its sales enablement software, alongside the core product itself.

“You can equip sales people with the best content, but if they are not trained and coached in the right way, it goes nowhere,” Bouten said.

Powered by WPeMatico

Monzo, the fast-growing U.K.-based challenger bank with more than two million account holders, has raised £113 million (~$144m) in additional funding.

Confirming TechCrunch’s scoop in April, the Series F round is led by Y Combinator’s “Continuity” growth fund, and gives the company a new £2 billion (~$2.5b) post-money valuation. That’s double the £1 billion valuation it garnered in October last year.

A number of other new and existing investors have also participated in the Series F. They include Latitude, General Catalyst, Stripe, Passion Capital, Thrive, Goodwater, Accel, and Orange Digital Ventures.

The investment by London-based Latitude, the growth fund from prolific seed investor LocalGlobe, is particularly noteworthy given that LocalGlobe itself didn’t previously back Monzo. The same might be said of YC’s Continuity, considering that Monzo isn’t a YC alumni (although GoCardless, Monzo co-founder Tom Blomfield’s previous startup, did take part in the Silicon Valley accelerator).

The take-away: a growth fund attached to an early-stage fund can be a great antidote to the anti-portfolio (the list of successful companies a VC firm either missed, were unable or chose not to invest in).

Meanwhile, Monzo’s new funding round and YC’s backing should be viewed within the context of not only fast growth and increasingly convincing product-market fit in the U.K. — the challenger bank is currently adding 200,000 new sign-ups for its current account each month — but also recently unveiled plans to tentatively launch across the pond.

We first reported that Monzo was busy assembling a U.S.-based team over five months ago, and the U.K. company made its U.S. plans official last week. This will see a U.S. Monzo app and connected Mastercard debit card available via in-person signups at events to be held soon. The rollout will initially consist of a few thousand cards, supported by a waitlist in preparation for a wider launch.

The U.S. launch is being done in partnership with a local bank, but in the longer term Monzo plans to apply for its own U.S. bank license, similar to the strategy it employed in the U.K. so as to own and operate as much of its technical, product and regulatory infrastructure as possible.

In the U.K., this has helped Monzo achieve an NPS score of 80, which Blomfield previously told me is unusually high for a bank. This is seeing 60% of U.K. signups remain long-term active, transacting at once per week. As a counterpoint, however, the percentage of Monzo users that pay a salary into their Monzo account sits at between about 27% and 30% of active users, suggesting that a significant number of Monzo customers aren’t yet using it as their main account (Monzo’s definition of salaried is anyone who deposits at least £1,000 per month by bank transfer).

Success in the U.S., therefore, isn’t a given, conceded Blomfield when I had a call with him earlier this month. Instead, he argued that the key to cracking North America will be creating a fully localised version of Monzo based on carefully listening to U.S. users and once again finding product-market fit. He says there are obvious and less obvious cultural and technical differences in the way Brits and Americans save, spend and manage their finances, and this will require significant product divergence from the U.K. version of Monzo. Today’s new £113 million injection of capital is clearly designed to provide some of the breathing space required to achieve that.

As a side note, there are encouraging signs from other London-based fintechs that have ventured across the pond. One recent example is the financial “digital assistant” chatbot Cleo, which entered the U.S. around a year ago and has been more successful than the company anticipated, seeing Cleo add 650,000 active U.S. users to date. In fact, the U.S. currently makes up more than 90% of new Cleo users, prompting one source to describe the U.K. startup as effectively a U.S. company now.

Powered by WPeMatico

Entrepreneurs take a long journey when naming their brainchild, comparable to a parent naming their own flesh and blood.

There are many reasons behind naming – one untalked-of and probably the most important. This is, how to choose a name that gets you more business.

Technology changes how we do business. So, when developing a business name, putting some thought into how people are going to find you and what you want them to do after they find you could go a long way.

Ignoring this could do just the opposite and result in being harder to find, getting less return from your advertising and having your competitors capitalize off your brand.

Businesses have been using things like alphabetical order, call to action, keywords and more to shape business names for optimized discovery, recall and responsiveness since the phone book.

When looking for a business, I’m sure you’ve seen at least one of these two business name optimizations frequently used in the past for discovery:

Pre-internet, a listing in the phone book was key to getting your business discovered – but how did businesses get to the top of the list in their category? Piece of cake. Free listings in the white pages were categorized by business type and ordered alphabetically. Many companies ended their name with a describing word of their category and started it with something like “AAA” “AA”, “AA1” and “A AAA” to be one of the first listings in their category. You will still find thousands of these business names in different locations by typing “AAA” into yellowpages.com.

Prior to 2012, search engine algorithms gave weight in their rankings to sites that included keywords in their domain, otherwise known as exact-match domains. So, Google was more likely to rank “accountantsmelbourne-dot-com” higher than “abc-partners-dot-com” if a user searched for “Accountants Melbourne” because the keywords matched the search with similar words in its domain.

Over time, domain names and business names alike grew longer. Many were purposefully packed with every major keyword applicable to their niche.

Powered by WPeMatico

Early-stage startup founders it’s now or never, it’s do-or-die, it’s [insert your preferred time-crunch cliché here]. The application deadline for the Startup Battlefield at Disrupt San Francisco 2019 expires in just 24 hours.

If you’re ready to go up against a cadre of approximately 15-30 outstanding startups on the Disrupt Main stage, then apply to compete in the Startup Battlefield before the application window slams shut on June 25th at 11:59 p.m. (PT).

Competing in Startup Battlefield is free. TechCrunch does not charge fees or take any equity. If you make it through the vetting process — TechCrunch editors set a high bar — you’ll receive free, extensive pitch coaching from our Startup Battlefield-tested editors. Their advice, coaching and guidance will prepare you to deliver a killer, six-minute presentation to a panel of expert judges — notable VCs and technologists. And you’ll be ready to handle the nerve-wracking Q&A that follows your pitch.

The teams that make it into the final round will present their pitch and demo again — to a second set of judges. And from that select group, one startup will be named champion, claim the $100,000 cash prize, hoist the Disrupt Cup and get ready for a very bright future.

The entire event takes place in front of thousands of avid startup fans and influencers — investors, founders and journalists from more than 400 media outlets. We also live-stream the entire event around the world on TechCrunch.com, YouTube, Facebook and Twitter — and make it available later on-demand.

All Startup Battlefield teams benefit from competing whether they win or not. You’ll be on the receiving end of intense media and investor attention. You’ll exhibit for free in Startup Alley for all three days of the show. You’ll receive invitations to VIP events, free passes to future TechCrunch events and complimentary subscriptions to our new editorial offering, Extra Crunch. That adds up to serious opportunity.

All that opportunity expires in just 24 hours. Don’t miss your chance — apply to the Startup Battlefield before June 25th at 11:59 p.m. (PT).

There’s more than one way to stand in the Disrupt SF spotlight. Apply for our TC Top Picks program. As part of this select group, you’ll receive a free Startup Alley Exhibitor Package, VIP treatment and plenty of investor and media attention — including an interview with a TechCrunch editor on the Showcase Stage.

Is your company interested in sponsoring or exhibiting at Disrupt San Francisco 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

The last few decades have produced many successful marketplaces. We went from goods marketplace pioneers such as eBay and Amazon to simple service marketplaces such as Uber, Lyft, Doordash, Upwork, Thumbtack, TaskRabbit, and Fiverr. But why haven’t we seen many successful B2B service marketplaces?

Some would argue that companies such as Upwork, Thumbtack, Fiverr, or TaskRabbit are horizontal B2B marketplaces in the sense that they provide access to suppliers of different services. But while businesses do indeed transact with freelancers on such “horizontal” marketplaces, for most service verticals these are limited-value, one-off transactions. They fail to enable long-term business collaborations.

So, such marketplaces haven’t delivered more valuable services nor introduced a new paradigm for how businesses buy specific services at scale and on an on-going basis. Why is that?

Horizontal services marketplaces don’t provide much value beyond matching clients with quality service providers. In other words, they don’t facilitate collaboration between buyers and suppliers, never mind provide ways for the two parties to collaborate more efficiently over time as they engage in follow-on projects.

In essence, the model these marketplaces were built around is not much different from the likes of Craigslist, which put a convenient UX on traditional classified advertisements.

In their article “What’s Next for Marketplace Startups?,” Andrew Chen and Li Jin found that there aren’t many successful service marketplaces because those offerings are complex, diverse, and difficult to evaluate. It’s challenging to define a successful transaction in a service marketplace because it’s harder to quantify success.

One reason is that several service providers must often work together to complete a single job for a buyer, requiring a complex workflow from end to end. As a result, it’s difficult for marketplaces to not only mediate service delivery but also make it significantly more efficient for buyers and suppliers. If both the buyer and suppliers don’t see a significant efficiency gain other than being initially matched, why would they continue using the marketplace?

(Image via Getty Images / Lidiia Moor)

The $50 billion translation industry is a prime example of complex B2B services marketplaces. On the supply side are roughly 50,000 small agencies around the globe responsible for more than 85% of this $50 billion industry. (Note we are referring to agencies here as suppliers, though they play on both sides.)

On the demand side are businesses that need to translate text from one language into another. Plus about 1,500,000 freelance linguists work in this industry, many of whom are more specialized than professionals in other industries.

Anyone can find and hire a translator on Fiverr or Upwork. Both provide a vast selection of language translators. However, the quality and cost of the translation depends on the translation tools available to the translator as well as their subject expertise.

Neither Fiverr nor Upwork provide computer-aided translation (CAT) and collaborative workflow solutions for users of their platforms. Additionally, neither provides an effective way for all parties to collaborate and continuously improve the efficiency and quality.

But the problem with traditional marketplaces goes even further: Multiple translators and reviewers are usually needed to complete a single job for a customer. Multi-language translation projects are even more complicated. Such projects require multiple service providers and cost estimates, in addition to project management tools.

This is why building a B2B service marketplace is difficult. Service marketplaces must not only connect buyers and suppliers, but also provide tools to enable an efficient and collaborative workflow that reduces wasted time and effort.

In addition to the problems already outlined, traditional marketplaces experience another issue that prevents them from growing and retaining market participants: Buyer and supplier attrition.

Many business services are based on regularly recurring engagements. In some cases, a buyer and a service provider interact daily, requiring a different workflow than gig-marketplaces are built around.

Buyers and suppliers have little motivation to continue interacting on a platform with no workflow automation solutions. They lack a way to improve service efficiency and quality, automate collaboration, payment, paperwork, and other basic processes required for a business.

This is why many traditional marketplaces suffer from slow network effects and high attrition. (A network effect is what happens when a platform, product, or service delivers more value the more it is used.

Think Facebook, eBay, WhatsApp.) Why wouldn’t companies work directly with service providers outside of a marketplace after they were introduced? What incentives keep the service transaction on the marketplace? These are critical questions to answer when building a marketplace.

Traditional marketplaces target broad services, making it nearly impossible to provide workflow solutions for buyers and suppliers. Going forward, successful service marketplaces will be developed relying on an industry-specific SaaS workflow. This will focus buyers and suppliers on longer-term projects and interactions that serve the unique needs of collaborations and transactions in a specific vertical.

Image via Getty Images / OstapenkoOlena

In “The next 10 Years Will Be About Market Networks,” James Currier, Managing Partner at NFX Ventures, defines a new era of service marketplaces, which he calls market networks.

A market network is a platform that combines elements of an n-sided marketplace, a network, and workflow solutions. An n-sided marketplace is one that requires coordination of multiple supply-side parties to provide a complex service for a single buyer.

Market networks enable multiple buyers and suppliers to interact, collaborate, and transact on the same platform. They provide users with industry-specific workflow solutions that enable efficient, ongoing collaboration on long-term projects. This reduces costs and leads to a higher quality of services and increased overall value for all users.

But how do you actually build a successful market-network platform? While the answer to that varies from company to company, here is our approach. We were able to build a market network for the translation industry that combines the components: network, marketplace, and workflow solution.

The first step to building an effective complex market network is to develop a workflow that is easy for users to embrace. It might not seem like much, but this increases productivity by enabling teams to perform tasks that were previously impossible.

Powered by WPeMatico

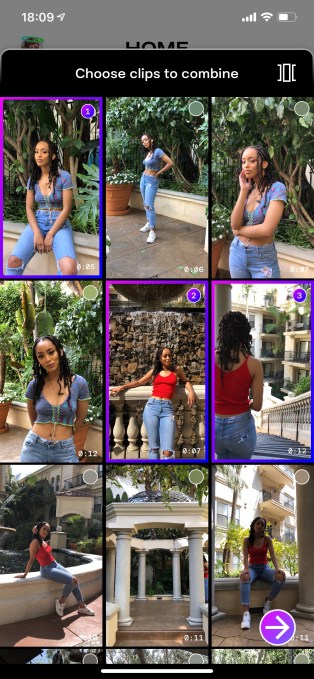

Trash is a new startup promising to make it easier for anyone to create well-edited videos.

Social video is an area that CEO Hannah Donovan knows well, having previously served as general manager at Vine (the video app that Twitter acquired and eventually shut down). She said that in user research, even though people had “really powerful cameras in their pockets,” when it came to editing their footage together, they’d always say, “Oh, I’m not technical enough, I’m not smart enough.”

Donovan, who also worked as head of creative at Last.fm, said she “got curious about whether we could use computer vision to analyze the video and synthesize it into a sequence.”

The result is the Trash app, which comes with a straightforward tag line: “You shoot, we edit.”

Donovan demonstrated the app for me last week, shooting a few brief clips around the TechCrunch New York office, which were then assembled into a video — not exactly an amazing video but much, much better than anything I could have done with the footage. We also got to tweak the video by adjusting the music, the speed or the “vibe,” then post it on Trash and other social networks.

Donovan founded the company with its Chief Scientist Genevieve Patterson, who has a Ph.D. from Brown and also did postdoctoral work with Microsoft Research.

Patterson told me that Trash’s technology covers two broad categories. First there’s analysis, where a neural network analyzes the footage to identify elements like people, faces, interesting actions and different types of shots. Then there’s synthesis, where “we try to figure out what are the most cool and interesting parts of the video, to create a mini-music video for you with a high diversity of content.”

The app should get smarter over time as it gets more training data to work with, Patterson added. For one thing, she noted that most of the initial training footage used “Hollywood-style cinematography,” but as Trash brings more users on-board, it can better adapt to the ways people shoot on their phone.

It’s starting that on-boarding process now with what Donovan calls a “creator beta,” where the team is looking for a variety of creators — particularly talented photographers who haven’t embraced video yet — to try things out. You can request an invite by downloading the iOS app. (Donovan said there are plans to build an Android version eventually.)

Trash has raised $2.5 million from sources as varied as the National Science Foundation, Japan’s Digital Garage and Dream Machine, the fund created by former TechCrunch Editor Alexia Bonatsos. Donovan said the startup isn’t focused on revenue yet — but eventually, it could make money through sponsorships, pro features and by allowing creators to sell their footage in the app.

And if you’re wondering where the name comes from, Donovan offered both a “snarky response” (“I don’t give a damn and I don’t take myself too seriously”) and a more serious one.

“We believe that one person’s trash is another person’s treasure,” she said. “With filmmaking, as you know, there’s a lot of things that get left on the cutting room floor. That’s one of the product concepts, in the longer term, that we want to explore.”

View this post on InstagramA post shared by TRASH (@thetrashapp) on

Powered by WPeMatico

What do early-stage startups Forethought, Pi and Recordgram have in common with successful tech companies like Dropbox, Mint and TripIt? They all competed in Startup Battlefield, our epic pitch competition.

If you’re ready to step up, go big and launch your startup to the world, you need to get moving. We stop accepting applications in just two days — on June 25th at 11:59 p.m. (PT). Apply to compete in the Startup Battlefield right now.

When we say, “go big” we mean it in every sense of the word. The crowd — more than 10,000 people flock to our flagship event. The stakes — a $100,000 equity-free cash prize. The competition — if you make the cut, you’ll go up against some of the finest early-stage startups on the Disrupt Main stage in front of an audience of thousands.

The room will be packed with founders, investors — and tech journalists from more than 400 media outlets. We’re talking influential people who can take your startup dreams and make them a reality. They’ll expect the best, and you’ll deliver.

You have nothing to lose. Applying and participating in Startup Battlefield is free. The selection process is competitive, and TechCrunch editors will choose approximately 15-30 startups to compete. Participating founders receive free, extensive pitch coaching to ensure peak performance.

On the big day, teams get six-minutes to pitch and present a live demo to the judges, a panel consisting of expert VCs and technologists. And that’s followed by a round of Q&A. Survive the first round and you’ll lather, rinse and repeat in front of a new set of judges.

One outstanding startup will emerge to claim the $100,000, the Disrupt Cup and serious bragging rights to become the toast of Disrupt SF ‘19.

But the benefits of competing extend to all Startup Battlefield participants. You’ll enjoy the VIP treatment at Disrupt — including invitations to private investor receptions, and you get free exhibit space in Startup Alley for all three days of the show. You’ll have access to CrunchMatch — our investor/startup matching program that simplifies networking. Oh, and we live-stream the entire event on TechCrunch.com, YouTube, Facebook and Twitter. Plus, it’s available later on-demand.

Disrupt San Francisco 2019 takes place on Oct. 2-4. Don’t miss your chance to step up, go big and go home with $100,000. Apply to Startup Battlefield before the deadline on June 25th at 11:59 p.m. (PT).

Not quite ready for prime time on the Disrupt Main stage? No worries. Why not apply for our TC Top Picks program? Our TC Top Picks receive a free Startup Alley Exhibitor Package, VIP treatment and plenty of media and investor exposure.

Powered by WPeMatico

Welcome back to this week’s transcribed edition of Equity.

This week, TechCrunch’s Danny Crichton filled in for co-host Alex Wilhelm – who was out in preparation for his wedding this weekend – joining Kate to cover the big news of the week.

Kate and Danny dive straight into Slack’s IPO and the implications of its direct listing strategy, before shifting gears to discuss the launch of Facebook’s new ‘Libra’ cryptocurrency and the VCs backing the initiative.

The duo then took a look at Lime’s latest fundraising efforts and the potential headwinds facing scooter companies with an appetite for capital. Lastly, Kate and Danny talk about underappreciated tensions for founders, including getting pushed out of their own companies and handling their own salaries.

Crichton: Talking about founders and compensation, our correspondent, Ron Miller, talked to a bunch of VCs to ask how are founders paying themselves today? Obviously, the cost of living in the Bay Area, in New York and other startup hubs has increased dramatically. So VCs have had to become acutely aware of their founders’ financial means.

One of the things that really came out of this survey though, from my perspective, was just how high the numbers are. We surveyed small number. We put it out in the interviews. It came out to post-Series A people are starting to get paid around 200K. But the numbers, even a couple of years ago, I seem to recall was like $120 was the magic number around the Series A, $90K if you had a serious seed fund and like $60 to $80 if you are just getting started.

But the numbers that we saw out of this were significantly higher. I think that shows a lot about how the cost of living has just continued to creep up in San Francisco and in New York.

Clark: Yeah. I think the point is made in the story. If you live in San Francisco and you’re paying a mortgage and you have kids, of course, you need to make six figures really to get by, which is just an unfortunate reality. I can’t say I was surprised by how those salaries looked. Seeing $125K for a founder, if anything, I thought was maybe a little low.

But it reminded me of, nearly a year ago at this point, when I wrote something on how much VCs are paid. I had written it based off data that was provided to me from a consulting firm. People were just up in arms at what I had written because, and I understand looking back, I think it grouped VCs together as VCs who work at really big funds who are getting the 2% carry out of a multi-billion dollar fund and who are paid a lot more.

And there are of course VCs who run seed funds or any kind of fund. There are many different sizes of VC funds. Some VCs actually don’t have a salary at all and are up against the same challenges, if not even more difficult challenges, of a startup founder.

Want more Extra Crunch? Need to read this entire transcript? Then become a member. You can learn more and try it for free.

Kate Clark: Hello, and welcome back to Equity, TechCrunch’s venture capital-focused podcast. My co-host, Alex, is getting married this weekend so he’s not with us today, unfortunately. But we’ve got TechCrunch editor, Danny Crichton on the line. Danny, how are you?

Powered by WPeMatico

Hello and welcome back to Startups Weekly, a newsletter published every Saturday that dives into the week’s noteworthy venture capital deals, funds and trends. Before I dive into this week’s topic, let’s catch up a bit. Last week, I noted my key takeaways from Recode + Vox’s Code Conference. Before that, I explored the bull versus bear arguments in regards to Peloton’s upcoming IPO.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.  Now, for some quick thoughts on what I’ll call the scooter funding desert. For months, electric scooter businesses were securing large rounds at even larger valuations. So much so that the venture capital funding extravaganza in e-scooters defined Silicon Valley in 2018.

Now, for some quick thoughts on what I’ll call the scooter funding desert. For months, electric scooter businesses were securing large rounds at even larger valuations. So much so that the venture capital funding extravaganza in e-scooters defined Silicon Valley in 2018.

But it’s 2019, and times have changed. In an effort to keep myself from falling into a scooter rabbit hole, I’ll just say this: raising capital is no longer a piece of cake for scooter companies. E-scooter companies have matured some and investors are more aware of the steep costs of building and scaling these hardware-heavy businesses.

Scoot, which recently sold to Bird, was unable to raise additional capital making an exit to Bird its only viable option, sources tell TechCrunch. Bird paid less than $25 million for Scoot, a significant decrease from Scoot’s most recent private valuation of $71 million.

A recent report from The Information suggests both Lime and Bird, the leaders in the U.S., may run out of cash if they don’t raise again soon. “Lime has raised a total of more than $1 billion in the last two years, and over the past eight months it has shuffled its executive team and put a deeper focus on how to squeeze more money out of each scooter ride. The company ran through its cash quickly last year, including a $23 million loss in one month, before raising $310 million mostly from existing investors in February,” The Information’s Cory Weinberg wrote.

Bird, for its part, is running on less than $100 million and is expected to raise again this summer.

Bird may be in a better position to secure fresh funds. The company enters VC deal talks hot off the heels of its acquisition of Scoot, which gives it access to San Francisco, a coveted market in the scooter universe. Lime, for its part, is said to be struggling. The company enters deal talks amid a number of personnel shake-ups. Multiple policy leaders at the business, including chief programs officer Scott Kubly, recently stepped down, as did Lime co-founder and CEO Toby Sun.

I’d wager that both Bird and Lime will announce mega rounds in the next few months, but at much smaller valuation step-ups than we’ve seen in the past, perhaps even at a flat valuation. It’s worth noting, however, that e-scooters are still exploding around the world. India’s Bounce, for example, closed on $72 million this week to scale its scooter rental business.

On to other news…

Slack’s big listing: It happened. Slack became a public company this week after completing a direct listing. The workplace communication software juggernaut debuted on the New York Stock Exchange up 48% Thursday, at $38.50 per share, after reports emerged Wednesday night that the business had agreed to a reference price of $26 per share. Slack, founded in 2009 as Tiny Speck, closed up 48.5% Thursday at $38.62 per share. The stock had climbed as high as $42 in intraday trading. Slack’s market cap now sits well above $20 billion, or nearly three times its most recent private valuation of $7 billion.

My inbox is full to the brim with unsolicited commentary on Slack’s direct listing. I’ll share some of the highlights.

— Kate Clark (@KateClarkTweets) June 19, 2019

Facebook’s new cryptocurrency: Explained

I know, I know, Facebook isn’t a startup, but Facebook’s attempts to create a new global financial system are worth learning about. TechCrunch’s Josh Constine wrote 4,000 words to help you understand the ins and outs of the new cryptocurrency, called Libra, which will let you buy things or send money to people with nearly zero fees.

The future of diversity and inclusion in tech

Here’s my must-read of the week. TechCrunch’s Megan Rose Dickey wrote what is perhaps the most comprehensive story on the state of D&I in tech today. She interviewed many leaders in the space, including Arlan Hamilton, Ellen Pao, Freada Kapor Klein and more, to provide a realistic rundown of the progress we’ve made in making the tech industry more inclusive — and what’s left to accomplish.

Is seed investing still a local business?

According to CB Insights, the number of seed-stage funding deals in the U.S. declined for the fourth straight year in 2018, continuing a trend that has seen the number of deals steadily drop, while the average size of deals increased. It’s safe to say this is the new normal. Yet, there continues to be a huge surplus of available capital and there are more funds out there than ever before. Here are three things entrepreneurs must remember when investors come calling from abroad.

Meero raises $230M for its on-demand photo business

Postman raises $50M to grow its API development platform

Navigator, the new project from the creators of Mailbox, launches with $12M

Nigerian motorcycle transit startup MAX.ng raises $7M

Humanising Autonomy pulls in $5M to help self-driving cars keep an eye on pedestrians

Armoire gets $4M to become the everyday Rent the Runway

Probably Genetic lands VC backing to launch D2C genetic testing business

San Francisco is getting closer to banning the sale of e-cigarettes in the city in a bid to prevent minors from accessing them. The city’s Board of Supervisors voted unanimously this week to approve two proposals: legislation that would ban the sale or delivery of e-cigarettes in San Francisco and a separate proposal that would prohibit the sale, manufacturing and distribution of tobacco products, including e-cigarettes, on property owned or managed by the city. It seems designed to take aim at Juul, since the company’s headquarters are in city-owned buildings at San Francisco’s Pier 70. Juul has already started lobbying to stop the ban.

If you’ve been unsure whether to sign up for TechCrunch’s awesome new subscription service, now is the time. Through next Friday, it’s only $2 a month for two months. Seems like a no-brainer. Sign up here. Here are some of my personal favorite EC pieces of the week:

The VCs behind Libra, Facebook’s new cryptocurrency

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, TechCrunch editor Danny Crichton and I discuss Facebook’s cryptocurrency, the scooter funding desert and more. You can subscribe to Equity here or wherever else you listen to podcasts.

Powered by WPeMatico

When it comes to the gods of finance, few people reach the stratosphere of Ray Dalio . The founder of Bridgewater, the investment firm that has grown to manage $150 billion in assets, Dalio is one of the most successful financial entrepreneurs of his generation, and indeed, of all time.

While Dalio and Bridgewater are known for their pathbreaking analysis of the world economic machine that has reaped them billions in returns, they aren’t just known for their financial results. Rather, Bridgewater is also widely known for its unique culture shaped over decades of trial and error.

Dalio has made sharing that culture his mission in life, publishing Principles, a book and companion mobile app, to train the next generation of founders, executives and business leaders about how to build a culture that seeks truth and excellence in all of its activities.

Dalio will be joining us for a fireside chat on the Extra Crunch stage this October at TechCrunch Disrupt SF, where he will discuss how to build a culture at a startup.

For startup founders, building the culture of their companies is one of the most important yet enigmatic activities they will undertake as leaders. Culture isn’t just a list of values pasted in the corner of a WeWork cubicle; rather, it is the accumulated actions and interactions that founders, employees and investors undertake every single day.

But what exactly should those actions be? How can a founder guide their companies to embody the right values? Dalio has strong views on what a culture should look like at a company. His Principles are based on constantly seeking access to the best information, assessing that information objectively and always striving to improve decision-making processes through thoughtful disagreement and learning.

On the Extra Crunch stage, Dalio will talk about how to instill the right behaviors into the core DNA of a company’s founders — even before they have hired employee number one. He will also discuss how to maintain and augment his Principles as a company scales, particularly in those high-growth phases where culture either intensifies or withers away amidst the deluge of new hires.

Dalio made his mark building out one of the most successful investment firms of all time. Now he will share his secrets to the founders building the next generation of unicorns.

Dalio joins a variety of amazing speakers who will be on our stage come October, with many still to be announced! Disrupt SF runs October 2 – October 4 at the Moscone Center right in SF. Tickets to the show are available here, but move quickly, because the Early-Bird pricing ends today!

Powered by WPeMatico