Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Fungible, a startup that wants to help data centers cope with the increasingly massive amounts of data produced by new technologies, has raised a $200 million Series C led by SoftBank Vision Fund, with participation from Norwest Venture Partners and its existing investors. As part of the round, SoftBank Investment Advisers senior managing partner Deep Nishar will join Fungible’s board of directors.

Founded in 2015, Fungible now counts about 200 employees and has raised more than $300 million in total funding. Its other investors include Battery Ventures, Mayfield Fund, Redline Capital and Walden Riverwood Ventures. Its new capital will be used to speed up product development. The company’s founders, CEO Pradeep Sindhu and Bertrand Serlet, say Fungible will release more information later this year about when its data processing units will be available and their on-boarding process, which they say will not require clients to change their existing applications, networking or server design.

Sindu previously founded Juniper Networks, where he held roles as chief scientist and CEO. Serlet was senior vice president of software engineering at Apple before leaving in 2011 and founding Upthere, a storage startup that was acquired by Western Digital in 2017. Sindu and Serlet describe Fungible’s objective as pivoting data centers from a “compute-centric” model to a data-centric one. While the company is often asked if they consider Intel and Nvidia competitors, they say Fungible Data Processing Units (DPU) complement tech, including central and graphics processing units, from other chip makers.

Sindhu describes Fungible’s DPUs as a new building block in data center infrastructure, allowing them to handle larger amounts of data more efficiently and also potentially enabling new kinds of applications. Its DPUs are fully programmable and connect with standard IPs over Ethernet local area networks and local buses, like the PCI Express, that in turn connect to CPUs, GPUs and storage. Placed between the two, the DPUs act like a “super-charged data traffic controller,” performing computations offloaded by the CPUs and GPUs, as well as converting the IP connection into high-speed data center fabric.

This better prepares data centers for the enormous amounts of data generated by new technology, including self-driving cars, and industries such as personalized healthcare, financial services, cloud gaming, agriculture, call centers and manufacturing, says Sindu.

In a press statement, Nishar said “As the global data explosion and AI revolution unfold, global computing, storage and networking infrastructure are undergoing a fundamental transformation. Fungible’s products enable data centers to leverage their existing hardware infrastructure and benefit from these new technology paradigms. We look forward to partnering with the company’s visionary and accomplished management team as they power the next generation of data centers.”

Powered by WPeMatico

The Customer Data Platform (CDP) has certainly been getting a lot of attention in marketing software circles over the last year as big dawgs like Salesforce and Adobe enter the fray, but Amperity, a Seattle-based startup, has been building a CDP solution since it launched in 2016, and today it announced some updates to give customers more control over the platform.

Chris Jones, chief product officer at Amperity, says this is an important step for the startup. “If you think about the evolution of our company, we started with an idea that turned into a [Marketing Data Platform], which was the engine that powered all of that, but that engine was largely operated by our delivery team. We’re now putting the power of that engine into the customers’ hands and giving them the full access to that,” Jones explained.

That is giving customers — which include Alaska Airlines, Nordstrom and The Gap — the power to control how the software works in the context of their companies, rather than using a black box approach where you have to use the software as delivered. He says that customers want the ability to start using the system to gain insights on their own.

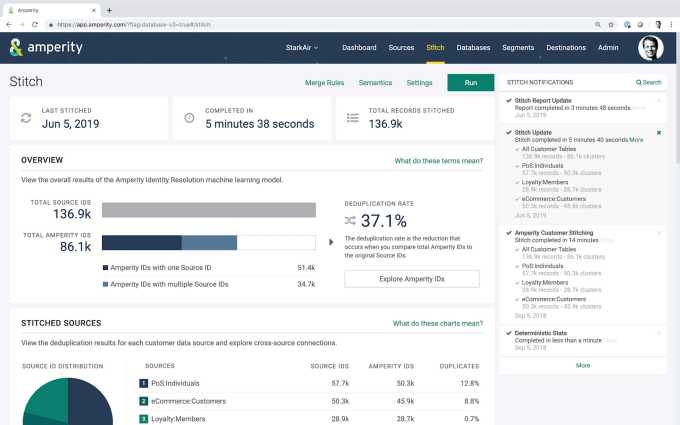

One of the primary pieces in the newest version of Amperity to allow them to do that is Stitch, a tool that lets users pull together all of the interactions from a customer in a single view — ingesting the data, sorting, deduplicating it and delivering a list of all the interactions a brand has had with a given customer. From there, they can use the new Customer 360 visualization to get a more graphical view of the data.

Amperity Stitch Screenshot: Amperity.

Jones says companies can use this data to help different groups within a company, whether marketing, sales or service, understand the customer better before or during an interaction. For example, a marketer can segment the data in a very granular way to find all of the regular customers who aren’t part of the company loyalty program, and deliver them an email listing all of the benefits of joining.

Amperity launched in 2016, and has raised $37 million across two rounds. Its most recent funding came in 2017, a $28 million investment led by Tiger Global Management, according to Crunchbase data.

Powered by WPeMatico

AUrate, a startup selling gold jewelry directly to consumers, announced today that it has raised $13 million in Series A funding.

The company’s co-founders Bouchra Ezzahraoui and Sophie Kahn said that AUrate’s prices range from $50 to $3,000, but they’re really aiming for what Ezzahraoui called “this new market sweet spot” of $300 to $500. And while that’s not exactly cheap, she said customers are getting a piece of fine jewelry made from real gold, which would normally be priced at $1,200 or more.

The jewelry is produced by local partners in New York City, and the gold comes from sustainable sources. Kahn also said while fine jewelry has traditionally been created “by men for women,” she designs AUrate’s pieces, and she’s “always looking for a balance between bold and feminine, which represents our women.”

In addition to selling jewelry online, AUrate also operates two brick-and-mortar stores in New York, with a third under construction in Washington, D.C. And it introduced something called Curate, where the company will send up to five recommended pieces to customers, which they can try at home with no commitment.

Founded in 2015, AUrate says its online revenue has been growing consistently by 400 percent every year, while its brick-and-mortar retail business has been doubling. Also noteworthy: 40 percent of its customers return for additional purchases, and 90 percent of customers are women.

The new funding was led by Michael Platt’s Bluecrest Capital, with participation from Point King Capital, Arab Angel Fund and Drake Management.

Powered by WPeMatico

Skubana, a startup promising to help e-commerce business manage what can be a dizzying array of logistical challenges, is announcing that it has raised $5.4 million in Series A funding.

The round was led by Defy Partners, with participation from Advancit Capital and FJ Labs. Early Skubana backer Brian Lee — who co-founded The Honest Company, ShoeDazzle and LegalZoom, and is also involved as a Defy Sage — is joining Skubana’s board of directors.

“When I first launched Shoedazzle and The Honest Company, one of our primary challenges was understanding how our products performed across channels,” Lee said in a statement. “Skubana solves a core problem that thousands of brands face and no other competitor solves well.”

CEO Chad Rubin said these were issues he faced when he started his own e-commerce business, Crucial Vacuum, a decade ago. In fact, Rubin’s co-founder and CTO DJ Kunovac (who was working at McKesson health IT) recalled visiting Rubin’s warehouse and saying, “What you’re experiencing right now is effectively where healthcare was a decade or two ago.”

The problem, Kunovac argued, is that there was separate software and systems for every part of the process. What was needed was a “horizontal platform of commerce.”

So with Skubana, Rubin and Kunovac have built a software platform that handles shipping, inventory management, restocking and more. The main thing Skubana doesn’t handle is the creating the actual online storefront and shopping cart. Instead, it’s built to take care of everything that a business needs to do once those orders start coming in.

As Rubin put it, “If Shopify is a city, then we’re everything underneath the ground.”

By bringing all the data together from various sales channels and applying and machine learning, the company says it can improve profitability and reduce issues like selling more product that you have in the inventory. There’s also an app store to integrate Skubana with other systems.

“We’re completely replacing these siloed, fragmented pieces of software,” Rubin said.

Brands already using the software include Bird Rides, Valvoline, and Deathwish Coffee. Kunovac noted that Skubana isn’t “entry-level software” — when brands sign up to use it, they’ve usually a growing a commerce business, which is when “the laws of physics have started to take over.” In other words: “They come to us from pain.”

With the new funding, Skubana says it will double its size in the next 18 months, build a number of new products and continue to invest in its app store ecosystem.

Powered by WPeMatico

Ready to tackle the colossus that is enterprise software? Join us and more than 1,000 attendees for TC Sessions Enterprise 2019 on September 5 at the Yerba Buena Center for the Arts in San Francisco. We’re talking founders, technologists and investors digging deep into the challenges facing established and emerging enterprise companies today. Get your early-bird tickets now and save.

TechCrunch’s first ever event focused on Enterprise is a prime networking opportunity that will feature a crowd drawn to a day of intensive, on-stage interviews (led by TechCrunch editors) with the king pins of enterprise as well as breakout sessions, exhibiting startups, receptions and much more. Naturally, we have a fantastic networking app to help attendees wring the most opportunity out of the show.

CrunchMatch (powered by Brella), is TechCrunch’s free business match-making service. Effective networking is more than just meeting people. CrunchMatch helps you search for the right people based on specific mutual criteria, goals and interests. The platform’s combination of curation and automation lets you easily find, vet, schedule and connect with the people you want to meet — founders, investors, technologists, researchers or MBA students. You decide, and CrunchMatch delivers.

CrunchMatch is available to all attendees. When the platform launches, keep an eye out for an email with a sign-up link. Fill out your profile with the pertinent details — your role (technologist, founder, investor, etc.) and who you want to connect with at the event. CrunchMatch will make meet-up suggestions, which you can approve or decline.

Now that you’re up to speed on the networking situation, all you need to do is buy a ticket to TC Sessions: Enterprise. Early-bird passes cost $395, and you can save an extra 15 percent when you buy group tickets (four or more) for $335 each. Student passes sell for $245. Bonus: for every TC Sessions: Enterprise ticket you buy, we’ll register you for one free Expo Only pass to Disrupt San Francisco 2019. Holla!

There are a limited number of Startup Demo Packages available for $2,000, which includes four tickets to attend the event.

TC Sessions: Enterprise takes place on September 5 in San Francisco. Join your community of enterprise-minded founders, investors, CTOs, CIOs and engineers to talk machine learning, AI, intelligent marketing automation, the cloud, quantum computing, blockchain and so much more. Buy your early-bird tickets now.

Interested in sponsoring TC Sessions: Enterprise? Fill out this form and a member of our sales team will contact you.

Powered by WPeMatico

Could you use a little summer startup fun? We’re rolling out our next round of tickets to the TechCrunch Summer Party at Park Chalet, San Francisco’s coastal beer garden. If you want to join your startup peers to eat, drink and be merry, don’t delay. These limited-release tickets will be snapped up before you can say “hold my beer.” Buy your Summer Party ticket today.

Our 14th annual summer soiree offers an opportunity to connect and converse with like-minded entrepreneurs in a relaxed setting with ocean views. Take a break from the daily grind, have a local brew and strike up a conversation. You never know where it might lead or when lightning might strike — especially with Lead VC Partner Merus Capital along with firms August Capital, Battery Ventures, Cowboy Ventures, Data Collective, General Catalyst, and Uncork Capital in the house.

Party-planning details you need to know:

Don’t miss your chance to enjoy a fun night that fosters both opportunity and community. We always mix it up with games and door prizes — like fun TechCrunch swag, Amazon Echos and tickets to Disrupt San Francisco 2019.

Remember, we release tickets to the Summer Party on a rolling basis and they sell out quickly. Buy your 14th Annual Summer Party ticket today. If you strike out this time, sign up to be notified when the next batch goes on sale.

Is your company interested in sponsoring or exhibiting at the TechCrunch 14th Annual Summer Party? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Two months ago, we reported that Carbon was set to raise up to $300 million, bringing the 3D printing company’s valuation up to a lofty $2.5 billion. The real numbers released this week by the company aren’t quite so lofty, but are impressive nonetheless. The Series E fetched $260 million, putting its valuation at closer to $2.4 billion.

The latest round follows a $200 million Series D that arrived in late-2017, bringing the company’s total raise to $680 million. What exactly is the bay area-based startup planning to do with that massive sum, in the wake of high profile manufacturing partnerships with companies like Adidas and Riddell?

CEO/co-founder Joseph M. DeSimone and recent addition CMO Dara Treseder (most recently of GE Ventures) stopped by our offices to discuss what the latest round means for the Bay Area-based company.

Asked for a timeline around when Carbon might exit, DeSimon offered a non-committal answer. “As we grow our business, we haven’t made announcements for our IPO or anything like that yet,” he told TechCrunch. But the revenue business is growing nicely. So we’re in pretty good shape.”

It’s hard to say precisely what goals the company is hoping to attain before going public, but at the very least, Carbon presents a good indicator that the 3D printing industry is back on the uptick — in some circles, at least.

Powered by WPeMatico

There’s a mythology around today’s factories that says everything is automated by robotics, and while there is some truth to that, it’s hard to bring that level of sophistication to every facility, especially those producing relatively small runs. Today, Bright Machines, a San Francisco startup announced its first product designed to put intelligence and automation in reach of every manufacturer, regardless of its size.

The startup, which emerged last fall with $179 million in Series A funding, has a mission to make every aspect of manufacturing run in a software-defined automated fashion. Company CEO Amar Hanspal understands it’s a challenging goal, and today’s announcement is about delivering version 1.0 of that vision.

“We have this ambitious idea to fundamentally change the way factories operate, and what we are all about is to get to autonomous programmable factories,” he said. To start on that journey, since getting its initial funding in October, the company has been building a team that includes manufacturing, software and artificial intelligence expertise. It brought in people from Autodesk, Amazon and Microsoft and opened offices in Seattle and Tel Aviv.

The product it is releasing today is called the Software Defined Microfactory and it consists of hardware and software components that work in tandem. “What the Software Defined Microfactory does is package together robotics, computer vision, machine handling and converged systems in a modular way with hardware that you can plug and play, then the software comes in to instruct the factory on what to build and how to build it,” Hanspal explained.

Obviously, this is not an easy thing to do, and it’s taken a great deal of expertise to pull it together over the last months since the funding. It’s also required having testing partners. “We have about 20 product brands around the world and about 25 production lines in seven countries that have been iterating with us toward version one, what we are releasing today,” Hanspal said.

The company is concentrating on the assembly line for starters, especially when building smaller runs like say a specialized computer board or a network appliance where the manufacturer might produce just 50,000 in total, and could benefit from automation, but couldn’t justify the cost before.

“The idea here is going after the least automated part inside of factory, which is the assembly line, which is typically where people have to throw bodies at the problem and assembly lines have been hard to automate. The operations around assembly typically require human dexterity and judgment, trying to align things or plug things in,” Hanspal said.

The hope is to create a series of templates for different kinds of tooling, where they can get the majority of the way there with the software and robotics, and eventually just have to work on the more customized bits. It is an ambitious goal, and it’s not going to be easy to pull off, but today’s release is a first step.

Powered by WPeMatico

Meme creators have never gotten their fair share. Remixed and reshared across the web, their jokes prop up social networks like Instagram and Twitter that pay back none of their ad revenue to artists and comedians. But 300 million monthly user meme and storytelling app Imgur wants to pioneer a way to pay creators per second that people view their content.

Today Imgur announces that it’s raised a $20 million venture equity round from Coil, a micropayment tool for creators that Imgur has agreed to build into its service. Imgur will eventually launch a premium membership with exclusive features and content reserved for Coil subscribers.

Users pay Coil a fixed monthly fee, install its browser extension, the Interledger protocol is used to route assets around, and then Coil pays creators dollars or XRP tokens per second that the subscriber spends consuming their content at a rate of 36 cents per hour. Imgur and Coil will earn a cut too, diversifying the meme network’s revenue beyond ads.

“Imgur began in 2009 as a gift to the internet. Over the last 10 years we’ve built one of the largest, most positive online communities, based on our core value to ‘give more than we take’” says Alan Schaaf, founder and CEO of Imgur. The startup bootstrapped for its first five years before raising a $40 million Series A from Andreessen Horowitz and Reddit. It’s grown into the premier place to browse ‘meme dumps’ of 50+ funny images and GIFs, as well as art, science, and inspirational tales. With the same unpersonalized homepage for everyone, it’s fostered a positive community unified by esoteric inside jokes.

While the new round brings in fewer dollars, Schaaf explains that Imgur raised at a valuation that’s “higher than last time. Our investors are happy with the valuation. This is a really exciting strategic partnership.” Coil founder and CEO Stefan Thomas who was formerly the CTO of cryptocurrency company Ripple Labs will join Imgur’s board. Coil received the money it’s investing in Imgur from Ripple Labs’ Xpring Initiative, which aims to fund proliferation of the Ripple XRP ecosystem, though Imgur received US dollars in the funding deal.

Thomas tells me that “There’s no built in business model” as part of the web. Publishers and platforms “either make money with ads or with subscriptions. The problem is that only works when you have huge scale” that can bring along societal problems as we’ve seen with Facebook. Coil will “hopefully offer a third potential business model for the internet and offer a way for creators to get paid.”

Founded last year, Coil’s $5 per month subscription is now in open beta, and it provides extensions for Chrome and Firefox as it tries to get baked into browsers natively. Unlike Patreon where you pick a few creators and choose how much to pay each every month, Coil lets you browse content from as many creators as you want and it pays them appropriately. Sites like Imgur can code in tags to their pages that tell Coil’s Web Monetization API who to send money to.

The challenge for Imgur will be avoiding the cannibalization of its existing content to the detriment of its non-paying users who’ve always known it to be free. “We’re in the business of making the internet better. We do not plan on taking anything away for the community” Schaaf insists. That means it will have to recruit new creators and add bonus features that are reserved for Coil subscribers without making the rest of its 300 million users feel deprived.

It’s surprising thT meme culture hasn’t spawned more dedicated apps. Decade-old Imgur precedes the explosion in popularity of bite-sized internet content. But rather than just host memes like Instagram, Imgur has built its own meme creation tools. If Imgur and Coil can prove users are willing to pay for quick hits of entertainment and creators can be fairly compensated, they could inspire more apps to help content makers turn their passion into a profession…or at least a nice side hustle.

Powered by WPeMatico

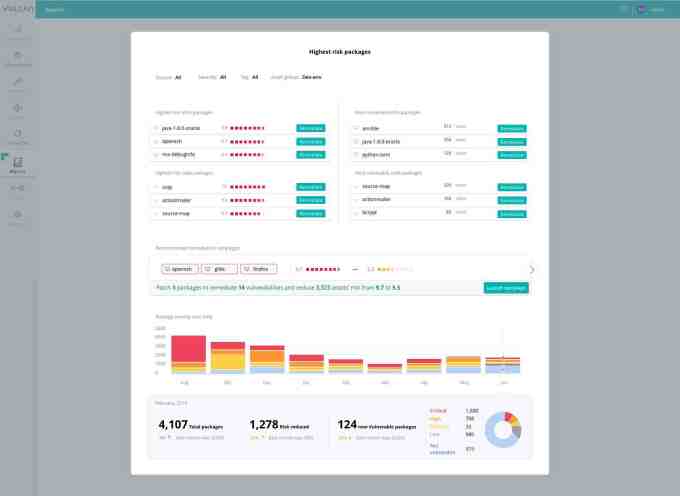

Many software vulnerabilities are already known, and vendors have even issued patches, but the problem is there are so many patches that it’s often difficult for companies to keep up. Vulcan Cyber wants to help by bringing a level of automation to the patching operation, and in the process reduce exposure to known risks.

Today, it announced a $10 million Series A round from Ten Eleven Ventures and YL Ventures .

In a typical scenario, security researchers find vulnerabilities, the vendors disclose them and patch them. From there it’s up to individual companies to take care of downloading and installing the patch, but Vulcan Cyber co-founder and CEO Yaniv Bar-Dayan says the number of patches has been growing at a furious pace with 6000 patches in 2016, 16,000 in 2017 and 18,000 last year. And that growth trajectory is continuing this year, he says.

Vulcan’s ultimate mission is to help companies remediate security vulnerabilities from their infrastructure. They do this by bringing a level of automation to the process, recognizing that humans can’t keep up with these numbers. “We automate the process of prioritization and deployment to remediate more vulnerabilities faster,” Bar-Dayan explained. What’s more, he said that Vulcan does this without risking business operations, while reducing risk and costs.

Vulcan Cyber risk prioritization view. Screenshot: Vulcan Cyber

The company raised a $4 million seed round last year, bringing the total raised to $14 million so far. As TechCrunch’s Frederic Lardinois pointed out while writing about that seed round, it’s able to achieve this level of automation, while working with the tools developers and security teams typically work with anyway.

“Vulcan Cyber plays nicely with all of the major cloud platforms, as well as tools like Puppet, Chef and Ansible, as well as GitHub and Bitbucket. It also integrates with a number of major security testing tools and vulnerability scanners, including Black Duck, Nessus, Fortify, Tripwire, Checkmarx, Rapid7 and Veracode,” Lardinois wrote.

The company was founded last year and has 25 employees. It plans to continue building its engineering team in Israel with the money from this round, as well as opening an office in San Francisco for sales, marketing and customer success.

Powered by WPeMatico