Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

As financial crime has become significantly more sophisticated, so too have the tools that are used to combat it. Now, Quantexa — one of the more interesting startups that has been building AI-based solutions to help detect and stop money laundering, fraud and other illicit activity — has raised a growth round of $153 million, both to continue expanding that business in financial services and to bring its tools into a wider context, so to speak: linking up the dots around all customer and other data.

“We’ve diversified outside of financial services and working with government, healthcare, telcos and insurance,” Vishal Marria, its founder and CEO, said in an interview. “That has been substantial. Given the whole journey that the market’s gone through in contextual decision intelligence as part of bigger digital transformation, was inevitable.”

The Series D values the London-based startup between $800 million and $900 million on the heels of Quantexa growing its subscriptions revenues 108% in the last year.

Warburg Pincus led the round, with existing backers Dawn Capital, AlbionVC, Evolution Equity Partners (a specialist cybersecurity VC), HSBC, ABN AMRO Ventures and British Patient Capital also participating. The valuation is a significant hike up for Quantexa, which was valued between $200 million and $300 million in its Series C last July. It has now raised over $240 million to date.

Quantexa got its start out of a gap in the market that Marria identified when he was working as a director at Ernst & Young tasked with helping its clients with money laundering and other fraudulent activity. As he saw it, there were no truly useful systems in the market that efficiently tapped the world of data available to companies — matching up and parsing both their internal information as well as external, publicly available data — to get more meaningful insights into potential fraud, money laundering and other illegal activities quickly and accurately.

Quantexa’s machine learning system approaches that challenge as a classic big data problem — too much data for a human to parse on their own, but small work for AI algorithms processing huge amounts of that data for specific ends.

Its so-called “Contextual Decision Intelligence” models (the name Quantexa is meant to evoke “quantum” and “context”) were built initially specifically to address this for financial services, with AI tools for assessing risk and compliance and identifying financial criminal activity, leveraging relationships that Quantexa has with partners like Accenture, Deloitte, Microsoft and Google to help fill in more data gaps.

The company says its software — and this, not the data, is what is sold to companies to use over their own data sets — has handled up to 60 billion records in a single engagement. It then presents insights in the form of easily digestible graphs and other formats so that users can better understand the relationships between different entities and so on.

Today, financial services companies still make up about 60% of the company’s business, Marria said, with seven of the top 10 U.K. and Australian banks and six of the top 14 financial institutions in North America among its customers. (The list includes its strategic backer HSBC, as well as Standard Chartered Bank and Danske Bank.)

But alongside those — spurred by a huge shift in the market to rely significantly more on wider data sets, to businesses updating their systems in recent years, and the fact that, in the last year, online activity has in many cases become the “only” activity — Quantexa has expanded more significantly into other sectors.

“The Financial crisis [of 2007] was a tipping point in terms of how financial services companies became more proactive, and I’d say that the pandemic has been a turning point around other sectors like healthcare in how to become more proactive,” Marria said. “To do that you need more data and insights.”

So in the last year in particular, Quantexa has expanded to include other verticals facing financial crime, such as healthcare, insurance, government (for example in tax compliance) and telecoms/communications, but in addition to that, it has continued to diversify what it does to cover more use cases, such as building more complete customer profiles that can be used for KYC (know your customer) compliance or to serve them with more tailored products. Working with government, it’s also seeing its software getting applied to other areas of illicit activity, such as tracking and identifying human trafficking.

In all, Quantexa has “thousands” of customers in 70 markets. Quantexa cites figures from IDC that estimate the market for such services — both financial crime and more general KYC services — is worth about $114 billion annually, so there is still a lot more to play for.

“Quantexa’s proprietary technology enables clients to create single views of individuals and entities, visualized through graph network analytics and scaled with the most advanced AI technology,” said Adarsh Sarma, MD and co-head of Europe at Warburg Pincus, in a statement. “This capability has already revolutionized the way KYC, AML and fraud processes are run by some of the world’s largest financial institutions and governments, addressing a significant gap in an increasingly important part of the industry. The company’s impressive growth to date is a reflection of its invaluable value proposition in a massive total available market, as well as its continued expansion across new sectors and geographies.”

Interestingly, Marria admitted to me that the company has been approached by big tech companies and others that work with them as an acquisition target — no real surprises there — but longer term, he would like Quantexa to consider how it continues to grow on its own, with an independent future very much in his distant sights.

“Sure, an acquisition to the likes of a big tech company absolutely could happen, but I am gearing this up for an IPO,” he said.

Powered by WPeMatico

The skies are on the cusp of getting busier — and louder — as drone delivery and electric vertical take-off and landing passenger aircraft startups move from moonshot to commercialization. One former NASA engineer and ex-director of Uber’s air taxi division is developing tech to ensure that more air traffic doesn’t equal more noise.

Mark Moore, who was most recently director of engineering at Uber Elevate until its acquisition by Joby Aviation, has a launched his own company called Whisper Aero. The startup, which came out of stealth this week, is aiming to designing an electric thruster it says will blend noise emitted from delivery drones and eVTOLs alike into background levels, making them nearly imperceptible to the human ear.

It’s a formidable challenge. Solving the noise problem comes down to more than simply cranking down the volume. Noise profiles are also characterized by other variables, like frequency. For example, helicopters have a main rotor and tail rotor that generate two separate frequencies, which makes them much more irritating to the human ear than if they were at a single frequency, Moore told TechCrunch in a recent interview.

Complicating the picture even further is that eVTOL companies are designing entirely new types of aircraft, ones that may generate different acoustic profiles than other rotorcraft (like helicopters). The U.S. Army recently undertook a research study confirming that eVTOL rotors generate more of a type of noise referred to as broadband, rather than tonal noise which is generated by helicopters. And as each eVTOL company is developing its own design, not all of the electric aircraft will generate the same level or kind of noise.

Whisper is designing its scalable product to be adoptable across the board.

Moore said the idea for the company had been fomenting for years. He and Whisper COO Ian Villa, who headed strategy and simulation at Elevate, realized years ago that noise (that is, less of it) was key to air taxis taking off.

“The thing that was abundantly clear was, noise matters most,” Villa said. “It is the hardest barrier to break through. And not enough of these developers were spending the time, the resources, the mindshare to really unlock that.”

Whisper CEO Mark Moore. Image Credits: Whisper Aero (opens in a new window)

Helicopters have mostly been able to get away with their terrible noise profile because they are used so infrequently. But eVTOL companies like Joby Aviation are envisioning far higher ride volumes. Moore is quick to point out that companies like Joby (which purchased Elevate at the end of 2020) are already developing aircraft that are many times quieter than helicopter, and are “a step in the right direction.”

“The question is, ‘is it enough of a step to get to significant adoption?’ And that’s what we’re focused on.”

Whisper is staying mum on the details of its thruster design. It has managed to attract around $7.5 million investment from firms like Lux Capital, Menlo Ventures, Kindred Ventures and Robert Downey Jr.’s FootPrint Coalition Ventures. It’s also aiming to convert its provisional patents with the United States Patent and Trademark Office sometime next year.

From there, the startup envisions launching in the small drone market around 2023, before scaling progressively up to air taxis. Moore said the goal is to get the thrusters manufactured and in vehicles by the end of the decade. Should the first generation of eVTOL go to market in 2024 (as Archer Aviation and Joby have proposed), Whisper’s product could potentially appear in second generation eVTOL.

In the meantime, Whisper will continue testing and working out remaining technical challenges – least among which is how to manufacture the end product at a reasonable cost. Whisper is also preparing to conduct dynamic testing in a wind tunnel, in addition to the static tests it has undertaken at its Tennessee headquarters, some in partnership with the U.S. Air Force.

“It’s got to be quiet enough to blend into the background noise,” Moore said. “We know this and that’s the technology we’re developing.”

Powered by WPeMatico

In nearly every Google algorithm update in recent memory, Google has rewarded old, megatraffic sites, sending their search rankings soaring at the expense of smaller, newer sites. Big sites have increased their search traffic by 28% year over year, according to GrowthBar’s organic search data on the 100 most visited sites.

Why? Large sites such as Wikipedia, LinkedIn, Pinterest, Amazon, Home Depot and Target have something the rest of us don’t — they’ve got years of built-up Google trust signals.

Start with best practices like making incredible content and securing backlinks to your best web pages, but also be willing to think a bit outside the box.

I’d contend that Google favors large sites more than ever before — and it’s a trend that doesn’t seem to be slowing down. After all, Google exists to deliver the best search experience to users. Bad search results would be a death sentence for their business, since Googlers would flock to alternatives like DuckDuckGo and Bing.

Especially today, where distrust of the media is at an all-time high, Google can’t risk its reputation by surfacing bad search results, so I think their algorithm errs on the side of caution. It’s simply safer for their business to surface household names at the top of the search engine results page, particularly in ultrasensitive your money, your life categories.

John Mueller, Google’s SEO mouthpiece, practically settled the debate that older sites are preferred by the algorithm when he said, ” … freshness is always an interesting one because it’s something that we don’t always use. Because sometimes it makes sense to show people content that has been established (SEJ).”

So, how can you hope to compete if you’re deploying an SEO strategy on one of the billions of smaller sites?

Help TechCrunch find the best growth marketers for startups.

Provide a recommendation in this quick survey and we’ll share the results with everybody.

Of course, you should start with best practices like making incredible content and securing backlinks to your best web pages, but you should also be willing to think a bit outside the box. The cards aren’t in your favor, so you need to be even more strategic than the big guys. This means executing on some cutting-edge hacks to increase your SEO throughput and capitalize on some of the arbitrage still left in organic search. I call these five tactics “advanced-ish,” because none of them are complicated, but all of them are supremely important for search marketers in 2021.

Businesses spent over $300 billion on content marketing last year. That’s in part because creating new content is the most straightforward way to draw in organic search traffic. Whether you’ve got a mature site or you’re just starting a WordPress SEO site, content is likely a large part of your SEO strategy.

But to scale content like a startup, you’ll need to devote a lot of time to it and/or manage a fleet of writers. Your time is probably better spent building your product or helping customers than on planning hundreds of blog articles. This is precisely where a content generator tool comes into play.

A whole new era of SEO tools is emerging, and some of these are augmented by OpenAI’s GPT-3 technology, the most advanced artificial intelligence language model. These tools have changed the game for SEOs and content creators by automating parts of the content creation cycle. Several tools utilize SEO signals and combine them with OpenAI to help you create blog outlines that include SEO-optimized titles, word counts, keywords, headlines, intro paragraphs and much more.

Powered by WPeMatico

Today we have new filings from Couchbase and Kaltura: Couchbase set an initial price range for its IPO, something we’ve been waiting for, and Kaltura’s offering is back from hiatus with a new price range and some fresh financial information to boot.

Both bits of news should help us get a handle on how the Q3 2021 IPO cycle is shaping up at the start.

TechCrunch has long expected the third quarter’s IPO haul to prove strong; investors said as 2020 closed that quarters one, three and four would prove very active in terms of public market exits this year. Then the second quarter surpassed expectations, with more companies going public than at least some market observers anticipated.

With that in mind, you can imagine why the newly launched Q3 could prove an active period.

So! Let’s start with a dig into the filing from NoSQL provider Couchbase, working to understand its first price range and what the numbers may say about market demand for technology debuts. Here’s our first look at the company’s value. Then we are taking the Kaltura saga back up, checking into the pricing and second-quarter results from the technology company that provides video-streaming software and services.

Frankly, I’ve been waiting for these filings to drop. So, let’s cut the chat and get into the numbers:

In its new S-1/A filing, Couchbase reports that it anticipates a $20 to $23 per share IPO price. With a maximum sale of just over 8 million shares, Couchbase could raise as much as $185.15 million in its public offering.

The company will have 40,072,801 shares outstanding after its IPO, not including 1,050,000 shares that are reserved for possible release. The math from here is simple. To calculate Couchbase’s possible simple IPO valuation we can just do a little multiplication:

If you want to include the company’s reserved shares, add $21 million to the first figure, and $24.2 million to the second. Notably, TechCrunch wrote before it priced that using a historical analog from the Red Hat-IBM sale — both Couchbase and Red Hat work in the OSS space — the company would be worth around $900 million. So, we were pretty close.

Powered by WPeMatico

Allan Jones dropped out of college and spent a decade learning how to run a startup. In 2016, that education resulted in the launch of Los Angeles-based Bambee, which helps small companies by acting as their HR department with the goal of keeping them in compliance with government rules and regulations.

But he found getting funded a challenge in spite of his background. He said that as a Black man, he had to move more carefully in the startup world.

“I think it came as part of the complexities of navigating a mostly white male ecosystem, a mostly straight cis white male ecosystem that either helps you create some skills that make you really effective at the job, or generates so much resentment that it becomes hard to be effective. […] I think that I was always one comment away from the opposite direction [I ended up going],” he explained.

Fortunately, that didn’t happen, and he kept on climbing and gaining skills and single-handedly founded his own company, one which has reached Series B and raised $33 million, a significant amount of money for any startup, but particularly for a startup run by a Black founder.

A study published by Crunchbase in February found that VC firms distributed $150 billion in venture funding in 2020. Of that, less than 1%, or around $1 billion, went to Black founders. That highlights just how difficult it has been for him to raise from such a limited pool of money in spite of having a great idea and the business skill and acumen to pull it off.

Jones got his start at the age of 20 at a startup called Helio, which targeted the youth market for multimedia services on mobile phones. It was eventually acquired by Virgin Mobile. He went on to run product at a couple of companies before landing as CMO at ZipRecruiter in 2013. He left that position after three years to launch Bambee in 2016.

In spite of all that experience, he felt that as a gay Black man in Silicon Valley that he was continually saddled with the label of “the kid with potential,” and not always taken as seriously as his straight white counterparts. “And I don’t think those intentions necessarily were bad, I think it was quite the opposite, which actually makes them almost worse because they were entrenched in a bias of how to characterize [my abilities].”

Jones launched Bambee, a startup that is going after SMBs with fewer than 500 employees, most of which are operating without an HR department, and could be out of compliance with federal mandates because they don’t have anyone in charge who is aware of the rules.

“Bambee aims to put an HR manager in every American small business. We’ve done so by building a model that allows you to hire one on our platform for $99 a month. So you pay us a flat fee and you get access to our platform and your own dedicated HR professional. […] She acts as your human resource manager and your human resource arm for your company. And our platform helps keep those companies compliant,” Jones explained.

Jones says that while he might not encounter direct bias as he builds his business, there is an unconscious bias that investing in Bambee could be riskier than investing in someone who fits the prototypical startup founder mold, and this is especially true in early-stage investing when investors are essentially betting on the entrepreneur.

“They take bets that they deem as a bit safer — entrepreneurs that look like a certain profile — white cis-gender males that come from Stanford and Harvard that match the profile of confidence and they have kind of built in an anti-bias determination around, so they automatically get the benefit of the doubt to those pedigrees, and those profiles,” Jones said.

He says that means that Black founders have to work that much harder to overcome those biases. Today Bambee has some decent metrics to show investors with revenue reaching tens of millions, growing 300% year over year with thousands of customers across all 50 states, according to Jones. With 100 employees, he plans to double that number by the end of this year.

Even with that, he says there are still barriers to entry he has to deal with. Even if it’s harder for investors to ignore the company’s numbers, he still sees a tendency to accentuate the negative.

“Building a great company with the deficit in belief in you that starts so early on in the venture process, the [obstacles] that you have to [overcome] to get here. It seems impossible with less than 1% of venture capital dollars going to Black founders, and it isn’t because Black founders don’t exist, it’s because the belief in us is not there at scale,” he said.

As Jones continues to build the company, he has learned to look for investors who believe in him and his vision for the company. If he senses that negativity from a potential investor, he moves on because he wants to work with people who want to help build the company and believe in it as much as he does. He says this won’t change when he goes to raise his C round, a stage few Black entrepreneurs reach.

“Is it going to be easier for me going forward? I don’t think so. I think the type of bias that I have to combat based on the class of entrepreneur I’m becoming, it starts to shift and change, and I’ve seen that in every round and I’m prepared for it in my Series C, as well.”

He says that the progress he’s made in the company and his belief in the business will help him find the right partners to continue on that journey, just as he has in previous rounds.

“We will navigate this […] and I think we’ll build a really great business, and ultimately the partners we discover along this journey will be the exact right ones who we were meant to.”

Powered by WPeMatico

Jake Rothstein is the co-founder of Papa, a Miami-based company that offers care and companionship to seniors. The business, which pairs elderly Americans with uncertified-yet-vetted pals, helps offer casual services, such as technology support, grocery delivery or even a fun conversation. It has raised upwards of $91 million in venture capital to date.

While Rothstein left day to day responsibilities at Papa in 2017, his experience there gave him a deeper look into the priorities of older adults and families as they go through the aging journey. While Papa was about meeting the elderly where they are, the co-founder began to think of a more complex question: What if “where they are” isn’t as supportive as it should be 24/7?

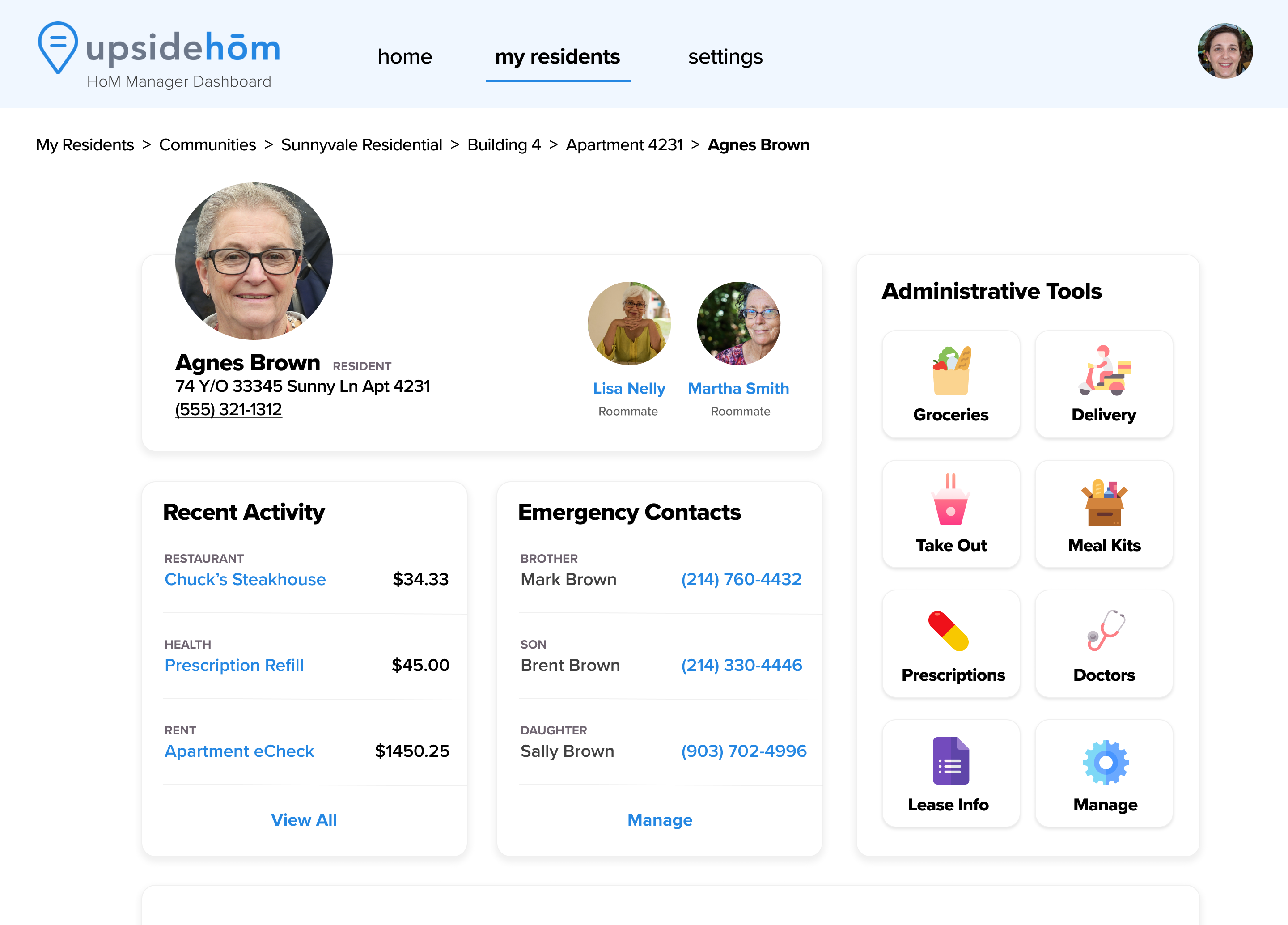

After a stint at another tech company, Rothstein launched a more modern take on senior living communities in January 2020, alongside co-worker turned co-founder Peter Badgley. UpsideHōM is a fully managed, tech-enabled living space for older adults in the United States. After a year of beta testing, the duo announced today that they have raised a $2.25 million seed round for UpsideHōM, led by Triple Impact Capital and Freestyle Capital, with participation from Techstars.

Alongside the funding, UpsideHōM announced its next big bet, dubbed a relaunch, that will sit atop furnished and furnished apartments that sit throughout Raleigh, Atlanta, Jacksonville, Tampa and South Florida: a software platform to take out all the clutter from move-in and maintenance. The platform will give residents one spot to chat with their house manager, pay bills and access perks such as on-demand tech support, house-keeping and companion visits thanks to a partnership with Papa. The company also offers add-on services and amenities, including freshly prepared meals, grocery delivery, fitness programming and accompanied transportation.

Image Credits: UpsideHōM

Part of UpsideHōM’s focus is in creating personalized solutions. Elders are diverse in age, needs and financial circumstances — which means the turnkey solution needs to be easily adaptable to service needs when they pop up. The company needs to be careful though: It can’t offer traditional caregiver services due to state by state compliance; instead Rothstein describes the offerings as supportive services, not in replacement of health assistant caregivers.

Image Credits: UpsideHoM

When the company first launched, it was betting on a more unconventional idea.

“I thought, let’s solve loneliness even more completely than what Papa is doing by building in companionship,” Rothstein said, instead of letting people order it on demand. The company decided to offer roommate matching services for elders as one of its core services, alongside the aforementioned supported living characteristics. It didn’t fully stick. Over half of inbound participants responded to the marketing efforts by saying that they liked the idea, but didn’t want to share the space. Today, 50% of UpsideHōM’s business covers individuals or people with spouses or significant others; the other half covers those looking to share units.

The synergies between UpsideHōM and Papa, Rothstein’s previous company, are clear beyond an overlapping customer base. Papa offered up to and almost including actual care, stopping at traditional care-giving services, which require their own vetting and compliance measures. UpsideHōM offers up to and almost including traditional senior living services, but gives supportive services instead of assisted living services, which similarly have their own logistic hurdles to figure out.

As for why Rothstein didn’t just launch supportive living services as a new product vertical within his earlier company, he chalked it up to the “tremendous” opportunity in the former, which warranted it’s own company. He also said that customer acquisition looks different between the two companies.

“At Papa, what we found was that acquiring customers in this space was incredibly challenging [so we went through] the Medicare Advantage route,” he said. “But senior living is a completely different segment.”

The millions in new venture capital money are coming as UpsideHōM prepares for aggressive growth. While the company did not disclose revenue or total residents, it did say it has hit 1,000% in new resident headcount in the first half of 2021 as a vague proxy. As the startup prepares for its next phase of growth, the co-founders will need to focus heavily on sustainable customer acquisition.

Rothstein thinks that downsizing elders into homes that work for them is a simple argument to make.

“You can age in place for as long as it’s practical, but there’s going to be a day and time when it’s not [going to] be practical,” Rothstein said. “Why would you want to make this decision after you’ve broken your hip, after you run out of money or after your spouse died?”

Editor’s note: A previous version of this story wrote that Rothstein had spent six years scaling Papa. This is incorrect. He left in 2017 but remains an investor in the company.

Powered by WPeMatico

API publishers among Postman’s community of more than 15 million are working toward more seamless and integrated developer experiences for their APIs. Distilled from hundreds of one-on-one discussions, I recently shared a study on increasing adoption of an API with a public workspace in Postman. One of the biggest reasons to use a public workspace is to enhance developer onboarding with a faster time to first call (TTFC), the most important metric you’ll need for a public API.

If you are not investing in TTFC as your most important API metric, you are limiting the size of your potential developer base throughout your remaining adoption funnel.

To understand a developer’s journey, let’s first take a look at factors influencing how much time and energy they are willing to invest in learning your technology and making it work.

With that context in mind, the following stages describe the developer journey of encountering a new API:

A developer browses your website and documentation to figure out what your API offers. Some people gloss over this step, preferring to learn what your tech offers interactively in the next steps. But judgments are formed at this very early stage, likely while comparing your product among alternatives. For example, if your documentation and onboarding process appears comparatively unorganized and riddled with errors, perhaps it is a reflection of your technology.

Signing up for an account is a developer’s first commitment. It signals their intent to do something with your API. Frequently going hand-in-hand with the next step, signing up is required to generate an API key.

Making the first API call is the first payoff a developer receives and is oftentimes when developers begin more deeply understanding how the API fits into their world. Stripe and Algolia embed interactive guides within their developer documentation to enable first API calls. Stripe and Twitter also use Postman public workspaces for interactive onboarding. Since many developers already use Postman, experiencing an API in familiar territory gets them one step closer to implementation.

Powered by WPeMatico

Bioengineering may soon provide compelling, low-carbon alternatives in industries where even the best methods produce significant emissions. Utilizing natural and engineered biological process has led to low-carbon textiles from AlgiKnit, cell-cultured premium meats from Orbillion and fuels captured from waste emissions via LanzaTech — and leaders from those companies will be joining us onstage for the Extreme Tech Challenge Global Finals on July 22.

We’re co-hosting the event, with panels like this one all day and a pitch-off that will feature a number of innovative startups with a sustainability angle.

I’ll be moderating a panel on using bioengineering to create change directly in industries with large carbon footprints: textiles, meat production and manufacturing.

AlgiKnit is a startup that is sourcing raw material for fabric from kelp, which is an eco-friendly alternative to textile crop monocultures and artificial materials like acrylic. CEO Aaron Nesser will speak to the challenge of breaking into this established industry and overcoming preconceived notions of what an algae-derived fabric might be like (spoiler: it’s like any other fabric).

Orbillion Bio is one of the new crop of alternative protein companies offering cell-cultured meats (just don’t call them “lab” or “vat” grown) to offset the incredibly wasteful livestock industry. But it’s more than just growing a steak — there are regulatory and market barriers aplenty that CEO Patricia Bubner can speak to, as well as the technical challenge.

LanzaTech works with factories to capture emissions as they’re emitted, collecting the useful particles that would otherwise clutter the atmosphere and repurposing them in the form of premium fuels. This is a delicate and complex process that needs to be a partnership, not just a retrofitting operation, so CEO Jennifer Holmgren will speak to their approach convincing the industry to work with them at the ground floor.

It should be a very interesting conversation, so tune in on July 22 to hear these and other industry leaders focused on sustainability discuss how innovation at the startup level can contribute to the fight against climate change. Plus it’s free!

Powered by WPeMatico

Last year, during the pandemic, a free browser extension called Netflix Party gained traction because it enabled people trapped in their homes to connect with far-flung friends and family by watching the same Netflix TV shows and movies simultaneously. It also enabled them to dish about the action in a side bar chat.

Yet that company — later renamed Teleparty — was just the beginning, argue two young companies that have raised seed funding. One, a year-old upstart in London that launched in December, just closed its round this week led by Craft Ventures. The other, a four-year-old, Bay Area-based startup, has raised $3 million in previously undisclosed seed funding, including from 500 Startups.

Both believe that while investors have thrown money at virtual events and edtech companies, there is an even bigger opportunity in developing a kind of multiplayer browsing experience that enables people to do much more together online. From watching sports to watching movies to perhaps even reviewing X-rays with one’s doctor some day, both say more web surfing together is inevitable, particularly for younger users.

The companies are taking somewhat different approaches. The startup on which Craft just made a bet, leading its $2.2 million seed round, is Giggl, a year-old, London-based startup that invites users of its web app to tap into virtual sessions. It calls these “portals” to which they can invite friends to browse content together, as well as text chat and call in. The portals can be private rooms or switched to “public” so that anyone can join.

Giggl was founded by four teenagers who grew up together, including its 19-year-old chief product officer, Tony Zog. It only recently graduated from the LAUNCH accelerator program. Still, it already has enough users — roughly 20,000 of whom use the service on an active monthly basis — that it’s beginning to build its own custom server infrastructure to minimize downtime and reduce its costs.

The bigger idea is to build a platform for all kinds of scenarios and to charge for these accordingly. For example, while people can chat for free while web surfing or watching events together like Apple Worldwide Developers Conference, Giggl plans to charge for more premium features, as well as to sell subscriptions to enterprises that are looking for more ways to collaborate. (You can check out a demo of Giggl’s current service below.)

Hearo.live is the other “multiplayer” startup — the one backed by 500 Startups, along with numerous angel investors. The company is the brainchild of Ned Lerner, who previously spent 13 years as a director of engineering with Sony Worldwide Studios and a short time before that as the CTO of an Electronic Arts division.

Hearo has a more narrow strategy in that users can’t browse absolutely anything together as with Giggl. Instead, Hearo enables users to access upwards of 35 broadcast services in the U.S. (from NBC Sports to YouTube to Disney+), and it relies on data synchronization to ensure that every user sees the same original video quality.

Hearo has also focused a lot of its efforts on sound, aiming to ensure that when multiple streams of audio are being created at the same time — say users are watching the basketball playoffs together and also commenting — not everyone involved is confronted with a noisy feedback loop.

Indeed, Lerner says, through echo cancellation and other “special audio tricks” that Hearo’s small team has developed, users can enjoy the experience without “noise and other stuff messing up the experience.” (“Pretty much we can do everything Clubhouse can do,” says Lerner. “We’re just doing it as you’re watching something else because I honestly didn’t think people just sitting around talking would be a big thing.”)

Like Giggl, Hearo Lerner envisions a subscription model; it also anticipates an eventual ad revenue split with sports broadcasters and says it’s already working with the European Broadcasting Union on that front. Like Giggl, Hearo’s users numbers are conservative by most standards, with 300,000 downloads to date of its app for iOS, Android, Windows, and macOS, and 60,000 actively monthly users.

It begs the question of whether “watching together online” is a huge opportunity, and the answer doesn’t yet seem clear, even if Hearo and Giggl have more compelling tech and viable paths to generating revenue.

The startups aren’t the first to focus on watch-together type experiences. Scener, an app founded by serial entrepreneur Richard Wolpert, says it has 2 million active registered users and “the best, most active relationship with all the studios.” But it markets itself a virtual movie theater, which is a slightly different use case.

Rabbit, a company founded in 2013, enabled people to more widely browse and watch the same content simultaneously, as well as to text and video chat. It’s closer to what Giggl is building. But Rabbit eventually ran aground.

Lerner says that’s because the company was screen-sharing other people’s copyrighted material and so couldn’t charge for its service. (“Essentially,” he notes, “you can get away with some amount of piracy if it’s not for your personal financial benefit.”) But it’s probably fair to wonder if there will ever be massive demand for services like his, particularly as the coronavirus fades into the distance and people reengage more actively in the physical world.

For his part, Lerner isn’t worried. He points to a generation that is far more comfortable watching video on a phone than elsewhere. He also notes that screen time has become “an isolating thing,” and predicts it will eventually become “an ideal time to hang out with your buddies,” akin to watching a game on the couch together.

There is a precedent, in his mind. “Over the last 20 years, games went from single player to multiplayer to voice chats showing up in games so people can actually hang out,” he says. “Because mobile is everywhere and social is fun, we think the same is going to happen to the rest of the media business.”

Zog thinks the trends play in Giggl’s favor, too. “It’s obvious that people are going to meet up more often” as the pandemic winds down, he says. But all that real-world socializing “isn’t really going to be a substitute” for the kind of online socializing that’s already happening in so many corners of the internet.

Besides, he adds Giggl wants to “make it so that being together online is just as good as being together in real life. That’s the end goal here.”

Powered by WPeMatico

One might think that a short week due to a U.S. holiday calls for a short weekly recap, but we have plenty to share about growth marketing from our coverage over the week. With the help of your recommendations, this week we were able to interview Peep Laja and Lucy Heskins, and publish multiple guest columns on growth-related topics including homepage testing, marketing lies to watch out for, VR ad opportunities, company-naming and ad compliance.

TechCrunch is collecting responses in this survey to find the best growth marketer for founders to work with. We’ve included some of our favorites, below the links.

This early-stage marketing expert says ‘B2B SaaS is actually very, very cool now’: Extra Crunch reporter Anna Heim interviews Wales-based growth marketer Lucy Heskins about her experience working with start-ups, how content marketing is best used, and more!

Navigating ad fraud and consumer privacy abuse in programmatic advertising: Did you know that “ad fraud exceeded $35 billion last year, a figure expected to rise to $50 billion by 2025”? Jalal Nasir, CEO of marketing compliance startup Pixalate, lends his thoughts about how business leaders and brands can ensure they don’t fall victim to the problem.

To stay ahead of your competitors, start building your narrative on day one: Anna also sat down with Peep Laja to discuss the importance of a startup being the one to write their own narrative and how it can mature with the company.

Demand Curve: How to double conversions on your startup’s homepage: Head of content Nick Costelloe looks at when it’s good to be unique, and when it’s best to stick to the status quo when working to double conversions on your homepage.

(Extra Crunch) Demand Curve: 10 lies you’ve been told about marketing: For subscribers, Costelloe goes through 10 lies you’ve heard about marketing, and what to try instead to create better results.

(Extra Crunch) Can advertising scale in VR?: Have you been on the fence about VR advertising for your company? AR/VR analyst Michael Boland lists out the pros and cons in this article.

(Extra Crunch) What I learned the hard way from naming 30+ startups: Naming a start-up might require more thought than you imagined. Marketing executive Drew Beechler takes us through what should be considered when picking out a name, like strategic alignment.

As always, please let us know if you can recommend a top-tier growth marketer who works with startups by filling out this quick survey.

Marketer: Nikita Vorobyev

Recommender: Ruby Club

Testimonial: “Nikita & his company, Buildrbrand, have worked tirelessly to bring my idea to life and did everything in his power to get it to the level it is today. He & his team created a world-class conditional quiz visual experience that I think would be really cool for him to share with the industry. He doesn’t know I nominated him, but I definitely wanted to give back to him in any way I can since I believe his agency creates some of the best brands going viral online right now.”

Marketer: Max van den Ingh, Unmuted

Recommender: Harry Willis, ShopPop

Testimonial: “They [have] shown considerable and demonstrable growth marketing success at various companies. One of them being MisterGreen, a Dutch Tesla-leasing company that had grown 10x under Max’s leadership.”

Marketer: Patricia (Patty) Spiller, Chief

Recommender: Livongo

Testimonial: “Hired her to lead Product Marketing and she identified the opportunity to do growth in a much different way, which could significantly accelerate our company’s growth. So, she founded the Growth Marketing team and scaled the team from 1 person to 30 people in less than 2 years, based on all the success they had in growing our member base.”

Powered by WPeMatico