Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

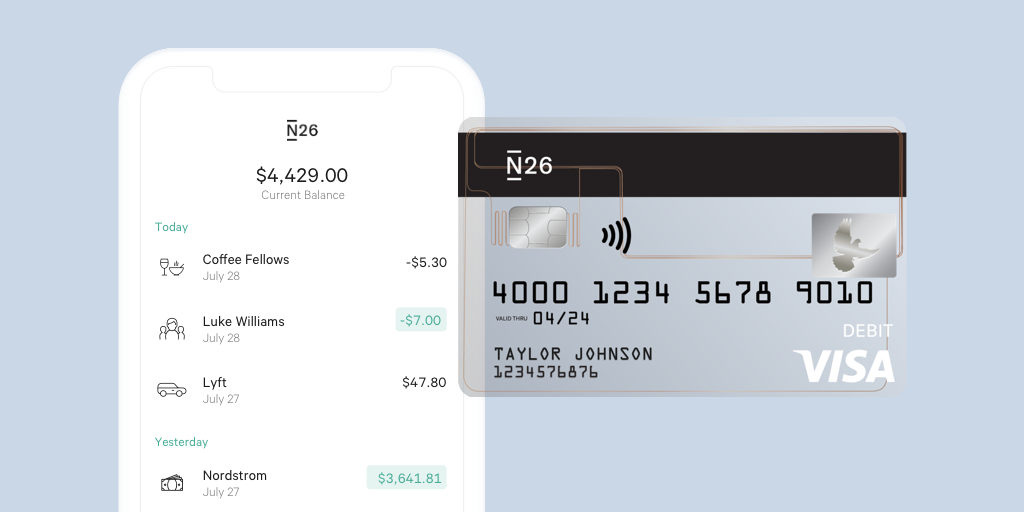

European fintech startup N26 is now accepting customers in the U.S. The company is launching a bank account with a debit card that should provide a better experience compared to traditional retail banks.

If you’re familiar with N26, the product that is going live today won’t surprise you much. Customers in the U.S. can download a mobile app and create a bank account from their phone in just a few minutes. It’s a true bank account with ACH payments, routing and account numbers.

A few days later, you receive a debit card that you can control from the mobile app. Every time you make a transaction, you instantly receive a push notification telling you how much money you just paid. You can set up your PIN code, customize limits, turn on and off online payments, and make ATM withdrawals or payments abroad.

And that’s about all there is to know. But what about fees? Basic N26 accounts are free. There’s no monthly fee and no minimum balance. There’s no fee on transactions in a foreign currency and you get two free ATM withdrawals per month.

N26 is going to progressively roll out signups over the summer as a sort of beta program. If you’ve signed up to the waitlist, you’ll get an invitation over the coming hours, days and weeks. There are currently 100,000 people on the waitlist. N26 will then open signups to everyone later this summer.

When N26 rolls out its final product in a couple of months, the company says that it plans to automatically find and reimburse fees the ATM operators are charging. N26 cards in the U.S. work on the Visa network instead of Mastercard.

Just like Chime, N26 will also try to let you get paid up to two days early if you get paid via direct deposit. Instead of waiting a couple of days to clear those transactions, N26 will go ahead and top up your account.

Behind the scenes, there are a few differences between N26 in Europe and N26 in the U.S. While N26 has a full-fledged banking license in Europe, the company has partnered with Axos Bank, which is acting as a white-label partner in the U.S.

Axos Bank essentially manages your money for you, and N26 acts as the interface between customers and their bank accounts. As a result, you get an FDIC-insured account.

N26 first partnered with a third-party company in Europe, as well. But it was a costly deal that wasn’t meant to stick around. The startup got a banking license in Germany that was good for Europe at large. In the U.S., it’s a different story, as the market is not as unified as in Europe — it’s complicated to get a license to operate in all 50 states.

“We looked at 30 players, we did some due diligence and we’re happy to partner with Axos Bank. The deals that you get in the U.S. for white-label banks are much more favorable than in Europe,” N26 co-founder and CEO Valentin Stalf told me. “It’s a setup for the longer term. It’s good for a couple million customers,” Stalf added later in the conversation.

N26 is already planning more features for the U.S. The company plans to roll out two premium plans — N26 Metal and then N26 Black.

And it sounds like there will be some changes when it comes to perks for premium users. “We took that to a separate level,” Stalf said.

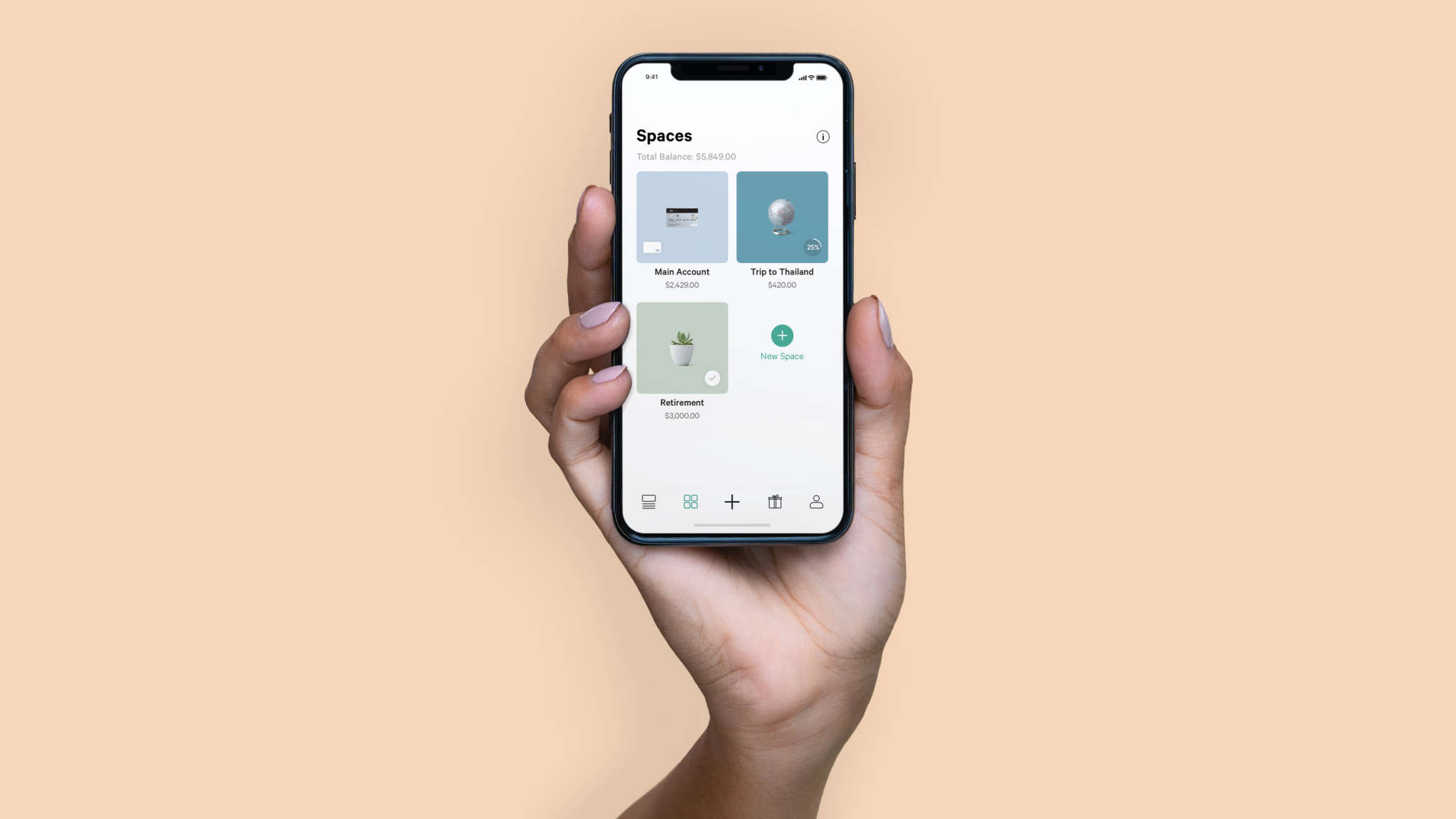

And shared Spaces are finally arriving in the coming months. Spaces are sub-accounts designed to put money aside. You can swipe money from one Space to another or you can set up automated rules.

Eventually, you’ll be able to share a Space with other people so that you can save money and spend money together. It’ll work “like a WhatsApp group,” Stalf said.

N26 currently has 3.5 million customers in Europe and has raised more than $500 million in total so far. There are now a thousand people working for N26 in Berlin, 60 employees in New York, 80 people in Barcelona and a small team of five to 10 people starting soon in Vienna.

“It went from being a small company to being an international company,” Stalf said.

Powered by WPeMatico

Robotic Process Automation has been the name of the game in enterprise software lately — with organizations using advances in machine learning algorithms and other kinds of AI alongside big-data analytics to speed up everything from performing mundane tasks to more complex business decisions.

To underscore the opportunity and growth in the market, today a startup in the wider segment of process automation is announcing a significant fundraise. Signavio, a company founded out of Berlin that provides tools for business process management — “providing the ‘P’ in RPA,” as the company describes it — has picked up an investment of $177 million at what we understand is a valuation of $400 million.

This round is large on its own, but even more so considering that before this the company — founded in 2009 — had only raised around $50 million, according to data from PitchBook. This latest capital injection is being led by Apax Digital (the growth equity team of Apax Partners), with DTCP. It notes that existing investor Summit Partners is also keeping a stake in the business with this deal.

The company was founded by a team of alums from the Hasso Plattner Institute in Potsdam, Germany, who used research they did there for creating the world’s first web modeler for business process management and analytics as the template for Signavio’s own Process Manager. (The name “Signavio” seems to be a portmanteau of “navigating through signals,” which essentially explains the basics of what BPM aims to do to help a business with its decision making.)

Partly because it’s raised so little money, Signavio has been somewhat under the radar, but it has seen a huge amount of growth. It says that revenues in the last 12 months have grown by more than 70%, and its software is used by more than one million users across 1,300 customers — with clients including SAP, DHL, Liberty Mutual, Deloitte, Comcast and Puma. It counts Silicon Valley as its second HQ these days; that trajectory will be followed further with this latest funding: Signavio says the funding in part will be going to international expansion of the business.

“10 years ago, we set out on a journey to tackle the time-consuming practices that limit business productivity,” said Dr. Gero Decker, CEO and co-founder of Signavio, in a statement. “This significant new investment further validates our approach to solve business problems faster and more efficiently, unleashing the power of process through our unique Business Transformation Suite. We are thrilled to welcome Apax Digital as our new lead partner, and look forward to building upon our success to date by leveraging our partners’ operating capabilities and global platforms for our international expansion.”

The other area of investment will be the company’s technology suite. While BPM has been around for years as a concept — and indeed there are a number of other companies that provide tools that are compared sometimes to Signavio’s, such as from biggies like IBM and Microsoft through to Kissflow and others — what’s interesting is how it’s had a surge of interest more recently as organizations increasingly start to add more automation into their IT infrastructure, in part to reduce the human labor needed for more mundane back-office tasks, and in part to reduce costs and speed up processes.

Robotic process automation companies like UiPath and Blue Prism bring some of the same processing tools to the table as Signavio, although the argument is that the latter — which says it helps to “mine, model, monitor, manage and maintain” customers’ data — provides a more sophisticated level of data crunching that can be used for RPA, or for other ends. (It also works with several of the big RPA players, mainly Blue Prism but also UiPath and Automation Anywhere.)

“As businesses have become more global, and workforces more distributed, business processes have proliferated, and become more complex,” noted Daniel O’Keefe, managing partner, and Mark Beith, managing director, of Apax Digital, in a joint statement. “Signavio’s cloud-native suite allows employees across an enterprise to collaborate and transform their businesses by digitizing, optimizing and ultimately automating their processes. We are tremendously excited to partner with the Signavio team and to support their vision.” The two will also be joining Signavio’s board with this round.

Powered by WPeMatico

Maker Faire and Maker Media are getting a second chance after suddenly going bankrupt, but they’ll return in a weakened capacity. Sadly, their flagship crafting festivals remain in jeopardy, and it’s unclear how long the reformed company can survive.

Maker Media suddenly laid off all 22 employees and shut down last month, as first reported by TechCrunch. Now its founder and CEO Dale Dougherty tells me he’s bought back the brands, domains, and content from creditors and rehired 15 of 22 laid off staffers with his own money. Next week, he’ll announce the relaunch of the company with the new name “Make Community“.

Read our story about how Maker Faire fell apart

The company is already working on a new issue of Make Magazine and the online archives of its do-it-yourself project guides will remain available. I hopes to keep publishing books. And it will continue to license the Maker Faire name to event organizers who’ve thrown over 200 of the festivals full of science-art and workshops in 40 countries. But Dougherty doesn’t have the funding to commit to producing the company-owned flagship Bay Area and New York Maker Faires any more.

“We’ve succeeded in just getting the transition to happen and getting Community set up” Dougherty tells me. But sounding shaky, he asks “Can I devise a better model to do what we’ve been doing the past 15 years? I don’t know if I have the answer yet.” Print publishing proved tougher and tougher recently. Combined with declining corporate sponsorships of the main events, Maker Media was losing too much money to stay afloat last time.

“On June 3rd, we basically stopped doing business. And, you know, the bank froze our accounts” Dougherty said at a meetup he held in Oakland to take feedback on his plan, according a recording made by attendee Brian Benchoff. Grasping for a way to make the numbers work, he told the small crowd gathered “I’d be happy if someone wanted to take this off my hands.”

Maker Faire [Image via Maker Faire Instagram]

For now, Dougherty is financing the revival himself “with the goal that we can get back up to speed as a business, and start generating revenue and a magazine again. This is where the community support needs to come in because I can’t fund it for very long.”

Maker Faire founder and Make Community CEO Dale Dougherty

The immediate plan is to announce a new membership model next week at Make.co where hobbyists and craft-lovers can pay a monthly or annual fee to become patrons of Make Community. Dougherty was cagey about what they’ll get in return beyond a sense of keeping alive the organization that’s held the maker community together since 2005. He does hope to get the next Make Magazine issue out by the end of summer or early fall, and existing subscribers should get it in the mail.

The company is still determining whether to move forward as a non-profit or co-op instead of as a venture-backed for-profit as before. “The one thing i don’t like about non-profit is that you end up working for the source you got the money from. You dance to their tune to get their funding” he told the meetup.

Last time, he burned through $10 million in venture funding from Obvious Ventures, Raine Ventures, and Floodgate. That could make VCs weary of putting more cash into a questionable business model. But if enough of the 80,000 remaining Make Magazine subscribers, 1 million YouTube followers, and millions who’ve attended Maker Faire events step up, pehaps the company can find surer footing.

“I hope this is actually an opportunity not just to revive what we do but maybe take it to a new level” Dougherty tells me. After all, plenty of today’s budding inventors and engineers grew up reading Make Magazine and being awestruck by the massive animatronic creations featured at its festivals.

Audibly peturbed, the founder exclaimed at his community meetup “It frustrates the heck out of me thinking that I’m the one backing up Maker Faire when there’s all these billionaires in the valley.”

Powered by WPeMatico

Scooter startup Bird is betting on the French market in a significant way. The company plans to open up its biggest European office in Paris. Eventually, Bird wants to hire 1,000 people by mid-2021, which is a meaningful number for a company that has been around for a couple of years.

Paris is an important market for Bird, and all scooter startups in general. It’s a relatively small city — when it comes to footprint, Paris is smaller than San Francisco. But it’s also a dense city. And of course, there are a ton of tourists who come to Paris just for a few days.

That’s why 12 different companies launched a scooter-sharing service in Paris (yes, twelve). But Les Échos recently reported that many of them have already left the city. Lime, Bird, Circ, Dott, Jump and B-Mobility are still around.

It’s a capital-intensive industry, and Bird has already raised a ton of money to outlive the competition. But money is just one thing.

Opening an office in Paris is also important to show city officials that Bird is serious about this market. Last month, the City of Paris announced that it would limit the number of scooter companies in Paris. They will hand out two or three licenses to operate. And Bird certainly wants to be one of them.

Bird will also use its Paris hub to educate users about safety. The company plans to hand out free helmets if you attend a safety training session.

Powered by WPeMatico

In 2017 — for the first time in over a decade — a computer worm ran rampage across the internet, threatening to disrupt businesses, industries, governments and national infrastructure across several continents.

The WannaCry ransomware attack became the biggest threat to the internet since the Mydoom worm in 2004. On May 12, 2017, the worm infected millions of computers, encrypting their files and holding them hostage to a bitcoin payment.

Train stations, government departments, and Fortune 500 companies were hit by the surprise attack. The U.K.’s National Health Service (NHS) was one of the biggest organizations hit, forcing doctors to turn patients away and emergency rooms to close.

Earlier this week we reported a deep-dive story into the 2017 cyberattack that’s never been told before.

British security researchers — Marcus Hutchins and Jamie Hankins — registered a domain name found in WannaCry’s code in order to track the infection. It took them three hours to realize they had inadvertently stopped the attack dead in its tracks. That domain became the now-infamous “kill switch” that instantly stopped the spread of the ransomware.

As long as the kill switch remains online, no computer infected with WannaCry would have its files encrypted.

But the attack was far from over.

In the days following, the researchers were attacked from an angry botnet operator pummeling the domain with junk traffic to try to knock it offline and two of their servers were seized by police in France thinking they were contributing to the spread of the ransomware.

Worse, their exhaustion and lack of sleep threatened to derail the operation. The kill switch was later moved to Cloudflare, which has the technical and infrastructure support to keep it alive.

Hankins described it as the “most stressful thing” he’s ever experienced. “The last thing you need is the idea of the entire NHS on fire,” he told TechCrunch.

Although the kill switch is in good hands, the internet is just one domain failure away from another massive WannaCry outbreak. Just last month two Cloudflare failures threatened to bring the kill switch domain offline. Thankfully, it stayed up without a hitch.

CISOs and CSOs take note: here’s what you need to know.

Powered by WPeMatico

Early-stage startup founders, you’re searching for opportunities to take your company to greater heights, amirite? Then allow me to direct your attention to Disrupt San Francisco 2019, TechCrunch’s flagship event that takes place October 2-4. More specifically to Startup Alley, the exhibition floor where opportunity thrives.

Grab that opportunity by the scruff and buy a Startup Alley Exhibitor Package. There’s simply no better way to place your early-stage startup in front of influential change agents. Yes, we’re biased, but that doesn’t make us wrong. Here are just three of the many reasons why you should exhibit in Startup Alley.

Media exposure

Along with 10,000+ attendees, Disrupt SF draws more than 400 media outlets. And all those journalists spend time prowling Startup Alley hunting for stories about fascinating founders, emerging tech trends or maybe even a future unicorn. Scoring media coverage can work wonders for your bottom line — as Luke Heron, CEO of TestCard, learned when he exhibited in Startup Alley:

We got a fantastic writeup in Engadget, which was really valuable. Cash at the beginning of the start-up journey is difficult to come by, and an article from a credible organization can help push things in the right direction.

Last year, TestCard closed a $1.7 million funding round.

Investor attention

Journalists aren’t the only influencers perusing the tech and talent on display in Startup Alley. Investors are just as eager to find up-and-coming prospects to add to their portfolios. It’s the perfect place to start conversations and develop relationships. Here’s what David Hall, co-founder of Park & Diamond, had to say about his experience:

Exhibiting in Startup Alley was a game-changer. The chance to have discussions and potentially form relationships with investors was invaluable. It completely changed our trajectory and made it easier to raise funds and jump to the next stage.

Last year, Park & Diamond closed its first round of funding, allowing the company to relocate to New York and make its first key hires.

Wild Card shot at Startup Battlefield

Exhibit in Startup Alley for a chance to win a Wild Card entry to the Startup Battlefield pitch competition. TechCrunch editors will select two standout startups as Wild Card teams. Both teams will compete head-to-head in Startup Battlefield for $100,000 equity-free cash, the Disrupt Cup and even more glorious investor and media attention.

There you have it. Three terrific reasons to buy a Startup Alley Exhibitor Package and strut your stuff at Disrupt San Francisco 2019.

Pro Tip: You have until July 19 to apply for our TC Top Picks program. If you make the cut, you’ll receive a free Startup Alley Exhibitor Package and sweet VIP perks.

Is your company interested in sponsoring at Disrupt SF 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Imitation meat is poised to expand its presence in our diets exponentially, if the success of dueling faux burger companies Impossible and Beyond are any indication — but where’s the chicken? Planted is a brand new Swiss company that claims its ultra-simple meatless poultry is nearly indistinguishable from the real thing, better in other ways and, soon, cheaper.

Made from only pea protein, pea fiber, water and sunflower oil, the company’s first product, which they call planted.chicken, imitates the texture and flavor (or lack thereof) of chicken meat very closely.

There are no exotic substances or techniques involved, which keeps production simple and vegans happy. It’s created by making a sort of fibrous dough using the ingredients mentioned, then using a carefully configured extrusion machine to essentially recreate the structure of the muscle fibers that make up the bulk of meat. These are reassembled into larger pieces with a similar texture to a piece of chicken breast.

Of course it has different properties than real chicken — having no fat, collagen or other complex animal substances, it won’t cook the same and can’t be simply substituted in any recipe, though it should cook a lot like it on a grill or stovetop. So for the innumerable dishes where something like a simple grilled and/or chopped chicken breast is called for, the Planted product has been shown to be a great fit.

Of course it has different properties than real chicken — having no fat, collagen or other complex animal substances, it won’t cook the same and can’t be simply substituted in any recipe, though it should cook a lot like it on a grill or stovetop. So for the innumerable dishes where something like a simple grilled and/or chopped chicken breast is called for, the Planted product has been shown to be a great fit.

Strangely enough, it all began with perhaps the most unpalatable substance conceivable (don’t worry, it doesn’t go in the food): hagfish slime. This strange substance secreted by the deep-dwelling creatures has interesting properties that attracted the attention of Lukas Böni and Erich Windhab in the food sciences labs of ETH Zurich.

“This amazing natural hydrogel and [Lukas’s] biomimetic approaches strongly contribute to our understanding of meat-like structures today and how they can be mimicked and eventually even improved from a biomaterials perspective,” said co-founder Pascal Bieri.

Böni soon connected with his other co-founders, Eric Stirnemann and Pascal Bieri, who shared an interest in reducing the waste and ecological costs associated with meat production. Though they are not opposed to meat eating fundamentally, they deplore the enormous amounts of land required for it, unethical production methods and other unhealthy byproducts of the industry. Their hope is to convince meat eaters to choose less wasteful alternatives without asking them to compromise on the quality of the food.

Planted began selling its product in May, and only officially founded the company last week, although the team has been working for a year and a half on their first product. Böni brought the food science and biological materials knowledge, and Stirnemann is an expert in extrusion techniques; together they were able, after much experimentation, to produce a truly chicken-like substance.

From hagfish slime to chicken-like substance — it doesn’t really sound palatable. But leaving aside that little about food production is really table conversation, the proof of the pudding, as they say, is in the tasting, and tests along those lines have gone very well.

At tests in restaurants across Switzerland, reception has been great, with some consumers unable to tell it apart from the real thing. And this isn’t being substituted for ground chicken in a stew or something — it’s front and center.

“We put a lot of research into the product to make it extremely close to chicken,” said Bieri. “Hence we price around a premium chicken at this stage. We do see strong potential to produce our product at a lower cost mid-term, given strong economies of scale.”

Getting to that mid-term is the problem, of course, but given the frenzy of demand around fake meat and growing investment in alternative proteins, it probably won’t be hard to find investors. Though the company declined to detail its current funding, its FAQ says it is at the “seed stage,” and, although it is independent from ETHZ, it’s hard to imagine Planted will be leaving the nest without a bit of help from the university that spawned it.

Currently Planted’s chicken substitute is only available at a handful of restaurants while they work out the rest of the business and prepare to scale up. The company is planning to expand its commercial presence internationally by early next year, so until then keep an eye on the location list and drop by if you’re in Zurich or Bern.

Powered by WPeMatico

Fintech startup Revolut is opening a small tech hub in Berlin. There’s already a ton of fintech talent in the city, as it’s the hometown of N26. The company plans to hire 80 people at first for many different tech jobs, from software engineering to data science, product and growth.

And this isn’t just about hiring talent in other cities. Revolut plans to customize its product a bit more for the German market, and more generally Europe.

In many ways, Revolut still feels like a British app. For instance, if you want to change your card PIN code, the company tells you to use an ATM to change it. This is simply not possible in Germany, France and many European markets.

And the team in Berlin will also work on Revolut’s commission-free stock trading feature, a sort of Robinhood competitor for Europe. The company is also working on an app for children, maybe as an alternative to a first bank account.

There are currently 150,000 Revolut users in Germany. The company will have a local marketing and communications team to expand more aggressively in that market.

It’s still hard to create a global fintech app that works all around the world. People manage their money in different ways depending on the country in which they live. And fintech startups are also realizing that, now that they have a solid product offering at home.

Powered by WPeMatico

Car shoppers now have several new options to avoid long-term debt and commitments. Automakers and startups alike are increasingly offering services that give buyers new opportunities and greater flexibility around owning and using vehicles.

In the first part of this feature, we explored the different startups attempting to change car buying. But not everyone wants to buy a car. After all, a vehicle traditionally loses its value at a dramatic rate.

Some startups are attempting to reinvent car ownership rather than car buying.

My favorite car blog Jalopnik said it best: “Cars Sales Could Be Heading Straight Into the Toilet.” Citing a Bloomberg report, the site explains automakers may have had the worst first half for new-vehicle retail sales since 2013. Car sales are tanking, but people still need cars.

Companies like Fair are offering new types of leases combining a traditional auto financing option with modern conveniences. Even car makers are looking at different ways to move vehicles from dealer lots.

Fair was founded in 2016 by an all-star team made up of automotive, retail and banking executives including Scott Painter, former founder and CEO of TrueCar.

Powered by WPeMatico

Brooklinen, the direct-to-consumer bed sheet brand backed by investors including FirstMark, is entering the apparel space with its first line of loungewear. The company says its designs, including tops, pants, shorts and a dress, are inspired by vintage athletic clothing and made from cotton and modal blended with spandex. Prices range from $28 for a t-shirt to $75 for jogger pants.

The startup, whose investors also include NYU Innovation Venture Fund and Dorm Room Fund, has built its reputation around high-quality but affordable linens and is able to offer lower prices by controlling the design, manufacturing and logistics and fulfillment of its sheets, comforters, pillows and towels. It is primarily an e-commerce startup, but has also run pop-up shops. Brooklinen’s last round of funding was a $10 million Series A announced in 2017.

Powered by WPeMatico