Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Ringing the Nasdaq market bell was the thrill of a lifetime — both when I did it as a founder and also vicariously as a VC via my incredible founders who have taken their companies public. There’s nothing like seeing the baby you nurtured mature into a multibillion-dollar public entity.

But times have changed. The dramatic influx of late-stage venture capital is enabling companies to slow walk their public offerings. In addition, the accumulation of mountains of cash by strategic buyers and the rise of private equity buy-out firms are making other forms of exits viable options.

Case in point: The number of publicly listed companies has dropped 52%, but entrepreneurship momentum hasn’t slowed; it has actually accelerated. Many of the companies that are finally going public this year are doing so several years after they could have — and would have — in years past. When Uber went public this year, its valuation was so large that it would have registered as 280 on this year’s Fortune 500 list. TransferWise prolonged any move to the public markets through a secondary sale that allowed them to stay private while more than doubling their valuation.

IPOs aren’t for everyone or every company — or indeed for most companies. According to PitchBook, only 3% of venture-backed companies in the last decade eventually went public. Most startups that don’t go public never had the option to do so. However, some founders who could IPO are actively choosing to delay IPOs due to the many challenges of managing a public company.

What’s best for one company isn’t necessarily what’s best for another.

For starters, employee moods shift with the stock price. I once had an employee mad at me for not telling him to sell when I knew we were going to have a weak quarter. That would have been illegal! Also, IPOs come with a burden of public scrutiny; the administrative hassles take up precious time, and 90-day reporting cycles often conflict with long-term strategic planning. In addition, many public investors are only interested in short-term moves; plus, there’s the related risk of activist investors upending the company’s long-term strategy in pursuit of their own short-term goals.

Despite the challenges, going public is still important for many high-growth companies. Here’s why:

For those founders with their eye on the IPO ball, here’s my advice:

Every company charts its own path to success, so what’s best for one company isn’t necessarily what’s best for another. I personally wouldn’t trade my experience of going public for the world, and I believe that the talented founders taking their companies public this year feel the same way. What’s great about today’s market environment is that going public — or not — is a choice that lies squarely where it should: in the hands of founders.

Powered by WPeMatico

Could Roblox create a new entertainment and communication category, something it calls “human co-experience”?

When it was a small startup, few observers would have believed in that future. But after 15 years — as told in the origin story of our Roblox EC-1 — the company has accumulated 90 million users and a new $150 million venture funding war chest. It has captured the imagination of America’s youth, and become a startup darling in the entertainment space.

But what, exactly, is human co-experience? Well, it can’t be described precisely — because it’s still an emerging category. “It’s almost like that fable where the nine blind men are touching and describing an elephant.

Everyone has a slightly different view,” says co-founder and CEO Dave Baszucki. In Roblox’s view, co-experience means immersive environments where users play, explore, talk, hang out, and create an identity that’s as thoroughly fleshed out (if not as fleshy) as their offline, real life.

But the next decade at Roblox will also be its most challenging time yet, as it seeks to expand from 90 million users to, potentially, a billion or more. To do so, it needs to pull off two coups.

First, it needs to expand the age range of its players beyond its current tween and teen audience. Second, it must win the international market. Accomplishing both of these will be a puzzle with many moving parts.

One thing Roblox has done very well is appeal to kids within a certain age range. The company says that a majority of all 9-to-12-year-old children in the United States are on its platform.

Within that youthful segment, Roblox has arguably already created the human co-experience category. Many games are more cooperative than competitive, or have goals that are unclear or don’t seem to matter much. One of Roblox’s most popular games, for instance, is MeepCity, where players can run around and chat in virtual environments like a high school without necessarily interacting with the game mechanics at all.

What else separates these environments from what you can see today on, say, the App Store or Steam? A few characteristics seem common.

For one, the environments look rough. One Robloxian put the company’s relaxed attitude toward looks as “not over-indexing on visual fidelity.”

Roblox games also ignore the design principles now espoused by nearly every game company. Tutorials are infrequent, user interfaces are unpolished, and one gets the sense that KPIs like retention and engagement are not being carefully measured.

That’s similar to how games on platforms like Facebook and the App Store started out, so it seems reasonable to say Roblox is just in a similarly early stage. It is — but it’s also competing directly with mobile games that are more rigorously designed. Over half of its players are on smartphones, where they could have chosen a free game that looks more polished, like Fortnite or Clash of Clans.

The more accurate explanation of why Roblox draws big player numbers is that there’s a gap in the kids entertainment market. So far, only Roblox fills that gap, despite its various shortcomings.

“The amount of unstructured, undirected play has been declining for decades. [Kids] have much more homework, and structured activities like theater after school.

One of the big unmet needs we solve is to give kids a place to have imagination,” explains Craig Donato, Roblox’s chief business officer. “If you play the experiences on our platform, you’re not playing to win. You go into these worlds with people you know and share an experience.”

Games like The Sims tried to do the same, but eventually faded in the children’s demo. Roblox’s trick has been continued growth: it provides kids with an endless array of games that unlock their imagination. But just like we don’t expect adults to have fun with Barbie dolls, it’s unlikely most adults would enjoy Roblox games.

Of course, it would be easy to point at Roblox and laugh off its ambitions to win over people of all ages. That laughter would also be short-sighted.

As David Sze, the Greylock Partners investor who led Roblox’s most recent round, pointed out: “When we invested in Facebook there was a huge amount of pushback that nobody would use it outside college.” Companies that have won over one demographic have a good chance of winning others.

Roblox has also proven its ability to evolve. At one time, the platform’s players were 90 percent male. Now, that’s down to about 60 percent. Roblox now has far more girls playing than the typical game platform.

Powered by WPeMatico

Birthday cakes, gift cards, free lunches, snacks, movie tickets, and other perks are generously bestowed on employees to celebrate life’s happy moments. This is an improvement from the industrial approach to management, but can we go deeper for our work-family members?

Life’s darker moments hold the greatest opportunity to exemplify a genuine and caring 21st-century workplace culture. One which fosters empathy and camaraderie. Employee turnover is highest when employees take leave, claim FMLA, or use PTO. According to Global Studies, 79% of employees report their reason for quitting was simply due to feeling unnoticed (lack of appreciation).

Appreciation for your employees is best demonstrated as an act of kindness in moments that really matter, like the loss of a family member. Acknowledging that someone great is gone, instead of ignoring the uncomfortable aspects of grief, is a valuable way to embed empathy into your workplace culture.

Recently, while working with a mid-sized (500+ employees) tech company, I asked what they were doing to support employees during the negative life moments. The HR Director replied, “um, nothing really”.

Once realizing how crappy that sounded, another executive countered her by saying he sent an employee a t-shirt and card after a miscarriage. I later learned that the employee he was referring to had been with the company for over 5 years, so it’s safe to assume that she had a couple of company swag t-shirts in her collection prior to getting one as a get well gift.

Even in the largest and most notable companies, where a variety of employee amenities and benefits are offered, the concept and practice of empathy is often neglected. Perhaps you haven’t come across such extreme examples of indifference in your workplace, but you may have participated in signing a generic condolences card or chipping in for some flowers.

Powered by WPeMatico

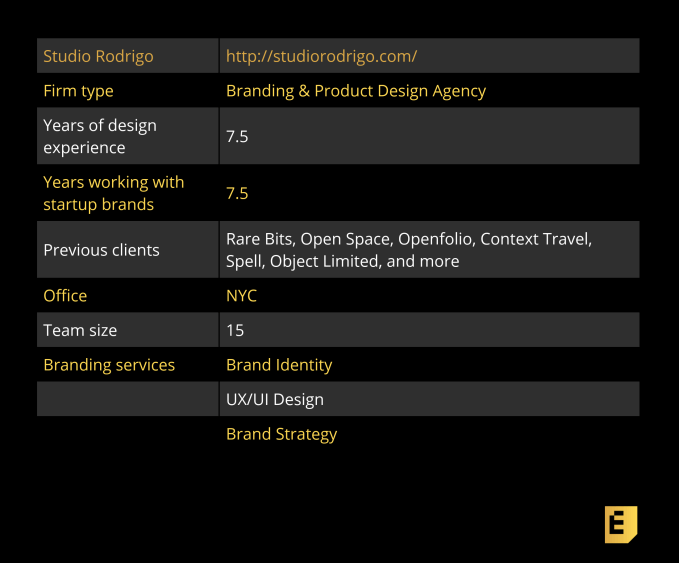

Ritik Dholakia worked as a startup product manager before he co-founded Studio Rodrigo, a branding and product design agency based in NYC. Unlike traditional branding firms, Studio Rodrigo is proud of its product design chops, especially when it comes to helping early-stage startups build version one of their product. It’s not an easy balancing act since most companies eventually want to bring their product design talent in-house, but it turns out, Studio Rodrigo can help with that too. Learn more about the studio in our Q&A with founder Ritik Dholakia.

“Studio Rodrigo listened to all of our goals and dreams, concerns and uncertainties, and created a brand identity, website, and marketing materials that were true to our vision but better than anything we could have imagined.” Tze Chun, NYC, Founder, Uprise Art

“Basically, we’re a full-stack product design team. We have people who can do brand identity from a pure graphic design and visual communications standpoint, and who can also connect the dots between design and technology, business, and customer needs. We don’t have a traditional agency model with a project and account management overhead. You work directly with our designers.”

“We like working with clients that are solving big, meaty, challenging problems. We’ve got a smart team that likes to wrap their heads around the kinds of technologies that are pushing industries forward. For us, that’s currently technologies like machine learning and artificial intelligence.”

Below, you’ll find the rest of the founder reviews, the full interview, and more details like pricing and fee structures. This profile is part of our ongoing series covering startup brand designers and agencies with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already.

Yvonne Leow: First things first, how did you get into brand design and product development?

Ritik Dholakia: I’ve been in digital design and product development for about 20 years now. I actually started my career as a product manager at a startup. I worked for two venture-backed startups as the first product manager. I was part of the Series A team, managing product development, acquiring initial customers, and building market traction.

The first startup was an enterprise software platform for customers doing triple bottom line reporting. The second one was one of the earliest social networking platforms, pre-Facebook, and around the same time as Friendster, LinkedIn, and Spoke.

Powered by WPeMatico

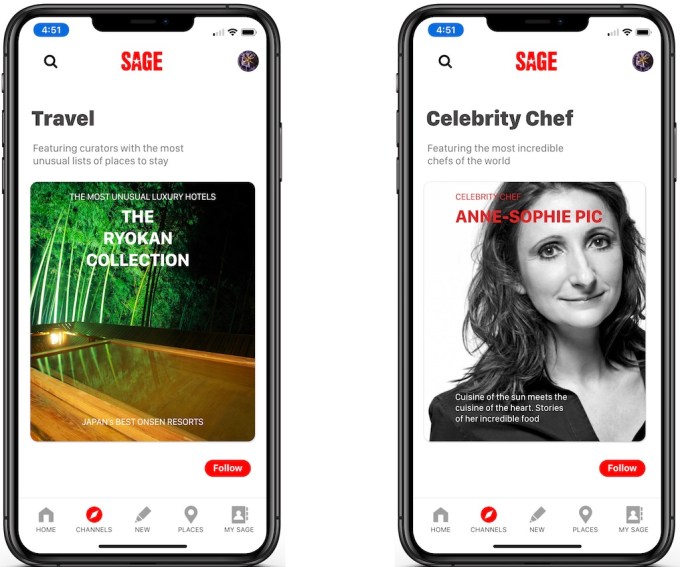

Sage is giving reviewers, chefs and other experts and publishers a central place to share all their content.

To do this, the startup has created a new product called Sage Plus for Experts, which isn’t open to the public yet, but is accepting signups from those aforementioned travel experts — the kinds of experts who can share content around things to do, food, drinks, experiences and shopping.

Founder and CEO Samir Arora (who previously led Mode Media/Glam Media) suggested that a Sage profile can serve as the center of a creator or publisher’s online presence. And eventually, it could become the foundation for them to build their own personal direct-to-consumer brand.

In the announcement, Arora said the product was designed to answer a simple question: “Why does the internet not offer a simple way to show recommendations by real experts or the authentic experiences and products by the brands we trust and love?”

Back in 2017, when he first told me about his vision for Sage, Arora said his goal was to create a reliable source for location data. In an interview earlier this month, he said the plan to focus on verified sources eventually led him to this new product.

“We started to say that the only way to have verified information is to go backwards, to verify the sources of information — the journalists,” he said.

To do that, Sage starting curating a list of trusted experts, and it started working with those experts, who Arora said were asking for something like this. He showed me how someone could come onto the Sage service and quickly connect their social media accounts and author pages —after that, the profile updates automatically.

So there’s no technical expertise required, and after the initial setup, no additional work — though if they want to, experts can also post reviews and lists made specifically for Sage. They can even publish their Sage profile as a separate mobile app, and start monetizing through things like bookings and merchandise sales.

In some cases, the profile will already exist, and the expert simply needs to claim it.

“We’ve been manually curating sources while training an AI to reliably go out into the world to find people who are professionally in this business,” Arora said.

He added that Sage’s list has already grown to 5 million experts, with 200,000 active profiles. The active experts include food critic Masuhiro Yamamoto (whom you may know from “Jiro Dreams of Sushi”).

Ultimately, all expert content goes back into the broader Sage platform, and it will allow the startup to recommend trustworthy publishers and provide travel recommendations on what to do and where to go.

Powered by WPeMatico

We can’t wait to dig into the competitive, high-stakes world of enterprise software at TC Sessions: Enterprise 2019 on September 5 at the Yerba Buena Center for the Arts in San Francisco. We’re channeling the excitement into creating extra ROI for you. How’s that work? Read on.

It starts with the $100 you’ll save when you buy your early-bird ticket. Here comes the extra part. For every ticket you buy to TC Sessions: Enterprise, we’ll register you for a free Expo-only pass to TechCrunch Disrupt SF 2019. Who doesn’t like free?

We expect more than 1,000 attendees — including some of the top minds, makers and investors in enterprise software — for a day-long intensive event focused on the promises and challenges of this massive $500 billion market. You can expect onstage interviews, exhibiting startups, breakout sessions, receptions and more. TechCrunch editors Frederic Lardinois, Ron Miller and Connie Loizos will interview founders from both established and emerging companies about crucial topics, like intelligent marketing automation, AI and the inevitability of the cloud.

Case in point. You can’t talk about enterprise software or its shift to the cloud without talking about the Kubernetes container management system. That’s why we’re thrilled to have the opportunity to sit down with Aparna Sinha, Google’s director of product management for Kubernetes; Tim Hockin, who currently works on Kubernetes and the Google Container Engine; Kubernetes co-founder Craig McLuckie; and Microsoft’s Brendan Burns — the lead engineer for Kubernetes during his time at Google.

These four heavy hitters will discuss the history of Kubernetes, why Google went open source with it and the five-year-old project’s rapid growth. It promises to be a fascinating look at the past, present and future of containers in the enterprise.

That’s just one presentation in a jam-packed day dedicated to all things enterprise. Check out the speakers we have on tap so far. And by all means, if there’s someone you want to hear on the stage, send us your speaker submissions.

TC Sessions Enterprise 2019 takes place September 5. Early-bird tickets cost $249, and student tickets sell for $75. Buy 4+ tickets to get the group rate and save another 20%. And remember, you’ll receive a free Expo-only pass to Disrupt SF 2019 with every TC Sessions: Enterprise ticket.

Get your early-bird tickets now, and we’ll see you in September!

Interested in sponsoring TC Sessions: Enterprise? Fill out this form and a member of our sales team will contact you.

Powered by WPeMatico

There are successful companies that grow fast and garner tons of press. Then there’s Roblox, a company which took at least a decade to hit its stride and has, relative to its current level of success, barely gotten any recognition or attention.

Why has Roblox’s story gone mostly untold? One reason is that it emerged from a whole generation of gaming portals and platforms. Some, like King.com, got lucky or pivoted their business. Others by and large failed.

Once companies like Facebook, Apple and Google got to the gaming scene, it just looked like a bad idea to try to build your own platform — and thus not worth talking about. Added to that, founder and CEO Dave Baszucki seems uninterested in press.

But overall, the problem has been that Roblox just seemed like an insignificant story for many, many years. The company had millions of users, sure. So did any number of popular games. In its early days, Roblox even looked like Minecraft, a game that was released long after Roblox went live, but that grew much, much faster.

Yet here we are today: Roblox now claims that half of all American children aged 9-12 are on its platform. It has jumped to 90 million monthly unique users and is poised to go international, potentially multiplying that number. And it’s unique. Essentially all other distribution services offering games through a portal have eventually fizzled, aside from some distant cousins like Steam.

This is the story of how Roblox not only survived, but built a thriving platform.

(Photo by Steve Jennings/Getty Images for TechCrunch)

Before Roblox, there was Knowledge Revolution, a company that made teaching software. While designed to allow students to simulate physics experiments, perhaps predictably, they also treated it like a game.

“The fun seemed to be in building your own experiment,” says Baszucki. “When people were playing it and we went into schools and labs, they were all making car crashes and buildings fall down, making really funny stuff.” Provided with a sandbox, kids didn’t just make dry experiments about mass or velocity — they made games, or experiences they could show off to friends for a laugh.

Knowledge Revolution was founded in 1989, by Dave Baszucki and his brother Greg (who didn’t later co-found Roblox, but is now on its board). Nearly a decade later, it was acquired for $20 million by MSC Software, which made professional simulation tools. Dave continued there for another four years before leaving to become an angel investor.

Baszucki put money into Friendster, a company that pre-dated Facebook and MySpace in the social networking category. That investment seeded another piece of the idea for Roblox. Taken together, the legacy of Knowledge Revolution and Friendster were the two key components undergirding Roblox: a physics sandbox with strong creation tools, and a social graph.

Baszucki himself is a third piece of the puzzle. Part of an older set of entrepreneurs, which might be called the Steve Jobs generation, Baszucki’s archetype seems closer to Mr. Rogers than Jobs himself: unfailingly polite and enthusiastic, never claiming superior insight, and preferring to pass credit for his accomplishments on to others. In conversation, he shows interests both central and tangential to Roblox, like virtual environments, games, education, digital identity and the future of tech. Somewhere in this heady mix, the idea of Roblox came about.

Powered by WPeMatico

When it comes to applying AI to the world around us, Andrew Ng has few if any peers. We are delighted to announce that the renowned founder, investor, AI expert and Stanford professor will join us onstage at the TechCrunch Sessions: Enterprise show on September 5 at the Yerba Buena Center in San Francisco.

AI promises to transform the $500 billion enterprise world like nothing since the cloud and SaaS. Hundreds of startups are already seizing the AI moment in areas like recruiting, marketing and communications and customer experience. The oceans of data required to power AI are becoming dramatically more valuable, which in turn is fueling the rise of new data platforms, another big topic of the show.

Last year, Ng launched the $175 million AI Fund, backed by big names like Sequoia, NEA, Greylock and SoftBank. The fund’s goal is to develop new AI businesses in a studio model and spin them out when they are ready for prime time. The first of that fund’s cohort is Landing AI, which also launched last year and aims to “empower companies to jumpstart AI and realize practical value.” It’s a wave businesses will want to catch if Ng is anywhere near right in his conviction that AI will generate $13 trillion in GDP growth globally in the next 20 years. You heard that right.

At TC Sessions: Enterprise, TechCrunch’s editors will ask Ng to detail how he believes AI will unfold in the enterprise world and bring big productivity gains to business.

As the former chief scientist at Baidu and the founding lead of Google Brain, Ng led the AI transformation of two of the world’s leading technology companies. Dr. Ng is the co-founder of Coursera, an online learning platform, and founder of deeplearning.ai, an AI education platform. Dr. Ng is also an adjunct professor at Stanford University’s Computer Science Department and holds degrees from Carnegie Mellon University, MIT and the University of California, Berkeley.

Early Bird tickets to see Andrew at TC Sessions: Enterprise are on sale for just $249 when you book here; but hurry, prices go up by $100 soon! Students, grab your discounted tickets for just $75 here.

Powered by WPeMatico

A marketplace dominated by Slack and Microsoft Teams, along with a host of other smaller workplace communication apps, might seem to leave little room for a new entrant, but Swit wants to prove that wrong. The app combines messaging with a roster of productivity tools, like task management, calendars and Gantt charts, to give teams “freedom from integrations.” Originally founded in Seoul and now based in the San Francisco Bay Area, Swit announced today that it has raised a $6 million seed round led by Korea Investment Partners, with participation from Hyundai Venture Investment Corporation and Mirae Asset Venture Investment.

Along with an investment from Kakao Ventures last year, this brings Swit’s total seed funding to about $7 million. Swit’s desktop and mobile apps were released in March and since then more than 450 companies have adopted it, with 40,000 individual registered users. The startup was launched last year by CEO Josh Lee and Max Lim, who previously co-founded auction.co.kr, a Korean e-commerce site acquired by eBay in 2001.

While Slack, which recently went public, has become so synonymous with the space that “Slack me” is now part of workplace parlance at many companies, Lee says Swit isn’t playing catch-up. Instead, he believes Swit benefits from “last mover advantage,” solving the shortfalls of other workplace messaging, collaboration and productivity apps by integrating many of their functions into one hub.

“We know the market is heavily saturated with great unicorns, but many companies need multiple collaboration apps and there is nothing that seamlessly combines them, so users don’t have to go back and forth between two platforms,” Lee tells TechCrunch. Many employees rely on Slack or Microsoft Teams to chat with one another, on top of several project management apps, like Asana, Jira, Monday and Confluence, and email to communicate with people at other companies (Lee points to a M.io report that found most businesses use at least two messaging apps and four to seven collaboration tools).

Lee says he used Slack for more than five years and during that time, his teammates added integrations from Asana, Monday, GSuite and Office365, but were unsatisfied with how they worked.

“All we could do with the integrations was receive mostly text-based notifications and there were also too many overlapping features,” he says. “We realized that working with multiple environments reduced team productivity and increased communication overhead.” In very large organizations, teams or departments sometimes use different messaging and collaboration apps, creating yet more friction.

Swit’s goal is to cover all those needs in one app. It comes with integrated Kanban task management, calendars and Gantt charts, and at the end of this year about 20 to 30 bots and apps will be available in its marketplace. Swit’s pricing tier currently has free and standard tiers, with a premium tier for enterprise customers planned for fall. The premium version will have full integration with Office365 and GSuite, allowing users to drag-and-drop emails into panels or convert them into trackable tasks.

While being a late-mover gives Swit certain advantages, it also means it must convince users to switch from their current apps, which is always a challenge when it comes to attracting enterprise clients. But Lee is optimistic. After seeing a demo, he says 91% of potential users registered on Swit, with more than 75% continuing to use it every day. Many of them used Asana or Monday before, but switched to Swit because they wanted to more easily communicate with teammates while planning tasks. Some are also gradually transitioning over from Slack to Swit for all their messaging (Swit recently released a Slack migration tool that enables teams to move over channels, workspaces and attachments. Migration tools for Asana, Trello and Jira are also planned).

In addition to “freedom from integrations,” Lee says Swit’s competitive advantages include being developed from the start for small businesses as well as large enterprises that still frequently rely on email to communicate across different departments or locations. Another differentiator is that all of Swit’s functions work on both desktop and mobile, which not all integrations in other collaboration apps can.

“That means if people integrate multiple apps into a desktop app or web browser, they might not be able to use them on mobile. So if they are looking for data, they have to search app by app, channel by channel, product by product, so data and information is scattered everywhere, hair on fire,” Lee says. “We provide one centralized command center for team collaboration without losing context and that is one of our biggest sources of customer satisfaction.”

Powered by WPeMatico

GDPR, and the newer California Consumer Privacy Act, have given a legal bite to ongoing developments in online privacy and data protection: it’s always good practice for companies with an online presence to take measures to safeguard people’s data, but now failing to do so can land them in some serious hot water.

Now — to underscore the urgency and demand in the market — one of the bigger companies helping organizations navigate those rules is announcing a huge round of funding. OneTrust, which builds tools to help companies navigate data protection and privacy policies both internally and with its customers, has raised $200 million in a Series A led by Insight that values the company at $1.3 billion.

It’s an outsized round for a Series A, being made at an equally outsized valuation — especially considering that the company is only three years old — but that’s because of the wide-ranging nature of the issue, according to CEO Kabir Barday, and OneTrust’s early moves and subsequent pole position in tackling it.

“We’re talking about an operational overhaul in a company’s practices,” Barday said in an interview. “That requires the right technology and reach to be able to deliver that at a low cost.” Notably, he said that OneTrust wasn’t actually in search of funding — it’s already generating revenue and could have grown off its own balance sheet — although he noted that having the capitalization and backing sends a signal to the market and in particular to larger organizations of its stability and staying power.

Currently, OneTrust has around 3,000 customers across 100 countries (and 1,000 employees), and the plan will be to continue to expand its reach geographically and to more businesses. Funding will also go toward the company’s technology: it already has 50 patents filed and another 50 applications in progress, securing its own IP in the area of privacy protection.

OneTrust offers technology and services covering three different aspects of data protection and privacy management.

Its Privacy Management Software helps an organization manage how it collects data, and it generates compliance reports in line with how a site is working relative to different jurisdictions. Then there is the famous (or infamous) service that lets internet users set their preferences for how they want their data to be handled on different sites. The third is a larger database and risk management platform that assesses how various third-party services (for example advertising providers) work on a site and where they might pose data protection risks.

These are all provided either as a cloud-based software as a service, or an on-premises solution, depending on the customer in question.

The startup also has an interesting backstory that sheds some light on how it was founded and how it identified the gap in the market relatively early.

Alan Dabbiere, who is the co-chairman of OneTrust, had been the chairman of Airwatch — the mobile device management company acquired by VMware in 2014 (Airwatch’s CEO and founder, John Marshall, is OneTrust’s other co-chairman). In an interview, he told me that it was when they were at Airwatch — where Barday had worked across consulting, integration, engineering and product management — that they began to see just how a smartphone “could be a quagmire of privacy issues.”

“We could capture apps that an employee was using so that we could show them to IT to mitigate security risks,” he said, “but that actually presented a big privacy issue. If [the employee] has dyslexia [and uses a special app for it] or if the employee used a dating app, you’ve now shown things to IT that you shouldn’t have.”

He admitted that in the first version of the software, “we weren’t even thinking about whether that was inappropriate, but then we quickly realised that we needed to be thinking about privacy.”

Dabbiere said that it was Barday who first brought that sensibility to light, and “that is something that we have evolved from.” After that, and after the VMware sale, it seemed a no-brainer that he and Marshall would come on to help the new startup grow.

Airwatch made a relatively quick exit, I pointed out. His response: the plan is to stay the course at OneTrust, with a lot more room for expansion in this market. He describes the issues of data protection and privacy as “death by 1,000 cuts.” I guess when you think about it from an enterprising point of view, that essentially presents 1,000 business opportunities.

Indeed, there is obvious growth potential to expand not just its funnel of customers, but to add more services, such as proactive detection of malware that might leak customers’ data (which calls to mind the recently fined breach at British Airways), as well as tools to help stop that once identified.

While there are a million other companies also looking to fix those problems today, what’s interesting is the point from which OneTrust is starting: by providing tools to organizations simply to help them operate in the current regulatory climate as good citizens of the online world.

This is what caught Insight’s eye with this investment.

“OneTrust has truly established themselves as leaders in this space in a very short time frame, and are quickly becoming for privacy professionals what Salesforce became for salespeople,” said Richard Wells of Insight. “They offer such a vast range of modules and tools to help customers keep their businesses compliant with varying regulatory laws, and the tailwinds around GDPR and the upcoming CCPA make this an opportune time for growth. Their leadership team is unparalleled in their ambition and has proven their ability to convert those ambitions into reality.”

Wells added that while this is a big round for a Series A it’s because it is something of an outlier — not a mark of how Series A rounds will go soon.

“Investors will always be interested in and keen to partner with companies that are providing real solutions, are already established and are led by a strong group of entrepreneurs,” he said in an interview. “This is a company that has the expertise to help solve for what could be one of the greatest challenges of the next decade. That’s the company investors want to partner with and grow, regardless of fund timing.”

Powered by WPeMatico