Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

100 Thieves has today announced the close of a $35 million Series B funding round. Artist Capital Management led the round, with ACM’s Chief Investment Officer Josh Dienstag joining Mike Sepso, MLG co-founder, on the board of directors. Aglaé Ventures, which is the technology investment firm of Groupe Arnault, controlling shareholder of Louis Vuitton Moet Hennessy (LVMH), also participated in the round.

CEO and founder Matthew “Nadeshot” Haag confirmed to TechCrunch that this latest round brings 100 Thieves’ post-funding valuation to $160 million, which is up from the $90 million valuation it had in October 2018.

100 Thieves was founded in 2017. Haag is a former pro gamer and content creator with one of the biggest followings in esports.

“The most important lesson I’ve learned going from gaming to leadership is ‘over-communicate, over-communicate, over-communicate,’ ” said Haag, explaining that he went from working by himself creating content to working with many people each day. “Making sure we’re all aligned on our goals for each day and each week and each month, to have an open and transparent environment, really builds a culture where everybody enjoys working with one another. Over-communication helps drive success.”

The org is co-owned by Drake, Dan Gilbert and Scooter Braun, alongside Haag. 100 Thieves has three revenue channels.

The first is esports. Right now, the organization competes in Call of Duty (where its team has won the last two tournaments), League of Legends and Fortnite (100 Thieves is sending six of its players to the Fortnite World Cup).

The second channel is content creation. 100 Thieves includes big-name streamers such as Jack “Courage” Dunlop, who has nearly 1.9 million Twitch followers, and Rachell “Valkyrae” Hofstetter, who has more than 800,000 Twitch followers.

Finally, 100 Thieves has gotten into apparel, with limited-edition hats, sweaters, jackets and t-shirts. As of right now, everything in the 100 Thieves Shop is sold out.

“What’s hurt me the most is having so many community members not be able to purchase this apparel for themselves,” said Haag. “We want 100 Thieves to be all inclusive. If you want to support us, you should be able to.”

According to Haag, one goal is to expand into new esports titles — a few titles in consideration include “Counter-Strike: Global Offensive,” “Rainbow 6 Siege” and “Rocket League.”

Another top-of-mind goal is building out a new HQ facility in Los Angeles that will house the esports, content creation and apparel divisions all under one roof. The 15,000-square-foot facility will include streaming stations, a content production sound stage for 100 Thieves’ two podcasts and will serve as the storefront for 100 Thieves apparel lines.

Powered by WPeMatico

Financial service companies like banks have seen some of their business cannibalised over the years with the rise of digital-based alternatives — often in the form of apps — that provide lower fees, faster responsiveness and more flexibility to consumers. Today, Toronto-based startup Flybits is announcing $35 million in funding for a platform that it believes can offer these banks a way of continuing to capture their users’ attention and help them pivot into the next generation of services, financial or otherwise.

Today, a typical end product for a customer of Flybits’ services will use insights to upsell a customer by offering financial services; for example, a bank providing an offer of a specific kind of loan or credit card that you are more likely to take; or to offer a loyalty program or rewards for usage. But the longer-term goal, said CEO and co-founder Hossein Rahnama, is to help its customers take on a bigger role as repositories that can be used for more than just money, and used beyond the walls of the bank.

“We don’t think banks will go away, as some do, but we think that they could have a role not just as money vaults, but as data vaults: a place where you can deposit data, which you trust,” he said in an interview. Indeed, some of the funding will be used to put into action some of the AI and machine learning patents the startup has amassed, with the building of a “data” marketplace for banks, fintechs and other data providers to partner and build more services together.

The Series C comes from an interesting group of investors that includes both strategic backers using Flybits’ services, as well as backers of the more non-strategic, financial kind. Led by Point72 Ventures (hedge fund supremo Steve Cohen’s VC fund), the list also includes Mastercard, Citi Ventures and Reinventure (the fund backed by Australia’s Westpac Banking Corporation), Portag3 Ventures, TD Bank and Information Venture Partners. Valuation is not being disclosed, and prior to this the company had raised around $15 million.

Much like another marketing tech company, Near — which today announced $100 million in funding — the premise that underpins Flybits’ technology is that there is a lot of disparate data out there that, if it’s treated correctly, can uncover a lot more insights about consumer behavior, and that by and large many companies are missing this opportunity because they haven’t found the right way of merging the data to unlock insights.

While Near is applying this to location-based data and a range of different verticals, Flybits’ primary target has been banks and the data that they and other financial services providers already possess.

Many smaller startups in the world of financial services have stolen a march on bigger incumbents by building personalization into their products from the ground up. (Indeed, some like Step, aimed at teens, are so personalised that they will actually change their service mix as their customer base grows up and needs new products.) This is something that incumbents might have been more readily able to do in the old days, when people knew their bank managers and tellers and made daily trips into branches to transact. In the digital age they have fallen behind and are now catching up.

Flybits’ investors have spotted that and this in part is why they are banking on technologies like this to help bigger companies catch up, not just in financial services (although with banking alone estimated to be a €6.9 trillion industry, this is clearly a good start).

“Personalization is mission-critical for all D2C businesses in the digital age. Flybits’ integrated platform allows financial services firms to offer contextualized experiences, driving product awareness and adding significant value to the lives of their customers,” said Ramneek Gupta, managing director and co-head of Venture Investing at Citi Ventures, in a statement. “We look forward to partnering with Flybits in its next phase of growth as it continues to set the bar for hyper-personalized customer experiences.”

Indeed, it’s not just banks that are working on upselling, or that have large repositories of data that are not used as well as they could be.

“Mastercard and Flybits share a vision on using data driven insights to enrich consumers’ experiences,” said Francis Hondal, president, Loyalty & Engagement at Mastercard, in a statement. “Our ultimate goal is to develop products and services that engage consumers in a highly contextual manner. Through this collaboration with Flybits, we’ll be able to offer rich, personalized experiences for them throughout their journeys.”

Powered by WPeMatico

One of the Holy Grails in the world of advertising and marketing has been finding a way to accurately capture and understand what consumers are doing throughout the day, regardless of whether it’s a digital or offline activity. That goal has become even more elusive in recent years, with the surge of regulations around privacy and data protection that limit what kind of information can be collected and used. Now, a startup believes it has cracked the code, and has raised a large round of funding that underscores its success so far and what it believes is untapped future demand.

Near — which has built an interactive, cloud-based AI platform called Allspark that works across 44 countries to create anonymised, location-based profiles of users (1.6 billion each month at present) based on a trove of information that it sources and then merges from phones, data partners, carriers and its customers, but which it claims was built “with privacy by design” — has raised $100 million.

The company believes that this Series D — from a single backer, Greater Pacific Capital (GPC) out of London — is one of the biggest rounds ever to be raised in this particular area of marketing technology. That’s not to say that others haven’t also been attracting investor attention (as one example, a direct competitor, Factual, raised $42 million last September).

Near is not disclosing its valuation, but founder and CEO Anil Mathews said in an interview that the company has been growing at a rate of 100% year-on-year and described it as “healthy,” with its customer list including News Corp, MetLife, Mastercard and WeWork.

Near (not to be confused with the blockchain startup that raised $12 million last week; yes sometimes startups have the same name…) has to date raised $134 million, with other backers including Sequoia, JP Morgan, Cisco and Telstra (Canaan Partners had been an investor too but sold its stake in a secondary deal).

The problem that Near is tackling is not a new one. The wider swing to digital platforms and using connected devices that we’ve seen in consumer behavior has created an opportunity for (and demand from) companies to better track who is using their products and services, and also to proactively figure out who would be the best audiences to target for future business.

But there have been two catches to that pull: how best to capture activity when it’s not specifically digital (for example, going into a physical store), and how best to capture activity in a way that doesn’t encroach on customers’ privacy and right to be anonymous if they so choose — with the latter becoming more than just a principle in many jurisdictions, but fully fledged rule of law.

Near’s approach is not entirely novel. Like many others that currently exist or preceded Near, the startup uses a collection of data points sourced from a variety of providers — in Near’s case, the list can include your mobile carrier, data providers that work with dozens or hundreds of apps to source activity, app providers directly, retailers and Wi-Fi operators.

The similarities end there, however, said Mathews. He says Near has a (patented) technique based on machine learning algorithms and other inferential AI technology, which it uses to accurately merge all of these details together to create individual profiles, all without ever attaching a name or real identifiers of any kind to that profile.

“If you ask me, that’s actually the hardest problem we’ve solved,” he said. “There is no other company out there that works with all this data to unify it into individual identities.”

Using mobile device IDs, he said Near can “with a high degree of confidence” connect specific profiles with transactions. “But it’s the fact that we can perform the data fusion in a compliant way, marrying that data in a world where privacy and data safety matter,” that makes the company unique, Mathews added.

PlaceIQ, Factual and Lifesight are other providers that are building similar technology, he noted, but Near is the first to extend the offering far (so to speak): none others have the same global reach, making it a popular partner for multinationals researching for campaigns and product development.

Marketing research is one of the main features of Allspark, the company’s flagship platform, where non-technical people can ask questions in natural language — example, show me how many women shop at Whole Foods in San Francisco — and you can get a data-based response, which you can then tweak with more tailored questions about the profile of a user, or use a dragging graphic tool on an interactive map to modify the geography, and so on.

Mathews notes that the “real” numbers that come up from such questions — in the case of the above query, it’s 71,904 women, by the way — are based on the figures of who is actually connected to the Near network. The ratios vary by city and country, but typically, he said that in the Bay Area, it’s capturing around 45% of any live audience (meaning, the actual number of female visitors is probably more like 150,000).

From there, you can save a query to return to it, or even use the Near platform to connect through to other services to craft and launch marketing campaigns. Notably, some features — such as the ability for a client to upload or use cookie data into the platform to use it to build profiles — are not available in all markets, part of how Near keeps itself on the right side of company’s own data compliance policies as well as data protection rules in different markets.

Those kinds of integrations is likely one area that will start to get developed even more with this round of funding, to keep Near’s technology from being too siloed and removed from how marketers and researchers typically work.

Companies like Facebook, Google and Amazon have made a huge business out of figuring out how to identify and target audiences and specific users with products and services by way of advertising and more. I asked, and Mathews said, that he doesn’t see them as threats in this area, simply because it would open a can of worms for them.

“They would get into a big privacy issue if they tried,” he said. “Companies like Google and Facebook have done [frankly] an amazing job at identifying audiences, but they are not designed for privacy. We started with privacy by design.”

Indeed, it was Near’s position as one of the “outliers” by emphasizing data protection and anonymity that Mathews said helped it get over the line with investors. “It’s a very tough funding environment for the industry we’re in, but we found interest because of our approach to privacy. That really helped us.”

Ketan Patel, CEO, GPC, echoed that sentiment. “Near provides insights into human behavior by analyzing where people are, and combining that with a multitude of data points to predict and influence behaviour,” he said in a statement. “Given it does this across the globe in a privacy protected manner, it is well-positioned to create an exciting new space that delivers value to both people, and those that wish to build relationships with them.”

Powered by WPeMatico

Challenger bank N26 has unveiled a new premium plan called N26 You. This plan replaces N26 Black with the same benefits and a few tweaks.

N26 is keeping its three-tier system with a free basic bank account, a premium account (N26 You) and a super premium account (N26 Metal). With N26’s free plan, you can pay anywhere in the world without any foreign transaction fee, but there’s a 1.7% markup on ATM withdrawals in a foreign currency.

N26 You costs the same price as the previous premium plan N26 Black, €9.90 in the Eurozone and £4.90 in the U.K. In addition to a travel and purchase insurance package, you can withdraw money without any foreign transaction fee (€9.90 is roughly what you’d pay in fees if you withdraw the equivalent of €580 with a free N26 account).

You also can create up to 10 Spaces to organize your money with savings goals, separate sub-accounts and more — free accounts can only create two Spaces.

And, of course, you get a better-looking card. N26 is reusing its pastel color palette to give you more options. You can now choose between five colors — Aqua, Rhubarb, Sand, Slate and Ocean. The card has a minimal design with a tiny N26 logo in the top-left corner, a transparent line at the bottom of the card and a solid color background.

N26 also plans to add perks to the N26 You plan, such as discounts on Hotels.com, WeWork, GetYourGuide, Babbel, Blinkist and Bloom & Wild. Those perks were limited to N26 Metal customers in the past, so it’s going to be interesting to see how the lineup will work once those perks are added to N26 You. If you’re an existing N26 Black customer, you automatically become an N26 You customer.

Changing N26 Black to a premium plan with multiple card designs might seem like a small detail, but it potentially opens up a lot of possibilities. You’ll soon be able to order an additional card.

Eventually, you could imagine having a blue card associated with your main account and a yellow card associated with a shared Space sub-account, for instance. At least, that’s what I hope the company will do.

Powered by WPeMatico

India’s Oyo has expanded its hotel chain business to more than 80 countries and entered the co-living spaces segment in recent years. The firm, which has raised about $1 billion since last September from several big names, including Airbnb, has now identified a new business to target: co-working spaces.

The Gurgaon-headquartered firm on Tuesday announced Oyo Workspaces, which is already operational across 10 cities in India with more than 20 centres. It currently has the capacity to serve more than 15,000 people. More than 6,000 employees from firms such as Swiggy, Paytm, Pepsi, Nykaa, OLX and Lenskart have already signed up for the service.

At a press conference in New Delhi, Rohit Kapoor, CEO of New Real Estate Businesses, said Oyo plans to have 50 Oyo Workspaces centres by the end of the year and aims to make it the largest co-working business in Asia by the end of next year.

As part of the announcement, Oyo confirmed that it has acquired Innov8, a co-working startup with more than 200 employees and 16 operational centres. The four-year-old startup was acquired for about $30 million, two sources familiar with the matter told TechCrunch.

Innov8 is one of the three in-house brands that is part of Oyo Workspaces. The other two brands — Workflo and Powerstation — are aimed at people who are looking for economical offering. A user could access one of these co-working spaces for as low as Rs 6,999 ($102) a month. Innov8 has been positioned as a premium option.

India’s co-working space, still a relatively new business category locally, is worth $390 million — a fraction of the $30 billion office and commercial real estate business. Kapoor said Oyo believes it can not only become a market leader in the nation but also expand the size of the market itself. Oyo Workspaces will compete with a range of companies, including 91Springboard, GoHive, Awfis, GoWork and the global giant WeWork.

Oyo Workspaces will offer a range of services across all of its centres, such as a Wi-Fi connection, in-house kitchen, housekeeping, storage and parking spaces. It is also offering users monthly and quarterly passes — currently being offered at heavily discounted rates — to further lower the price points of its co-working spaces.

Oyo, which serves more than half a million users each day across more than 850,000 rooms it operates, is aggressively expanding its business through partnerships with local players as it emerges as the third-largest hotel chain in the world. The six-year-old startup was valued at more than $5 billion at its last funding round, TechCrunch reported earlier.

Oyo, which serves as both listings and reservations platforms, makes most of its money from fee-paying franchises and bookings. Kapoor said the company will use part of the $200 million Oyo has committed to invest in its India and Southeast Asia businesses this year.

Powered by WPeMatico

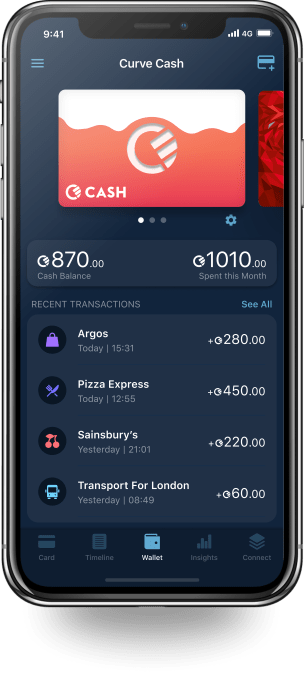

Curve, the London-based “over-the-top banking platform,” has raised $55 million in new funding. The startup lets you consolidate all of your bank cards into a single Curve card and app to make it easier to manage your spending and access other benefits.

Curve’s Series B round is led by Gauss Ventures, the U.S.-based fintech investor, alongside Creditease, IDC Ventures and previous backer Outward VC (formerly Investec’s INVC fund). A number of other early investors, including Santander InnoVentures, Breega, Seedcamp and Speedinvest also followed on.

The new round of funding values Curve at $250 million (or one-quarter unicorn, so to speak), and will be used by the company to continue adding more features to its platform and for further European expansion. The company claims 500,000 users and says it is on track to reach 1 million by the end of the year.

Curve is currently available in 31 countries across Europe, with around 30% of its customer base coming from outside the U.K. “We [have] identified a few countries where the organic pull is fantastic, and we are about to double down on them,” Curve founder and CEO Shachar Bialick tells me.

Like a plethora of fintech startups, Curve is building a platform that essentially turns your mobile phone into a financial control centre that re-bundles disparate financial products or functionality to offer a single app to help you manage “all things money.”

However, rather than building a new current account — as is the case with the challenger banks such as Monzo, Starling and Revolut — Curve’s “attack vector” is a card and app that lets you connect all of your other debit and credit cards (sans Amex) so you only ever have to carry a single card.

Once you’ve added your cards to Curve, you use the app to switch from which underlying debit or credit cards you wish the Curve Mastercard to spend, and can track and see a single and consolidated view of your spending regardless of which card was charged (and therefore which of your bank accounts the money was pulled from).

In other words, Curve isn’t asking to replace your existing bank accounts but is pitched as a cloud-based platform that runs “over-the-top” of existing banking and payments infrastructure. Historically, the over-the-top terminology has been used to describe the way video streaming services such as Netflix run “over-the-top” of existing broadband infrastructure.

“For Curve to succeed in its mission of bringing banking to the cloud, we need [to continue] to build the product; tiny experiences that together create a whole new offering,” Bialick continues. “Our money is everywhere and the job of connecting it all together to one seamless experience requires many resources, and especially many talented people. The latest Series B will enable Curve to re-bundle more of your money: experiences such as Curve Send (peer-to-peer payments), and Curve Credit (post transaction installments for any payment, anywhere).”

Alongside Curve’s all-your-cards-in-one functionality, the Curve app lets you lock your Curve card at a touch of a button, provides instant spend notifications, “zero FX fees” when spending abroad or in a foreign currency and the ability to switch payment sources retroactively. The latter is dubbed “Go Back in Time” and means if you make a purchase via Curve that gets charged to a card other than the one you intended, you have two weeks to change your mind.

Alongside Curve’s all-your-cards-in-one functionality, the Curve app lets you lock your Curve card at a touch of a button, provides instant spend notifications, “zero FX fees” when spending abroad or in a foreign currency and the ability to switch payment sources retroactively. The latter is dubbed “Go Back in Time” and means if you make a purchase via Curve that gets charged to a card other than the one you intended, you have two weeks to change your mind.

More recently, Curve has re-vamped its cashback feature in a bid to draw in more customers for the premium versions of the Curve card. With the new Curve Cash programme, customers get 1% instant cash back on top of any existing rewards cards that they have plugged into the app, potentially earning customers double rewards on purchases. You simply pick from the list of retailers supported for cashback — you are allowed to choose between three and six retailers, depending on which Curve plan you are on — and then get 1% cashback for any purchases made at those stores.

Bialick claims that Curve’s over-the-top model is also producing higher engagement than many challenger banks, with customers spending on average £1,500 per month through the Curve platform. (As an imperfect reference point, challenger bank Monzo says that around 30% of its users top up their account by £1,000 or more per month). I’m also told that 15% of Curve’s users have added a challenger bank card to their Curve account, which also makes for an intriguing and even more nuanced comparison.

And whilst Curve is arguably trying to define a new market category — at least here in the West — and therefore isn’t the easiest of products to explain, Bialick says that existing Curve customers are the startup’s biggest advocates.

“There isn’t just one thing that pulls customers to Curve, there are as many pulls as [there are] the number of ‘money jobs’ one has. All your cards in one, fee-free spending abroad, ‘Go Back In Time,’ to name a few, all attract and retain our customer base. Indeed, awareness and brand building is key, especially amongst all the noise, but that’s where our customers are proving invaluable, telling their friends about Curve, which drives most of our adoption with 2,000 plus new accounts per day.”

To win in this new category of banking, Bialick says the company needs to steadfastly stick to its mission to reduce the number of steps it takes to carry out everyday money-related tasks. “The winners will be the companies… [that] create the most seamless experience, removing as much friction between the customer and their money.”

Powered by WPeMatico

The unchecked digital land grab for consumers’ personal data that has been going on for more than a decade is coming to an end, and the dominoes have begun to fall when it comes to the regulation of consumer privacy and data security.

We’re witnessing the beginning of a sweeping upheaval in how companies are allowed to obtain, process, manage, use and sell consumer data, and the implications for the digital ad competitive landscape are massive.

On the backdrop of evolving privacy expectations and requirements, we’re seeing the rise of a new class of digital advertising player: consumer-facing apps and commerce platforms. These commerce companies are emerging as the most likely beneficiaries of this new regulatory privacy landscape — and we’re not just talking about e-commerce giants like Amazon.

Traditional commerce companies like eBay, Target and Walmart have publicly spoken about advertising as a major focus area for growth, but even companies like Starbucks and Uber have an edge in consumer data consent and, thus, an edge over incumbent media players in the fight for ad revenues.

Image via Getty Images / alashi

By now, most executives, investors and entrepreneurs are aware of the growing acronym soup of privacy regulation, the two most prominent ingredients being the GDPR (General Data Protection Regulation) and the CCPA (California Consumer Privacy Act).

Powered by WPeMatico

AllBright, the London-based women’s membership club backed by private real estate investment firm Cain International, has raised $18.8 million to expand into the U.S.

The company’s new round was led by Cain International and was designed to take AllBright into three U.S. locations — Los Angeles, New York and Washington, DC.

The company said that the new facilities would be opening in the coming months.

Coupled with the launch of a new networking application called AllBright Connect and the company’s AllBright Magazine, the women’s networking organization is on a full-on media blitz.

Other investors in the round include Allan Leighton, who serves as the company’s non-executive chairman; Gail Mandel, who acquired Love Home Swap (a company founded by AllBright’s co-founder Debbie Wosskow); Stephanie Daily Smith, a former finance director to Hillary Clinton; and Darren Throop, the founder, president and chief executive of Entertainment One.

A spokesperson for the company said that the new financing would value the company at roughly $100 million.

The club’s current members include actors, members of the House of Lords and other fancy pants, high-falutin folks from the worlds of politics, business and entertainment.

The club’s first American location will be in West Hollywood, and is slated to open in September 2019. The largest club, in Mayfair, has five floors and boasts more than 12,000 square feet and features rooftop terraces, a dedicated space for coaching and mentoring, a small restaurant and a bar.

Powered by WPeMatico

VidCon, the annual summit in Anaheim, CA for social media stars and their fans to meet each other drew over 75,000 attendees over last week and this past weekend. A small subset of those where entertainment and tech executives convening to share best practices and strike deals.

Of the wide range of topics discussed in the industry-only sessions and casual conversation, five trends stuck out to me as takeaways for Extra Crunch members: the prominence of TikTok, the strong presence of Chinese tech companies in general, the contemplation of deep fakes, curiosity around virtual influencers, and the widespread interest in developing consumer product startups around top content creators.

Photo by Jerod Harris/Getty Images

TikTok, the Chinese social video app (owned by Bytedance) that exploded onto the US market this past year, was the biggest conversation topic. Executives and talent managers were curious to see where it will go over the next year more than they were convinced that it is changing the industry in any fundamental way.

TikTok influencers were a major presence on the stages and taking selfies with fans on the conference floor. I overheard tweens saying “there are so many TikTokers here” throughout the conference. Meanwhile, TikTok’s US GM Vanessa Pappas held a session where she argued the app’s focus on building community among people who don’t already know each other (rather than being centered on your existing friendships) is a fundamental differentiator.

Kathleen Grace, CEO of production company New Form, noted that Tik Tok’s emphasis on visuals and music instead of spoken or written word makes it distinctly democratic in convening users across countries on equal footing.

Esports was also a big presence across the conference floor with teens lined up to compete at numerous simultaneous competitions. Twitch’s Mike Aragon and Jana Werner outlined Twitch’s expansion in content verticals adjacent to gaming like anime, sports, news, and “creative content’ as the first chapter in expanding the format of interactive live-streams across all verticals. They also emphasized the diversity of revenue streams Twitch enables creators to leverage: ads, tipping, monthly patronage, Twitch Prime, and Bounty Board (which connects brands and live streamers).

Powered by WPeMatico

Brave Care is an urgent care facility for pediatric care that costs, on average, about 80% less than a pediatric ER visit. Darius Monsef and his co-founder came up with the idea shortly after a fateful week for the Monsef family, during which their four-year-old dove off a bike ramp and their one-year-old started having breathing problems.

For both visits, he went to a pediatric urgent care facility where his kids were thoughtfully and patiently treated by Dr. Corey A. Fish. Monsef and Fish went to coffee a couple of weeks later, and Fish revealed he wanted to build out more pediatric urgent cares but needed a business partner.

The duo brought on a COO, Maryam Taheri, and a CTO, Asa Miller, and Brave Care was born.

In 2015, there were approximately 30 million pediatric emergency room visits in the United States — 96.7% of them were treat-and-release visits.

It’s no surprise that parents are quick to pull the trigger on an emergency room visit when their kid is hurt or injured. But ER visits are incredibly expensive, leaving caring parents in a punishing situation.

The idea behind Brave Care is to provide a service that fits in between a child’s regular doctor and the emergency room.

“We don’t want the treatment of an injury or illness to be more traumatic than how you got it,” said Monsef.

Brave Care is built specifically for children, meaning that the waiting rooms are kid-friendly and the medical instruments are kid-sized and not intimidating. Plus, Brave Care goes the extra step to make sure little patients aren’t afraid, whether that means numbing gels for injections or offering medicine in liquid form.

For now, Brave only has one location, in the Portland area, but the vision is to expand the brand to many locations across the country. Brave also wants to introduce a triage tool to help parents at home who are making difficult decisions about what to do with a sick or injured kid.

“One thing parents often do is they try to Google for whatever symptom or problem their kid is having,” said Monsef. “And searching for a problem is pretty awful because search engines are trained to return the most interesting result, and I don’t want that. That’s terrifying. What I want is to reasonably narrow down the area of the problem so I can find a better answer.”

He went on to explain that sometimes it can be very difficult to search a symptom without the right terminology. For example, how do you describe a certain type of cough?

In the near future, Brave Care wants to introduce a self-guided triage tool for parents looking to understand the basics of the issue so they can make informed decisions on where they need to go, what they need to do and how urgently they need to do it.

The triage product is currently in development and will launch soon.

Eventually, Monsef sees the opportunity to introduce an asynchronous telemedicine product, which would combine in a HIPAA-compliant messaging system the data collected from the self-serve triage tool with pictures and videos provided by the parent.

That said, Monsef believes that fully remote telemedicine leads to overprescription of antibiotics and says Brave Care will stay away from remote-only care in the short term.

“Without the right device in a consumer’s hand, there isn’t much we can do remotely,” said Monsef. “We can’t look in the ear or throat, or listen to the heart. But as consumers get more of these devices, we can improve remote care for kids.”

For now, however, Brave Care is simply focused on providing the best possible care to patients in its Portland facility.

Brave Care is in the current Y Combinator class and has raised a total of $1.45 million in funding.

Powered by WPeMatico