Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Weed may be legal in California, but the black market is still the top spot for buyers looking for bud on a budget.

Flower Co. graduated from Y Combinator’s latest class on the promise that they could cut customers better deals by focusing on partnering with growers directly to create their own house brands while pushing users to order ahead of time. The company calls itself the “Costco of cannabis.”

The company just announced the close of a $2.8 million seed round from investors including Slome Capital, Prehype, Rob Stavis, Adam Draper, Josh Abramson and Camille Hyde.

Even in California where weed has been legalized, the black market is still king due to the high prices buoyed by high taxes. Flower Co.’s CEO Ted Lichtenberger says the regulated market is just 1/4 the size of the unregulated market. Flower Co.’s ultimate goal is less focused on getting people to ditch their existing dispensary as much as they are focused on getting black market regulars to go legit thanks to the better deals and conveniences of their platform.

Part of building allegiance to the Flower Co. brand is the company’s membership plan. Anybody can make a purchase on the site, but members save up to 40% on purchases, a number that makes a big difference when you’re buying weed by the ounce. An ounce of “Forbidden Fruit” goes for $192 without a membership and $142 with one, for example. With a membership, the company’s “House Sativa” goes for $63 an ounce.

An annual membership to Flower Co. is $119, and in addition to the discounts, users get faster delivery and beta access to the company’s “private events and concert series.” The company just recently launched a two-day delivery service for customers in Sacramento.

The company is just flexing its muscles in a few markets in California, but is hoping that by scaling slowly they can be ready to attack new opportunities as the regulatory environment shifts.

“We understand that we’re in the first inning of what’s probably a pretty long game, because this industry, as it goes federally legalized is going to have another massive transition moment just like it’s having right now as it’s getting legalized and regulated in California,” Lichtenberger says. “So if we have a great understanding of our customers and stay focused on keeping them delighted, and then be nimble in the face of that change, then we can come out as the dominant player in the delivery market.”

Powered by WPeMatico

Uber and Lyft aren’t designed to transport people who need a little help getting out of the house or need someone to help get them from the doctor’s waiting room back to their home. While Uber, for example, has launched Uber Health to help patients get to their appointments, the drivers are not vetted with patient assistance in mind. This is where Onward comes in.

Onward, with $1.5 million in seed funding from Royal Street Ventures, Matchstick Ventures and JPK Capital, launched a few months ago in the San Francisco Bay Area to help seniors safely get from point A to point B. Unlike Uber and Lyft, Onward offers round-trip, door-to-door rides and aims to provide freedom for older adults who may feel isolated, Onward co-founder Mike Lewis told TechCrunch.

The idea for Onward emerged from Lewis’ experience with his mother-in-law who had Alzheimer’s. It got him and his co-founder, Nader Akhnoukh, thinking about the idea of aging in place and how older people may feel isolated as they become unable to do the tasks they’ve spent their whole lives doing, like driving.

“The minute you can’t do that, it’s sad and scary,” Lewis said.

Onward has three types of customers: older adults who are no longer able to drive, someone who can’t drive for medical reasons (surgeries, eye exams, etc.) and caregivers who are unable to provide transportation to their loved ones.

Similar to Uber and Lyft, Onward drivers are 1099 contractors, but a key difference is that they are paid hourly — at least $20 per hour. Currently, there are more than 25 drivers on board who are all trained in CPR, dementia, and have gone through a background check and car inspection.

Onward also ensures its drivers know how to fold wheelchairs, though, only some drivers have the ability to transport those in powered wheelchairs. This time next year, Onward expects to have hundreds of drivers. Lewis says he also expects the number of vehicles with the ability to transport people in powered wheelchairs to increase as the company grows.

For riders, they can expect to pay $35 per hour. The minimum charge for the trip is one hour, so this is definitely geared toward people who may need the driver to wait for them during a doctor’s appointment, for example. After the first hour, Onward charges by the minute.

That hourly fee gets riders round-trip rides with the driver waiting for you at the destination, door-to-door assistance at each stop and the ability to request favorite drivers.

Onward completed its first ride in March in the San Francisco Bay Area. For the rest of the year, Onward plans to focus on San Francisco as well as one other launch market. To date, Onward has completed more than 500 trips.

Powered by WPeMatico

It’s that time of year again. When startup founders fret for weeks on end as the long-awaited Demo Day approaches. Investors pore through lists of startups participating in various accelerator programs and have their associates ping dozens of founders for coffee meetings.

Demo Day season is upon us. Soon Y Combinator’s latest cohort of startups will pitch to investors for two days, beginning August 19, and 500 Startups, another San Francisco-based accelerator program for early-stage companies, will host its own Demo Day on August 22.

We’ll report live from YC’s Demo Day next month. For now, here’s a closer look at all the startups finishing out 500 Startups’ latest program. As a reminder, through its four-month seed program, the 500 Startups seed fund invests $150,000 in participating companies in exchange for 6% equity. The companies below include a mix of fintech, digital health, edtech and e-commerce businesses, 33% of which 500 Startups says are women-led and 40% have Black or Latinx founders.

Powered by WPeMatico

Employee engagement isn’t just about the morale of individual workers—it also enables broader workforce productivity and leads to better business outcomes. In fact, research conducted by The Society for Human Resource Management (SHRM) argues that an understanding of the role employee engagement plays in driving morale and productivity is critical to business success.

At Slack, my team of researchers and analysts spends time studying how people work and what they need to do their best work. We consistently find that an important signal of employee engagement lies in how people feel about the tools they use at work.

Good tools can enable both productivity as well as increase morale. We’ve done research to learn more about successful and thriving Slack teams, and what it is about Slack that enables them to do better work.

These teams don’t just talk about how Slack improves efficiency, but also how it builds community and in some ways modernizes the company. We also found that the top three emotions people associate with Slack are happy, fun and easy, which you might not expect from a productivity tool.

Technology overall has impacted how, for how long, and from where we work, as well as our efficiency in getting things done. Engaging employees with technology isn’t just about supplying more robust software, but giving people tools that they look forward to using everyday as much as their preferred personal apps.

When products and technology reflect the nuances of human communication, while at the same time making information more accessible, employees feel more connected — both with the workplace and with their co-workers – resulting in a stronger, more trusting relationships and better performance.

So, how can we challenge ourselves to set higher expectations for the work products we build and use every day, and what would it look like to bring more humanity, fun and delight into the tools we use for work? Here are some principles to keep in mind.

Powered by WPeMatico

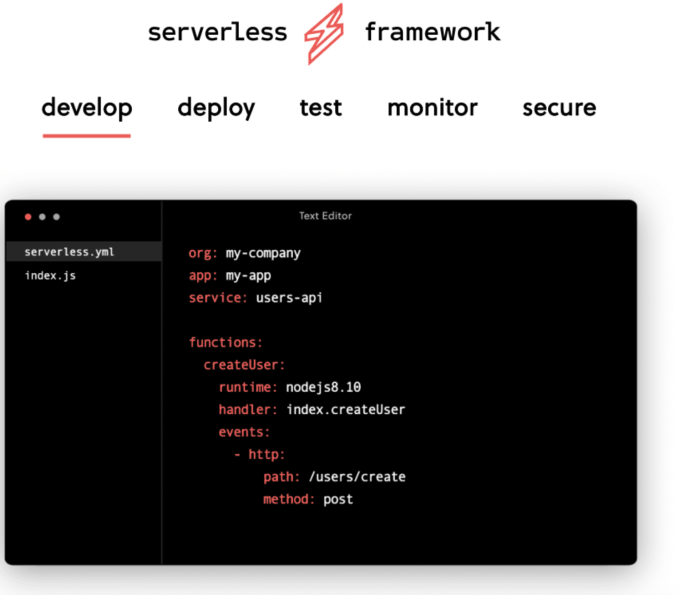

Serverless development has largely been a lonely pursuit until recently, but Serverless, Inc. has been offering a free framework for intrepid programmers since 2015. At first, that involved development, deployment and testing, but today the company announced it is expanding into monitoring and security to make it an end-to-end tool — and it’s available for free.

Serverless computing isn’t actually server-free, but it’s a form of computing that provides a way to use only the computing resources you need to carry out a given function — and no more. When the process is complete, the resources effectively go away. That has the potential to be more cost-effective than having a server that’s always on, regardless of whether you’re using it or not. That requires a new way of thinking about how developers write code.

While serverless offers a compelling value proposition, up until Serverless, Inc. came along with some developer tooling, early adherents were pretty much stuck building their own tooling to develop, deploy and test their programs. Today’s announcement expands the earlier free Serverless, Inc. Framework to provide a more complete set of serverless developer tools.

Company founder and CEO Austen Collins says that he has been thinking a lot about what developers need to develop and deploy serverless programs, and talking to customers. He says that they really craved a more integrated approach to serverless development than has been available until now.

“What we’re trying to do is build this perfectly integrated solution for developers and developer teams because we want to enable them to innovate as much as possible and be as autonomous as possible,” Collins told TechCrunch. He says at the same time, he recognizes that operations need to connect to other tools, and the Serverless Framework provides hooks into other systems, as well.

The new tooling includes an integrated environment, so that once you deploy, you can simply click an error or security event and drill down to a dashboard for more information about the issue. You can click for further detail to see the exact spot in the code where the issue occurred, which should make it easier to resolve more quickly.

While no tool is 100% comprehensive, and most large organizations, and even individual developers, will have a set of tools they prefer to use, this is an attempt to build a one-stop solution for serverless developers for the first time. That in itself is significant, as serverless moves beyond early adopters and begins to become more of a mainstream kind of programming and deployment option. People starting now probably won’t want to cobble together their own toolkits, and the Serverless, Inc. Framerwork gives them a good starting point.

Serverless, Inc. was founded by Collins in 2015 out of a need for serverless computing tooling. He has raised more than $13.5 million since inception.

Powered by WPeMatico

Hello and welcome back to Startups Weekly, a weekend newsletter that dives into the week’s noteworthy startups and venture capital news. Before I jump into today’s topic, let’s catch up a bit. Last week, I wrote about Zoom and Superhuman’s PR disasters. Before that, I noted the big uptick in VC spending in 2019.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

Now let’s talk about mental health startups. VCs may be confident in the potential of teletherapy, but struggling companies in the space tell another story.

Nine months ago Basis launched a website and app for guided conversations via chat or video with pseudo-therapists or people trained in research-backed approaches but who lack the same certifications as a counseling or clinical psychologist. I wrote a story noting that the company, led by former Uber VP Andrew Chapin, had raised a $3.75 million round from Bedrock, Wave Capital and Lightspeed Venture Partners.

But last month, things took a turn for the worse. Basis quietly shut down its website and app, its co-founder and chief science officer, Lindsay Trent, a former research psychologist at Stanford, exited and a good chunk of eight-person team went out the door.

Basis was one of many startups to benefit from VCs’ growing appetite for innovative businesses in the mental health sector. As the stigma associated with seeking mental health support has dwindled and technology developments have allowed for personalized mental health tools and practices, more entrepreneurs have entered the space. Basis, despite having many of the ingredients needed for startup success, couldn’t achieve success with its direct-to-consumer approach to therapy.

Basis co-founder and CEO Andrew Chapin (center) with the founding team last year

When asked why the Basis app and website were no longer active, Chapin said the company is in the process of “shifting business models.” He declined to provide further details. Lightspeed declined to comment. Wave Capital and Bedrock did not respond to requests for comment.

Basis, which did not claim to treat diagnosable conditions like bipolar disorder or schizophrenia, charged $35 per 45-minute phone call with its paraprofessionals. Its use of unlicensed therapists sparked concern in the mental health provider community. Harley Therapy founder Sheri Jacobson, an accredited counselor and psychotherapist, noted flaws with the service: “For me, replacing professional therapists and all of their lived experience and empathy with telepsychiatry administered by novice advisers could be potentially dangerous,” Jacobson said in a statement. “Would you let a learner driver navigate an oil tanker?”

What could go wrong?

“Because Basis works with paraprofessionals — people trained in research-backed approaches but who don’t have the same certifications as a counseling or clinical psychologist — it’s a much cheaper alternative to paying for a therapist.”

— Christina Farr (@chrissyfarr) October 4, 2018

Consumer mental health startups continue to attract capital from private market investors. Workplace mental health service Unmind, Blackthorn Therapeutics (a neurobehavioral health company using machine learning to create personalized medicine for mental health) and Talkspace (a leader in the online counseling space) have all closed funding rounds in 2019.

Whether Basis will find its footing is TBD. What’s clear is VCs are still willing to dole out checks as they experiment with the mental health space, but if startups don’t start proving viable business models and learn to navigate the complex adoption curve, we’ll see additional startups cease operations and mental health tech’s moment in the sun will end all too soon.

Now for a quick look at the top VC and startup news of the week:

Adam Neumann (WeWork) at TechCrunch Disrupt NY 2017

The eccentric co-founder and CEO of the international real estate co-working startup WeWork has reportedly cashed out of more than $700 million from his company ahead of its upcoming IPO. According to Axios, a majority of that capital came in the form of loans while the remaining $300 million came from stock sales. The size and timing of the payouts is unusual, considering that founders typically wait until after a company holds its public offering to liquidate their holdings. But even with the big sale, Neumann remains the single largest shareholder in WeWork.

The customer experience management platform priced shares of its stock at $21 apiece Thursday, closing up Friday a whopping 76%. Money left on the table? I think so, and I bet Bill Gurley does too. The nearly two-decades-old company sold a total of 15.5 million shares in its IPO, raising $326 million at a $2.5 billion valuation in the process. Medallia’s $268 million in VC funding came from Sequoia Capital — which owned a roughly 40% pre-IPO stake — Saints Capital, TriplePoint Venture Growth and Grotmol Solutions.

The stock was dramatically mispriced by an archaic hand allocated matching process that needs to go away. This is 2019 and everyone intelligent knows there is a better way to match supply and demand. These are failures.

— Bill Gurley (@bgurley) June 29, 2019

Uber finally sets diversity and inclusion goals

Within the next three years, Uber aims to increase the percentage of women at levels L5 and higher (manager and above) to 35% and increase the percentage of underrepresented employees at levels L4 and higher to 14%. Currently, Uber is 9.3% black and 8.3% Latinx compared to just 8.1% black and 6.1% Latinx last year. Uber’s tech team, however, is just 3.6% black, 4.4% Latinx and 2.7% multi-racial. Unsurprisingly, there’s little representation of black and brown people in leadership roles. While Uber CEO Dara Khosrowshahi commented that he’s proud the promotion rates for women have improved over the last couple of years, he added, “I can’t yet say the same for promotions for people of color.”

Email platforms and productivity apps and subscription tools, oh my!

Startups focused on improving productivity and email are unstoppable this year. The latest to close VC rounds are Substack and Notion. Andreessen Horowitz is betting that there’s still a big opportunity in newsletters, leading a $15.3 million Series A in Substack. The company, which consists of just three employees working out of a living room, says that newsletters on the platform have now amassed a total of 50,000 paying subscribers (up from 25,000 in October) and that the most popular Substack authors are already making hundreds of thousands of dollars per year. As for Notion, The Information reported this week that it raised $10 million at an $800 million valuation. Notion is a note-taking and task management app that hasn’t sought much VC funding and, as a result, VCs have been desperately knocking at its door.

Other notable funding events of the week:

Silicon Valley has many dreams. One dream — the Hollywood version anyway — is for a down-and-out founder to begin tinkering and coding in their proverbial garage, eventually building a product that is loved by humans the world over and becoming a startup billionaire in the process. But when it comes to that Silicon Valley dream of a nice house from a decent return on exit, it’s getting narrower and less widely distributed. Blitzscaling is making a lot of people a lot of wealth, but early employees? Not so much.

Read more from TechCrunch editor Danny Crichton.

TechCrunch’s senior transportation reporter Kirsten Korosec.

TechCrunch senior transportation reporter Kirsten Korosec has something great in the works. All of us here at TechCrunch are very excited to announce The Station, a new TechCrunch newsletter all about mobility. Each week, in addition to curating the biggest transportation news, Kirsten will provide analysis, original reporting and insider tips on the fast-growing industry. Sign up here to get The Station in your inbox beginning in August.

While we’re on the subject of amazing TechCrunch #content, it’s probably time for a reminder for all of you to sign up for Extra Crunch. For a low price, you can learn more about the startups and venture capital ecosystem through exclusive deep dives, Q&As, newsletters, resources and recommendations and fundamental startup how-to guides. Here are some of my personal favorite EC posts from the past week:

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Equity co-host Alex Wilhelm and I debate Forbes’ latest next billion-dollar startups list.

Extra Crunch subscribers can read a transcript of each week’s episode every Saturday. Read last week’s episode here and learn more about Extra Crunch here. Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

That’s all, folks.

Powered by WPeMatico

Adam Neumann, the co-founder and chief executive of the international real estate co-working startup WeWork has reportedly cashed out of more than $700 million from his company ahead of its initial public offering.

The size and timing of the payouts, made through a mix of stock sales and loans secured by his equity in the company, is unusual, considering that founders typically wait until after a company holds its public offering to liquidate their holdings.

Despite the loans and sales of stock, first reported by The Wall Street Journal, Neumann remains the single largest shareholder in the company.

According to the Journal’s reporting, Neumann has already set up a family office to invest the proceeds and begun to hire financial professionals to run it.

He’s also made significant investments in real estate in New York and San Francisco, including four homes in the greater New York metropolitan area, and a $21 million, 13,000-square-foot house in the Bay Area, complete with a guitar-shaped room (I guess a fiddle would be too on the nose). In all, Neumann reportedly spent $80 million on real estate.

Neumann has also invested in commercial real estate (the kind that WeWork leases to provide work space with more flexible leases for companies and entrepreneurs), including properties in San Jose, Calif. and New York. Indeed, four of Neumann’s properties are leased to WeWork — to the tune of several million dollars in rent. According to the Journal, Neumann will transfer those property holdings to a WeWork-controlled fund.

The WeWork chief executive has also invested in startups in recent years. He’s got an equity stake in seven companies: Hometalk, Intercure, EquityBee, Selina, Tunity, Feature.fm and Pins, according to CrunchBase.

The rewards that Neumann is reaping from the loans and stock sales are among the highest recorded by a private company executive. In recent years, Evan Spiegel sold $8 million in stock and borrowed $20 million from Snap before its 2017 public offering, and Slack Technologies chief executive Stewart Butterfield sold $3.2 million of stock before Slack’s public offering in June.

The only liquidation of stock and other payouts that have been disclosed that come close to Neumann’s payouts are the $300 million that Groupn co-founder Eric Lefkofsky sold before his company’s IPO and the over $100 million that Mark Pincus took off the table ahead of Zynga’s offering.

WeWork declined to comment for this article.

Powered by WPeMatico

Customer experience management platform Medallia (NYSE: MDLA) rose more than 70% in its New York Stock Exchange debut Friday.

The nearly two-decades-old business priced its shares at $21 apiece, the top of its proposed range, Thursday evening and traded as high as $39.54 the following morning. Medallia closed up roughly 76% at about $37 per share on Friday.

Medallia sold a total of 15.5 million shares in its IPO, raising $326 million at a $2.5 billion valuation in the process.

San Mateo-headquartered Medallia, led by chief executive officer Leslie Stretch, operates a platform meant to help businesses better provide for their customers. Its core product, the Medallia Experience Cloud, provides employees real-time data on customers collected from online review sites and social media. The service leverages that data to provide insights and tools to improve customer experiences.

The company is backed by four venture capital firms: Sequoia Capital — which owned a roughly 40% pre-IPO stake — Saints Capital, TriplePoint Venture Growth and Grotmol Solutions, the latter which invested a small amount of capital in 2010. Medallia has raised a total of $268 million in equity funding, including a $70 million Series F funding earlier this year.

Sequoia’s 40% stake was worth upwards of $1.8 billion at Medallia’s high price Friday.

Powered by WPeMatico

We’ve got great news for all the time-strapped female founders out there. Yeah, we’re looking at you, sister. We’re extending the application deadline to apply for the All Raise “ask me anything” (AMA) sessions at Disrupt SF 2019. Don’t miss this rare opportunity to meet with a leading female VC and, well, ask her anything. Apply for an AMA session by August 15.

Not familiar with All Raise? This startup nonprofit, dedicated to accelerating female founder success, will host a day-long AMA event on October 3 at Disrupt SF 2019 — in a dedicated section of Startup Alley. Each AMA session lasts 30 minutes and consists of three founders and one VC. All Raise expects more than 100 female founders to take part in at least 30 sessions scheduled throughout the day.

Don’t bring your pitches, bring your questions — the kind of questions that keep you up at night. It’s a rare opportunity to ask a leading VC advice on topics like your next raise, key hires, your competition. Imagine receiving business advice from any of these female VCs:

You can apply for an All Raise AMA session if you’re a U.S.-based woman founder and you’ve raised at least $250,000 in a seed, A or B round. All Raise gives special consideration to founders from underrepresented groups (e.g. Black, Latinx or LGBTQIA women).

All Raise will review the applications and notify the founders. Acceptance is based on availability for session spots, investor fit with industry sector and company stage, as well as demand for certain categories.

If you’re selected, your next step is to buy any pass to Disrupt SF (including Expo Only). All Raise will send an email to let you know what time they’ve scheduled your session.

Networking opportunities of this caliber don’t come along very often — especially for women in tech. Build connections, learn from expert female VCs and move your startup forward. Take advantage of the deadline extension and apply for an AMA session before August 15. We want to see you in San Francisco!

If you are interested in sponsoring this event or exhibiting at Disrupt San Francisco 2019, fill out this form to get in contact with our sales team.

Powered by WPeMatico

The fast-growing Indian hospitality business Oyo has garnered a valuation of $10 billion after its founder, Ritesh Agarwal, purchased $2 billion in shares from venture capital firms Sequoia Capital and Lightspeed Venture Partners, the company announced Friday.

Agarwal, 25, founded Oyo in 2013 at the age of 19. Following immense growth of the now global hotel chain business, Agarwal opted to increase his 10% stake to 30% via a Cayman Islands company called RA Hospitality Holdings, according to The Wall Street Journal. SoftBank has also increased its percent ownership as part of this round, now owning nearly half of the company.

Oyo has raised a whopping $1.6 billion in equity funding to date, reaching a valuation of $5 billion at its last funding round. Other investors in the company include Airbnb, Grab Holdings and Didi Chuxing.

Oyo is active in 800 cities in 80 countries, with more than 23,000 hotels in its portfolio. Recently, the company announced plans to invest $300 million in the U.S. market, where it currently operates more than 50 Oyo Hotels in 35 cities and 10 states.

Earlier this week, the Gurgaon-headquartered firm introduced Oyo Workspaces. The new entity was born out of its acquisition of Innov8, a co-working startup with more than 200 employees. The four-year-old startup was acquired for about $30 million, according to reporting by TechCrunch’s Manish Singh.

Powered by WPeMatico