Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Pitching is perhaps the single most important skill that any founder needs to hone, so not surprisingly, we kicked off our TechCrunch Early Stage 2021 — Marketing & Fundraising event with a deep dive on all the tips and tricks required to get the most out of pitching and slide decks. On hand was Adina Tecklu, a principal at Khosla Ventures, and who formerly built out Canaan Beta, the consumer seed practice at Canaan Partners.

We talked about the importance of knowing your customer (aka your potential investor), focusing on story, typical slides in a deck, the appendix slides, formatting, and then alternative formats and which to avoid in a pitch deck.

Help TechCrunch find the best growth marketers for startups.

Provide a recommendation in this quick survey and we’ll share the results with everybody.

We kicked off our discussion with advice that remains as valuable as it is obvious. Even today, despite the wealth of resources available on the internet to background research potential investors, founders regularly walk into their pitch meetings like deer in headlights with no sense of that particular investor’s interests, tastes, stage of investment and more. Don’t be that founder.

Key number one is know your audience. The best founders understand their users, whether that is an end consumer, or an enterprise customer. They’ve done the research to understand what motivates their customers, how they make buying decisions, and also what their customers like and don’t like as much about their own product. When fundraising, your VC essentially becomes your customer. And so before you begin pitching, or even building your deck, it’s really important to do your research beforehand to understand the firms and the partners that you intend to pitch. (Timestamp: 2:25)

If you do that right,

That knowledge allows you to proactively address any concerns that they might have. And really make sure that you position your business in a way that is both authentic, but in a way that will be well received by the VC. (Timestamp: 3:20)

Data is the most important source of wisdom in Silicon Valley, or so the belief holds. But the reality, particularly in early-stage investing, is that the data can only paint a partial picture of a startup and a founder’s ambition. Don’t let a dense copse of trees occlude the wider forest, which is what investors are really investing in.

Powered by WPeMatico

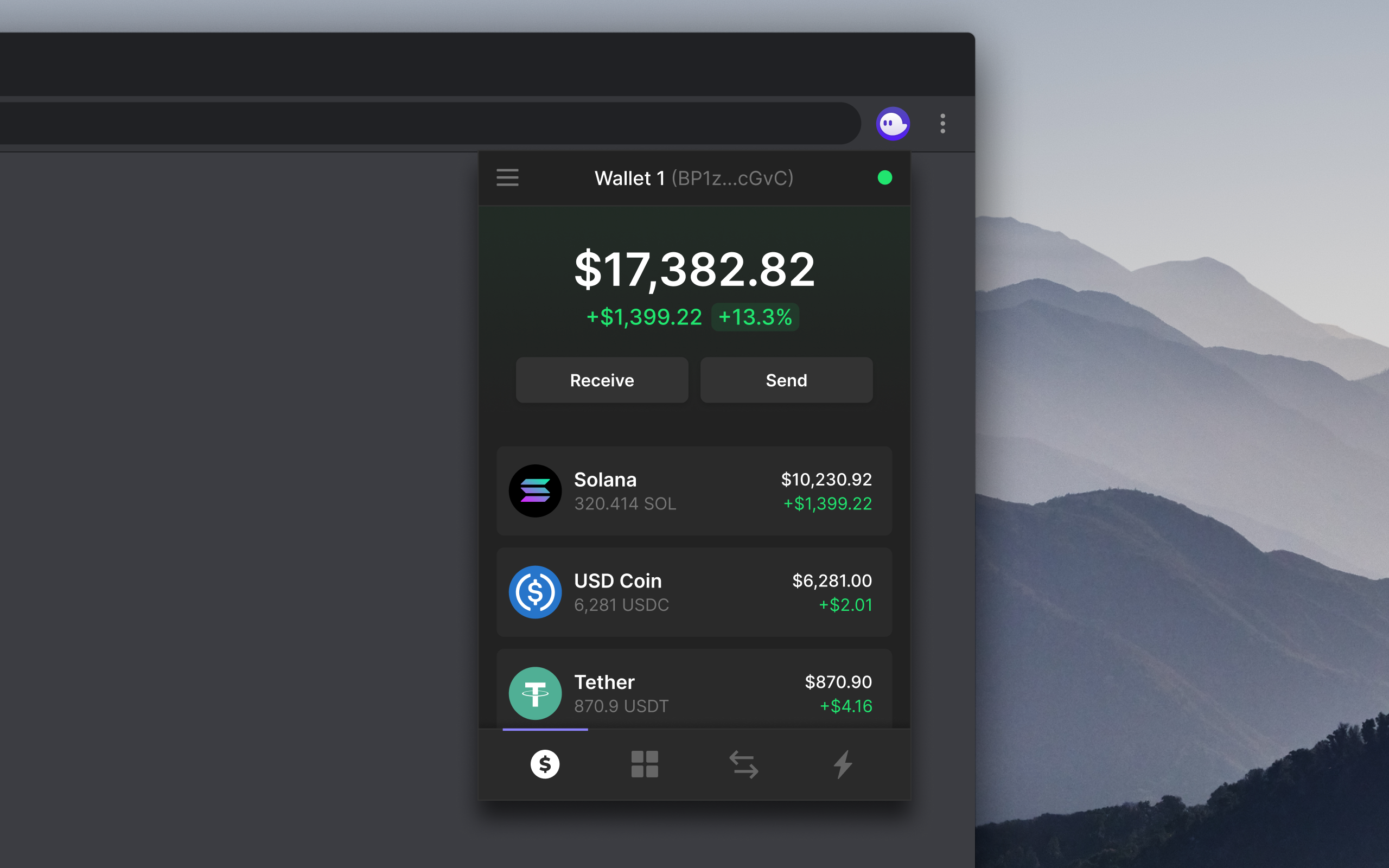

While retail investors grew more comfortable buying cryptocurrencies like Bitcoin and Ethereum in 2021, the decentralized application world still has a lot of work to do when it comes to onboarding a mainstream user base.

Phantom is part of a new class of crypto startups looking to build infrastructure that streamlines blockchain-based applications and provides a more user-friendly UX for navigating the crypto world, something that can make the entire space more approachable to a non-developer audience. Users can download the Phantom wallet to their browsers to interact with applications, swap tokens and collect NFTs.

The crypto wallet startup has banked a $9 million Series A round led by Andreessen Horowitz (a16z), with Variant Fund, Jump Capital, DeFi Alliance, Solana Foundation and Garry Tan also participating. The round, which closed earlier this summer, comes as some venture capital firms embrace a crypto future even as volatility continues to envelop the broader market. Last month, a16z announced a whopping 2.2 billion crypto fund, the firm’s largest vertical-specific investment vehicle ever.

Image via Phantom

The co-founding team of CEO Brandon Millman, CPO Chris Kalani and CTO Francesco Agosti all come aboard from crypto infrastructure startup 0x.

At the moment, Phantom is best-known among the Solana community, where it has become the go-to wallet for applications on that blockchain. The startup’s ambition is to interface with more and more networks, currently building out compatibility with Ethereum and looking to embrace other blockchains, aiming to be a product built for a “multichain world,” Millman tells TechCrunch.

Alongside building out support for other networks, Phantom wants to build more sophisticated DeFi mechanisms right into their wallet, allowing users to stake cryptocurrencies and swap more tokens inside the wallet.

The startup says they have some 40,000 users of their existing wallet product.

Building out a presence on the popular Ethereum blockchain, which already has a handful of popular wallet providers, will be a challenge, but Phantom’s broadest challenge is helping a new breed of crypto-curious users interface with a network of apps that still have a long way to go when it comes to being mainstream-friendly.

“The entire space is kind of stuck in this ‘built by developers for other developers mode,’ ” Millman says. “This bar has been kind of stuck there, and no one is really stepping up to push the bar up higher.”

Powered by WPeMatico

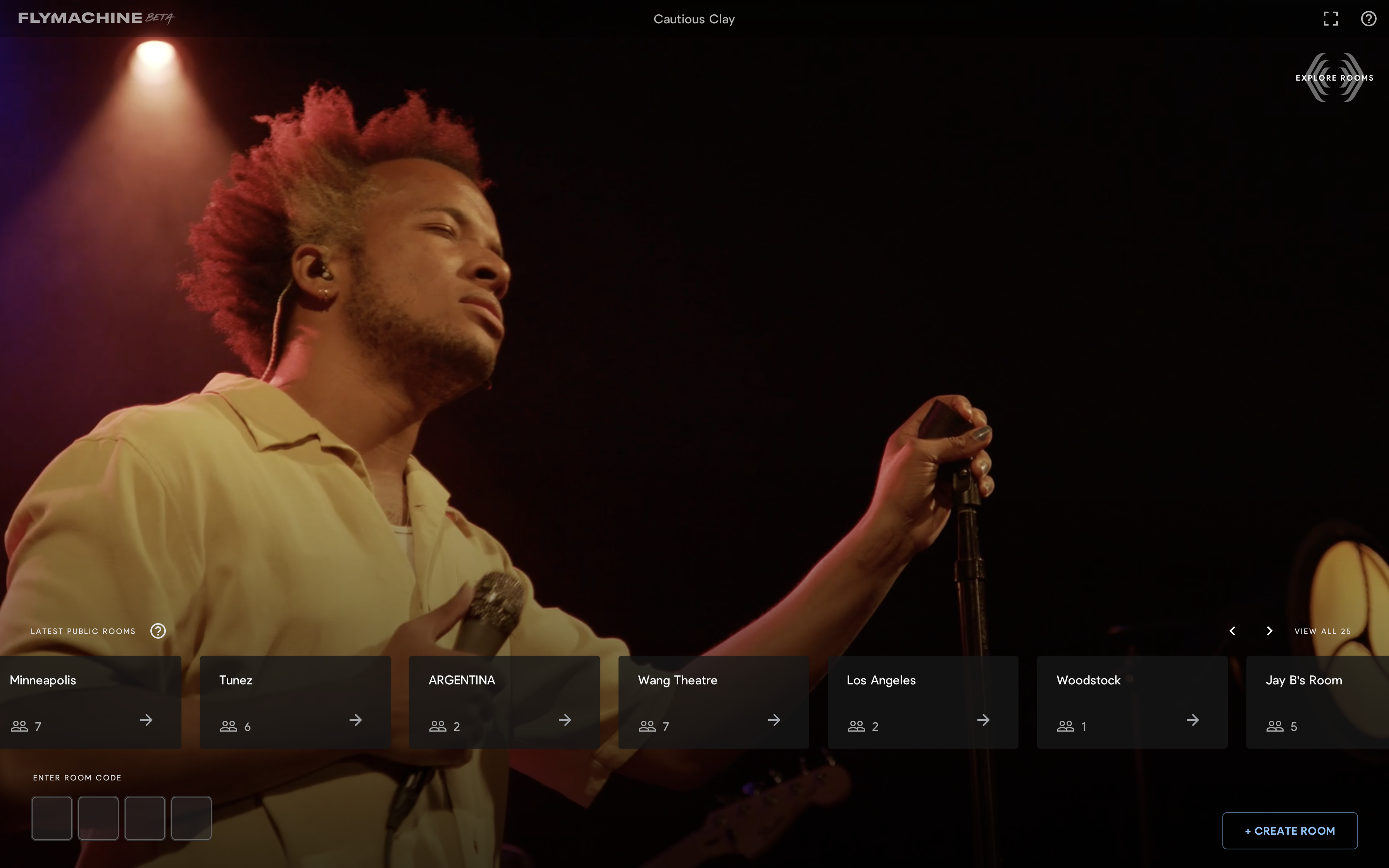

As concerts and live events return to the physical world stateside, many in the tech industry have wondered whether some of the pandemic-era opportunities around virtualizing these events are lost for the time being.

San Francisco-based Flymachine is aiming to seek out the holy grail of the digital music industry, finding a way to capture some of the magic of live concerts and performances in a livestreamed setting. The startup hopes that pandemic-era consumer habits around video chat socialization combined with an industry in need of digital diversification can push their flavor of virtual concerts into the lives of music fans.

The startup’s ambitions aren’t cheap, Flymachine tells TechCrunch it has raised $21 million in investor funding to bankroll its plans. The funding has been led by Greycroft Partners and SignalFire, with additional participation from Primary Venture Partners, Contour Venture Partners, Red Sea Ventures and Silicon Valley Bank.

The virtual concert industry didn’t have as big of a lockdown moment as some hoped for. Spotify experimented with virtual events. Meanwhile, startups like Wave raised huge bouts of VC funding to turn real performers into digital avatars in a bid to create more digital-native concerts. And while some smaller artists embraced shows over Zoom or worked with startups like Oda, which created live concert subscriptions, there were few mainstream hits among bigger acts.

To make Flymachine’s brand of virtual concerts a thing, the startup isn’t trying to convert potential in-person attendees of a show into virtual participants, instead hoping to create an attractive experience for the folks who would normally have to skip the show. Whether those virtual attendees were too far from a venue, couldn’t get a babysitter for the night or just aren’t jazzed about a mosh pit scene anymore, Flymachine is hoping there are enough potential attendees on the bubble to sustain the startup as they try to blur the lines between “a night in and a night out,” CEO Andrew Dreskin says.

The startup’s strategy centers on building up partnerships with name brand concert venues around the U.S. — Bowery Ballroom in New York City, Bimbo’s 365 Club in San Francisco, The Crocodile in Seattle, Marathon Music Works in Nashville and Teragram Ballroom in Los Angeles, among them — and livestreaming some of the shows at those venues to at-home audiences. Flymachine’s team has deep roots in the music industry; Dreskin founded Ticketfly (acquired by Pandora) while co-founder Rick Farman is also the co-founder of Superfly, which puts on the Bonnaroo and Outside Lands music festivals.

Image Credits: Flymachine

In terms of actual experience — and I had the chance to experience one of the shows (pictured above) before writing this — Flymachine has done their best to recreate the experience of shouting over the tunes to talk with your buddies nearby. In Flymachine’s world this is attending the show in a “private room” with your other friends livestreaming in video chat bubbles from their homes. It’s well done and doesn’t distract too much from the actual concert, but you can adjust the sound levels of your friends and the music when the time calls for it.

Flymachine’s platform launch earlier this year, arriving as many Americans have been vaccinated and many concert-goers are preparing to return to normal, might have been considered a bit late to the moment, but the founding team sees a long-term opportunity that COVID only further highlighted.

“We weren’t in a mad dash to get the product out the door while people were sequestered in their homes because we knew this would be part of the fabric of society going forward,” Dreskin tells TechCrunch.

Powered by WPeMatico

When it comes to tough environments to build new technology, firefighting has to be among the most difficult. Smoke and heat can quickly damage hardware, and interference from fires will disrupt most forms of wireless communications, rendering software all but useless. From a technology perspective, not all that much has really changed today when it comes to how people respond to blazes.

Qwake Technologies, a startup based in San Francisco, is looking to upgrade the firefighting game with a hardware augmented reality headset named C-THRU. Worn by responders, the device scans surrounding and uploads key environmental data to the cloud, allowing all responders and incident commanders to have one common operating picture of their situation. The goal is to improve situational awareness and increase the effectiveness of firefighters, all while minimizing potential injuries and casualties.

The company, which was founded in 2015, just raised about $5.5 million in financing this week. The company’s CEO, Sam Cossman, declined to name the lead investor, citing a confidentiality clause in the term sheet. He characterized the strategic investor as a publicly-traded company, and Qwake is the first startup investment this company has made.

(Normally, I’d ignore fundings without these sorts of details, but given that I am obsessed with DisasterTech these days, why the hell not).

Qwake has had success in recent months with netting large government contracts as it approaches a wider release of its product in late-2021. It secured a $1.4 million contract from the Department of Homeland Security last year, and also secured a partnership with the U.S. Air Force along with RSA in April. In addition, it raised a bit of angel funding and participated in Verizon’s 5G First Responder Lab as part of its inaugural cohort (reminder that TechCrunch is still owned by Verizon).

Cossman, who founded Qwake along with John Long, Mike Ralston, and Omer Haciomeroglu, has long been interested in fires, and specifically, volcanos. For years, he has been an expeditionary videographer and innovator who climbed calderas and attempted to bridge the gap between audiences, humanitarian response, and science.

“A lot of the work that I have done up until this point was focused on earth science and volcanoes,” he said. “A lot of projects were focused on predicting volcanic eruptions and looking at using sensor networks and different things of that nature to make people who live in those regions that are exposed to volcanic threats safer.”

During one project in Nicaragua, his team suddenly found itself lost amidst the smoke of an active volcano. There were “thick, dense superheated volcanic gases that prevented us from navigating correctly,” Cossman said. He wanted to find technology that might help them navigate in those conditions in the future, so he explored the products available to firefighters. “We figured, ‘Surely these men and women have figured out how do you see in austere environments, how do you make quick decisions, etc.’”

He was left disappointed, but also with a new vision: to build such technology himself. And thus, Qwake was born. “I was pissed off that the men and women who arguably need this stuff more than anybody — certainly more than a consumer — didn’t have anywhere to get it, and yet it was entirely possible,” he said. “But it was only being talked about in science fiction, so I’ve dedicated the last six years or so to make this thing real.”

Building such a product required a diverse set of talent, including hardware engineering, neuroscience, firefighting, product design and more. “We started tinkering and building this prototype. And it very interestingly got the attention of the firefighting community,” Cossman said.

Qwake offers a helmet-based IoT product that firefighters wear to collect data from environments. Image Credits: Qwake Technologies

Qwake at the time didn’t know any firefighters, and as the founders did customer calls, they learned that sensors and cameras weren’t really what responders needed. Instead, they wanted more operational clarity: not just more data inputs, but systems that can take all that noise, synthesize it, and relay critical information to them about exactly what’s going on in an environment and what the next steps should be.

Ultimately, Qwake built a full solution, including both an IoT device that attaches to a firefighter’s helmet and also a tablet-based application that processes the sensor data coming in and attempts to synchronize information from all teams simultaneously. The cloud ties it all together.

So far, the company has design customers with the fire departments of Menlo Park, California and Boston. With the new funding, the team is looking to advance the state of its prototype and get it ready for wider distribution by readying it for scalable manufacturing as it approaches a more public launch later this year.

Powered by WPeMatico

As mobile developers build apps, they push them out into the world and problems inevitably develop, which engineers have to scramble to fix. Mobile.dev, a new startup from a former Uber engineer, wants to flip that story and catch errors before the app launches. Today, the company emerged from stealth with a beta of their solution and a $3 million seed investment led by Cowboy Ventures with participation from multiple tech luminaries.

While he was at Uber, company CEO and co-founder Leland Takamine says that he observed this workflow where an app was put out in the world, a company set up tooling to monitor the app and then worked to fix the problem as users reported issues or the monitoring software picked them up. At Uber, they began building tooling to try to catch problems pre-production.

When he started mobile.dev with COO Jacob Krupski, the goal was to build something like this, but for every company regardless of the size. “The insight that we had was that anything we could do to catch problems before releasing an app was 100 times more valuable than anything that you can monitor in production,” Takamine told me.

And that’s what the company aims to do.”Our mission at mobile.dev at a high level is to empower companies to deliver high-quality mobile applications. And more specifically, stop sacrificing users and start catching issues before you release,” he said.

He says that when he speaks to app developers about a solution like this, they are intrigued because as he says “it’s really a no-brainer” question, but unless you have the scale of a company like Uber and vast engineering resources there hasn’t been a solution like this available for the average company or individual developer. And it was that deep technical expertise he built at Uber that laid the groundwork for what they are building at mobile.dev.

The two founders launched the company a year ago and have been working with design partners and initial customers, particularly Reddit. The product goes into beta today. For now, they are the only two employees, but that is going to change with the new capital as they look to add more engineering talent.

With a very specific set of skills required to build a solution like this, it makes it even more challenging to hire diverse employees, but Takamine says that the goal is to build a diverse team. “I think it’s making sure that we look beyond just our immediate network and making sure that we’re looking at diverse sources,” he said.

The company launched during the pandemic and with just the two founders involved have been fully remote up until now, and they intend to keep it that way as they add new employees in the coming months.

“We’re going to be fully remote, I think we have a great advantage that we’re starting from remote, and it’s much more difficult to transition from an office to remote. So we’re starting from first principles here and building our culture around remote work,” he said.

Powered by WPeMatico

Today a new software company from two former Nutanix executives called DevRev emerged from stealth with a $50 million seed round from Mayfield Fund, Khosla Ventures and several industry luminaries. The company, which aims to bring the coding and revenue processes closer together, already has 75 employees working on the new software platform, which they hope to have ready to launch later this year.

It’s not every day you see a $50 million seed round, but perhaps the fact that former Nutanix co-founder and CEO Dheeraj Pandey and his former SVP of engineering Manoj Agarwal are involved, could help explain the investor enthusiasm for the new project.

Pandey says that he has seen a gap between developers and the revenue the applications they create are supposed to generate. The idea behind the new company is to break down the silos that exist between the front of the office and the back of the office and give developers a deeper understanding of the customers using their products, or at least that’s the theory.

“Dev and rev are yin and yang to each other. In today’s world they are really far apart with tons of bureaucracy between these two parties. Our goal to bring dev and rev to get rid of the bureaucracy,” Pandey told me

The company intends to build an API to help developers pull this information from existing systems for companies already working with a CRM tool like Salesforce, while helping gather that customer information for younger companies who might lack a tool. Regardless, the idea is to bring that info where the developer can see it to help build better products.

The way it works in most companies is customer service or sales hears complaints or suggestions about the product, and tickets get generated, but putting these issues in front of the people building the software isn’t always easy or direct. DevRev hopes to change that.

Navin Chaddha, managing director at Mayfield, whose firm is investing in DevRev, sees a need to bring these different parts of the company together in a more direct way. “The code that developers work on today is used by support as well as marketing and sales. By bringing the world of issues and tickets closer to the world of revenue and growth, DevRev’s unified platform bridges the gap between developer and customer and elevates the developer to a business leader,” Chaddha said.

With 75 employees working on the problem, DevRev is already a substantial startup. As experienced founders Pandey and Agarwal certainly understand the importance of building a diverse and inclusive company. Pandey sees the top of the employment funnel really being focused on engineering, design and business schools and the company is working to bring in a diverse group of young employees.

“[We are looking at ways] to search for talent and to promote talent, to make them into leaders. I think we have an empty canvas by the way, and we have this idea of COVID, and being able to do remote work has really grown the top of the funnel, the mouth of the funnel now can be anything and everything. […] [Colleges and universities] are I would say the real source of all diversity at the end of the day. We have seen how engineering schools, design schools and business schools are actually getting so diverse,” he said.

The company is working to build the product now and reaching out to developer communities on Discord, GitHub and other places that developers gather online to get their input, while testing and improving the product in-house and with design partners.

Nutanix, the founders’ previous company, launched in 2009 and raised over a $1 billion before going public in 2016. Pandey and Agarwal left Nutanix at the end of last year to launch the new company.

Powered by WPeMatico

Investment apps in Southeast Asia are attracting a lot of funding, and now some are raising fast follow-on rounds, too. For example, Indonesian robo-advisor app Bibit raised $65 million in May just four months after a $30 million growth round. Now Singapore-based Syfe is announcing that it has closed a $40 million SGD (about $29.6M USD) Series B, only nine months after its Series A. It also said all of Syfe’s full-time employees will receive equity in the company.

The latest round’s lead investor is Valar Ventures, which also led Syfe’s Series A, marking the fintech-focused venture capital firm’s first investment in an Asian startup. Returning investors Presight Capital and Unbound participated, too.

This brings Syfe’s total raised so far to $70.7 million SGD (about $52.3 million USD) since it was founded in 2019. The startup did not disclose its Series B post-money valuation, but founder and chief executive officer Dhruv Arora told TechCrunch it increased 3.6 times from its Series A. The company also hasn’t disclosed total user numbers, but assets under management have grown four times since January, thanks in large part to user referrals and the launch of new products like Syfe Cash+ and Core portfolios.

“To be honest, we weren’t really looking to raise a Series B,” Arora told TechCrunch. “We saw some of the positive outcomes of resources from our Series A. We really scaled up the team and started launching new products and options for our users.” Syfe probably could have waited another six months to a year to raise a new round, he added, but its investors approached the startup again and offered good terms for another round.

About 50% to 70% of new users each month come through recommendations from existing customers, which keeps Syfe’s acquisition costs extremely low, Arora says. Since the beginning of this year, it has also doubled its team in Singapore to more than 100 people, allowing the startup to explore different kind of distribution strategies and partnerships. The app currently has users in 42 countries, but only actively markets in Singapore, where it holds a Capital Markets Services license from the Monetary Authority of Singapore (MAS). It has plans to announce a second market soon.

Syfe was founded in 2017 and launched its app in July 2019. Prior to starting Syfe, Arora was an investment banker at UBS Investment Bank before serving as vice president and head of growth at Indian grocery delivery startup Grofers.

While retail investment rates are still low in Southeast Asia, interest has jumped significantly over the past year. One of the reasons most commonly cited is the economic impact of COVID-19, which motivated people to earn returns from their money instead of keeping it in saving accounts.

“Most of my career has been within Hong Kong, Singapore and parts of India. I think culturally we’ve always been told to save, save, save,” Arora says. “It made sense because banks were giving good interest rates, but now the majority of economies are in negative real rate of interest.” Along with consumers’ growing familiarity with online wallets and other digital financial services, this set the stage for investment apps to come in, attracting customers who might not have gone to traditional brokerages.

Arora says he expected people to become more interested in investing, but gradually, over the course of about five to seven years. Instead, that shift is happening much more quickly. “My view is that tomorrow’s saving accounts become smart investing accounts. That’s been my view ever since we started Syfe, but this last year has made it evident that it has to happen and has to happen much bigger. So I think this wave will continue,” he says.

While many investment apps focus on millennial users, Syfe’s target demographic is wider. In the last six to nine months, Arora says there has been an uptick in users aged 50 and above on the platform, and its oldest user is 93 years old.

“The users in that segment have become a bigger percentage and the reality is that they typically have more disposable income. The average customer in their 50s will deploy, in our experience, almost twice the more conventional demographic which might be between 30 to 40,” says Arora.

Out of the many investment apps that have emerged in Southeast Asia, users most often compare Syfe to Stashaway, Endowus and Autowealth when shopping around for a platform. Arora says the space has a lot of room to grow because retail investment in the region is still very low. “I think it’s still super early in the game. There is enough room for multiple players and I think more will come into this domain, because if you can get your acquisition metrics into place, this can be a very profitable business.”

In terms of differentiating, Syfe is focused on new product development and user localization and personalization so customers can create more customized portfolios.

Syfe has a team of financial advisors for users who want person-to-person consultations, but Arora says most of Syfe’s investors rely entirely on its app to decide how to invest. Over the last nine months, it has only added one new advisor to its team, while focusing on making its user interface more intuitive.

“The human touch is optional, but it’s not necessary and in many cases, it’s only needed to help people understand the offering once,” says Arora. “But our goal is always going to be technology company and for the app to become so intuitive that whether you are 18 or 93, you are able to use the offering with very limited guidance.”

In a press statement, Valar Ventures founding partner Andrew McCormack says, “Syfe was our first investment in Asia and we’ve been impressed by its rapid, sustained growth over the past couple of years. The opportunity for the company to meet the saving and investment needs of a burgeoning mass-affluent consumer population in Asia remains significant, and we are confident that Syfe will continue to expand at pace.”

Powered by WPeMatico

Telehealth platform Eucalyptus raised a $22.3 million Series B round of funding to build a digital health portfolio for primary care in Australia.

NewView Capital led the round with participation from existing investors Blackbird Ventures and W23, and new investor AirTree Ventures. As part of the investment, Ravi Viswanathan, NewView founder and managing partner, will be joining the Eucalyptus board.

The new round gives the Sydney-based company a total of $32.8 million raised since it was founded in 2019 by Tim Doyle, Benny Kleist, Alexey Mitko and Charlie Gearside.

Australia’s healthcare system is a two-payer model, where most of the care is paid for by the government, and there is a smaller insurance coverage that is owned by individuals. Eucalyptus fits into these models as a private-pay option selling directly to consumers. In some cases, the company is able to charge lower copays for care than the average $25 per doctor visit, Doyle told TechCrunch.

He touts the company as the “largest vertically integrated telehealth platform in Australia,” serving more than 200,000 patients across four demographic-focused brands: contraception and fertility, skincare, men’s health and sexual wellness. Each brand has its own core platform of healthcare providers, patient data repository, remote monitoring tools and partnerships with pathology labs and pharmacies.

All of that results in a higher touch and higher quality relationship between doctor and patient, Doyle said.

“We are seeing an opportunity to shorten the amount of time between identification of a condition and diagnosis,” he added. “We also want to go more in-depth into diabetes, heart conditions and mental health. People are dropping out of diabetes and mental care because there are not enough touch points that are easy to use. If we can build a hub, it will make it easier to treat those conditions.”

In addition to product development, the new funding enables Eucalyptus to build toward being a major player in the telehealth industry. The company will introduce new brands in the next year around chronic care like behavioral health, weight management and diabetes.

Eucalyptus grew its revenue between 200% to 300% year over year since 2019, Doyle said. This is not unlike other startups in the digital health sector, where 2020 saw another record year for venture capital investment. He expects similar growth in 2021, including adding about 20 employees to be over 100 by the end of the year.

Meanwhile, Doyle said he is excited to work with NewView, especially with Viswanathan and principal Christina Fa, who said Eucalyptus is proving that Australia can lead in digital healthcare.

“The team is impressive in terms of clarity of vision and execution, especially in the way they brought in people to manage the brands,” she told TechCrunch. “It is unique being based in Australia where they don’t have Teledoc and other digital health companies. Instead, Eucalyptus had to build all of that in-house and do the hard work upfront. In addition, they curated a network of health providers and four brands, each with their own personalities. This allows them to be fully vertically integrated and own the customer journey.”

Powered by WPeMatico

Masten Space Systems, a startup that’s aiming to send a lander to the moon in 2023, will develop a lunar navigation and positioning system not unlike GPS here on Earth.

Masten’s prototype is being developed as part of a contract awarded through the Air Force Research Laboratory’s AFWERX program. Once deployed, it’ll be a first-of-its-kind off-world navigational system.

Up until this point, spacecraft heading to the moon must carry equipment onboard to detect hazards and assist with navigation. To some extent, it makes sense that a shared navigation network has never been established: Humans have only landed on the moon a handful of times, and while there have been many more uncrewed landings, lunar missions still haven’t exactly been a regular occurrence.

But as the costs of going to orbit and beyond have drastically decreased, thanks in part to innovations in launch technology by companies like SpaceX, space is likely to get a lot busier. Many private companies and national space divisions have set their sights on the moon in particular. Masten is one of them: It was chosen by NASA to deliver commercial and private payloads to a site near the Haworth Crater at the lunar south pole. That mission, originally scheduled for December 2022, was pushed back to November 2023.

Other entities are also looking to go to the moon. Chief amongst them is NASA with its Artemis program, which will send two astronauts to the lunar surface in 2024. These missions will likely only increase in the coming decades, making a common navigation network more of a necessity.

“Unlike Earth, the moon isn’t equipped with GPS so lunar spacecraft and orbital assets are essentially operating in the dark,” Masten’s VP of research and development Matthew Kuhns explained in a statement.

The system will work like this: Spacecraft will deploy position, navigation and timing (PNT) beacons onto the lunar surface. The PNT beacons will enable a surface-based network that broadcasts a radio signal, allowing spacecraft and other orbital assets to wirelessly connect for navigation, timing and location tracking.

Image Credits: Masten Space Systems (opens in a new window)

The company already concluded Phase I of the project, which involved completing the concept design for the PNT beacons. The bulk of the engineering challenge will come in Phase II, when Masten will develop the PNT beacons. They must be able to withstand harsh lunar conditions, so Masten is partnering with defense and technology company Leidos to build shock-proof beacon enclosures. The aim is to complete the second phase in 2023.

“By establishing a shared navigation network on the moon, we can lower spacecraft costs by millions of dollars, increase payload capacity and improve landing accuracy near the most resource-rich sites on the moon,” Kuhns said.

Powered by WPeMatico

On a recent episode of Extra Crunch Live, Retail Zipline founder Melissa Wong and Emergence Capital investor Lotti Siniscalco joined Managing Editor Jordan Crook to walk attendees through Zipline’s Series A deck.

Interestingly, the conversation revealed that Wong declined an invitation to do a virtual pitch and insisted on an in-person meeting.

“She was one of the few or maybe the only CEO who ever stood up to pitch the entire team,” said Siniscalco.

“She pointed to the screen projected behind her to help us stay on the most relevant piece of information. The way she did it really made us stay with her. Like, we couldn’t break eye contact.”

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Beyond Wong’s pitch technique, this post also examines some of the key “customer love” metrics that helped Zipline win the day, such as CAC, churn rates and net promoter score.

“In retrospect, I really underestimated the competitive advantage of coming from the industry,” said Wong. “But it resulted in the numbers in our deck, because I know what customers want, what they want to buy next, how to keep them happy and I was able to be way more capital-efficient.”

Read our recap with highlights from their conversation, or click though to watch a video with their entire chat.

Thanks very much for reading Extra Crunch this week!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Nigel Sussman (opens in a new window)

Global venture capital reached $156 billion in Q2 2021, a YOY increase of 157%. A record number of unicorns found their feet during the same period and valuations rose across the board, report Anna Heim and Alex Wilhelm in today’s edition of The Exchange.

Even if round counts didn’t set all-time highs, “the general vibe of Q2 venture capital data was clear: It’s a great time for startups looking to raise capital.”

Anna and Alex are interviewing VCs in different regions to find out why they’re feeling so generous and optimistic. Today, they started with the following U.S.-based investors:

Image Credits: AzmanJaka (opens in a new window) / Getty Images

The construction industry might seem like a sector wanting innovation, Safe Site Check In CEO and founder David Ward writes in a guest column, but there are unique challenges that make construction firms slow to adapt to new technology.

From the way construction projects are funded to complicated local regulations, there’s no one-size-fits-all solution for the construction industry’s tech problems.

Construction tech might be appealing to investors, Ward writes, but it must be “easy to use, easy to deploy or access while on a job site, and improve productivity almost immediately.”

Image Credits: AP Photo/Isaac Brekken/John Locher

Now that he’s stepping away from AWS and taking over for Jeff Bezos, what are the biggest challenges facing incoming Amazon CEO Andy Jassy?

Enterprise reporter Ron Miller reached out to three analysts to get their take:

Amazon is listed second in the Fortune 500, but it’s not all sunshine and roses — maintaining growth, unionization, and the potential for antitrust regulation at home and abroad are just a few of his responsibilities.

“I think the biggest to-do is to just continue that momentum that the company has had for the last several years,” Kodali says. “He has to make sure that they don’t lose that. If he does that, I mean, he will win.”

Image Credits: Peter Dazeley (opens in a new window) / Getty Images

Publishing an API isn’t enough for any startup: Once it’s released, the hard work of cultivating a developer base begins.

Postman’s head of developer relations, Joyce Lin, wrote a guest post for Extra Crunch based on the findings of a study aimed at increasing adoption of APIs that utilize a public workspace.

Lin found that the most important metric for a public API is time to first call (TTFC). It makes sense — faster TTFC allows developers to begin using new tools quickly. As a result, “legitimately streamlining TTFC results in a larger market potential of better-educated users for the later stages of your developer journey,” writes Lin.

This post isn’t just for the developers in our audience: TTFC is a metric that product and growth teams should also keep top of mind, they suggest.

“Even if your market is defined as a limited subset of the developer community, any enhancements you make to TTFC equate to a larger available market.”

Image Credits: olli0815/iStock

Couchbase and Kaltura offered new filings Monday, with NoSQL provider Couchbase setting an initial price range for its IPO and Kaltura resurrecting its public offering with a fresh price range and new financial information.

“Both bits of news should help us get a handle on how the Q3 2021 IPO cycle is shaping up at the start,” Alex Wilhelm writes.

Image Credits: PM Images (opens in a new window)/ Getty Images

Mark Spera, the head of growth marketing at Minted, offers SEO tips to help smaller sites stand out.

He writes in a guest column that Google’s algorithm “errs on the side of caution,” which leads the search engine to favor larger, more established websites.

“The cards aren’t in your favor, so you need to be even more strategic than the big guys,” he writes. “This means executing on some cutting-edge hacks to increase your SEO throughput and capitalize on some of the arbitrage still left in organic search. I call these five tactics ‘advanced-ish,’ because none of them are complicated, but all of them are supremely important for search marketers in 2021.”

Powered by WPeMatico