Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

For nearly 15 years LanzaTech has been developing a carbon capture technology that can turn waste streams into ethanol that can be used for chemicals and fuel.

Now, with $72 million in fresh funding at a nearly $1 billion valuation and a newly inked partnership with biotechnology giant Novo Holdings, the company is looking to expand its suite of products beyond ethanol manufacturing, thanks, in part, to the intellectual property held by Novozymes (a Novo Holdings subsidiary).

“We are learning how to modify our organisms so they can make things other than ethanol directly,” said LanzaTech chief executive officer Jennifer Holmgren.

From its headquarters in Skokie, Ill., where LanzaTech relocated in 2014 from New Zealand, the biotechnology company has been plotting ways to reduce carbon emissions and create a more circular manufacturing system. That’s one where waste gases and solid waste sources that were previously considered to be un-recyclable are converted into chemicals by LanzaTech’s genetically modified microbes.

The company already has a commercial manufacturing facility in China, attached to a steel plant operated by the Shougang Group, which produces 16 million gallons of ethanol per year. LanzaTech’s technology pipes the waste gas into a fermenter, which is filled with genetically modified yeast that uses the carbon dioxide to produce ethanol. Another plant, using a similar technology, is under construction in Europe.

Through a partnership with Indian Oil, LanzaTech is working on a third waste gas converted to ethanol using a different waste gas taken from a Hydrogen plant.

The company has also inked early deals with airlines like Virgin in the U.K. and ANA in Japan to make an ethanol-based jet fuel for commercial flight. And a third application of the technology is being explored in Japan which takes previously un-recyclable waste streams from consumer products and converts that into ethanol and polyethylene that can be used to make bio-plastics or bio-based nylon fabrics.

Through the partnership with Novo Holdings, LanzaTech will be able to use the company’s technology to expand its work into other chemicals, according to Holmgren. “We are making product to sell into that [chemicals market] right now. We are taking ethanol and making products out of it. Taking ethylene and we will make polyethylene and we will make PET to substitute for fiber.”

Holmgren said that LanzaTech’s operations were currently reducing carbon dioxide emissions by the equivalent of taking 70,000 cars off the road.

“LanzaTech is addressing our collective need for sustainable fuels and materials, enabling industrial players to be part of building a truly circular economy,” said Anders Bendsen Spohr, senior director at Novo Holdings, in a statement. “Novo Holdings’ investment underlines our commitment to supporting the bio-industrials sector and, in particular, companies that are developing cutting-edge technology platforms. We are excited to work with the LanzaTech team and look forward to supporting the company in its next phase of growth.”

Holmgren said that the push into new chemicals by LanzaTech is symbolic of a resurgence of industrial biotechnology as one of the critical pathways to reducing carbon emissions and setting industry on a more sustainable production pathway.

“Industrial biotechnology can unlock the utility of a lot of waste carbon emissions,” said Holmgren. “[Municipal solid waste] is an urban oil field. And we are working to find new sources of sustainable carbon.”

LanzaTech isn’t alone in its quest to create sustainable pathways for chemical manufacturing. Solugen, an upstart biotechnology company out of Houston, is looking to commercialize the bio-production of hydrogen peroxide. It’s another chemical that’s at the heart of modern industrial processes — and is incredibly hazardous to make using traditional methods.

As the world warms, and carbon emissions continue to rise, it’s important that both companies find pathways to commercial success, according to Holmgren.

“It’s going to get much, much worse if we don’t do anything,” she said.

Powered by WPeMatico

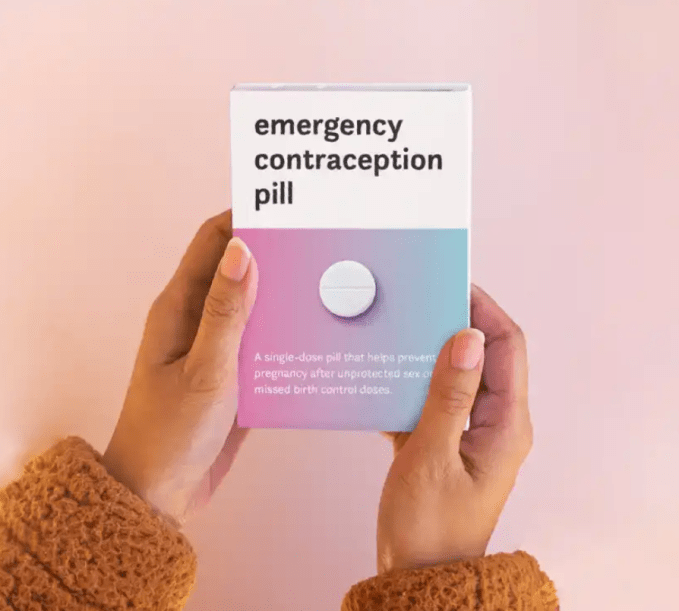

Eleven million women in the U.S. live more than an hour from an abortion clinic, a number expected to increase as facilities close up shop following new restrictions on women’s healthcare in several states.

Planned Parenthood and other leading nonprofits continue to put up a good fight while private “mission-driven” companies in the burgeoning women’s health tech sector are all talk and little action. But a new effort from The Pill Club, an Alphabet-backed birth control and prescription delivery startup, may lead to change in the nascent sector.

The Pill Club has partnered with Power To Decide, a nonprofit campaign to prevent unplanned pregnancies, to dole out free emergency contraception to women in need. Together they’ll distribute 5,000 units of a generic form of Plan B, a pill taken after sex to stop a pregnancy before it starts. For the next three months The Pill Club will also match all donations up to $10,000 made to Power To Decide’s Contraceptive Access Fund, which helps low-income women access contraception. Anyone can sign up now to receive free units.

The Pill Club’s decision to share resources with a nonprofit comes as several states this year have imposed new laws restricting or outlawing abortion procedures. Alabama, for example, earlier this year passed a Senate bill banning abortion in the state. Arkansas, Indiana, Kentucky and others have also OK’d new restrictions on abortion.

This is The Pill Club’s first effort to donate emergency contraception to populations in need, as well as its first partnership with a not-for-profit entity. Co-founder and chief executive officer Nick Chang says the startup thought long and hard about how it could be most helpful to women in this political climate.

“We thought, what can we do to support women in these states in ways that other companies may not be able to?,” Chang tells TechCrunch. “This is the moment where private companies can really go out and benefit women in ways that may not be supported in other avenues. Since we have the means and ability to do it in ways that are more convenient and private, it’s our opportunity to drive access and support.”

Founded in 2014 and backed with more than $60 million in venture capital funding, one might argue The Pill Club should have forged partnerships like this from the get-go. Curious what efforts other well-funded birth control startups were making to support women in 2019, especially women in contraceptive deserts who are likely unfamiliar with the new line of consumer birth control brands, I reached out to The Pill Club’s competitors Nurx, a fellow birth control delivery company, and Hers, a line of women’s healthcare products owned by the billion-dollar startup Hims.

Both companies emphasized the fact that many of their customers live in Southern states, or the region most impacted by new limitations to abortion care, but didn’t mention any new efforts to increase access, like partnerships with nonprofits or donations. Hers provided this quote from the company’s co-founder Hilary Coles, which didn’t answer my question but did make clear the company is thinking about serving contraceptive deserts:

“At Hers, our mission is to provide women with more convenient and affordable access to the healthcare system,” Hers co-founders Hilary Coles said in a statement. “Approximately 3.5 million patients go without care because they cannot access transportation to their providers and 19.5 million women have reported not having access to a clinic that provides birth control specifically. That’s simply unacceptable. Closing the gaps caused by geographic barriers between patients and their doctors was one of the primary challenges we set out to address when founding Hers. We’re proud to be a resource for women nationwide, including those who live in contraceptive deserts who may not otherwise have access to the care they need. It’s crucial to Hers to be part of the solution in alleviating the pain points women experience within the healthcare system.”

It’s not the responsibility of these companies to improve the political landscape of the U.S., but with $340 million in private capital shared between them, the trio does have a unique opportunity to innovate, share, collaborate and influence. After all, that’s what’s so great about healthtech; it brings new, innovative solutions to an industry characterized by antiquated systems and slow movers. For once, Silicon Valley’s “move fast and break things” mantra may be appropriately applied to a facet of healthcare. Women need sustained access to contraception and abortion care. Fast.

“This is the time when private companies can step in,” Chang concluded. “We can come in and help out and it’s our responsibility to do that.”

Powered by WPeMatico

Private rocket launch startup and SpaceX competitor Rocket Lab made a big announcement today: It’ll be looking to re-use the first stage of its Electron rockets, returning them to Earth with a controlled landing after they make their initial trip to orbit with the payload on board. The landing sequence will be different from SpaceX’s however: They’ll attempt to catch the returned first stage mid-air using a helicopter.

That’s in part because, as Rocket Lab founder and CEO Peter Beck told a crowd when announcing the news today, the company is “not doing a propulsive re-entry” and “we’re not doing a propulsive landing,” and instead will leach off its immense speed upon return to Earth through a turnaround burn in space before releasing a parachute to slow it down enough for a helicopter to catch it.

There are a number of steps required to get to that point, but already, Rocket Lab has been looking to measure all the data it needs to ensure this is possible through its last few launches. It’s upgrading the instrumentation for its eighth flight to gather yet more data, and then on flight 10 it’ll have the rocket splash down into the ocean to recover that rocket for even more learning. Then, during a flight to be determined later (Beck is unwilling to put a number on it at this stage) they’ll try to actually bring one down in good enough shape to reuse it.

As for why, there’s a clear advantage to being able to re-fly rockets, and it’s a simple one to understand when you realize that there’s a huge amount of demand for commercial launches.

“The fundamental reason we’re doing this is launch frequency,” Beck said. “Even if I can get the stage done once, I can effectively double production ratio.”

Beck also added that the biggest difficulty will be braking the rocket’s speed as it returns to Earth — a feat next to which he said the actual mid-air capture of the Electron via helicopter is actually pretty easy, from his POV as an amateur helicopter pilot in training.

Rocket Lab has an HQ in Huntington Beach, Calif. and its own private launch site in New Zealand; it was founded in 2006 by Beck. The company has been test launching its orbital Electron rocket since 2017, and serving customers commercially since 2018. It also intends to launch from Virginia in the U.S. starting in 2019.

The company revealed its Photon satellite platform earlier this year, which would allow small satellite operators to focus on their specific service and use the off-the-shelf Photon design to skip the step of actually designing and building the satellite itself.

Powered by WPeMatico

Last year, we told you about a New York-based startup that had begun lending cold, hard, cash to cryptocurrency holders who don’t want to offload their holdings but also don’t necessarily want so much of their assets tied up in cryptocurrencies.

Today, that two-year-old company, BlockFi, is announcing $18.3 million in Series A funding led by Peter Thiel’s Valar Ventures, with participation from Winklevoss Capital, Morgan Creek Digital, Akuna Capital and earlier backers Galaxy Digital Ventures and ConsenSys Ventures.

Apparently, BlockFi is gaining some traction.

Last year, after raising $1.5 million in seed funding from ConsenSys Ventures, SoFi and Kenetic Capital, it secured $50 million led by Galaxy Digital Ventures (the digital currency and blockchain tech firm founded by famed investor Mike Novogratz) that is used to loan out cash to customers who use their bitcoin and ethereum holdings as collateral.

The minimum deposit required: $20,000 worth of cryptocurrency.

According to founder Zac Prince, who talked with Bloomberg about BlockFi’s newest round, enough people are now using those loans that BlockFi has seen its monthly revenue grow more than 10 times since January.

No doubt the uptick in loans correlates with the rebound in Bitcoin’s value, which was priced as low as $3,400 earlier this year but is now valued at roughly $11,400.

Prince also told the outlet that he expects annual revenue to hit eight figures by the end of this year. In startup land, that means it’s time to roll out new money-making services. BlockFi already introduced a savings account product earlier this year that it says enables investors to earn interest on their assets. They are not backed by the FDIC, though the company says it “operates with a focus on compliance with U.S. laws and regulations.” And while it won’t say exactly what’s coming up next, it says in a statement about the new round more products are being added to its existing platform.

Prince previously spent roughly five years in consumer lending and began investing his own money in crypto in early 2016.

He told us last year that his “lightbulb moment” for the company came as he was in the process of getting a loan for an investment property. Instead of using a traditional bank, he decided to list his crypto holdings to see what would happen, and the response was overwhelming. “I realized that there was no debt or credit outside of [person-to-person] margin lending on a few exchanges, and I had the feeling that this was a big opportunity that I was well-suited to go after.”

Other companies providing crypto-backed loans that are issued in fiat currencies include CoinLoan, SALT Lending, Nexo.io and Celsius Network, among others.

Powered by WPeMatico

Why is tech still aiming for the healthcare industry? It seems full of endless regulatory hurdles or stories of misguided founders with no knowledge of the space, running headlong into it, only to fall on their faces.

Theranos is a prime example of a founder with zero health background or understanding of the industry — and just look what happened there! The company folded not long after founder Elizabeth Holmes came under criminal investigation and was barred from operating in her own labs for carelessly handling sensitive health data and test results.

But sometimes tech figures it out. It took years for 23andMe to breakthrough FDA regulations — it’s since more than tripled its business and moved into drug discovery.

And then there’s Oscar Health, which first made a mint on Obamacare and has since ventured into Medicare. Combined with Bright, the two health insurance startups have pulled in a whopping $3 billion so far.

It’s easy to shake our fists at fool-hardy founders hoping to cash in on an industry that cannot rely on the old motto “move fast and break things.” But it doesn’t have to be the code tech lives or dies by.

So which startups have the mojo to keep at it and rise to the top? Venture capitalists often get to see a lot before deciding to invest. So we asked a few of our favorite health VC’s to share their insights.

Powered by WPeMatico

Shouting out to all the fierce female founders. Have you applied to participate in the All Raise “ask me anything” (AMA) sessions at Disrupt SF 2019? No? Women, it’s time to act. Apply for an AMA session by the August 30 deadline and you could win a free Expo Only Pass.

You heard that right. We have 30 free Expo Only passes, and we’ll give them away at random to women founders who get accepted to the All Raise program at Disrupt SF 2019.

All Raise, a startup nonprofit committed to accelerating female founder success, will host a day-long AMA event in a dedicated area in Startup Alley (aka the Disrupt expo floor). They’ll schedule a series of 30-minute sessions throughout the day for roughly 100 women founders.

Each session consists of three founders and one of the All Raise community’s leading VCs. You’ll have the opportunity to ask in-depth questions about the next raise, key hires, the competition or any other business issues that keep you up at night. You can learn plenty from experienced, successful investors like these:

If you’re a U.S.-based woman founder — and you’ve raised at least $250,000 in a seed, A or B round — you can apply for an AMA session. All Raise gives special consideration to founders from underrepresented groups (e.g. Black, Latinx or LGBTQIA women).

All Raise will review the applications and notify the founders. Acceptance is based on availability for session spots, investor fit with industry sector and company stage, as well as demand for certain categories.

If All Raise selects you to participate — and you don’t happen to win a free Expo Only pass — simply buy any pass to Disrupt SF (including Expo Only). All Raise will send an email to let you know what time they’ve scheduled your session.

Don’t miss this rare opportunity to get answers and advice from some of the best investors around. Free admission to Disrupt SF 2019 and free investor advice — that’s a potent combination. Beat the August 30 deadline and apply for an All Raise AMA session today!

Is your company interested in sponsoring or exhibiting at Disrupt San Francisco 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

The yet-to-launch tech journalism site The Markup has had a bumpy 2019 — co-founder and editor-in-chief Julia Angwin was fired, prompting the departure of the majority of the editorial staff. Soon after, The Markup’s other founders (whose disputes with Angwin apparently led to her ouster) left the company themselves.

Now things may be back on track, with Angwin returning to the EIC role, and the six staffers who’d quit in protest returning, as well.

In fact, a New York Times story about Angwin’s reinstatement suggests that there’s been a surprising amount of continuity behind the scenes, with The Markup continuing to pay Angwin and her staff while they continued to work on articles and meet in Angwin’s living room.

In addition to announcing Angwin’s return, The Markup says it has hired former BuzzFeed vice president and associate general counsel Nabiha Syed to serve as president, along with Evelyn Larrubia, who will become managing editor for investigations.

“Technology is shaping our world faster than most people can keep up, before we can digest the implications of any of it,” Angwin said in the announcement. “We believe our data-driven approach to tech accountability journalism will bring facts to this emotional debate. And I can’t think of two more accomplished leaders in their fields than Nabiha and Evelyn to join me in the venture.”

The plan is for Angwin and Syed to report to a not-yet-appointed independent board of directors, and for the site to start publishing by the end of 2019.

When The Markup made a splash with its kickoff last year, it wasn’t just for the involvement of Angwin (a Pulitzer Prize-winning investigative reporter from The Wall Street Journal and ProPublica), but also because its funding included a $20 million donation from Craigslist founder Craig Newmark.

The recent controversy prompted the site’s backers to declare that it had become “necessary to reassess our support,” but today’s announcement closes with this note: “The Markup remains supported by a coalition of major foundations, including Craig Newmark Philanthropies, the Ford Foundation, the John D. and Catherine T. MacArthur Foundation, the Edwin Barbey Charitable Trust, the Ethics and Governance of Artificial Intelligence Initiative, and the Open Society Foundations.”

Powered by WPeMatico

Synchronize your Fitbits, people. You have 72 hours left to get your fiscal fitness on. Three days to save $100 on tickets to TC Sessions: Enterprise 2019 in San Francisco on September 5. Buy your early-bird ticket by August 9 at 11:59 p.m. (PT) and then go back to counting your steps.

We say with confidence that no tech category’s more competitive than enterprise software. The gigantic, $500 billion market generates a constant flow of multibillion-dollar acquisitions every year. And it takes a special kind of fierce early-stage enterprise startup to jump in, invent new services and shake up old-school incumbents.

More than 1,000 attendees will be in the house to explore this rich, complex topic, TechCrunch-style. Our editors will interview top titans in the enterprise world — like SAP CEO, Bill McDermott; Atlassian co-founder, Scott Farquhar; and Jocelyn Goldfein, managing director at Zetta Venture Partners. They’ll also tap rising founders of upstart startups.

The enterprise just can’t get enough of AI, but large companies face a huge challenge: packaging all that data in machine learning models — a necessary element for using AI to automate processes. That’s why we’re especially excited that Bindu Reddy, co-founder and CEO at RealityEngines, will join us onstage.

Her company aims to create research-driven cloud services to reduce some of the inherent complexity of working with AI tools. Reddy, along with investor Jocelyn Goldfein, a managing director at Zetta Venture Partners, and others will talk about the growing role of AI in the enterprise.

That’s just the tip of the Enterprise iceberg. More than 20 interviews, panel discussions, Q&As and breakout sessions will cover a wide range of technologies, including intelligent marketing automation, the cloud, Kubernetes and even quantum and blockchain. Peruse the agenda to see what else we have in store for you.

Early-bird pricing for TC Sessions: Enterprise 2019 ends in just 72 hours. Buy your ticket by August 9 at 11:59 p.m. (PT) and you’ll save $100. But wait, there’s more — for every ticket you buy, we’ll register you for a free Expo-only pass to TechCrunch Disrupt SF 2019. Now that’s fiscal fitness.

Is your company interested in sponsoring or exhibiting at TC Sessions: Enterprise? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Cockroach Labs, makers of CockroachDB, sits in a tough position in the database market. On one side, it has traditional database vendors like Oracle, and on the other there’s AWS and its family of databases. It takes some good technology and serious dollars to compete with those companies. Cockroach took care of the latter with a $55 million Series C round today.

The round was led by Altimeter Capital and Tiger Global along with existing investor GV. Other existing investors, including Benchmark, Index Ventures, Redpoint Ventures, FirstMark Capital and Work-Bench, also participated. Today’s investment brings the total raised to more than $110 million, according to the company.

Spencer Kimball, co-founder and CEO, says the company is building a modern database to compete with these industry giants. “CockroachDB is architected from the ground up as a cloud native database. Fundamentally, what that means is that it’s distributed, not just across nodes in a single data center, which is really table stakes as the database gets bigger, but also across data centers to be resilient. It’s also distributed potentially across the planet in order to give a global customer base what feels like a local experience to keep the data near them,” Kimball explained.

At the same time, even while it has a cloud product hosted on AWS, it also competes with several AWS database products, including Amazon Aurora, Redshift and DynamoDB. Much like MongoDB, which changed its open-source licensing structure last year, Cockroach did as well, for many of the same reasons. They both believed bigger players were taking advantage of the open-source nature of their products to undermine their markets.

“If you’re trying to build a business around an open-source product, you have to be careful that a much bigger player doesn’t come along and extract too much of the value out of the open-source product that you’ve been building and maintaining,” Kimball explained.

As the company deals with all of these competitive pressures, it takes a fair bit of money to continue building a piece of technology to beat the competition, while going up against much deeper-pocketed rivals. So far the company has been doing well, with Q1 revenue this year doubling all of last year. Kimball indicated that Q2 could double Q1, but he wants to keep that going, and that takes money.

“We need to accelerate that sales momentum and that’s usually what the Series C is about. Fundamentally, we have, I think, the most advanced capabilities in the market right now. Certainly we do if you look at the differentiator around just global capability. We nevertheless are competing with Oracle on one side, and Amazon on the other side. So a lot of this money is going towards product development too,” he said.

Cockroach Labs was founded in 2015, and is based in New York City.

Powered by WPeMatico

Cybereason, which uses machine learning to increase the number of endpoints a single analyst can manage across a network of distributed resources, has raised $200 million in new financing from SoftBank Group and its affiliates.

It’s a sign of the belief that SoftBank has in the technology, since the Japanese investment firm is basically doubling down on commitments it made to the Boston-based company four years ago.

The company first came to our attention five years ago when it raised a $25 million financing from investors, including CRV, Spark Capital and Lockheed Martin.

Cybereason’s technology processes and analyzes data in real time across an organization’s daily operations and relationships. It looks for anomalies in behavior across nodes on networks and uses those anomalies to flag suspicious activity.

The company also provides reporting tools to inform customers of the root cause, the timeline, the person involved in the breach or breaches, which tools they use and what information was being disseminated within and outside of the organization.

For co-founder Lior Div, Cybereason’s work is the continuation of the six years of training and service he spent working with the Israeli army’s 8200 Unit, the military incubator for half of the security startups pitching their wares today. After his time in the military, Div worked for the Israeli government as a private contractor reverse-engineering hacking operations.

Over the last two years, Cybereason has expanded the scope of its service to a network that spans 6 million endpoints tracked by 500 employees, with offices in Boston, Tel Aviv, Tokyo and London.

“Cybereason’s big data analytics approach to mitigating cyber risk has fueled explosive expansion at the leading edge of the EDR domain, disrupting the EPP market. We are leading the wave, becoming the world’s most reliable and effective endpoint prevention and detection solution because of our technology, our people and our partners,” said Div, in a statement. “We help all security teams prevent more attacks, sooner, in ways that enable understanding and taking decisive action faster.”

The company said it will use the new funding to accelerate its sales and marketing efforts across all geographies and push further ahead with research and development to make more of its security operations autonomous.

“Today, there is a shortage of more than three million level 1-3 analysts,” said Yonatan Striem-Amit, chief technology officer and co-founder, Cybereason, in a statement. “The new autonomous SOC enables SOC teams of the future to harness technology where manual work is being relied on today and it will elevate L1 analysts to spend time on higher value tasks and accelerate the advanced analysis L3 analysts do.”

Most recently the company was behind the discovery of Operation SoftCell, the largest nation-state cyber espionage attack on telecommunications companies.

That attack, which was either conducted by Chinese-backed actors or made to look like it was conducted by Chinese-backed actors, according to Cybereason, targeted a select group of users in an effort to acquire cell phone records.

As we wrote at the time:

… hackers have systematically broken in to more than 10 cell networks around the world to date over the past seven years to obtain massive amounts of call records — including times and dates of calls, and their cell-based locations — on at least 20 individuals.

Researchers at Boston-based Cybereason, who discovered the operation and shared their findings with TechCrunch, said the hackers could track the physical location of any customer of the hacked telcos — including spies and politicians — using the call records.

Lior Div, Cybereason’s co-founder and chief executive, told TechCrunch it’s “massive-scale” espionage.

Call detail records — or CDRs — are the crown jewels of any intelligence agency’s collection efforts. These call records are highly detailed metadata logs generated by a phone provider to connect calls and messages from one person to another. Although they don’t include the recordings of calls or the contents of messages, they can offer detailed insight into a person’s life. The National Security Agency has for years controversially collected the call records of Americans from cell providers like AT&T and Verizon (which owns TechCrunch), despite the questionable legality.

It’s not the first time that Cybereason has uncovered major security threats.

Back when it had just raised capital from CRV and Spark, Cybereason’s chief executive was touting its work with a defense contractor who’d been hacked. Again, the suspected culprit was the Chinese government.

As we reported, during one of the early product demos for a private defense contractor, Cybereason identified a full-blown attack by the Chinese — 10,000 thousand usernames and passwords were leaked, and the attackers had access to nearly half of the organization on a daily basis.

The security breach was too sensitive to be shared with the press, but Div says that the FBI was involved and that the company had no indication that they were being hacked until Cybereason detected it.

Powered by WPeMatico