Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Most of us, by now, are aware that all sorts of crazy stuff is happening to the planet’s climate, and the blame is pretty much universally recognized as lying with humans pumping more and more carbon into the atmosphere. Scientists are now saying tree planting, for instance, has to happen very, very quickly if we are to avert disaster.

A few startups, such as Changers, have tried to incentivize us to do things like walk instead of taking the car, with mixed results.

Now a blockchain startup thinks it may have the making of one solution, rewarding us with crypto tokens for making the right choices for the planet. Now, before you roll your eyes, hear me out…

Imagine rewarding people for taking the bus instead of their car — and them exchanging that token to offset their carbon by planting a tree? Or incentivizing passengers for sharing their travel data — helping companies to improve their experience in the future? That’s the big idea here.

Here’s how it works: The DOVU platform offers a token, wallet and marketplace and allows users to earn tokens and spend them to carbon-offset their activity and on rewards within the mobility ecosystem, starting with their Uber rides.

Users link their Uber account to their DOVU wallet, enabling them to earn DOV tokens for every journey taken. The startup has connected to Uber APIs, meaning that, once authenticated, the user has to do nothing other than take the journey.

The DOVU CO2 calculator then automatically rewards the value of tokens depending on the length of the journey. The DOV tokens can then be spent within the DOVU Action, and the user can choose the project to back or the user can ask DOVU to choose the project on their behalf to ensure the carbon offsetting happens.

The platform can connect to any published API, meaning it is in a notional position to have an immediate impact on all the new mobility solutions globally.

With Jaguar Land Rover as shareholders, DOVU potentially has the backing to try to make this happen.

Mobility-related organizations often have a need to reward, incentivize or nudge their users to do the right thing. It might be sharing their data for better service planning, taking an alternate route to help ease traffic congestion or charging electric batteries at times that are best for the grid. Whether it’s influencing consumer behavior or encouraging data sharing, the DOVU platform could, in theory, provide a solution that meets the needs of both the mobility provider and the end user. That at least is their pitch.

Hell, given the state of the planet, it might be worth a shot…

Powered by WPeMatico

Incorta, a startup founded by former Oracle executives who want to change the way we process large amounts of data, announced a $30 million Series C today led by Sorenson Capital.

Other investors participating in the round included GV (formerly Google Ventures), Kleiner Perkins, M12 (formerly Microsoft Ventures), Telstra Ventures and Ron Wohl. Today’s investment brings the total raised to $75 million, according to the company.

Incorta CEO and co-founder Osama Elkady says he and his co-founders were compelled to start Incorta because they saw so many companies spending big bucks for data projects that were doomed to fail. “The reason that drove me and three other guys to leave Oracle and start Incorta is because we found out with all the investment that companies were making around data warehousing and implementing advanced projects, very few of these projects succeeded,” Elkady told TechCrunch.

A typical data project involves ETL (extract, transform, load). It’s a process that takes data out of one database, changes the data to make it compatible with the target database and adds it to the target database.

It takes time to do all of that, and Incorta is trying to make access to the data much faster by stripping out this step. Elkady says that this allows customers to make use of the data much more quickly, claiming they are reducing the process from one that took hours to one that takes just seconds. That kind of performance enhancement is garnering attention.

Rob Rueckert, managing director for lead investor Sorenson Capital, sees a company that’s innovating in a mature space. “Incorta is poised to upend the data warehousing market with innovative technology that will end 30 years of archaic and slow data warehouse infrastructure,” he said in a statement.

The company says revenue is growing by leaps and bounds, reporting 284% year over year growth (although they did not share specific numbers). Customers include Starbucks, Shutterfly and Broadcom.

The startup, which launched in 2013, currently has 250 employees, with developers in Egypt and main operations in San Mateo, Calif. They recently also added offices in Chicago, Dubai and Bangalore.

Powered by WPeMatico

Imagine a moving tower made of huge cement bricks weighing 35 metric tons. The movement of these massive blocks is powered by wind or solar power plants and is a way to store the energy those plants generate. Software controls the movement of the blocks automatically, responding to changes in power availability across an electric grid to charge and discharge the power that’s being generated.

The development of this technology is the culmination of years of work at Idealab, the Pasadena, Calif.-based startup incubator, and Energy Vault, the company it spun out to commercialize the technology, has just raised $110 million from SoftBank Vision Fund to take its next steps in the world.

Energy storage remains one of the largest obstacles to the large-scale rollout of renewable energy technologies on utility grids, but utilities, development agencies and private companies are investing billions to bring new energy storage capabilities to market as the technology to store energy improves.

The investment in Energy Vault is just one indicator of the massive market that investors see coming as power companies spend billions on renewables and storage. As The Wall Street Journal reported over the weekend, ScottishPower, the U.K.-based utility, is committing to spending $7.2 billion on renewable energy, grid upgrades and storage technologies between 2018 and 2022.

Meanwhile, out in the wilds of Utah, the American subsidiary of Japan’s Mitsubishi Hitachi Power Systems is working on a joint venture that would create the world’s largest clean energy storage facility. That 1 gigawatt storage would go a long way toward providing renewable power to the Western U.S. power grid and is going to be based on compressed air energy storage, large flow batteries, solid oxide fuel cells and renewable hydrogen storage.

“For 20 years, we’ve been reducing carbon emissions of the U.S. power grid using natural gas in combination with renewable power to replace retiring coal-fired power generation. In California and other states in the western United States, which will soon have retired all of their coal-fired power generation, we need the next step in decarbonization. Mixing natural gas and storage, and eventually using 100% renewable storage, is that next step,” said Paul Browning, president and CEO of MHPS Americas.

Energy Vault’s technology could also be used in these kinds of remote locations, according to chief executive Robert Piconi.

Energy Vault’s storage technology certainly isn’t going to be ubiquitous in highly populated areas, but the company’s towers of blocks can work well in remote locations and have a lower cost than chemical storage options, Piconi said.

“What you’re seeing there on some of the battery side is the need in the market for a mobile solution that isn’t tied to topography,” Piconi said. “We obviously aren’t putting these systems in urban areas or the middle of cities.”

For areas that need larger-scale storage that’s a bit more flexible there are storage solutions like Tesla’s new Megapack.

The Megapack comes fully assembled — including battery modules, bi-directional inverters, a thermal management system, an AC breaker and controls — and can store up to 3 megawatt-hours of energy with a 1.5 megawatt inverter capacity.

The Energy Vault storage system is made for much, much larger storage capacity. Each tower can store between 20 and 80 megawatt hours at a cost of 6 cents per kilowatt hour (on a levelized cost basis), according to Piconi.

The first facility that Energy Vault is developing is a 35 megawatt-hour system in Northern Italy, and there are other undisclosed contracts with an undisclosed number of customers on four continents, according to the company.

One place where Piconi sees particular applicability for Energy Vault’s technology is around desalination plants in places like sub-Saharan Africa or desert areas.

Backing Energy Vault’s new storage technology are a clutch of investors, including Neotribe Ventures, Cemex Ventures, Idealab and SoftBank.

Powered by WPeMatico

International money transfer startup TransferWise’s debit card is now available in Australia and New Zealand, with a Singapore launch expected by the end of this year as the company expands its presence in the Asia-Pacific region. TransferWise’s debit card, which features low, transparent fees and exchange rates, first launched in the United Kingdom and Europe last year before arriving in the United States in June. Since its launch, the company claims the debit card has been used for 15 million transactions.

Australian and New Zealand customers will have access to the TransferWise Platinum debit Mastercard (a business debit card is also available). Cards are linked to TransferWise accounts, which give holders bank account numbers and details in multiple countries, making it easier and cheaper to send and receive multiple currencies. The company says that over the past year, customers have deposited more than $10 billion in their accounts.

TransferWise’s debit cards allow users to spend in more than 40 currencies at real exchange rates. In an email, co-founder and CEO Kristo Käärmann told TechCrunch that TransferWise decided to launch its debit card in Australia and New Zealand because its business there has already been growing quickly. “In addition to responding to customer demand, launching the card in Australia and New Zealand was also driven by the fact that Aussies and Kiwis are being overcharged by banks for using their own money abroad. It is expensive to use debit, travel and credit cards for spending or withdrawals,” he said.

Käärmann added that “independent research conducted by Capital Economics showed that Australians lost $2.14 billion last year alone just for using their bank-issued card abroad. This is because banks and other providers charge transaction fees every time someone uses their card abroad, plus an inflated exchange rate. Similarly, in New Zealand, Kiwis lost $1 billion simply for using their card abroad.”

One of TransferWise’s competitive advantages is that unlike most legacy banking and money transfer services, its accounts and cards were designed from the start to be used internationally. “While there are existing multi-currency cards that exist in Australia and New Zealand, they are prohibitively expensive to use. For example in Australia, the TransferWise Platinum debit Mastercard is on average 11 times cheaper than most travel, debit, prepaid and credit cards,” Käärmann said.

TransferWise cards don’t have transaction fees or exchange rate markups and cardholders are allowed to withdraw up to AUD $350 every 30 days for free at any ATM in the world.

The company is currently talking to regulators in several Asian countries, a process that can take up to two years, Käärmann said. It was recently granted a remittance license in Malaysia, and plans to make its remittance service available there by the end of this year.

Powered by WPeMatico

Flatfair, a London-based fintech that lets landlords offer “deposit-free” renting to tenants, has raised $11 million in funding.

The Series A round is led by Index Ventures, with participation from Revolt Ventures, Adevinta, Greg Marsh (founder of Onefinestay), Jeremy Helbsy (former Savills CEO) and Taavet Hinrikus (TransferWise co-founder).

With the new capital, Flatfair says it plans to hire a “significant” number of product engineers, data scientists and business development specialists.

The startup will also invest in building out new features as it looks to expand its platform with “a focus on making renting fairer and more transparent for landlords and tenants.”

“With the average deposit of £1,110 across England and Wales being just shy of the national living wage, tenants struggle to pay expensive deposits when moving into their new home, often paying double deposits in between tenancies,” Flatfair co-founder and CEO Franz Doerr tells me when asked to frame the problem the startup has set out to solve.

“This creates cash flow issues for tenants, in particular for those with families. Some tenants end up financing the deposit through friends and family or even accrue expensive credit card debt. The latter can have a negative impact on the tenant’s credit rating, further restricting important access to credit for things that really matter in a tenant’s life.”

To remedy this, Fatfair’s “insurance-backed” payment technology provides tenants with the option to pay a per-tenancy membership fee instead of a full deposit. They do this by authorising their bank account via debit card with Flatfair, and when it is time to move out, any end-of-tenancy charges are handled via the Flatfair portal, including dispute resolution.

So, for example, rather than having to find a rental deposit equivalent to a month’s rent, which in theory you would get back once you move out sans any end-of-tenancy charges, with Fatfair you pay about a quarter of that as a non-refundable fee.

Of course, there are pros and cons to both, but for tenants that are cashflow restricted, the startup’s model at least offers an alternative financing option.

In addition, tenants registered with Flatfair are given a “trust score” that can go up over time, helping them move tenancy more easily in the future. The company is also trialing the use of Open Banking to help with credit checks by analysing transaction history to verify that you have paid rent regularly and on time in the past.

Landlords are said to like the model. Current Flatfair clients include major property owners and agents, such as Greystar, Places for People and CBRE. “Before Flatfair, deposits were the only form of tenancy security that landlords trusted,” claims Doerr.

In the event of a dispute over end-of-tenancy charges, both landlords and tenants are asked to upload evidence to the Flatfair platform and to try to settle the disagreement amicably. If they can’t, the case is referred by Flatfair to an independent adjudicator via mydeposits, a U.K. government-backed deposit scheme with which the company is partnering.

“In such a case, all the evidence is submitted to mydeposits and they come back with a decision within 24 hours,” explains Doerr. “[If] the adjudicator says that the tenant owes money, we invoice the tenant who then has five days to pay. If the tenant doesn’t pay, we charge their bank account… What’s key here is having the evidence. People are generally happy to pay if the costs are fair and where clear evidence exists, there’s less to argue about.”

More broadly, Doerr says there’s significant scope for digitisation across the buy-to-let sector and that the big vision for Flatfair is to create an “operating system” for rentals.

“The fundamental idea is to streamline processes around the tenancy to create revenue and savings opportunities for landlords and agents, whilst promoting a better customer experience, affordability and fairness for tenants,” he says.

“We’re working on a host of exciting new features that we’ll be able to talk about in the coming months, but we see opportunities to automate more functions within the life cycle of a tenancy and think there are a number of big efficiency savings to be made by unifying old systems, dumping old paper systems and streamlining cumbersome admin. Offering a scoring system for tenants is a great way of encouraging better behaviour and, given housing represents most people’s biggest expense, it’s only right renters should be able to build up their credit score and benefit from paying on time.”

Powered by WPeMatico

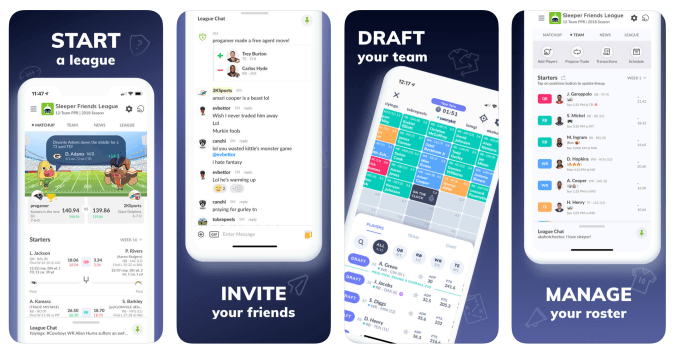

Sleeper is looking to take on fantasy league apps from major players like ESPN and has amassed venture funding from Silicon Valley investors to take them down.

The Bay Area startup is aiming to treat a fantasy football league more like a social platform than a loose jumble of league mechanics, distinguishing itself as a simple and free, ad-free option.

Sleeper has done limited press as it has been ramping up its app over the past two seasons, but the team has been courting the interest of investors to scale the product, raising more than $7 million from VCs to date. The company closed a $5.3 million Series A late last year led by General Catalyst. In early 2017, the startup also closed a $2 million seed led by Birchmere Ventures with participation from Uber co-founder Garrett Camp’s startup studio, Expa.

There isn’t much in terms of monetization options at the moment. CEO Nan Wang tells TechCrunch that the focus right now is “amassing a large base of users and making it the stickiest and highest engagement product in the category.”

Wang says the app’s users spend 50 minutes per day on average during the season, numbers he calls “Instagram-like.” The main contributor to that number seems to be that chat is always a swipe away and that all of the actions that are happening during the season show up inside chats to encourage engagement.

This unifies the experience for users, many of whom have had to piecemeal their experience by using a WhatsApp or GroupMe group in addition to the other fantasy league apps that they’ve been using. Sleeper’s more differentiated UI seems to be largely popular among early vocal users as well as the up-to-the-minute notifications that deliver league updates.

Poaching users from other platforms is definitely a priority, but Wang says the team has really been looking at how to nab users who have stayed away from the convoluted confusion of fantasy leagues as well. Taking on the leading apps from ESPN, Yahoo and NFL can be daunting; another stress for the younger startup is just how tight the user acquisition window is, though things compound quickly if you can create one loyal user that brings their entire league to the platform.

“The user acquisition window for fantasy football leagues is strongest from the second week of August until the first week of September. Historically, we’ve seen that about 70% of users create their leagues in that three-week window,” Wang tells me.

The funding has been used to build out its team, which is still just 10 full-time employees, as well as expand their ambitions beyond fantasy football alone into other sports, including basketball and soccer.

Powered by WPeMatico

Shout out to all the savvy enterprise software startuppers. Here’s a quick, two-part money-saving reminder. Part one: TC Sessions: Enterprise 2019 is right around the corner on September 5, and you have only two days left to buy an early-bird ticket and save yourself $100. Part two: for every Session ticket you buy, you get one free Expo-only pass to TechCrunch Disrupt SF 2019.

Save money and increase your ROI by completing one simple task: buy your early-bird ticket today.

About 1,000 members of enterprise software’s powerhouse community will join us for a full day dedicated to exploring the current and future state of enterprise software. It’s certainly tech’s 800-pound gorilla — a $500 billion industry. Some of the biggest names and brightest minds will be on hand to discuss critical issues all players face — from early-stage startups to multinational conglomerates.

The day’s agenda features panel discussions, main-stage talks, break-out sessions and speaker Q&As on hot topics including intelligent marketing automation, the cloud, data security, AI and quantum computing, just to name a few. You’ll hear from people like SAP CEO Bill McDermott; Aaron Levie, Box co-founder; Jim Clarke, director of Quantum Hardware at Intel and many, many more.

Customer experience is always a hot topic, so be sure to catch this main-stage panel discussion with Amit Ahuja (Adobe), Julie Larson-Green (Qualtrics) and Peter Reinhardt (Segment):

The Trials and Tribulations of Experience Management: As companies gather more data about their customers and employees, it should theoretically improve their experience, but myriad challenges face companies as they try to pull together information from a variety of vendors across disparate systems, both in the cloud and on prem. How do you pull together a coherent picture of your customers, while respecting their privacy and overcoming the technical challenges?

TC Sessions: Enterprise 2019 takes place in San Francisco on September 5. Take advantage of this two-part money-saving opportunity. Buy your early-bird ticket by August 16 at 11:59 p.m. (PT) to save $100. And score a free Expo-only pass to TechCrunch Disrupt SF 2019 for every ticket you buy. We can’t wait to see you in September!

Interested in sponsoring TC Sessions: Enterprise? Fill out this form and a member of our sales team will contact you.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week was a bit special. Instead of meeting up at the TechCrunch HQ to record the episode, Kate and Alex met up in muggy Boston at Drift’s office, where we linked up with Axios’s Dan Primack. And because we were feeling chatty, we went a bit long.

After checking in with Primack (he has a newsletter and a podcast), we first dealt with the latest from Tumblr. In short, Verizon Media is selling Tumblr to Automattic for a few dollars. How did Verizon wind up owning Tumblr? Ah. Well, Yahoo bought it. Later, after Verizon bought AOL, it bought Yahoo. Then it smushed them together and called it Oath. Then Verizon decided that it didn’t like that much and renamed the group Verizon Media. But Verizon doesn’t want to own media (besides TechCrunch, of course), so it sold Tumblr to Automattic, a venture-backed company best known for operating WordPress.

That’s a lot, I know. What matters is that Yahoo bought Tumblr for more than $1 billion. Verizon sold it for around $3 million. Now, Automattic has a few hundred new employees and a shot at juicing its user base before it goes public.

After that, we lamented that the WeWork S-1 had yet to appear. This was a tragedy, frankly. We had expected to spend half the show riffing on WeWork’s financials, alas…

So we turned to some normal material, like Ramp’s recent $7 million raise to take on Brex, and, SmartNews’s recent round, which gave it an eye-popping $1.1 billion valuation.

We ran a bit long because we were having fun, fitting in some conversation surrounding the notes from the SEC regarding the now-dead and then-fraudulent Rothenberg Ventures. More on that here if you want to get angry.

And finally, Vision Fund 2. It’s been a big source of interest for everyone on the show, and we expect whatever the second-act Vision Fund winds up becoming to be a big damn deal. The fund will invest in more than just consumer marketplaces; in fact, it’s eyeing more AI businesses and even biotech. That should be interesting.

All that and we have a lot more good stuff coming. Thanks for listening to the show, and we’ll be right back.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Recharge, a startup that tried convincing hotels to let its customers rent their rooms by the hour and even minute, has revamped and rebranded. Now Globe, the company is hoping to convince guests to sign up for short stays instead in people’s homes so that they can kick back between other commitments, and, if the host allows it, to shower and nap.

It’s at once crazy sounding and intriguing, which is perhaps why the popular accelerator program Y Combinator accepted the company into its most recent class of companies. (It shows off its newest batch of startups next week.) YC was famously early to spy the opportunity that Airbnb could chase, after all. The question is whether Globe, which likens itself to an Airbnb for day breaks, will have anywhere near the same appeal.

Its proposition is certainly similar. Home owner or renter wrings out some extra income by renting out all or part of their home, except that unlike with Airbnb, where the minimum stay is at least one night, with Globe, a host rents out his or her space for smaller increments of time.

In a world where the economic divide continues to grow between the haves and have-nots, it’s easy to see the logic in maximizing an underutilized asset — even one’s living room — in order to live more comfortably. It’s especially easy to see the logic in prohibitively expensive cities like San Francisco and New York.

At the same time, letting in a stranger — even a “businessperson” — for a shorter period of time is not going to be a no-brainer for many people who might otherwise rent their home while away for a weekend. And on the other side of the marketplace, getting enough hosts with nice enough places to become hosts is a high hurdle for Globe to surmount. After all, if someone is looking for an alternative to Starbucks for a few hours, and that individual has to take some form of transportation to get to a host’s couch that may or may not be as nice as pictured, that individual may well go the coffee shop route instead. (The company is also up against startups like Breather that offer hourly or daily “space as a service.”)

Founder Manny Bamfo appreciates the challenge, he says. In fact, after running Recharge for a couple of years, he’s gotten well-acquainted with adversity.

Though he says that Recharge wound up seeing $4 million in revenue from its hotel partners, renting rooms to Recharge customers “wasn’t their number one priority, and that made it hard to provide a consistent experience for our customers.” Bamfo suggests their “unionized cleaning labor” wasn’t excited at the prospect of cleaning rooms more frequently than once daily, either, which is partly why Recharge decided to relaunch as a home-sharing service instead.

It’s not just a branding exercise. Along with the new name, Globe is starting from scratch with a new cap table, though Bamfo says Globe opened up a small round for previous investors that was “oversubscribed instantly.” Recharge had raised $10 million from investors. (One of these backers was Binary Capital, which has since evolved into little more than a tangle of lawsuits. Another backer was the real estate-focused firm Fifth Wall Ventures, which maintains a small stake in the new company, says Bamfo.)

In the meantime, Globe is looking to “do a proper seed round at [YC’s] Demo Day.” And it’s busy spreading the word in an effort to build up its burgeoning new marketplace of homes and apartments for rent, and advertising a rate of $50 per hour to people who host their entire home by the hour and $25 per hour to those who share less room.

Globe keeps 20% of the fee.

Globe is also promising $1 million in general liability insurance and, for now, guests who have been verified and vetted by Bamfo himself. It’s not a scalable solution, he acknowledges, but at the moment, he says, it’s all about building the right community, and he sounds optimistic, of course, about its odds.

“People view it like selling a lamp on Craigslist. ‘If it’s not much work, and it’s another form of income, I’ll do it,’” he says. The reality are a “lot of people with great jobs living in cities that are very expensive — people who are cops, who are teachers, who aren’t quite making six figures, and any extra income is a godsend.”

It all begs the question of why, if it’s such a big opportunity, Airbnb isn’t already it. Bamfo’s answer is that it’s basic time management, as well as a different market. “For any company to do this well, it has to be their number one priority.” Besides, he adds, Airbnb is “a travel company. We’re localized, with the ability to charge on a minute-by-minute basis. It’s a huge engineering undertaking and, for now, it’s part of our moat, too.”

Powered by WPeMatico

Imagine you’re a billionaire starting a new company. You’re happy to bet your entire fortune on it. As a result, capital is no constraint. How fast should you burn money?

You probably wouldn’t use the generic startup math of dividing your available capital by 18 months and burn $55.5 million a month — though it would be fun. So if capital is no longer the currency that determines how fast you go, what should?

It’s confidence, not capital, that should be the currency of acceleration at a startup — no matter if you have a million dollars or a billion dollars to burn.

Confidence is often misunderstood by those who feign it. It is not bluster or arrogance. It’s not “trusting your gut.” Competitors raising big rounds of funding shouldn’t change your level of confidence one way or the other unless they’re doing exactly what you are. Glowing press coverage helps team morale, but it shouldn’t color your assessment of readiness to scale up.

It’s also important to note that venture capital interest is a terrible proxy for founder confidence. VCs have different structural incentives than founders; in an easy money environment, placing a big bet in a hot category, backed by a good enough team, is a job well done for a VC. Remember that they have a portfolio of companies, you’ve just got the one.

So what should drive you to scale up spend? There’s no perfect answer, but if you consistently see strong customer response to your product, marketing delivering more qualified leads for less money, sales channels becoming better instrumented and more efficient, LTV expanding with product improvements and lower churn thanks to your customer success team, you’re probably in good position to accelerate investment.

Too many startups feel pressure to spend money based on hope, not confidence.

Compounding successes at all levels of the business should provide data points that give you the determination to plan out a more ambitious trajectory. The requirement for confidence shouldn’t be mistaken for conservatism. Startups need to take risks in order to thrive, but they should be calculated, not capricious. There is a limited speed any company should go based on what they’ve learned to date about their market and offering.

If you have a high degree of confidence that you can turn $1 into $2, or $10, you should invest immediately. If you don’t have that confidence, you should spend time, but limited capital, to build it. Unfortunately, too many startups feel pressure to spend money based on hope, not confidence.

Startups appreciate in value through growth. This isn’t just another VC mantra: even bootstrapped startups or public companies become more valuable when they grow faster. Two $10 million companies where one is growing at 80% and the other 20% will be valued very differently. Even if the slower-growth company is generating some limited cash flow and the high-growth company is burning within reason, the high-growth company will usually be worth much more.

So given that growth drives value, why shouldn’t every startup grow as quickly as it possibly can? With capital in hand, why not spend to generate more growth and therefore more value?

Capital without confidence shouldn’t dictate a startup’s acceleration.

Companies that misuse capital as the driver of acceleration cause irreparable harm to confidence. When a company over-accelerates and misses, it takes a painful amount of time to observe the mistake, admit the mistake, correct the mistake and rebuild confidence with the team and investors that you won’t repeat the mistake. Eventually, the company must undertake the inevitable process of taking a huge step back to try to rebuild that faith. This requires going much slower than a similar company that has never faltered.

If you spend a small amount of money on a pilot and it fails, you’ve helped home in on what your product should be, and you’ve not burnt any credibility with your team or investors. Spend 10 times that amount and you’ll have no more confidence in what to do next, far less credibility and a diminished balance sheet. Worst yet, the next time you want to lean in on a major initiative, the lack of confidence of key stakeholders will likely overwhelm what may well be the right decision.

Companies create value by compounding learning and therefore compounding confidence in their future. As confidence grows, companies will earn credibility inside the management team and with investors. Once you have both, it usually gets easier and easier to find the right amount of capital needed to fuel that confidence. Confidence is the most important currency, followed closely by credibility, and only then, cash. By way of contrast, driving up revenue artificially by burning capital with low return on investment is not sustainable and does not create long-term value. This will ultimately damage confidence and credibility.

Arguably, there should be little difference between the acceleration of two competitive companies that have the same amount of confidence but radically different capitalizations. If both are early-stage startups and one company has $10 million in cash and the other has $1 billion, they should spend their money with the same principle in mind: what does it cost to build confidence that our most important experiments are working?

Authentic confidence is the only real winning weapon at a startup.

For a company with a million dollars, this may mean hiring a single inside sales rep to test out a direct channel based on some early successes with a specific type of customer. A company with a billion dollars will likely make the mistake to open global offices to meet international demand, without first validating that they can make that single inside sales rep successful. In both cases, the confidence of the management team and their ability to execute should be driving the decision, not the available capital.

If you spend like you’re headed to $20 million ARR and only hit $10 million ARR, your business is in a very difficult position. Not only because you sustained large losses, but also because you’ve damaged confidence in execution — team members and investors won’t believe in the company’s ability to achieve the target the next time it wants to hit the gas pedal hard.

Conversely, If you confidently hit $10 million in sales and have sight lines to $20 million, you will not struggle to raise more money to achieve your goals. The more the management team meets its goals, the more confidence grows and the pace of acceleration can be increased. Compound confidence and acceleration is boundless.

One of the biggest mistakes of the startup community, fueled by an overcapitalized venture market and an overhyped argument about winner takes all market dynamics, is the belief that capital is a weapon that will win the startup wars.

Authentic confidence is the only real winning weapon at a startup. Capital can fuel that weapon, but when used without confidence, it usually becomes a weapon of self-destruction.

Powered by WPeMatico