Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

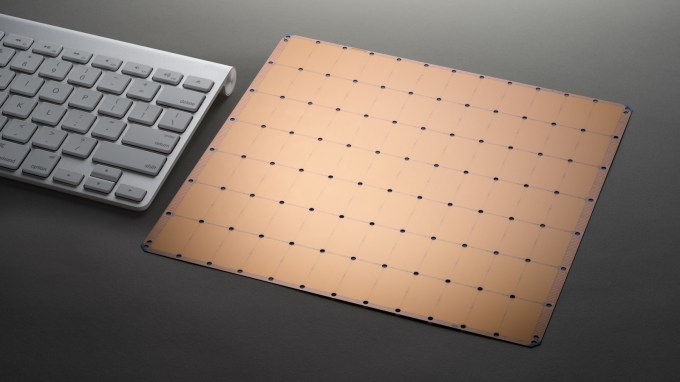

Superlatives abound at Cerebras, the until-today stealthy next-generation silicon chip company looking to make training a deep learning model as quick as buying toothpaste from Amazon. Launching after almost three years of quiet development, Cerebras introduced its new chip today — and it is a doozy. The “Wafer Scale Engine” is 1.2 trillion transistors (the most ever), 46,225 square millimeters (the largest ever), and includes 18 gigabytes of on-chip memory (the most of any chip on the market today) and 400,000 processing cores (guess the superlative).

Cerebras’ Wafer Scale Engine is larger than a typical Mac keyboard (via Cerebras Systems)

It’s made a big splash here at Stanford University at the Hot Chips conference, one of the silicon industry’s big confabs for product introductions and roadmaps, with various levels of oohs and aahs among attendees. You can read more about the chip from Tiernan Ray at Fortune and read the white paper from Cerebras itself.

Superlatives aside though, the technical challenges that Cerebras had to overcome to reach this milestone I think is the more interesting story here. I sat down with founder and CEO Andrew Feldman this afternoon to discuss what his 173 engineers have been building quietly just down the street here these past few years with $112 million in venture capital funding from Benchmark and others.

First, a quick background on how the chips that power your phones and computers get made. Fabs like TSMC take standard-sized silicon wafers and divide them into individual chips by using light to etch the transistors into the chip. Wafers are circles and chips are squares, and so there is some basic geometry involved in subdividing that circle into a clear array of individual chips.

One big challenge in this lithography process is that errors can creep into the manufacturing process, requiring extensive testing to verify quality and forcing fabs to throw away poorly performing chips. The smaller and more compact the chip, the less likely any individual chip will be inoperative, and the higher the yield for the fab. Higher yield equals higher profits.

Cerebras throws out the idea of etching a bunch of individual chips onto a single wafer in lieu of just using the whole wafer itself as one gigantic chip. That allows all of those individual cores to connect with one another directly — vastly speeding up the critical feedback loops used in deep learning algorithms — but comes at the cost of huge manufacturing and design challenges to create and manage these chips.

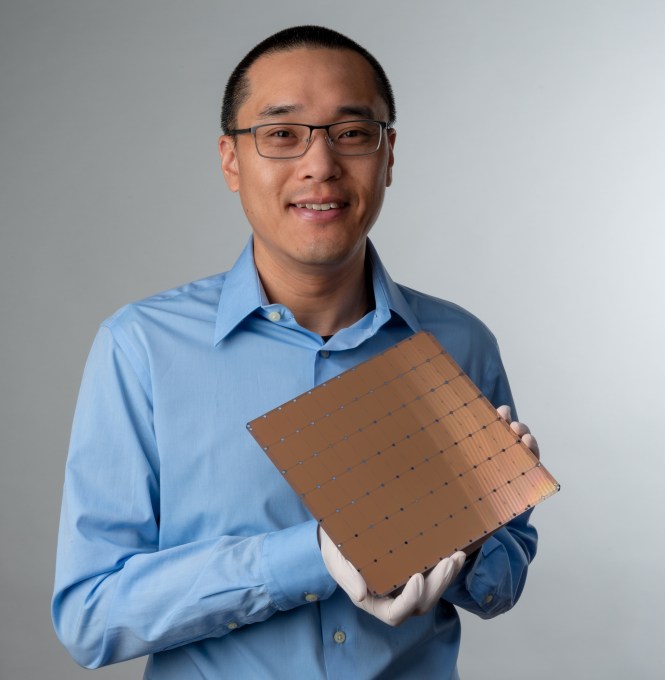

Cerebras’ technical architecture and design was led by co-founder Sean Lie. Feldman and Lie worked together on a previous startup called SeaMicro, which sold to AMD in 2012 for $334 million. (Via Cerebras Systems)

The first challenge the team ran into according to Feldman was handling communication across the “scribe lines.” While Cerebras chip encompasses a full wafer, today’s lithography equipment still has to act like there are individual chips being etched into the silicon wafer. So the company had to invent new techniques to allow each of those individual chips to communicate with each other across the whole wafer. Working with TSMC, they not only invented new channels for communication, but also had to write new software to handle chips with trillion plus transistors.

The second challenge was yield. With a chip covering an entire silicon wafer, a single imperfection in the etching of that wafer could render the entire chip inoperative. This has been the block for decades on whole wafer technology: due to the laws of physics, it is essentially impossible to etch a trillion transistors with perfect accuracy repeatedly.

Cerebras approached the problem using redundancy by adding extra cores throughout the chip that would be used as backup in the event that an error appeared in that core’s neighborhood on the wafer. “You have to hold only 1%, 1.5% of these guys aside,” Feldman explained to me. Leaving extra cores allows the chip to essentially self-heal, routing around the lithography error and making a whole wafer silicon chip viable.

Those first two challenges — communicating across the scribe lines between chips and handling yield — have flummoxed chip designers studying whole wafer chips for decades. But they were known problems, and Feldman said that they were actually easier to solve that expected by re-approaching them using modern tools.

He likens the challenge though to climbing Mount Everest. “It’s like the first set of guys failed to climb Mount Everest, they said, ‘Shit, that first part is really hard.’ And then the next set came along and said ‘That shit was nothing. That last hundred yards, that’s a problem.’”

And indeed, the toughest challenges according to Feldman for Cerebras were the next three, since no other chip designer had gotten past the scribe line communication and yield challenges to actually find what happened next.

The third challenge Cerebras confronted was handling thermal expansion. Chips get extremely hot in operation, but different materials expand at different rates. That means the connectors tethering a chip to its motherboard also need to thermally expand at precisely the same rate lest cracks develop between the two.

Feldman said that “How do you get a connector that can withstand [that]? Nobody had ever done that before, [and so] we had to invent a material. So we have PhDs in material science, [and] we had to invent a material that could absorb some of that difference.”

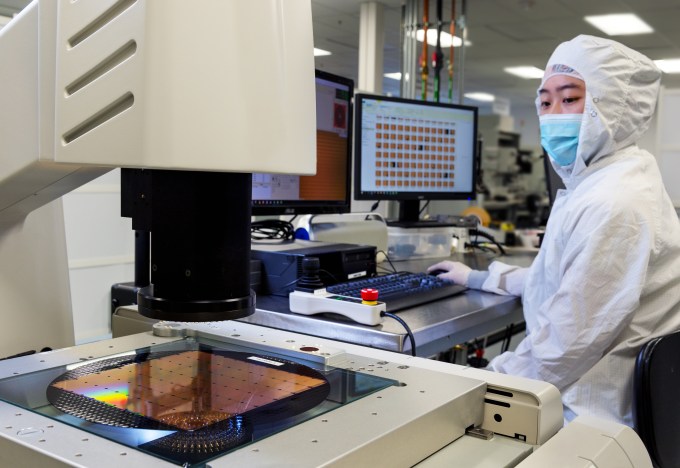

Once a chip is manufactured, it needs to be tested and packaged for shipment to original equipment manufacturers (OEMs) who add the chips into the products used by end customers (whether data centers or consumer laptops). There is a challenge though: absolutely nothing on the market is designed to handle a whole-wafer chip.

Cerebras designed its own testing and packaging system to handle its chip (Via Cerebras Systems)

“How on earth do you package it? Well, the answer is you invent a lot of shit. That is the truth. Nobody had a printed circuit board this size. Nobody had connectors. Nobody had a cold plate. Nobody had tools. Nobody had tools to align them. Nobody had tools to handle them. Nobody had any software to test,” Feldman explained. “And so we have designed this whole manufacturing flow, because nobody has ever done it.” Cerebras’ technology is much more than just the chip it sells — it also includes all of the associated machinery required to actually manufacture and package those chips.

Finally, all that processing power in one chip requires immense power and cooling. Cerebras’ chip uses 15 kilowatts of power to operate — a prodigious amount of power for an individual chip, although relatively comparable to a modern-sized AI cluster. All that power also needs to be cooled, and Cerebras had to design a new way to deliver both for such a large chip.

It essentially approached the problem by turning the chip on its side, in what Feldman called “using the Z-dimension.” The idea was that rather than trying to move power and cooling horizontally across the chip as is traditional, power and cooling are delivered vertically at all points across the chip, ensuring even and consistent access to both.

And so, those were the next three challenges — thermal expansion, packaging, and power/cooling — that the company has worked around-the-clock to deliver these past few years.

Cerebras has a demo chip (I saw one, and yes, it is roughly the size of my head), and it has started to deliver prototypes to customers according to reports. The big challenge though as with all new chips is scaling production to meet customer demand.

For Cerebras, the situation is a bit unusual. Since it places so much computing power on one wafer, customers don’t necessarily need to buy dozens or hundreds of chips and stitch them together to create a compute cluster. Instead, they may only need a handful of Cerebras chips for their deep-learning needs. The company’s next major phase is to reach scale and ensure a steady delivery of its chips, which it packages as a whole system “appliance” that also includes its proprietary cooling technology.

Expect to hear more details of Cerebras technology in the coming months, particularly as the fight over the future of deep learning processing workflows continues to heat up.

Powered by WPeMatico

There are niche startups and then there are VR companies going after fans of the “cyberpunk fantasy anime aesthetic.”

Ramen VR is one of only a few virtual reality startups that Y Combinator has bet on in the past few years and is only one of two in the company’s most recent batch of bets. It has a niche approach, but it’s hoping to build an MMO that can leanly grow alongside the slow-but-steady virtual reality market. Like any content play that’s hoping for VC dollars, Ramen VR wants eventually to be a platform.

“Long-term, our goal isn’t just to create a game, but we’ve seen the issues of VR platforms that tried to be platforms before they had a meaningful use case. If you’re just trying to be a chat room or platform without any users, that doesn’t work,” CEO Andy Tsen tells TechCrunch.

The company’s first title is called Zenith, and it’s an anime-inspired fantasy title that plays with cyberpunk themes as well. The founders are really aiming to give VR geeks the game that they want, one that taps into the 80s futuristic aesthetic with gameplay that pays tribute to popular sci-fi books, movies and games of the era.

MMOs are attracting quite a bit of inbound interest in the venture-backed startup world. Part of the reasoning has been because of people seeing the scope a title like Fortnite was able to achieve so quickly after going virall; the other part is the prevalence of developer tools that gaming startups are able to easily plug into their tech stacks. Ramen VR is using Improbable’s SpatialOS to bring persistent online gameplay to its users.

The company just rolled out a Kickstarter to gauge interest for Zenith; they launched a week ago and have raised $132,000 in the crowdfunding campaign thus far. Backers get access to a VR version of the title as well as a desktop PC copy. The startup plans to roll out across VR devices, including PC systems, PlayStation VR and Oculus Quest.

“The whole point is that it’s not just on one device, it’s a world, it’s literally the Upside Down from Stranger Things layered on top of your entire world. At any point, no matter what screen you’re on, you can access that,” CTO Lauren Frazier tells us.

The startup still has a bit of development ahead of them, but the current plan is to launch an Alpha in six months, a beta in nine months and to go live broadly a year from now.

Powered by WPeMatico

Hello and welcome back to Startups Weekly, a weekend newsletter that dives into the week’s noteworthy startups and venture capital news. Before I jump into today’s topic, let’s catch up a bit. Last week, I wrote about the differences between raising cash from angels and traditional venture capitalists. Before that, I summarized DoorDash’s acquisition of Caviar.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

It’s Friday morning and I don’t want to dig into another IPO prospectus. The startups don’t care though, they’re in a mad dash to get to the public markets, reporters be damned.

This week, three billion-dollar venture-backed “unicorns” unveiled S-1 filings, the paperwork necessary to complete an IPO. First came WeWork, the $47 billion co-working giant beloved by SoftBank. Then came Cloudflare, a business that provides web security and denial-of-service protection for websites. Then this morning, after we all thought it was time for a breather, “teledentistry” company SmileDirectClub made its filing public.

There’s plenty to read on each of these high-profile IPOs; here’s a quick reading list:

WeWork

WeWork reveals IPO filing

WeWork’s S-1 misses these three key points

Making sense of WeWork’s S-1 (or trying to)

Cloudflare

Cloudflare files for initial public offering

Cloudflare says cutting off customers like 8chan is an IPO ‘risk factor’

In its IPO filing, Cloudflare thanks a third co-founder: Lee Holloway

SmileDirectClub

SmileDirectClub files to go public amid concerns from dental associations

On to other things…

Meet the startups in Y Combinator’s summer batch

As you may know, YC summer demo days are next week. A whopping 176 companies are expected to present and we’ll be there reporting live, as usual. In preparation, we’ve been cherry-picking companies in the latest batch that interest us. Here’s a look at our latest — more to come:

Equity Podcast

This was a very special week for Equity. We taped two great episodes, one in which we hung out with Axios’ Dan Primack in Boston, the other featuring me recording out of a New York City Blue Bottle Coffee shortly after WeWork dropped its S-1 filing. You can listen to our latest episodes here and here. Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts or Spotify.

Extra Crunch

In our latest installment of EC-1, in which go deep on an up-and-coming startup, TechCrunch’s Eric Peckham tells the founding story of Kobalt, the world’s next music tech unicorn. Here’s a passage from Peckham’s extensive piece: “You may not have heard of Kobalt before, but you probably engage with the music it oversees every day, if not almost every hour. Combining a technology platform to better track ownership rights and royalties of songs with a new approach to representing musicians in their careers, Kobalt has risen from the ashes of the 2000 dot-com bubble to become a major player in the streaming music era. It is the leading alternative to incumbent music publishers (who represent songwriters) and is building a new model record label for the growing ‘middle class’ of musicians around the world who are stars within niche audiences.”

Powered by WPeMatico

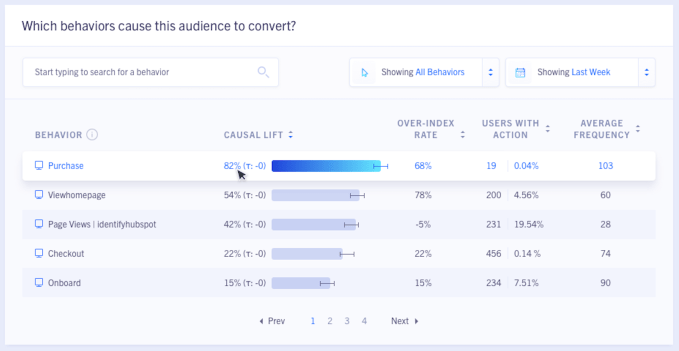

Businesses need to understand cause and effect: Someone did X and it increased sales, or they did Y and it hurt sales. That’s why many of them turn to analytics — but Bilal Mahmood, co-founder and CEO of ClearBrain, said existing analytics platforms can’t answer that question accurately.

“Every analytics platform today is still based on a fundamental correlation model,” Mahmood said. It’s the classic correlation-versus-causation problem — you can use the data to suggest that an action and a result are related, but you can’t draw a direct cause-and-effect relationship.

That’s the problem that ClearBrain is trying to solve with its new “causal analytics” tool. As the company put it in a blog post, “Our goal was to automate this process [of running statistical studies] and build the first large-scale causal inference engine to allow growth teams to measure the causal effect of every action.”

You can read the post for (many) more details, but the gist is that Mahmood and his team claim they can draw accurate causal relationships where others can’t.

The idea is to use this in conjunction with A/B testing — customers look at the data to prioritize what to test next, and to make estimates about the impact of things that can’t be tested. Otherwise, Mahmood said, “If you wanted to measure the actual impact of every variable on your website and your app — the actual impact it has on conversation — it could take you years.”

When I wrote about ClearBrain last year, it was using artificial intelligence to improve ad targeting, but Mahmood said the company built the new analytics technology in response to customer demand: “People didn’t just want to know who was going to convert, they wanted to know why, and what caused them to do so.”

The causal analytics tool is currently available to early access users, with plans for a full launch in October. Mahmood said there will be a number of pricing tiers, but they’ll be structured to make the product free for many startups.

In addition to launching the analytics tool in early access, ClearBrain also announced this week that it’s raised an additional $2 million in funding from Harrison Metal and Menlo Ventures.

Powered by WPeMatico

The phrase “pull yourself up by your own bootstraps” was originally meant sarcastically.

It’s not actually physically possible to do — especially while wearing Allbirds and having just fallen off a Bird scooter in downtown San Francisco, but I should get to my point.

This week, Ken Cuccinelli, the acting Director of the United States Citizenship and Immigrant Services Office, repeatedly referred to the notion of bootstraps in announcing shifts in immigration policy, even going so far as to change the words to Emma Lazarus’s famous poem “The New Colossus:” no longer “give me your tired, your poor, your huddled masses yearning to breathe free,” but “give me your tired and your poor who can stand on their own two feet, and who will not become a public charge.”

We’ve come to expect “alternative facts” from this administration, but who could have foreseen alternative poems?

Still, the concept of ‘bootstrapping’ is far from limited to the rhetorical territory of the welfare state and social safety net. It’s also a favorite term of art in Silicon Valley tech and venture capital circles: see for example this excellent (and scary) recent piece by my editor Danny Crichton, in which young VC firms attempt to overcome a lack of the startup capital that is essential to their business model by creating, as perhaps an even more essential feature of their model, impossible working conditions for most everyone involved. Often with predictably disastrous results.

It is in this context of unrealistic expectations about people’s labor, that I want to introduce my most recent interviewee in this series of in-depth conversations about ethics and technology.

Mary L. Gray is a Fellow at Harvard University’s Berkman Klein Center for Internet and Society and a Senior Researcher at Microsoft Research. One of the world’s leading experts in the emerging field of ethics in AI, Mary is also an anthropologist who maintains a faculty position at Indiana University. With her co-author Siddharth Suri (a computer scientist), Gray coined the term “ghost work,” as in the title of their extraordinarily important 2019 book, Ghost Work: How to Stop Silicon Valley from Building a New Global Underclass.

Ghost Work is a name for a rising new category of employment that involves people scheduling, managing, shipping, billing, etc. “through some combination of an application programming interface, APIs, the internet and maybe a sprinkle of artificial intelligence,” Gray told me earlier this summer. But what really distinguishes ghost work (and makes Mary’s scholarship around it so important) is the way it is presented and sold to the end consumer as artificial intelligence and the magic of computation.

In other words, just as we have long enjoyed telling ourselves that it’s possible to hoist ourselves up in life without help from anyone else (I like to think anyone who talks seriously about “bootstrapping” should be legally required to rephrase as “raising oneself from infancy”), we now attempt to convince ourselves and others that it’s possible, at scale, to get computers and robots to do work that only humans can actually do.

Ghost Work’s purpose, as I understand it, is to elevate the value of what the computers are doing (a minority of the work) and make us forget, as much as possible, about the actual messy human beings contributing to the services we use. Well, except for the founders, and maybe the occasional COO.

Facebook now has far more employees than Harvard has students, but many of us still talk about it as if it were little more than Mark Zuckerberg, Cheryl Sandberg, and a bunch of circuit boards.

But if working people are supposed to be ghosts, then when they speak up or otherwise make themselves visible, they are “haunting” us. And maybe it can be haunting to be reminded that you didn’t “bootstrap” yourself to billions or even to hundreds of thousands of dollars of net worth.

Sure, you worked hard. Sure, your circumstances may well have stunk. Most people’s do.

But none of us rise without help, without cooperation, without goodwill, both from those who look and think like us and those who do not. Not to mention dumb luck, even if only our incredible good fortune of being born with a relatively healthy mind and body, in a position to learn and grow, here on this planet, fourteen billion years or so after the Big Bang.

I’ll now turn to the conversation I recently had with Gray, which turned out to be surprisingly more hopeful than perhaps this introduction has made it seem.

Greg Epstein: One of the most central and least understood features of ghost work is the way it revolves around people constantly making themselves available to do it.

Mary Gray: Yes, [What Siddarth Suri and I call ghost work] values having a supply of people available, literally on demand. Their contributions are collective contributions.

It’s not one person you’re hiring to take you to the airport every day, or to confirm the identity of the driver, or to clean that data set. Unless we’re valuing that availability of a person, to participate in the moment of need, it can quickly slip into ghost work conditions.

Powered by WPeMatico

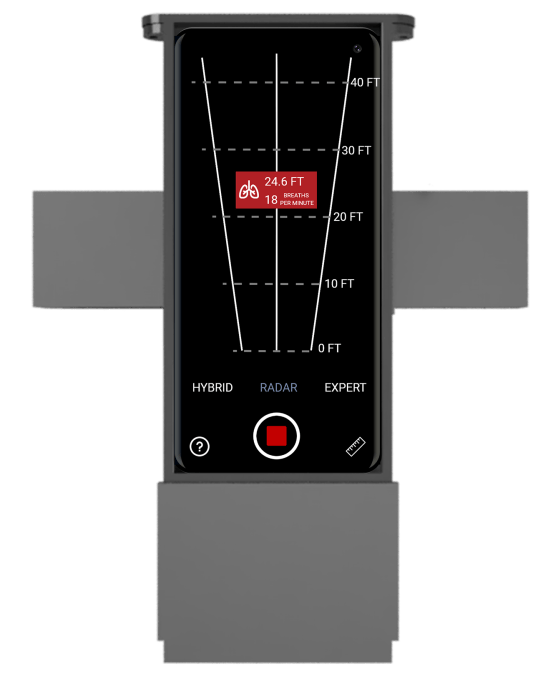

Any first responder knows that situational awareness is key. In domestic violence disputes, hostage rescue or human trafficking situations, first responders often need help determining where humans are behind closed doors.

That’s why Megan Lacy, Corbin Hennen and Rob Kleffner developed Lumineye, a 3D-printed radar device that uses signal analysis software to differentiate moving and breathing humans from other objects, through walls.

Lumineye uses pulse radar technology that works like echolocation (how bats and dolphins communicate). It sends signals and listens for how long it takes for a pulse to bounce back. The software analyzes these pulses to determine the approximate size, range and movement characteristics of a signal.

On the software side, Lumineye’s app will tell a user how far away a person is when they’re moving and breathing. It’s one dimensional, so it doesn’t tell the user whether the subject is to the right or left. But the device can detect humans out to 50 feet in open air; that range decreases depending upon the materials placed in between, like drywall, brick or concrete.

One scenario the team gave to describe the advantages of using Lumineye was the instance of hostage rescue. In this type of situation, it’s crucial for first responders to know how many people are in a room and how far away they are from one another. That’s where the use of multiple devices and triangulation from something like Lumineye could change a responding team’s tactical rescue approach.

Machines that currently exist to make these kind of detections are heavy and cumbersome. The team behind Lumineye was inspired to manufacture a more portable option that won’t weigh down teams during longer emergency response situations that can sometimes last for up to 12 hours or overnight. The prototype combines the detection hardware with an ordinary smartphone. It’s about 10 x 5 inches and weighs 1.5 pounds.

Lumineye wants to grow out its functionality to become more of a ubiquitous device. The team of four is planning to continue manufacturing the device, selling it directly to customers.

Lumineye’s device can detect humans through walls using radio frequencies

Lumineye has just started its pilot programs, and recently spent a Saturday at a FEMA event testing out the the device’s ability to detect people covered in rubble piles. The company was born out of the Boise, Idaho cohort of Stanford’s Hacking4Defense program, a course meant to connect Silicon Valley innovations with the U.S. Department of Defense and Intelligence Community. The Idaho-based startup is graduating from Y Combinator’s Summer 2019 class.

Megan Lacy, Corbin Hennen and Rob Kleffner

Powered by WPeMatico

If there is one company at the top of everyone’s mind this year, it is Slack.

The now-ubiquitous workplace messaging tool began trading on the New York Stock Exchange in June after taking an unusual route to the public markets, known as a direct listing. Slack bypassed the typical IPO process in favor of putting its current stock on the NYSE without doing an additional raise or bringing on underwriter banking partners.

Slack co-founder and chief technology officer Cal Henderson and Slack investor and Spark Capital general partner Megan Quinn will join us onstage at TechCrunch Disrupt SF to give a behind the scenes look at Slack’s banner year, the company’s origin story and what convinced Quinn to participate in the business’s funding round years ago.

Early in his career, Henderson was the technical director of Special Web Projects at Emap, a U.K. media company. Later, he became the head of engineering for Flickr, the photo-sharing tool co-founded by Slack chief Stewart Butterfield. In April 2009, he was reported to be starting a new stealth social gaming company with Butterfield, a project that would ultimately become Slack.

Quinn, for her part, invested in Slack before joining Spark Capital (Updated: 8/16/19 at 3:25 p.m.). Spark became an investor in Slack in 2015, participating in the company’s $160 million Series E at a valuation of $2.8 billion. No small startup at the time, Slack already had 750,000 daily users and backing from Accel, Andreessen Horowitz, Social Capital, GV and Kleiner Perkins.

Quinn is a seasoned investor, known for striking deals with Coinbase, Glossier, Rover and Wealthfront, among others. She first entered the venture capital scene in 2012 as an investment partner at Kleiner Perkins (where she first invested in Slack and other early to mid-stage consumer tech startups). Quinn joined Spark Capital in 2015 to make growth-stage investments in companies across the board.

Before trying her hand at VC, she spent seven years in product management and strategic partnership development at Google and one year as the head of product at payments company Square.

Disrupt SF runs October 2 to October 4 at the Moscone Center in San Francisco. Tickets are available here.

Powered by WPeMatico

What’s the lifeblood of any early-stage startup? Money and media coverage. Opportunities to acquire both abound at Disrupt San Francisco 2019, our flagship tech conference that takes place on October 2-4. It’s all about networking and making the right connections to make your startup dreams come true, and there’s no better networking mecca than Startup Alley.

Buy a Startup Alley Exhibitor Package and plant your early-stage startup in the path of more than 10,000 attendees, including leading technologists, investors, 400 accredited media outlets and other leading influencers. The package includes one full exhibit day and three Founder passes.

You’ll have access to three days of Disrupt programming across the Main Stage, the Extra Crunch Stage, the Showcase Stage and the Q&A Stage. You can watch Startup Battlefield, our epic pitch competition, to see who takes home the $100,000 prize. You’ll also receive invitations to VIP events, like a reception with top-tier investors and global media outlets.

You’ll have CrunchMatch at your side to make networking as easy as possible. This free, business match-making platform helps you find and connect with the people who can move your business forward. It matches people based on their mutual business interests, suggests meetings and sends out invitations (which recipients can easily accept or decline). CrunchMatch even lets you reserve dedicated meeting spaces where you can network in comfort.

And how’s this for opportunity? Every early-stage startup that exhibits in Startup Alley is eligible for a chance to win a Wild Card entry to the Startup Battlefield pitch competition. TechCrunch editors will select two standout startups as Wild Card teams to compete for $100,000 in Startup Battlefield.

It might sound like a longshot (and it is), but RecordGram earned a Wild Card spot and went on to become the Startup Battlefield champ at Disrupt NY 2017. Because dreams do come true.

Disrupt San Francisco 2019 takes place on October 2-4. Buy a demo table, exhibit in Startup Alley and network your way to greatness. Come on and show the world what you’ve got.

Is your company interested in sponsoring at Disrupt SF 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

If you’re a New Yorker, one of the easiest ways to keep up-to-date on the latest consumer products — furniture, beauty products, mobile apps, you name it — is to hop on the subway.

Even before you board, you may find yourself walking through a station filled with colorful startup ads. And once you’re actually on the train, you may find yourself surrounded by even more of those of ads.

It felt very different when I first moved to New York in 2013, back when the only companies that seemed to buy subway ads were local colleges, law firms and sketchy-sounding surgeons. Over the next few years, I noticed that the companies I wrote about in TechCrunch were starting to show up on the subway walls.

These ads are managed by Outfront Media, which has an exclusive contract with the MTA and says it’s worked with more than 150 startups and direct-to-consumer brands since 2018.

“Startups and DTC brands, now more than ever before, are looking for ways to raise awareness and gain market share among a heavy competitor set,” said Outfront’s chief product experience officer Jason Kuperman via email. “For these brands, it is all about testing and learning, and leveraging out-of-home (OOH) [advertising] and advertising on the subway allows them to do just that.”

Kuperman added that when they launch their subway campaigns, many of these startups are unknown, so they “find value in a permanent place to advertise that people pass through every day.”

John Laramie, CEO of out-of-home advertising agency Project X, agreed that there’s been a big shift over the past few years.

He and I first spoke in 2011 about startups buying billboard ads alongside Silicon Valley’s main highway, Route 101. More recently, he told me, “Fast forward to the last four years, and who cares about the 101? It’s all about the New York City subway.”

Powered by WPeMatico

SmileDirectClub, the at-home teeth-straightening service, is on its way to becoming a public company. SmileDirectClub is seeking to raise up to $100 million in its IPO, according to its S-1 filed today. The number of shares and price range for the offering have yet to be determined.

Prior to this, SmileDirectClub reached a $3.2 billion valuation following a $380 million funding round last October. Investors from Clayton, Dubilier & Rice led the round, which featured participation from Kleiner Perkins and Spark Capital. This funding came on top of Invisalign maker Align Technology’s $46.7 million investment in SmileDirectClub in 2016, and another $12.8 million investment in 2017 to own a total of 19% of the company.

In 2018, SmileDirectClub’s revenues came in at $432.2 million, a significant uptick from just $147 million the year prior.

The company ships invisible aligners directly to customers, and licensed dental professionals (either orthodontists or general dentists) remotely monitor the progress of the patient. Before shipping the aligners, patients either take their dental impressions at home and send them to SmileDirectClub or visit one of the company’s “SmileShops” to be scanned in person. SmileDirectClub says it costs 60% less than other types of teeth-straightening treatments, with the length of treatments ranging from four to 14 months. The average treatment lasts six months.

Though, members of the American Association of Orthodontists have taken issue with SmileDirectClub, previously asserting that SmileDirectClub violates the law because its methods of allowing people to skip in-person visits and X-rays is “illegal and creates medical risks.” The organization has also filed complaints against SmileDirectClub in 36 states, alleging violations of statutes and regulations governing the practice of dentistry. Those complaints were filed with the regulatory boards that oversee dentistry practices and with the attorneys general of each state.

SmileDirectClub explicitly calls out those issues in its S-1 as potential risk factors. Here’s a key nugget:

A number of dental and orthodontic professionals believe that clear aligners are appropriate for only a limited percentage of their patients. National and state dental associations have issued statements discouraging use of orthodontics using a teledentistry platform. Increased market acceptance of our remote clear aligner treatment may depend, in part, upon the recommendations of dental and orthodontic professionals and associations, as well as other factors including effectiveness, safety, ease of use, reliability, aesthetics, and price compared to competing products.

Furthermore, our ability to conduct business in each state is dependent, in part, upon that particular state’s treatment of remote healthcare and that state dental board’s regulation of the practice of dentistry, each which are subject to changing political, regulatory, and other influences. There is a risk that state authorities may find that our contractual relationships with our doctors violate laws and regulations prohibiting the corporate practice of dentistry, which generally bar the practice of dentistry by entities. Two state dental boards have established new rules or interpreted existing rules in a manner that purports to limit or restrict our ability to conduct our business as currently conducted.

Additionally, as the S-1 notes, a national dental association recently filed a petition with the U.S. Food and Drug Administration claiming that SmileDirectClub’s manufacturing violates “prescription only” requirements. While no regulations or laws have been passed that would affect SmileDirectClub to date, it’s a possible scenario that would greatly impact the company’s core business.

Powered by WPeMatico