Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Team TechCrunch was back for Day 2 of Y Combinator’s Summer 2019 Demo Days where we heard from another massive chunk of startups that are taking disruption very seriously, even if they’re aiming to upend companies that only launched in Y Combinator a few classes ago.

The total class of on-record Demo Days launches came to 166 startups, after 82 presentations today. If you missed out on our tireless coverage yesterday, check that out too. We also picked our 11 favorites from yesterday’s batch here.

Here’s what we all saw today:

And that’s a wrap!

Thanks for reading through the full list, we’ll be scouring through our top picks for a post coming soon and we’ll be back at Y Combinator Demo Days next year for their winter 2020 class.

Powered by WPeMatico

This guest post was written by David Teten, Venture Partner, HOF Capital. You can follow him at teten.com and @dteten. This is part of an ongoing series on revenue-based investing VC that will hit on:

A new wave of revenue-based investors are emerging who are using creative investing structures with some of the upside of traditional VC, but some of the downside protection of debt.

I’ve been a traditional equity VC for 8 years, and I’m researching new business models in venture capital. As I’ve learned about this model, I’ve been impressed by how these venture capitalists are accomplishing a major social impact goal… without even trying to.

Many are reporting that they’re seeing a more diverse pool of applicants than traditional equity VCs — even though virtually none have a particular focus on women or underrepresented founders. In addition, their portfolios look far more diverse than VC industry norms.

For context, revenue-based investing (“RBI”) is a new form of VC financing, distinct from the preferred equity structure most VCs use. RBI normally requires founders to pay back their investors with a fixed percentage of revenue until they have finished providing the investor with a fixed return on capital, which they agree upon in advance. For more background, see “Revenue-based investing: A new option for founders who care about control“.

I contacted every RBI venture capital investor I could identify, and learned:

By contrast, according to PitchBook Data, since the beginning of 2016, companies with women founders have received only 4.4% of venture capital deals. Those companies have garnered only about 2% of all capital invested. This is despite the fact that the data says that in fact you’re better off investing in women.

Paul Graham href=”http://www.paulgraham.com/bias.html”> observes, “many suspect that venture capital firms are biased against female founders. This would be easy to detect: among their portfolio companies, do startups with female founders outperform those without?

A couple months ago, one VC firm (almost certainly unintentionally) published a study showing bias of this type. First Round Capital found that among its portfolio companies, startups with female founders outperformed those without by 63%.”

Why are RBI investors investing disproportionately in women & underrepresented founders, and vice versa: why do these founders approach RBI investors?

I’d argue it’s not that RBI is so unbiased and attractive; it’s that traditional equity VC is biased structurally against some women and underrepresented founders.

The Boston Consulting Group and MassChallenge, a US-based global network of accelerators, partnered to study why “women-owned startups are a better bet”. Through their analysis and interviews, BCG identified three primary reasons why female founders are less likely to receive VC funds.

The study used multivariate regression analysis to control for education levels and pitch quality to conclude that gender was a statistically significant factor. I argue that these 3 reasons are much less applicable for RBI investors than for conventional VCs.

Traditional equity VCs are looking for high-risk, high-reward, “swing for the fences” models. The founders of such companies inherently are taking financial risk, reputational risk, and career risk.

Paul Graham, co-founder of Y Combinator, said, “few successful founders grew up desperately poor.” Ricky Yean, a serial founder, agrees: “building and sustaining a company that is “designed to grow fast” is especially hard if you grew up desperately poor”.

Most of the founders of the paradigmatic VC home runs were privileged: male, cisgender, well-educated, from affluent families, etc. Think Bill Gates and Mark Zuckerberg .

That privilege makes it easier for them to take very high risk. The average person, worried about students loans and long term employability, quite rationally is less likely to take the huge risk of founding a company. It’s far safer to just get a job.

Investors who back diverse teams can win much higher returns than the industry norm. Both RBI investors and the founders they back will hopefully benefit from this pattern.

Note that none of the lawyers quoted or I are rendering legal advice in this article, and you should not rely on our counsel herein for your own decisions. I am not a lawyer. Thanks to the experts quoted for their thoughtful feedback.

Powered by WPeMatico

You’re working on launching a new VC fund; congratulations! I’ve been a traditional equity VC for 8 years, and I’m now researching revenue-vased investing and other new approaches to VC. The question I’m asking myself: should a new VC fund use revenue-based investing, traditional equity VC, or possibly both (likely from two separate pools of capital)?

Revenue-based investing (“RBI”) is a new form of VC financing, distinct from the preferred equity structure most VCs use. RBI normally requires founders to pay back their investors with a fixed percentage of revenue until they have finished providing the investor with a fixed return on capital, which they agree upon in advance.

This guest post was written by David Teten, Venture Partner, HOF Capital. You can follow him at teten.com and @dteten. This is part of an ongoing series on Revenue-based investing VC that will hit on:

From the investors’ point of view, the advantages of the RBI models are manifold. In fact, the Kauffman Foundation has launched an initiative specifically to support VCs focused on this model. The major advantages to investors are:

Powered by WPeMatico

DoorDash has been on an acquisition tear of late, with Scotty Labs as its latest target. Terms of the deal were not disclosed, but this comes after DoorDash acquired Caviar in a deal worth $410 million.

Scotty Labs, a tele-operations company that is working on technology to enable people to remotely control self-driving cars, raised a $6 million seed round from Gradient Ventures, with participation from Horizon Ventures and Hemi Ventures, last March. The startup had previously worked with Voyage for its self-driving cars in retirement communities.

“Our core belief at Scotty has always been that Autonomy + Remote Assistance is the future,” Scotty CEO Tobenna Arodiogbu wrote on Medium. “We have intentionally always considered ourselves to be the anti-hype company and focused intensely on developing core infrastructure and algorithms to ensure the safe deployment of autonomous vehicles.”

Meanwhile, DoorDash quietly brought on the two co-founders from Lvl5, another company that had built tech to create high-resolution maps for autonomous driving using crowdsourced imagery and computer vision to merge and process the images. In April, Lvl5 announced it was shutting down after the acquisition.

Details of how Scotty Labs and Lvl5 will fit into DoorDash’s business are nonexistent, but you could imagine DoorDash using Scotty’s technologies to remotely control delivery robots or other types of autonomous vehicles.

“We’ll share more updates in the near future but for now, we’re really excited to be part of the amazing DoorDash family and looking forward to building something magical together,” Scotty Labs co-founder Tobenna Arodiogbu wrote on Medium.

From what we understand, the Lvl5 deal was more of an acqui-hire and did not include any of the maps that were built using the company’s technology. Instead, startup Mapillary obtained that trove of hundreds of millions of images.

DoorDash would not comment on what the new hires are working on, but through its robot pilots and partnership with GM, the startup has made no secret of its interest in exploring autonomous technology, specifically looking at how it can improve the cost and efficiency of deliveries, and it would make sense that it would also want to have in-house expertise to own and manage those projects.

DoorDash has experimented with delivery robots before. In 2017, DoorDash partnered with both Starship Technologies and Marble to test food delivery via robot. More recently, DoorDash announced a partnership with GM’s Cruise to test self-driving food delivery cars. DoorDash is also beefing up its in-house team of autonomous and navigation specialists.

This investment in autonomous tech through its acquisition of Scotty Labs and acqui-hire of the team from Lvl5 comes at a time when DoorDash says it is revamping its policies around driver wages.

The enthusiasm and potential of autonomous tech had led to startups creating literally dozens of interesting products that focus on different aspects of this field. But it will take a village to get this tech off the ground, which means that consolidation is inevitable.

DoorDash — operating on the principle of economies of scale — has been pretty aggressive in positioning itself as one of those consolidators. We have heard it tried to merge with Postmates. It bought Caviar this summer. And it has raised an absolute ton of money. In May, DoorDash raised a $400 million round, valuing it at $12.6 billion. Meanwhile, DoorDash’s main competitor, Postmates, is gearing up to go public this quarter. Just this month, the company received the first permit to deploy autonomous delivery bots in San Francisco.

As technology becomes a key way for the crowded arena of delivery startups to differentiate themselves, investing in its own autonomous tech R&D — by way of picking up some of these disparate startups that may have struggled to survive on their own — is one way for DoorDash to build out that tech cred.

Powered by WPeMatico

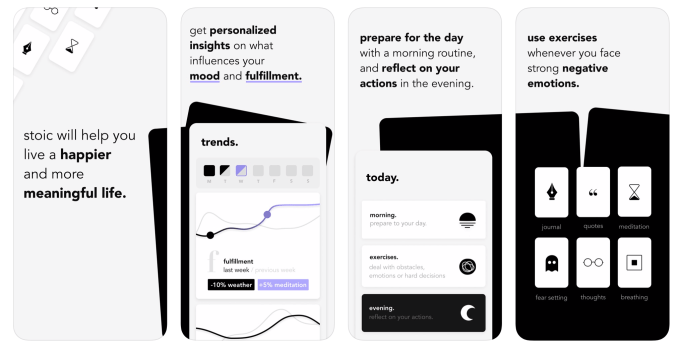

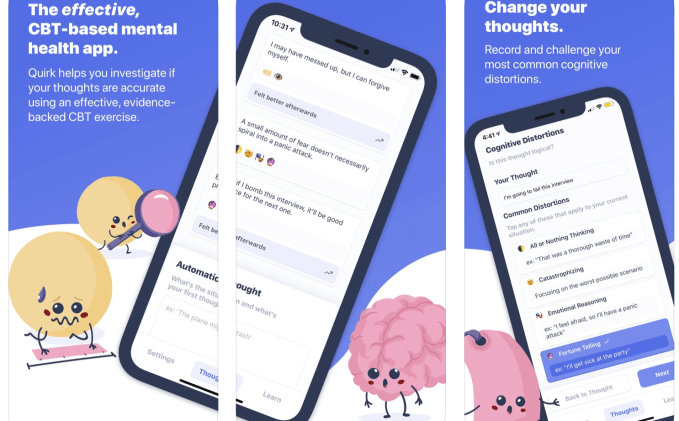

The process of using the Stoic journaling app is simple: You open the app in the morning and the evening, when you’ll be prompted to answer a couple of questions and perform a few simple exercises.

For example, this evening the app asked me to rate my current level of fulfillment and to identify what made me smile today, while also pointing me to guided exercises like journaling and breathing.

Stoic is part of the current batch of startups at Y Combinator (it’s taking the stage today at Demo Day). Founder Maciej Lobodzinski told me that his goal is to help users understand the different factors influencing their mental and emotional state.

“The core of the app is: We have this insight and we see what influences your mood and what you feel,” Lobodzinski said. He suggested that this is very different from the “super transactional” idea embedded in my other mental health and wellness apps, where “you pay for my app and you feel better.” In his view, “You should feel how you feel. It’s okay, how you feel, but you should know why you are feeling this way.”

So once there are a couple of weeks of data in the app, you should be able to look back and see how you were feeling on a certain day, and if there were activities that made you feel more or less fulfilled. Over time, Lobodzinski hopes to add more insights about “what influenced you, why you feel this way, why you are productive.”

As the name implies, Stoic is inspired by Lobodzinski’s interest in classical Stoic philosophy (he’s not the first to suggest that the approach has direct applications in the tech industry), and the app even includes quotes from Stoic philosophers.

“It’s an extremely practical framework,” he said. “When I talk to users, there are entrepreneurs, investors, traders — people who found out about the app because they were looking for how to deal with their stress …

If you are stressed with your everyday life and you can get the advice of the emperor of Rome, who dealt with much more serious things, it’s amazing how much better you can feel after that.”

At the same time, users have the option to receive quotes from different schools of thought — not just Stoicism but also Buddhism, Taoism and Catholicism. For some users, their app experience won’t be explicitly focused on Stoicism, but Lobodzinski said that even then, it forms the “spine” of the app’s approach.

The basic app is free, but Stoic charges $27.99 per year for a premium version that includes iCloud syncing and additional content.

Powered by WPeMatico

H2O.ai‘s mission is to democratize AI by providing a set of tools that frees companies from relying on teams of data scientists. Today it got a bushel of money to help. The company announced a $72.5 million Series D round led by Goldman Sachs and Ping An Global Voyager Fund.

Previous investors Wells Fargo, Nvidia and Nexus Venture Partners also participated. Under the terms of the deal, Jade Mandel from Goldman Sachs will be joining the H2O.ai board. Today’s investment brings the total raised to $147 million.

It’s worth noting that Goldman Sachs isn’t just an investor. It’s also a customer. Company CEO and co-founder Sri Ambati says the fact that customers Wells Fargo and Goldman Sachs have led the last two rounds is a validation for him and his company. “Customers have risen up from the ranks for two consecutive rounds for us. Last time the Series C was led by Wells Fargo where we were their platform of choice. Today’s round was led by Goldman Sachs, which has been a strong customer for us and strong supporters of our technology,” Ambati told TechCrunch.

The company’s main product, H2O Driverless AI, introduced in 2017, gets its name from the fact it provides a way for people who aren’t AI experts to still take advantage of AI without a team of data scientists. “Driverless AI is automatic machine learning, which brings the power of a world-class data scientists in the hands of everyone. lt builds models automatically using machine learning algorithms of every kind,” Ambati explained.

They introduced a new recipe concept today, which provides all of the AI ingredients and instructions for building models for different business requirements. H2O.ai’s team of data scientists has created and open-sourced 100 recipes for things like credit risk scoring, anomaly detection and property valuation.

The company has been growing since its Series C round in 2017, when it had 70 employees. Today it has 175 and has tripled the number of customers since the prior round, although Ambati didn’t discuss an exact number. The company has its roots in open source and has 20,000 users of its open-source products, according to Ambati.

He didn’t want to discuss valuation and wouldn’t say when the company might go public, saying it’s early days for AI and they are working hard to build a company for the long haul.

Powered by WPeMatico

The Los Angeles-based gaming company Scopely is expanding its geographical footprint in Spain and Ireland.

The company is building out its Barcelona offices, tripling its office space and planning to significantly expand its 100-person-strong team in the city. Meanwhile, Scopely is also planning to invest heavily in expanding its strategy-focused game studio, DIGIT, in Dublin.

Scopely didn’t say how many jobs it would be adding in either location.

The company has now hit lifetime revenue of more than $1 billion across its franchises and recently launched “Star Trek Fleet Command” and “Looney Tunes World of Mayhem.” Scopely also has licenses to develop games for World Wrestling Entertainment and The Walking Dead franchise.

“We are thrilled to expand our European footprint to accommodate our exponential growth,” said Javier Ferreira, co-CEO of Scopely, in a statement. “I am excited to further lean in to the Barcelona market, which has top-quality talent. The same is true in Dublin with top tech talent flocking to the area, and both offices have amassed impressive highly-specialized expertise. Our Dublin and Barcelona teams play a critical role in the Scopely journey, and we are actively hiring across both markets.”

The company also plans to double its footprint in its hometown of Los Angeles in 2020.

The company has raised more than $250 million in financing to date, from investors including Greenspring Associates, Greycroft Partners, Revolution Growth, Evolution Media Partners, Highland Capital Partners, Horizons Ventures, Sands Capital Ventures, The Chernin Group, Take-Two Interactive, Kobe Bryant, Arnold Schwarzenegger, Peter Guber, Jimmy Iovine and Brendan Iribe.

Powered by WPeMatico

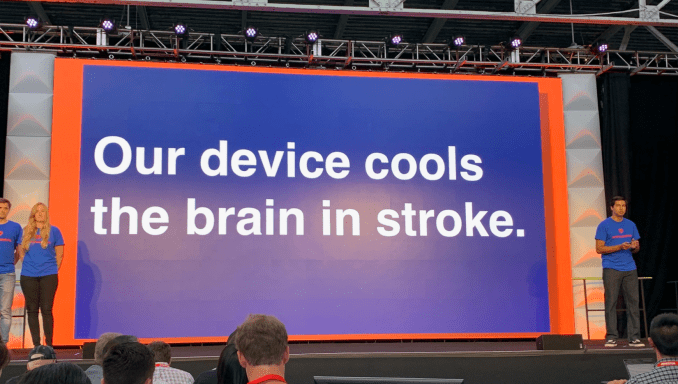

It’s that time of year, Silicon Valley’s investor technocrati and advice-giving Twitter celebrities descended upon Pier 48 in San Francisco to judge the latest summer batch of Y Combinator startups. TechCrunch was there, as well, and we were tapping away feverishly as co-founders pitched to woo investors.

There are 197 companies in total in the summer YC batch, we heard from 84 of them today — in addition to a few off-the-record pitches which we agreed to hold off publicizing as they remain in stealth. We’ll hear from another chunk of them tomorrow, so check back tomorrow for even more startup blurbs.

Demo Day used to be the debut for many of these companies, but as Y Combinator’s prestige has grown so has the likelihood that the batch’s best will be closing rounds at outsized valuations before the first pitches have been made.

We’ll undoubtedly be reporting on some of these rounds moving forward, but for now here are the 84 companies whose founders pitched onstage today at Y Combinator Demo Days – Day 1.

That’s all for Day 1, we’ll be posting our favorites from today’s batch soon and we’ll be back tomorrow with the rest of the batch.

Powered by WPeMatico

This guest post was written by David Teten, Venture Partner, HOF Capital. You can follow him at teten.com and @dteten. This is part of an ongoing series on Revenue-Based Investing VC that will hit on:

So you’re interested in raising capital from a Revenue-Based Investor VC. Which VCs are comfortable using this approach?

A new wave of Revenue-Based Investors (“RBI”) are emerging. This structure offers some of the benefits of traditional equity VC, without some of the negatives of equity VC.

I’ve been a traditional equity VC for 8 years, and I’m now researching new business models in venture capital.

(For more background, see the accompanying article “Revenue-based investing: A new option for founders who care about control” published on Extra Crunch.

RBI normally requires founders to pay back their investors with a fixed percentage of revenue until they have finished providing the investor with a fixed return on capital, which they agree upon in advance.

I’ve listed below all of the major RBI venture capitalists I’ve identified. In addition, I’ve noted a few multi-product lending firms, e.g., Kapitus and United Capital Source, which provide RBI as one of many structural options to companies seeking capital.

Alternative Capital: “You qualify if you have $5k+ MRR. We have a special program if you are pre-seed and need product development. Since 2017 we’ve managed $3 million in revenue-based financing, which helps cash-strapped technology companies grow. In 2019 we partnered with several revenue-based lending providers, effectively creating a marketplace.”

Bigfoot Capital: According to Brian Parks, “Bigfoot provides RBI, term loans, and lines of credit to SaaS businesses with $500k+ ARR. Our wheelhouse is bootstrapped (or lightly capitalized) SMB SaaS. We make fast, data-driven credit decisions for these types of businesses and show Founders how the math/ROI works. We’re currently evaluating about 20 companies a month and issuing term sheets to 25% of them; those that fit our investment criteria. We’re also regularly following-on for existing portfolio companies.”

Investment Criteria:

Benefits:

Corl: “No need to wait 3-9 months for approval. Find out in 10 minutes. Corl can fund up to 10x your monthly revenue to a maximum of $1,000,000. Payments are equal to 2-10% of your monthly revenue, and stop when the business buys out the contract at 1-2x the investment amount.”

According to Derek Manuge, Corl CEO, “Funds are closed significantly quicker than the industry average at under 24 hours. The majority of businesses that apply for funding with Corl are E-commerce, SaaS, and other digital businesses.”

Manuge continues, “Corl connects to a business’ bank accounts, accounting software, payment processors, and other digital services to collect 10,000+ historical data points that are analyzed in real-time. We collect more data on an individual business than, to our knowledge, any other RBI investor, through our application process, data partners, and various public sources online. We have reviewed the application process of other RBI lenders and have not found one that has more API connections that ours. We have developed a proprietary machine learning algorithm that assesses the risk and return profile of the business and determines whether to invest in the business. Funding decisions can take as little as 10 minutes depending on the amount of data provided by a business.”

In the past 12 months, 500+ companies have applied for funding with Corl. The following information is based on companies funded by us and/or our capital partners:

Decathlon Capital: According to John Borchers, Co-founder, Decathlon is the largest revenue-based financing investor in the US. His description: “We announced a new $500 million fund in Q1 of 2019, in our 10th year. Unlike many RBI investors, a full 50% of our investment activity is in non-tech businesses. Like other RBI firms, Decathlon does not require warrants, governance involvement, or the types of financial covenants that are often associated with other venture debt type solutions. Decathlon typically targets monthly payment percentages in the 1% to 4% range, with total targeted multiples of 1.5x to 3.0x.”

Earnest Capital: Earnest is not technically RBI. Tyler Tringas, General Partner, observes, “Almost all of these new [RBI] forms of financing really only work for more mature companies (say $25-50k MRR and up) and there are still very few new options at the stage where we are investing.” From their website: “We invest via a Shared Earnings Agreement, a new investment model developed transparently with the community, and designed to align us with founders who want to run a profitable business and never be forced to raise follow-on financing or sell their business.” Key elements:

Feenix Venture Partners: Feenix Venture Partners has a unique investment model that couples investment capital with payment processing services. Each of Feenix’s portfolio companies receives an investment in debt or equity and utilizes a subsidiary of Feenix as its credit card payment processor (“Feenix Payment Systems”). The combination of investment capital and credit card processing (CCP) fees creates a “win-win” partnership for investors and portfolio companies. The credit card processing data provides the investor with real-time sales transparency and the CCP fee margin provides the investor high current income, with equity-like upside and significant recovery for downside protection. Additionally, portfolio companies are able to access competitive and often non-dilutive financing by monetizing an unavoidable expense that is being paid to its current processors, thus yielding a mutual benefit for both parties.

Feenix focuses on companies in the consumer space across a number of industry verticals including: multi-unit Food & Beverage operators, hospitality, managed workspace (office or food halls), location-based entertainment venues, and various direct to consumer online companies. Their average check size is between $1-3 million, with multi-year term and competitive interest rates for debt. Additionally, Feenix typically needs fewer financial covenants and can provide quicker turnaround for due diligence with the benefit of transparency they receive by tracking credit card sales activity. 10% of Feenix’s portfolio companies have received VC equity prior to their financing.

Founders First Capital Partners: “Founders First Capital Partners, LLC is building a comprehensive ecosystem to empower underrepresented founders to become leading premium wage job creators within their communities. We provide revenue-based funding and business acceleration support to service-based small businesses located outside of major capital markets such as Silicon Valley and New York City.”

“We focus our support on businesses led by women, ethnic minorities, LGBTQ, and military veterans, especially teams and businesses located in low to moderate income areas. Our proprietary business accelerator programs, learning platform, and growth methodologies transition these underserved service-based businesses into companies with $5 million to $50 million in recurring revenue. They are tech-enabled companies that provide high-yield investments for fund limited partners (LPs) that perform like bonds but generate returns on par with equity investments. Founders First Capital Partners defines these high performing organizations as Zebra Companies .”

“Each year, Founders First Capital Partners works with hundreds of entrepreneurs. Three tracks of pre-funding accelerator programs determine the appropriate level of funding and advisory support needed for each founder to achieve their desired expansion: 1) Fastpath for larger companies with $2 million to $5 million in annual revenue, 2) Founders Growth Bootcamp program for companies with $250,000 to $2 million in annual revenue, and 3) Elevate My Business Challenge for companies with $50,000 to $250,000 in annual revenue.”

“Founders First Capital Partners (FFCP) runs a 5-step process:

According to Kim Folson, Co-Founder, “Founders First Capital Partner (F1stcp) has just secured a $100M credit facility commitment from a major institutional impact investor. This positions F1stcp to be the largest revenue-based investor platform addressing the funding gap for service-based, small businesses led by underserved and underrepresented founders.”

GSD Capital: “ GSD Capital partners with early-stage SaaS founders to fund growth initiatives. We work with founding teams in the Mountain West (Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah and Wyoming) who have demonstrated an ability to get sh*t done… We empower founders with a 30-day fundraising process instead of multiple months running a gauntlet. ”

“To best explain the process of RBF funding, let’s use an example. Pied Piper Inc needs funding to accelerate customer acquisition for its SaaS solution. GSD Capital loans $250,000 to Pied Piper taking no ownership or control of the business. The funding agreement outlines the details of how the loan will be repaid, and sets a “cap”, or a point at which the loan has been repaid. On a 3-year term, the cap amounts typically range from 0.4-0.6x the loan amount. Each month Pied Piper reviews its cash receipts and sends the agreed upon percentage to GSD. If the company experiences a rough patch, GSD shares in the downside. Monthly payments stop once the cap is reached and the loan is repaid. In a situation where Pied Piper’s revenue growth exceeds expectations, prepayment discounts are built into the structure, lowering the cost of capital.”

“Requirements for funding consideration:

Indie.VC: Part of the investment firm O’Reilly AlphaTech Ventures. See Indie VC’s Version 3.0 . “On the surface, our v3 terms are a fairly vanilla version of a convertible note with a few key variables to be negotiated between the investor and the founder: investment amount, equity option, and repurchase start date and percentage.”

Kapitus: Offers RBI among many other options. “Because this [RBI] is not a loan, there is no APR or compounded interest associated with this product. Instead, borrowers agree to pay a fixed percentage in addition to the amount provided.”

Lighter Capital: “Since 2012, we’ve provided over $100 million in growth capital to over 250 companies.” Revenue-based financing which “helps tech entrepreneurs get to the next level without giving up equity, board seats, or personal guarantees… At Lighter Capital, we don’t take equity or ask you to make personal guarantees. And we don’t take a seat on your board or make you write a big check if you’re having a down month.”

Novel Growth Partners: ” We invest using Revenue-Based Investing (RBI), also known as Royalty-Based Investing… We provide up to $1 million in growth capital, and the company pays that capital back as a small percentage (between 4% and 8%) of its monthly revenue up to a predetermined return cap of 1.5-2.2x over up to 5 years. We can usually provide capital in an amount up to 30% of your ARR. Our approach allows us to invest without taking equity, without taking board seats, and without requiring personal guarantees. We also provide tailored, tactical sales and marketing assistance to help the companies in our portfolio accelerate their growth.” Keith Harrington, Co-Founder & Managing Director at Novel Growth Partners, observes that he sees two categories of RBI:

He said, “We chose the structure we did because we think it’s easier to understand, for both LPs and entrepreneurs.”

Podfund: Focused on podcast creators. “We agree to provide funding and services to you in exchange for a percentage of total gross revenue (including ads/sponsorship, listener support, and ancillary revenue such as touring, merchandise, or licensing) per quarter. PodREV terms are 7-15% of revenue for 3-5 years, depending on current traction, revenue, and projected growth. At any time you may also opt to pay down the revenue share obligation in full, as follows:

RevUp: “Companies receive $100K-250K in non-dilutive cash… [paid back in a] 36-month return period with revenue royalty ranging from 4-8%, no equity .”

Riverside Acceleration Capital: Closed Fund I for $50m in 2016. Fund II has raised over $100m as of mid-2019.

” Investment size : $1 – 5+ million, significant capacity for additional investment.

Return method: Small percentage of monthly revenue. Keeps capital lightweight and aligned to companies’ growth.

Capped return: 1.5 – 2x the investment amount. Company maximizes equity upside from growth.

Investment structure: 5-year horizon. Long-term nature maximizes flexibility of capital.”

Jim Toth writes, “One thing that makes us different is that we live inside of an $8Bn private equity firm. This means that we have a tremendous amount of resources that we can leverage for our companies, and our companies see us as being quite strategic. We also have the ability to continue investing behind our companies across all stages of growth.”

ScaleWorks: “We developed Scaleworks venture finance loans to fill a need we saw for our own B2B SaaS companies. No personal guarantees, board seats, or equity sweeteners. No prepayment penalties. Monthly repayments as a percentage of revenue.”

United Capital Source: Provides a wide structure of loans, including but not limited to RBI. The firm has provided more than $875 million in small business loans in its history, and is currently extending about $10m/month in RBI loans. Jared Weitz, Founder & CEO, said, “[Our] typical RBF client is $120K-$20M in annual revenue, with 4-200 employees. We only look at financials for deals over a certain size.

For smaller deals, we’ll look at bank statements and get a pretty good picture of revenues, expenses and cash flow. After all, since this is a revenue-based business loan, we want to make sure revenues and cash flow are consistent enough for repayment without hurting the business’s daily operations. When we do look at financials to approve those larger deals we are generally seeing a 5 to 30% EBITDA margin on these businesses.” United Capital Source was selected in the 2015 & 2017 Inc. 5000 Fastest Growing Companies List.

Note that none of the lawyers quoted or I are rendering legal advice in this article, and you should not rely on our counsel herein for your own decisions. I am not a lawyer. Thanks to the experts quoted for their thoughtful feedback. Thanks to Jonathan Birnbaum for help in researching this topic.

Powered by WPeMatico

Does the traditional VC financing model make sense for all companies? Absolutely not. VC Josh Kopelman makes the analogy of jet fuel vs. motorcycle fuel. VCs sell jet fuel which works well for jets; motorcycles are more common but need a different type of fuel.

A new wave of Revenue-Based Investors are emerging who are using creative investing structures with some of the upside of traditional VC, but some of the downside protection of debt. I’ve been a traditional equity VC for 8 years, and I’m now researching new business models in venture capital.

I believe that Revenue-Based Investing (“RBI”) VCs are on the forefront of what will become a major segment of the venture ecosystem. Though RBI will displace some traditional equity VC, its much bigger impact will be to expand the pool of capital available for early-stage entrepreneurs.

This guest post was written by David Teten, Venture Partner, HOF Capital. You can follow him at teten.com and @dteten. This is part of an ongoing series on Revenue-Based Investing VC that will hit on:

RBI structures have been used for many years in natural resource exploration, entertainment, real estate, and pharmaceuticals. However, only recently have early-stage companies started to use this model at any scale.

According to Lighter Capital, “the RBI market has grown rapidly, contrasting sharply with a decrease in the number of early-stage angel and VC fundings”. Lighter Capital is a RBI VC which has provided over $100 million in growth capital to over 250 companies since 2012.

Lighter reports that from 2015 to 2018, the number of VC investments under $5m dropped 23% from 6,709 to 5,139. 2018 also had the fewest number of angel-led financing rounds since before 2010. However, many industry experts question the accuracy of early-stage market data, given many startups are no longer filing their Form Ds.

John Borchers, Co-founder and Managing Partner of Decathlon Capital, claims to be the largest revenue-based financing investor in the US. He said, “We estimate that annual RBI market activity has grown 10x in the last decade, from two dozen deals a year in 2010 to upwards of 200 new company fundings completed in 2018.”

Powered by WPeMatico