Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

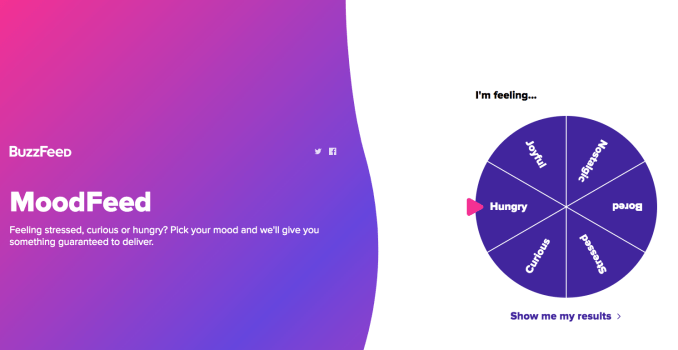

BuzzFeed is offering readers a new approach to finding content that fits the way they’re feeling right now.

It’s not the boring old approach of following a link on social media or search, or of typing BuzzFeed.com into your browser. Instead, on MoodFeed, readers can identify their mood, then they’ll get a list of articles that match those feelings.

There are currently six options — curious, stressed, bored, nostalgic, joyful or hungry. If you select “curious,” you’ll see a list of BuzzFeed posts about strange facts, life hacks and the like. If, on the other hand, you go with “nostalgic,” you’ll get lots of headlines about pop culture history. And if you’re not sure, you can just give the mood wheel a spin and see what it lands on.

Talia Halperin, BuzzFeed’s vice president of brand management, described this as an experiment in “getting our audience engaged and excited in a non-traditional way.” The team apparently created these recommendations by first identifying the main mood options, then “reverse-engineering” which articles would be a good fit.

And while BuzzFeed’s never offered this kind of interface before, Halperin argued that the broader strategy is one that the organization uses “all the time, in a curated, audience-focused way” — when the team is sharing and promoting articles, it’s thinking about moods and associated identities.

In fact, the BuzzFeed team has actually built AI tools to help with this process, automating the ability to identify which BuzzFeed stories should be posted on which BuzzFeed pages, when “evergreen” stories should be re-promoted and at what time headlines should be shared.

In the case of MoodFeed, Halperin made it sound like this is very much an experiment, with the company still figuring out things like “how often we should refresh it, what our strategy is around that.”

At the same time, she said there’s plenty of room for expansion.

“This could scale in a really interesting way,” she added. “You may have noticed that there are only six moods, but of course, there are several different moods that come along with certain events [so we’re interested] in really being able expand to expand the moods at different times of the year.”

Powered by WPeMatico

Whether you’re a time-crunched procrastinator or a last-minute decision-maker, we have great news for early-stage hardware startup founders! You get one more week to apply to compete in Hardware Battlefield at TC Shenzhen on November 11-12 in China.

Did we just hear a collective sigh of relief? Take advantage of the reprieve and grab this opportunity for all it’s worth — $25,000 in prize money for starters. What are you waiting for? Submit your application by the new deadline: August 28 at 11:59 p.m. (PT).

This Battlefield takes place as part of the larger TechCrunch Shenzhen show, produced in collaboration with our China partner TechNode, that runs November 9-12. Shenzhen, the heartland of hardware, earned its stellar reputation for supporting hardware startups through a combination of accelerators, rapid prototyping and world-class manufacturing.

We accept applications from early-stage hardware startups from any country. Participating in this pitch competition will place your startup in front of some of the most influential technologists, investors and media. Win or lose, that kind of world-class exposure can change the course of your business.

You’re qualified to apply if you can meet these minimum requirements:

Here’s how the Hardware Battlefield works. Applying and participating is free. TechCrunch editors will pore over all qualified applications and then select 10-15 of the best hardware startups to compete. If you make the cut, get ready for six weeks of intense prep as our Battlefield team coaches you (for free) on crafting the perfect pitch.

Each startup has just six minutes to pitch and demo their creation to the judges — all expert VCs, founders and technologists. After you pitch, you’ll face a tough Q&A with the judges. That free coaching will sure come in handy. If you make it through the first round, you’ll pitch all over again to a fresh set of judges.

Only one startup will be declared the winner, earn serious bragging rights and that $25,000 equity-free prize. But every team receives invaluable media and investor interest. That exposure goes way beyond the live audience. We record the Battlefield on video and publish it on TechCrunch to a global audience.

Hardware Battlefield at TC Shenzhen takes place on November 11-12. This is your chance to launch your hardware startup on a global stage. Take advantage of the extra week and apply to Hardware Battlefield at TC Shenzhen before August 28 at 11:59 p.m. (PT). Come and show us your hardware!

Is your company interested in sponsoring or exhibiting at Hardware Battlefield at TC Shenzhen? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

While some analysts are calling WeWork’s IPO filing a “masterpiece of obfuscation,” the esteemed tech observer Professor Scott Galloway simply calls it “WeWTF.”

There is another company that is coming up fast in the “WeViewMirror” — if you will — and that’s Knotel. Also a “flexible workspace provider,” Knotel has reversed the WeWork model and instead of “We” branding everywhere, simply leases buildings, takes a small office for its staff and then kits out the building with modular furniture a company can just move straight into and call their own.

Knotel has now completed a $400 million financing, led by Wafra, an investment arm of the Sovereign Wealth Fund of Kuwait. Mori Trust (one of Japan’s leading real estate business operators), Itochu (one of Japan’s largest trading conglomerates) and Mercuria (a leading Japanese equity firm) also participated in the financing. Returning and previous Knotel investors include Norwest Venture Partners, Newmark Knight Frank, Bloomberg Beta and Rocket Internet.

Knotel will use the financing to grow its footprint in existing markets, continue expanding into “the world’s 30 largest cities” and also “deepen its engagement with global enterprise accounts.” Basically, that is code for going after the world’s biggest businesses who now require the flexibility of offices like they require AWS Cloud Service provision for their applications.

In a statement, Amol Sarva, co-founder and CEO of Knotel, said: “Knotel is building the future of the workplace, and we are excited to welcome a group of investors who believe passionately in our product, vision and ability to execute. Wafra will help us continue our rapid global expansion and solidify our position as the leader in a fast-growing, trillion-dollar flexible office market.”

Unlike traditional co-working players, which provide shared spaces for freelancers and company satellite locations, Knotel focuses on providing private and fully furnished workspaces to large enterprises. The whole idea is to make it very simple: flexible workspaces; cheaper capital expenditures; operational flexibility.

There is also a tech play here. Its “Baya” product is a blockchain platform used internally to facilitate data-driven acquisition decisions and reduce company costs, while “Geometry” is a subscription service to make furnishing your office far easier, faster and cost-flexible.

Speaking to TechCrunch, Sarva said: “This funding is timely because that other IPO [referring to the WeWork IPOD] is in the works. People have been complaining about some of the aspects of that and some of the inefficiencies they have. But the core of this new investment for us is about making the business capitally efficient.” He said everything they do is geared toward this.

He said Knotel will do this in three ways: “We will go way deeper into cities. Many individual cities are getting bigger than whole competitor companies in revenue. NYC, Paris, London SF. So doing that is way more efficient and others don’t understand this.

“Secondly we are adding about a dozen more cities. Not 1,200. No-one makes money in Cairo.

“Thirdly, every time we announce a product or tech product it’s about the core business. A product like Geometry, or modular furniture etc. That is all about making us grow faster with less capital. Making real estate less painful, faster and with less friction.”

The company now has more than 4 million square feet across more than 200 locations in New York, San Francisco, London, Los Angeles, Washington, D.C., Paris, Berlin, Toronto, Boston, São Paulo and Rio de Janeiro. In less than four years, the company has raised a total of $560 million, and is now valued at more than $1 billion. Its London footprint now stands at 263,000 square feet across 63 locations. It’s now aiming to be London’s top flexible office provider (by building count), having achieved this in New York earlier in the year, it says.

Powered by WPeMatico

Unlike most agencies, We Are Off The Record’s (WAOTR) mission is to advise and train in-house growth teams to scale their business. CEO and founder Bas Prass prides his team’s “train and transfer method” because it has allowed them to work with tech startups and giant corporations from all around the world. WAOTR is based in the Netherlands, but learn more about their approach to growth, agency values, and more.

Image via We Are Off the Record

“As far as I know, we’re still the only growth bureau in Europe with our approach to growth — we help startups from within. We work with their in-house teams, which means we are literally in the same room as our clients. We want to lead by example. I don’t believe in any other approach anymore because growth has to come from within the business itself.”

“WAOTR walks the talk: they actually do growth instead of solely advising.” Rutger Planken, Rotterdam, The Netherlands, Director & Founder, FoodServicehub

“Our ideal clients are the ones that understand that growth takes time and doesn’t happen overnight. They understand that we need to touch multiple domains within their business and that growth isn’t only in the marketing or product department but in the entire culture of the company. This is also the reason we insist to work with founders and/or want involvement from C-level positions.”

Below, you’ll find the rest of the founder reviews, the full interview, and more details like pricing and fee structures. This profile is part of our ongoing series covering startup growth marketing agencies with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already.

Yvonne Leow: How did you become a growth marketer and start working with tech startups?

Bas Prass: I started designing websites and building websites at the age of twelve and quickly figured out how to survive in the digital jungle. I learned by doing and was pretty active within online communities.

Powered by WPeMatico

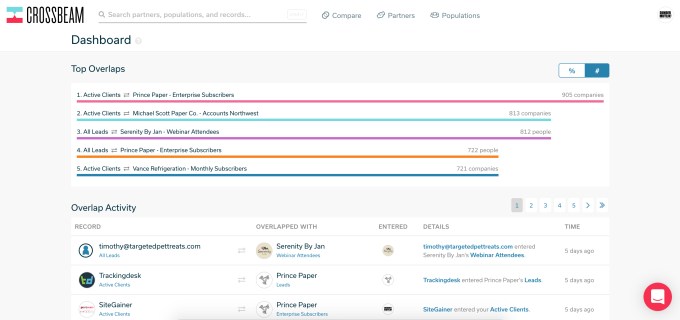

When Crossbeam CEO and co-founder Bob Moore was working at previous startups, he noticed a problem around sharing information with potential partners. In fact, it was so acute he decided to create a startup to solve that problem, and today, Crossbeam announced a $12.5 million Series A round led by FirstMark Capital, with participation from existing investors Uncork Capital and Slack Fund.

Moore says that in his previous jobs, he was encountering issues with getting partners integrated and answering basic questions like how many customers do we have in common or are my sales reps currently selling to any of the same people that your sales reps are selling to, and so forth.

“We eventually realized the reason these questions were hard to answer was that you can’t draw a Venn diagram of all the data unless you have all of the data in both of the circles,” Moore told TechCrunch. In other words, each company has only half of the picture, what they already know, and it’s hard to make data-driven decisions without more information.

Crossbeam Summary Dashboard (Screenshot: Crossbeam)

He added that there is danger in the age of GDPR and the upcoming California Consumer Privacy Act (CCPA) in oversharing of data, but at the other extreme is not sharing at all. Moore said he created Crossbeam to deal with this. “It seemed like the solution would be to build something that could almost function as an escrow service for data, which could sit between companies that are partnering with each other, and allow them to combine their data sets and identify that when certain conditions are met — like an overlapping need, or an overlapping customer — to take very specific precise actions as a result of that overlap,” Moore explained.

The product works by sharing data from tools like Salesforce, HubSpot or even a .csv file and comparing that data inside of Crossbeam. Partners can see the overlap and where it makes sense for them to work together. Sometimes that may involve customer names, but other times it may be common sales reps across accounts. He says that many companies start with highly trusted partners to get comfortable with the product before branching out.

The company, which was founded in July 2018, has 15 employees and is based in Philadelphia. It previously received a $3.3 million seed round at the end of 2018.

Powered by WPeMatico

Holy sonderangebot, startup fans — yet another special offer you don’t want to miss! You’ve got just three days left to take advantage of our a 2-for-1 summer flash sale on passes to Disrupt Berlin 2019. Imagine scoring two Innovator, Founder or Investor passes for the price of one. That’s some mighty big ROI.

Don’t delay, because this deep 2-for-1 discount offer disappears August 23 at precisely 11:59 p.m. (CEST). Buy your 2-for-1 passes right here.

You’ll get the full Disrupt experience at half the price. Sweet! Come and hear some of the startup world’s most innovative thinkers, founders and investors. They’ll join TechCrunch editors on the Disrupt Main Stage and discuss crucial tech and investor topics affecting startups of every stripe.

Want to delve deeper into one topic or have the chance to ask follow-up questions in a smaller, more personal setting? Then be sure to attend the Q&A Sessions. These audience-interactive discussions — moderated by TC editors — feature subject-matter experts answering your burning questions related to Disrupt Berlin’s category tracks — Artificial Intelligence/Machine Learning, Biotech/Healthtech, Blockchain, Fintech, Gaming, Investor Topics, Media, Mobility, Privacy/Security, Retail/E-commerce, Robotics/IoT/Hardware, SaaS, Space and Social Impact & Education.

The only way to benefit is to be there in person because we don’t record or stream these sessions — or allow media to attend (except for the moderating TC editors). Show up early, because seating is limited.

Networking is a major event at any Disrupt, and we’re making it easier than ever for you to find the right people — you know, the ones who align with your goals and can help you move forward. CrunchMatch — our free business-matching platform — cuts through the noise to help you zero in on the connections that matter most to you and your business.

We’ll notify all pass holders when CrunchMatch goes live. Then simply create a profile listing your specific criteria, goals and interests. CrunchMatch (powered by Brella) works a bit of algorithmic magic to find like-minded startuppers and will suggest matches and, subject to your approval, propose meeting times and send meeting requests.

You’ll be fully prepped and ready to explore the hundreds of early-stage startups in Startup Alley with a tool that helps you connect with just the right opportunities.

That’s only a taste of what Disrupt Berlin 2019 has to offer, and now you can get it — and a whole lot more — for a whole lot less. This special offer disappears on August 23 at 11:59 p.m. (CEST). Buy your 2-for-1 passes today. Sonderangebot!

Is your company interested in sponsoring or exhibiting at Disrupt Berlin 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

After his tenure as chief scientist at Baidu, Andrew Ng, the founder of the Google Brain project and former CEO of Coursera, set up a number of different projects that all focus on making AI more approachable. These include the education startup Deeplearning.ai, the AI Fund startup studio for building AI companies and Landing.ai, which helps enterprises (and especially manufacturing companies) use AI. Today, Ng announced he has opened a second office for these projects in Medellin, Colombia.

At first, Medellin may seem like an odd choice. But today’s Medellin is very different from the one you may have seen on Narcos (and a lot safer). It’s home to a number of universities and, over the course of the last few years, it’s a hub for Colombia’s startup scene thanks to incubators like Ruta N and others.

Ng told me that he chose Medellin after looking at a wide range of cities in Europe, Asia and Latin America. Medellin, he believes, offers a strong talent pool, educational system and business ecosystem. It also helps that the Colombia government has made tech a focus in recent years.

“I see early signs of momentum for Colombia being a talent magnet both regionally and globally,” he told me. Indeed, the company was able to hire team members from Poland, Bangladesh, Egypt and Chile for its offices in Medellin, which now has just under 50 people. Over the course of the next two years, Ng plans to expand this team to between 150 and 200 employees.

It’s important, Ng argues, that we set up AI hubs outside of Silicon Valley and China, in part, because they’ll provide a different perspective. “We are able to share our AI ecosystem and Silicon Valley know-how with Medellín,” he writes in today’s announcement. “We’re equally thrilled for our Silicon Valley team to be learning from the Medellín community. Local knowledge and innovation shared with a global community is what will catapult the technology forward.”

The teams in Medellin will work on all of Ng’s projects, including four unannounced stealth portfolio companies that are looking into using AI in sectors like healthcare, education and customer support. In total, the teams in Medellin are working on about a dozen projects right now. And that’s very much Ng’s approach to AI — and for Landing.ai in particular: build lots of specialized components for various verticals that can then be generalized. “AI isn’t some piece of SaaS software that everybody can just swipe their credit card and use,” he said.

Andrew Ng will also join us for our first TechCrunch Sessions: Enterprise event in San Francisco on September 5 to talk about Landing.ai and the future of AI in general. You can find more information about the event (and buy tickets) here.

Powered by WPeMatico

Cosi, a new Berlin-based startup operating in the hospitality space with an alternative to boutique hotels and managed short-stay apartments, has picked up €5 million in seed funding pre-launch.

Leading the round are venture capital firms Cherry Ventures and e.ventures, with participation from a number of travel, real estate and hospitality entrepreneurs and experts. They include Nils Regge (founder of HomeToGo and Dreamlines), Gleb Tritus (MD Lufthansa Innovation Hub), Manuel Stotz (founder of Kingsway Capital), Mato Peric (founder of Immo), Andreas Brehmke, Loric Ventures, and Lions Venture.

That’s quite a lineup for a company that won’t launch for another few months, but is no doubt based in part on the track record of Cosi’s founders.

They are Christian Gaiser, the startup’s CEO, who preciously founded Bonial.com, the local shopping platform sold to Axel Springer in 2011; Dimitri Chandogin, who co-founded Doc+, a prominent digital healthcare provider in Russia; and CTO Gerhard Maringer, who has a background in fintech and previously built ForexFix, an FX hedging platform.

“More and more guests prefer to stay in a unique apartment versus a boring hotel, i.e. travelers tend to book their stay at a private host via Airbnb. [However], the experience can be frustrating though due to lack of quality and service: long check-in/check-out times, poor interior design, lack of cleanliness, not enough linen, no service hotline in case of questions, to name a few examples,” Gaiser tells TechCrunch.

“Many guests, therefore, decide not to stay in a unique home for quality reasons. Cosi solves this problem as a full-stack hospitality brand: We control the entire guest journey from end-to-end.”

To offer a “full-stack” hospitality service that hopes to compete with well-run boutique hotels or traditional local managed apartments, Gaiser says the company signs long-term leases with property owners, and then furnishes those apartments itself to “control” the interior design experience. “On top of that, we offer a digital service along the entire guest journey from initial contact to loyalty. Finally, we rent out our apartments short-term as a hotel replacement,” he explains.

That requires technology to drive “the entire value chain,” and Gaiser points out that the tech guests experience directly is only the tip of the iceberg. “Running a hospitality business requires a lot of tools in the background for housekeeping, maintenance, yield management, to name a few, that will create an efficiency edge for us,” says the Cosi co-founder.

With regards to target customers, Cosi broadly covers travelers that want the quality assurance of a hotel but appreciate the unique design and “coziness” of a personal home. More specifically, the company has two main target groups in mind: tourists that spend a few days in Berlin to immerse themselves in the local culture and history (“live like a real Berliner”), and business travelers that need to stay several weeks or months and are fed up with the traditional hotel experience.

“Cosi creates a new category, but the closest direct competitors include smaller boutique hotels or traditional local serviced apartment operators for tourists,” says Gaiser. “In a broader sense, we also compete with the big hotel companies like Marriott or Hilton in business travel.”

There are potential U.S. competitors, too, with Sonder and Lyric operating a similar model. “They might also look into Europe,” concedes Gaiser, “[but] it will be challenging for them to comply with local regulations and to establish real estate relationships. It is a very local game.”

Powered by WPeMatico

Tala, a Santa Monica, Calif.-headquartered startup that creates a credit profile to provide uncollateralized loans to millions of people in emerging markets, has raised $110 million in a new financing round to enter India’s burgeoning fintech space.

The Series D financing for the five-year-old startup was led by RPS Ventures, with GGV Capital and previous investors IVP, Revolution Growth, Lowercase Capital, Data Collective VC, ThomVest Ventures and PayPal Ventures also participating in the round.

The new round, which takes the startup’s total fundraising to more than $215 million, valued it above $750 million, a person familiar with the matter told TechCrunch. Tala has also raised an additional $100 million in debt, including a $50 million facility led by Colchis in the last year.

Tala looks at a customer’s texts and calls logs, merchant transactions, overall app usage and other behavioral data through its Android app to build their credit profile. Based on these pieces of information, its machine learning algorithms evaluate the individual risk and provide instant loans in the range of $10 to $500 to customers.

This model is different from how banks and most other online lenders assess a person’s eligibility for a loan. Banks look at a user’s credit score while most online lenders check the financial history.

Tala is also much faster. It approves loans within minutes and disburses the money via mobile payment platforms. The startup has lent over $1 billion to more than 4 million customers to date — up from issuing $300 million in loans to 1.3 million customers last year, Shivani Siroya, founder and CEO of Tala, told TechCrunch in an interview.

The startup, which employs more than 550 people, will use the new capital to enter India, said Siroya, who built Tala after interviewing thousands of small and micro-businesses.

In the run up to launch in India, Tala began a 12-month pilot program in the country last year to conduct user research and understand the market. It has also set up a technology hub in Bangalore, she said.

Shivani Siroya (Tala CEO) at TechCrunch Disrupt NY 2017

“The opportunity is very massive in India, so we spent some time customizing our service for the local market,” she said.

According to World Bank, more than 2 billion people globally have limited access to financial services and working capital. For these people, many of whom live in India, securing a small size loan is extremely challenging as they don’t have a credit score.

In recent years, several major digital payment platforms in India, including Paytm and MobiKwik, have started to offer small-sized loans to users. Traditional banks are still lagging to serve this segment, industry executives say. (Outside India, Tala competes with Branch, a five-year-old San Francisco-based startup that has raised more than $170 million to date and earlier this year inked a deal with Visa.)

Tala goes a step further and takes liability for any unpaid returns, Siroya said. More than 90% of Tala users pay back their loan in 20 to 30 days and are recurring customers, she added.

The startup also forwards the positive credit history and rankings to the local credit bureaus to help people secure bigger and long-term loans in the future, she added.

Tala, which charges a one-time fee that is as low as 5% for each loan, relies on referrals, and some marketing through radio and television to acquire new customers. “But a lot of these users come because they heard about us from their friends,” Siryoa said.

As part of the new financing round, Kabir Misra, founding general partner of RPS Ventures, has joined Tala’s board of directors, the startup said.

Tala said it will use a portion of its new fund to expand its footprint and team in its existing markets — East Africa, Mexico and the Philippines — and also build new solutions.

Siroya said the startup has identified some more markets that it wishes to serve. She did not disclose the names, but said she is eyeing more countries in South Asia and Latin America.

Powered by WPeMatico

Tandem, one of the most sought after companies to graduate from Y Combinator’s summer batch, will emerge from the accelerator program with a supersized seed round and an uncharacteristically high valuation.

The months-old business, which is developing communication software for remote teams after pivoting from crypto, is raising a $7.5 million seed financing at a valuation north of $30 million, sources tell TechCrunch. Airbnb investor Andreessen Horowitz is leading the round.

Tandem and a16z declined to comment for this story. The round has yet to close, which means the deal size is subject to change. Y Combinator startups raise capital using SAFE agreements, or simple agreements for future equity, which allow investors to buy shares in a future priced round at a previously agreed-upon valuation.

We’re told several top venture capital firms were vying for a stake in Tandem. One firm even gifted the founders a tandem bike, sources tell TechCrunch, resorting to amusing measures to sway the Tandem team. But it was A16z — which has an established interest in the growing future of work sector, evidenced by its recent investment in the popular email app Superhuman — that ultimately won the coveted lead investor spot.

Tandem provides a virtual office for remote teams, complete with video-chatting and messaging capabilities, as well as integrations with top enterprise tools including Notion, GitHub and Trello. The service launched one month ago and has signed contracts with Airbnb, Dropbox and others. The company claims to be growing 50% week-over-week.

“Every company is a remote company,” Tandem chief executive officer Rajiv Ayyangar said during his pitch to investors on day two of Y Combinator Demo Days this week. “You have salespeople in the field, [companies with] multiple offices, people working from home. Tandem isn’t just building the future of remote work, it’s building the future of work.”

Ayyangar was previously a data scientist at Yahoo before joining Yakit, a startup seeking to simplify ecommerce delivery, as the director of product. Co-founders Bernat Fortet Unanue and Tim Su are also Yahoo alums.

We’re told Tandem’s fundraise was nearly complete before it pitched to investors Tuesday afternoon. Startups that participate in YC are often flooded with offers from VCs throughout the three-month program. Firms are hungry for the batch’s Airbnb, Dropbox or Stripe — graduates of the program — and will pay premiums on startup equity for their chance to invest in a future ‘unicorn.’

As a result, the median seed deal for U.S. startups in 2018 was roughly $2 million — a record high — with typical pre-money valuations hovering north of $10 million. Tandem’s seed financing represents both a trend of swelling seed deals and valuations, as well as a tendency for VCs to dole out more cash to fresh-from-YC companies amid heightened competition amongst their peers.

The previous YC batch, which wrapped up in March, included ZeroDown, Overview.AI and Catch, a trio of companies that pocketed venture capital ahead of demo day. ZeroDown, a financing solution for real estate purchases in the Bay Area, raised upwards of $10 million at a $75 million valuation before demo day, sources told TechCrunch at the time (months after demo day, Zero Down announced a whopping $30 million financing). ZeroDown was an outlier, of course, as the company’s founders had previously co-founded the billion-dollar HR software company Zenefits.

As for the summer batch, we’re told Actiondesk, Taskade and Tandem are amongst the startups to garner the most hype from investors. Some even forwent the demo day pitch altogether. BraveCare, which is creating urgent care clinics intended just for kids, raised $4.1 million ahead of demo day, we’re told. The company opted not to pitch to additional investors this week.

You can read about all the company’s that pitched during demo day one here and demo day two here.

Powered by WPeMatico