Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Megvii Technology, the Beijing-based artificial intelligence startup known in particular for its facial recognition brand Face++, has filed for a public listing on the Hong Kong stock exchange.

Its prospectus did not disclose share pricing or when the IPO will take place, but Reuters reports that the company plans to raise between $500 million and $1 billion and list in the fourth quarter of this year. Megvii’s investors include Alibaba, Ant Financial and the Bank of China. Its last funding round was a Series D of $750 million announced in May that reportedly brought its valuation to more than $4 billion.

Founded by three Tsinghua University graduates in 2011, Megvii is among China’s leading AI startups, with its peers (and rivals) including SenseTime and Yitu. Its clients include Alibaba, Ant Financial, Lenovo, China Mobile and Chinese government entities.

The company’s decision to list in Hong Kong comes against the backdrop of an economic recession and political unrest, including pro-democracy demonstrations, factors that have contributed to a slump in the value of the benchmark Hang Seng index. Last month, Alibaba reportedly decided to postpone its Hong Kong listing until the political and economic environment becomes more favorable.

Megvii’s prospectus discloses both rapid growth in revenue and widening losses, which the company attributes to changes in the fair value of its preferred shares and investment in research and development. Its revenue grew from 67.8 million RMB in 2016 to 1.42 billion RMB in 2018, representing a compound annual growth rate of about 359%. In the first six months of 2019, it made 948.9 million RMB. Between 2016 and 2018, however, its losses increased from 342.8 million RMB to 3.35 billion RMB, and in the first half of this year, Megvii has already lost 5.2 billion RMB.

Investment risks listed by Megvii include high R&D costs, the U.S.-China trade war and negative publicity over facial recognition technology. Earlier this year, Human Rights Watch published a report that linked Face++ to a mobile app used by Chinese police and officials for mass surveillance of Uighurs in Xinjiang, but it later added a correction that said Megvii’s technology had not been used in the app. Megvii’s prospectus alluded to the report, saying that in spite of the correction, the report “still caused significant damages to our reputation which are difficult to completely mitigate.”

The company also said that despite internal measures to prevent misuse of Megvii’s tech, it cannot assure investors that those measures “will always be effective,” and that AI technology’s risks and challenges include “misuse by third parties for inappropriate purposes, for purposes breaching public confidence or even violate applicable laws and regulations in China and other jurisdictions, bias applications or mass surveillance, that could affect user perception, public opinions and their adoption.”

From a macroeconomic perspective, Megvii’s investment risks include the restrictions and tariffs placed on Chinese exports to the U.S. as part of the ongoing trade war. It also cited reports that Megvii is among the Chinese tech companies the U.S. government may add to trade blacklists. “Although we are not aware of, nor have we received any notification, that we have been added as a target of any such restrictions as of the date this Document, the existence of such media reports itself has already damaged our reputation and diverted our management’s attention,” the prospectus said. “Whether or not we will be included as a target for economic and trade restrictions is beyond our control.”

Powered by WPeMatico

Hello and welcome back to Startups Weekly, a weekend newsletter that dives into the week’s noteworthy startups and venture capital news. Before I jump into today’s topic, let’s catch up a bit. Last week, I wrote about the flurry of IPO filings. Before that, I noted the differences between raising cash from angels vs. traditional venture capitalists.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

Venture capitalists look for companies poised to disrupt markets untouched by innovative technology. Believe it or not, a very small percentage of jewelry shopping is done online, which means there’s a big opportunity — for the right team — to bring jewelry buyers and sellers to the 21st century.

Enter Pietra, a new startup that’s just raised $4 million in a round led by Andreessen Horowitz’s Andrew Chen (Substack & Hipcamp investor). Robert Downey Jr.’s VC fund Downey Ventures and Will Smith’s fund Dreamers Fund also participated, as did Hollywood manager Scooter Braun, Michael Ovitz and supermodel Joan Smalls.

I spoke to the founding team, which includes Uber alum Ronak Trivedi and Ashley Bryan, who hails from fashion e-commerce site Moda Operandi. The pair bring a healthy mix of technology and fashion expertise to the mix. Trivedi tells TechCrunch he’s drawn on his Uber experience to recruit engineers from top tech companies and to advocate for fast growth. Meanwhile, Bryan has leveraged her fashion industry connections to establish relationships with luxury designers.

“Fashion is typically really under-resourced in terms of tech,” Bryan tells TechCrunch. “[The fashion industry] is great at the creativity part but it’s tough, especially with jewelry because you really have to put up a lot of capital.”

Pietra’s plan is to create a high-end marketplace for consumers to connect with jewelry designers. To do this, the team has adopted the standard marketplace approach, taking a 30% marketplace fee from sellers, as well as a 7% fee from buyers commissioning jewelry on the platform.

“Whether you do custom jewelry or engagement jewelry or you do jewelry for celebrities like Drake, you can come on Pietra and connect with a global marketplace,” says Trivedi.

The jewelry market is expected to be worth more than $250 billion by 2020, according to McKinsey research. And where there’s a billion-dollar market, there are VCs.

“Even though gemstones and jewelry have been at the center of art, commerce, and culture since the dawn of human civilization — going from stone jewelry created 40,000 years ago in Africa to the trade routes between East and West to Fifth Avenue in New York to the Instagram feed on your phone — the technology for discovering, designing, and purchasing jewelry online hasn’t evolved much at all,” writes a16z’s Chen, who overlapped with Trivedi during his Uber tenure.

Pietra completed its official launch this week. It has 100 designers on the platform and counting, along with what the founders say is a lengthy waitlist.

This week I published a long feature on the state of seed investing in the Bay Area. The TL;DR? Mega-funds are increasingly battling seed-stage investors for access to the hottest companies. As a result, seed investors are getting a little more creative about how they source deals. It’s a dog-eat-dog world out there and everyone wants a stake in The Next Big Thing. Read the story here.

Y Combinator graduated another batch of 200 companies this week. We were there both days, taking notes on each and every company. To make things easy on you, I’ve put together the ultimate YC reading list:

Here’s a look at some of the profiles we’ve written on the S19 companies:

We recorded two great episodes of Equity, TechCrunch’s venture capital podcast, this week. The first was with YC CEO Michael Seibel, in which he speaks to trends at the seed stage of investing, changes at the accelerator program, including its move to San Francisco and more. You can listen to that one here. Plus, we had on Unusual Ventures co-founder and partner John Vrionis, who talked to us about direct listings versus IPOs and the future of DoorDash and Airbnb. You can listen to that one here.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast and Spotify.

Contributors Tyler Elliston and Kevin Barry share advice for B2B companies: “Over the years, we’ve seen a lot of B2B companies apply ineffective demand generation strategies to their startup. If you’re a B2B founder trying to grow your business, this guide is for you. Rule #1: B2B is not B2C. We are often dealing with considered purchases, multiple stakeholders, long decision cycles, and massive LTVs. These unique attributes matter when developing a growth strategy. We’ll share B2B best practices we’ve employed while working with awesome B2B companies like Zenefits, Crunchbase, Segment, OnDeck, Yelp, Kabbage, Farmers Business Network, and many more.” Read the full story here. (Extra Crunch membership required.)

Powered by WPeMatico

It’s easy to forget that Silicon Valley starts with ‘silicon’, and that there would be no technology innovation without innovation at the silicon level. And Graphcore is well aware of that as the Bristol-based company is designing its own dedicated AI chipset. That’s why I’m glad to announce that Graphcore co-founder and CEO Nigel Toon is joining us at TechCrunch Disrupt Berlin.

Graphcore has managed to attract a ton of attention from day one. Originally founded in 2016, the startup has raised more than $300 million from top investors, such as Sequoia Capital, BMW, Microsoft, Samsung and a ton of others.

The company last raised a $200 million Series D round led by Atomico and Sofina. It values the company at $1.7 billion.

So what is the magic product behind Graphcore? The startup’s flagship product is an Intelligence Processor Unit (IPU) PCIe processor card combined with a software framework. Essentially, it lets you build your own AI applications more efficiently. Those dedidacted AI chips should perform better than repurposed GPUs.

Tobias Jahn, principal at BMW i Ventures, summed it up pretty well in a statement for the Series D round: “The versatility of Graphcore’s IPU – which supports multiple machine learning techniques with high efficiency – is well-suited for a wide variety of applications from intelligent voice assistants to self-driving vehicles. With the flexibility to use the same processor in both a data centre and a vehicle, Graphcore’s IPU also presents the possibility of reduction in development times and complexity.”

It seems crazy that a tiny startup is competing directly with giant chip companies, such as Nvidia, AMD, Intel, Qualcomm, etc. But this isn’t Nigel Toon’s first company. He has been the CEO of Picochip and Icera, two companies that have been sold to Intel and Nvidia.

Graphcore believes that there’s an underserved niche with a lot of potential. And it feels like there’s a race to create the most efficient AI chip. So I can’t wait to hear Nigel Toon’s take on that race.

Buy your ticket to Disrupt Berlin to listen to this discussion and many others. The conference will take place on December 11-12.

In addition to panels and fireside chats, like this one, new startups will participate in the Startup Battlefield to compete for the highly coveted Battlefield Cup.

Graphcore (graphcore.ai) is a new silicon and systems company based in Bristol, UK and Palo Alto, USA that has developed a new type of processor, the Intelligence Processing Unit (IPU), to accelerate machine learning and AI applications. Since its founding in 2016, Nigel has secured over $300m in funding and support for the company from some of the world’s leading venture capital firms including Sequoia Capital, Foundation Capital and Atomico, from major corporations including BMW, Bosch, Dell, Microsoft and Samsung and from eminent Artificial Intelligence innovators.

Nigel has a background as a technology business leader, entrepreneur and engineer having been CEO at two successful VC-backed processor companies XMOS and Picochip (sold to Nasdaq:MSPD, now Intel), a founder at Icera (sold to Nasdaq: NVDA) and VP/GM at Altera (Nasdaq: ALTR, sold to Intel for $17Bn) where he spent over 13 years and was responsible for establishing and building the European business unit that he grew to over $400m in annual revenues. Nigel was a non-executive director at Imagination Technologies PLC until itsacquisition in 2017 and is the author on 3 patents.

Powered by WPeMatico

The day of reckoning for the “flexible office space as a startup” is coming, and it’s coming up fast. WeWork’s IPO filing has fired the starting gun on the race to become the game-changer both in the future of property and real estate but also the future of how we live and work. As Churchill once said, “we shape our buildings and afterwards our buildings shape us.”

Until recently, WeWork was the ruler by which other flexible-space startups were measured, but questions are now being asked if it deserves its valuation. The profitable IWG plc, formerly Regus, has been a business providing serviced offices, virtual offices, meeting rooms and the rest, for years, and yet WeWork is valued by 10 times more.

That’s not to mention how it exposes landlords to $40 billion in rent commitments, something which a few of them are starting to feel rather nervous about.

Some analysts even say WeWork’s IPO is a “masterpiece of obfuscation.”

Powered by WPeMatico

India today addressed a long-standing challenge that has been affecting the country’s booming startup ecosystem. As part of a raft of measures to boost overall economic growth from a five-year low, Finance Minister Nirmala Sitharaman said New Delhi is exempting startups from Section 56(2) — a provision more popularly known as an “angel tax” in the local income tax laws — that required startups to pay a certain tax if they received an investment at a rate higher than their “fair market valuation.”

Local tax authority in India does not recognize the discounted cash flow method that many investors use to value early-stage startups, and instead value the company for what it is worth currently, which as you can imagine, is very little. Investors assess a startup’s value based on what it could eventually become in the future.

Prior to today’s announcement, the government levied a 30% tax on affected startups. Sitharaman said any startup that is registered with the Department of Industrial Policy & Promotion, a government body, will be exempted from the angel tax. Those not registered will remain subjected to it, she said in a press conference Friday.

More than 24,000 startups are currently registered with the Department of Industrial Policy & Promotion. The law was originally introduced amid concerns that wealthy people could invest in bogus startups as a way to launder money.

“Angel tax was there to stop shell companies from creating capital from nowhere,” Piyush Goyal, a minister for commerce and industry as well as railways, said in a statement Friday.

The angel tax, which was introduced in 2012, became a roadblock for many investors who wanted to fund early-stage startups. The announcement today comes weeks after the Narendra Modi government said it would address this issue.

Many prominent investors, startup founders, analysts and other industry executives have long publicly criticized the angel tax, telling the government that it is severely hurting the health of the local ecosystem.

Anand Mahindra, chairman of Mahindra Group, said last year that the angel tax needs “immediate attention or else all chances of building a rival to Silicon Valley in India will be lost.”

Sreejith Moolayil, a founder of health food startup True Elements, said the existence of an angel tax would leave many entrepreneurs like him with no choice but to shut down their companies.

Late last year, India’s tax department sent a flurry of notices to startups demanding them to pay the angel tax on funds they received from individual investors. The notices sparked an uproar, with many calling it “harassment.”

“Hope this will address the concerns of DPIIT registered startups. The proposed cell should look into concerns of all startups including those who are already under notice,” said Ashish Aggarwal, who oversees Public Policy at industry body Nasscom, of today’s announcement.

The government will also set up a dedicated cell to address other tax problems that startups face, Sitharaman said. “A startup having any income-tax issue can approach the cell for quick resolution,” the ministry said in a statement.

Jayanth Kolla, founder and chief analyst at research firm Convergence Catalyst, told TechCrunch earlier that the angel tax was the primary reason early-stage startups in the nation were struggling to raise money from investors.

Even as Indian tech startups raised a record $10.5 billion in 2018, early-stage startups saw a decline in the number of deals they participated in and the amount of capital they received. Early-stage startups participated in 304 deals in 2018 and raised $916 million in funds last year, down from $988 million they raised from 380 rounds in 2017 and $1.096 billion they raised from 430 deals the year before, research firm Venture Intelligence told TechCrunch.

I’ve said before, a willingness to relook at policies is a display of strength, not https://t.co/8y4tPp8Iva’s press conference by @nsitharaman will, I hope, mark the start of a new, interactive & interdependent relationship between Govt&business. @narendramodi @AmitShah (1/4)

— anand mahindra (@anandmahindra) August 23, 2019

Sitharaman also announced the country was scrapping a recently introduced additional levy on foreign funds. The government would revoke the surcharge, which increased tax on foreign companies investing in India to over 40%, she said. She also promised to pay out all pending tax refunds owed to small and medium enterprises within 30 days. Companies have long complained that the tax authority takes too much time to refund the money owed to them.

Powered by WPeMatico

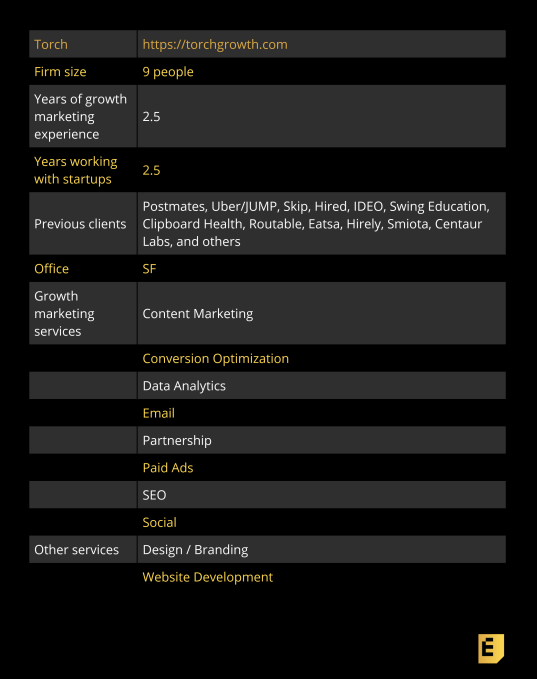

CEO Jeremy OBriant never intended to create Torch, an agile growth marketing agency based in San Francisco. He started his career as a CPA, but after leading a growth team at Sidecar and running growth projects on his own, forming Torch was the most obvious thing to do. He now leads a team that implements “agile growth,” an iterative approach that involves setting clear goals and running smaller experiments over the course of monthly sprints. Learn more about their approach to growth, their ideal client, and more.

“Torch offers custom solutions to whatever you need. They are fast and deliver on what they promise. They are also scrappy and willing to try stuff to solve unique needs.” Head of Product in SF

“We aim to be the thought leaders of Agile Growth. We didn’t invent the term, but we are certainly becoming the leading voice of the process in the growth marketing world. Agile simply means being able to move quickly and with ease. We start with clearly defined business goals and prioritize growth tactics based on the impact, cost, and efficiency. Then collaborate with growth teams to execute a handful of items in recurring growth sprints, typically on a monthly cadence.”

“Our ideal partner has product-market fit, is redefining their category, and is ready to scale in a sustainable way. We are very strategic in the types of businesses we work with and steer clear of doing narrow prescriptive tactics. We love to collaborate with partners that are open to taking a fresh strategic look at their entire growth stack and embrace the agile approach to discover the right strategy for their unique situation.”

Below, you’ll find the rest of the founder reviews, the full interview, and more details like pricing and fee structures. This profile is part of our ongoing series covering startup growth marketing agencies with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already.

Yvonne Leow: Tell me about your background and how you became a growth marketer.

Jeremy OBriant: People are often surprised when I tell them I started my career as a CPA. I ended up working in the trenches on several M&A deals and heard lots of founding stories from entrepreneurs.

Powered by WPeMatico

One of the private companies aiming to deliver a commercial lunar lander to the Moon has adjusted the timing for its planned mission, which isn’t all that surprising, given the enormity of the task. Japanese startup ispace is now targeting 2021 for their first lunar landing, and 2023 for a second lunar mission that will also include deploying a rover on the Moon’s surface.

The company’s HAKUTO-R program was originally planned to include a mission in 2020 that would involve sending a lunar orbital vehicle for demonstration purposes without any payloads, but that part of the plan has been scrapped in favor of focusing all efforts on delivering actual payloads for commercial customers by 2021 instead.

This updated focus, the company says, is due mostly to the speeding up of the global market for private launch services and payload delivery, including for things like NASA’s Commercial Lunar Payload Services program, wherein the agency is looking for a growing number of private contractors to support its own needs in terms of getting stuff to the Moon.

Although ispace itself isn’t on the list of nine companies selected in round one of NASA’s program, the Japanese company is supporting American nonprofit Draper in its efforts, which was one of the chosen. The Draper/ispace team-up happened after ispace’s initial commitment to its 2020 orbital demo, so its change in priorities makes sense given the new tie-up.

HAKUTO-R will use SpaceX’s Falcon 9 for its first missions, and the company has also signed partnerships with JAXA, Japan’s space agency, as well as new corporate partners including Suzuki, Sumitomo Corporation, Shogakukan and Citizen Watch.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we were helmed by Kate Clark, Alex Wilhelm and yet another extra special guest. Unusual Ventures co-founder and partner John Vrionis joined us to talk soil investing (yes, it’s a thing), seed investing, growth investing and all the somewhat meaningless funding stages.

Vrionis was a longtime investor at Lightspeed Venture Partners and has made big bets on a number of companies, including AppDynamics, Heptio and MuleSoft.

It was a great episode that kicked off with some conversation around DoorDash, the food delivery company that continues to make headlines week after week. We’d like to stop talking about the company, but it intrudes regularly into our notes.

This time DoorDash bought a few companies, purchases that appear set to allow the firm to boost its investment and research into self-driving delivery robots. (Kate saw one in the wild recently!)

Next we went deep into the subject of seed. John, of course, has been a seed investor for years and has lots to say on the topic. Mostly, we discussed Kate’s latest piece on mega-funds making an increasing number of deals at the earliest stage. John doesn’t think “stage-agnostic” investing makes any sense. You need experts at each stage making bets on a specific type of company. In his words, “a heart surgeon wouldn’t deliver your baby, right.”

Then we moved on to one of our favorite subjects, namely direct listings, the IPO market and if money is too often left on the table. The question takes on extra import when we see results like Dynatrace’s IPO, which rose around 50% its first day. It seems likely that we’ll see other companies pursue the sort of direct listings that Spotify and Slack managed.

That segued us brilliantly into our final topic: Airbnb and its financial health. The firm, we reckon, is a good candidate for a direct listing itself. We talked over its numbers, and if we were to sum up our perspectives, we’d say that Airbnb is about as impressive as we expected.

All that and we had fun, as usual.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Some eight months after it was reported that Ping Identity’s owners Vista Equity had hired bankers to explore a public listing, today Ping Identity took the plunge: the Colorado-based online ID management company has filed an S-1 form indicating that it plans to raise up to $100 million in an IPO on the Nasdaq exchange under the ticker “Ping.”

While the initial S-1 filing doesn’t have an indication of price range, Ping is said to be looking at a valuation of between $2 billion and $3 billion in this listing.

The company has been around since 2001, founded by Andre Durand (who is still the CEO), and it was acquired by Vista in 2016 for about $600 million — at a time when a clutch of enterprise companies that looked like strong IPO candidates were going the private equity route and staying private instead.

But more recently, there has been a surge in demand for better IT security linked to identity and authentication management, so it seems that Vista Equity is selling up. The PE firm is taking advantage of the fact that the market’s currently very strong for tech IPOs, but there is so much M&A in enterprise right now (just yesterday VMware acquired not one but two companies, Carbon Black for $2.1 billion and Pivotal for $2.7 billion) that I can’t help but wonder if something might move here too.

The S-1 reveals a number of details on the company’s financials, indicating that it’s currently unprofitable but on a steady growth curve. Ping had revenues of $112.9 million in the first six months of 2019, versus $99.5 million in the same period a year before. Its loss has been shrinking in recent years, with a net loss of $3.1 million in the first six months of this year versus $5.8 million a year before (notably in 2017 overall it was profitable with a net income of $19 million. It seems that the change is due to acquisitions and investing for growth).

Its annual run rate, meanwhile, was $198 million for the first six months of the year, compared to $159.6 million in the same period a year ago.

The area of identity and access management has become a cornerstone of enterprise IT, with companies looking for efficient and secure ways to centralise how not just their employees, but their customers, their partners and various connected devices on their networks can be authenticated across their cloud and on-premise applications.

The demand for secure solutions covering all the different aspects of a company’s IT stack has grown rapidly over recent years, spurred not just by an increased move to centralised applications served through the cloud, but also by the drastic rise in breaches where malicious hackers have exploited vulnerabilities and loopholes in companies’ sign-on screens.

Ping has been one of the bigger companies building services in this area and tackling all of those use cases, competing with the likes of Okta, OneLogin, AuthO, Cisco and dozens more off-the-shelf and custom-built solutions.

The company offers its services on an SaaS basis, covering services like secure sign-on, multi-factor authentication, API access security, personalised and unified profile directories, data governance and AI-based security policies. It claims to be the pioneer of “Intelligent Identity,” using AI to help its system analyse user, device and network behavior to better identify potentially malicious activity.

More to come.

Powered by WPeMatico

3D printing has become commonplace in the hardware industry, but because few materials can be used for it easily, the process rarely results in final products. A Swiss startup called Spectroplast hopes to change that with a technique for printing using silicone, opening up all kinds of applications in medicine, robotics and beyond.

Silicone is not very bioreactive, and of course can be made into just about any shape while retaining strength and flexibility. But the process for doing so is generally injection molding, great for mass-producing lots of identical items but not so great when you need a custom job.

And it’s custom jobs that ETH Zurich’s Manuel Schaffner and Petar Stefanov have in mind. Hearts, for instance, are largely similar but the details differ, and if you were going to get a valve replaced, you’d probably prefer yours made to order rather than straight off the shelf.

“Replacement valves currently used are circular, but do not exactly match the shape of the aorta, which is different for each patient,” said Schaffner in a university news release. Not only that, but they may be a mixture of materials, some of which the body may reject.

But with a precise MRI the researchers can create a digital model of the heart under consideration and, using their proprietary 3D printing technique, produce a valve that’s exactly tailored to it — all in a couple of hours.

A 3D-printed silicone heart valve from Spectroplast.

Although they have created these valves and done some initial testing, it’ll be years before anyone gets one installed — this is the kind of medical technique that takes a decade to test. So in the meantime they are working on “life-improving” rather than life-saving applications.

One such case is adjacent to perhaps the most well-known surgical application of silicone: breast augmentation. In Spectroplast’s case, however, they’d be working with women who have undergone mastectomies and would like to have a breast prosthesis that matches the other perfectly.

Another possibility would be anything that needs to fit perfectly to a person’s biology, like a custom hearing aid, the end of a prosthetic leg or some other form of reconstructive surgery. And of course, robots and industry could use one-off silicone parts as well.

![]()

There’s plenty of room to grow, it seems, and although Spectroplast is just starting out, it already has some 200 customers. The main limitation is the speed at which the products can be printed, a process that has to be overseen by the founders, who work in shifts.

Until very recently Schaffner and Stefanov were working on this under a grant from the ETH Pioneer Fellowship and a Swiss national innovation grant. But in deciding to depart from the ETH umbrella they attracted a 1.5 million Swiss franc (about the same as dollars just now) seed round from AM Ventures Holding in Germany. The founders plan to use the money to hire new staff to crew the printers.

Right now Spectroplast is doing all the printing itself, but in the next couple of years it may sell the printers or modifications necessary to adapt existing setups.

You can read the team’s paper showing their process for creating artificial heart valves here.

Powered by WPeMatico