Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

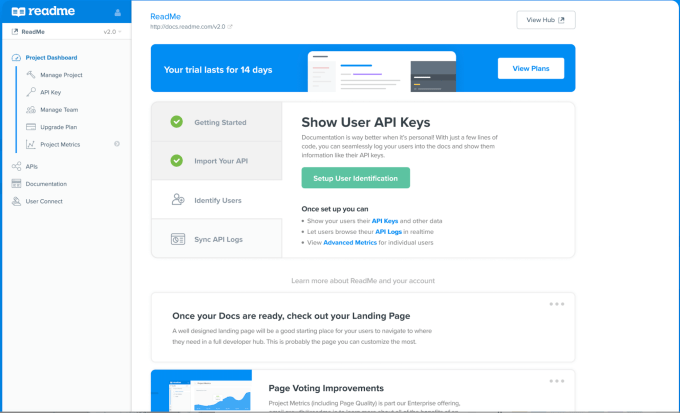

Software APIs help different tools communicate with one another, let developers access essential services without having to code it themselves and are critical components for driving a platform-driven strategy. Yet they require solid documentation to help make the best use of them. ReadMe, a startup that helps companies customize their API documentation, announced a $9 million Series A today led by Accel with help from Y Combinator. The company was part of the Y Combinator Winter 2015 cohort.

Prior to today’s funding announcement, the company had taken just a $1.2 million seed round in 2014. Today, it reports 3,000 paying customers and that it has been profitable for the last several years, an unusual position for a startup. In spite of this success, co-founder and CEO Gregory Koberger said as the company has taken on larger customers, they have more sophisticated requirements, and that prompted them to take this round of funding.

In addition, it has expanded the platform to use a company’s API logs to help create more dynamic documentation and improve customer support kinds of scenarios. But by taking on data from other companies, it needs to make sure the data is secure, and today’s funding will help in that regard.

“We’re going to still build the company traditionally by hiring more engineers, more support people, more designers, the obvious stuff, but the main impetus for doing this was that we started working with bigger companies with more secure data. So a lot of the money is going to help make sure that we handle that right,” Koberger explained.

Image: ReadMe

He says this ability to make use of the API logs has opened up all kinds of possibilities for the company, as the data provides a valuable window into how people use the APIs. “It’s amazing how much you get by just actually seeing what the server sees. When people are having problems with an API, they can debug it themselves because they can actually see the problems, the support team can see it as well,” Koberger said.

Accel’s Dan Levine, whose firm is leading the investment, believes that having good documentation is the difference between making and breaking an API. “APIs don’t just create technical integration, they create ecosystems around core services and underpin corporate partnerships that generate billions of dollars. ReadMe is as much a strategy as it is a service for businesses. Providing clean, interactive, data-driven API documentation to make developers love working with you can be the difference between 100 partnerships or 1,000 partnerships,” Levine said.

ReadMe was founded in 2014. It has 22 employees in their San Francisco office, a number that should increase with today’s funding.

Powered by WPeMatico

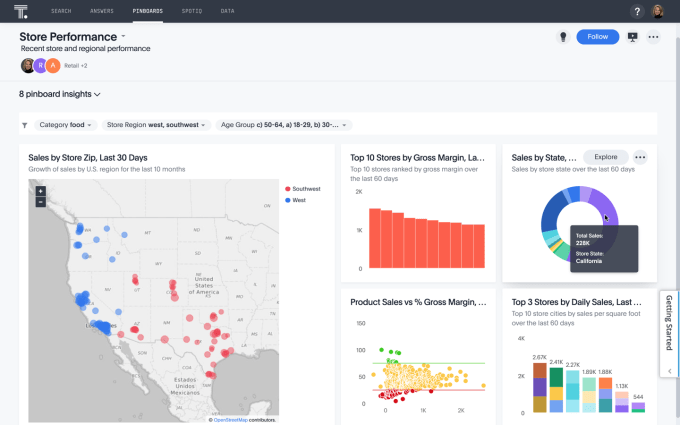

ThoughtSpot was started by a bunch of ex-Googlers looking to bring the power of search to data. Seven years later the company is growing fast, sporting a fat valuation of almost $2 billion and looking ahead to a possible IPO. Today it announced a hefty $248 million Series E round as it continues on its journey.

Investors include Silver Lake Waterman, Silver Lake’s late-stage growth capital fund, along with existing investors Lightspeed Venture Partners, Sapphire Ventures and Geodesic Capital. Today’s funding brings the total raised to $554 million, according to the company.

The company wants to help customers bring speed to data analysis by answering natural language questions about the data without having to understand how to formulate a SQL query. As a person enters questions, ThoughtSpot translates that question into SQL, then displays a chart with data related to the question, all almost instantly (at least in the demo).

It doesn’t stop there though. It also uses artificial intelligence to understand intent to help come up the exact correct answer. ThoughtSpot CEO Sudheesh Nair says that this artificial intelligence underpinning is key to the product. As he explained, if you are looking for the answer to a specific question, like “What is the profit margin of red shoes in Portland?,” there won’t be multiple answers. There is only one answer, and that’s where artificial intelligence really comes into play.

“The bar on delivering that kind of answer is very high and because of that, understanding intent is critical. We use AI for that. You could ask, ‘How did we do with red shoes in Portland?’ I could ask, ‘What is the profit margin of red shoes in Portland?’ The system needs to know that we both are asking the same question. So there’s a lot of AI that goes behind it to understand the intent,” Nair explained.

Image: ThoughtSpot

ThoughtSpot gets answers to queries by connecting to a variety of internal systems, like HR, CRM and ERP, and uses all of this data to answer the question, as best it can. So far, it appears to be working. The company has almost 250 large-company customers, and is on a run rate of close to $100 million.

Nair said the company didn’t necessarily need the money, with $100 million still in the bank, but he saw an opportunity, and he seized it. He says the money gives him a great deal of flexibility moving forward, including the possibility of acquiring companies to fill in missing pieces or to expand the platform’s capabilities. It also will allow him to accelerate growth. Plus, he sees the capital markets possibly tightening next year and he wanted to strike while the opportunity was in front of him.

Nair definitely sees the company going public at some point. “With these kind of resources behind us, it actually opens up an opportunity for us to do any sort of IPO that we want. I do think that a company like this will benefit from going public because Global 2000 kind of customers, where we have our most of our business, appreciate the transparency and the stability represented by public companies,” he said.

He added, “And with $350 million in the bank, it’s totally [possible to] IPO, which means that a year and a half from now if we are ready to take the company public, we can actually have all options open, including a direct listing, potentially. I’m not saying we will do that, but I’m saying that with this kind of funding behind us, we have all those options open.”

Powered by WPeMatico

About one-fourth of the startups in Y Combinator’s summer batch had a female founder. Not the most disappointing statistic if you consider this: Companies with at least one female founder have raised only about 11% of venture capital funding in the U.S. in 2019, according to PitchBook. Companies with female founders exclusively have raised just 3%.

There is so much room for improvement.

To close the funding gap, programs tailored to female entrepreneurs are working tirelessly to mentor and incubate upstarts in hopes of impressing venture capitalists. Ready, Set, Raise, an accelerator program built for women, by women, is amongst the new efforts to help female and non-binary founders raise more dollars, or, at the very least, build relationships with investors.

The accelerator program, created by the Seattle-based network of startup founders and investors called the Female Founders Alliance, is today announcing its second batch of companies, a group that includes a sextech business, an AI-powered tool for podcasters and a line of workwear created for women who work on farms, construction sites and factory floors.

Ready, Set, Raise has partnered with Microsoft for Startups to provide entrepreneurs $120,000 in Azure credits, as well as technical and business mentoring from executives of the Redmond-based software giant. Other new partners include Brex and Carta, two well-funded companies that plan to lend the support of their executives to teach entrepreneurs about startup finance, valuation and fundraising terms.

“Both FFA and Microsoft recognize a major lapse in opportunities given to women and non-binary founders,” writes Ian Bergman, a managing director of Microsoft for Startups, in a statement. “We look forward to our continued work together to promote this necessary shift in the VC landscape.”

“My experience fundraising was undeniably shaped by the fact that I am a woman, and at the time was a new mom,” Feinzaig, who previously founded an edtech startup, told Seattle Business Magazine earlier this year. “A year later, I was about to give up. Instead, I started a Facebook group, including all of the founders and tech startup leaders I knew. It was the group that I needed, made up of people who knew exactly what I was going through. That’s how the Female Founders Alliance was born.”

FFA’s Ready, Set, Raise provides its companies childcare throughout the six-week program, in which companies work one-on-one with experienced coaches ahead of a demo day that will take place on October 16th.

Here’s a look at Ready, Set, Raise’s sophomore class of startups:

Powered by WPeMatico

Airship announced today that it has acquired Apptimize, an A/B testing company whose customers include Glassdoor, HotelTonight and The Wall Street Journal.

Formerly known as Urban Airship, the more concisely named Airship has built a platform for companies to manage their customer communication across SMS, push notifications, email, mobile wallets and more.

It says that by acquiring Apptimize, it can help customers test the impact of their messages. That means integrating Apptimize’s testing capabilities into the Airship platform, but the company says it will also continue to support Apptimize as a standalone platform.

“By combining Apptimize mobile app and web testing with Airship’s deep insight into customer engagement across channels, marketers and developers can focus innovation on the most critical areas while creating the seamless end-to-end experiences customers really want,” said Airship president and CEO Brett Caine in a statement.

The financial terms of the acquisition were not disclosed. Apptimize had raised a total of $18.6 million from US Venture Partners, Costanoa Ventures and others, according to Crunchbase.

Airship says it will be bringing over 19 Apptimize team members (a little less than two-thirds of the startup’s total workforce) across engineering, customer service and sales.

Powered by WPeMatico

You can’t talk enterprise software without talking SAP, one of the giants in a $500 billion industry. And not only will SAP’s CEO Bill McDermott share insights at TC Sessions: Enterprise 2019 on September 5, but the company will also sponsor two breakout sessions.

The editors will sit down with McDermott and talk about SAP’s quick growth due, in part, to several $1 billion-plus acquisitions. We’re also curious to hear about his approach to acquisitions and his strategy for growing the company in a quickly changing market. No doubt he’ll weigh in on the state of enterprise software in general, too.

Now about those breakout sessions. They run in parallel to our Main Stage set and we have a total of two do-not-miss presentations for you to enjoy. On September 5, you’ll enjoy three breakout sessions –two from SAP and one from Pricefx. You can check out the agenda for TC Sessions: Enterprise, but we want to shine the light on the sponsored sessions to give you a sense of the quality content you can expect:

TC Sessions: Enterprise 2019 takes place in San Francisco on September 5. It’s a jam-packed day (agenda here) filled with interviews, panel discussions and breakouts — from some of the top minds in enterprise software. Buy your ticket today and remember: You receive a free Expo-only pass to TechCrunch Disrupt SF 2019 for every ticket you buy.

Powered by WPeMatico

PlaceIQ is announcing a strategic investment from Experian.

CEO Duncan McCall said the investment is part of a growth round that PlaceIQ raised after divesting itself of its advertising business (which is being taken over by Zeta Global). He declined to disclose the size of the round, or of the Experian investment.

“It’s a multi-year, strategic partnership, where we will work together to license data [to Experian], and they also proactively become an investor in the company,” McCall said, adding that this “coincided nicely with us divesting of our media business and raising a modest growth round.”

While Experian is best-known for credit reporting, this partnership involves its marketing services business. Under the deal, the Experian Marketing Services will incorporate PlaceIQ’s LandMark location data product into its broader suite of data and measurement tools.

“With the mindset that consumers need to be at the heart of every marketing strategy, brands and agencies need to find ways to reach them and deliver more relevant messages,” said Experian’s president of marketing services Kevin Dean in a statement.” We believe quality data and advanced technology underpin that entire approach, and our collaboration and investment with PlaceIQ reinforce our commitment to helping brands meet that expectation.”

Asked about the direction of PlaceIQ’s business going forward, McCall explained that the company started with a focus on selling location data, and now, it’s gone back to “being a data-only company again.”

“Of course, we would have preferred to have focused on just one business model all these years, but life’s not that simple,” he said.

In his telling, PlaceIQ had to expand into the ad sales business because the infrastructure didn’t exist at the time to incorporate that data into the ad-buying process. Now that the infrastructure is there, PlaceIQ can focus once more on selling location data, which can then be used for targeting on a broad range of ad-buying platforms.

According to Crunchbase, PlaceIQ previously raised a total of $52 million in funding.

Powered by WPeMatico

The hype around blockchain seems to have cooled a bit, but companies like Kadena have been working on enterprise-grade solutions for some time, and continue to push the technology forward. Today, the startup announced that Kadena Scalable Permissioned Blockchain on Azure is available for free in the Azure Marketplace.

Kadena co-founder and CEO Will Martino says today’s announcement builds on the success of last year’s similar endeavor involving AWS. “Our private chain is designed for enterprise use. It’s designed for being high-performance and for integrating with traditional back ends. And by bringing that chain to AWS marketplace, and now to Microsoft Azure, we are servicing almost all of the enterprise blockchain market that takes place in the cloud,” Martino told TechCrunch.

The free product enables companies to get comfortable with the technology and build a Proof of Concept (PoC) without making a significant investment in the tooling. The free tool provides 2,000 transactions a second across four nodes. Once companies figure this out and want to scale, that’s when the company begins making money, but Martino recognizes that the technology is still immature and companies need to get comfortable with it, and that’s what the free versions on the cloud platforms like Azure are encouraging.

Martino says Kadena favors a hybrid approach to enterprise blockchain that combines public and private chains, and in his view, gives customers the best of both worlds. “You can run a smart contract on our public Chainweb protocol that will be launching on October 30th, and that smart contract can be linked to a cluster of private permission chain nodes that are running the other half of the application. This allows you to have all of the market access and openness and transparency and ownerlessness of a public network, while also having the control and the security that you find in a private network,” he said.

Martino and co-founder Stuart Popejoy both worked on early blockchain projects at JPMorgan, but left to start Kadena in 2016. The company has raised $14.9 million to date.

Powered by WPeMatico

Cybersecurity asset management startup Axonius has raised $20 million in its second round of funding this year.

Venture capital firm OpenView led the Series B, joining existing investors in bringing $37 million to date following the startup’s $13 million Series A in February.

The security startup, founded in 2017, helps companies keep track of their enterprise assets, such as how many clouds, computers and devices are on their network. The logic goes that if you know what you have — including devices plugged into your network by employees or guests — you can keep track and discover holes in your enterprise security. That insight allows enterprises to enforce security policies to keep the rest of the network safe — like installing endpoint security software, or blocking devices from connecting to the network altogether.

Axonius’ co-founder and chief executive Dean Sysman said the company takes a different approach to asset management.

“You can’t secure what you don’t know about,” he told TechCrunch. “Almost everything you’re doing in security relies on a foundation of knowing your assets and how they stack up against your security policies. Once you get that foundation taken care of, everything else you do will benefit,” he said.

Instead, Axonius integrates with more than a hundred existing security and management solutions to build up a detailed picture of an entire organization.

Clearly it’s a strategy that’s paying off.

The company already has big-name clients like The New York Times and Schneider Electric, as well as a handful of customers in the Fortune 500.

Sysman said the bulk of the funding will go toward the expansion of its sales and marketing teams, but also the continued improvement and development of its product. “We’re hitting the gas and continuing to bring our solution to as many organizations in the market as we can,” he said.

Axonius said OpenView partner Mackey Craven, who focuses on cloud computing and enterprise infrastructure companies, will join the board of directors following the fundraise.

Powered by WPeMatico

Hedvig, a Swedish startup, is following in the footsteps of Lemonade, building a new generation of insurance platforms that use AI to help evaluate customers and operate on a policy of using surplus for social good. Today the company announced the next stage of its growth. The startup has closed a SEK100 million ($10.4 million) round of funding to expand from its current offering of property insurance into a wider range of categories, and begin the costly process of expanding its business into more countries beyond its home market.

The funding values the company at SEK342 million ($35.5 million) — a modest figure considering Lemonade’s recent $300 million round, reportedly (per PitchBook) at a $2.1 billion post-money valuation — but helps position the company to set its sights on being a strong regional player (if not an acquisition target for Lemonade if it wants to quickly add new regions: the latter kicked off its first services in Europe earlier this year, so its global aspirations are clear).

It currently has 15,000 customers in its home market of Sweden, who use it for property insurance on rented or owned apartments, and Lucas Carlsen, the co-founder and CEO, said in an emailed interview with TechCrunch that it “definitely” plans to expand that to houses as well as other categories. Home insurance also covers contents, such as gadgets, and travel, and Carlsen said that the former (gadgets) accounts for the majority of claims at the moment.

The round was led by Obvious Ventures, the venture fund co-founded by Twitter/Medium/Blogger co-founder Ev Williams, with D-Ax, the early-stage investment arm of Swedish retail giant Axel Johnson Group, also participating, along with past investor Cherry Ventures.

“We are building a global company. We just started in Sweden since we happened to live here, and it serves as a good test market as we have some of the worlds’ most progressive and demanding consumers. Today, we do not have any news to share about future markets, but stay tuned!,” said Carlsen.

“The new funding will mainly be used to fuel growth in Sweden, but we’ll also be looking at extending into new markets and insurance categories. Insurance is capital intensive and our new partners are committed to supporting our long-term vision,” he continued.

Indeed, getting an investor like Obvious (which published its own short announcement about the investment) involved could open the door to introductions with a number of other investors down the road.

“Hedvig is harnessing its purpose, the power of AI, and its human-centered product to create a modern, full-stack insurance company. Their incredible team is delivering against the mission – to give people the world’s most incredible insurance experience – and we at Obvious are honored to help scale it further,” said Vishal Vasishth, one of Obvious Ventures’ other co-founders, in a statement.

Hedvig — named, Carlsen said, after a legend of “someone who stood up for others and fought for their causes: that’s what we do,” — will sound familiar to you if you know Lemonade.

It follows in a wave of more socially forward businesses that are being created, which are using technology to help disrupt the status quo but also to bridge the gap between building services that consumers need and the principles they would like to adhere to more if possible. (Other examples include the likes of Beyond Meat, which is also backed by Obvious; as well as the plethora of electric and hybrid vehicle makers; and more.)

In the case of Hedvig and the challenge of insurance, the proposition goes like this:

Hedvig uses technology and innovative algorithms to help assess a potential customer, who is then provided with lowest-cost, and often competitively priced, premiums. Then, as a “full-stack” digital company, it also uses its algorithms to help process claims. After Hedvig uses its bigger pot of money to pay out claims, the annual surplus is donated to charities selected by its customers.

“By not pocketing this money ourselves we can focus on providing the best service possible to you and not on making more money from denying claims,” Carlsen said.

Hedvig itself makes money by taking a cut off users’ monthly premiums (it doesn’t specify how much). To date, Hedvig has not disclosed how much it has been able to “give back” according to its business model. But the philosophy is that by digitising some of the more mundane processes that are relegated to human adjustors and customer agents at traditional agencies — and by not being inherently greedy — the startup is able to provide a more pleasant, more efficient and more conscionable service.

Powered by WPeMatico

The Slovenian founders behind PredictLeads, another recent Y Combinator graduate, applied to the prestigious accelerator five times before they were admitted.

Their business, which helps venture capital firms and sales teams identify high-growth companies, i.e. potential investments and potential customers, had come a long way since it was founded in 2016. And earlier this year — finally — YC gave them the green light to complete its three-month accelerator program.

“We almost ran out of money in 2017 and then I took a loan from my mother because the bank wouldn’t give me the loan at that point,” PredictLeads chief executive officer Roq Xever tells TechCrunch. “But by then, the data was getting much better and we were able to make higher-value sells and that got us to profitability.”

You read that right. Unlike most of today’s tech startups, PredictLeads is profitable, though, only out of pure necessity: “We didn’t know we would ever get into YC to raise the money we needed, so we structured the company to make more money than we spent.”

Xever leads the small PredictLeads team alongside marketing chief Miha Stanovnik and chief technology officer Matic Perovsek. Xever tells TechCrunch it wasn’t until they realized the opportunity to sell their product to VCs that YC became interested. Today, PredictLeads has eight venture firms as customers, the names of which they were not able to disclose.

The tool helps investors track companies they’ve considered in the past. PredictLeads notifies users if certain companies start getting traction so they can reevaluate the deal and helps investors become aware of startups they may not have otherwise heard of.

More and more venture capital firms are turning to third-party tools to help them make sense of and leverage data in the investment and company-tracking process, leading to the birth of new data-focused companies. Social Capital co-founder Chamath Palihapitiya is spinning out a company from his venture capital fund-turned-family-office, TechCrunch learned earlier this year. The new entity, temporarily dubbed CaaS (short for capital-as-a-service) Technologies, will focus on providing data-driven insights to VC firms, for example.

Startups have also realized the importance of data. Narrator, another recent YC graduate, is betting big on this trend. The startup wants to become the operating system for data science by providing companies software that claims to fulfill the same service as a data team for the price of an analyst.

PredictLeads, for its part, collects data from websites, press releases, news articles, blogs and career sites, then uses supervised machine learning to extract and structure the data. The startup tracks 20 million public and private companies.

Now that it’s a graduate of YC, the team is in the process of moving its headquarters to the U.S. Either New York or San Francisco, says Xever, who’s currently navigating the difficult visa application process.

The startup is today raising a $1.5 million seed financing at a $10 million valuation. They plan to use the capital to expand their service to cater to quant funds, build a Salesforce app to better support sales teams and, of course, expand their small team.

Powered by WPeMatico