Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

As someone who covers Africa’s tech scene, I’m frequently asked about Andela . That’s not surprising, given the venture gets more global press (arguably) than any startup in Africa.

I’ve found many Silicon Valley investors have heard of Andela but aren’t exactly sure what it does.

In a bite, Andela is Series D stage startup―backed by $180 million in VC―that trains and connects African software developers to global companies for a fee.

The revenue-focused venture is often misread as a charity. In 2017, Andela CEO Jeremy Johnson described the organization as “a mission-driven for-profit company” ― a model for the concept “that you can actually build businesses that create real impact.”

I asked Johnson recently to clarify the objective behind Andela’s drive. “It’s the exact same mission as when we started, based around our founding principle… that brilliance and talent are distributed equally around the world, but opportunity is not,” he said.

“We’re about breaking down the walls that prevent brilliance and opportunity from connecting to each other.”

A major barrier for Africa’s software engineers, according to Johnson, is simply the fact that the continent has been totally off the network that companies look to for developer talent.

Powered by WPeMatico

2019 has already been an active year for U.S. tech IPOs. Some highly anticipated unicorns, such as Uber and Lyft, have disappointed investors with their IPO debuts and their first results as public companies. Others, such as Fiverr, Zoom and CrowdStrike, have soared. And food-tech brand Beyond Meat (two words you normally don’t see together) hit a high of $239 from their $25 IPO price.

The first of these 2019 tech IPO companies will soon face a new challenge as the early investor and employee lockups expire — often 180 days after the IPO — allowing them to sell and increasing the number of shares available to trade. Lyft will remain at the front of the 2019 pack when the lockups expire, bringing more of the company’s stock into play on the public market. Regardless of what happens next, it’s amazing to see the trajectory of companies that have built such impressive businesses in such a remarkably short period of time.

I was recently at the New York Stock Exchange (NYSE) to ring the opening bell and celebrate our three- millionth borrower on the platform. It brought back great memories from when our company, LendingClub, entered the public fray in 2014. LendingClub was the largest U.S. tech IPO that year, and is still one of the biggest U.S. tech IPOs of all time. We listed at a $5.4 billion valuation, and our shares surged 67% on the first day of trading. We were thrilled to celebrate the validation of our hard work and excited about the next stage of our growth. However, by the time our lockups expired, we had fallen back to around our IPO valuation of $15 a share.

Since then, despite being the market leader in the fastest-growing sector of consumer credit in the country with double-digit annual growth, the company today is worth less than a fifth of what it was in 2014. Our story is thankfully unique, and I’ll spare you the details here, but suffice to say… we had a rough period. We are back on track now, delivering growth and margin expansion while executing against our vision.

However bespoke our story, there are some observations I’ll share that might be useful for others as they think about life post-IPO. I’m not going to cover the issues around short-termism and the tyranny of quarterly targets (which have been well-documented elsewhere), but rather a few of the implications that sure would have been useful for me to know going in…

I’d compare the period leading up to the IPO to the period when you are expecting a baby. Intellectually, you know things will be different when you bring home a newborn. But knowing it and living it are two different things. Going public is a transformational event that permanently changes your company and how the CEO, CFO and board spend their time (with obvious trickle-down effects). From the moment we rang the NYSE bell on December 11, 2014, everything changed.

Investors buying your stock are essentially valuing your future cash flow. At some point, you have to have your “show them the money” moment and become profitable. Amazon famously lost a total of $2.8 billion over 17 straight quarters after their IPO and was the subject of a lot of skepticism and criticism throughout. The company maintained their strategy, delivering top-line growth and investing in their future and, suffice to say, investor patience paid off!

At LendingClub, we have invested millions of dollars to develop products that delight our 3 million+ customers (and, at 78, our NPS is at its highest level in the history of the company) and expand our competitive moat. We are now driving toward adjusted net income profitability.

Once you go public, some people stop thinking of you as a business, and start thinking about you as a stock price. And that stock price is always broadcasting. It broadcasts to your equity investors, your employees, your partners, your board — to everyone who is listening.

You can’t preserve your culture, but you can and must maintain the values your company holds dear.

When the stock is up, everyone feels great. But, in a volatile market or a downturn, there are a lot of people who will be needing to hear your view on what’s happening. Communication to your stakeholders is not in the way of you doing your job, it is a critical part of your job that just got A LOT bigger. You need to stay ahead of it and deliberately carve out the time to make it a priority.

When you are starting out, the world is divided into two types of people: those who love you, and those who don’t know/care. When you are a public company, a lot of voices join the conversation. You’ll add a different beat of reporters focused on your financials. You have analysts who are paid to research and think about your company, your strategy, your prospects and your value. These analysts may have never covered a company quite like yours (after all, you are breaking new ground) and you’ll need to spend time together to understand what matters.

You also can attract a whole new kind of investor, a “short” who has a vested interest in your stock going down. All of these voices are speaking to your stakeholders and you need to understand what they are saying and how it should affect your own communications.

Remember those days when everyone attended the “all hands” and you could share the details of your product road map, your corporate strategy, what’s working and what isn’t? Yeah, those are over. The risk of material nonpublic information leaking means you need to find a new balance in transparency with your employees (and your friends and partners for that matter).

It’s a change to behavior and to culture that doesn’t come naturally (at least it didn’t to me). It’s a change that can be frustrating to employees as the necessary opacity can erode trust as people feel out of the loop. At LendingClub, we still regularly communicate as much as we can and trust our employees, but there are places where you have to draw the line.

Ironically enough, while your ability to share key details with employees is limited, you are sharing a lot with your competition. Shareholders and money managers want to know your battle plans and expect a detailed update at your earnings call every quarter. You can expect that your competitors are taking notice and taking notes.

As the above would indicate, being public means that you are inevitably going to be spending less time running the business, and more time focused externally. Not a bad thing, but something you need to plan for so that you have the resources in place underneath you to maintain business momentum. If your management team isn’t materially different as you head to the market than it was a few years ago, I’d be surprised if you have what you need.

I once asked a senior Google executive advice on how to preserve culture when going through massive periods of transition. She told me that you can’t preserve your culture, but you can and must maintain the values your company holds dear. Her advice, which I have followed and am passing on to you, is to make sure you write them down, hire against them and assess performance against them.

We started this practice years ago and it is remarkable how consistent our values have remained even as the company has evolved and matured. We codified six core values that put the customer at the center of everything we do. We are guided by our No. 1 value — Do What’s Right. You know a LendingClubber when you meet them, and it is part of what makes us great.

Being a public company is not for the faint-hearted, but being public is part of growing up. Being public legitimizes the company, unlocks liquidity to fuel growth and enables you to attract the next generation of talent. We always said that going public would allow us to deliver more value to a greater number of consumers and would lend legitimacy to our growing industry. We have facilitated more than $50 billion in loans and are still at a small percentage of our immediately addressable market. Although challenging at times, we’re seeing our dream to truly help everyday Americans come to life.

We’ve worked hard since our IPO to change the face people associate with finance. We’ve built a diverse team, established strong core values and nurtured a culture that has resulted in the kind of company we want to represent fintech and the tech industry as a whole — both inside and outside Silicon Valley.

So, to the new joiners in the public sphere — life in the spotlight is a wild ride. Congratulations on this step in your journey, and on to the next!

Powered by WPeMatico

Salesforce chairman, co-founder and CEO Marc Benioff took a lot of big chances when he launched the company 20 years ago. For starters, his was one of the earliest enterprise SaaS companies, but he wasn’t just developing a company on top of a new platform, he was building one from scratch with social responsibility built-in.

Fast-forward 20 years and that company is wildly successful. In its most recent earnings report, it announced a $4 billion quarter, putting it on a $16 billion run rate, and making it by far the most successful SaaS company ever.

But at the heart of the company’s DNA is a charitable streak, and it’s not something they bolted on after getting successful. Even before the company had a working product, in the earliest planning documents, Salesforce wanted to be a different kind of company. Early on, it designed the 1-1-1 philanthropic model that set aside 1% of Salesforce’s equity, and 1% of its product and 1% of its employees’ time to the community. As the company has grown, that model has serious financial teeth now, and other startups over the years have also adopted the same approach using Salesforce as a model.

In our coverage of Dreamforce, the company’s enormous annual customer conference, in 2016, Benioff outlined his personal philosophy around giving back:

You are at work, and you have great leadership skills. You can isolate yourselves and say I’m going to put those skills to use in a box at work, or you can say I’m going to have an integrated life. The way I look at the world, I’m going to put those skills to work to make the world a better place.

This year Benioff is coming to TechCrunch Disrupt in San Francisco to discuss with TechCrunch editors how to build a highly successful business, while giving back to the community and the society your business is part of. In fact, he has a book coming out in mid-October called Trailblazer: The Power of Business as the Greatest Platform for Change, in which he writes about how businesses can be a positive social force.

Benioff has received numerous awards over the years for his entrepreneurial and charitable spirit, including Innovator of the Decade from Forbes, one of the World’s 25 Greatest Leaders from Fortune, one of the 10 Best-Performing CEOs from Harvard Business Review, GLAAD, the Billie Jean King Leadership Initiative for his work on equality and the Variety Magazine EmPOWerment Award.

It’s worth noting that in 2018, a group of 618 Salesforce employees presented Benioff with a petition protesting the company’s contract with the Customs and Border Patrol (CBP). Benioff in public comments stated that the tools were being used in recruitment and management, and not helping to separate families at the border. While Salesforce did not cancel the contract, at the time, co-CEO Keith Block stated that the company would donate $1 million to organizations helping separated families, as well as match any internal employee contributions through its charitable arm, Salesforce.org.

Disrupt SF runs October 2 to October 4 at the Moscone Center in the heart of San Francisco. Tickets are available here.

Did you know Extra Crunch annual members get 20% off all TechCrunch event tickets? Head over here to get your annual pass, and then email extracrunch@techcrunch.com to get your 20% discount. Please note that it can take up to 24 hours to issue the discount code.

Powered by WPeMatico

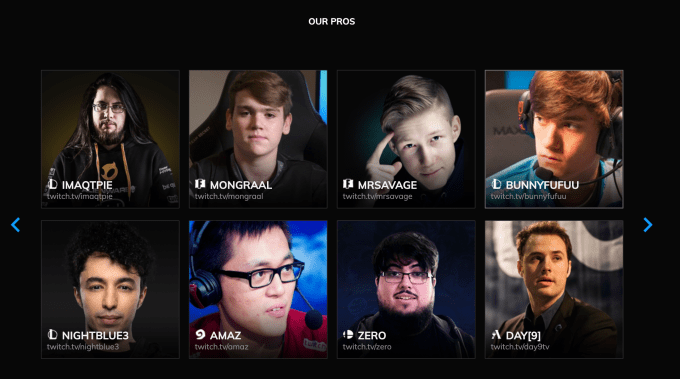

When ProGuides pulled the covers off of its service earlier this year, the young Los Angeles-based startup intended to give gamers a way to train with professional and semi-pro esports players from around the world.

But as users signed on to the service, it became clear that they weren’t looking for training necessarily… Instead, what players wanted was a ringer.

“After we launched the beta, we found some interesting user behavior,” says Sam Wang. “We found that gamers were experienced already and wanted experienced players who are better than [the matches] the game can provide… At the end of the day you do get to play with someone pretty awesome and is something that I think can make games better.”

That’s right, ProGuides is pitching a marketplace for experienced gamers so that its customers aren’t randomly matched with some noob if they can’t game with their usual partners.

“Our tagline is ‘Play with pros’ now,” says Wang. “We already have over 5,000 sessions that were played in the last two months.”

The professional gamers who list their services on the site charge an average of $10 per session and ProGuides takes about a 25% cut. The company lowers its rates for popular gamers or gamers who are willing to spend more time on the platform either selling their services or actually coaching esports players.

Wang says that pros on the platform are making anywhere from $750 to $2,500 per month and that there are currently 250 coaches on the platform.

A typical session on ProGuides lasts around 45 minutes and players are available for Fortnite, League of Legends, Super Smash Brothers, CS:GO and Hearthstone.

ProGuides raised $1.9 million in pre-seed funding last June. The company is backed by Amplify, an LA-based early-stage investor and company accelerator, Quest Venture Partners, Greycroft Tracker fund and the GFR Fund.

The LA-based company also has some venture-backed competition on the East Coast. Gamer Sensei, which has raised roughly $6 million (according to Crunchbase) has a similar proposition. It’s backed by Accomplice and Advancit Capital.

Powered by WPeMatico

If you think about the traditional hotel business, there hasn’t been a ton of innovation. You mostly still stand in a line to check in, and sometimes even to check out. You let the staff know about your desire for privacy with a sign on the door. Mews believes it’s time to rethink how hotels work in a more modern digital context, especially on the administrative side, and today it announced a $33 million Series B led by Battery Ventures.

When Mews founder Richard Valtr started his own hotel in Prague in 2012, he wanted to change how hotels have operated traditionally. “I really wanted to change the way that hotel systems are built to make sure that it’s more about the experience that the guest is actually having, rather than facilitating the kind of processes that hotels have built over the last hundred years,” Valtr told TechCrunch.

He said most of the innovation in this space has been in the B2C area, using Airbnb as a prime example. He wants to bring that kind of change to the way hotels operate. “That’s essentially what Mews is trying to do. [We want to shift the focus to] the fundamental things about why we love to travel and why people actually love to stay in hotels, experience hotels, and be cared for by professional staff. We are trying to do that in a way that that actually delivers a really meaningful experience and personalized experience to that one particular customer,” he explained.

For starters, Mews is a cloud-based system that automates a lot of the manual tasks, like room assignments that hotel staff at many hotels often still have to handle as part of their jobs. Valtr believes by freeing the staff from these kinds of tedious activities, it enables them to concentrate more on the guests.

It also offers ways for guests and hotels to customize their stays to get the best experience possible. Valtr says this approach brings a new level of flexibility that allows hotels to create new revenue opportunities, while letting guests choose the kind of stay they want.

From a guest perspective, they could by-pass the check-in process altogether, sharing all of their registration details ahead of time and getting a pass code sent to their phone to get into the room. The system integrates with third-party hotel booking sites like Booking.com and Expedia, as well as other services, through its open hospitality API, which offers lots of opportunities for properties to partner with local businesses.

The company is currently operating at 1,000 properties across 47 countries, but it lacks a presence in the U.S. and wants to use this round to open an office in NYC and expand into this market. “We really want to attack the U.S. market because that’s essentially where most of the decision makers for all of the major chains are. And we’re not going to change the industry if we don’t actually change the thinking of the biggest brands,” Valtr said.

Today, the company has 270 employees spread across 10 offices around the world. Headquarters are in Prague and London, but the company is in the process of opening that NYC office, and the number of employees will expand when that happens.

Powered by WPeMatico

Grab your economic zombie mask: A Halloween “no deal” Brexit is careening into view. New prime minister Boris Johnson has pledged that the country will leave the European Union on October 31 with or without a deal — “do or die” as he put it. A year earlier as the foreign secretary, he used an even more colorful phrase to skewer diplomatic concern about the impact of a hard Brexit on business — reportedly condensing his position to a pithy expletive: “Fuck business.”

It was only a few years ago during the summer of 2016, following the shock result of the UK’s in/out EU referendum, the government’s aspiration was to leave in a “smooth and orderly” manner as the prelude to a “close and special” future trading partnership, as then PM Theresa May put it. A withdrawal deal was negotiated but repeatedly rejected by parliament. The PM herself was next to be despatched.

Now, here we are. The U.K. has arrived at a political impasse in which the nation is coasting toward a Brexit cliff edge. We’re at the brink here, with domestic politics turned upside down, because “no deal” is the only leverage left for “do or die” brexiteers that parliament can’t easily block.

Ironic because there’s no majority in parliament for “no deal.” But the end of the Article 50 extension period represents a legal default — a hard deadline that means the U.K. will soon fall out of the EU unless additional action is taken. Of course time itself can’t be made to grind to a halt. So “no deal” is the easy option for a government that’s made doing anything else to sort Brexit really really hard.

After three full years of Brexit uncertainty, the upshot for U.K. business is there’s no end in sight to even the known unknowns. And now a clutch of unknown unknowns seems set to pounce come Halloween when the country steps into the chaos of leaving with nada, as the current government says it must.

So how is the U.K. tech industry managing the risk of a chaotic exit from the European Union? The prevailing view among investors about founders is that Brexit means uncertain business as usual. “Resilience is the mother of entrepreneurship!” was the almost glib response of one VC asked how founders are coping.

“This is no worse than the existential dread that most founders feel every day about something or other,” said another, dubbing Brexit “just an enormous distraction.” And while he said the vast majority of founders in the firm’s portfolio would rather the whole thing was cancelled — “most realize it’s not going to be so they just want to get on.”

Powered by WPeMatico

Bestmile, a transportation software startup, has raised $16.5 million in a Series B round led by Blue Lagoon Capital and TransLink Capital.

Existing investors Road Ventures, Partech, Groupe ADP, Airbus Ventures, Serena and others also participated in the round. The company, which launched in 2014, has raised $31 million to date.

Bestmile has developed fleet management software that orchestrates the delicate balance between demand for, and supply of transportation. Managing fleets isn’t new. However, the emergence of new and varied ways for people and packages to move within cities has created new opportunities for software companies.

Bestmile is aiming to become the preferred platform for public transit operators, automakers and taxi companies that offer ride-hailing, microtransit, autonomous shuttle services and even robotaxis. While Bestmile emphasizes the ability of the platform to manage more futuristic means of travel, namely autonomous shuttles, fleet management software is designed to be agnostic. This means it will work for human-driven fleets like traditional taxi cabs as well as autonomous shuttles and, someday, robotaxis.

The startup’s investors also see opportunities for the platform that extend beyond microtransit, ride-hailing and autonomous shuttles. For instance, Airbus Ventures sees Bestmile as a key enabler for urban air mobility, according to Thomas d’Halluin, a managing partner at the Airbus’ venture arm.

The platform works by collecting real-time data such as weather, traffic, demand and vehicle telemetry. It then uses the data to squeeze the most out of the fleet. That means balancing demand from customers with the cost of operations.

The startup, which is based in Lausanne, Switzerland and has an office in San Francisco, already has a number of customers, including autonomous shuttle operators. The company’s software is managing 15 deployments globally. Bestmile announced earlier this week that it has partnered with Beep, an autonomous shuttle company in Orlando, Fla.

Blue Lagoon partners Rodney Rogers and Kevin Reid have joined Bestmile’s board. Rogers is now board chairman. The pair, which have first-hand experience as co-founders, should be able to provide the kind of insight needed to scale a company. Rogers and Reid co-founded enterprise cloud services company Virtustream, which was acquired by EMC Corporation in 2015 for $1.2 billion. The business is now part of Dell Technologies.

Powered by WPeMatico

It’s a countdown to savings, startup fans. Calculate it any way you like — 72 hours, 4,320 minutes or 259,200 seconds — you have just three days left to save up to $1,300 with early-bird pricing on passes to Disrupt San Francisco 2019. The deadline strikes at exactly 11:59 p.m. (PST) on August 30. Buy your early-bird pass right now and save.

One of the many reasons Disrupt SF draws more than 10,000 people from around the world is to hear an impressive array of speakers — leading experts and top players in the startup world. They’ll address crucial topics like security and the challenges of protecting your most valuable asset: your customers and their data.

That issue applies to startups and multinationals alike, and we’re thrilled to have Google’s Heather Adkins, IOActive’s Jennifer Sunshine Steffens and Duo’s Dug Song join us to discuss how to build a secure startup from the ground up without slowing growth. That’s just one example — you can peruse the Disrupt agenda here.

Need more reasons to attend Disrupt SF on October 2-4? Let us count the ways. Networking — with more than 1,200 early-stage startups and sponsors exhibiting in Startup Alley, you’ll find opportunity upon opportunity to build your network. Whether you’re an investor hunting for a startup to round out your portfolio, a founder in search of an angel or a software engineer cruising for a new gig, Startup Alley is your networking mecca.

Want to prepare ahead of time? We’ve got you. Search our directory of startups exhibiting in Startup Alley. Then be sure to take advantage of CrunchMatch, our free business-matching platform. Once you fill out your profile, CrunchMatch automatically matches companies based on mutual business interests and goals. It suggests meetings and sends out invitations (which recipients can easily accept or decline).

Don’t miss the always-epic Startup Battlefield. We have a fierce cadre of early-stage startups ready to take the Main Stage to launch, pitch and demo their product to the world and a tough panel of judges. Oh yeah — they’re also competing for $100,000 and a chance to change the trajectory of their business. It’s a live-action thrill ride and an opportunity to see the next generation of household tech names — it can and has happened. Fitbit, Mint, Box and a host of other companies launched at a TechCrunch event.

Disrupt San Francisco 2019 takes place October 2-4, but you have only three days left to take advantage of our early-bird pricing and save up to $1,300. Don’t waste time counting the minutes. Buy your tickets before the deadline hits at 11:59 p.m. (PST) on August 30. We can’t wait to see you in San Francisco!

Is your company interested in sponsoring or exhibiting at Disrupt San Francisco 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

The traditional world of publishing has been challenged hard by the digital revolution. Reading as a pastime has been in significant decline, in part because of the proliferation of screens and options for what to watch and do on them. On the other hand, Amazon has led the charge in changing the economics of publishing: the returns on book sales, and profits to publishers and writers, have all seen margins squeezed in the e-reader universe.

A Berlin-based startup called Inkitt has built a crowdsourced publishing platform to buck those trends. It believes that there is still a place for reading in our modern world, if it’s presented in the right way (more on that below), and today it is announcing a $16 million round of funding that underscores its success to date — the Inkitt community today has 1.6 million readers and 110,000 writers with some 350,000 uploaded stories, with a run-rate of $6 million from a new “bite-sized”, immersive reading app it launched earlier this year called Galatea — and its ambitions going forward.

How big are those ambitions? Ali Albazaz, Inkitt’s founder and CEO, said the mission is to build the “Disney of the 21st century.” Digital novels are just the beginning, in his view: plans include a move into audio, TV, games and film, “and maybe even theme parks.”

But before we ride a rollercoaster based on The Millennium Wolves — one of the best sellers on the platform, with $1 million in sales in the first six months of its release; 24-year-old author Sapir Englard is using her royalties to finance her jazz studies at Berklee in Boston, Massachusetts — Inkitt is starting small.

In addition to continuing to search for authors that might make good Galatea fodder, it’s going to add 10 new languages in addition to English, along with more data science to improve readership and connecting audiences with the stories that are most engaging to them. The company has sourced some of its most successful works from places like India and Israel, so the thinking is that it’s time to make sure non-English readers in those countries are also getting a look in.

“It’s a long plan, and we’re working on it step by step,” Albazaz said in an interview this week. “We are looking for the best talents and the best stories, wherever they are being told. We want to find them, unearth them and turn them into globally successful franchises.”

The Series A is being led by Kleiner Perkins, with participation also from HV Holtzbrinck Ventures, angel investor Itai Tsiddon, Xploration Capital, Redalpine Capital, Speedinvest, and Earlybird. Inkitt is not disclosing its valuation, but it had raised $5 million before this (including this seed round led by Redalpine).

Inkitt got its start several years ago with a very basic idea: an app for people (usually unsigned authors) to upload excerpts of fictional works in progress, or entire fiction manuscripts — novels specifically — to connect them with readers to provide feedback. It would gather data that it collected from these readers to provide more insights into what people wanted to read, to feed its algorithm, and to give feedback to the writers.

It was a simple concept that competed with a plethora of other places where unpublished writers can get their work out there (including Kindle).

But then, six months ago, that concept of data-based, crowdsourced writing and reading took an interesting turn with the launch of Galatea.

With this, Inkitt selects the stories that perform the best on its first app — most readers, most often completed reading, best feedback, most recommended, and so on — and its in-house team of editors and developers reformat them for Galatea as short-form, bite-sized “mini episodes” that come with specific effects attuned to each page you read to make the experience more immersive.

This includes features like sound, haptic effects like the phone vibrating with crashes and heartbeats, fire spreading across the screen in a burning moment, and a requirement for users to swipe to proceed to the next section. (It’s a fitting name for the app: Galatea was the ivory statue that Pygmalion carved that came to life.)

As Albazaz describes it, Galatea was created as a response to the generation of consumers whose attention is constantly being diverted through notifications, and who have become used to getting information in short bursts.

“Nowadays you have Snapchat, Instagram and the rest, and they all send you notifications, but when you read you need a lot of attention,” he said.

So the solution was to cut down the page size to a paragraph at a time.

“Instead of flipping pages as you would on an e-reading app, you flip paragraphs.” These take up no more than about 20% of the screen, he said.

A reader gets one “episode” (about 15 minutes of reading, with several pages of text) free every day, so in theory you could read books on Galatea without paying anything, but typically people buy credits to continue reading a bit more than that each day, and it works out on average to about $12 per book in revenue. Inkitt is now adding multiple thousands of users (installs) each day across its two apps.

In addition to making this about tailoring a reading app to what consumers are most likely to do on a screen today, it’s about rethinking the model for how to source literature to disseminate in the first place.

“We all love stories and the way we create and consume them is evolving continuously,” said KP partner Ilya Fushman. “Inkitt’s rich and dynamic story format is rapidly capturing the imagination of a new generation of readers. Their content marketplace is connecting consumers with authors around the globe to entertain and democratize publishing.”

To date, the focus has very much been on original content that Inkitt has sourced itself. The basic model leaves a lot on the table, though. For one, what about all of the literature that has already been published in the world that either hasn’t really hit the right chord yet with readers, or classics, or popular works that might just be a little more interesting with the Galatea treatment?

On the other hand, the Galatea model seems to be inherently biased towards the most obvious “hits” — page turners that are engaging from the get-go, or are written on themes that have already proven to be popular. What about the wider body of literature that might not be accessible page-turners but are definitely worthwhile reading, stories that might one day become a part of the literary canon. For every Harry Potter series, some still want and need a Finnegan’s Wake or Milkman.

Albazaz has an answer for both of those: he says that his startup has already been approached by a number of publishers to work on ways of using its platform for their own works, and so that is something you might imagine will get turned on down the line. And he acknowledged the blockbuster element of the work on the platform now, but said that as it grows and scales its audience, it will be looking for works that appeal to a wider range of tastes.

The company’s business is a veritable David to Amazon’s Goliath, but one thing Inkitt has going for it is that it offers those who will take a chance on its platform a promise of making a good return.

Albazaz claims that the average writer on Galatea earns 30 to 50 times more than what would be earned via Amazon, which he calls “a horrible partner to work with as a publisher.” He wouldn’t comment exactly on the royalties split is on Inkitt, or whether that higher figure is due to more readers or a better cut (or both), except that he said that there are simply “more readers” of your work, “making you more money.”

It’s also a more flexible platform in another regard: if you want to publish elsewhere at the same time, you can. “No one is locked in,” he said. “Our mission statement, which we have across the wall in our office, is to be the fairest and most objective publisher. That’s the only way you will discover hidden talents.”

Powered by WPeMatico

Ride-hailing company Grab is going to focus some of its efforts on Vietnam with a $500 million investment over the next five years to grow its activities in the country.

While Grab started as a ride-hailing company, it is now much more than that. The company has become a “super app” that you can open to order a ride, order food from restaurants, make payments, get insurance products, loans and much more. It is mostly active in Southeast Asia.

The company recently announced that it would use some of the $7 billion that it has raised to date to bet on Indonesia. Grab plans to invest $2 billion in Indonesia to modernize the country’s transportation infrastructure. The Indonesian government is supporting the move, and Grab is using this opportunity to capture market share.

With today’s move, Grab is essentially doing the same thing at a smaller scale in Vietnam. In particular, Grab is once again partnering with government officials. It has announced a “Tech for Good” road map in the country that should foster Vietnam’s economic development at large.

Grab plans to provide work opportunities in 63 cities in order to fight unemployment. The company is looking for drivers, delivery persons and merchants. They will be able to access credit and insurance products. Of course, this plan will only work if there are enough Grab customers in those cities over the long term.

The company plans to invest in local startups through GrabVentures. Grab will also launch programs to improve digital and financial literacy. Finally, Grab plans to share data with local governments in order to tackle traffic congestion and pollution.

When it comes to metrics, Grab is already quite big in Vietnam. For instance, the company is currently handling 300,000 food deliveries per day through GrabFood. It represents a 400% increase in gross merchandise volume during the first half of 2019. Grab drivers have generated close to $1 billion in revenue over the years.

Powered by WPeMatico