Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Early-stage startups tend to claim that their go-to-market strategy is fully operational. In reality, GTM is a stark numbers game, and even with a solid plan in place, it can be easily foiled by common problems like turf battles and poor communication.

Finding GTM fit is a milestone for any startup that includes everything from expanding the engineering team to launching your first media buy. But how do you know when you’ve reached that magic moment?

“You have to consider three metrics: gross churn rate, the magic number and gross margin,” says Tae Hea Nahm, co-founder and managing director of Storm Ventures.

High churn means customers aren’t delighted, low gross margins mean poor unit economics, and that so-called magic number?

“You can calculate it by taking new ARR divided by your marketing and sales spending,” Nahm writes. “But keep in mind that the magic number is a lagging indicator, and it may take you a few quarters to see a positive result.”

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

If you are methodical in your approach to building a larger customer base, it is not difficult to foster steady growth.

Marketers who shift with whichever way the wind is blowing — or blindly follow someone else’s idea of best practices — are less likely to be successful.

“The not-so-secret secret here is that the key to great retention is really simple,” said growth expert Susan Su recently at TechCrunch Early Stage: Marketing and Fundraising. “It is building a product that solves a real and especially persistent problem for people.”

In conversation with Managing Editor Eric Eldon, Su delved into several issues, including tips on how founders should discuss growth with investors, and her methods for developing a sample qualitative growth model.

“I firmly believe that every founder should try their hand at growth,” said Su.

Thanks very much for reading Extra Crunch this week!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Lucas Knappe/EyeEm (opens in a new window)/ Getty Images

Few startups go to market with the exact product their founders first envisioned.

Today, Tractable is known for developing tech that allows drivers to upload photos of their vehicles after a collision so its AI can assess the damage. Its first paying customer, however, used Tractable to inspect plastic pipe welds.

And as fate would have it, that customer also fired them just as the founders were raising their first round.

“We struck gold with car insurance,” says co-founder Alex Dalyac, as it was “a huge and inefficient market in desperate need of modernization.”

In an Extra Crunch guest post, he shares several takeaways from the last six years spent scaling a unicorn that have value for founders of all stripes. Step one?

“Search for complementary co-founders who will become your best friends,” advises Dalyac.

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm and Anna Heim continued their exploration of the scorching global VC market, this time taking a look at Europe.

For perspective, they analyzed data from Dealroom and spoke to four VCs about the continent’s investment climate:

“There’s little indication that what we’ve seen thus far from Europe in 2021 will slow in Q3 or Q4,” Alex and Anna write.

“Even though Europe has a reputation for lengthy summer vacations, investors don’t expect much — if any — slowdown to come in Europe during this sun-drenched quarter.”

Image Credits: Bryce Durbin

“Amid the chaos of the COVID-19 pandemic and the murky path to profitability for shared electric micromobility, an increasing number of companies have turned to subscriptions,” Rebecca Bellan writes in a roundup about the future of micromobility.

“It’s a business model that some founders and investors argue hits the profit center sweet spot — an approach that appeals to customers who are wary of sharing as well as paying upfront to own a scooter or e-bike, all while minimizing overhead costs and depreciation of assets.”

Image Credits: Nigel Sussman (opens in a new window)

After noting that Robinhood anticipates a decline in revenue in the third quarter as a result of slowing crypto trading, Alex Wilhelm got to thinking about what that forecast means for Coinbase.

“The now-public unicorn has lived through crypto ups and crypto downs,” he writes. “A decline in consumer interest in the next few months or quarters is not a huge deal, assuming one keeps a long enough perspective and the crypto-infused future that its fans expect comes to pass.”

But will it?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I handle people ops as a consultant at several different tech startups. Many have employees on OPT or STEM OPT who didn’t get selected in this year’s H-1B lottery.

The companies want to retain these individuals, but they’re running out of options. Some companies will try again in next year’s H-1B lottery, even though they face long odds, particularly if the H-1B lottery becomes a wage-based selection process next year.

Others are looking into O-1A visas, but find that many employees don’t yet have the experience to meet the qualifications. Should we look at Canada?

— Specialist in Silicon Valley

Image Credits: MediaNews Group/Bay Area News via Getty Images (opens in a new window)/ Getty Images (Image has been modified)

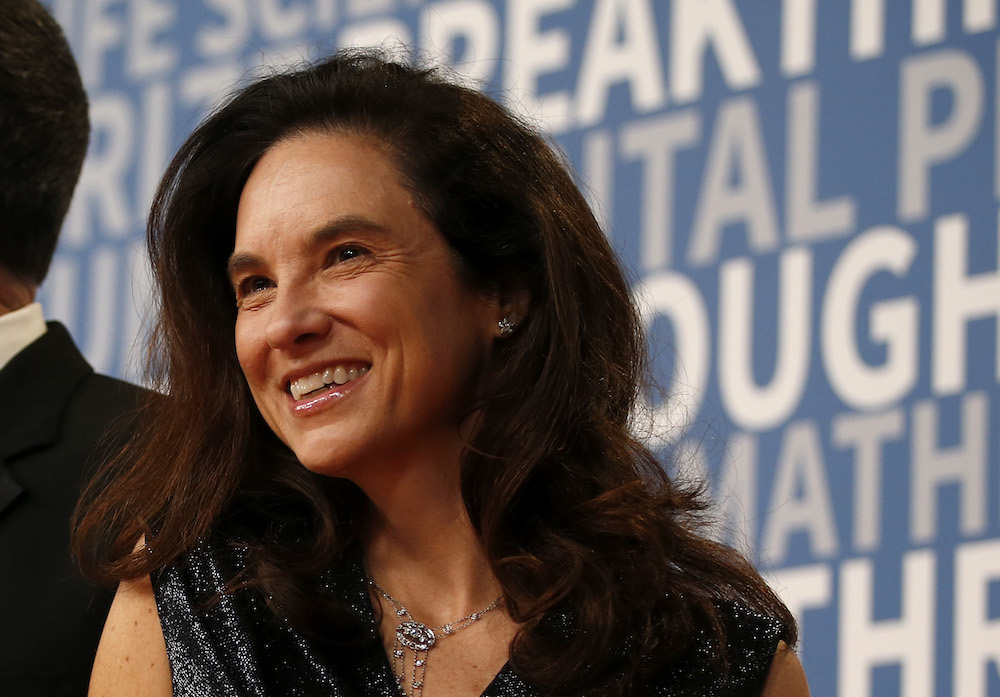

Caryn Marooney, a Silicon Valley communications professional turned venture capitalist, spoke extensively on storytelling at TechCrunch Early Stage: Marketing and Fundraising.

Throughout her time in Silicon Valley, she helped companies like Salesforce, Amazon, Facebook and more launch products and sharpen their messaging. In 2019, she left Facebook, where she was VP of technology communication, and joined Coatue Management as a general partner.

Marooney uses the acronym RIBS to describe her basic strategy for startup messaging: Relevance, Inevitability, Believability and keeping it Simple.

Image Credits: Nigel Sussman (opens in a new window)

For The Exchange, Alex Wilhelm and Anna Heim looked at Canada’s VC market in the first half of 2021, and if you’ve been reading their work, you know what’s coming.

Canada, like the rest of the globe, was absolutely scorching in the first half.

“Canada’s venture capital results now rival those of the entire Latin American region, with exits and mega-deals coming in roughly on par in the second quarter, and a similar number of total venture capital rounds in the period,” they write.

“That caught our attention.”

With more venture funding flowing into the startup ecosystem than ever before, there’s never been a better time to be a growth expert.

At TechCrunch Early Stage: Marketing and Fundraising earlier this month, Greylock Partners’ Mike Duboe dug into a number of lessons and pieces of wisdom he’s picked up leading growth at a number of high-growth startups, including StitchFix. His advice spanned hiring, structure and analysis, with plenty of recommendations for where growth teams should be focusing their attention and resources.

Image Credits: Erlon Silva/TRI Digital (opens in a new window) / Getty Images

Thanks to sprawling fulfillment centers, seamless logistics networks and ubiquitous internet access, consumers in many regions can now order groceries and a new set of cookware during breakfast and reasonably expect everything to arrive in time for dinner.

In Latin America, a lack of technology infrastructure makes delivery operations complex, and these supply chains are often managed with spreadsheets, paper and pen.

Algorithms that manage delivery routes or automatically dispatch drivers “are almost unheard of in the Latin America retail logistics sector,” says Bob Ma, an investor at WIND Ventures.

But thanks to growing consumer demand and expanding investment in last-mile delivery startups, Ma says the region is at a turning point.

Since Latin America’s middle class has grown 50% in the last decade and e-commerce constitutes just 6% of all retail, several unicorns have emerged in recent years, with more waiting in the wings.

Image Credits: Nigel Sussman (opens in a new window)

China’s edtech industry is estimated to be worth $100 billion, but its leaders are reportedly considering a plan that would require these firms to operate as non-profits.

“When it comes to control, the Chinese government doesn’t mind wiping out a few dozen billion dollars in market cap here and there,” writes Alex Wilhelm in this morning’s edition of The Exchange.

“That’s not a great system.”

Powered by WPeMatico

Here at memoryOS, we have a saying we repeat often: “Most of the Kickstarter happens before the actual Kickstarter.”

Preparation is the key. But even if you understand that most of the work is done in advance, you should still prepare yourself for some sleepless nights after the launch date. The usual startup mantra will apply to your crowdfunding campaign just as well: Measure, analyze and adjust along the way.

As you may know, crowdfunding fits some B2C products better than it does others. So to give you our product context here, memoryOS is a gamified app that teaches memorization skills with the help of virtual mind palaces and interactive microlessons taught by our co-founder, two-time World Memory Champion, Jonas von Essen.

Image Credits: memoryOS (opens in a new window)

Before becoming the most funded app on Kickstarter and getting it 6,400% funded (and carrying it further to the Indiegogo platform right after), we spent countless hours researching down the rabbit hole of crowdfunding tips and tricks. We also had calls with several top-tier crowdfunding project creators who were kind enough to answer our questions and share bits of knowledge from their experience.

We’re sharing our approach (and secrets) to building a successful crowdfunding campaign because we know just how tough it can be to launch your own product. So here is a complete 10-step guide:

You should have a unique idea for a product that would solve at least one problem for your target audience. The proven approach is to set two major hypotheses right at the start and then work on getting them tested:

You will need to build a base prototype to test the first hypothesis and, if it works, you can then work on turning it into an MVP or a short demo version for your future commercial product. You can then get people to test it for free and prepay for the full version.

Getting people to actually back their interest with their wallet means you already have customers, not merely enthusiasts, and it significantly increases the chances of a successful project.

Yes, it’s important that you get people to pay a minimum reservation deposit at this point and receive their commitment to pay the remaining amount for the full product later on. Getting people to actually back their interest with their wallet means you already have customers, not merely enthusiasts, and it significantly increases the chances of a successful project.

As soon as you have something to test, conduct short surveys to better understand your customers by gathering and analyzing the reasons why and for what purpose(s) they would want your product.

Here at memoryOS, we called the first couple thousand of our leads and had many insightful conversations to help us connect to our audience on a more personal and emotional level.

Once you have a demo or prototype for the users to test, make sure to add a feedback form right at the end of their experience (or gather feedback using Google Forms for surveys, or via email inquiries).

Powered by WPeMatico

Rivian announced Friday that it has closed a $2.5 billion private funding round led by Amazon’s Climate Pledge Fund, D1 Capital Partners, Ford Motor and funds and accounts advised by T. Rowe Price Associates Inc.

Third Point, Fidelity Management and Research Company, Dragoneer Investment Group and Coatue also participated in the round, according to Rivian.

“As we near the start of vehicle production, it’s vital that we keep looking forward and pushing through to Rivian’s next phase of growth,” Rivian CEO RJ Scaringe said in a statement. “This infusion of funds from trusted partners allows Rivian to scale new vehicle programs, expand our domestic facility footprint, and fuel international product rollout.”

D1 Capital Partners founder Dan Sundheim said the firm is excited to increase its “investment in Rivian as it reaches an inflection point in its commercialization and delivers what we believe will be exceptional products for customers.”

Rivian has raised roughly $10.5 billion to date. The company did not share a post-money valuation.

The electric automaker, which now employs 7,000 and is preparing to deliver its R1T pickup truck in September, last raised funds in January. That round brought in $2.65 billion from existing investors T. Rowe Price Associates Inc., Fidelity Management and Research Company, Amazon’s Climate Pledge Fund, Coatue and D1 Capital Partners. New investors also participated in that round, which pushed Rivian’s valuation to $27.6 billion, a source familiar with the investment round told TechCrunch at the time.

The news comes just a day after Rivian confirmed it plans to open a second U.S. factory. It also follows Rivian’s decision to delay deliveries of its R1T truck and R1S SUV from this summer to September due to delays in production caused by “cascading impacts of the pandemic,” particularly the ongoing global shortage of semiconductor chips.

Powered by WPeMatico

“It’s about focusing on the metric that directly reflects the value that your company and products bring to your customers,” growth marketer Maya Moufarek told us in an interview for one of our most popular marketing articles of the week. “For Airbnb, that may be the number of nights booked; for Spotify, minutes listened to. It’s all about simplifying your strategy into something that is digestible, memorable and applicable.”

In the interview, Moufarek speaks about the importance of Sean Ellis’ North Star metric, how she audits her clients, brand building and more.

Help TechCrunch find the best growth marketers for startups.

Provide a recommendation in this quick survey and we’ll share the results with everybody.

Marketing Cube founder Maya Moufarek’s lessons for customer-focused startups: Founder of growth consultancy Marketing Cube Maya Moufarek joins Miranda Halpern for an interview as part of the TechCrunch Experts series. Moufarek shares her advice for startups and explains why there’s no one-size-fits-all approach to marketing.

In growth marketing, creative is the critical X factor: Self-proclaimed “growth marketing nerd” and current Uber growth team member Jonathan Martinez breaks down how to be successful with creative testing. Martinez discusses how to do this when faced with the current privacy restrictions.

(Extra Crunch) Susan Su on how to approach growth as your startup raises each round: Managing Editor Eric Eldon recaps growth marketing expert Susan Su’s talk from TechCrunch Early Stage: Marketing & Fundraising. Su goes through a sample qualitative growth model and the importance of always having a growth team.

(Extra Crunch) Silicon Valley comms expert Caryn Marooney shares how to nail the narrative: Senior Editor Matt Burns recaps Caryn Marooney’s talk from TechCrunch Early Stage: Marketing & Fundraising. Marooney, current VC and former communications expert, touches on her RIBS method — read the article to find out what it stands for and how to apply it to your own narrative.

(Extra Crunch) Greylock’s Mike Duboe explains how to define growth and build your team: Editor Lucas Matney breaks down the TechCrunch Early Stage: Marketing & Fundraising presentation from early-stage speaker Mike Duboe, partner at Greylock. This talk is split into 10 key points about growth, including tips on prioritizing retention, hiring for growth and more.

If you haven’t already, please fill out our ongoing growth marketing survey. We’re using these recommendations of top-tier growth marketers around the world to shape our editorial coverage.

Marketer: Illia Termeno, founder of Extrabrains

Recommended by: Anonymous

Testimonial: “T-shaped expertise with focus on strategy and long-term ROI.”

Marketer: Adam DuVander, EveryDeveloper

Recommended by: Karl Hughes, Draft.dev

Testimonial: “In addition to writing a book on developer marketing, Adam draws from deep experience as a developer and developer advocate to make sure his clients set a winning strategy in motion.”

Marketer: Jonathan Metrick, Portage Ventures

Recommended by: Matt Byrd

Testimonial: “Jonathan was truly transformative at Policygenius. Prior to his arrival, we were running a smart but disjointed marketing effort. Our messaging was inconsistent, and our approach to understanding channel efficacy was weaker than it could have been. Jonathan brought a growth mindset to the team, and built a hypereffective org in a short amount of time.”

Powered by WPeMatico

Startups developing so-called deep tech often find it challenging to raise capital for various reasons. At TechCrunch Early Stage: Marketing and Fundraising, two experienced investors spoke on the subject and advised startups facing a challenging fundraising path.

Pae Wu and Garrett Winther are both partners at SOSV and run the fund’s programs around biotech and hardware. SOSV doesn’t shy away from startups building complex technology, and because of this, Wu and Winther are well placed to advise on fundraising. They presented three key points targeting startups fundraising for deep tech applications, but the points are applicable to startups of any variety.

Before giving advice, the two acknowledged the nuances across the deep tech ecosystem and each industry. Their presentation is focused on general guidance applicable to nearly every startup.

The first point on Wu and Winther’s presentation sounds a bit self-serving but is based on solid advice. When building a deep tech startup, find the right investor, they said. This is general advice for startups, but according to these two, it’s even more important when building a company that might take longer for the investor to see a return.

In deep tech, it’s essential to think about founder-investor fit. And what we mean by this is understanding why an investor is even in VC in the first place. And what it is that’s driving you, the founder, to do what you do.

And so we look at this fit as a Venn diagram between founders who have a near maniacal devotion to wanting to solve a core systemic problem and investors that thrive on the unique risk profile that comes in deep tech. Because with deep tech, we’re talking about both technical risk, where maybe that insight that is core to the company merely proves that we’re no longer having to break any laws of physics to do whatever it is you’re trying to do. So there’s a big technical risk. (Timestamp: 6:09)

We, as investors, love to see methodical founders who can see the first step that will converge at the right moment of technical and business milestones.

Breakthrough technology hardly came from sudden breakthroughs. As explained in this presentation, it’s critical to set obtainable goals that lead to the desired outcome.

Powered by WPeMatico

Monarch, a subscription-based platform that aims to help consumers “plan and manage” their financial lives, has raised $4.8 million in seed funding.

Accel led the round, which also included participation from SignalFire, and brings the Mountain View-based yet fully distributed startup’s total funding since its 2019 inception to $5.5 million.

Co-founder and CEO Val Agostino was the first product manager on the original team that built Mint.com. There, he said, he saw firsthand that Americans with a greater understanding of financial matters “needed software solutions that went beyond just tracking and budgeting.”

“They needed help planning their financial future and understanding the tradeoffs between competing financial priorities,” he said.

Monarch aims to help people address those needs with software it says “makes it easy” for people to outline their financial goals and then create a detailed, forward-looking plan toward achieving them.

“We then help customers track their progress against their plan and automatically course correct as their financial situation changes, which it always does,” Agostino said.

Monarch came out of private beta in early 2021 with apps for web, iOS and Android, and is priced at $9.99 per month or $89.99 per year. The startup intentionally opted to not be ad-supported or sell customers’ financial data.

These approaches are “misaligned with users’ financial interests,” Agostino said.

“We felt that a subscription business model would best support that ethos and align our users’ interests with our own,” he added. Since launching publicly, Monarch has been growing its paid subscriber base by about 9% per week.

Image Credits: Monarch

Monarch launched during the pandemic, the uncertainty of which carried over into people’s financial lives, believes Agostino.

“As a result, we saw a lot of people make use of Monarch’s forecasting features to compare different ‘what if ‘scenarios such as switching jobs or moving to a different city or state,” he said.

Earlier this month, TechCrunch reported on a company with a similar mission, BodesWell, teaming up with American Express on a financial planning tool for its cardholders. Agostino said that Monarch is similar to BodesWell in that both startups help customers map a financial plan and future.

“The difference is that Monarch also has a full suite of PFM tools, such as budgeting, reporting and investment analysis,” he said. “The benefit to the consumer is that because Monarch is connected to your entire financial picture, we can help you actually stay on track with your financial plan and/or update the plan in real time if needed.”

Accel’s Daniel Levine said that until he came across Monarch, he was “somehow still a Mint customer despite its obsolescence.”

Over the past decade, the landscape for financial products has expanded dramatically, with more people having brokerage and crypto accounts, for example, Levine said.

In his view, Monarch stands out for a couple of reasons. For one, it’s a subscription product.

“One thing I always hated about Mint was when it would suggest the objectively wrong credit card for me,” Levine said. “It has all of my transaction data, it should tell me the card with the best rewards for me. Monarch is set up to never compromise what’s best for the user in favor of advertising.”

Secondly, Monarch’s aim is to serve as the infrastructure for its customers. To do that, it needs to monitor all of someone’s finances.

“They need to track checking, credit cards, brokerage, real estate and crypto,” he said. “Monarch is committed to doing that. It’s an incredibly painful problem and even though Monarch is a new entrant in the space, I think they’ve clearly separated themselves on that dimension.”

Powered by WPeMatico

News that China’s government may force domestic tutoring-focused companies to go nonprofit is taking a huge bite out of the value of several technology companies. Bloomberg notes that the value of companies like New Oriental Education & Technology Group and TAL Education are tumbling in light of the news, which would constitute merely the latest salvo against tech companies in the autocratic country.

New Oriental’s Hong Kong-listed shares fell 44.22% in after-hours trading after the nonprofit news broke, while NYSE-shares of TAL are off an even sharper 51.75% in pre-market trading. With Yahoo Finance listing a roughly $13.8 billion market cap for TAL ahead of its impending declines at the market open, billions of equity value are about to get deleted. The list goes on: China Online Education Group is off 39.97% in after-hours trading, for example.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

A new decision by China’s government to exert more control over a sector of its domestic economy should not surprise. And we shouldn’t be shocked that online tutoring is in the country’s targets; today’s news is a follow-up to prior regulatory action in the sector from earlier in the year.

As China has become synonymous with edtech startups in recent years, the news impacts more than just public companies. The expected rules change may also hit a host of private, venture-backed companies.

As China has become synonymous with edtech startups in recent years, the news impacts more than just public companies. The expected rules change may also hit a host of private, venture-backed companies.

For example, what will happen to Yuanfudao? The company was valued at $15.5 billion last year, offering what TechCrunch described as “live tutoring, an online Q&A arm and a math-problem-checking arm.” Will the company see its wings clipped?

Or how about Zuoyebang, which raised $1.6 billion in a single round last year? TechCrunch wrote that Zuoyebang offers “online courses, live lessons and homework help for kindergarten to 12th grade students.” Is it in trouble as well?

All this comes on the same day that shares in Zomato began to float, with the Indian online food delivery company seeing its shares close up nearly 65% in their first day’s trading. TechCrunch has viewed the Zomato IPO as a possible bellwether for the larger Indian startup market, and the results augur well for other growth-focused, loss-making unicorns in the country.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

We were a smaller team this week, with Natasha and Alex together with Chris to sort through yet another summer frenzy of a week.

This time around we actually recorded live on Twitter Spaces, which was a first for the podcast. If you missed it, it’s probably because we didn’t promote the taping since it was just an experiment. Good news, though, is that it went well, and we’re going to do some more live tapings of the show with the entire crew on the mics. Make sure to follow the show on the Big Tweet to ensure that you can come hang with us next week. We’ll also do some Q&A at the end, if we’re in good moods.

Until then, let’s live in the present. Here’s what we got into in today’s show:

Powered by WPeMatico

Your startup might rely on clever growth tactics to get off the ground, but you need more than spreadsheets if you want to turn viral spikes into a real business. You need a qualitative growth model to guide the strategy that you can use to tell your story to your team and investors.

Growth marketing expert Susan Su sat down with us at TechCrunch Early Stage: Marketing and Fundraising this month to share pointers for young companies that are trying to raise money after initial market traction. In the presentation below, she maps out a growth strategy from seed through Series A and B rounds and details how your milestones, budgets, investor updates and other measures change as you advance.

The not-so-secret secret here is that the key to great retention is really simple. It is building a product that solves a real and especially persistent problem for people.

Throughout the process, “a qualitative model tells the story of growth that you can use at early stages and really all throughout your company life cycle,” she explains. “A quantitative model or quantitative growth accounting charts the numerical course for how you actually deliver against that narrative and becomes more relevant at later stages when you actually have real numbers.

Formerly a strategic growth adviser to companies at Sound Ventures, a growth marketing lead focused on startups at Stripe, and the first hire and head of growth at Reforge, Su just became a partner investing in climate tech for early-stage fund Toba Capital. She also writes a popular newsletter on climate investing and runs a six-week course for other investors on the topic.

Here’s more about growth, and how to talk about it with investors, from her presentation:

So here’s a sample qualitative growth model that I built for one of our portfolio companies with some modifications for anonymity. At the bottom, we have our linear inputs that form the foundation of awareness — in other words, traffic or leads that feed into our growth machine.

Once those leads come in, we have our acquisition loops, working to turn that non-repeatable spiky linear traffic (aka TechCrunch traffic, if you get so lucky as to be written up in TechCrunch) into scalable, repeatable acquisition. You cannot repeat the TechCrunch effect.

For this sample business, I happened to spec out five different acquisition loops — I was really ambitious. Many companies will struggle to identify this many. But the key to being able to scale is to have multiple viable acquisition loops, not just one single thing that works.

Powered by WPeMatico

Paystone, a payments and integrated software company, secured another strategic investment this year, this time $23.8 million ($30 million CAD) from Crédit Mutuel Equity, the private equity arm of Crédit Mutuel Alliance Fédérale.

The Canada-based company got its start in 2008 as the payment processing company Zomaron, and rebranded itself as Paystone in 2019. Today it provides electronic payments and customer engagement technology to businesses, particularly those that provide services, CEO Tarique Al-Ansari told TechCrunch.

“Paystone is on a mission to help businesses grow, and we were enthralled by their commitment to that mission and their focus on service-oriented verticals,” said Léa Perge, investor at Crédit Mutuel Equity in Canada, via email.

While most of the company’s peers focus on product companies, Al-Ansari saw how underserved the service side was: their needs are different, and unlike retail, aren’t looking to sell online. Rather, they need an online presence and digital marketing to engage with customers, but their focus is being findable and having content that tells people why they should do business with them.

Paystone provides the marketing through content, help with reviews and with loyalty and rewards programs. However, rather than reward for spending, Paystone rewards for behavior. Refer a friend, get a reward. Write a review, get a reward. Al-Ansari calls it “payments as a benefit.” Referrals and reviews are how businesses become more findable, and the more content that’s out there, the more it helps people consider the business trustworthy, he added.

The new funding gives Canada-based Paystone total funds raised in 2021 of $78.8 million in a mix of debt and equity. It raised $54.9 million in January, funds that were barely touched as of yet, Al-Ansari said.

Though he wasn’t actively seeking new funds, Al-Ansari had been speaking with Crédit Mutuel Equity, which used to be CIC Capital Canada, prior to the pandemic, and their deal was put on hold.

Crédit Mutuel Equity came back with similar interest, and taking into account the kind of talent Paystone wanted to go after and its acquisition strategy — the company has already acquired five companies — Al-Ansari decided to take the additional funds. He said it gives the company options to hire more and double down on building the company, as well as enough capital to look for more acquisitions.

This year, Paystone entered the U.S. market for the first time and will do a proper launch later this year. The company has over 30,000 merchant locations on its platform throughout North America, and Al-Ansari expects that to grow by 5,000 this year. The company has 150 employees currently, and another 50 are expected to come on board by the end of the year.

In addition, Al-Ansari expects growth to accelerate for the rest of the year. The company processes around $6 billion in credit card payments and is on track to bring in $55.7 million in revenue this year. It is cash flow positive, residuals from the company’s origins of being bootstrapped, he said.

“We want to become the go-to destination for service businesses to set up a digital presence to accept payments and provide loyalty and rewards,” Al-Ansari said. “We will do this by solidifying our market position and growing our platform with the tools that customers want.”

Powered by WPeMatico