Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

According to one estimate, Americans call 911 about 240 million times every year.

Sending emergency services to the right location sounds straightforward, but each 911 call is routed through one of thousands of call centers known as public safety answering points (PSAPs).

“Every 911 center is very different and they are as diverse and unique as the communities that they serve,” said Karin Marquez, senior director of public safety at RapidSOS.

One PSAP that serves New York City is a 450,000-square-foot, blast-resistant cube set on nine acres, but you also have “agencies in rural America that have one person working 24/7 and they’re there to answer three calls a day,” Marquez noted.

Founded eight years ago, RapidSOS processes more than 150 million emergencies each year across approximately 5,000 PSAPs. The company’s technology helps call centers integrate requests from cell phones, landlines and IoT devices.

“Its technology is almost certainly integrated into the smartphone you’re carrying and many of the devices you have lying around,” Managing Editor Danny Crichton writes in a four-part series that studies the company’s origins and ensuing success:

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

“I’ve honestly never met a company like RapidSOS with so many signed partnerships,” says Danny, who initially wrote about the firm six years ago.

“It’s closed dozens of partnerships and business development deals, and with some of the biggest names in tech. How does it do it? This story is about how it built a successful BD engine.”

Thanks very much for reading Extra Crunch this week!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Reinhard Krull / EyeEm (opens in a new window) / Getty Images

The headlines might be littered with mega deals, IPOs and SPACs, but in all likelihood, you will exit your startup via a relatively smaller merger or acquisition, Ben Boissevain writes in a guest column.

“The IPO market is healthy again, but M&A still represents 88% of exits: So far this year, there were 503 IPOs and 5,203 deals,” writes Boissevain, founder of Ascento Capital.

“While it is good to strive for a billion-dollar-plus sale, a successful IPO or a SPAC deal, it is practical to prepare your startup for a smaller transaction.”

Image Credits: Nigel Sussman (opens in a new window)

U.S. edtech company Duolingo bumped up its IPO price range Monday morning, targeting $95 to $100 per share, up from previous guidance of $85 to $95 per share.

“The fact that Duolingo is raising its IPO price range indicates that we are more likely on the path for a strong offering than a weak one,” Alex Wilhelm notes.

Image Credits: VCG (opens in a new window) / Getty Images

Many Extra Crunch readers will not have heard of China’s fastest-growing bottled beverage company: Genki Forest is a direct-to-consumer startup that started selling its sodas, milk teas and other products just five years ago.

Today, its products are available in 40 countries and the company hopes to generate revenue of $1.2 billion in 2021. After closing its latest funding round, Genki Forest is valued at $6 billion.

Industry watchers frequently compare the upstart to giants like PepsiCo and Coca-Cola, but founder Binsen Tang comes from a tech background, having funded ELEX Technology, a social gaming company that found success internationally.

“China doesn’t need any more good platforms,” Tang told his team in 2015, “but it does need good products.”

Leveraging China’s robust distribution network, lighting-fast manufacturing capabilities and a vast pool of data that enables holistic digitization, Genki Forest sells more than 30% of its products online.

“Everything feels right about the company,” said VC investor Anna Fang. “The space, the founder, the products and the back end … they exemplify the new Chinese consumer brand.“

Sequoia’s Mike Vernal joined us on TechCrunch Early Stage: Marketing and Fundraising to discuss how founders should approach product-market fit, with a specific focus on tempo.

It doesn’t mean fast in the kind of uncontrolled, reckless, crashing sense. It means fast in a sort of consistent, maniacal, get-a-little-bit-better-each-day kind of way. And it’s actually one of the top things that we look for, at least when evaluating a team: How consistently fast they move.

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm spent the end of last week and the beginning of this one looking at Chinese regulations targeting its edtech sector, aiming to understand “precisely what is going on with the various regulatory changes.”

“For startups, the regulatory changes aren’t a death blow; indeed, many Chinese tech startups won’t be affected by what we’ve seen thus far,” he writes. “But on the whole, it feels like the risk profile of doing business in China has risen.”

Image Credits: Porsche AG

To ensure a steady supply of batteries, automakers are increasingly looking to joint ventures.

“Like if you’re VW, and you say, ‘We’re going to go 50% electric by whatever year,’ but then the batteries don’t show up, you’re bankrupt, you’re dead,” Sila Nano CEO Gene Berdichevsky said in a recent interview.

“Their scale is so big that even if their cell partners have promised them to deliver, automakers are scared that they won’t.”

Image Credits: AndreyPopov / Getty Images

The team at memoryOS “spent countless hours researching down the rabbit hole of crowdfunding tips and tricks” before it successfully became the most-funded app on Kickstarter, the company’s CEO, Alex Ruzh, writes in a guest column.

“We’re sharing our approach (and secrets) to building a successful crowdfunding campaign because we know just how tough it can be to launch your own product,” he writes.

Startups developing so-called deep tech often find it challenging to raise capital for various reasons.

At TechCrunch Early Stage: Marketing and Fundraising, two experienced investors, SOSV partners Pae Wu and Garrett Winther, spoke on the subject and advised startups facing a challenging fundraising path.

Image Credits: Dilok Klaisataporn (opens in a new window)

Processing payments, credit and authorizations for B2B purchases is all handled electronically, but that’s not a panacea.

For example, volume sellers prefer to work through traditional accounts payable systems instead of paying the service fees smaller companies accept as the cost of doing business.

However, the combination of fraud and identity protection with credit handling and digital payments “creates a powerful network, the type that can not only build trust but enable one-click transactions at scale,” says Andrew Steele, an investor at Activant Capital.

At TechCrunch Early Stage: Marketing and Fundraising, Cowboy Ventures’ Ted Wang spoke about why he encourages founders in his portfolio to work with executive coaches.

I don’t think you need to limit advice from people who are “been there, done that.” I think it is really important to get input from those people, but in terms of personal development, I think you want insight from people who understand how human beings listen and learn and grow.

Powered by WPeMatico

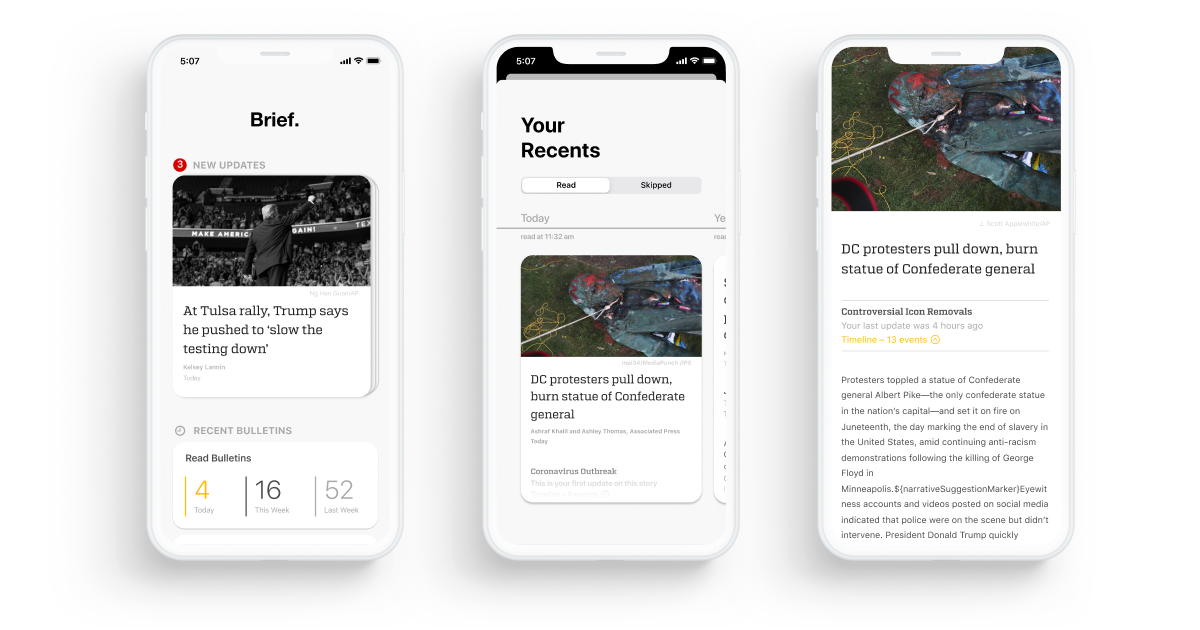

Twitter’s recent acquisition spree continues today as the company announces it has acqui-hired the team from news aggregator and summary app Brief. The startup from former Google engineers launched last year to offer a subscription-based news summary app that aimed to tackle many of the problems with today’s news cycle, including information overload, burnout, media bias and algorithms that promoted engagement over news accuracy.

Twitter declined to share deal terms.

Before starting Brief, co-founder and CEO Nick Hobbs was a Google product manager who had worked on AR, Google Assistant, Google’s mobile app, and self-driving cars, among other things. Co-founder and CTO Andrea Huey, meanwhile, was a Google senior software engineer, who worked on the Google iOS app and had a prior stint at Microsoft.

Image Credits: Brief

While Brief’s ambitious project to fix news consumption showed a lot of promise, its growth may have been hampered by the subscription model it had adopted. The app required a $4.99 per month commitment, despite not having the brand-name draw of a more traditional news outlet. For comparison, The New York Times’ basic digital subscription is currently just $4 per week for the first year of service, thanks to a promotion.

Twitter says the startup’s team, which also includes two other Brief employees, will join Twitter’s Experience.org group where they’ll work on areas that support the public conversation on Twitter, including Twitter Spaces and Explore.

While Twitter wouldn’t get into specifics as to what those tasks may involve, the company did tell TechCrunch it hopes to leverage the founders’ expertise with Brief to build out and accelerate projects in both those areas.

Explore, of course, is Twitter’s “news” section, where top stories across categories are aggregated alongside trending topics. But what it currently lacks is a comprehensive approach to distilling the news down to the basic facts and presenting balance, as Brief’s app had offered. Instead, Twitter’s news items include a headline and a short description of the story, followed by notable tweets. There’s certainly room for improvement there.

It’s also possible to imagine some sort of news-focused product built into Twitter’s own subscription service, Twitter Blue — but that’s just speculation at this point.

Twitter says it proactively reached out to Brief with its offer. As part of its current M&A strategy, the company is on the hunt for acquiring talent that will complement its existing teams and help to accelerate its product developments.

Over the past year, Twitter has made similar acqui-hires, including those for distraction-free reading service Scroll, social podcasting app Breaker, social screen-sharing app Squad, and API integration platform Reshuffle. It also bought products, like newsletter platform Revue, which it directly integrated. The company even held acquisition talks with Clubhouse and India’s ShareChat, which would have been much larger M&A deals.

“We’re really glad we ended up at Twitter,” Hobbs told TechCrunch.

“Andrea and I founded Brief to build news that fostered a healthy discourse, and Twitter’s genuine commitment to improve the public conversation is deeply inspiring,” he said. “While we can’t discuss specifics on future plans, we’re confident our experience at Brief will help accelerate the many exciting things happening at Twitter today,” he added.

Hobbs said the team remains optimistic about the future of paid journalism, too, as Brief demonstrated that some customers would pay for a new and improved news experience.

“Brief pioneered a fresh vision for journalism, focused on getting you just the news you need rather than as much as you could withstand,” remarked Ilya Kirnos, founding partner and CTO at SignalFire, who backed Brief at the seed stage. “That respect for its readers made SignalFire proud to support founders Nick Hobbs and Andrea Huey, who are now bringing that philosophy to the top source of breaking news — Twitter.”

To date, Brief had raised a million in seed funding from SignalFire and handful of angel investors, including Sequoia Scouts like David Lieb, Maia Bittner and Matt Macinnis.

As a result of today’s deal, Brief will wind down its subscription app on July 31. The company says it will alert its current user base today via a notification about its forthcoming shutdown but the app will remain on the App Store offering new features that allow users to explore its archives.

Powered by WPeMatico

Sometimes, the best missions are the hardest to fund.

For the founders of RapidSOS, improving the quality of emergency response by adding useful data, like location, to 911 calls was an inspiring objective, and one that garnered widespread support. There was just one problem: How would they create a viable business?

The roughly 5,700 public safety answering points (PSAPs) in America weren’t great contenders. Cash-strapped and highly decentralized, 911 centers already spent their meager budgets on staffing and maintaining decades-old equipment, and they had few resources to improve their systems. Plus, appropriations bills in Congress to modernize centers have languished for more than a decade, a topic we’ll explore more in part four of this EC-1.

Who would pay? Who was annoyed enough with America’s antiquated 911 system to be willing to shell out dollars to fix it?

People obviously desire better emergency services — after all, they are the ones who will dial 911 and demand help someday. Yet, they never think about emergencies until they actually happen, as RapidSOS learned from the poor adoption of its Haven app we discussed in part one. People weren’t ready to pay a monthly subscription for these services in advance.

So, who would pay? Who was annoyed enough with America’s antiquated 911 system to be willing to shell out dollars to fix it?

Ultimately, the company iterated itself into essentially an API layer between the thousands of PSAPs on one side and developers of apps and consumer devices on the other. These developers wanted to include safety features in their products, but didn’t want to engineer hundreds of software integrations across thousands of disparate agencies. RapidSOS’ business model thus became offering free software to 911 call centers while charging tech companies to connect through its platform.

It was a tough road and a classic chicken-and-egg problem. Without call center integrations, tech companies wouldn’t use the API — it was essentially useless in that case. Call centers, for their part, didn’t want to use software that didn’t offer any immediate value, even if it was being given away for free.

This is the story of how RapidSOS just plowed ahead against those headwinds from 2017 onward, ultimately netting itself hundreds of millions in venture funding, thousands of call agency clients, dozens of revenue deals with the likes of Apple, Google and Uber, and partnerships with more software integrators than any startup has any right to secure. Smart product decisions, a carefully calibrated business model and tenacity would eventually lend the company the escape velocity to not just expand across America, but increasingly across the world as well.

In this second part of the EC-1, I’ll analyze RapidSOS’ current product offerings and business strategy, explore the company’s pivot from consumer app to embedded technology and take a look at its nascent but growing international expansion efforts. It offers key lessons on the importance of iterating, how to secure the right customer feedback and determining the best product strategy.

It became clear from the earliest stages of RapidSOS’ journey that getting data into the 911 center would be its first key challenge. The entire 911 system — even today in most states — is built for voice and not data.

Karin Marquez, senior director of public safety at RapidSOS, who we met in the introduction, worked for decades at a PSAP near Denver, working her way up from call taker to a senior supervisor. “When I started, it was a one-man dispatch center. So, I was working alone, I was answering 911 calls, non-emergency calls, dispatching police, fire and EMS,” she said.

RapidSOS senior director of public safety Karin Marquez. Image Credits: RapidSOS

As a 911 call taker, her very first requirement for every call was figuring out where an emergency is taking place — even before characterizing what is happening. “Everything starts with location,” she said. “If I don’t know where you are, I can’t send you help. Everything else we can kind of start to build our house on. Every additional data [point] will help to give us a better understanding of what that emergency is, who may be involved, what kind of vehicle they’re involved in — but if I don’t have an address, I can’t send you help.”

Powered by WPeMatico

Among Silicon Valley circles, a fun parlor game is to ask to what extent world GDP levels are held back by a lack of computer science and technical training. How many startups could be built if hundreds of thousands or even millions more people could code and bring their entrepreneurial ideas to fruition? How many bureaucratic processes could be eliminated if developers were more latent in every business?

The answer, of course, is on the order of “a lot,” but the barriers to reaching this world remain formidable. Computer science is a challenging field, and despite proactive attempts by legislatures to add more coding skills into school curriculums, the reality is that the demand for software engineering vastly outstrips the supply available in the market.

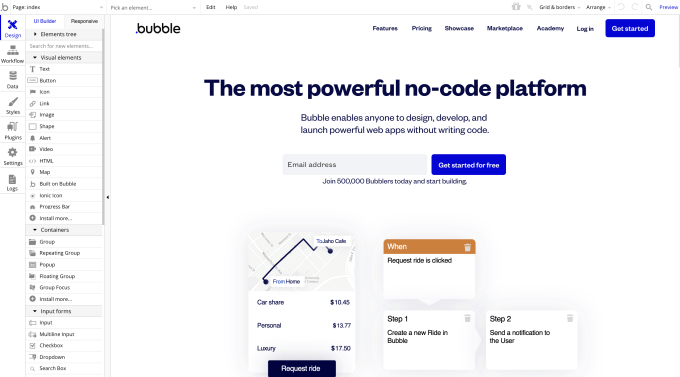

Coding is not a bubble, and Bubble wants to empower the democratization of software development and the creation of new startups. Through its platform, Bubble enables anyone — coder or not — to begin building modern web applications using a click-and-drag interface that can connect data sources and other software together in one fluid interface.

It’s a bold bet — and it’s just received a bold bet as well. Bubble announced today that Ryan Hinkle of Insight Partners has led a $100 million Series A round into the company. Hinkle, a longtime managing director at the firm, specializes in growth buyout deals as well as growth SaaS companies.

If that round size seems huge, it’s because Bubble has had a long history as a bootstrapped company before reaching its current scale. Co-founders Emmanuel Straschnov and Josh Haas spent seven years bootstrapping and tinkering with the product before securing a $6.5 million seed round in June 2019 led by SignalFire. Interestingly, according to Straschnov, Insight was the first venture firm to reach out to Bubble all the way back in 2014. Seven years on, the two have now signed and closed a deal.

Since the seed round, Bubble has been expanding its functionality. As a no-code tool, any missing feature could potentially block an application from being built. “In our business, it’s a features game,” Straschnov said. “[Our users] are not technical, but they have high standards.” He noted that the company introduced a plugins system that allows the Bubble community to build their own additions to the platform.

Image Credits: Bubble. Its editor offers a clickable interface for designing dynamic web applications.

As the platform matured, it happened to nail the timing of the COVID-19 pandemic last year, which saw people scrambling for new skills and improving their prospects amid a gloomy job market. Straschnov says that Bubble saw an immediate bump in usage in March and April 2020, and the company has tripled revenue over the past 12 months.

Bubble’s focus for the past eight years has been on helping people turn their ideas into startups. The company’s proposition is that a large number of even venture-backed companies could be built using Bubble without the expense of a large engineering team writing code from scratch.

Unlike other no-code tools, which focus on building internal corporate apps, Straschnov says that the company remains as focused today on these new companies as it has always been. “[We’re] not trying to move upmarket just yet — we are trying to do the same thing that AWS and Stripe did five years ago,” he said. Instead of trying to dominate the enterprise, Bubble wants to grow with its nascent customers as they expand in scale.

The company today charges a range of prices depending on the performance and scale requirements of an application. There’s a free tier, and then professional pricing starts at $25/month all the way to $475/month for its top-listed offering. Enterprise pricing is also available, as is special pricing for students.

On the latter point, Bubble is looking to invest heavily in education using its newly raised capital. While the platform is easy to use, the reality is that any design of a web application can be intimidating for a new user, particularly one who isn’t technical. So the company wants to create more videos and documentation while also heavily investing in partnerships with universities to get more students using the platform.

While the no-code space has seen prodigious investment, Straschnov said that “I don’t look at all the no-code players as competition … the true competition we have is code.” He noted that while the no-code label has been assumed by more and more startups, very few companies are focused on his company’s specific niche, and he believes he offers a compelling value proposition in that category.

The company has doubled headcount since the beginning of the pandemic, growing from around 21 employees to about 45 today. They are lightly concentrated in New York City, but the company operates remotely and has folks in 15 states as well as in France. Straschnov says that the company is looking to aggressively hire technical talent to build out the product using its new funds.

Powered by WPeMatico

Site reliability engineering platform Blameless announced Tuesday it raised $30 million in a Series B funding round, led by Third Point Ventures with participation from Accel, Decibel and Lightspeed Venture Partners, to bring total funding to over $50 million.

Site reliability engineering (SRE) is an extension of DevOps designed for more complex environments.

Blameless, based in San Mateo, California, emerged from stealth in 2019 after raising both a seed and Series A round, totaling $20 million. Since then, it has turned its business into a blossoming software platform.

Blameless’ platform provides the context, guardrails and automated workflows so engineering teams are unified in the way they communicate and interact, especially to resolve issues quicker as they build their software systems.

It originally worked with tech-forward teams at large companies, like Home Depot, that were “dipping [their toes] into the space and now [want] to double down,” co-founder and CEO Lyon Wong told TechCrunch.

The company still works with those tech-forward teams, but in the past two years, more companies sought out resident SRE architect Kurt Anderson to advise them, causing Blameless to change up its business approach, Wong said.

Other companies are also seeing a trend of customers asking for support — for example, in March, Google Cloud unveiled its Mission Critical Services support option for SRE to serve in a similar role as a consultant as companies move toward readiness with their systems. And in February, Nobl9 raised a $21 million Series B to provide enterprises with the tools they need to build service-level-objective-centric operations, which is part of a company’s SRE efforts.

Blameless now has interest from more mainstream companies in the areas of enterprise, logistics and healthcare. These companies aren’t necessarily focused on technology, but see a need for SRE.

“Companies recognize the shortfall in reliability, and then the question they come to us with is how do they get from where they are to where they want to be,” Anderson said. “Often companies that don’t have a process respond with ‘all hands on deck’ all the time, but instead need to shift to the right people responding.”

Lyon plans to use the new funding to fill key leadership roles, the company’s go-to-market strategy and product development to enable the company to go after larger enterprises.

Blameless doubled its revenue in the last year and will expand to service all customer segments, adding small and emerging businesses to its roster of midmarket and large companies. The company also expects to double headcount in the next three quarters.

As part of the funding announcement, Third Point Ventures partner Dan Moskowitz will join Blameless’ board of directors with Wong, Accel partner Vas Natarajan and Lightspeed partner Ravi Mhatre.

“Freeing up engineering to focus on shipping code is exactly what Blameless achieves,” said Moskowitz in a written statement. “The Blameless market opportunity is big as we see teams struggle and resort to creating homegrown playbooks and point solutions that are incomplete and costly.”

Powered by WPeMatico

Reusable rocket startup iRocket has entered into a new partnership with NASA in its quest to reach commercialization in just two years.

The partnership will give iRocket access to testing facilities and engineering support, chiefly at the NASA Marshall Space Flight Center in Huntsville, Alabama. The company is hoping that it will conduct its first rocket engine test — an on-the-ground engine firing test — at the Huntsville site in September.

iRocket is earmarking $50 million over the next five years for the testing and development of its reusable engines and launch vehicle. Access to NASA facilities also means access to test stands — crucial infrastructure that provides controlled conditions for engine testing. iRocket will be able to conduct vacuum testing (which simulates space conditions) at the Glenn Research Center in Ohio and sea level testing at Marshall.

“We’re engaged in very intimate discussions, all the way at the center level, at Marshall Space Flight Center,” iRocket CEO Asad Malik said in a recent interview with TechCrunch.

The engines in question will eventually power iRocket’s inaugural Shockwave launch vehicles, fully reusable, autonomous small launchers capable of carrying payload with a maximum size of around 300 kg (661 lbs.) and 1,500 kg (around 3,300 lbs.). Manufactured via 3D printing, the engines will be powered by methane and liquid oxygen. “Methane is going to be the fuel of choice for deep space missions,” Malik said.

The New York-based startup is also aiming to make the engines hypersonic capable, an ambitious goal. But iRocket has ambitious plans. Malik wants to turn the company into the premier supplier for both reusable rocket engines and the rockets themselves. Because it’s designing both rocket stages to be reusable as well — a striking difference between it and other rocket developers — Malik said the company could one day not only launch satellites and cargo missions, but also clear space junk or retrieve experiments for biotech companies.

Malik pointed out that the sale of Aerojet Rocketdyne to Lockheed Martin — which is still under review by the Federal Trade Commission — is going to leave a gap in the market. “That’s going to open up the U.S. without an independent rocket supplier at a time when Congress is really pushing hard for us to move away from foreign-bought parts,” he said. “So it’s an opportunity for us to work with the government, the Pentagon, NASA and other partners to develop this next-generation space propulsion capability that we need.”

Powered by WPeMatico

U.S. edtech company Duolingo released a revised IPO price range this morning, boosting its potential per-share value to $100 after initially targeting a range that topped out at $95 per share.

Per the unicorn’s SEC filings, Duolingo is now targeting a $95 to $100 per share IPO price range, up from $85 to $95 per share, or a gain of around 12% at the bottom and 5% at the top.

TechCrunch previously called the Duolingo debut a bellwether of sorts for the larger U.S. edtech ecosystem; if Duolingo can price and trade well, investors in private companies may be more willing to invest, given a more proven and attractive exit market. On the other hand, if Duolingo prices weakly or trades poorly, the company could place a wet blanket atop the startup edtech world.

The fact that Duolingo is raising its IPO price range indicates that we are more likely on the path for a strong offering than a weak one.

For edtech companies that have hit unicorn status — like Masterclass, Course Hero, Quizlet and Outschool — it’s good news. For reference, those companies have raised $461.4 million, $97.4 million, $62 million and $130 million, respectively, per Crunchbase data.

The terms of the company’s IPO have not changed, aside from its proposed price. So, Duolingo is still selling 3.7 million shares in its debut, and some 1.41 million shares will be sold by existing equity holders. The company’s underwriters also reserved their right to buy 765,916 shares of the company’s stock at IPO price in the 30 days following its debut.

At the upper and lower bands of the company’s IPO price, its simple valuation excluding underwriter shares now lands between $3.41 billion and $3.59 billion. Inclusive of its greenshoe offering, those numbers rise to $3.48 billion and $3.67 billion.

Recall that when private, Duolingo’s November 2020 Series H valued the company at just over $2.4 billion. So long as Duolingo prices in its range, it will provide investors with a nice bump in the value of their investment. Duolingo was valued at just $1.6 billion in mid-2020, indicating that it has more than doubled in value since that investment.

Powered by WPeMatico

Despite the plentiful headlines about mega billion-dollar M&A transactions, record IPOs and the rapid growth of SPACs, small deals will continue to be the most likely exit for the vast majority of tech startups. In the over 30 years I’ve worked on M&A at White & Case, Barclays and my current firm Ascento Capital, I have seen too many startups that are not prepared for an exit via a merger or sale. This article will provide specific recommendations on how to prepare your startup for M&A.

While it is good to strive for a billion-dollar-plus sale, a successful IPO or a SPAC deal, it is practical to prepare your startup for a smaller transaction.

Global M&A hit record highs in the second quarter with a total deal value of $1.5 trillion, but smaller transactions vastly outnumber mega billion-dollar deals. The U.S. saw a total of 16,672 deals in the year ended June 31, but only 583, or 3% of that number, were valued at more than a billion dollars (FactSet). The IPO market is healthy again, but M&A still represents 88% of exits: So far this year, there were 503 IPOs and 5,203 deals, according to the CB Insights Q2 2021 State of Venture Report. After the SEC announced in early April that it was considering new guidance on SPAC IPOs, the rate of new SPAC issuances fell by around 90%.

While it is good to strive for a billion-dollar-plus sale, a successful IPO or a SPAC deal, it is practical to prepare your startup for a smaller transaction.

Here are a few recommendations that will prepare your startup for an M&A exit:

Set up an alert on Google News for M&A activity in your subsector. For example, if your startup is in the IoT subsector, search for “IoT acqui” and this will pick up news stories on acquisitions in the IoT space. Save the search so you can go to Google News on a regular basis. Also track your closest competitors on Google News, particularly to see who is selling their company.

Prepare a list of the companies or firms most likely to buy your startup. This list should include domestic and international companies, businesses in non-tech industries, private equity firms and their portfolio companies, as well as VC-backed companies. Track these likely acquirers on Google News as well.

Consider approaching the top 10 likely acquirers when you are raising the next round of capital. If your startup gets M&A offers and VC term sheets at the same time, this will provide your board of directors choices on the path ahead. Knowing the M&A activity in your startup’s subsector and the 10 most likely acquirers will impress VCs and increase the chances of being funded.

Powered by WPeMatico

The whole human proteome may be free to browse thanks to DeepMind, but at the bleeding edge of biotech new proteins are made and tested every day, a complex and time-consuming process. Glyphic Biotechnologies accelerates the critical but slow sequencing step, potentially cutting drug development times down by a huge amount, and the startup just raised a $6 million seed to bring its clever solution to market.

Proteins are at the heart of many new treatments and products; the ubiquitous and infinitely varied chains of amino acids twist into shapes that interact with cells, substances in the body, and other proteins, doing everything from interpreting DNA to controlling access to secure areas (“sorry, no potassium allowed”).

In the drug discovery and biotech world, proteins represent unlimited possibility — the right one could clamp onto cancer cells, facilitate natural healing processes, or prompt the creation of helpful substances. But finding and testing novel molecules is not easy — and a big part of that is sequencing, which confirms the exact makeup of the protein you’re trying to test.

Right now there are several large companies doing good business in the protein discovery world, and generally the process involves identifying the amino acid at the end of the protein chain, then snipping it off, identifying the next one, and so on until you’ve done the whole thing.

The trouble with this approach is that the protein’s shape or the molecular properties of the next amino acid in line can interfere with the process of binding to and identifying the one on the very end. As a result there’s a certain amount of uncertainty and a lack of unreliability inherent to the process.

Glyphic Biotechnologies changes that by adding a step where the target amino acid is detached first and then tethered nearby using a novel molecule called ClickP developed by one of the co-founders. A single stationary amino acid attached to a known molecule is much, much easier to identify, and when it’s done, the process repeats as before.

It’s briefly stated but the advance is significant. Current techniques in the antibody discovery space produce and inspect on the order of tens of thousands of proteins per week per (very expensive) machine. It sounds like a lot but with proteins essentially innumerable, it’s just a drop in the bucket. Even running 24/7 this rate doesn’t come close to satisfying demand.

Glyphic’s approach, utilizing ClickP and single-molecule microscopy (like that used by DNA sequencing giant Illumina), should be capable of millions to tens of millions per week, possibly climbing to billions in time. Even at the most conservative estimate you’re talking about orders of magnitude in improvement — those tens of thousands in the other techniques include lots of (perhaps mostly) repeat or junk information due to their use of B cell cultivation to produce the antibodies in question.

Not only that, but because the ClickP process avoids the problem of interference from the next amino acid in the chain, it has way, way higher specificity and confidence. So you wouldn’t just be sequencing a hundred or a thousand times as many proteins, you’d be far more sure about the results.

At first Glyphic would be processing samples sent to them, but ultimately their tech could live in other labs as their competitors do now. Going from service to hardware sales and support is the current roadmap.

If everything works as advertised, Glyphic could be the new standard in protein sequencing just as demand skyrockets in the biotech world. To do so, though, it needs just a bit more time in the incubator.

The process they pioneered was the result of work done by co-founders Joshua Yang (CEO) and Daniel Estandian (CTO) at the lab of MIT’s Ed Boyden (on the team as “scientific founder”).

Yang explained that what stands between them and potential industry dominance is a mere matter of chemical engineering.

“My co-founder [Estandian] developed ClickP himself. The chemistry works,” he told me. “But as a spinout of an academic lab, we didn’t develop all 20 binders, because it would have bankrupted the lab. This isn’t an ‘off-the-shelf’ molecule.”

These binders are a bit like adapters that make the process work for each of the 20 amino acids. It takes time and money to engineer them, so they decided to show the system off with a handful first in order to get the cash to make the rest. “It’s really just about putting the time into getting them out there,” said Yang.

The $6.025 million seed round should finance the company through this early stage as it builds its platform. It was led by OMX ventures (which previously invested in 10X Genomics and Twist Bioscience), with participation from Osage University Partners, Wing VC, Artis Ventures, Cantos Ventures, Civilization Ventures, and Axial VC, and has an angel investor in Mammoth Biosciences CEO Trevor Martin.

Glyphic will be making its first home at Bakar Labs, the freshly inaugurated new Berkeley biotech incubator. There it will stay until it’s ready to take the next big step, likely hardware manufacturing next year on the back of an A round to be raised then. 2022 should then also see the company’s first paid services. And the antibody market, as large as it is, is only the beginning.

“Antibodies are just a starting point, as numerous applications can benefit from protein sequencing,” Josh explained in an email after we spoke. “Another high value area is in industrial biotechnology, where protein-sequencing-based screening of evolved enzymes can help identify enhanced or novel functions (e.g., better laundry detergents, waste-water treatment). Development of diagnostic tests would also benefit because, the more proteins you can sequence and identify in a sample set, the increased likelihood you can identify rare yet important biomarkers and/or develop a robust panel of biomarkers that together can detect or predict disease.”

A company like Glyphic may seem like a perfect target to get snapped up by one of the more deep-pocketed competitors out there, but Yang said they’re confident enough to ride it out.

“The activity in this space is insane. My co-founder and I really want to be the next Illumina or 10X Genomics — we really want to be that leader in proteomics.” And unless the competition has a few cards hidden up their sleeves, Yang’s ambition seems like a distinct possibility.

Powered by WPeMatico

The Exchange spent a little time on Friday ruminating on the impact of then-rumored regulation in China targeting its edtech sector. News that the Chinese government intended to crack down further on the education technology market hit shares of public, China-based edtech companies. It was a mess.

Then over the weekend, the rumors became reality, and the impact is still being felt today in the global markets.

But there’s more. China is also bringing new regulatory pressure on food-delivery companies and Tencent Music. More precisely, we’ve seen successive market-dynamic-changing moves from the Chinese government in the last few days, coming as 2021 had already proved to be a turbulent environment for China-based technology companies.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Today we have to do a little bit of work to understand precisely what is going on with the various regulatory changes. Why? Because the Chinese venture capital market is a key player in the global venture scene. And Chinese startups have gone public on both Chinese, Hong Kong and U.S. exchanges; there’s a lot of capital tied up in companies impacted today — and possibly tomorrow.

For startups, the regulatory changes aren’t a death blow; indeed, many Chinese tech startups won’t be affected by what we’ve seen thus far. And upstart tech companies in sectors less likely to be targeted by central authorities may become more attractive to investors than they were before the regulatory onslaught kicked off. But on the whole, it feels like the risk profile of doing business in China has risen. That could curb the pace at which capital is invested, cut valuations and lower interest in the Chinese startup market from private-market investors able to invest globally.

Let’s parse what’s changed, examine market reactions and then consider what could be next. We want to better understand today’s Chinese startup market and what its new form could mean for existing players and future performance.

Let’s parse what’s changed, examine market reactions and then consider what could be next. We want to better understand today’s Chinese startup market and what its new form could mean for existing players and future performance.

The edtech clampdown did not start last week. China’s edtech sector started to rack up penalties and fines in June, which led to what the Asia Times called “warning bells” in the sector. From there, things went from penalties to punishing regulatory changes.

Powered by WPeMatico