Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

There are very few marketing channels as well rounded as email newsletters. They provide a direct, owned line of communication with your audience; nearly 40x return on investment (~$40 generated per every dollar spent), are infinitely scalable and virtually free.

But to unlock these benefits, you’re going to need to be strategic. In this article, I’m going to share tactics we’ve used at Demand Curve to grow our newsletter list to over 50,000 highly-qualified subscribers and maintain an open rate of over 50%.

While they’re often thought of as intrusive, pop-ups work. On average, they convert 3% of site visitors, and strategic, high-performing pop-ups can reach conversion of about 10%.

To make higher-converting, less intrusive pop-ups, try the 60% rule.

So if the average time spent on a page is 50 seconds, set your pop-up to appear 30 seconds (60% of total time) after visitors land on that page.

Why 60%? Readers have shown interest in your content, but are nearing the end of their session. Prompting them to join your newsletter to see more relevant content in exchange for their email will feel fair.

To encourage new subscribers to open your welcome email, try breaking the welcome email pattern using delayed gratification and a recognizable sender.

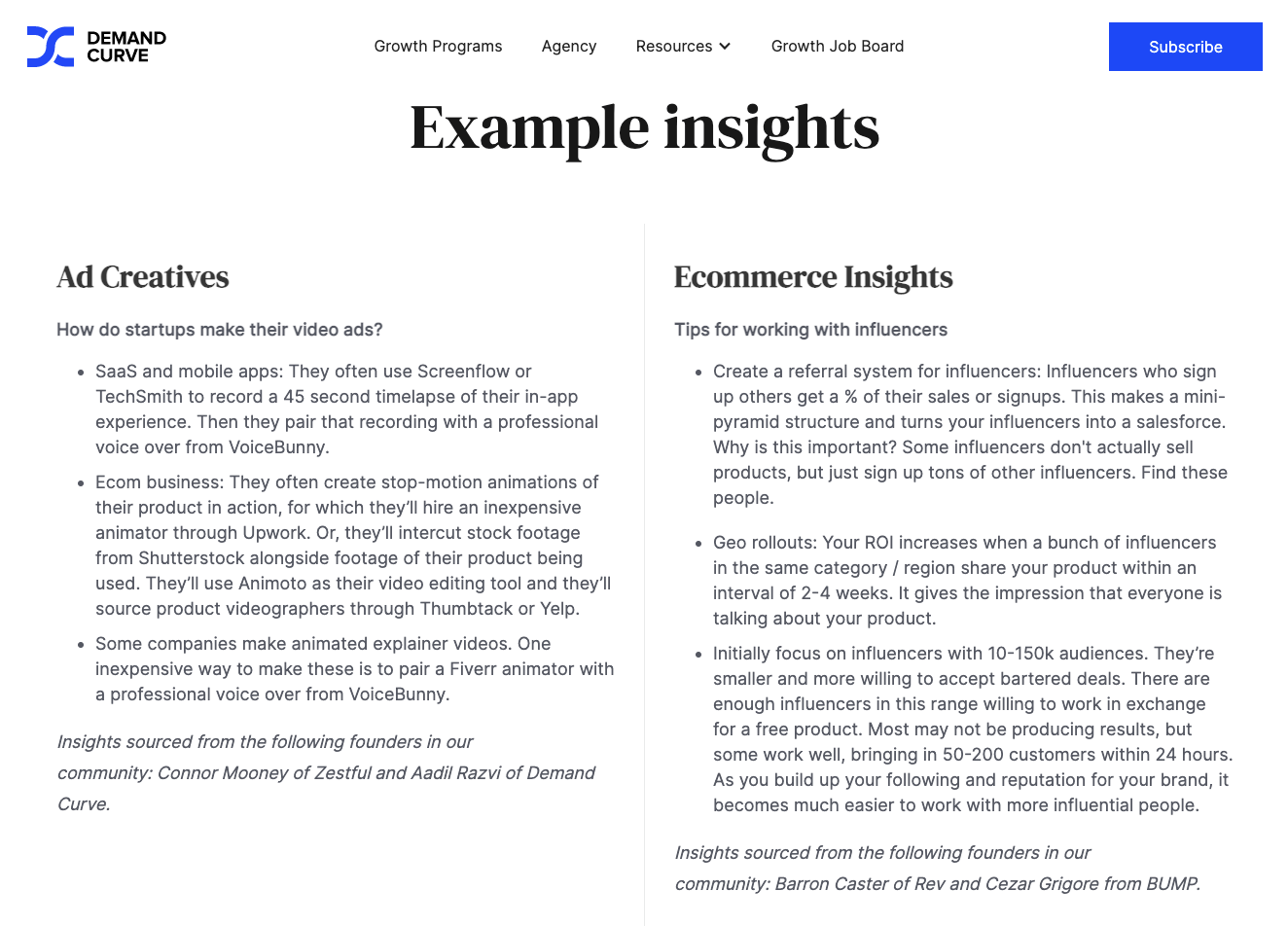

If a visitor is new to your content, asking them to sign up for your newsletter can be a big step, and most new visitors won’t convert. To narrow the gap between a new reader and subscriber, provide a sample on the sign-up page. Use your most engaging newsletter as a sample to prove that your content is high quality.

To source your most engaging content, filter by open rate and replies. In your email service provider, sort your previous editions by open rate. This will help you identify which subject lines are most popular with existing readers. Modify your most popular subject line to turn it into a header on your newsletter sign-up page.

Next, go into your inbox and sort by replies to your newsletter. Identify which newsletter got the most replies from your readers. This is a positive signal that the content from that edition resonated the most and would be a solid choice for your free sample.

Image Credits: Demand Curve

People reflexively ignore welcome emails after they sign up. But, those who do open your welcome email are more likely to consistently open your newsletters.

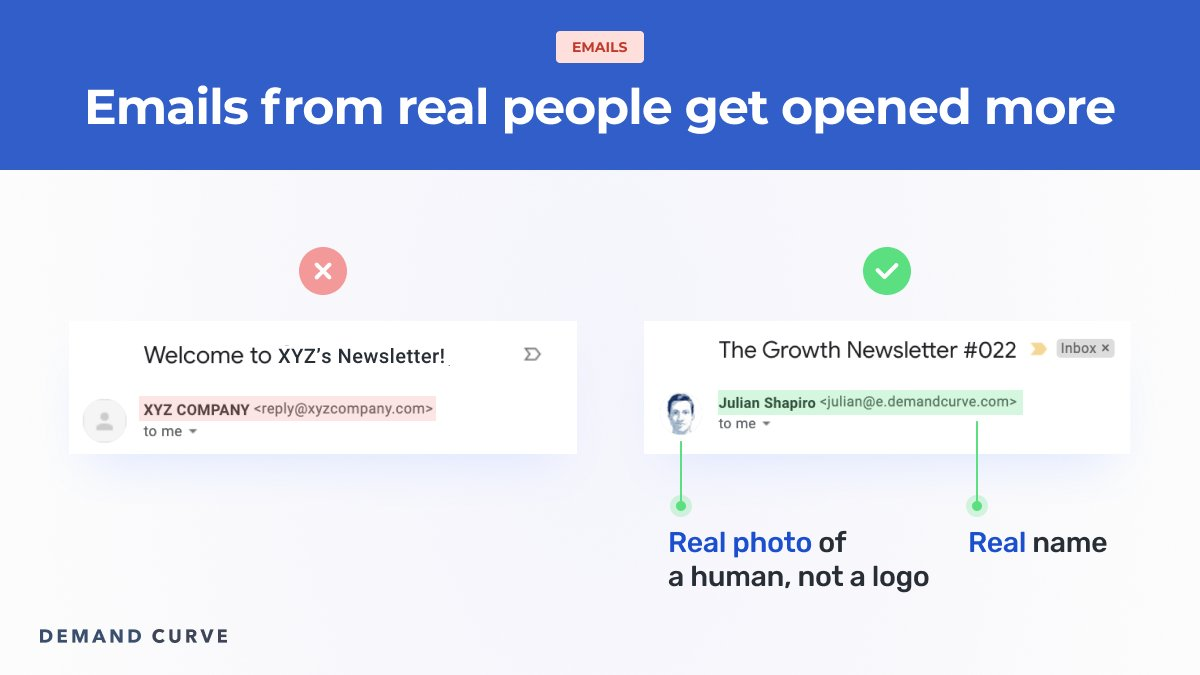

To encourage new subscribers to open your welcome email, try breaking the welcome email pattern using delayed gratification and a recognizable sender.

Delay your welcome email by 45 minutes. This will bypass the reflex that new subscribers have to ignore an email that pings them seconds after signing up. We’ve found 45 minutes to be ideal, because the delay is long enough that it breaks the pattern, but not so long that your email gets buried in their inbox.

Send your welcome from a person, not from a business account. We’ve found this tactic to be especially effective when the sender is the founder of the business or someone with an established audience. Use a photo of that person and not your company logo to help the email stand out.

To avoid overflowing the sender’s real inbox, create a subdomain for your website that will be used exclusively for sending emails. Create an account for your sender and begin using it for your newsletter. This avoids overwhelming their inbox and maintains the health of your sending domain.

Image Credits: Demand Curve

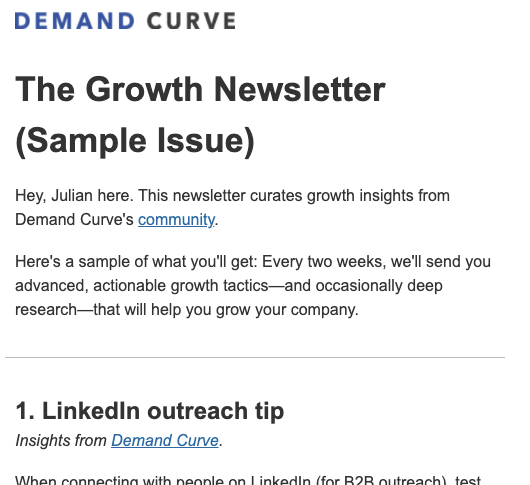

A new subscriber will be keen to receive their first issue. To ensure they’re satisfied, piece together your best content from past issues into a superissue. But be careful not to use the same content you included as samples on your sign-up page.

Send this first superissue with the welcome email so that your new subscribers are immediately receiving value from your newsletter. Starting with your best content first will get your subscribers excited to open future emails.

We’ve found that shorter welcome emails perform better than long-winded ones. Keep your welcome message short and your opening issue tight. Once they’ve received the welcome email and the first superissue, add them to the regular email cadence.

Image Credits: Demand Curve

We polled over 24,000 marketers on Twitter asking whether people suffer from “newsletter fatigue,” causing them to unsubscribe.

The results: 80% of respondents unsubscribe when they get too many emails.

To avoid overwhelming your subscribers:

Give your subscribers control over how often they are emailed: Some subscribers want them weekly, while others want monthly. In the footer of your email, create opt-out links that allow subscribers to customize the cadence they’ll receive emails. Giving them the opportunity to opt out of frequent emails while still remaining subscribed keeps them as valid contacts on your email list. You want to avoid losing them completely as a subscriber.

Send fewer emails: Putting a constraint on how many emails you’re allowed to send every quarter will force you to be more thoughtful about the contents of those emails. A high volume of emails just for the sake of being in your subscribers’ inbox can burn you and your readers out. We’ve seen very little correlation between volume of emails and the resulting conversion rate.

Most emails in your inbox are serious. To stand out, consider injecting some lighthearted memes, jokes or interesting links from around the web.

We’ve found this tactic works extremely well, because it gives your readers a dopamine hit in every email. Not every piece of newsletter content you write will resonate with every subscriber. Humor, on the other hand, can have broad appeal. Including interesting and fun content will ensure that every reader is left feeling satisfied.

It also helps build a habit. If every edition is slightly different, your reader will never be sure what they’re opening when a new edition hits their inbox. We’ve found that including something fun at the bottom of the newsletter gives readers a reward: Read the serious stuff, then get rewarded with the fun stuff.

We add a meme to each issue. People reply to tell us how much they appreciate it.

Image Credits: Demand Curve

Referrals are a free way to grow your newsletter. To increase the chances of subscribers referring you to others, make sure the process takes no longer than 25 seconds.

Remind readers at the end of each issue that they can refer others. A simple way is to ask them to forward the email to a friend who would find it interesting. Include a short sentence in the intro to your newsletter telling people being referred where they can subscribe. Include a link.

An advanced tactic is to include a subscriber’s unique link to a referral program so they can track how many people they’ve invited. Give them the option to share through email or social media.

You should also have a web version of every issue so that your content can be easily shared outside of email. Most email service providers will automatically generate a web link that you can promote through social media or elsewhere. You can also copy the content and post it to your website as a blog post to generate traffic from search engines.

Consider providing rewards to those who refer your newsletter. Merchandise will likely only work as an incentive if your brand is well known or very unique. We suggest incentivizing referrals using exclusive content. Send a monthly bonus issue to subscribers who have referred five or more friends. This will keep your costs down and give your subscribers more of what they already want.

Note that you will need a critical mass of subscribers before referrals will prove to be effective. We’ve found the threshold is about 10,000 subscribers. But if your audience is extremely engaged or the community you serve is active, implementing a free referral program has virtually no downside.

Your subscribers will likely become aware of your content through a social media channel, but social media audiences are rented from the platform — you do not own a direct channel to communicate with them. Converting followers into newsletter subscribers is one way to control a direct line of communication and deepen your relationship with your audience.

When pitching your followers to subscribe to your newsletter, include a link in your bio. This may sound obvious, but many people don’t do it. When someone comes across your social media profile, make signing up for your newsletter the call to action. Otherwise, they’ll have no idea that you even have a newsletter.

You could also cut a Twitter thread or LinkedIn post short and tell people to subscribe for the rest of the insights. You probably don’t want to overuse this tactic.

Create an offer or unique piece of content that can only be accessed through the newsletter. This will motivate your followers to join your email list to get access to exclusive content or unique offers.

Getting new subscribers: Use pop-ups that are relevant and only to high-intent readers on your site. Provide proof of why they should subscribe to your newsletter with sample content. Make your welcome email stand out and front-load the first issue with your best content.

Keeping subscribers: To keep your subscribers wanting more, send fewer emails. Sprinkle in humor and interesting links to turn your newsletter into a habit.

Promoting your newsletter: Use exclusivity and offers to hook your social media followers into subscribing to your newsletter. Ask your subscribers to refer your newsletter to others to grow your subscriber base.

Powered by WPeMatico

Indian fintech startup BharatPe has raised $370 million in a new round of financing as it looks to aggressively scale its business in the next two years. It’s the nineteenth Indian startup to become a unicorn this year (up from 11 last year) as several high-profile global investors double down in the South Asian market.

The new round — a Series E — was led by Tiger Global and valued the New Delhi-based startup at $2.85 billion (post-money), it said in a statement Tuesday evening. Dragoneer Investor Group and Steadfast Capital also participated in the new round, which brings the startup’s to-date raise to over $580 million against equity.

Tuesday’s news confirms a TechCrunch scoop from June in which we reported that the four-year-old startup was looking to raise about $250 million at a pre-money valuation of $2.5 billion. BharatPe was valued at about $900 million in its Series D round in February this year, and $425 million last year.

BharatPe co-founder Ashneer Grover confirmed that the startup was indeed looking to raise $250 million until inbound requests from investors prompted an oversubscription. The new investment also includes some secondary transactions.

BharatPe, which counts Coatue, Ribbit Capital and Sequoia Capital India among its existing investors, operates an eponymous service to help offline merchants accept digital payments and secure working capital.

Even as India has already emerged as the second-largest internet market, with more than 650 million users, much of the country remains offline.

Among those outside of the reach of the internet are merchants running small businesses, such as roadside tea stalls and neighborhood stores. To make these merchants comfortable with accepting digital payments, BharatPe relies on QR codes and point of sale machines that support government-backed UPI payments infrastructure.

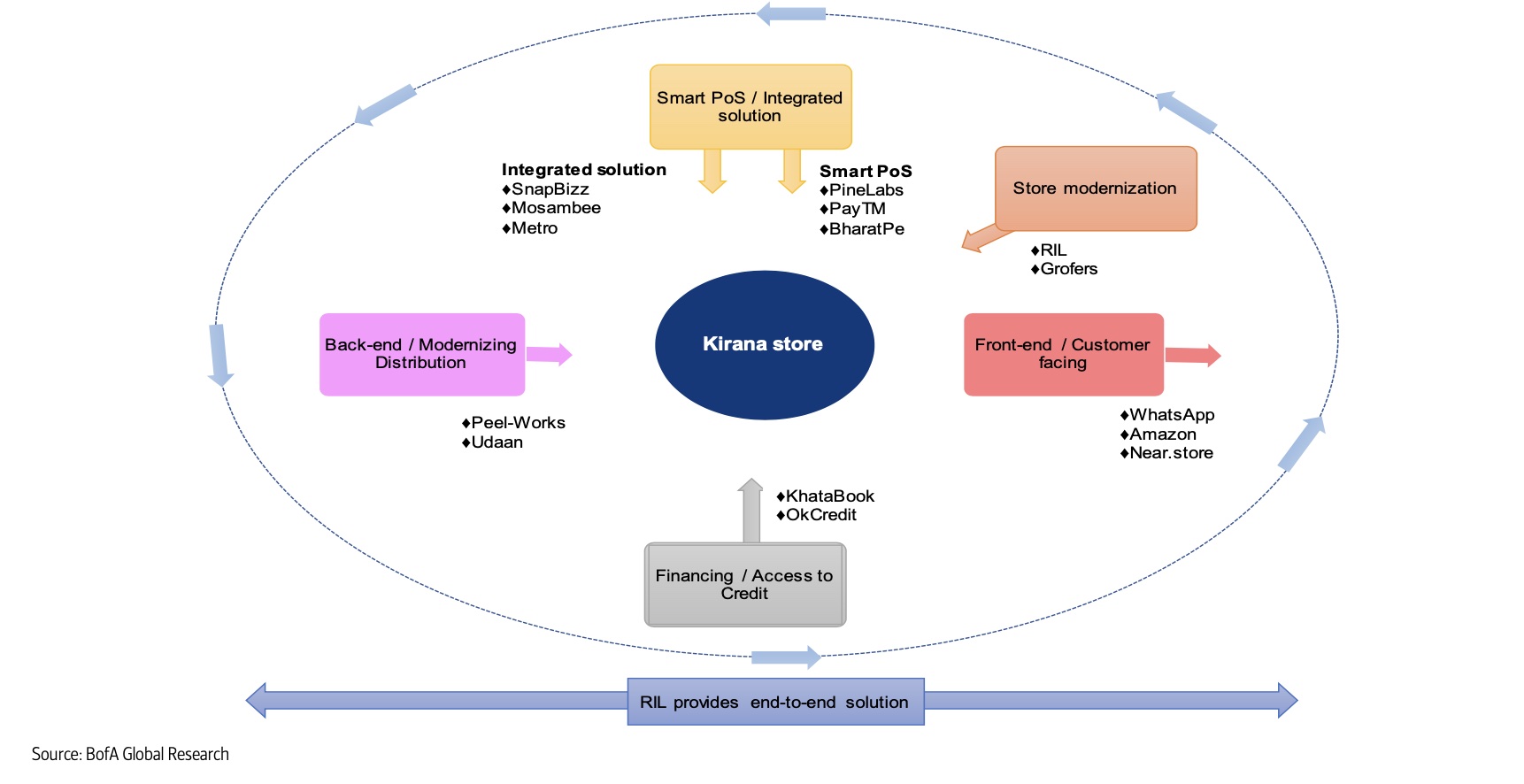

Scores of giants and startups are attempting to serve neighborhood stores in India. Image Credits: Bank of America Research

The startup, which serves more than 7 million merchants in over 130 Indian cities, said it has disbursed close to $300 million to merchant partners. It does not charge merchants for universal QR code access, but is looking to make money by lending.

The startup plans to expand its product offerings as well as work with Centrum Financial Services, with which it was recently granted the license by India’s central bank (Reserve Bank of India) to set up a small finance bank. (Centrum Financial Services has collaborated with BharatPe for the license, and the Indian startup says the two are “equal” partners.)

Tuesday’s development further illustrates the growing interest of Tiger Global in India. The New York-headquartered firm has backed dozens of Indian startups, including social commerce startup DealShare, edtech Classplus, Apna (an app that helps blue-collar workers connect with recruiters) and home services platform Urban Company in recent months.

On Tuesday, Infra.Market, an Indian startup that helps construction and real estate companies procure materials and handle logistics for their projects, said it had raised $125 million in a round led also by Tiger Global.

Powered by WPeMatico

With the pandemic wreaking havoc amongst early years education amid school lockdowns, it’s no wonder edtech startups have piled into the space. But it has also served to highlight the abysmal nature of early years teaching: Some 40 million teachers across the globe are leaving the sector, according to the World Bank. Of the 1.5 billion primary-age children, only a few can access high-quality education, and approximately 58 million primary-age children are out of education, most of whom are girls.

So the opportunity to make a difference, using online teaching, in these very young years, is great, because classes sizes can be reduced online, and the quality of teaching improved.

This is the idea behind bina, which bills itself as a “digital primary education ecosystem”. It has now raised $1.4 million to aim at the education of 4- to 12-year-olds.

The funding round was led by Taizo Son, one of Japan’s billionaires. Other investors and advisors include Jutta Steiner, founder at Parity Technologies, the company behind Polkadot decentralized protocol, and Lord Jim Knight, ex-Minister of Education (U.K.).

Bina’s “schtick” is that it has very small online class sizes of six students (3x smaller than the OECD average).

It also boasts of “adaptive learning paths” that cover international standards; teachers with a minimum of eight years of digital teaching experience; and data-driven decision making for its pedagogical approach.

Noam Gerstein, bina’s CEO and founder said: “I’ve interviewed students, teachers and parents globally for years, and it is clear a new systemic design is needed. With our founding families, we are building a world in which every child has access to quality education, educators’ skills are valued and continuously developed, and parents don’t need to choose between their work and family life.”

He says it also grants pupils company shares (RSUs) as they grow with the school. Currently available to English-speaking students in the CET time zone, the bina School is planning a SaaS product for governments, NGOs and school systems.

“We right now compete against companies like Outschool, Pearson’s online Academy, Primer and Prisma,” he told me over a call. “So these are the big names of the last year for the first phase. But the strategy is that we’re building it in two phases. The first phase is actually building a school that we operate as a ‘lab’ school. And the second phase is what we call ‘bina as a service’. So it’s a SaaS ‘school as a service’. The idea is that we offer collaboration with NGOs and governments, doing accreditation and training and licencing of the product. So for that second part we’re actually competing against the big accreditation system.”

Powered by WPeMatico

Startup Alley is the place to be at TechCrunch Disrupt 2021 on September 21-23. The sold-out expo area is the virtual home to hundreds of innovative startups ready to demo their tech and talent. While exhibiting offers plenty of opportunity for all, a VIP experience kicked off in July for 50 startup exhibitors the TechCrunch staff chose to form the first Startup Alley+ cohort.

Part of that experience includes a series of master classes in the run-up to Disrupt. Case in point, on August 24, Dan Olsen will lead a master class called “How to Create Product-Market Fit.” Now, we’re ready to share the next presentation, and it’s another great one, folks.

On August 17th, John Lynn, co-founder of CELA Innovation, and Jade Kearney, Lean Startup expert and co-founder and CEO of She Matters, will present a master class called, “The Key Principles of the Lean Startup Methodology.”

A quick tangent: If you’re not already familiar with CELA or what it does, the NYC-based company matches early-stage startups to world-class accelerators and incubators that align with a startup’s vertical and business goals. Last year, at Disrupt 2020, CELA connected the winners of our Pitchers and Pitches mini pitch-off competitions with an accelerator to boost their business.

Meanwhile, back at the master class: Change — positive or negative — is inevitable, and this master class will focus on what founders can do when change arrives on their doorstep. Examples of change can include receiving funding, running out of funding, losing a co-founder or a key customer or anything else that’s shaking up their situation.

John and Jade will help each cohort founder produce a Lean Startup transformation for one current business situation. Founders can then use it as a template for optimizing anything in their business the next time change comes calling.

The session begins by examining why you should use the Lean Startup methodology at inflection points — when there is a sudden change to your company, good or bad.

You’ll learn how you can use the Lean Startup methodology to create resources when you are overwhelmed by opportunity or just feel like you have gone as far as you can go with what you have.

Next, John and Jade will show how this methodology makes the difference between knowing what you want to build and learning what you need know about your customers, industry or product.

Lastly, Team CELA will isolate some of your key business activities as they exist right now. Then they will walk you through a process to turn that activity into a Lean Startup experiment that produces insights, new value and new opportunities.

TechCrunch Disrupt 2021 takes place September 21-23. Don’t miss your opportunity to meet the Startup Alley+ cohort and hundreds of other innovative startups in our expo area. Opportunity is knocking — buy your TC Disrupt 2021 pass and go kick down the door.

Is your company interested in sponsoring or exhibiting at Disrupt 2021? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

British venture capital firm Draper Esprit recently moved its listing from the AIM to the main board in London, the LSE. The investing group also moved its secondary listing from Dublin’s Euronext Growth Market to its larger sister exchange, Euronext Dublin, which makes sense given its long connection to Irish capital.

Draper has always felt like something of an anomaly from our perspective, a generalist venture capital firm that was itself public. But this July, Forward Partners listed its shares on the AIM, and there are other venture firms in Europe that are also listed.

At first blush, the setup may seem odd; venture capital firms invest in companies that they hope to see go public one day — why would they float themselves? But Draper Esprit co-founder Stuart Chapman told TechCrunch in an interview that he finds it shocking “that venture capital backs some of the most mind-blowing tech advances in our history over the last 70 years, using the same legal structure as a 1958 property vehicle in New York.” It’s a reasonable point.

Perhaps fundraising success is part of why the venture model has not seen much disruption in recent decades, apart from rising fund sizes. But the model is not perfect. It can foist artificial time constraints on investors and force them to focus their deal flow into particular stages for fund-construction reasons. As we found out researching this piece, the public venture model highlights some of these limitations — and may be able to alleviate them in part.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

And yet we can’t come up with a single U.S. venture capital firm, for example, that has publicly listed in the same manner as Draper Esprit or Forward Partners.

To better understand why we’re seeing European VCs float, and not their peers in other markets, The Exchange reached out to Draper Esprit, Forward Partners, and fellow listed venture investors Mercia and Augmentum Fintech. From the group, we’ve learned that there are plenty of reasons why the model may be popular in the U.K. and not in the U.S.

But there are also reasons why being a public venture capitalist can make the VC game a rather different, longer-term effort. The firms in question did not go public on a whim.

So let’s talk about the good, the bad, and the regulatory concerning publicly listed venture capital firms. The future? Or just a regional quirk?

Following its move, Draper Esprit is now the largest “purely tech VC” listed on London’s Main Market. Its initial listing had also been a market milestone: “Listing Draper Esprit five years ago was a radical and unusual step for a venture capital business,” Chapman said of Draper’s 2016 dual-listing on London’s AIM and Dublin’s Enterprise Securities Market (ESM) — now Euronext Growth.

Just last month, two tech-related investment funds IPO’d on the London Stock Exchange: space-focused Seraphim Capital and Nic Brisbourne’s Forward Partners. In both cases, Draper Esprit was happy to assist with information, Chapman told us, adding that the firm also invested in Forward via its fund-of-funds effort.

The news adds up to a roster of listed investors that also includes fintech fund Augmentum Fintech, asset manager Mercia Asset Management PLC and intellectual property commercialization company IP Group. “We’re supportive of others following in our footsteps and we will be big fans of having much wider diversity,” Chapman told TechCrunch in an interview, which you can read in full here.

Having recently joined the club, Forward Partners’ founder and CEO Nic Brisbourne gave us a good overview of the three high-level reasons that could lead a fund to list: open opportunities to create more value from new initiatives that sit outside traditional investment capital; breaking the cycle of fundraising; and opening access to the early-stage venture capital asset class. Let’s take a closer look.

Powered by WPeMatico

Rani Therapeutics, a San Jose-based company developing a pill to replace medical injections, went public on Friday.

According to S-1 filings, shares were estimated to price between $14 and $16 last week. On Friday, shares debuted slightly lower, around $11. Rani raised about $73 million in its debut.

Rani’s debut comes amidst a flurry of IPO activity in therapeutics. In 2020, 71 biotech companies went public. Already in 2021, 59 companies have IPO’ed, and even more are on the way. On July 30 alone, eight biotech companies were expected to begin trading, including Rani Therapeutics.

Rani Therapeutics, is, as founder Mir Imran puts it, “laser focused” on itself, rather than the IPO activity around it. The decision to go public was partially bolstered by the results of a phase I study — early evidence that the RaniPill, the company’s flagship product, could be brought into the clinic.

“We are already in humans, and clearly on a strong path to make oral biologics [a] reality. This is a hot and unique market for life science direction and we’re excited to be driving innovation in this area,” Imran tells TechCrunch.

Rani Therapeutics’ flagship product is RaniPill, essentially, a capsule designed to deliver medicines that would usually be delivered via injections. TechCrunch covered the pill in more detail here, but it works according to a few basic steps.

The pill is covered by a coating resistant to stomach acid. Once the pill enters the small intestine, the coating dissolves, allowing for a small balloon to inflate. Once that small balloon inflates, medication is delivered by a microneedle (which dissolves after the drug is administered). Then, the rest of the balloon is “excreted through normal digestive processes,” per the company’s S-1 filing.

This whole process occurs in a pill that, on the outside, looks like a gel capsule.

There is evidence for some conditions suggesting patients prefer oral drugs to injections: for example, studies on cancer patients have illuminated patient preference for oral therapies rather than regular injections. That’s not the case for every condition. Some patients show preference to long-acting medicines delivered via injection rather than having to take lots of pills (this is the case for some HIV patients).

However, it’s fair to say that needles aren’t exactly pleasant. A 2019 review and meta analysis of 35 studies found that between 20% and 30% of young adults are afraid of needles, a fear that can lead some people to avoid medical treatments or vaccines.

Rani Therapeutics has been developing capsules for drugs that have already been approved by the FDA, but are often administered via regular injections. They include:

The product furthest along in the research cycle is the pill developed to administer octreotide (called RT-101), which was tested in a phase I clinical trial on 62 participants. The trial results, partially reported in the S-1 filing, showed 65% bioavailability of the octreotide drug, compared to an injection. That suggests that the pills can get the drugs into the body efficiently, though these results are early.

Next year, the company plans to initiate two additional Phase I studies on PTH for osteoporosis, and human growth hormone. Studies on the rest of the drugs in the pipeline are scheduled for 2023.

Ultimately, the company’s goal is to validate the RaniPill independently of specific drugs. The company is pursuing an Investigational Device Exemption (IDE), which would allow the company to test RaniPill in a clinical study without a drug involved. This study aims to establish how safe the product is for repeated dosing, and is slated to begin next year.

“I think we want to continue to generate data with drugs, because we will be making drugs. But nonetheless, it’s important to establish what the platform’s safety and tolerability is,” said Imran. So that’s quite important as well.”

The company’s leadership does have a track record of successful exits in the biotech space.

Rani Therapeutics was founded in 2012 by Mir Imran, who has already overseen several exits and acquisitions of medical device companies. In 1985, Imran developed an implantable cardiac defibrillator as part of his first company, Intec Systems, which was later acquired by Eli Lilly. Since, he has started 20 medical device companies, of which 15 have either IPOed or been acquired.

However, for now, Rani Therapeutics financials report significant losses. Net losses for 2019 and 2020 totaled $26.6 million and $16.7 million, respectively. As of March 2021, the company was running a deficit of $119.6 million.

In total, the company has raised about $211.5 million in funding since inception, without counting cash generated from today’s IPO. Rani Therapeutics has plans to use the $73 million raised during the IPO to fund the IDE study and pursue additional clinical trials.

Powered by WPeMatico

Marvell announced this morning it has reached an agreement to acquire Innovium for $1.1 billion in an all-stock deal. The startup, which raised over $400 million according to Crunchbase data, makes networking ethernet switches optimized for the cloud.

Marvell president and CEO Matt Murphy sees Innovium as a complementary piece to the $10 billion Inphi acquisition last year, giving the company, which makes copper-based chips, more ways to work across modern cloud data centers.

“Innovium has established itself as a strong cloud data center merchant switch silicon provider with a proven platform, and we look forward to working with their talented team who have a strong track record in the industry for delivering multiple generations of highly successful products,” Marvell CEO Matt Murphy said in a statement.

Innovium founder and CEO Rajiv Khemani, who will remain as an advisor post-close, told a familiar tale from a startup CEO being acquired, seeing the sale as a way to accelerate more quickly as part of a larger organization than it could on its own. “As we engaged with Marvell, it became clear that our data center optimized portfolio combined with Marvell’s scale, leading technology platform and complementary portfolio, can accelerate our growth and vision of delivering breakthrough switch silicon for the cloud and edge,” he wrote in a company blog post announcing the deal.

The company, which was founded in 2014, raised more than $143 million last year on a post-money valuation of $1.3 billion, according to PitchBook data. The question is, was this a reasonable deal for the company given that valuation?

No company wants to sell for less than it was last valued by its investors. In some cases, such deals can still be accretive for early backers of the selling concern, but not always. In this case TechCrunch is not privy to all the details of the Innovium cap table and what its later investors may have built into their deals with the company in the form of downside protection; such measures can tilt the value of the sale of a company more toward its later and final investors. This is usually managed at the expense of its earlier backers and employees.

Still, the Innovium deal should not be seen as a failure. Building a company that sells for north of $1 billion in equity value is impressive. The deal appears to be slightly smaller in enterprise value terms. In the business world, enterprise value is a useful method of valuing the true cost of an acquisition. In the case of Innovium, a large cash position, what was described as “Innovium cash and exercise proceeds expected at closing of approximately $145 million,” lowered the cost of the transaction to a more modest $955 million in net outlays.

Our general perspective is that the sale is probably not the outcome that Innovium’s backers had hoped for, but that it may still prove lucrative to early workers and early investors, and still works at that lower figure. It’s also notable how in today’s market of mega-rounds and surfeit unicorns, an exit north of the $1 billion mark in equity terms can be viewed as a disappointment in any terms. Innovium is selling for around the price that Facebook paid for Instagram in 2012, a deal that at the time was so large that it dominated technology headlines around the world.

But with so much capital available today, private valuations are soaring and mega deals abound. And recent rounds north of $100 million, much like Innovium’s 2020-era, $143 million round, can set companies up with rich valuations and a narrow path in front of them to beat those heightened expectations.

What likely happened? Perhaps Innovium found itself with more cash than opportunities to spend it; perhaps it simply needed a large partner to help it better sell into its market. With expected revenues of $150 million in Marvell’s fiscal 2023, its next fiscal period, Innovium did not fail to reach scale. It may have simply grown well as a private, independent company, and stalled out after its last round.

Regardless, a billion-dollar exit is a billion-dollar exit. The deal is expected to close by the end of this year. While both company boards have approved the deal, it still must clear regular closing hurdles, including approval by Innovium’s private stock holders.

Powered by WPeMatico

In “Macbeth,” Shakespeare described sleep as the “chief nourisher in life’s feast.” But like his titular character, many adults aren’t sleeping well. Revery wants to help with an app that combines cognitive behavioral therapy (CBT) for insomnia with mobile gaming concepts.

Founded in March 2021, Revery is currently in beta stealth mode and plans to launch its app in the United States later this year. The company announced today it has raised $2 million, led by Sequoia Capital India’s Surge program. Participants included GGV Capital, Pascal Capital, zVentures (Razer’s corporate venture arm) and angel investors like MyFitnessPal co-founder Albert Lee; gaming entrepreneur Juha Paananen; CRED founder Kunal Shah; Mobile Premier League founder Sai Srinivas; Carolin Krenzer; and Josh Lee.

Lee, a mutual friend, first introduced Revery’s founders, Tammie Siew and Khoa Tran, to one another. Before launching the startup, Siew worked at Sequoia Capital India, Boston Consulting Group and CRED, while Tran was a former product manager at Google.

Revery plans to focus on other mental health issues in the future, but it’s starting with sleep because “it has such a strong correlation with mental health and we’re leveraging protocols, cognitive behavioral therapy for insomnia, that’s robust and have been tried and tested for 30 years,” Siew told TechCrunch. “That is the first indication, but the goal is to build multiple games for other wellness indications as well.”

A study by research firm Infinium found that about 30% to 45% of adults in the world experience insomnia, a problem exacerbated by the COVID-19 pandemic. Chronic lack of sleep is linked to a host of health issues, including high blood pressure, strokes, depression and lowered immunity.

For Revery’s team, which also includes former Zynga and King lead game designer Kriti Sawa and software engineer Stephanie Wong, their focus on sleep is personal.

“Everyone on our team has a deeply personal connection to the mission, because everyone on our team has experienced, or had a family member or friends go through challenges in mental health,” said Siew. “They’ve seen how late intervention creates consequences that could have been avoided if they had gotten help earlier.”

When Tran was 15, he was diagnosed with hypertension and several other health conditions that needed medication. It wasn’t until he was 26 that Tran found out that sleep apnea was at the root of his medical issues. After getting surgery, Tran’s blood pressure became normal and many of his other conditions also improved.

“When I finally got treatment for my sleep disorder, only then did I realize the impact of sleep on mental health,” Tran said. “For me, I was really lucky that a doctor caught my sleep disorder and super lucky to have the time and resources to get treatment. For many people, it’s incredibly inaccessible.”

Revery’s medical advisory team includes the doctor who performed Tran’s surgery, Stanford Sleep Surgery Fellowship director Dr. Stanley Liu; Stanford professor and behavioral sleep medicine expert Dr. Fiona Barwick; and Dr. Ryan Kelly, a clinical psychologist who researches how video games can be used in therapy.

When people think of sleeping apps, ones that focus on meditation (Calm and Headspace, for example) or soothing noises usually come to mind. The Revery team isn’t sharing a lot of details about its app before launch, but says it draws from casual mobile games, which are designed to get people to return for short play sessions over a long period of time. The goal is to use gamification to make CBT practices interactive and fun, so it becomes part of users’ daily routines.

“That’s the same kind of gameplay that Zynga and King have used, which is why Kriti’s experience is super helpful,” said Siew. Casual games revolve around rewarding people for small actions, and for the Revery app, that means positive reinforcement for habits that contribute to better sleep. For example, it will reward people for putting down their phones.

“I think a lot of people have the misconception that solving sleep is only at the time you fall asleep. They don’t realize that sleep is impacted by what you do throughout the day,” Siew said. “A big part is also what are your thoughts, behavior and the other things that you do, so in order to effectively and sustainably improve sleep, we also have to change your thoughts and behaviors outside of the time you’re trying to fall asleep.”

In a statement, GGV Capital managing director Jenny Lee said, “We are excited about the growing mental wellness market, and believe that Revery’s unique mobile game-based approach has the opportunity to create immense impact. We are happy to back such a mission-driven team in this space.”

Powered by WPeMatico

One of the big reasons you’re giving 110% of your talent and effort to your private company is because you’re hoping to eventually cash in on all those vested incentive stock options (ISOs) that have been sitting in some account, waiting for the day your company goes public.

There’s nothing wrong with that. Who doesn’t dream of reaping an options windfall and using it to retire early, buy a house, pay off their college loans, travel around the world or become a full-time philanthropist?

Unfortunately, when it comes to figuring out how to cash in their stock awards, most employees are on their own.

Their employers can’t always provide the answers they need — especially when the questions relate to personal finances. Most companies admit they need to be better at explaining how ISOs work in general, but they can’t legally work one-on-one with employees to help them exercise and sell shares the right way.

Most companies admit they need to be better at explaining how ISOs work in general, but they can’t legally work one-on-one with employees to help them exercise and sell shares the right way.

That’s why, when the time is right, many employees actively look for help from a qualified fiduciary financial adviser who can walk these could-be “options millionaires” through various cash-in scenarios.

Here’s a real-life example (using a pseudonym).

Kurt is a 50-year-old VP of product management at a healthcare startup that just went public. Over his three years with the company, Kurt had amassed 350,000 ISOs worth approximately $6 million. Unlike many options millionaires, he didn’t intend to cash in everything and retire early. He planned to stay with the firm but wanted to liquidate enough ISOs to pay for a vacation home and add greater diversification to his investment portfolio. This presented significant tax risks that Kurt wasn’t aware of.

If Kurt exercised his ISOs and sold the shares before a year had passed, his profits would be characterized as short-term capital gains, which are taxed as ordinary income.

To illustrate the potential tax implications of this action, we created a hypothetical scenario that showed if Kurt exercised all of his ISOs and sold the shares immediately, he would incur approximately $6 million in ordinary income, which would push him into the top tax bracket and put him on the hook for almost $3 million in combined federal and state taxes.

Powered by WPeMatico

If you’re trying to develop fluency in a non-native tongue, language immersion is a crucial part of the learning process. Surrounding yourself with native speakers helps with pronunciation, context building, and most of all, confidence.

But what if you’re an eight-year-old kid in Spain learning English and can’t swing a solo trip to the United States for the summer?

Novakid, founded by Maxim Azarov, wants to be your next best option. The San Francisco-based edtech startup offers virtual-only, English language immersion for kids between the ages of four through 12, by combining a mix of different services from live tutors to gamification.

After closing its $4.25 million Series A round last December, Novakid announced today that it is back with a $35 million Series B financing, led by Owl Ventures and Goodwater Capital. Existing investors also participated in the round, including PortfoLion, LearnStart, TMT Investments, Xploration Capital, LETA Capital and BonAngels.

The startup is raising capital in response to an active start to its year. The company’s active client base grew 350% year over year, currently at over 50,000 paying students. The money will be used to get more students into its universe of tools, as well as help Novakid expand into international markets with high populations of speakers who want to learn English.

The company’s suite of services are built around two principles: First, that it can immerse early-age learners into the world of English at scale, and second, that it can actually be fun to use.

When a user signs up, they are first connected to one of Novakid’s 2,000 live tutors for their first class. Tutors must be native English speakers with a B.A. degree or higher, as well as an international teaching certificate such as DELTA, CELTA, TESOL or TEFL.

“One of the things that is really important, even psychologically, is to start listening to the language, start interacting with a live person, and remove being afraid of not understanding something,” Azarov said. The company wants to recreate the conditions of how a kid likely learned their first language.

In the class, the tutors only speak English, and users are encouraged to do the same to slowly build and mistake their way into confidence. While the live, video-based classes are a key part of Novakid’s product, Azarov said it was important that his company “was not just giving you access to a teacher” as its main value proposition.

“Most of the competitors are taking teachers and making them available remotely so you don’t have to travel and you have a bigger selection,” he said. But if you look at the industry in the bigger picture, guys like Oxford, Cambridge, Pearson who provide content for the language learning industry, their product basically sucks. It’s really bad.” So, Novakid puts most of its energy into rebuilding a curriculum that works with better design, and includes games.

Gamified content lives both in and out of classes. Within the classroom, a teacher may take a student on a VR-enhanced tour through famous landmarks and museums to practice vocabulary. Self-paced content could look like a multiplayer “battle” between two students answering questions within a certain time period to get a better score. Novakid has an entire team dedicated to game design and development.

Students are clicking in. Novakid users spend two-thirds of their time on the website with tutors, and one-third with self-paced content that the company built in-house. The company wants to switch those concentrations because more students are spending time with the asynchronous content around grammar and vocabulary, and teachers are reserved for more complex information like speaking and conversation.

Part of the difficulty of scaling up a language learning business is that users need to stay motivated. Gamification helps with engagement, but Novakid’s clientele of children could also be fast to churn compared to adult learners, simply due to priorities. Azarov said that he sees how some would view selling exclusively to children as a disadvantage, but he views their focus as differentiation.

“You get better brand equity when you’re more focused,” he said. “The way kids learn language is vastly different from the way adults learn language, and I don’t think the general players who do ‘everything from everybody’ will be able to do [the former] as well as we are.” Duolingo recently launched Duolingo ABC, a free English literacy app with hundreds of short-form exercises. While the now-public company has strong branding, Novakid’s strategy differs by adding in more services around live learning and speaking.

So far, the company has proven that its strategy is sticking. Its revenue in 2020 was $9 million, and in 2021 it is expected to hit between $36 million to $45 million in revenue. It declined to disclose the specifics around diversity of the team, but plans to kick off a quite intensive recruiting spree going forward. Azarov plans to add 200 people to his 300-person company in the next six months.

Powered by WPeMatico