Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Cent was founded in 2017 as an ad-free creator network that allows users to offer each other crypto rewards for good posts and comments — it’s like gifting awards on Reddit, but with Ethereum. But in late 2020, Cent’s small, San Francisco-based team created Valuables, an NFT market for tweets, and by March, the small blockchain startup was thrown a serendipitous curveball.

“We just wrapped up for the day, and I was about to go eat dinner, and all these people started texting me,” remembers CEO Cameron Hejazi. Then, he realized that Twitter CEO Jack Dorsey had minted Twitter’s first-ever Tweet through Cent’s Valuables application. “I was basically like, mildly shivering for the rest of the night. The whole team, we were like, ‘Okay, battle stations, prepare to get hacked!’ ”

Dorsey ended up selling his NFT for $2.9 million, and he donated the proceeds to Give Directly’s Africa Response fund for COVID-19 relief. But for Cent, it was as if the small company had just been handed a free marketing campaign. Now, about five months later, Cent is announcing a $3 million round of seed funding with investors like Galaxy Interactive, former Disney chairman Jeffrey Katzenberg, will.i.am and Zynga founder Mark Pincus.

On Valuables, anyone on the internet can place an offer on any tweet, which then makes it possible for someone else to make a counter-offer. If the author of the tweet accepts an offer (logging into Valuables requires you to validate your Twitter account), then Cent will mint the tweet on the blockchain and create a 1-of-1 NFT.

The NFT itself contains the text of the tweet, the username of the creator, the time it was minted and the creator’s digital signature. The NFT also includes a link to the tweet, though the linked content lives outside the blockchain.

Image Credits: Cent (opens in a new window)

There’s nothing proprietary about minting tweets as NFTs — another company could do the same thing that Cent is doing. Even Twitter itself has recently dabbled in giving away free NFT art, though it hasn’t tried to sell actual tweets as NFTs like Cent. Still, Hejazi sees Dorsey’s use of Cent like an endorsement — he thinks it would be difficult for Twitter to shut them down, since Dorsey made $2.9 million on the platform himself. After all, Dorsey chose Cent instead of taking a screenshot of his first tweet, minting the .JPG as an NFT and posting it on a larger NFT platform, like OpenSea.

“We’ve spoken with people at Twitter. I’m positive that we have a healthy relationship going,” Hejazi said (Twitter declined to comment on or confirm whether that’s true). “We thought about applying this approach to other social platforms, like Instagram and TikTok, but we hypothesized that this is particularly suited for Twitter, because it’s a conversation platform, and it’s where all of the crypto people are actually living.”

With Cent’s seed funding Hejazi hopes to continue building the platform. The company’s goal is to enable anyone creative to make an income through the use of NFTs — that means developing tools to make it simpler for its users to mint NFTs, but also, building out its existing creator-focused social network. The content people post on Cent is usually creative work, like art and writing, rather than short posts — it’s closer to DeviantArt than it is to Reddit. These are lofty goals for a $3 million seed funding round, but there are aspects of Cent’s Beta platform that make it promising.

“There’s already value in what we post on social media. It’s just being proxied through ad dollars, and it doesn’t have to be the case that there’s so much wealth concentration in a single entity. We can work toward a system that decentralizes that wealth,” said Hejazi. “These networks as they exist have monopolies on distribution — you can’t take your Twitter audience, download it as a .CSV and send them all an email.”

A screenshot of Cent’s social platform.

In addition to independent distribution lists, Hejazi wants to move away from the ad-supported internet. He references Substack as an example of a company where the creator has control of their list, and at the same time, the platform can remain ad-free, since the money that propels it comes from the users who pay to subscribe to newsletters (and also, venture capital helps).

But Cent does something different by allowing users to essentially invest in creators who they think have the potential to take off on their platform.

Users can “seed” a post, which is how you subscribe to a creator participating on the creatives side of Cent’s platform. As the seeder, you pay a set fee of at least one dollar per month. There’s an incentive to support up-and-coming creators on the platform, because seeders get a portion of the creators’ future profit — it’s like making a bet on them that they will continue to make great content in the future. Five percent of profits go toward Cent, but the remaining 95% is split 50/50 between the creator and all of their past seeders. Participating on this platform would allow creators to network and show support for one another, but doesn’t prevent them from more directly monetizing their work on other creator platforms, like Patreon.

In addition to seeding posts, users can also “spot” other people’s posts — Cent’s version of a “like” button. Each “spot” is the equivalent of one cent from the user’s crypto wallet. Cent’s argument is that getting 1,000 likes on a post on other platforms yields nothing but a vague sensation of social clout. But on Cent, if a user gets 1,000 “spots,” that’s $10. Still, a project like this can only work if enough people use the platform.

“When we started Cent, we chose cryptocurrencies because we loved the idea of someone being able to earn money with nothing more than their creativity and a crypto address,” Hejazi said. “Over time, we’ve found it to be limiting as a payment type — very few people actually own it and have it ready to spend. We’re working on ways to make payments to creators using Cent easier, and are exploring both crypto-native and non-crypto options.”

This mindset echoes other NFT startups like Yat, which allows payments via credit card as part of its “progressive decentralization” model. So much of these companies’ success depends on public buy-in toward an eventual decentralized, blockchain-based internet. But until then, companies like Cent will continue to experiment in reimagining how creatives can get paid online.

Powered by WPeMatico

During the pandemic, especially when we were in lockdown, just about every retailer had to build its online presence and do it quickly. As people move to shop online in larger numbers, being able to personalize that experience has become more crucial. That made the pandemic a pivotal moment for Bluecore, an e-commerce personalization platform, and today the company announced a $125 million Series E on a $1 billion valuation.

Existing investor Georgian led the round, with participation from other existing investors FirstMark and Norwest, along with new investor Silver Lake Waterman. Today’s investment brings the total raised to $225 million, according to the company.

Until fairly recently, Bluecore CEO and co-founder Fayez Mohamood says that retail outreach was mostly about driving traffic to brick and mortar stores or to the company website, but as more business gets conducted online, it has changed how brands have to interact with their customers.

“We believe in that shift, and Bluecore is a retail-specific, multichannel personalization platform, and we combine basically three types of data. First is customer identity. Second is shopper behavior. And then thirdly and most importantly, the product catalog of a retailer, and using that we drive personalized experiences on various channels,” Mohamood explained.

The company was founded in 2013, and has been able to evolve the notion of personalization since then in a significant way. Mohamood says the pandemic really pushed things into the digital realm where his company’s strength lies, and that’s one of the primary reasons they are taking on this funding.

“Personalization has always been important, but I think the value retailers can derive from it has dramatically accelerated as digital became a bigger and bigger portion of everybody’s revenue stream. And over the last year, that became even more critical,” he said.

As the company’s growth has accelerated, so has the hiring. In May 2020, Bluecore had 236 employees; today it has more than 300, and it’s shooting to be over 400 by the end of the year. He says that as he grows the company, diversity and inclusion is a crucial component to have the employee base reflect the diversity of the customers they serve.

“It starts with the executive team, so I’m extremely proud of the fact that on our executive team close to half our team is female. We have a committee that is represented by the core employees that is a diversity, equity and inclusion committee where we have thoughts and ideas and most most importantly actions on how we can build a better diverse, inclusive workplace. And that translates it into OKRs,” he said.

As a Series E company with a billion-dollar valuation, Mohamood can see becoming a public company at some point, but it is not an immediate goal, as he pursues growth over profitability. “The way we think about it is we have this brand that’s going to help us invest in our product capabilities, our leadership capabilities and our go-to-market capabilities to build something that has the ability to [be a public company some day]. Having said that, we’re pursuing growth, and if that’s the goal, we find that staying private helps us do that,” he said. And with $125 million of runway, the company has plenty of freedom to take its time.

Powered by WPeMatico

As more people dust off their luggage and passports after stowing them away during the global pandemic, Elude aims to show travelers a new way to take spontaneous trips.

The Los Angeles-based startup launched its travel discovery mobile app Thursday, a budget-first search engine that shows people how far their money will take them. The platform’s personalized onboarding experience customizes trip packages and offers future travel suggestions based on those preferences.

The idea for the company came three years ago from Alex Simon, CEO, and Frankie Scerbo, CMO, who met in college and bonded over their love of traveling and would do so together any time they had a long weekend. One New Year’s they tried planning a trip, but everything was too expensive. Not being able to find something on their budget, they came up with the idea for Elude.

Rather than searching by destination, Elude gathers information like budget, time frame and trip preferences (think beach versus mountains), then presents users with flight and hotel results for destinations they may never have thought existed or could be traveled to on their budgets.

The company taps into the same flight and hotel databases that all online travel companies use that store hundreds of thousands of flights and hotels and only suggests hotels with 3.5 stars and above.

Elude app

The co-founders have now raised $2.1 million in seed funding led by a group of investors including Mucker Capital, Unicorn Ventures, Upfront Scout Fund, StartupO, Grayson Capital and Flight VC.

When Erik Rannala, co-founder and managing partner at Mucker Capital, initially invested in Elude, it was before the global pandemic. However, he sees travel getting back to normal, though with flights now more expensive than before, more people are looking for travel deals, something that wasn’t being addressed until Elude came along.

Travel is “a massive category,” with most people in either “look mode” or “book mode,” with the money only being made in book mode, Rannala said. By taking a budget-first approach, Elude is bridging people from look mode to book mode more quickly.

“The way they have done it is to help people discover something new based on their budget that is available to book right now,” he added. “It’s a unique way to solve the problem and to give people a good deal.”

With millenials spending over $200 billion annually on travel, Elude’s goal is to reduce the hours of scrolling in search of a trip and more time actively booking vacations. Whereas competitors may show flights only or hotels only, Elude produces flight and hotel packages.

“In just a few clicks, we can show you, for example, that you could go to Barcelona for the same price as Miami,” Scerbo told TechCrunch. “If you knew that kind of information, you would take a better trip. This opens doors to taking a trip every few months instead of the one or two trips a year most people take.”

Prior to today, Elude was in private beta mode where the company had amassed some 40,000 people on the waitlist. Simon said.

Elude plans to use the funding to advance technology, marketing function, operations and customer support.

Powered by WPeMatico

Statsig is taking the A/B testing applications that drive Facebook’s growth and putting similar functionalities into the hands of any product team so that they, too, can make faster, data-informed decisions on building products customers want.

The Seattle-based company on Thursday announced $10.4 million in Series A funding, led by Sequoia Capital, with participation from Madrona Venture Group and a group of individual investors, including Robinhood CPO Aparna Chennapragada, Segment co-founder Calvin French-Owen, Figma CEO Dylan Field, Instacart CEO Fidji Simo, DoorDash exec Gokul Rajaram, Code.org CEO Hadi Partovi and a16z general partner Sriram Krishnan.

Founder and CEO Vijaye Raji started the company with seven other former Facebook colleagues in February, but the idea for the company started more than a year ago.

He told TechCrunch that while working at Facebook, A/B testing applications, like Gatekeeper, Quick Experiments and Deltoid, were successfully built internally. The Statsig team saw an opportunity to rebuild these features from scratch outside of Facebook so that other companies that have products to build — but no time to build their own quick testing capabilities — can be just as successful.

Statsig’s platform enables product developers to run quick product experiments and analyze how users respond to new features and functionalities. Tools like Pulse, Experiments+ and AutoTune allow for hundreds of experiments every week, while business metrics guide product teams to build and ship the right products to their customers.

Raji intends to use the new funding to hire folks in the area of design, product, data science, sales and marketing. The team is already up to 14 since February.

“We already have a set of customers asking for features, and that is a good problem, but now we want to scale and build them out,” he added.

Statsig has no subscription or upfront fees and is already serving millions of end-users every month for customers like Clutter, Common Room and Take App. The company will always offer a free tier so customers can try out features, but also offers a Pro tier for 5 cents per thousand events so that when the customer grows, so does Statsig.

Raji sees adoption of Statsig coming from a few different places: developers and engineers that are downloading it and using it to serve a few million people a month, and then through referrals. In fact, the adoption the company is getting is “bottom up,” which is what Statsig wants, he said. Now the company is talking to bigger customers.

There are plenty of competitors for this product, including incumbents in the market, according to Raji, but they mostly focus on features, while Statsig provides insights and ties metrics back to features. In addition, the company has automated analysis where other products require manual set up and analysis.

Sequoia partner Mike Vernal worked at Facebook prior to joining the venture capital firm and had worked with Raji, calling him “a top 1% engineer” that he was happy to work with.

Having sat on many company boards, he has found that many companies spend a long time talking about sales and marketing, but very little on product because there is not an easy way to get precise numbers for planning purposes, just a discussion about what they did and plan to do.

What Vernal said he likes about Statsig is that the company is bringing that measurement aspect to the table so that companies don’t have to hack together a poorer version.

“What Statsig can do, uniquely, is not only set up an experiment and tell if someone likes green or blue buttons, but to answer questions like what the impact this is of the experiment on new user growth, retention and monitorization,” he added. “That they can also answer holistic questions and understand the impact on any single feature on every metric is really novel and not possible before the maturation of the data stack.”

Powered by WPeMatico

Though 2021 is far from over, it’s already witnessed a record level of venture capital activity in the technology sector. With larger round sizes announced daily, founders may have their pick of term sheets — but they need to think critically and strategically about which firms to add to their cap table.

So far this year, we’ve seen $292.4 billion in venture financing across the globe, of which $138.9 billion was raised in the United States. Specific to tech companies, the capital is only accelerating: In Q2, founders raised 157% more capital compared to the same period last year, according to the latest data from CB Insights.

It’s not just that more companies are raising money — they are doing so at a higher valuation. Median seed and Series A stage valuations today stand at $12 million and $42 million, respectively, up 20% to 30% from 2020. This can be partly attributed to growing exits/M&A activity in the technology sector, a record number of IPOs and a general bullishness around technology, as well as low interest rates and liquidity in the market.

Good VCs who are aligned with a startup’s vision create more value than the dollars they bring to the table.

At a time when we are witnessing record VC activity, founders would be well served to go back to the basics and focus on the principles of fundraising when determining who sits on their cap table. Here are a few pointers for founders in that direction:

Good VCs who are aligned with a startup’s vision create more value than the dollars they bring to the table. Typically, such value is created across a few distinct functions — product, sales, domain expertise, business development and recruiting, to name a few — based on the background of the partners of the fund and the composition of their limited partners (investors in the venture fund).

Further, the right VC can serve as an authentic, objective sounding board for CEOs, which can be an asset to have as a startup navigates uncertainty and the typical challenges that come with scaling a young company. As founders assess multiple term sheets, it’s worth thinking through whether they should optimize for VCs who offer the highest valuation, or for ones who bring the most value to the table.

Running an efficient fundraising process, in part, entails holding VCs accountable to their own diligence requests. While it is unfortunately common for VCs to request a lot of data upfront, startups should share information after assessing intent and appetite on the investors’ part.

For every additional data request, founders are well within their rights (and should) check with their potential investors on where the process stands and get indicative timelines for moving forward with next steps. Mark Suster said it best: “Data rooms are where fundraising processes go to die.”

Powered by WPeMatico

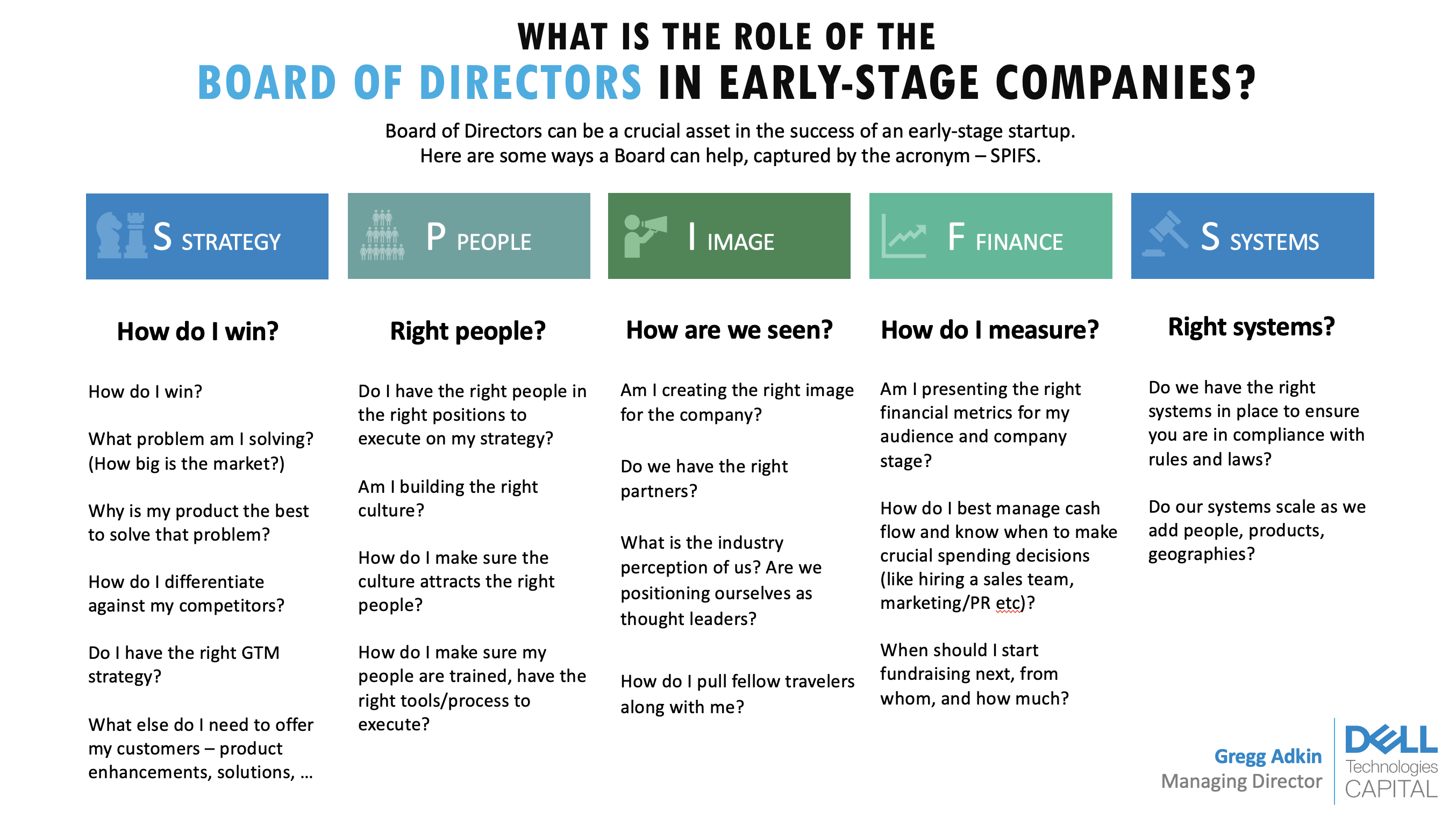

What’s the board’s role in an early-stage startup?

Startup founders frequently ask me about the role of a board of directors. A board can be a crucial asset in an early-stage startup.

Here’s a framework for how it can help drive success at your company: Strategy, People, Image, Finance and Systems for compliance, or “SPIFS.”

The board of directors helps with governance of the company. U.S. law requires that any company have one, though does not require how big it should be. By generic definition, the board of directors consists of elected individuals that represent shareholders. It is the governing body that provides company oversight and helps set business policy and strategy.

On a more practical level and in a startup environment, the board can aid in creating a successful business strategy, putting together the right management team, developing branding, building good financial habits, and avoiding legal and compliance issues. The needs and composition of the board will change depending on the startup’s stage, management and financing history (e.g., if there are preferred shareholders, investors that require a board seat and more).

Investors often ask founders about their board: It says a lot about their character, their judgment and their willingness to be challenged.

Investors often ask founders about their board for two reasons. First, it says a lot about their character, their judgment and their willingness to be challenged. The founder can typically choose who is on their board (through careful selection of investors and advisers) and negotiate a board structure they prefer.

Typically, a healthy board will have a good balance between common shareholders, preferred shareholders and independents. It also helps investors and analysts understand who will ask critical questions and give important advice to the company’s executive management, especially when the going gets tough (it inevitably does!).

After 20 years as a venture capitalist and board member, I boiled down the value of a board into five main pieces under the acronym SPIFS: Strategy, People, Image, Finance and Systems for compliance.

Image Credits: Dell Technologies Capital

Setting business strategy is one of the main ways that the board helps founders, especially if it’s their first time running a business. It is a valuable sounding board for validating that you have taken a sober account of the market and have the right plan to develop your product and acquire customers.

The board should ask these questions when guiding founders through setting strategy:

Powered by WPeMatico

The future of technology is determined by a handful of venture capitalists. The world’s 10 leading venture capital firms have, together, invested over $150 billion in technology startups. The venture capitalists who run these firms decide which startups today will develop the new platforms and technologies that will shape our lives tomorrow.

There is a startling lack of diversity within the venture capital sector. This means that a small group of men — mostly white men — make decisions that affect all of us. Unsurprisingly, they all too often ignore the broader societal and human rights implications of these investment decisions.

We all live in a world shaped by venture capital. As of 2019, 81% of all venture capital funds worldwide are clustered in just a handful of countries, primarily in the U.S., Europe and China, which in turn are shaping the future of technology. If you spend time on Facebook or Twitter, use Google, travel in an Uber or stay in an Airbnb, then you’ve experienced firsthand the impact of venture capital funding.

Venture capital firms, which provide equity financing for early- and growth-stage startups, play a critical gatekeeper role, deciding which new technologies and technology companies will receive funding.

Venture capital firms need to institute human rights due diligence processes that meet the standards set forth in the UN Guiding Principles on Business and Human Rights.

All businesses — including venture capital — have a responsibility to respect human rights. In order to ensure that their investments are not undermining our human rights, it is therefore critical for venture capital firms to conduct due diligence processes before making investments.

Amnesty International recently surveyed the world’s largest venture capital firms and startup accelerators. Of the world’s 10 largest venture capital firms, not a single one had an adequate human rights due diligence process that met the standards set forth in the UN Guiding Principles on Business and Human Rights.

Unfortunately, this is true of the broader venture capital sector as well. Overall, of the 50 VC firms and three startup accelerators analyzed by Amnesty International, we found that almost all of them lacked adequate human rights due diligence policies and processes.

This failure to carry out adequate due diligence means that a vast majority of VC firms are failing in their responsibility to respect human rights.

This almost complete lack of respect for human rights among the world’s largest venture capital firms has three key impacts. First, and most immediately, it means that venture capital firms invest in companies whose products and services have been implicated in ongoing human rights abuses, such as companies that provide support to the Chinese government’s repression of the Uyghur population in Xinjiang and across China.

Second, it means that venture capital firms continue to fund companies whose business models have a significant negative impact on human rights, including our privacy and labor rights. For instance, leading venture capital firms continue to support companies that rely on app-based or “gig” workers, who often face exploitative or otherwise abusive work conditions, as well as companies whose “surveillance capitalism” business model undermines our right to privacy.

Third, the lack of human rights due diligence by venture capital firms dramatically increases the risk that they fund new and “frontier” technologies without ensuring that adequate human rights safeguards are in place.

For instance, the application of increasingly powerful artificial intelligence/machine learning (AI/ML) tools across a wide variety of sectors risks amplifying existing societal biases and discrimination. Seemingly objective algorithms can be biased by reliance on incomplete or unrepresentative training data, and/or by replicating the unconscious bias of those who developed the algorithms.

This is a critical blind spot, especially as VC-funded startups seek to disrupt such fundamental parts of our lives as education, finance and health.

The negative impacts of the VC firms’ lack of human rights due diligence — especially regarding issues like algorithmic bias — are magnified by these firms’ own lack of gender and racial diversity. For instance, women comprise only 23% of venture capital investment professionals (i.e., those involved in deciding which startups to fund).

The numbers are even worse when it comes to racial diversity — just 4% of investment professionals at VC firms in the U.S. are Latinx, and only 4% are Black. Groups like Blck VC, Diversity VC and digitalundivided have been calling attention to this issue for years, but venture capitalists have been slow to respond so far.

This lack of diversity is mirrored in the gender and racial composition of founders who receive VC funding. In 2018, all-female founding teams received just 2.2% of all U.S.-based venture funding. At the same time, Black and Latinx founders received less than 2.3% of all U.S.-based venture capital funding in 2019.

With power comes responsibility. Venture capital firms need to institute human rights due diligence processes that meet the standards set forth in the UN Guiding Principles on Business and Human Rights.

Further, they should provide support to their portfolio companies to ensure that they comply with human rights standards. Venture capital firms should also publicly commit to hiring more diverse teams, especially in investment-related positions. Finally, they should publicly commit to funding more diverse startup founders as part of their flagship funds.

VC firms have a responsibility to ensure that their investments are not causing harm. A responsibility that they have, to date, largely ignored.

Powered by WPeMatico

Japanese startup ispace has raised $46 million in a fresh round of Series C funding as it looks to complete three lunar lander missions in three years.

The funding will go toward the second and third of the planned missions, scheduled for 2023 and 2024. The first mission, which ispace aims to conduct in the latter half of 2022, is being furnished by earlier financing.

The Series C was led by Japanese VC firm Incubate Fund, with additional investment from partnerships managed by Innovation Engine, funds managed by SBI Investment Co., Katsunori Sago, Aizawa Investments and funds managed by HiJoJo Partners and Aizawa Asset Management. Incubate Fund’s investments in ispace stretch back to the company’s seed round in 2014.

Ispace’s total funding now stands at $195.5 million.

The company said last month it had started building the lunar landing flight module for the 2022 mission at a facility owned by space launch company ArianeGroup, in Lampoldshausen, Germany. The lander for that first mission, the Hakuto-R, will take three months to reach the moon, largely to save costs and additional weight from propellant. It will deliver a 22-pound rover for Saudi Arabia’s Mohammed bin Rashid Space Center, a lunar robot for the Japan Aerospace Exploration Agency and payload from three Canadian companies. The lander will reach the moon aboard a SpaceX Falcon 9 rocket.

The 7.5 foot-tall Hakuto-R will also be used in the second mission in 2023, to deposit a small ispace rover that will collect data to support the company’s subsequent missions to the moon. For the final mission, the Toyko-based startup is developing a larger lander in the United States.

Ispace describes its long-term goal as being a “gateway for private sector companies to bring their business to the Moon.” The company has particular interest in helping spur a space-based economy, noting on its website that the moon’s water resources represent “untapped potential.”

Powered by WPeMatico

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

Extra Crunch members receive access to weekly “Dear Sophie” columns; use promo code ALCORN to purchase a one- or two-year subscription for 50% off.

Dear Sophie,

I’ve been working on an H-1B in the U.S. for nearly two years.

While I’m immensely appreciative of my company’s sponsorship and that I made it through the H-1B lottery and am working, I’m stuck in a rut. I really want to start something of my own and work on my own terms in the United States.

Are there any immigration options that would allow me to do that?

— Seeking Satisfaction near Stanford

Dear Seeking,

A couple of exciting immigration news updates to get us started today! In breaking startup founder news, U.S. Rep. Zoe Lofgren (D-CA) introduced the LIKE Act for startup founders in the House of Representatives last week. Below, we’ll share what this could mean for your startup aspirations. Also, U.S. Citizenship and Immigration Services (USCIS) conducted a second H-1B lottery because it didn’t receive enough H-1B petitions to meet the annual cap. So, if you or your employer were selected, be sure to file an H-1B petition by November 3.

Although job dissatisfaction and frustration on an H-1B can be normal, according to Edward Gorbis, there’s a lot you can do to take control of your U.S. immigration situation and go out on your own. I interviewed Gorbis for my podcast; he’s the founder of Career Meets World and a performance coach who works with immigrants and first-generation professionals to help them find fulfillment and thrive in their careers and life. Gorbis said that “once immigrants reach stability, they start to think, ‘Who am I, what do I value, what’s my core identity?’” It’s possible for any of us to retrain our brain for success.

Gorbis said that imagining overcoming the hurdles that stand in the way of doing the work that will fulfill you is the first step. So, here are some options that can help you imagine how to build the life of your dreams.

A great new option for aspiring entrepreneurs is International Entrepreneur Parole (IEP), a new immigration program in the United States that allows CEOs, CTOs and others to live in the U.S. and run their company for 2.5 years with an option for a 2.5-year extension. Your spouse can obtain a work permit.

How to qualify? You need to own at least 10% of a U.S. company, such as a Delaware C corporation registered in California. Ideally, you’ll want to show that your company bank account has at least $250,000 raised from qualified U.S. investors, but you can use other evidence to demonstrate that your company has the potential to grow rapidly and create jobs in the U.S.

A startup visa and path to a green card may be soon on the way for entrepreneurs and their crucial employees: Last week, Lofgren introduced the Let Immigrants Kickstart Employment (LIKE) Act. The requirements for the proposed startup visa are the same as for IEP but would allow a longer stay — up to eight years total if the startup creates jobs and generates substantial revenue.

I’m very proud to have aided in drafting the LIKE Act. It’s a thrill to see how my suggestions were included, such as making Startup Green Cards not subject to the visa bulletin, clarifying that you can seek consecutive Startup Visas from different companies, how to allocate employee visas to startups, ensuring the Startup Visa is a dual intent status, and adding premium processing. It was such a joy to be able to contribute ideas to this amazing process. I look forward to supporting this bill to become a law; please reach out to me if you want to support this worthy cause.

Image Credits: Joanna Buniak / Sophie Alcorn (opens in a new window)

There is technically no limit to how many H-1B employers you can have or how many — or few — hours you work in an H-1B position. So, think about other companies.

One option would be to have concurrent H-1Bs: Keep your current H-1B job for stability and start your own company, preferably with another individual or two, and have your startup sponsor you for an H-1B. Take a look at this Dear Sophie column for what to do before embarking on this path.

Another option would be to transfer your H-1B to another employer, or your own startup if you are going to work there. Since you already went through the H-1B lottery with your current employer, you will not have to go through the lottery process again for a second H-1B whether you choose the concurrent or transfer option.

Setting up a startup that can sponsor you for an H-1B is complicated, so I suggest you work with both a corporate attorney and an immigration attorney. Keep in mind that you will not be able to do any work for your startup until an H-1B with your startup has been approved, which is why having co-founders is helpful. Another reason is H-1Bs require an employer-employee relationship between a startup and the H-1B candidate. That means a co-founder — or the startup’s board — must supervise you and have the ability to fire you. Moreover, we often advise founders that it may be best to own less than a 50% stake in the startup when applying for an H-1B.

If you end up pursuing concurrent H-1Bs, consider asking your employer whether it is willing to sponsor you for a green card. If that’s not the case, your startup can sponsor you for one, or you can self-petition for a green card:

All EB-2 green cards — except the EB-2 NIW — and the EB-3 green card require labor certification approval (PERM) from the U.S. Department of Labor. The two green cards that allow an individual to self-sponsor are the EB-1A and EB-2 NIW.

Many startup founders qualify for an O-1A extraordinary ability visa. However, you cannot have both an H-1B and an O-1A at the same time, so if your startup sponsors you for an O-1A, you will be required to leave your current H-1B job once an O-1A is approved.

An O-1A offers more flexibility than an H-1B. You can work for a single petitioning company or on multiple gigs through an agent. However, qualifying for an O-1A is more difficult than an H-1B. Resources, such as through my firm, support people with getting qualified. The one similarity with the H-1B is that you must show your startup and you have an employer-employee relationship.

The E-2 visa for treaty investors and employees is ideal for startup founders whose home country has a treaty of commerce and navigation with the U.S. Here is a list of treaty countries. For more details on E-2 visas for founders and employees, check out this previous Dear Sophie column and podcast episode.

Although there is no minimum dollar amount that a founder must invest in a startup to qualify for an E-2, we often advise founders to invest at least $100,000 to have a strong case. You cannot have both an H-1B and an E-2, so you will need to leave your current H-1B job if your E-2 is approved.

An immigration attorney can offer additional options based on your personal circumstances and legal advice tailored to you.

Enjoy the journey of building your dreams!

Sophie

Have a question for Sophie? Ask it here. We reserve the right to edit your submission for clarity and/or space.

The information provided in “Dear Sophie” is general information and not legal advice. For more information on the limitations of “Dear Sophie,” please view our full disclaimer. You can contact Sophie directly at Alcorn Immigration Law.

Sophie’s podcast, Immigration Law for Tech Startups, is available on all major platforms. If you’d like to be a guest, she’s accepting applications!

Powered by WPeMatico

Less than six months after raising $55 million in a Series C round of funding, SMB 401(k) provider Human Interest today announced it has raised $200 million in a round that propels it to unicorn status.

The Rise Fund, TPG’s global impact investing platform, led the round and was joined by SoftBank Vision Fund 2. The financing included participation from new investor Crosslink Capital and existing backers NewView Capital, Glynn Capital, U.S. Venture Partners, Wing Venture Capital, Uncork Capital, Slow Capital, Susa Ventures and others.

Over the past year, the San Francisco-based company has raised $305 million. With the latest financing, it has now raised a total of $336.7 million since its 2015 inception.

The company admittedly has an IPO in its sights, as evidenced by the appointment of former Yodlee CFO Mike Armsby to the role of CFO at Human Interest. It’s targeting a traditional IPO sometime in 2023, with execs saying the target is to have “$200 million+ in run-rate revenue before going public.” Currently, it’s at “tens of millions of run-rate revenue” now, and adding millions of new revenue each month.

Human Interest’s digital retirement benefits platform allows users “to launch a retirement plan in minutes and put it on autopilot,” according to the company. It also touts that it has eliminated all 401(k) transaction fees.

Demand for 401(k)s by SMBs appears to be at an all-time high, with Human Interest reporting that its sales tripled over the last year. The company has also more than doubled its headcount over the last 12 months to 350 employees.

The startup said it is seeing strong adoption in verticals that have not previously had retirement benefits, including construction, retail, manufacturing, restaurants, nonprofits and hospitality. For example, over the past three quarters, Human Interest has seen 4.5x customer growth in the restaurant sector. Since the start of the pandemic, Human Interest has experienced 2x higher enrollment growth among hourly workers than salaried workers, and hourly worker assets have tripled.

“Promoting financial health is a core investment pillar for The Rise Fund. Human Interest delivers one of the most compelling solutions to the persistent problem that roughly half of Americans will not have enough savings when they reach retirement age,” said Maya Chorengel, co-managing partner at The Rise Fund, in a written statement. “Despite recent legislation, primarily at the state level, legacy programs have not, to date, produced the same participant outcomes as Human Interest.”

The company said it will be using its new capital to expand its network of integrations and partnerships with financial advisers, benefits brokers and payroll companies. It also expects to, naturally, do some hiring –– another 200 employees by year’s end, primarily in its product, engineering and revenue teams.

The 401(k) for SMB space is heating up as of late. In June, competitor Guideline also raised $200 million in a round led by General Atlantic.

Additional details around the IPO and revenue were added post-publication.

Powered by WPeMatico