Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

When you think about startup hubs, Tulsa, Oklahoma is probably not the first city that comes to mind.

A coalition of business, education, government and philanthropists are working to foster a startup ecosystem in a city that’s better known for its aerospace and energy companies. These community leaders recognized that raising the standard of living for a wide cross-section of citizens required a new generation of companies and jobs — which takes commitment from a broad set of interested parties.

In Tulsa, that effort began with George Kaiser Family Foundation (GKFF), a philanthropic organization, and ended with the creation of Tulsa Innovation Labs (TIL), a partnership between GKFF, Israeli cybersecurity venture capitalists Team8 and several area colleges and local government.

Tulsa is a city of more than 650,000 people, with a median household income of $53,902 and a median house price of $150,500. Glassdoor reports that the average salary for a software engineer in Tulsa is $66,629; in San Francisco, the median home price is over $1.1 million, household income comes in at $112,376 and Glassdoor’s average software engineer salary is $115,822.

Home to several universities and a slew of cultural attractions, the city has a lot to offer. To sweeten the deal, GKFF spun up “Tulsa Remote,” an initiative that offers $10,000 to remote workers who will relocate and make the city their home base. The goal: draw in new, high-tech workers who will help build a more vibrant economy.

Tulsa is the second-largest city in the state of Oklahoma and 47th-most populous city in the United States. Photo Credit: DenisTangneyJr/Getty Images

Local colleges are educating the next generation of workers; Tulsa Innovation Labs is working with the University of Tulsa in partnership with Team8 through the university’s Cyber Fellows program. There are also ongoing discussions with Oklahoma State University-Tulsa and the University of Oklahoma-Tulsa about building a similar relationship.

These constituencies are trying to grow a startup ecosystem from the ground up. It takes a sense of cooperation and hard work and it will probably take some luck, but they are starting with $50 million, announced just this week from GKFF, for startup investments through TIL.

Powered by WPeMatico

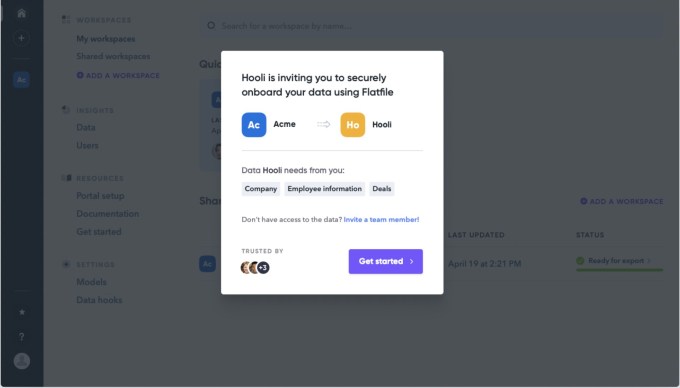

One of the huge challenges companies like enterprise SaaS vendors face with new customers is getting customer data into their service. It’s a problem that Flatfile founders faced firsthand in their jobs, and they decided to solve it. Today, the company announced a healthy $7.6 million seed investment to expand on that vision.

The company also announced the release of its latest product, called Concierge.

Two Sigma Ventures led the investment, with participation from previous investors Afore Capital, Designer Fund and Gradient Ventures (Google’s AI-focused venture fund).

Company CEO David Boskovic says he and co-founder Eric Crane recognized that this is a problem just about every company faces. Let’s say you sign up for a CRM tool like HubSpot (which is a Flatfile customer). Your first step is to get your customer data into the new service.

As Boskovic points out, if you have thousands of existing customers that can be a real problem, often involving days or even weeks to prepare the data, depending on the size of your customer base. It typically includes importing your data from an existing source, then manually moving it to an Excel spreadsheet.

“What we’re trying to solve for at Flatfile is automating that entire process. You can drop in any data that you have and get it into a new product, and what that solves from a market perspective is the speed of adopting new software,” Boskovic told TechCrunch.

Image Credit: Flatfile

He says they have automated the process to the point it usually takes just a few minutes to process the data, If there are problems that Flatfile can’t solve, it presents the issue to the user who can fix it and move on.

The founders realized that not every use case is going to involve a simple one-to-one data transfer, so they created their new product called Concierge to help companies manage more complex data integration scenarios for their customers.

“What we do is we provide a bridge between disparate data formats that are a little bit more complex and let our customers collaborate with their new customers that they are onboarding to bring the data to the right state to use it in the new system,” Boskovic explained.

Whatever they are doing, it seems to be working. The company launched in 2018 and today has 160 customers with 300 sitting on a waiting list. It has increased that customer count by 5x since the beginning of the year in the middle of a pandemic.

Any product that reduces labor and increases efficiency and collaboration in a digital context is going to get the attention of customers right now, and Flatfile is seeing a huge spike in interest in spite of the current economy. “We’re helping onboard customers quickly and more efficiently. And our Concierge service can also help reduce in-person touch points by reducing this long, typical data onboarding process,” Boskovic said.

The company has not had to change the way it has worked because of the pandemic, as it has been a distributed workforce from day one. In fact, Boskovic is in Denver and co-founder Eric Crane is based in Atlanta. The startup currently has 14 employees, but plans to fill at least 10 roles this year.

“We’ve got a pretty aggressive hiring map. Our pipeline is bigger than we can handle from a sales perspective,” he said. That means they will be looking to fill sales, marketing and product jobs.

Powered by WPeMatico

Figma is one of the fastest-growing companies in the world of design and in the broader SaaS category. So it goes without saying that we’re absolutely thrilled to have Figma CEO Dylan Field join us at Early Stage, our virtual two-day conference on July 21 and 22, as a speaker. You can pick up a ticket to the event here!

Early Stage is all about giving entrepreneurs the tools they need to be successful. Experts across a wide variety of core competencies, including fundraising, growth marketing, media management, recruiting, legal and tech development will offer their insights and answer questions from the audience.

Field joins an outstanding speaker list that includes Lo Toney, Ann Muira Ko, Dalton Caldwell, Charles Hudson, Cyan Banister and more.

Field founded Figma in 2012 after becoming a Theil fellow. The company spent four years in development before launching, working tediously on the technology and design of a product that aimed to be the Google Docs of design.

Figma is a web-based design product that allows people to design collaboratively on the same project in real time.

The design space is, in many respects, up for grabs as it goes through a transformation, with designers receiving more influence within organizations and other departments growing more closely involved with the design process overall.

This also means that there is fierce competition in this industry, with behemoths like Adobe iterating their products and growing startups like InVision and Canva sprinting hard to capture as much market as possible.

Figma, with $130 million+ in total funding, has lured investors like Index, A16Z, Sequoia, Greylock, and KPCB.

At Early Stage, we’ll talk to Field about staying patient during the product development process and then transitioning into an insane growth sprint. We’ll also chat about the fundraising process, how he built a team from scratch, and how he took the team remote in the midst of a pandemic, as well as chatting about the product development strategy behind Figma.

Figma spent four years in stealth before ever launching a product. But when it finally did come to market, its industry was in the midst of a paradigm shift. Entire organizations started participating in the design process, and conversely, designers became empowered, asserting more influence over the direction of the company and the products they built. We’ll hear from Figma founder and CEO Dylan Field on how he stayed patient with product development and sprinted towards growth.

Get your pass to Early Stage for access to over to 50 small-group workshops along with world-class networking with CrunchMatch. They start at just $199 but prices increase in a few days so grab yours today.

Powered by WPeMatico

A Swiss startup called HMCARE, spun out of the École polytechnique fédérale de Lausanne, has raised a million Swiss Francs (equivalent to about $105 million) to commercialize its transparent and relatively eco-friendly surgical masks.

The founders were inspired by healthcare workers in the 2015 Ebola outbreak and at children’s hospitals around the world working closely with patients but unable to show their faces. Likewise parents and relatives of immunocompromised people who must make a human connection with two-thirds of their face covered.

There were technically transparent masks available, but they were just regular masks with a plastic window in them, which can fog up and isn’t breathable. Thierry Pelet, now CEO of the company, approached his EPFL colleagues with a prototype of a transparent mask material meeting the rigorous demands of a medical environment. It must permit air through but not viruses or bacteria, and so on.

The team worked with Swiss materials center Empa to create a new type of textile. Using biomass-derived transparent fibers placed 100 nanometers apart to form sheets and then triple-layered, they made a flexible, breathable material that’s also nearly transparent — a bit like lightly frosted glass. They call it the HelloMask.

The material can be made in bulk and formed into mask shapes just like normal cloth, but there is the matter of spinning up manufacturing for it. Fortunately, the world is desperate for masks, and the idea of a transparent one was clearly catnip for investors. HMCARE easily raised a million-franc seed round, the R&D work having been done using nonprofit donations and grants.

While the HelloMasks could launch as early as the start of 2021, they’ll be primarily for the medical community, though public availability is certainly a possibility.

Powered by WPeMatico

We won’t sit here as we have for so many years with strong faces and encouraging words and pretend that we’re not tired.

We’re tired because we’ve spent yet another week mourning our Black brothers and sisters who died unjust deaths. We’re tired because we spent half of that week holding the hands of White allies as they were reminded that racism still exists and that it is, indeed, sad. We’re tired because we’re a broken record, telling firms and companies what they can do to fight racism and rarely getting the action they so emotionally promise they care about. We’re tired of holding back anger and sadness as we talk about these issues, knowing our industry isn’t even doing the bare minimum to support Black investors. On top of advising allies, mourning lives lost and working full time jobs, we also raised over $100,000. And we’re tired of racism.

Last week, BLCK VC hosted We Won’t Wait, a day of action where we called on venture firms to discuss, donate and diversify. We asked these firms to discuss Venture’s role in combating institutional racism, to donate to nonprofits that promote racial equity and to release their data on the diversity of their investment teams and portfolio founders. These are the first steps. If you haven’t done these, you’re likely not ready for “Office Hours.” So before we get ahead of ourselves, let’s address why these steps aren’t straightforward or sufficient.

Discuss. It took nationwide uprisings for many VC firms to discuss how they could combat institutional racism. Yet, 80% of firms don’t have one Black investment professional who can identify with what we go through in both our professional and personal lives. BLCK VC held its own discussion to share that perspective, centered on the experiences of Black investors and entrepreneurs.

During this discussion, Terri Burns of GV said, “when a Black person is murdered yet again by police, it is not correct to say that the system has failed, because the system was designed that way.” It is clear that systemic racism leads to the maltreatment, dehumanization and unjustified deaths of Black people across the country. Van Jones of Drive Capital drew a fitting analogy: “Being Black is like being in lane eight with a weight vest and cement boots.” Sounds uncomfortable. But that’s how every Black person in America feels stepping out of bed everyday. For Black founders, discrimination by VCs is par for the course. Elise Smith is not alone when she puts on her daily armor to allow herself to show up in the White-dominated industries of venture capital and Silicon Valley tech.

But we’re not going to repeat what they said. Because you can watch the video, and you can do the research, and you can understand the problem on your own. Truthfully, we have no interest in explaining the problem to White VCs again and again when so many of my brothers and sisters have already spoken on it. If you’d like to know why institutional racism made venture capital so homogeneous and exclusive and racist, please see here, here, here, here and here.

What we are interested in explaining is that these are just examples of what Black investors and entrepreneurs deal with everyday. For almost every Black person in tech, these examples are not only relatable, they are commonplace. These are not the stories that shock and surprise the Black community, these are the stories of the everyday. We didn’t talk about the times we heard the N-word from your colleagues or the times they said our natural hair and beards were unprofessional. We talked about the systems.

There are so many more stories and experiences out there besides what was shared by those seven voices, so please think about what perspectives are missing when you have your discussions. Not just your discussion about racism, but your discussions about the future of venture capital, and about aerospace investing, and about COVID-19 and D2C businesses, and about hiring, and about mentoring and about golf. Black voices are so often left out of the conversations where relationships are built and investment decisions are made, but discussions that lack a Black perspective are incomplete.

Donate. Many VC firms and investors spoke last week about donating their time and resources to Black entrepreneurs and investors — what an interesting way to talk about your job. Please do not donate your time or your money to Black investors or entrepreneurs.

Invest in Black founders because they’re some of the best entrepreneurs. Invest in them because they understand an issue that you do not. Invest in them for the same reason you invest in all of your entrepreneurs — because they’re good. When you frame what you’re doing as a donation, it not only demeans what these entrepreneurs are doing and perpetuates some of the most racist aspects of venture capital, but it also prevents you from understanding that you’re bad at your job. Yes, if you don’t have a diverse pipeline or a diverse portfolio you are bad at your job. Making a separate space and separate fund for Black entrepreneurs removes firms from the responsibility they have to search for, invest in and support Black founders.

If you would like to donate money, donate money to nonprofits that fight institutional racism. If you would like to donate time, volunteer. If you would like to become a better investor, figure out why your pipeline is so homogeneous and fix it.

Diversify. Let’s circle back to an important statistic: More than 80% of venture capital firms don’t have a single Black investor. This statistic is interesting because, as much as it’s about industry trends, it’s really about the failings of individual firms. Most firms don’t have a diverse investing staff. They don’t have a diverse investing staff because they don’t understand the value of racial diversity. They don’t understand the value of racial diversity because there are no diverse investors to force them to think about diversity. Rinse. Repeat.

The single most important part of diversifying a VC firm and diversifying VC broadly is tracking the lack of diversity. Most firms do not routinely track data on their investor, deal pipeline, event or investment diversity. As a result, they rarely think about racial diversity. This is where we ask firms to start. Yes, mentorship can be helpful, office hours can be helpful, but if you’re not tracking your firm’s diversity metrics, they will not improve.

What now? Okay, you’ve discussed racism with your partners, you’ve donated money to nonprofits and you (hopefully) started tracking the diversity of your firm. Now what? Racism resolved? Probably not.

Hopefully these conversations made you realize where your firm’s specific shortcomings are, and you have to address those. Most firms will realize they have a pipeline problem, so start there. Do all of your events, dinners and programs have Black representation? When you’re trying to fill an investor role, did you post the job on your website and in different Black online communities? Did your final round of candidates reflect the diversity of our country? Did you support the diverse investors you already employ so they don’t feel disadvantaged, under-advocated and left out? When you’re trying to write new checks, did you utilize Black scouts and consider businesses that don’t address you directly?

When you’ve done all of that, ask yourself this: When the protests quiet down, and articles about racial oppression aren’t at the top of your timeline, what will you be doing? Don’t let it just be office hours. Don’t let the enormity of the work ahead paralyze you against taking action now. Your actions matter. Your inaction matters.

The resilience of the Black community is unparalleled. That resilience means that no matter how tired we are, we will still fight to change this country and to change this industry. It means that no matter how many times we don’t want to advise allies, we will. And it means that no matter how many times we face oppression and mourn for our brothers and sisters, we will still rise to the challenges. And while the stories of overt racism and microaggressions will continue, so too will our drive to move forward and our action to break down barriers. We will continue to build a home for ourselves in this industry. We will continue to work to ensure that Black Lives Matter.

Powered by WPeMatico

In the past few weeks, several venture capital firms have published different variations of the same pledge: we’ll do a better job supporting the Black community.

My timeline, and I’m assuming yours too, has been filled with statements from non-Black venture capitalists saying that they will rethink how to be more inclusive with their hiring and wiring.

There is no need to applaud firms for taking long overdue steps to treat others equally. What is more important is how we’re going to hold these firms accountable going forward, after a history of inaction.

In a memo published on Friday, Matchstick Ventures outlined a series of commitments to fight racism and underrepresentation. The firm, which manages nearly $37 million dollars and is led by Ryan Broshar and Natty Zola, turned to Black entrepreneur Clarence Bethea for advice on how to proceed.

The pledge stood out for two firm reasons: It is more robust than most promises we have seen by high-profile firms, and it has actual numbers and a deadline, which are key to benchmarking progress.

Matchstick says 7% of the companies it has invested in have Black founders or founding team members, which is seven times the industry average. Portfolio diversity data needs to be more largely released by the VC community because it’s the only way to determine if progress is being made. So far, beyond Matchstick, we’ve only seen Initialized Capital release diversity metrics. Union Square Ventures said that of moe than 100 investments, only a few have been in self-identified Black founders.

Powered by WPeMatico

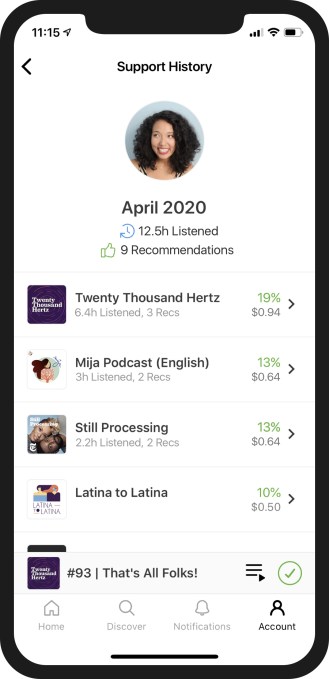

Podhero is offering listeners a new way to pay their favorite podcasters.

The startup behind the app is led by Pete Curley and Garret Heaton, who previously founded HipChat (sold to Atlassian) and launched Swoot last year, which was focused on helping you find new podcasts through sharing.

In a Medium post published today, Curley wrote that despite Swoot’s “great retention and passionate users,” the team realized that podcasters faced a bigger problem: “It’s really hard to make money,” with 97.2% of podcasts not monetizing at all.

You’re probably used to hearing ads in some of your favorite podcasts, but Curley said only 1.4% of podcasts have ads. Meanwhile, he suggested that “subscription services are the most fair and predictable way for creators to make money,” and that “if 50% of podcast listeners paid for ad-free shows — creators would make $3.7 billion/year, nearly 6x more than ads made in 2019.”

So Podhero has launched its own subscription podcast app, but unlike Luminary — which has been criticized for taking a more closed approach to the previously open podcast ecosystem — it’s not trying to lure listeners to pay for exclusive content. Instead, it’s taking something closer to the Patreon approach of financially supporting creators.

Of course, podcasters can already ask for support via Patreon, but Curley argued that the service isn’t right for many podcasters, due to the extra work involved, the 8% cut taken by Patreon, the pressure to create bonus content and the fact that they simply don’t like asking for money.

Podhero is supposed to make it easier for both the podcaster and the listener, who pays a $5.99 subscription fee every month. That includes an optional $1 fee for Podhero, plus $4.99 that’s divvied up among podcasts.

Podhero will automatically create a list of podcasts based on your listening activity, but you can adjust the list and the percentages at any time. And Curley isn’t fully giving up on sharing as a discovery mechanism — listeners can also recommend podcast episodes, which affects their payouts as well.

While Podhero is launching today, the company says it’s already populated with more than 1 million podcasts. Most of those podcasters don’t work with Podhero — for example, TechCrunch’s podcasts are in the app even though we don’t have a business relationship. Curley told me via email that if a podcaster isn’t working with the startup yet, any money contributed by fans will be saved for whenever they claim their Podhero profile.

“We may have to do something with unclaimed money at some point, but [that’s] not a problem we’ll be worrying about for some time,” he said.

Powered by WPeMatico

We’re just 24 hours away from the second installment of Pitchers & Pitches. If you want to whip your elevator pitch into shape, select your favorite beverage and join us for an interactive pitch-off and feedback session. We kick off tomorrow, June 10 at 4pm ET / 1pm PT. It won’t cost you a penny, so register here today.

You’ll walk away with insightful advice and actionable tips to help you create a 60-second pitch that highlights the best of your business. The companies competing in the pitch-off will vie for a consulting session with cela, an organization that connects early-stage startups to accelerators and incubators that can help them scale their business.

Note: The Pitchers & Pitches webinar series is free and open to all, but only companies that purchased a Disrupt Digital Startup Alley Package are eligible to pitch. We randomly chose these five startups to compete:

The VCs providing feedback for this session are Amish Jani, managing director at First Mark Capital and Merritt Hummer, partner at Bain Capital Ventures. On the TechCrunch side, we have Darrell Etherington and Jordan Crook, two TechCrunch editors with years of experience coaching founders in Startup Battlefield, the OG of startup pitch competitions. The four will evaluate the pitches and offer insightful feedback. The virtual audience will declare the pitch-off winner.

Whether you compete or simply watch and take copious notes, you’ll hear plenty of ideas and tips to help you craft the kind of pitch that captures investor interest, imagination and — not to be too crass about it — money.

Grab every opportunity to keep your startup moving forward. Register for Pitches & Pitchers today, and join us tomorrow, June 10 at 4pm ET / 1pm PT.

Is your company interested in sponsoring or exhibiting at Disrupt 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Grow Credit, the startup that launched last year to help customers build out their credit scores by providing a credit line for online subscriptions like Spotify and Netflix, has added Mucker Labs as an investor and closed its seed round with $2 million in total commitments.

The Los Angeles startup founded by serial entrepreneur Joe Bayen, had been bootstrapped initially and then received funding from a clutch of core angel investors before signing a deal with Mucker earlier this month, according to Bayen.

Using the Marqeta platform, Grow Credit can extend a loan to customers to expand their subscription services. Using the Mastercard network for payments, and Marqeta’s tools to restrict payment access, Grow offers credit facilities to its customers to pay for their monthly subscriptions. By using Grow Credit for those payments, users can improve their credit scores by as much as 61 points in a nine-month span, says Bayen.

The company doesn’t charge any fees for its loans, but users can upgrade their service. The initial tier is free for access to $15 of credit, once a user connects their bank account. For a $4.99 monthly fee, customers can get up to $50 of subscriptions covered by the service. For $9.99 that credit line increases to $150, Bayen said.

Increases to a user’s credit score can make a significant dent in their costs for things like lease agreements for cars, mortgages for houses and better rates on other credit cards, said Bayen.

“Everything is cheaper, you can get access to a credit card with lower interest rates and better rewards,” he said. “We’re looking at ourselves as the single best route to getting access to an Apple card.”

Additional capital for the new round came from individual investors like DraftKings chief executive, Jason Robins; former National Football League player and hall of famer Ronnie Lott; and Sebastien Deguy, VP of 3D at Adobe.

Coming up, Grow Credit said it has a deal in the works with one very large consumer bank in the U.S. and will be launching the Android version of its app in a few weeks.

Powered by WPeMatico

Axiom, a startup that helps companies deal with their internal data, has secured a new $4 million seed round led by U.K.-based Crane Venture Partners, with participation from LocalGlobe, Fly VC and Mango Capital. Notable angel investors include former Xamarin founder and current GitHub CEO Nat Friedman and Heroku co-founder Adam Wiggins. The company is also emerging from a relative stealth mode to reveal that is has now raised $7 million in funding since it was founded in 2017.

The company says it is also launching with an enterprise-grade solution to manage and analyze machine data “at any scale, across any type of infrastructure.” Axiom gives DevOps teams a cloud-native, enterprise-grade solution to store and query their data all the time in one interface — without the overhead of maintaining and scaling data infrastructure.

DevOps teams have spent a great deal of time and money managing their infrastructure, but often without being able to own and analyze their machine data. Despite all the tools at hand, managing and analyzing critical data has been difficult, slow and resource-intensive, taking up far too much money and time for organizations. This is what Axiom is addressing with its platform to manage machine data and surface insights, more cheaply, they say, than other solutions.

Co-founder and CEO Neil Jagdish Patel told TechCrunch: “DevOps teams are stuck under the pressure of that, because it’s up to them to deliver a solution to that problem. And the solutions that existed are quite, well, they’re very complex. They’re very expensive to run and time-consuming. So with Axiom, our goal is to try and reduce the time to solve data problems, but also allow businesses to store more data to query at whenever they want.”

Why did they work with Crane? “We needed to figure out how enterprise sales work and how to take this product to market in a way that makes sense for the people who need it. We spoke to different investors, but when I sat down with Crane they just understood where we were. They have this razor-sharp focus on how they get you to market and how you make sure your sales process and marketing is a success. It’s been beneficial to us as were three engineers, so you need that,” said Patel.

Commenting, Scott Sage, founder and partner at Crane Venture Partners added: “Neil, Seif and Gord are a proven team that have created successful products that millions of developers use. We are proud to invest in Axiom to allow them to build a business helping DevOps teams turn logging challenges from a resource-intense problem to a business advantage.”

Axiom co-founders Neil Jagdish Patel, Seif Lotfy and Gord Allott previously created Xamarin Insights that enabled developers to monitor and analyse mobile app performance in real time for Xamarin, the open-source cross-platform app development framework. Xamarin was acquired by Microsoft for between $400 and $500 million in 2016. Before working at Xamarin, the co-founders also worked together at Canonical, the private commercial company behind the Ubuntu Project.

Powered by WPeMatico