Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

If you’re a business owner or investor and are wondering about the long-term impacts of the COVID-19 pandemic on the business world, you’re not alone.

Today’s business leaders have been plunged into the deep end of telecommuting with little notice, and the way we do business has been impacted at almost every level. Travel is restricted, meetings are virtual and delivery of goods and even raw materials is being delayed. While some industries that depend on large gatherings are seeing extremely difficult challenges due to the pandemic, others such as the tech industry, see the opportunity and responsibility for innovation and growth.

As many states begin phased reopening, companies are trying to determine what the workplace and business environment will look like in a post-quarantine world. The first obvious step is the integration of personal protective equipment (PPE). Sanitization and face masks will become required and nonessential face-to-face meetings will be a thing of the past, along with shaking hands.

Additionally, relationship-driven careers such as sales and recruiting will have to find new ways to connect to be successful. Physical distancing rules will have to be established, which may include employees coming in alternate days while telecommuting the other days of the week to keep offices at reduced capacity. Large offices of 10 or more may implement thermographic camera technology for fever screening or other real-time technology-based health screenings.

One thing is for sure: IoT devices that enable physical distancing will become an integral part of reopening businesses, facilitating sales connections and embracing a different way of living.

There are a variety of IoT devices available that can help business leaders successfully implement physical distancing in their offices. Thermographic camera technology coupled with facial recognition can create a baseline for each employee and then assist in determining if an employee has a temperature outside of their norm. Other remote health monitoring may also take place with healthcare providers, helping employees determine on a daily basis if they are well enough to go into work.

Powered by WPeMatico

In the ten years she spent as a member of the European Parliament, Marietje Schaake became one of Brussels’ leading voices on technology policy issues.

A Dutch politician from the centrist-liberal Democrats 66 party, Schaake has been called “Europe’s most wired” politician. Since stepping down at the last European Parliament elections in 2019, she has doubled down with her work on cyber policy, becoming president of the CyberPeace Institute in Geneva and moving to the heart of Silicon Valley, where she has joined Stanford University as both the International Director of Policy at Stanford’s Cyber Policy Center, as well as an International Policy Fellow at its Institute for Human-Centered Artificial Intelligence.

I spoke with her about her top cyber policy concerns, the prospects of greater U.S.-EU cooperation on technology and much more.

Can you tell me about your journey from MEP in Brussels to think tank in academia?

There were a variety of reasons why I thought a third term was not the best thing for me to do. I started thinking about what would be a good way to continue, focusing on the fight for justice, for universal human rights and increasingly for the rule of law. A number of academic institutions, especially in the U.S. reached out, and we started a conversation about what the options might be, what I thought would be worthwhile. [My goal] was to understand where tech is going and what does it mean for society, for democracy, for human rights and the rule of law? But also how do the politics of Silicon Valley work?

I feel like there’s a huge opportunity, if not to say gap, on the West Coast when it comes to a policy shop — both to scrutinize policy that the companies are making and to look at what government is doing because Sacramento is super interesting.

So from a policy perspective, what areas of tech are you thinking about most?

I’m very concerned about the future of democracy in the broadest sense of the word. I feel like we need to understand better how the architecture of information flows and how it impacts our offline democratic world. The more people get steered in a certain direction, the more the foundations of actual liberalism and liberal democracy are challenged. And I feel like we just don’t look at that enough.

Powered by WPeMatico

How do you give your brand a voice that feels authentic and unique? How can you communicate with users in a way that helps and engages without feeling weird or forced?

We’re thrilled to announce that Anna Pickard, Head of Brand Communications at Slack, will be joining us at TC Early Stage to teach us all that and more.

In her role at Slack, Pickard helps teams across the company figure out how to communicate with users in a way that feels unified and professional, but not overly canned or corporate.

In her TC Early Stage breakout session aptly called “A brand personified,” Pickard will share some of those lessons with the rest of us.

TC Early Stage is our brand-new, all-virtual event that focuses on helping new founders get exactly the information they need, straight from the experienced founders, executives, investors and lawyers that know it best. It’ll run from July 21 to July 22 and will feature over 50 breakout sessions on topics on everything from fundraising, to hiring your first engineers, to the tech stack you build your product on.

And because it’s all virtual, you don’t even have to go anywhere. Tune in and kick back in your pajamas. We won’t judge.

Pickard joins an outright incredible list of speakers presenting at TC Early Stage, alongside people like Sarah Guo, Jeff Clavier, Sophie Alcorn, Cyan Banister and Garry Tan.

One catch: each of the 50+ breakout sessions at Early Stage will be capped at just 100 people and will be filled on a first-come, first-serve basis. Buy your ticket today (starting at $199) and you’ll be able to sign up for any breakout sessions we announce, plus any we’ve already announced that still have room. Prices increase in two short weeks so secure your seat today!

If you want to know more about TC Early Stage, you can find everything you need to know — things like who’s speaking, what sessions to expect and more — right here.

Interested in sponsoring Early Stage? Contact us here.

Powered by WPeMatico

Startups need money. State and local governments need startups and the employment growth they offer. It should be obvious that the two groups can work together and make each other happy. Unfortunately, nothing could be further from the truth.

Each year, governments spend tens of billions of dollars on economic development incentives designed to attract employers and jobs to their communities. There are a huge number of challenges, however, for startups and individual contributors trying to apply for these programs.

First, economic development leaders typically focus on massive, flagship projects that are splashy and will drive the news cycle and bring good media attention to their elected official bosses. So, for example, you get a massive, $10 billion Foxconn plant in Wisconsin tied to hundreds of millions of incentives, only to see the project sputter into the ground.

Then there is the paperwork. As you’d expect with any government application process, it can be arduous to find the right incentive programs, apply for credits at the right time and max out the opportunities available.

That’s where MainStreet comes in.

Its CEO and founder Doug Ludlow’s third company. He previously founded Hipster, which sold to AOL, and The Happy Home Company, which sold to Google. After that transaction, Ludlow went on to become chief of staff for SMB ads at the tech giant, where he saw firsthand the challenges that startups and all small companies face in growing outside of major urban hubs like San Francisco.

When he and his co-founders Dan Lindquist and Daniel Griffin first started, they were focused on what Ludlow described as “a network of remote work hubs.” As they were experimenting last November they tried paying people to leave the Bay Area, offering them $10,000 if they moved to other cities. The offer caused a sensation, with outlets like CNN covering the news.

While the interest from customers was great, what ignited Ludlow and his co-founders’ passions was that “literally dozens of cities, states and counties reached out, letting us know that they had an incentive program.” As the team explored further, they realized there was a huge untapped opportunity to connect startups to these preexisting programs.

MainStreet was born, and it’s an idea that has also attracted the attention of investors. The company announced today that it raised a $2.3 million round from Gradient Ventures, Weekend Fund and others.

Startups apply for economic incentives through MainStreet’s platform, and then MainStreet takes a 20% cut of any successful application. Notably, that cut is only taken when the incentive is actually disbursed (there’s no upfront cost), and there is also no on-going subscription fee to use the platform. “If you identify the credit that you’re able to use six months from now, we will charge you six months from now, when you’re actually getting that credit. It seems to be a business model that is aligned well with founders,” Ludlow said.

Right now, he says that the average MainStreet client saves $51,000, and that MainStreet has crossed the $1 million ARR run rate threshold.

Right now, the company’s core clientele are startups applying for payroll credits and research and development credits, but Ludlow says that MainStreet is working to expand beyond its tech roots to all small businesses such as restaurants. The company also wants to expand the number of economic development programs that startups can apply for. Given the myriad of governments and programs, there are hundreds if not thousands of more programs to onboard onto the platform.

MainStreet’s team. Image Credits: MainStreet

While MainStreet is helping startups and small businesses, it also wants to help governments improve their operations around economic development. With MainStreet, “we can report back to cities and states showing exactly what their tax dollars or tax credits are being utilized for,” Ludlow said. “So the accountability is orders of magnitude greater than they had before. So already, there’s this better system for tracking the success of incentives.”

The big question for MainStreet this year is navigating the crisis around the COVID-19 pandemic. While more small businesses than ever need help navigating credits, state and local governments have suffered huge shortfalls in revenues as taxes have dried up and Washington continues to debate over what, if any aid, to offer. There’s no money for economic development, yet, economic development has never been more important than right now.

Ultimately, MainStreet is pushing the vanguard of economic development thinking forward away from massive checks designed to underwrite industrial factories to a more flexible and dynamic model of incentivizing knowledge workers to move to areas outside the major global cities. It’s an interesting bet, and one that, at the very least, will help many startups get the economic incentives they rightly have access to.

Outside of Gradient and Weekend Fund, Shrug Capital, SV Angel, Remote First Capital, Basement Fund, Basecamp Ventures, Backend Capital and a host of angels participated in the round.

Powered by WPeMatico

When 2020 began, the year seemed set to include another year of record-setting venture capital investment and, perhaps, some long-awaited IPOs. All that quickly faded when COVID-19 spread globally, shutting economies, undercutting swaths of the business world and rearranging the working life in countries around the globe.

Here at TechCrunch we’re navigating the changing landscape, talking to the founders and venture capitalists that make up the startup realm that we cover, hoping to decipher the new normal.

One way that we’ve done that this year is through a daily look at the private markets. This regular effort (you can read the full archive here) has been an attempt to understand the financial side of the startup world, and how the public markets exert gravity (or lift) on private companies, especially during tumultuous economic times.

The project kicked off with a look at companies that have reached the $100 million ARR mark (a series that is still ongoing), and has touched on all sorts of things since, including the growing popularity of venture debt, China’s VC slowdown, lots of coverage of VC-backed companies trying to go public and, recently, why API startups are so hot right now.

The project kicked off with a look at companies that have reached the $100 million ARR mark (a series that is still ongoing), and has touched on all sorts of things since, including the growing popularity of venture debt, China’s VC slowdown, lots of coverage of VC-backed companies trying to go public and, recently, why API startups are so hot right now.

Today I’m happy to announce that we’re giving the daily post a name and a lovely set of art. Previously called nothing at all, the series is now called “The Exchange.”

As a writer, this is an exciting moment. I’ve written a daily column focused on the markets since mid-2016 for various publications, but I’ve never had one that was as put together as The Exchange can now claim to be. A big thanks to Eric and Walter and Henry and Bryce and Holden and Natasha for their help and encouragement.

Looking ahead, we’re seeing more mega rounds than I would have anticipated, more market demand for tech IPOs than I think anyone anticipated, record highs for tech stocks until about 48 minutes ago and lots of new rounds worth digging into from a trends perspective. So, there’s a lot to do and I’m excited to talk about it all with you each and every weekday morning on The Exchange.

That’s it for now. The Exchange comes out Monday through Friday morning on TechCrunch for Extra Crunch subscribers. Use the code “EXCHANGE” for a discount if you’d like one.

A huge thanks to everyone who already reads this series, and a hug for everyone who’s signed up so that they can access it. Here’s to another hundred entries. And then one hundred more.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines. This is Equity Monday, our short-form week-starter in which we go over the weekend, look to the week ahead, talk about some neat funding rounds and dig into what is stuck on our minds.

So, by section then:

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Akron, Ohio, the hometown of LeBron James; the seat of the U.S. tire industry; the 127 largest city in the U.S.; and the home of America’s first toy company, is now the latest site of a global experiment in whether cities can use behavioral economics to help foster good citizenship.

Thanks to the work of the city’s deputy mayor for integrated development, James Hardy, Akron is the first city to roll out services from an Israeli-based company called Colu. A startup backed by just over $20 million in financing from American and Israeli investors, the company has developed an app-based rewards service that cities can roll out to provide perks to users.

In Akron’s case, the initiative rewards points for shopping at local businesses that can be redeemed for discounts at those stores. The initial effort, which includes a platform for businesses to market directly to the app’s users, focuses on businesses owned by women and minorities (a response to the movement for racial justice that has sprung up in the wake of the murder of George Floyd in Minneapolis).

Akron is the first city of what Colu founder Amos Meiri expects to be a nationwide rollout throughout the U.S. The company already has managed to ink another agreement with the city of Chula Vista, Calif.

Colu, which has raised its capital from investors associated with blockchain technologies like Barry Silbert’s Digital Currency Group; the Boston-based venture capital firm, Spark Capital; New York’s Box Group and the Israeli corporate conglomerate, IDB Group, has deep ties to the cryptocurrency world of alternative financial instruments through Meiri.

One of the original architects of the Color coin blockchain experiment, Meiri’s work with Colu is in some ways an extension of that effort to create new kinds of economies powered by alternative financial mechanisms.

Meiri said cities typically pay for Colu out of their marketing budgets as a new way to communicate and attempt to influence civic behavior.

For Akron’s government officials, the company’s services are a way to boost locally owned businesses that have been hit hard by the state’s attempts to contain the COVID-19 outbreak.

“Our locally owned small businesses are facing enormous challenges and we need out-of-the-box ideas that safely connect them to consumers and turn local spending into a source of pride for residents,” said Akron Mayor Dan Horrigan, in a statement. “Our partnership with Colu will enable the city to reward customers for shopping local, improving revenues for our small businesses while helping folks stretch their dollars.”

Earlier work with the municipal government in Tel Aviv promoted sustainable business practice and encouraged businesses to do more to manage their waste and carbon footprint by introducing a “green label.” Businesses that followed the city’s guidelines were given the label and shoppers were encouraged to frequent those merchants.

Colu envisions itself as more than just a marketing and rewards platform for businesses. The company hopes it can draw users into a kind of social networking platform for civic engagement where users can share their own stories about city-life and their interactions with local business owners and the community.

In some ways, it’s a kinder, gentler version of China’s social credit scoring system, which is also designed to influence civic behavior. In this formulation, there’s a rewards system, but no mechanisms to punish citizens for bad behavior.

“Akron has a long history of innovation within our economy — this initiative draws on that legacy,” said Deputy Mayor Hardy, in a statement. “By putting the future of Akron’s locally owned small businesses in the palm of our citizens’ hands, we hope to make it easy for consumers to keep their money local and continue to strengthen our incredible community.”

Powered by WPeMatico

This past weekend was a busy one for rocket launches, including for new launch companies hoping to join the ranks of SpaceX and Rocket Lab as private, operational space launch providers. Edinburgh-based Skyrora achieved a significant milestone for its program, successfully launching its Skylark Nano rocket from an island off the coast of Scotland on Saturday.

Skyrora has been developing its launch system with a goal of devouring affordable transportation for small payloads. The company has flown its Skylark Nano twice previously, including a first launch back in 2018, but this is the first time it has taken off from Shetland, a Scottish site that is among three proposed commercial spaceports to be located in Scotland.

Skylark Nano is a development spacecraft that Skyrora created while it works on its Skylark-L and Skyrora XL orbital commercial launch vehicles. Nano doesn’t reach space — it flies to a height of around 6KM (roughly 20,000 feet) but it does help the company demonstrate its propulsion technologies, and also gather crucial information that helps it in developing its Skylark L suborbital commercial launch craft, as well as Skyrora XL, which will aim to serve customers with orbital payload needs.

Skylark L is currently in development, and Skyrora recently achieved a successful full static test fire of that rocket. The goal is to begin launching commercially from a U.K.-based spaceport as early as 2022.

Skyrora’s approach is also unique because it employs both additive manufacturing (3D printing) in construction of its vehicles and uses a kerosene fuel developed from discarded plastic waste that the company claims produces fewer emissions than traditional rocket fuel.

Powered by WPeMatico

Sherman Ye founded VESoft in 2018 when he saw a growing demand for graph databases in China. Its predecessors, like Neo4j and TigerGraph, had already been growing aggressively in the West for a few years, while China was just getting to know the technology that leverages graph structures to store data sets and depict their relationships, such as those used for social media analysis, e-commerce recommendations and financial risk management.

VESoft is ready for further growth after closing an $8 million funding round led by Redpoint China Ventures, an investment firm launched by Silicon Valley-based Redpoint Ventures in 2005. Existing investor Matrix Partners China also participated in the Series pre-A round. The new capital will allow the startup to develop products and expand to markets in North America, Europe and other parts of Asia.

The 30-people team is comprised of former employees from Alibaba, Facebook, Huawei and IBM. It’s based in Hangzhou, a scenic city known for its rich history and housing Alibaba and its financial affiliate Ant Financial, where Ye previously worked as a senior engineer after his four-year stint with Facebook in California. From 2017 to 2018, the entrepreneur noticed that Ant Financial’s customers were increasingly interested in adopting graph databases as an alternative to relational databases, a model that had been popular since the 80s and normally organizes data into tables.

“While relational databases are capable of achieving many functions carried out by graph databases… they deteriorate in performance as the quantity of data grows,” Ye told TechCrunch during an interview. “We didn’t use to have so much data.”

Information explosion is one reason why Chinese companies are turning to graph databases, which can handle millions of transactions to discover patterns within scattered data. The technology’s rise is also a response to new forms of online businesses that depend more on relationships.

“Take recommendations for example. The old model recommends content based purely on user profiles, but the problem of relying on personal browsing history is it fails to recommend new things. That was fine for a long time as the Chinese [internet] market was big enough to accommodate many players. But as the industry becomes saturated and crowded… companies need to ponder how to retain existing users, lengthen their time spent, and win users from rivals.”

The key lies in serving people content and products they find appealing. Graph databases come in handy, suggested Ye, when services try to predict users’ interest or behavior as the model uncovers what their friends or people within their social circles like. “That’s a lot more effective than feeding them what’s trending.”

Neo4j compares relational and graph databases (Link)

The company has made its software open source, which the founder believed can help cultivate a community of graph database users and educate the market in China. It will also allow VESoft to reach more engineers in the English-speaking world who are well-acquainted with the open-source culture.

“There is no such thing as being ‘international’ or ‘domestic’ for a technology-driven company. There are no boundaries between countries in the open-source world,” reckoned Ye.

When it comes to generating income, the startup plans to launch a paid version for enterprises, which will come with customized plug-ins and host services.

The Nebula Graph, the brand of VESoft’s database product, is now serving 20 enterprise clients from areas across social media, e-commerce and finance, including big names like food delivery giant Meituan, popular social commerce app Xiaohongshu and e-commerce leader JD.com. A number of overseas companies are also trialing Nebula.

The time is ripe for enterprise-facing startups with a technological moat in China as the market for consumers has been divided by incumbents like Tencent and Alibaba. This makes fundraising relatively easy for VESoft. The founder is confident that Chinese companies are rapidly catching up with their Western counterparts in the space, for the gargantuan amount of data and the myriad of ways data is used in the country “will propel the technology forward.”

Powered by WPeMatico

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

Many in the tech industry saw the threat of the novel coronavirus early and reacted correctly. Fewer have seemed prepared for its aftereffects, like the outflow of talented employees from very pricey office real estate in expensive and troubled cities like San Francisco.

And few indeed have seemed prepared for the Black Lives Matter protests that have followed the death of George Floyd. This was maybe the easiest to see coming, though, given how visible the structural racism is in cities up and down the main corridors of Silicon Valley.

Today, the combination of politics, the pandemic and the protests feels almost like a market crash for the industry (except many revenues keep going up and to the right). Most every company is now fundamentally reconsidering where it will be located and who it will be hiring — no matter how well it is doing otherwise.

Some, like Google and Thumbtack, have been caught in the awkward position of scaling back diversity efforts as part of pandemic cuts right before making statements in support of the protesters, as Megan Rose Dickey covered on TechCrunch this week. But it is also the pandemic helping to create the focus, as Arlan Hamilton of Backstage Capital tells her:

It is like the world and the country has a front-row seat to what Black people have to witness, take in, and feel all the time. And it was before they were seeing some of it, but they were seeing it kind of protected by us. We were kind of shielding them from some of it… It’s like a VR headset that the country is forced to be in because of COVID. It’s just in their face.

This also putting new scrutiny on how tech is used in policing today. It is renewing questions around who gets to be a VC and who gets funding right when the industry is under new pressure to deliver. It is highlighting solutions that companies can make internally, like this list from BLCK VC on Extra Crunch.

As with police reforms currently in the national debate, some of the most promising solutions are local. Property tax reform, pro-housing activism and sustainable funding for homelessness services are direct ways for the tech industry to address the long history of discrimination where the modern tech industry began, Catherine Bracy of TechEquity writes for TechCrunch. These changes are also what many think would make the Bay Area a more livable place for everyone, including any startup and any tech employee at any tech company (see: How Burrowing Owls Lead To Vomiting Anarchists).

Something to think about as we move on to our next topic — the ongoing wave of tech departures from SF.

In this week’s staff survey, we revisit the remote-first dislocation of the tech industry’s core hubs. Danny Crichton observes some of the places that VCs have been leaving town for, and thinks it means bigger changes are underway:

“Are VCs leaving San Francisco? Based on everything I have heard: yes. They are leaving for Napa, leaving for Tahoe, and otherwise heading out to wherever gorgeous outdoor beauty exists in California. That bodes ill for San Francisco’s (and really, South Park’s) future as the oasis of VC.

But the centripetal forces are strong. VCs will congregate again somewhere else, because they continue to have that same need for market intelligence that they have always had. The new, new place might not be San Francisco, but I would be shocked just given the human migration pattern underway that it isn’t in some outlying part of the Bay Area.

And then he says this:

As for VCs — if the new central node is a bar in Napa and that’s the new “place to be” — that could be relatively more permanent. Yet ultimately, VCs follow the founders even if it takes time for them to recognize the new balance of power. It took years for most VCs to recognize that founders didn’t want to work in South Bay, but now nearly every venture firm of note has an office in San Francisco. Where the founders go, the VCs will follow. If that continues to be SF, its future as a startup hub will continue after a brief hiatus.

It’s true that another outlying farming community in the region once became a startup hub, but that one had a major research university next door, and at the time a lot of cheap housing if you were allowed access to it. But Napa cannot be the next Palo Alto because it is fully formed today as a glorified retirement community, Danny.

I’m already on the record for saying that college towns in general are going to become more prominent in the tech world, between ongoing funding for innovative tech work and ongoing desirability for anyone moving from the big cities. But I’m going to add a side bet that cities will come back into fashion with the sorts of startup founders that VCs would like to back. As Exhibit A, I’d like to present Jack Dorsey, who started a courier dispatch in Oakland in 2000, and studied fashion and massage therapy during the aftermath of the dot-com bubble. His success with Twitter a few years later in San Francisco inspired many founders to move as well.

Creative people like him are drawn to the big, creative environments that cities can offer, regardless of what the business establishment thinks. If the public and private sectors can learn from the many mistakes of recent decades (see last item) who knows, maybe we’ll see a more equal and resilient sort of boom emerge in tech’s current core.

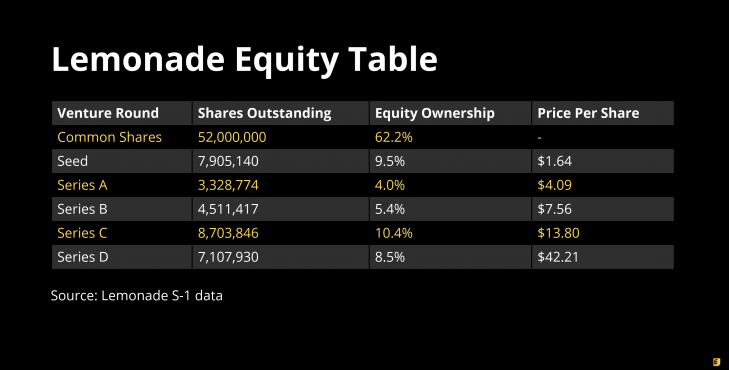

There are probably some amazing puns to be made here but it has been a long week, and the numbers speak for themselves. Lemonade sells insurance to renters and homeowners online, and managed to reach a private valuation of $3.5 billion before filing to go public on Monday — with the common stockholders still comprising the majority of the cap table.

Danny crunched the numbers from the S-1 on Extra Crunch to generate the table, included, that illustrates this rather unusual breakdown. Usually, as you almost certainly know already, the investors own well over half by the time of a good liquidity event. “So what was the magic with Lemonade?” he ponders. “One piece of the puzzle is that company founder Daniel Schreiber was a multi-time operator, having previously built Powermat Technologies as the company’s president. The other piece is that Lemonade is built in the insurance market, which can be carefully modeled financially and gives investors a rare repeatable business model to evaluate.”

(Photo by Paul Hennessy/NurPhoto via Getty Images)

Our investor surveys for Extra Crunch this week covered the space industry’s startup opportunities, and looked at how enterprise investors are assessing the impact of the pandemic. Here’s Theresia Gouw of Acrew Capital, explaining how two of their portfolio companies have refocused in recent months:

A common theme we found when joining our founders for these strategy sessions was that many pulled forward and prioritized mid- to long-term projects where the product features might better fit the needs of their customers during these times. One such example in our portfolio is Petabyte’s (whose product is called Rhapsody) accelerated development of its software capabilities that enable veterinarians to provide telehealth services. Rhapsody has also incorporated key features that enable a contactless experience when telehealth isn’t sufficient. These include functionality that enables customers to check-in (virtual waiting room), sign documents, and make payments from the comfort and safety of their car when bringing their pet (the patient!) to the vet for an in-person check-up.

Another such example would be PredictHQ, which provides demand intelligence to enterprises in travel, hospitality, logistics, CPG, and retail, all sectors who saw significant change (either positive or negative) in the demand for their products and services. PredictHQ has the most robust global dataset on real-world events. Pandemics and all the ensuing restrictions and, then, loosening of restrictions fall within the category of real-world events. The company, which also has multiple global offices, was able to incorporate the dynamic COVID government responses on a hyperlocal basis, by geography, and equip its customers (e.g., Domino’s, Qantas, and First Data) with up to date insights that would help with demand planning and forecasting as well as understanding staffing needs.

Extra Crunch Live: Join Superhuman CEO Rahul Vohra for a live Q&A on June 16 at 2pm EDT/11 AM PDT

Join us for a live Q&A with Plaid CEO Zach Perret June 18 at 10 a.m. PDT/1 p.m. EDT

Two weeks left to save on TC Early Stage passes

Learn how to ‘nail it before you scale it’ with Floodgate’s Ann Miura-Ko at TC Early Stage SF

How can startups reinvent real estate? Learn how at TechCrunch Disrupt

Stand out from the crowd: Apply to TC Top Picks at Disrupt 2020

TechCrunch

Theaters are ready to reopen, but is America ready to go back to the movies?

Edtech is surging, and parents have some notes

When it comes to social media moderation, reach matters

Zoom admits to shutting down activist accounts at the request of the Chinese government

Extra Crunch

TechCrunch’s top 10 picks from Techstars’ May virtual demo days

Software’s meteoric rise: Have VCs gone too far?

Recession-proof your software engineering career

The complicated calculus of taking Facebook’s venture money

The pace of startup layoffs may be slowing down

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

After a pretty busy week on the show we’re here with our regular Friday episode, which means lots of venture rounds and new venture capital funds to dig into. Thankfully we had our full contingent on hand: Danny “Well, you see” Crichton, Natasha “Talk to me post-pandemic” Mascarenhas, Alex “Very shouty” Wilhelm and, behind the scenes, Chris “The Dad” Gates.

Make sure to check out our IPO-focused Equity Shot from earlier this week if you haven’t yet, and let’s get into today’s topics:

And that is that; thanks for lending us your ears.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico