Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Adtech startup Admix is announcing that it has raised $7 million in Series A funding.

The London-based company was founded by CEO Samuel Huber (previously owner of an indie gaming studio) and COO Joe Bachle-Morris (who previously worked in the ad agency world). The company is working to bring ads to games, esports, virtual reality and augmented reality.

In-game advertising is already a huge market, but Admix says it’s differentiated by focusing on building a product that supports game advertising at scale, where advertisers can bid programmatically through traditional ad-buying platforms, rather than relying on an ad agency model.

For developers, Admix offers an SDK for the Unity and Unreal game engines, allowing them to drag and drop into their games ad formats like billboards, posters and 3D spaces. The startup says it’s working with more than 200 developers and is running campaigns from more than 500 advertisers each month, with past advertisers including National Geographic, Uber and State Farm.

“The concept of putting ads in games is obviously not new, but the scalability of our solution is what is revolutionary, delivering instant and consistent revenue to game makers, or streaming platforms,” Huber said in a statement. “This coupled with the fact that 1.5B people play games globally every day, means that gaming is becoming a truly mainstream advertising channel.”

Admix previously raised $2.1 million, according to Crunchbase. The Series A was led by U.K.-based Force Over Mass, with the participation from Speedinvest, Sure Valley Ventures and Nigel Morris (a former Dentsu Aegis executive), as well as other angel investors.

Powered by WPeMatico

Headless CMS company Contentful today announced that it has raised an $80 million Series E funding round led by Sapphire Ventures, with participation from General Catalyst, Salesforce Ventures and a number of other new and existing investors. With this, the company has now raised a total of $158.3 million and a Contentful spokesperson tells me that it is approaching a $1 billion valuation.

In addition, the company also today announced that it has hired Bridget Perry as its CMO. She previously led Adobe’s marketing efforts across Europe, the Middle East and Africa.

Currently, 28% of the Fortune 500 use Contentful to manage their content across platforms. The company says it has a total of 2,200 paying customers right now and these include the likes of Spotify, ITV, the British Museum, Telus and Urban Outfitters.

Steve Sloan, the company’s CEO who joined the company late last year, attributes its success to the fact that virtually every business today is in the process of figuring out how to become digital and serve its customers across platforms — and that’s a process that has only been accelerated by the coronavirus pandemic.

“Ten or 15 years ago, when these content platforms or content management systems were created, they were a) really built for a web-only world and b) where the website was a complement to some other business,” he said. “Today, the mobile app, the mobile web experience is the front door to every business on the planet. And that’s never been any more clear than in this recent COVID crisis, where we’ve seen many, many businesses — even those that are very traditional businesses — realize that the dominant and, in some cases, only way their customers can interact with them is through that digital experience.”

But as they are looking at their options, many decide that they don’t just want to take an off-the-shelf product, Sloan argues, because it doesn’t allow them to build a differentiated offering.

Perry also noted that this is something she saw at Adobe, too, as it built its digital experience business. “Leading marketing at Adobe, we used it ourselves,” she said. “And so the challenge that we heard from customers in the market was how complex it was in some cases to implement, to organize around it, to build those experiences fast and see value and impact on the business. And part of that challenge, I think, stemmed from the kind of monolithic, all-in-one type of suite that Adobe offered. Even as a marketer at Adobe, we had challenges with that kind of time to market and agility. And so what’s really interesting to me — and one of the reasons why I joined Contentful — is that Contentful approaches this in a very different way.”

Sloan noted that putting the round together was a bit of an adventure. Contentful’s existing investors approached the company around the holidays because they wanted to make a bigger investment in the company to fuel its long-term growth. But at the time, the company wasn’t ready to raise new capital yet.

“And then in January and February, we had inbound interest from people who weren’t yet investors, who came to us and said, ‘hey, we really want to invest in this company, we’ve seen the trend and we really believe in it.’ So we went back to our insiders and said, ‘hey, we’re going to think about actually moving in our timeline for raising capital,” Sloan told me. “And then, right about that time is when COVID really broke out, particularly in Western Europe in North America.”

That didn’t faze Contentful’s investors, though.

“One of the things that really stood out about our investors — and particularly our lead investor for this round Sapphire — is that when everybody else was really, really frightened, they were really clear about the opportunity, about their belief in the team and about their understanding of the progress we had already made. And they were really unflinching in terms of their support,” Sloan said.

Unsurprisingly, the company plans to use the new funding to expand its go-to-market efforts (that’s why it hired Perry, after all), but Sloan also noted that Contentful plans to invest quite a bit into R&D, as well, as it looks to help its customers solve more adjacent problems.

Powered by WPeMatico

CRM software has become a critical piece of IT when it comes to getting business done, and today a startup focusing on one specific aspect of that stack — sales automation — is announcing a growth round of funding underscoring its own momentum. Outreach, which has built a popular suite of tools used by salespeople to help identify and reach out to prospects and improve their relationships en route to closing deals, has raised $50 million in a Series F round of funding that values the company at $1.33 billion.

The funding will be used to continue expanding geographically — headquartered in Seattle, Outreach also has an office in London and wants to do more in Europe and eventually Asia — as well as to invest in product development.

The platform today essentially integrates with a company’s existing CRM, be it Salesforce, or Microsoft’s, or Kustomer, or something else — and provides an SaaS-based set of tools for helping to source and track meetings, have to-hand information on sales targets, and a communications manager that helps with outreach calls and other communication in real time. It will be investing in more AI around the product, such as its newest product Kaia (an acronym for “knowledge AI assistant”), and it has also hired a new CFO, Melissa Fisher, from Qualys, possibly a sign of where it hopes to go next as a business.

Sands Capital — an investor out of Virginia that also backs the likes of UiPath and DoorDash — is leading the round, Outreach noted, with “strong participation” also from strategic backer Salesforce Ventures. Other investors include Operator Collective (a new backer that launched last year and focuses on B2B) and previous backers Lone Pine Capital, Spark Capital, Meritech Capital Partners, Trinity Ventures, Mayfield and Sapphire Ventures.

Outreach has raised $289 million to date, and for some more context, this is definitely an up round: the startup was last valued at $1.1 billion when it raised a Series E in April 2019.

The funding comes on the heels of strong growth for the company: More than 4,000 businesses now use its tools, including Adobe, Tableau, DoorDash, Splunk, DocuSign and SAP, making Outreach the biggest player in a field that also includes Salesloft (which also raised a significant round last year on the heels of Outreach’s), Clari, Chorus.ai, Gong, Conversica and Afiniti. Its sweet spot has been working with technology-led businesses and that sector continues to expand its sales operations, even as much of the economy has contracted in recent months.

“You are seeing a cambric explosion of B2B startups happening everywhere,” Manny Medina, CEO and co-founder of Outreach, said in a phone interview this week. “It means that sales roles are being created as we speak.” And that translates to a growing pool of potential customers for Outreach.

It wasn’t always this way.

When Outreach was first founded in 2011 in Seattle, it wasn’t a sales automation company. It was a recruitment startup called GroupTalent working on software to help source and hire talent, aimed at tech companies. That business was rolling along, until it wasn’t: In 2015, the startup found itself with only two months of runway left, with little hope of raising more.

“We were not hitting our stride, and growth was hard. We didn’t make the numbers in 2014 and then had two months of cash left and no prospects of raising more,” Medina recalled. “So I sat down with my co-founders,” — Gordon Hempton, Andrew Kinzer and Wes Hather, none of whom are at the company anymore — “and we decided to sell our way out of it. We thought that if we generated more meetings we could gain more opportunities to try to sell our recruitment software.

“So we built the engine to do that, and we saw that we were getting 40% reply rates to our own outreaching emails. It was so successful we had a 10x increase in productivity. But we ran out of sales capacity, so we started selling the meetings we had managed to secure with potential talent directly to the tech companies themselves,” in other words, the other side of its marketplace, those looking to fill vacancies.

That quickly tipped over into a business opportunity of its own. “Companies were saying to us, ‘I don’t want to buy the recruitment software. I need that sales engine!” The company never looked back, and changed its name to work for the pivot.

Fast-forward to 2020, and times are challenging in a completely different way, defined as we are by a global health pandemic that affects what we do every day, where we go, how we work, how we interact with people and much more.

Medina says the impact of the novel coronavirus has been a significant one for the company and its customers, in part because it fits well with two main types of usage cases that have emerged in the world of sales in the time of COVID-19.

“Older sellers now working from home are accomplished and don’t need to be babysat,” he said, but added they can’t rely on their traditional touchpoints “like meetings, dinners and bar mitzvahs” anymore to seal deals. “They don’t have the tools to get over the line. So our product is being called in to help them.”

Another group at the other end of the spectrum, he said, are “younger and less experienced salespeople who don’t have the physical environment [many live in smaller places with roommates] nor experience to sell well alone. For them it’s been challenging not to come into an office because especially in smaller companies, they rely on each other to train, to listen to others on calls to learn how to sell.”

That’s the other scenario where Outreach is finding some traction: They’re using Outreach’s tools as a proxy for physically sitting alongside and learning from more experienced colleagues, and using it as a supplement to learning the ropes in the old way.

“Outreach’s leadership position in the market, clear mission, and value-added approach make the company a natural investment choice for us,” said Michael Clarke, partner at Sands Capital’s Global Innovation Fund, in a statement. “Now more than ever, companies need an AI-powered sales engagement platform like Outreach. Enterprise sales teams are rapidly adopting sales engagement platforms and Outreach’s rapid growth reflects this.”

Like a lot of sales tools that are powered by AI, Outreach in part is taking on some of the more mundane jobs of salespeople.

But Medina doesn’t believe that this will play out in the “man versus machine” scenario we often ponder when we think about human obsolescence in the face of technological efficiency. In other words, he doesn’t think we’re close to replacing the humans in the mix, even at a time when we’re seeing so many layoffs.

“We are at the early innings,” he said. “There are 6.8 million sales people and we only have north of 100,000 users, not even 2% of the market. There may be a redefinition of the role, but not a reduction.”

Powered by WPeMatico

Fintech startup Revolut has expanded its open banking feature to Ireland. The feature first launched in the U.K. back in February. Once again, the startup is partnering with TrueLayer to let you add third-party bank accounts to your Revolut account.

The feature launch also marks the launch of TrueLayer in Ireland. For now, Revolut users can only link their Revolut account with AIB, Permanent TSB, Ulster Bank and Bank of Ireland. Revolut and TrueLayer will add support to other banks in the future. Revolut currently has 1 million customers in the Republic of Ireland.

The idea behind open banking is quite simple. Many online services rely on application programming interfaces (APIs) to talk to each other. You can connect with your Facebook account on many online services, you can interact with other services from Slack, etc.

Financial institutions have been lagging behind on this front, but it is changing thanks to new regulation and technical updates. With open banking, your bank account should work more like a traditional internet service.

When you connect your bank account with Revolut, you can view your balance and past transactions from a separate tab that lists all your linked accounts. Users can also take advantage of Revolut’s budgeting features with their bank accounts.

As TechCrunch’s Steve O’Hear noted when he first covered Revolut’s open banking feature, Revolut was originally authorized for Account Information Services (AIS) by the U.K. regulator, the Financial Conduct Authority. It lets you access and display information from other financial institutions.

But the startup now has permission to carry out Payment Initiation Services (PIS). It means that you’ll soon be able to initiate transfers from your bank account directly from Revolut. It should make it much easier to top up your Revolut balance, for instance.

While this feature might seem anecdotal, Revolut wants to build a comprehensive financial hub for all your financial needs — a sort of super app for everything related to money. With open banking, you theoretically no longer have to open your traditional banking app.

Image Credits: Revolut

Powered by WPeMatico

Pale Blue Dot, a newly outed European venture capital firm focused on climate tech, announced this week the first closing of its debut fund at €53 million.

Targeting pre-seed and seed stage startups, the firm says it will consider software and technology investments with a strong positive climate impact. Current areas of focus include food/agriculture, industry, fashion/apparel, energy and transportation, with plans to back up to 40 companies out of fund one.

Founding partners Hampus Jakobsson, Heidi Lindvall and Joel Larsson are stalwarts of the Nordic tech ecosystem and beyond: Jakobsson co-founded TAT (The Astonishing Tribe), which was sold to Blackberry in 2012, and is a prominent angel investor in Europe, most recently a venture partner at BlueYard Capital . Lindvall is the former head of accelerator and investment team at Fast Track Malmö, with a background in human rights and media. Larsson was previously managing director at Fast Track Malmö, with a technical background and prior fund management experience.

I put questions to all three, delving deeper into Pale Blue Dot’s remit and the firm’s investment thesis. We also discussed the macro trends that warrant a fund specializing in climate tech and why Europe is poised to become a leader in the space.

Pale Blue Dot is a new VC fund specializing in climate tech, but in a sense — and to varying degrees — isn’t every venture capital fund a climate tech fund these days?

Heidi Lindvall: We think all funds should be “planet-positive” and working for a better world, but it will take time until it is a focus. Still, most funds look at a potential positive impact late in their assessment and will not decline the deal if the startups wouldn’t be significantly pulling the world in a good direction.

Hampus Jakobsson: Focus has both upsides and downsides.

The negative part with being niche is that we won’t do investments in amazing people or startups that we don’t think are “climate-contributing enough” or that the founders aren’t doing it in a genuine way (as the risk of them to paying attention to the impact might lead them to become a noncontributing company).

Powered by WPeMatico

Canva, the design platform for non-designers, has recently inked a partnership with FedEx Office to help businesses reopen amid the coronavirus pandemic with a design-to-print integration.

Canva declined to disclose the financial terms of the partnership.

With the new partnership, Canva and FedEx customers alike will be able to use Canva’s extensive libraries of templates, images and illustrations to design print materials for their businesses, like disposable restaurant menus, new hours of operation, information around new safety policies in the wake of the pandemic and more.

These customers can send their designs directly to FedEx for printing and pick up from over 2,000 FedEx Office locations across the U.S.

Canva’s target demographic is not hardcore, professional designers but rather non-designers, with a mission of democratizing design across professional organizations and more broadly to amateur designers.

As of October 2019, the Australia-based company was valued at $3.2 billion. At the time, Canva introduced enterprise collaboration software that allows sales teams, HR teams and other non-design teams to build out their own decks and materials with a simple drag-and-drop interface.

Since, Canva has complemented its design product with video editing software, as well.

The partnership with FedEx Office marks a big push into the U.S. market, with increased brand awareness and distribution via the established print and shipping giant.

Pricing around FedEx Office printing of Canva designs remains the same as FedEx’s usual pricing structure, but through August 31 FedEx is offering a 25% discount on orders of more than $50.

Powered by WPeMatico

COVID-19 has transformed the way Americans use their phones and the way they spend their time and money online. These shifts present both a number of challenges and a raft of opportunities for savvy growth marketers.

We’ve seen COVID-19 affect a number of verticals. A number of industries have taken a hit (like music streaming and sports), while some are expanding due to the pandemic (groceries, media, video gaming). Others have found distinctive ways to adjust the way they position and sell their product, allowing them to take advantage of changes in buyer behavior.

The key to being able to read and react to changes in this still-tumultuous time and tailoring your growth marketing accordingly is to understand how public sentiment is reflected in new purchasing behaviors. Here’s an overview of the most important trends we’re seeing that will allow you to adjust your growth marketing effectively.

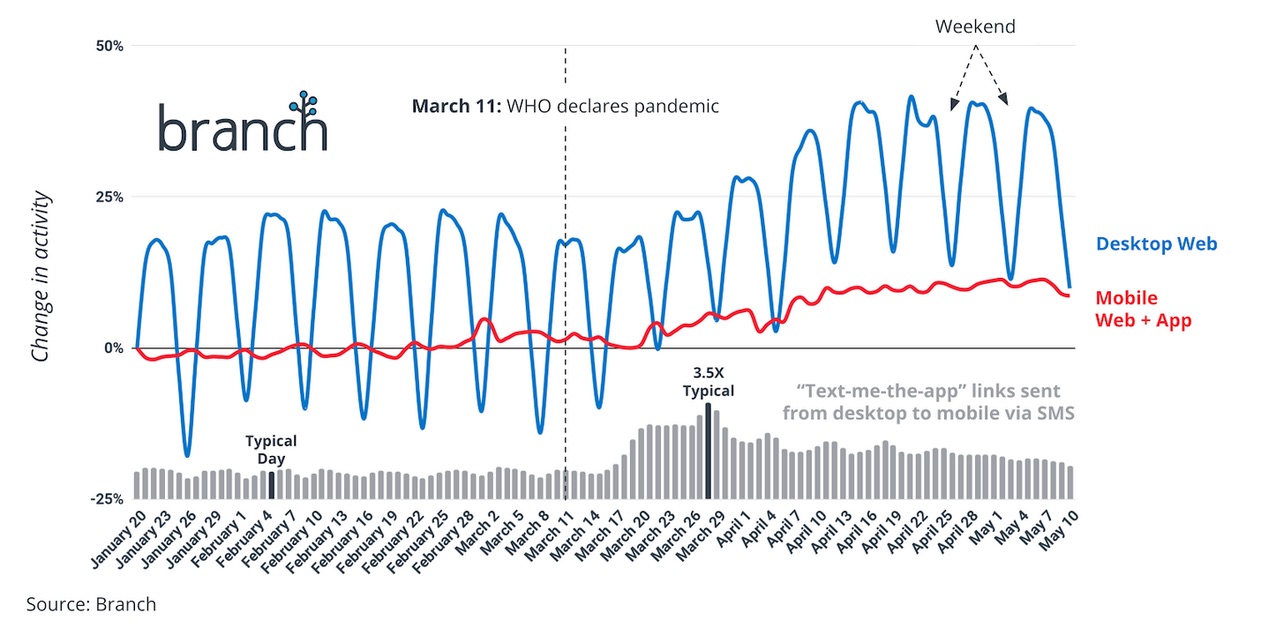

Virtually all of the data we’ve seen shows a marked difference in buyer behavior following the WHO’s declaration of a pandemic on March 11, 2020. With consumers encouraged to stay home to deter the spread of COVID-19, it’s no surprise that the biggest change is the spike in online activity.

Image Credits: Branch (opens in a new window)

Powered by WPeMatico

Square acquired Verse, a Spanish peer-to-peer payment app that works across Europe. Terms of the deal are undisclosed. According to Crunchbase, Verse had raised $37.6 million from Spark Capital, eVentures, Greycroft Partners and others.

Square has attracted a ton of users with Cash App, its peer-to-peer payment app that lets you easily send and receive money from your phone. But Cash App has only been available in the U.S. and the U.K.

Acquiring Verse seems like a good fit to expand Square’s presence in Europe. Verse’s team will join the Cash App division within Square.

There are many similarities between Cash App and Verse. Verse’s main feature is that it lets you send and receive money from a mobile app. Users don’t pay any fees and transfers occur in just a few seconds.

Verse users sign up with their phone numbers, which means that you can send money to other users as long as you have their phone numbers in your address book. If you don’t have enough money on your Verse account, the app can charge your debit card directly. And if you want to withdraw money from your Verse account, you can transfer your balance to your bank account.

You can also track group expenses from the app (like Splitwise), create money pots and organize events with a basic ticketing feature.

More recently, Verse launched a Visa debit card in Spain, which lets you spend money on your Verse account directly. You don’t pay any foreign exchange fees and you get two free ATM withdrawals per month. Verse uses Visa’s exchange rate.

While the startup hasn’t shared usage numbers for a while, according to App Annie, it is currently the No. 247 most downloaded app in the App Store in Spain across all categories. Peer-to-peer payment is a fragmented market. For instance, French startup Lydia has 3 million users in France.

“At this point, our main priority is enabling Verse to continue their successful growth in Europe. Verse will continue to operate as an independent business, working out of their offices with no immediate changes to their existing products, customers, or business operations,” Square wrote in the announcement.

The three most important words in this statement are “at this point.” Square doesn’t want to fix what isn’t broken. But I wouldn’t be surprised if Verse slowly evolves to become Cash App in Europe.

Image credits: Square

Powered by WPeMatico

An email app with a waitlist? No, this isn’t 2004 and I’m not talking about Gmail. Superhuman has managed to attract and maintain constant interest for its subscription email product, with a wait list at over 275,000 people long at last count – all while asking users to pay $30 per month to gain access to the service. Founder and CEO Rahul Vohra will join us on Tuesday, June 26 at 2pm ET/11am PT for an Extra Crunch Live Q&A.

We have plenty of questions of our own, but we bet you do, too! Extra Crunch members can ask their own questions directly to Vohra during the chat.

We’re thrilled to be able to sit down with Vohra for a discussion about email, why it was in need of change, and what’s bringing so much attention and interest to Superhuman on a sustained basis. We’ll talk about the current prevailing market climate and what that’s meant for the business, as well as how you manage to create not one, but two companies (Vohra previously founded and sold Rapportive) that have adapted email to more modern needs – and struck a chord with users as a result.

Meanwhile, SaaS seems to be one of the bright spots in an otherwise fairly gloomy global economic situation, and Superhuman’s $30 per month subscription model definitely qualifies. We’ll ask Vohra what it means to build a successful SaaS startup in 2020, and how there might be plenty of opportunity even in so-called ‘solved’ problems like email and other aspects of our digital lives that have become virtually invisible thanks to habit.

Audience members can also ask their own questions, so come prepared with yours if you’re already an Extra Crunch member. And if you aren’t yet – now’s a great time to sign up.

We hope to see you there!

Powered by WPeMatico

Stockwell AI entered the world with a bang but it is leaving with a whimper. Founded in 2017 by ex-Googlers, the AI vending machine startup formerly known as Bodega first raised blood pressures — people hated how it referenced and poorly ‘disrupted’ mom-and-pop shops in one fell swoop — and then raised a lot of money. But ultimately, it was no match for COVID-19 and the hit it has had on how we live.

TechCrunch has learned and confirmed that Stockwell will be shutting down at the end of this month, after it was unable find a viable business for its in-building app-controlled “smart” vending machines stocked with convenience store items.

“Regretfully, the current landscape has created a situation in which we can no longer continue our operations and will be winding down the company on July 1st,” co-founder and CEO Paul McDonald wrote in an email to TechCrunch. “We are deeply grateful to our talented team, incredible partners and investors, and our amazing shoppers that made this possible. While this wasn’t the way we wanted to end this journey, we are confident that our vision of bringing the store to where people live, work and play will live on through other amazing companies, products and services.”

We originally reached out after we were tipped off by someone who had received an email about the closure. Stockwell’s vending boxes were distributed primarily in apartment and office buildings, and it has been contacting those customers for the past week to break the news.

For what it’s worth, the building operator that was using Stockwell vending machines said it is actively in search of a replacement provider, so it seems it did get some use, but more pointedly it’s been very hard for the vending machine industry, where some distributors have seen business losses of up to 90%.

Stockwell’s closure is notable because it underscores how in the current climate, having a strong list of backers and a very decent amount of funding cannot always guarantee insulation for everyone.

As of last September, Stockwell had raised at least $45 million in funding from investors that included NEA, GV, DCM Ventures, Forerunner, First Round, and Homebrew. Its network had grown to 1,000 “stores”, smart vending machines that work a little like advanced hotel minibars: sensors detect and charge you for what you take out, and you use a smartphone app both to track what you buy and to pay for it.

As of last autumn, the company appeared to be gearing up for a widening of its business model, allowing its customers (building, office and apartment managers) to have a bigger say in what got stocked beyond the items Stockwell itself put into its machines, which included water and other beverages, savoury and sweet snacks, and a few home basics like laundry detergent and pain killers.

By December, it seems that McDonald’s co-founder, Ashwath Rajan, had quietly left the startup, and then as 2020 kicked into gear, COVID-19 took its toll.

First, consumers found themselves spending much more time working and simply being at home, going out less and bulk buying to minimise shopping efforts. That, in turn, had a big impact on the sustainability of business models based on casual, small purchases, such as the kind that one would typically make from vending machines like Stockwell’s.

Second, at a time when many are trying to minimise the spread of infection by wearing face masks, washing hands and minimising touching random objects, a big question mark hangs over the whole concept of unattended vending machines, and whether they can ever be properly sanitised. That’s impacted not only people buying items, but the workforce that’s meant to help stock and maintain these kiosks.

There have been some interesting twists in how the vending industry has handled COVID-19. Some are swapping out pretzels and Snickers and replacing them with PPE equipment, and others are finding opportunity in stocking them with healthy food specifically for front-line workers who have no other options and need quick but nutritious fixes during critical times.

But more generally, the vending machine industry has been hit hard by the pandemic.

The wider market in a normal year is estimated to be worth some $30 billion annually — one reason why Stockwell nee Bodega likely caught the eye of investors — but business has fallen off a cliff for many key operators.

The president of the European Vending Association, in an appeal in April to government leaders for financial assistance, said that business had dropped off by 90% and described COVID-19 as having a “devastating effect” on the sector. Difficult numbers for the Pepsi’s and Mondelez’s (nee Kraft) of the world, but surely the nail in the coffin for a young, promising AI-based vending machine startup that nonetheless some doubted from the word go.

Powered by WPeMatico