Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

The venture capital industry is less transparent today than at any time in recent memory.

For all the talk about expanding access and improving its sordid record on diversity, in reality, it has never been harder for founders to figure out who can even write a check to their startups in the first place.

When I first returned to TechCrunch after my second stint in venture capital, my first piece was entitled “The loss of first check investors.” While working in the venture capital industry, it was maddening to see — particularly at the pre-seed and seed stages — how few investors were really willing to go out on a limb and invest in founders before another VC had committed a check.

It’s only gotten worse in the past two years since that article, and the complexity comes from a number of different places. As our investigation showed more than a year ago, fewer and fewer venture rounds are being announced through SEC Form D filings.

There are almost no publicly accountable datasets left indicating who is writing checks in the venture industry and which companies are receiving those checks. While stealthiness is valid in the early days of a startup, the excuse wears thin after years.

Powered by WPeMatico

Conduct an online search and you’ll find close to one million websites offering their own definition of DevSecOps.

Why is it that domain experts and practitioners alike continue to iterate on analogous definitions? Likely, it’s because they’re all correct. DevSecOps is a union between culture, practice and tools providing continuous delivery to the end user. It’s an attitude; a commitment to baking security into the engineering process. It’s a practice; one that prioritizes processes that deliver functionality and speed without sacrificing security or test rigor. Finally, it’s a combination of automation tools; correctly pieced together, they increase business agility.

The goal of DevSecOps is to reach a future state where software defines everything. To get to this state, businesses must realize the DevSecOps mindset across every tech team, implement work processes that encourage cross-organizational collaboration, and leverage automation tools, such as for infrastructure, configuration management and security. To make the process repeatable and scalable, businesses must plug their solution into CI/CD pipelines, which remove manual errors, standardize deployments and accelerate product iterations. Completing this process, everything becomes code. I refer to this destination as “IT-as-code.”

Whichever way you cut it, DevSecOps, as a culture, practice or combination of tools, is of increasing importance. Particularly these days, with more consumers and businesses leaning on digital, enterprises find themselves in the irrefutable position of delivering with speed and scale. Digital transformation that would’ve taken years, or at the very least would’ve undergone a period of premeditation, is now urgent and compressed into a matter of months.

Security and operations are a part of this new shift to IT, not just software delivery: A DevSecOps program succeeds when everyone, from security, to operations, to development, is not only part of the technical team but able to share information for repeatable use. Security, often seen as a blocker, will uphold the “secure by design” principle by automating security code testing and reviews, and educating engineers on secure design best practices. Operations, typically reactive to development, can troubleshoot incongruent merges between engineering and production proactively. However, currently, businesses are only familiar with utilizing automation for software delivery. They don’t know what automation means for security or operations. Figuring out how to apply the same methodology throughout the whole program and therefore the whole business is critical for success.

Powered by WPeMatico

Three years ago almost to the day, Intercom announced that it was bringing former Intuit exec Karen Peacock on board as COO. Today, she got promoted to CEO, effective July 1. Current CEO and company co-founder Eoghan McCabe will become Chairman.

As it turns out, these moves aren’t a coincidence. McCabe had been actively thinking about a succession plan when he hired Peacock. “When I first started talking to Eoghan three years ago, he shared with me that his vision was to hire someone as COO, who could then become the CEO at the right time and he could transition into the chairman role,” Peacock told TechCrunch .

She said while the idea was always there, they didn’t feel the need to rush the process. “We were just looking for whatever the right time was, and it wasn’t something we were expected to do in the first year or two. And now is really the right time to transition with all of the momentum that we’re seeing in the market,” she said.

She said as McCabe makes the transition away from running the company he helped found, he will still be around, and they will continue working together on things like product and marketing strategy, but Peacock brings a pedigree of her own to the new role.

Not only has she been in charge of commercial aspects of the Intercom business for the past three years, prior to that she was SVP at Intuit where she ran small business products that included QuickBooks, and grew it from a $500 million business to a hefty $2.5 billion during her tenure.

McCabe says that experience was one of the reasons he spent six months trying to convince Peacock to become COO at Intercom in 2017. “It’s really hard to find a leader that’s as well rounded, and as unique as Karen is. You know she doesn’t actually fit your typical very experienced operator,” he said. He points to her deep product background, calling her a “product nerd,” and her undergraduate degree in applied mathematics from Harvard as examples.

In spite of the pandemic, she’s taking over a company that’s still managing to grow. The company’s business messenger products, which enable companies to chat with customers online, have become increasingly important during the pandemic with many brick-and-mortar businesses shut down and the majority of business is being conducted digitally.

“Our overall revenue is $150 million in annual recurring revenue, and a supporting data point to what we were just talking about is that our new business to up market customers through our sales teams has doubled year over year. So we’re really seeing some quite nice acceleration there,” she said.

Peacock says she wants to continue building the company and using her role to build a diverse and inclusive culture. “I believe that [diversity and inclusion] is not one person’s job, it’s all of our jobs, but we have one person who’s the center post of that (a head of D&I). And then we work with outside consulting firms as well to just try and stay in a place where we understand all of what’s possible and what we can do in the world.”

She adds, “I will say that we need to make more progress on diversity and inclusion. I wouldn’t step back and pat ourselves on the back and say we’ve done this perfectly. There’s a lot more that we need to do, and it’s one of the things that I’m very excited to tackle as CEO.”

According to a February Wall Street Journal article, less than 6% of women hold CEO jobs in the U.S. Peacock certainly sees this and wants to continue to mentor women as she takes over at Intercom. “It is something that I’m very passionate about. I do speak to various different groups of up and coming women leaders, and I mentor a group of women outside of Intercom,” she said. She also sits on the board at Dropbox with other women leaders like Condoleezza Rice and Meg Whitman.

Peacock says that taking over during a pandemic makes it interesting, and instead of visiting the company’s offices, she’ll be doing a lot of video conferences. But neither is she coming in cold to the company having to ramp up on the business side of things, while getting to know everyone.

“I feel very fortunate to have been with Intercom for three years, and so I know all the people and they all know me. And so I think it’s a lot easier to do that virtually than if you’re meeting people for the very first time. Similarly, I also know the business very well, and so it’s not like I’m trying to both ramp up on the business and deal with a pandemic,” she said.

Powered by WPeMatico

Flipboard is giving news publishers and other curators on the platform a new way to highlight content through a format called Storyboards.

Until now, Flipboard has largely focused on its Smart Magazines, which are ongoing collections that mix human and algorithmic curation, allowing readers to dive deeply into and keep up-to-date on a given topic.

Storyboards, on the other hand, are more of a one-time collection of articles, videos, podcasts, tweets and other media. Content-wise, they may not be that different from an “everything you need to know about X” roundup article, but they give publishers an easy and visually stylish way to put those roundups together.

Publishers have already been beta testing it. For example, TheGrio created a Storyboard collecting the latest coverage of George Floyd’s death and the resulting protests, while National Geographic curated a package of new and old stories commemorating the 40th anniversary of the eruption of Mount St. Helens. And TechCrunch tried it out by doing daily roundups of coverage coming out of last year’s Disrupt conference in San Francisco.

Image Credits: Flipboard

Flipboard CEO Mike McCue told me this is something curators have been asking for, as a way to “structure their curation better and be able to do better storytelling.”

He also said that Storyboards could be a great way to highlight different products and make money with affiliate links, especially since “curated commerce is something that will probably play more and more of a significant role in our revenue.”

Vice President of Engineering Troy Brant gave me a quick tour of the product, showing me how a curator can create different sections in a Storyboard, tweak the look of those sections and populate them with different kinds of content.

These new Storyboards can be discovered in Flipboard based on the topics with which the curator tags them. They’re also shareable and embeddable via Twitter, LinkedIn, Facebook and email.

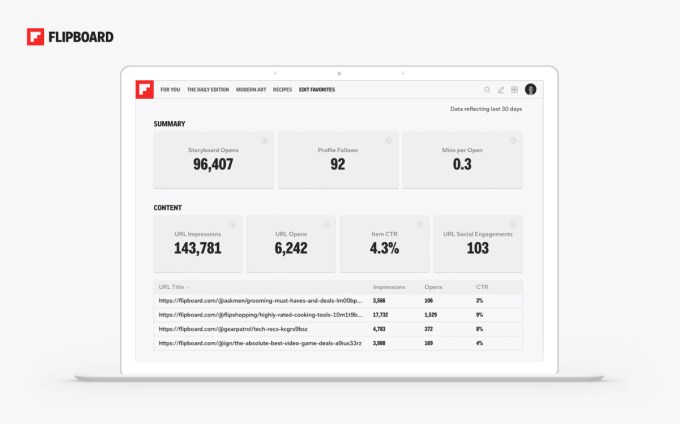

Image Credits: Flipboard

Brant noted that Storyboards are “complementary” with Flipboard magazines, as magazines can include Storyboards and Storyboards can include magazines. He also said the company is developing “more product capabilities” to highlight the best curation, whether that takes the form of a Storyboard or magazine: “That’s actually a work in progress at the moment.”

And Storyboards come with detailed analytics about how many people are viewing them, liking them, commenting on them, flipping them and more.

All of this is part of a new tool in Flipboard called Curator Pro, which is now available to all verified users in English-speaking countries, with plans for a more global rollout soon. Brant added that Storyboards are just the “first step” for Curator Pro, with more magazine curation tools and analytics on the way as well.

Powered by WPeMatico

As an increasing number of daily and essential services move to digital platforms — a trend that’s had a massive fillip in the last few months — having efficient but effective ways to verify that people are who they say they are online is becoming ever more important. Now, a startup called Payfone, which has built a B2B2C platform to identify and verify people using data (but no personal data) gleaned from your mobile phone, has raised $100 million to expand its business. Specifically, Rodger Desai, the co-founder and CEO, said in an interview that plan will be to build in more machine learning into its algorithms, expand to 35 more geographies and make strategic acquisitions to expand its technology stack.

The funding is being led by Apax Digital, with participation from an interesting list of new and existing backers. They include Sandbox Insurtech Ventures, a division of Sandbox Industries, which connects corporate investment funds with strategic startups in their space); Ralph de la Vega, the former vice chairman of AT&T; MassMutual Ventures; Synchrony; Blue Venture Fund (another Sandbox outfit); Wellington Management LLP; and the former CEO of LexisNexis, Andrew Prozes.

Several of these investors have a close link to the startup’s business: Payfone counts carriers, healthcare and insurance companies, and banks among its customers, which use Payfone technology in their backends to help verify users making transactions and logging in to their systems.

Payfone tells me it has now raised $175 million to date, and while it’s not disclosing its valuation with this round, according to PitchBook, in April 2019 when it raised previously, it was valued at $270 million. Desai added that Payfone is already profitable and business has been strong lately.

“In 2019 we processed 20 billion authentications, mostly for banks but also healthcare companies and others, and more generally, we’ve been growing 70% year-over-year,” he said. The aim is to boost that up to 100 billion authentications in the coming years, he said.

Payfone was founded in 2008 amongst a throng of mobile payment startups (hence its name) that emerged to help connect consumers, mobile content businesses and mobile carriers with simpler ways to pay using a phone, with a particular emphasis on using carrier billing infrastructure as a way of letting users pay without inputting or using cards (especially interesting in regions where credit and debit card penetration and usage are lower).

That has been an interesting if slowly growing business, so around 2015 Payfone starting to move toward using its tech and infrastructure to delve into the adjacent and related space of applying its algorithms, which use authentication data from mobile phones and networks to help carriers, banks and many other kinds of businesses verify users on their networks.

(Indeed, the connection between the technology used for mobile payments that bypasses credit/debit cards and the technology that might be used for ID verification is one that others are pursuing, too: Carrier billing startup Boku — which yesterday acquired one of its competitors, Fortumo, in a $41 million deal as part of a wider consolidation play — also acquired one of Payfone’s competitors, Danal, 18 months ago to add user authentication into its own range of services.)

The market for authentication and verification services was estimated to be worth some $6 billion in 2019 and is projected to grow to $12.8 billion by 2024, according to research published by MarketsandMarkets. But within that there seems to be an almost infinite amount of variations, approaches and companies offering services to carry out the work. That includes authentication apps, password managers, special hardware that generates codes, new innovations in biometrics using fingerprints and eye scans, and more.

While some of these require active participation from consumers (say by punching in passwords or authentication codes or using fingerprints), there’s also a push to develop more seamless and user-friendly, and essentially invisible, approaches, and that’s where Payfone sits.

As Desai describes it, Payfone’s behind-the-scenes solution is used either as a complement to other authentication techniques or on its own, depending on the implementation. In short, it’s based around creating “signal scores” and tokens, and is built on the concept of “data privacy and zero data knowledge architecture.” That is to say, the company’s techniques do not store any personal data and do not need personal data to provide verification information.

As he describes it, while many people might only be in their 20s when getting their first bank account (one of the common use cases for Payfone is in helping authenticate users who are signing up for accounts via mobile), they will have likely already owned a phone, likely with the same phone number, for a decade before that.

“A phone is with you and in your use for daily activities, so from that we can opine information,” he said, which the company in turn uses to create a “trust score” to identify that you are who you say you are. This involves using, for example, a bank’s data and what Desai calls “telecoms signals” against that to create anonymous tokens to determine that the person who is trying to access, say, a bank account is the same person identified with the phone being used. This, he said, has been built to be “spoof proof” so that even if someone hijacks a SIM it can’t be used to work around the technology.

While this is all proprietary to Payfone today, Desai said the company has been in conversation with other companies in the ecosystem with the aim of establishing a consortium that could compete with the likes of credit bureaus in providing data on users in a secure way.

“The trust score is based on our own proprietary signals but we envision making it more like a clearing house,” he said.

The fact that Payfone essentially works in the background has been just as much of a help as a hindrance for some observers. For example, there have been questions raised previously about how data is sourced and used by Payfone and others like it for identification purposes. Specifically, it seems that those looking closer at the data that these companies amass have taken issue not necessarily with Payfone and others like it, but with the businesses using the verification platforms, and whether they have been transparent enough about what is going on.

Payfone does provide an explanation of how it works with secure APIs to carry out its services (and that its customers are not consumers but the companies engaging Payfone’s services to work with consumer customers), and offers a route to opt out of of its services for those that seek to go that extra mile to do so, but my guess is that this might not be the end of that story if people continue to learn more about personal data, and how and where it gets used online.

In the meantime, or perhaps alongside however that plays out, there will continue to be interesting opportunities for approaches to verify users on digital platforms that respect their personal data and general right to control how any identifying detail — personal or not — gets used. Payfone’s traction so far in that area has helped it stand out to investors.

“Identity is the key enabling technology for the next generation of digital businesses,” said Daniel O’Keefe, managing partner of Apax Digital, in a statement. “Payfone’s Trust Score is core to the real-time decisioning that enterprises need in order to drive revenue while thwarting fraud and protecting privacy.” O’Keefe and his colleague, Zach Fuchs, a principal at Apax Digital, are both joining the board.

“Payfone’s technology enables frictionless customer experience, while curbing the mounting operating expense caused by manual review,” said Fuchs.

Powered by WPeMatico

Meet Vivid, a new challenger bank launching in Germany that promises low fees and an integrated cashback program. The two co-founders, Alexander Emeshev and Artem Yamanov, previously worked as executives for Russian bank Tinkoff Bank.

Vivid doesn’t try to reinvent the wheel and is building its product on top of well-established players. It relies on solarisBank for the banking infrastructure, a German company with a banking license that provides banking services as APIs to other fintech companies. As for debit cards, Vivid is working with Visa.

If you live in Germany and want to sign up to Vivid, you can expect a lot of features that you can find in other challenger banks, such as N26, but with a few additional features. Vivid users get a current account and a debit card. They can then manage their money from the mobile app.

The physical Vivid card doesn’t feature any identifiable details — there’s no card number, expiry date or CVV. Just like Apple’s credit card in the U.S., you have to check the mobile app to see those details. Every time you make a purchase, you receive a notification. You can lock and unlock your card from the app. The card works in Google Pay but not yet in Apple Pay.

In order to make money management easier, Vivid lets you create pockets. Those are sub-accounts presented in a grid view, like on Lydia or N26 Spaces. You can move money between pockets by swiping your finger from one pocket to another. Each pocket has its own IBAN.

You can associate your card with any pocket. Soon, you’ll also be able to share a pocket with another Vivid user. Like on Revolut, you can exchange money to another currency. The company adds a small markup fee but doesn’t share more details.

As for the cashback feature, the startup focuses on a handful of partnerships. You can earn 5% on purchases at REWE, Lieferando, BoFrost, Eismann, HelloFresh and Too Good To Go, and 10% on online subscriptions, such as Netflix, Prime Video, Disney+ and Nintendo Switch Online. While it’s generous, you’re limited to €20 maximum in cash back per month.

Interestingly, Vivid also wants to bring back Foursquare-style mayorship. If you often go to the same bar or café and you spend more than any other Vivid user over a two-week window, you become the mayor and receive 10% cashback.

Vivid has two plans — a free plan and a Vivid Prime subscription for €9.90 per month. Prime users receive a metal card, more cash back on everyday purchases and higher withdrawal limits.

The company plans to launch stock and ETF trading in the coming months. Vivid also plans to expand into other European countries this year.

Vivid is entering a crowded market, but already offers a solid product if everything works as expected. It’s going to be interesting to see how the product evolves and if they can attract a large user base.

Powered by WPeMatico

Email is one of those things that no one likes but that we’re all forced to use. Superhuman, founded by Rahul Vohra, aims to help everyone get to inbox zero.

Launched in 2017, Superhuman charges $30 per month and is still in invite-only mode with more than 275,000 people on the waitlist. That’s by design, Vohra told us earlier this week on Extra Crunch Live.

“I think a lot of folks misunderstand the nature of our waitlist,” he said. “They assume it’s some kind of FOMO-generating technique or some kind of false scarcity. Nothing could be further from the truth. The real reason we have the waitlist is that I want everyone who uses Superhuman to be deliriously happy with their experience.”

Today, the app is only available for desktop and iOS. Superhuman started with iOS because most premium users have iPhones, Vohra said. Still, many users have Android, so Superhuman’s waitlist consists mostly of Android users.

“We don’t think that if we onboard them they’d have the best experience with Superhuman because email really is an ecosystem product,” he said. “You do it just as much on the go as you do from your laptop. There’s a lot of reasons like that. So if you’re a person who identifies that as a must-have, well, we’ll take in the survey, we’ll learn about you so we know when to reach out to you. Then when we have those things built or integrated, we’ll reach out.”

We also chatted about his obsession with email, determining pricing for a premium product, the impact of COVID-19, diversity in tech in light of the police killing of George Floyd and so much more.

Throughout the conversation, Vohra also offered up some good practical advice for founders. Here are some highlights from the conversation.

Yeah, I’m not at all worried. I used to get worried about this. You know, 10 years ago, even as recently as five years ago, I would get worried about competitors. But I think Paul Graham has really, really great advice on this. I think he says pretty much verbatim: Startups don’t kill other startups. Competition generally doesn’t kill the startup. Other things do, like running out of money being the biggest one, or lack of momentum or lack of motivation or co-founder feuds; these are all really dangerous things.

Competition from other startups generally isn’t the thing that gets you and you know, props to the Basecamp team and everything they’ve done with Hey. It’s really impressive. I think it’s for an entirely different demographic than Superhuman is for.

Superhuman is for the person for whom essentially email is work and work is email. Our users kind of almost personally identify with their email inbox, and they’re coming from Gmail or G Suite. Typically it’s overflowing so they often receive hundreds if not thousands of emails a day, and they send off 100 emails a day. Superhuman is for high-volume email for whom email really matters. Power users, essentially, though power users isn’t quite the right articulation. What I actually say is prosumers because there’s a lot of people who come to us at Superhuman and they’re not yet power users of email, but they know they need to be.

That’s what I would call a prosumer — someone who really wants to be brilliant at doing email. Now Hey doesn’t seem to be designed for that target market. It doesn’t seem to be designed for high-volume emailers or prosumers or power users.

Powered by WPeMatico

DroneBase, a Los Angeles-based provider of drone pilots for industrial services companies, has raised $7.5 million during the pandemic to double down on its work with renewable energy companies.

While chief executive Dan Burton acknowledged that the company was fundraising prior to the pandemic, the industrial lockdown actually accelerated demand for the company’s services.

Even with the increased demand, the company had to make some changes. It laid off six employees and refocused its business.

“In the past three months it’s become clear that this is a moment for drones as an industry,” Burton said. “We were really pushing hard as a company, certainly on revenue growth and harvesting all the investments we made in technology and having a clear, near-term view to profitability.”

The new round, which closed in May, was a slight down round, according to people familiar with the company’s business.

“We see raising a growth round later this year,” Burton said.

New investors in the company included Valor Equity Partners and Razi Ventures, who joined Union Square Ventures, Upfront Ventures, Hearst Ventures, Pritzker Group Venture Capital and DJI.

In all, DroneBase has raised nearly $32 million in financing, according to a company statement.

The new round will enable the company to focus on its data and analytics services that it has been developing around its core drone pilot provisioning technology — and gives DroneBase more financial wherewithal to expand its European operations under DroneBase Europe, which operates out of Germany.

“DroneBase’s expansion into renewable energy reflects our belief in the growth potential of wind and solar energy industries,” said Burton in a statement. “Since many energy companies have both wind and solar assets, we are well positioned to leverage our DroneBase Insights platform to grow our global market share in renewable energy.”

The key application for DroneBase has been allowing wind power companies to monitor and manage their turbines, improving uptimes and spotting problems before they effect operations, the company said.

For solar power companies, DroneBase offers a network of pilots trained in infrared imaging to detect anomalies like defects or hot spots on solar panels, the company said.

“DroneBase has established themselves as the drone leader in the commercial market, and its new work in renewables will have a lasting impact on the future of energy by keeping infrastructure operational for generations,” says Sam Teller, partner at Valor Equity Partners, in a statement. “We believe DroneBase will continue to be a valuable partner in drone operations and data analysis across a multitude of industries globally.”

Powered by WPeMatico

The alchemy for a successful startup can be hard to parse. Sometimes, it’s who you know. Sometimes it’s where you go to school. And sometimes it’s what you do. In the case of La Haus, a startup that wants to bring U.S. tech-enabled real estate services to the Latin American real estate market, it’s all three.

The company was founded by Jerónimo Uribe and Rodrigo Sánchez Ríos, both graduates of Stanford University who previously founded and ran Jaguar Capital, a Colombian real estate development firm that had built over $350 million worth of retail and residential projects in the country.

Uribe, the son of the controversial Colombian President Daniel Uribe (who has been accused of financing paramilitary forces during Colombia’s long-running civil war and wire-tapping journalists and negotiators during the peace talks to end the conflict) and Sánchez Ríos, a former private equity professional at the multi-billion-dollar firm Lindsay Goldberg, were exposed to the perils and promise of real estate development with their former firm.

Now the two entrepreneurs are using their know-how, connections and a new technology stack to streamline the home-buying process.

It’s that ambition that caught the attention of Pete Flint, the founder of Trulia and now an investor at the venture capital firm NFX. Flint, an early investor in La Haus, saw the potential in La Haus to help the Latin American real estate market leapfrog the services available in the U.S. Spencer Rascoff, the co-founder of Zillow, also invested in the company.

“Latin America is very early on in its infancy of having really professional agents and really professional brokerages,” said Flint.

La Haus guides home buyers through every stage of the process, with its own agents and salespeople selling properties sourced from the company’s developer connections.

“The average home in the U.S. sells in six weeks or less,” said La Haus chief financial officer Sánchez Ríos in an interview. “That timing in Latin America is 14 months. That’s the dramatic difference. There is no infrastructure in Latin America as a whole.”

La Haus began by reaching out to the founders’ old colleagues in the real estate development industry and started listing new developments on its service. Now the company has a mix of existing and new properties for sale on its site and an expanded geographic footprint in both Colombia and Mexico.

“We have a portal… that acts as a lead-generating machine,” said Sánchez Ríos. “We aggregate listings, we vet them. We focus on new developers.”

The company has about 500 developers using the service to list properties in Colombia and another 200 in Mexico. So far, the company has facilitated more than 2,000 transactions through its platform in three years.

“Real estate now is turning fully digital and also in this market professionalizing,” said Flint. “The publicly traded online real estate companies are approaching all-time highs. People are just prizing the space that they spend their time in… the technologies from VR and digital walkthroughs to digital closes become not just a nice to have but a necessity. “

Capitalizing on the open field in the market, La Haus recently closed on $10 million in financing led by Kaszek Ventures, one of the leading funds in Latin America. That funding will be used to accelerate the company’s geographic expansion in response to increasing demand for digital solutions in response to the COVID-19 epidemic.

“Because of Covid-19, consumers’ willingness to conduct real estate transactions online has gone through the roof,” said Sánchez Ríos, in a statement. “Fortunately we were in the position to enable that, and we expect to see a permanent shift online in how people conduct all, or at least most, of the home-buying process. This funding gives us ample runway to build the end-to-end real estate experience for the post-Covid Latin America.”

Joining NFX, Rascoff, and Kaszek Ventures are a slew of investors, including Acrew Capital, IMO Ventures and Beresford Ventures. Entrepreneurs like Nubank founder David Velez; Brian Requarth, the founder of Vivareal (now GrupoZap); and Hadi Partovi, CEO and founder of Code.org, also participated in the financing.

“We backed La Haus because we saw many of the same ingredients that resulted in a fantastic outcome for many of our successful companies: A world-class team with complementary skills; a huge addressable market; and an almost religious zeal by the founders to solve a big problem with technology,” said Hernan Kazah, co-founder and managing partner of Kaszek Ventures.

Powered by WPeMatico

In another up for technology shares, software companies saw their values reach new heights today.

The day’s trading comes after a sell-off last week eased some of technology companies’ rebounds from their COVID-19 lows; stocks in tech companies have more than made up for their early-year declines in mid-2020, with the Nasdaq reaching 10,000 points before giving up some ground.

Today the Nasdaq Composite index rose 0.15% to 9,910.53 points, just a few bips short of its all-time highs. A thematic tech index focused on fintech also saw their values recover to a mote under previous highs. The S&P 500 fell 0.36% to close at $3,113.41 and the Dow Jones Industrial Average Index decreased 0.65% to $26,119.13.

But software companies, tech’s highest fliers, set new records as measured by the Bessemer cloud index. According to the Financial Times, the software-and-cloud tracking index has seen gains of more than 45% during the last year, a sharp advance during a year of economic uncertainty and occasional stock market carnage.

Looking around more broadly, tech shares with a bit more of a value flavor — GAAP profitability, regular dividends, etc. — performed well, with Apple setting new record highs as well. The smartphone giant and services shop is worth more than $1.5 trillion, underscoring how attractive stable-tech has proved in 2020. On the same theme, Microsoft is a few points from all-time highs, and is worth around $1.48 trillion.

But while software’s growth has proved attractive, as has the stability of megacorp tech shops, less certain bets have also proved attractive. Nikola, an electric vehicle company that went public recently in a reverse debut, is still worth around $26 billion despite having no reported revenue. On a similar theme, Tesla shares are up from around $225 a year ago to over $993 today, a gain of 340% or so. In Q1 2020 the company posted 38% year-over-year growth.

$420 per share feels like a long time ago.

Speaking of transportation, Uber and Lyft had separate announcements Wednesday that should have primed the ol’ investor pump. Instead, shares of both companies bopped from flat to slightly down throughout the day.

Uber announced Wednesday that it will manage an on-demand service for Marin County in the San Francisco Bay area, marking the company’s broader push to Software as a Service and public transit.

Transportation Authority of Marin (TAM) will pay Uber a subscription fee to use its management software to facilitate requesting, matching and tracking of its high-occupancy vehicle fleet, starting with a service that operates along the Highway 101 corridor. Marin Transit trips will show up in the Uber app and let users book and even share rides.

This fundamental piece of news should have appealed to investors. Today they responded with a resounding “meh,” even though it represents the first steps into generating a new stream of revenue.

Uber shares closed down 0.60% to $33.29.

Meanwhile, rival Lyft pledged Wednesday that every car, truck and SUV on its platform will be all electric or powered by another zero-emission technology by 2030, a commitment that will require the company to coax drivers to shift away from gas-powered vehicles.

The target, which Lyft plans to pursue with help from the Environmental Defense Fund, will stretch across multiple programs. It will include the company’s autonomous vehicles, the Express Drive rental car partner program for rideshare drivers, consumer rental cars for riders and personal cars that drivers use on the Lyft app.

Perhaps investors understand that even with a decade-long timeline, the target could be difficult to meet.

Lyft shares closed at $35.32, down 3.79%.

TechCrunch has slowed its public market coverage as tech equities have returned to a more stable period; that they have made back lost ground has been worth noting, but lower volatility has lowered the market’s newsworthiness. Still, from time-to-time when new all-time highs are hit, it’s worth putting our toes back into the water. And on days when different blocs of public tech set records, we can’t help but make a public note.

Tech and tech-ish stocks: still in fashion.

Powered by WPeMatico