Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

Which startups investors are actually first to backing the best companies? If you know this information before fundraising, you can avoid pitching investors who were always going to tell you that you’re “too early” anyway. The problem is that everyone claims credit for success, and by the time you pick through databases, investor sites, blogs, tweets and news clippings, you have no real idea who made what call when.

That’s why our solution is to just ask founders about who really made it happen. Our new product, The TechCrunch List, will feature the investors who wrote the first checks, to help any founder find the help they need when they need it. Here’s more, from Arman Tabatabai and Danny Crichton:

Over the next few weeks, we’re going to be collecting data around which individual investors are actually willing to write the proverbial “first check” into a startup’s fundraising round and help catalyze deals for founders — whether it be seed, Series A or otherwise (i.e. out of your Series A investors, the first person who was willing to write the check and get the ball rolling with other investors). Once we’ve collected, cleaned and analyzed the data, we’ll publish lists of the most recommended “first check” investors across different verticals, investment stages and geographies, so founders can see which investors are potentially the best fit for their company….

In all, The TechCrunch List will publish the most recommended “first check” writers across 22 different categories, ranging from D2C & e-commerce brands to space, and everything in between. Through some data analysis around total investments in each space, we believe our 22 categories should cover the entirety or majority of the venture activity today.

To make this project a success and create a useful resource for founders, we need your help. We want to hear from company builders and we want to hear from them directly. We will be collecting endorsements submitted by founders through the form linked here.

(Photo by Steven Damron used under Creative Commons).

Despite much discussion about investors pulling back en masse from startup investing, a new survey out from Silicon Valley tech law firm Fenwick & West about activity in the region over April says that valuations went up, markdown rounds did not grow as a percentage of deals, and the overall pace of deals actually increased. The catch, Connie Loizos writes for TechCrunch, is that much of this was due to later-stage rounds, and of course, it is generalized across industries that have been variously propelled or pummeled by the pandemic.

Alex Wilhelm then looks at a couple additional reports for Extra Crunch, from Docsend and NFX. They appear to show ongoing investor activity growth since April, as well as growing founder optimism — but early stage did in fact appear to be more turbulent, as, ahem, one might expect if one has experience in early-stage fundraising. He separately notes that the latest tracking data sources appear to show a decline in startup layoffs. Both are, by the way, written as part of The Exchange, his new daily column about the latest trends in the startup world for EC subscribers (use code EXCHANGE to get 25% off a subscription).

Image Credits: Klaud Vedfelt (opens in a new window) / Getty Images (Image has been modified)

Juneteenth has been celebrated since 1866 to mark the end of slavery after the American Civil War. But this year, it is being taken up by tech companies as an official holiday to help show their concern for structural discrimination in the wake of the George Floyd killing and ensuing global protests. What does it really mean though? Here’s Megan Rose Dickey for TechCrunch:

Recognition of such a historic day is good. But the way these companies are publicly announcing their plans, seeking press as they do, suggests their need for some affirmative pat on the back. It’s perfectly acceptable to do the right thing and not get credit for it. It shows humility. It shows that a company is more interested in doing right by its workers than it is in saving face….

Instead, as Hustle Crew founder Abadesi Osunsade has said, tech companies need to go beyond one-off actions and form habits around racial justice work. Forming habits around hiring Black people, promoting Black employees, paying Black employees fairly, funding Black founders and making room for Black people in leadership positions is what will lead to concrete change in this industry.

Meanwhile, given the ongoing issues in fundraising, Delali Dzirasa of Fearless writes about other resources Black entrepreneurs can use to get their companies off the ground, including equity crowdfunding, mentor programs, 8(a) programs, SBA resources, and your local commercial banker.

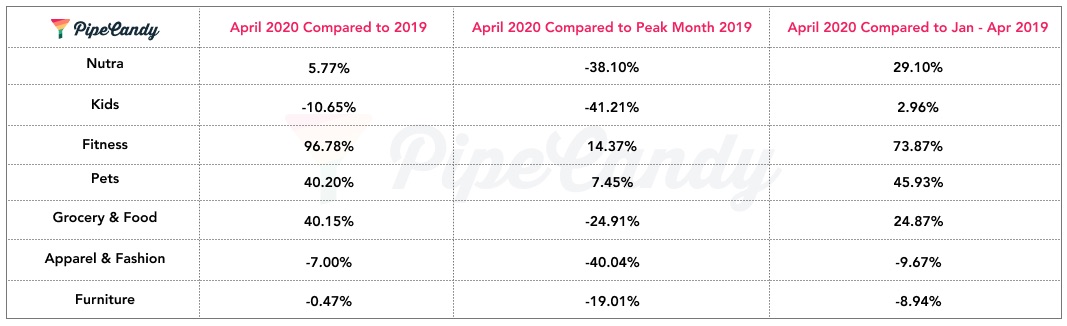

Image Credits: PipeCandy

Two marketing experts shared fresh data on what categories are winning and losing during the pandemic for Extra Crunch this week, perhaps revealing where some of the founder and investor enthusiasm is coming from? First, here’s Ethan Smith of Graphite, who provides an overview of how money is being spent online during the pandemic using data from Branch through mid-May:

The good news for vendors overall is that people are still shopping online, but they’re buying different things and in different volumes than they used to. Kid/pet-oriented mobile activity and associated purchases have skyrocketed. We’ve also seen spikes in the purchase of activewear, fashion items, shoes and arts and crafts items, as people wait out the lockdown and prepare for what they hope will be a summer of freedom.

To dig into the direct-to-consumer category in more detail, here’s Ashwin Ramasamy of PipeCandy, who uses a mix of data sources to look at subcategory trends versus what the year might have looked like without a pandemic:

Kids, cookware and kitchen tools, apparel, fine jewelry, fashion, women’s health, mattresses, furniture and skincare actually deviated negatively from the forecast. This is not to say that these categories declined. We are actually saying that these categories didn’t keep up with the growth trends they orchestrated in 2019. That said, the devil is in the details. For instance, within furniture, there is a category of D2C brands that sell shelves and office furniture. Consumers did invest in them heavily, presumably to allow participants in the Zoom call to absorb more the titles of the books stacked in those shelves than from the calls themselves. Wine/spirits, grocery, fitness, baby care, pets and nutraceuticals did better than anticipated. Basically, anything that helped numb the reality (alcohol), sweeten the reality (food), distract from the reality (baby care and pets), survive the reality (fitness) or hallucinate an alternative reality (nutraceuticals) did well. I will leave you with another interesting conclusion we arrived at, through further research that is currently underway: The spotlight category in e-commerce is not direct to consumer — it is the mid-market and large pure-play e-commerce companies. It is one segment where the compounded quarterly growth rate of active companies is better than the 2019 average.

Founders can reap long-term benefits after exhibiting in Disrupt’s Startup Alley

New sessions announced at TC Early Stage from Dell, Perkins Coie and SVB

HappyFunCorp’s Ben Schippers and Jon Evans will talk tech stacks at TC Early Stage

TechCrunch:

Despite pandemic setbacks, the clean energy future is underway

TikTok explains how the recommendation system behind its ‘For You’ feed works

Chris Sacca advises new fund managers to strike right now

Extra Crunch:

What’s next for space tech? 9 VCs look to the future

How Liberty Mutual shifted 44,000 workers from office to home

Investors based in San Francisco? That’s so 2019

How Reliance Jio Platforms became India’s biggest telecom network

4 months into lockdown, Eventbrite CEO Julia Hartz sees ‘exciting signs of recovery’

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Your humble Equity team is pretty tired but in good spirits, as there was a lot to talk about this week…

And that’s that. Have a lovely weekend and catch up on some sleep.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

This one goes out to all the early-stage startup founders. Whether you’re overwhelmed by the state of the world, overworked — or procrastination is simply an intrinsic part of your DNA — it matters not. Here’s reason to smile. We’re giving you an extra week to apply to compete in Startup Battlefield during Disrupt 2020. Fill out your application before the new deadline expires on June 26 at 11:59 pm (PT).

This is your moment to grab a double fistful of opportunity and step into a global spotlight. The virtual Disrupt 2020 represents our largest viewing audience and our biggest launch platform ever — more investors, more media and more, well, everything. If you’re chosen to compete in our premier pitch-off, you’ll go up against some of the best early-stage startups around the world.

Here’s what’s at stake: Massive exposure that can — whether you win the battle or not — change the trajectory of your startup, a launch article on TC.com, a 6 week mini-training program with TC editorial, all the perks of a Digital Disrupt Digital Pro pass (and then some) and a shot at $100,000, the Disrupt cup and all the bragging rights.

You’re eligible to apply if your company is early stage, has an MVP with a tech component (software, hardware or platform) and hasn’t received much, if any, major media coverage. Note: TechCrunch does not charge any application or participation fees or take any equity. We accept founders from all backgrounds, geographies and industries.

Veteran TechCrunch Battlefield editors (such a picky bunch) review every application and select startups that meet their discerning standards for innovation and growth potential. The virtual competition takes place during Disrupt 2020, which runs from Sept. 14 – 18.

Feel that flop sweat building up? Don’t stress. All competing founders receive weeks of free expert coaching from TechCrunch. Your pitch, demo and business model will shine like never before on game day.

Startup Battlefield consists of two rounds. Each team has six minutes to pitch and demo to our panel of TC editors, expert VCs and top entrepreneurs. Each team also faces a six-minute Q&A. Out of the original cohort, a handful of teams will move to the finals — on the last day of Disrupt — and pitch again to a new set of judges. They’ll choose one team to take home the title, the cup and the $100,000 prize.

Let’s take a peek at what other opportunities Battlefield competitors enjoy.

You’ll also join the likes of Vurb, Dropbox, GetAround, Mint, Yammer, Fitbit and other members of the Startup Battlefield Alumni community. This impressive group, comprised (so far) of 902 companies, has collectively raised $9 billion and generated 115 exits.

Rejoice, you have one extra week to apply to compete in Startup Battlefield at Disrupt 2020. The new deadline expires on June 26 at 11:59 pm (PT). Don’t wait another minute. Make the most of this extended opportunity.

Is your company interested in sponsoring or exhibiting at Disrupt 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Early-stage founders, July 21 – 22 is coming up fast and that means it’s time get ready for TC Early Stage — the virtual startup conference designed with you in mind. We’ve packed this two-day event with more than 50 breakout sessions covering topics and issues early-stage startup founders need to succeed — even more so in these unprecedented times. You have just one week left to buy an early-bird ticket and save $50. Don’t wait — prices increase on June 26 at 11:59 p.m. (PT).

Early-stage founders have so much to learn. Building a startup is no mean feat under ordinary circumstances and, thanks to Covid-19, global circumstances are by no means ordinary right now. In addition to navigating a pandemic, there are plenty of other issues to keep you up at night:

How to hire the best talent? What’s the best time to raise funds? Crafting a media strategy? How to create the culture you want straight out of the gate? What the heck is wrong with my pitch deck? The questions are endless. Come to TC Early Stage and get answers to help you grow your business.

All breakout sessions feature leading experts from across the startup ecosystem. We’re adding sessions regularly to the agenda, and ticket holders receive 24-hour notice before we announce the next batch.

We’re limiting each session to about 100 people, and seats are available on a first come, first serve basis — sign up quickly to make sure you get the ones you want most. Hot tip: If you run into a schedule conflict, you can drop a breakout session and choose another one. Plus videos of all the sessions will be available on demand to ticket holders exclusively.

Here’s a quick peek at just some of the breakout sessions.

TC Early Stage takes place on July 21 – 22, and you have just one week left to buy an early-bird ticket. Grab this rare opportunity to have your tough startup questions answered by the pros and save.

Is your company interested in sponsoring the TC Early Stage? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

“Eventbrite is in the unique club that nobody wants to be in,” says CEO and co-founder Julia Hartz. “Which is the first affected and one of the most directly affected businesses of the COVID-19 era.”

Hartz, who co-founded the company with her husband Kevin Hartz and Renaud Visage, joined ExtraCrunch Live recently to discuss moving forward when your core business isn’t just threatened, but wiped out completely.

“You never as a founder — at least I never — ever wondered what would happen if the whole basis of our mission was tested,” she said.

The events world was one of the first industries to feel the pandemic’s impacts and will likely be among the last to be restored. For Eventbrite, which was built on a core business of in-person events and event ticketing, it meant making swift decisions to stay afloat.

External data show some bright spots. According to an operational update from Eventbrite, paid ticket volume on its platform increased 33% in May compared to April 2020. Eventbrite is down 82% in paid tickets in May 2020 compared to the same month year ago.

“A massive market and industry dislocation and disruption. I mean, we’re a living example of that,” she said. “It’s not a victory lap. Certainly, we’re seeing some really exciting signs of recovery, but it’s still very sobering.”

Hartz offered founders at all levels advice on how to work on culture during a crisis and offered tips on communication and transparency.

We also chatted about how open consumers are to paying for virtual events, how the company curates and moderates political events and how Eventbrite plans to address racial injustice beyond, in Hartz’s words, “episodic outrage.”

We pulled out a couple of highlights for you to peruse.

Structurally, events are pivoting to in-person. So it’s not just pivoting online. A good example is the Beanstalk Music Festival in Colorado, a two-day music festival that pivoted to an in-person drive-in night concert. They were wildly successful in selling tickets to this new format.

It was a testament to the strength of their community and the pent-up demand to get together and listen to great music. But what we’re seeing beyond sort of those really creative uses of new types of space and venues that are outdoors are smaller events. Classes, workshops, seminars, small meetups are starting to come back. I think that as creators start to think about how to bring their community back in person, there’s a huge element of trust that exists in this new world.

We’re helping our creators establish that trust and be very upfront about what their event goers and attendees can expect in that moment as you bring yourself together in-person again.

Powered by WPeMatico

It all started with an email from a customer: “Do you know why Bain Capital Ventures is reaching out to me about Clockwise?”

That email would mark the beginning of a journey toward closing $18 million in new funding that will dramatically accelerate my company, Clockwise . It would require getting to know a partner in lockdown, long nights assembling a pitch deck and many bleary-eyed Zoom calls with some of the best VCs in the world.

Here’s how Ajay Agarwal from Bain Capital Ventures and I established trust online, how I made high-stakes decisions in extreme economic uncertainty and how we were able to turn the pandemic’s constraints into opportunities.

Let’s start at the beginning.

Clockwise was founded in late fall of 2016. We realized that, as personal as time is, our schedules inside modern work environments are intertwined by a network of calendar events and attendees. People schedule meetings without considering the preferences of colleagues by simply hunting for any available “white space” (read: time to do real work). The net effect is that our most valuable resource, time, is easy to take and almost impossible to protect.

More than two years later, in June of 2019, we launched Clockwise to the public. After years of experimentation and refinement, we delivered to the world an intelligent calendar assistant that frees up your time so you can focus on what matters. Workers soon confirmed our hunch that they’re hungry for a tool that gives them more productive hours in their day. Our rapid user growth carried throughout 2019.

By January of 2020, we were on fire. Since January 1, our user base has grown by more than 90%, expanding at a clip of well over 5% week-over-week. As people sought remote tools during shelter-in-place, our rate of growth accelerated even further.

Our growth, incredible team, top-tier existing investors (Accel and Greylock) and strong cash position meant we didn’t need to raise additional capital until the fall of 2020. While COVID-19 certainly sent shock waves through the community, I was in regular communication with a few highly engaged investors who still seemed eager to invest in the future of productivity. I felt cautiously confident more capital could wait.

But, you know, best-laid plans.

Powered by WPeMatico

Building a business is hard; about 50% of businesses fail in the first five years. The early years of an entrepreneur’s journey can be difficult and lonely. When starting my digital services firm Fearless, I convinced my wife to rent out our home and move in with my mother so we could have an extra income while I built Fearless in my mother’s basement.

That was 10 years ago — Fearless now has over 115 employees.

That story of struggling to build a tech company and working out of a basement or garage until you “make it” is pretty common, but the barriers facing Black entrepreneurs make it harder to find success and support.

Research by the University of California, Santa Cruz states that minority-owned startups have access to less capital than their white counterparts. The right investors can offer more than just funding to early-stage companies; the connections those in the venture capitalist world have can bring an entrepreneur the new business, mentorship and employees needed to grow.

Venture capital firms like Harlem Capital and Black Angel Tech Fund are focused on changing the faces of entrepreneurship by diversifying their portfolio, but traditional venture capitalist funding is not the only way to grow your business.

There are other avenues and opportunities to get the support, financial and otherwise, to help build a successful company:

Equity crowdfunding: Similar to crowdfunding campaigns like GoFundMe or Kickstarter, equity crowdfunding allows nontraditional investors to support businesses and receive equity. Enabled through Title III of the 2012 JOBS Act’s Regulation CF, equity crowdfunding allows all companies to sell securities, whether in the form of equity in the company, debt, revenue shares, convertible notes and more. Equity crowdfunding platforms include WeFunder and LocalStake.

Mentor programs: Fearless was lucky enough to be accepted into the DoD Mentor-Protégé program early in our growth. As the oldest continuously operating federal mentor-protégé program in existence, the DoD program helped us establish and expand our footprint in the federal government contracting space. NewMe and Black Girl Ventures are two programs that specialize in mentorship for early-stage companies.

Become 8(a) certified: The federal government has a goal of awarding at least 5% of all federal contracting dollars to small, disadvantaged businesses each year. These businesses fall under the 8(a) classification. To qualify for the program, you must be a small business with 51% of ownership and control from U.S. citizens who are economically and socially disadvantaged and the owner’s adjusted gross income for three years is $250,000 or less.

The full definition of what counts as being economically and socially disadvantaged can be found in Title 13 Part 124 of the Code of Federal Regulations. Fearless has been classified as an 8(a) company for several years and we have been able to secure several contracts through the certification.

Tap into Small Business Administration resources: More than a million users visit SBA.gov to utilize tools like the SBA Business Guide and Lender Match site. By using the SBA website and reaching out to your local SBA office, you can make full use of the programs available and connect with business owners who can offer advice and mentorship.

Identify supportive bankers: Your business is your top priority and the people you engage with should view your company as a priority too. You need someone vested in your success who will advocate for you when you need them. If you meet with a banker and get a sense that you would be an account number instead of a person, then find another one. If you don’t have your banker’s personal cell phone number, and they aren’t willing to visit you at your business, then take a pass and find a true partner who supports you.

I am putting the call out to business owners and entrepreneurs who are further along in their journey to mentor and invest in Black-owned businesses. Think back on the support you received, and be that model for someone else. Or be the mentor that you wished you had when you were starting out. Take time to invest in other Black-owned tech companies or fund the programs that do. Share your knowledge and experience with Black tech leaders.

If there isn’t a resource hub for Black entrepreneurs in your city, create one. Fearless is a small company and we have still managed to help 13 new companies get off the ground through our accelerator program, Hutch.

Hutch is an intensive 12-month program that gives entrepreneurs a blueprint for building successful digital service firms, by empowering them with the tools, mentorship and peer support they need to have a lasting impact. We think of this program kind of like a home base for our entrepreneurs, providing them with a foundation of support so they can grow without getting lost amongst bigger companies in the industry.

Help create the spaces in your community that will foster innovation and business growth.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Your humble Equity team is pretty tired but in good spirits, as there was a lot to talk about this week. But, first, three things to start us off:

All that said, here’s what we talked about on the show:

And that’s that. Have a lovely weekend and catch up on some sleep.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Plume, the Denver-based startup that provides hormone replacement therapies and medical consultations tailored to the trans community, could not be launching at a time when the company’s services are more needed.

It’s no hyperbole to say that transgender citizens in the United States are under attack. Whether from government policies that are intended to defund their access to insurer-provided medical care, or actual physical assaults, transgender Americans are living in physically and politically perilous times.

That’s one reason why Matthew Wetschler and his co-founder Jerrica Kirkley founded Plume, which provides telehealth services tailored for the transgender community.

The two doctors met and became friends in medical school. From the earliest days, the two were inseparable, Dr. Wetschler recalled. “She and I spent nearly 12 hours a day together,” he said.

Dr. Jerrica Kirkley, Plume co-founder Image Credit: Plume

After medical school, Wetschler moved to the Bay Area to finish his residency at Stanford and then went on to run a consulting firm that worked primarily with digital health startups. Kirkley, who is transgender, focused on gender therapy in the trans community.

A little over a year ago the two began to discuss the potential for creating a primarily telehealth service for the trans community, Wetschler said.

“We have always shared a belief that the healthcare system can do better for patients and doctors,” he said. And almost no population is quite as exposed to the shortcomings of the current healthcare system as the transgender community.

“I had been increasingly interested in the telehealth space and the emerging trend of leveraging mobile technology to provide unparalleled access to clinical care at the touch of a button,” said Wetschler. “And many of the problems [Kirkley] was seeing with her patients involved finding doctors with expertise and safe sources of medications.”

In many instances, despite the duty of care that physicians have to maintain, transgender patients are subjected to discriminatory practices and even the denial of care. Roughly 20% of transgender patients who seek care are either denied that care or harassed because of their gender identity, Wetschler said.

Many patients don’t have access to the medications they need, which can lead to up to 30% of patients seeking out the medications they need on the black market.

It’s an issue for the more than 1.4 million Americans who identify as transgender.

Plume provides a safe, on-demand service for patients that need it, said Wetschler. And does it for $99 per month.

The company doesn’t perform gender reassignment surgeries, but that’s about the only limitation on the care that the company offers. It can recommend local surgeons who will perform those procedures and it will provide consultations for patients or potential patients considering various hormone-related or surgical therapies. A majority of the Plume care team is transgender, according to Wetschler.

“What we’re proud of with Plume is that we offer a way of accessing this way of trans-specific care regardless of policy or insurance coverage,” said Wetschler.

At the heart of Plume’s services is access to gender-affirming hormone therapy. “This is the fundamental medical treatment for the trans community,” Wetschler said. “The trans experience is unique in that for most it involves navigating a gender and cis-normative healthcare system that may not understand their experiences. It can be highly traumatic.”

Plume offers a medical evaluation, ongoing monitoring and lab assignments and prescriptions. Soon, the company will also provide medication delivery, as well.

For most Americans, there’s a presumption that medical care will be delivered in a non-judgmental and safe way (both psychologically and physically). For many trans Americans there’s a lack of comfort and risk that’s inherent in the end-to-end care experience. Plume is trying to solve for that.

Dr. Matthew Wetschler, Plume, co-founder Image Credit: Plume

Investors from the nation’s top venture capital firms, General Catalyst and Slow Ventures, believe in the company’s vision and have backed it with $2.9 million in seed financing. Springbank Collective is also an investor in the company.

“What I was drawn to with Plume is the commitment and conviction Mathew and Jerrica operate with in providing the trans community — a woefully underserved group with access to the health care they deserve,” wrote General Catalyst partner, Olivia Lew, in a statement. “The rollback of healthcare protections for the trans community this past week have only heightened awareness for the dire need for this company. One of the things we’re most excited about in the next wave of health innovation are companies that are using modern platforms like telehealth to serve people’s individual needs with more consumer friendly, personalized experiences.”

These personalized services become even more important for populations at risk, like the trans community, and they’re also more valuable.

“When people take hormone therapy… there’s an opportunity to have an ongoing longitudinal relationship and that’s something that’s highly valued,” said Wetschler.

Currently the transgender population spends around $4.5 billion to $6 billion on medication. And there’s an opportunity to provide better emotional and behavioral support to patients, as well, according to Wetschler.

Plume began providing services in Colorado a year ago, and is now available in California, New York, Florida, Texas, Colorado, North Carolina, Virginia, Oregon, Maine and Massachusetts.

There are roughly 700,000 transgender patients who can now avail themselves of the services Plume offers, but the population, and therefore the need, is growing.

“The estimates on the size of the trans population since a decade ago has been growing 20% year over year,” says Wetschler. “And Generation Z is five times more likely than baby boomers to identify as trans. The full visibility of the trans community is yet to be realized.”

Powered by WPeMatico

Mapillary, the Swedish startup that wants to take on Google and others in mapping the world via a crowdsourced database of street-level imagery, has been acquired by Facebook, according to the company’s blog. Terms of the deal aren’t being disclosed.

The Mapillary team and project will become part of Facebook’s broader open mapping efforts. Mapillary also says its “commitment to OpenStreetMap stays.” Writes Mapillary co-founder and CEO Jan Erik:

From day one of Mapillary, we have been committed to building a global street-level imagery platform that allows everyone to get the imagery and data they need to make better maps. With tens of thousands of contributors to our platform and with maps being improved with Mapillary data every single day, we’re now taking the next big step on that journey.

As Erik notes, Facebook is known to be “building tools and technology to improve maps through a combination of machine learning, satellite imagery and partnerships with mapping communities.” Mapping has immediate use-cases for the social networking behemoth, such as Facebook Marketplaces and its local business offerings, while another application is augmented reality.

This saw it recently acquire another European startup, Scape, news that TechCrunch broke in February. Founded in 2017, Scape Technologies was developing a “Visual Positioning Service” based on computer vision, which lets developers build apps that require location accuracy far beyond the capabilities of GPS alone. The technology initially targeted augmented reality apps, but also had the potential to be used to power applications in mobility, logistics and robotics. More broadly, Scape wanted to enable any machine equipped with a camera to understand its surroundings.

Mapillary is also the latest “open” project to join and now be funded by Facebook. Last December, it quietly acquired U.K.-based Atlas ML, the custodian of “Papers With Code,” the free and open resource for machine learning papers and code.

Returning to Mapillary, the startup is keen to stress that it will continue being a “global platform for imagery, map data, and improving all maps.” “You will still be able to upload imagery and use the map data from all the images on the platform,” says Erik. It is also changing the license to permit commercial use:

Historically, all of the imagery available on our platform has been open and free for anyone to use for non-commercial purposes. Moving forward, that will continue to be true, except that starting today, it will also be free to use for commercial users as well. By continuing to make all images uploaded to Mapillary open, public, and available to everyone, we hope to enable new use cases, and grow the breadth of coverage and usage to benefit mapping for everyone. While we previously needed to focus on commercialisation to build and run the platform, joining Facebook moves Mapillary closer to the vision we’ve had from day one of offering a free service to anyone.

Powered by WPeMatico

Over the past two decades, the venture capital industry has exploded beyond anyone’s wildest imaginations.

What began as a sleepy industry in Boston and Menlo Park has now expanded to dozens of cities the world over. The National Venture Capital Association estimates that VCs deployed more than $130 billion in 2018 and 2019, and thousands of new investors have joined the ranks in recent years to find the next great startups.

All that activity, though, poses a dilemma for founders: Who actively writes checks? Who is a leader in a specific market or vertical? Who has the conviction to underwrite pathbreaking investments? Who, ultimately, do you want to have by your side for the next decade as your startup grows?

There are lists that rank VCs by their exit returns. There are lists that rank young VCs by their potential. There are lists of VCs who claim investment interest in various sectors. There are lists that try to ferret out deal volume, impact and other quantitative metrics. There are internal lists at accelerators that share collective wisdom between founders.

Who actively writes checks? Who is a leader in a specific market or vertical? Who has the conviction to underwrite pathbreaking investments? Who, ultimately, do you want to have by your side for the next decade as your startup grows?

All those lists and rankings have an important function to serve, but for all the compilations of investors out there, we couldn’t find a single one that publicly answered a simple yet vital question: Who are the VC investors who are leaders in specific verticals who should be a founder’s first stop during a fundraise?

Today’s venture industry is made up of thousands of investors with varying specialties, and far too many passive investors that are willing to participate in rounds but don’t actively participate in deals unless other investors have committed. Many don’t actively push to get deals done or don’t actively lead the charge to build a syndicate of investors.

With all that in mind, we’re excited to launch a new initiative that we hope will help answer those questions and help founders find that first check — The TechCrunch List.

Over the next few weeks, we’re going to be collecting data around which individual investors are actually willing to write the proverbial “first check” into a startup’s fundraising round and help catalyze deals for founders — whether it be seed, Series A or otherwise (i.e. out of your Series A investors, the first person who was willing to write the check and get the ball rolling with other investors). Once we’ve collected, cleaned and analyzed the data, we’ll publish lists of the most recommended “first check” investors across different verticals, investment stages and geographies, so founders can see which investors are potentially the best fit for their company.

Founders are used to being specialized; after all, they have to live and breathe their startups every single day. So it can be jarring to start talking to generalist investors who know little about a category and ask shallow questions only to render a judgment with irrelevant advice. One of the greatest impetuses for us to put together The TechCrunch List is that like founders, we also struggle to cut through the noise around the interests of individual VCs.

We’d argue that’s close to impossible. There is more spend on technology than ever before in history. Verticals are getting more competitive — market maps that used to have 10 to 50 companies have expanded to hundreds. The only way to compete today is to specialize, and that has never been more true for VCs.

In all, The TechCrunch List will publish the most recommended “first check” writers across 22 different categories, ranging from D2C & e-commerce brands to space, and everything in between. Through some data analysis around total investments in each space, we believe our 22 categories should cover the entirety or majority of the venture activity today.

To make this project a success and create a useful resource for founders, we need your help. We want to hear from company builders and we want to hear from them directly.

To make this project a success and create a useful resource for founders, we need your help. We want to hear from company builders and we want to hear from them directly. We will be collecting endorsements submitted by founders through the form linked here.

Through the form, founders will be asked to submit their name, their startup, the stage of company, the name of the one “first check” investor they want to endorse and a couple of minor logistical items. We are asking founders here for their on-the-record endorsement. We ask that you limit your recommendations to one (1) person per fundraise round.

While many investors may have helped you in your journey, we are specifically interested in the person who most helped you get a round underway and closed. The one who catalyzed your round. The one who guided you through the fundraise process. The one investor you would ultimately recommend to other founders who are trying to find their VC champion.

Our main goal is to help founders, dreamers and company builders find investors who will invest in them today, and with your help, we think we can. The TechCrunch List is not meant to identify every possible investor under the sun who might make an investment within a space, nor just the big household-name VCs whose reputations can sometimes seem more linked to their follower counts on Twitter as opposed to their bold term sheets.

Our hope is that this can be a go-to resource for founders looking to fundraise going forward, and with that in mind, we are very determined to improve the glaring representation gaps in the venture industry. It’s no secret that the world of VC still looks like a country-club membership roster, dominated by white men with strong opinions and loud voices. Looking at the data, it’s clear that there are groups that are particularly underrepresented, with only a small portion of the industry made up of Black, Latinx and female investors, for example.

We want to amplify these voices and we want to hear particularly from founders of color, female founders and other underrepresented groups. We also want to make sure our recommended investor lists are sufficiently representative and highlight underrepresented investors who might not have had equal opportunities in the past.

We want to help builders wade through the BS politics and fundraising annoyances that founders complain to us about on a daily basis, and help them identify qualified leads that are actually active, engaged and specialized and are the best fit to help founders raise money and grow now.

Thank you for your support. We’re excited to build The TechCrunch List with you — and for you.

Powered by WPeMatico