Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Back in December 2020 we covered the launch of a new kind of smartphone app-based search engine, Xayn.

“A search engine?!” I hear you say? Well, yes, because despite the convenience of modern search engines’ ability to tailor their search results to the individual, this user-tracking comes at the expense of privacy. This mass surveillance might be what improves Google’s search engine and Facebook’s ad targeting, to name just two examples, but it’s not very good for our privacy.

Internet users are admittedly able to switch to the U.S.-based DuckDuckGo, or perhaps France’s Qwant, but what they gain in privacy, they often lose in user experience and the relevance of search results, through this lack of tailoring.

What Berlin-based Xayn has come up with is personalized, but a privacy-safe web search on smartphones, which replaces the cloud-based AI employed by Google et al. with the innate AI in-built into modern smartphones. The result is that no data about you is uploaded to Xayn’s servers.

And this approach is not just for “privacy freaks”. Businesses that need search but don’t need Google’s dominant market position are increasingly attracted by this model.

And the evidence comes today with the news that Xayn has now raised almost $12 million in Series A funding led by the Japanese investors Global Brain and KDDI (a Japanese telecommunications operator), with participation from previous backers, including the Earlybird VC in Berlin. Xayn’s total financing now comes to more than $23 million.

It would appear that Xayn’s fusion of a search engine, a discovery feed and a mobile browser has appealed to these Asian market players, particularly because Xayn can be built into OEM devices.

The result of the investment is that Xayn will now also focus on the Asian market, starting with Japan, as well as Europe.

Leif-Nissen Lundbæk, co-founder and CEO of Xayn said: “We proved with Xayn that you can have it all: great results through personalization, privacy by design through advanced technology and a convenient user experience through clean design.”

He added: “In an industry in which selling data and delivering ads en masse are the norm, we choose to lead with privacy instead and put user satisfaction front and center.”

The funding comes as legislation such as the EU’s GDPR or California’s CCPA have both raised public awareness about personal data online.

Since its launch, Xayn says its app has been downloaded around 215,000 times worldwide, and a web version of its app is expected soon.

Over a call, Lundbæk expanded on the KDDI aspect of the fund-raising: “The partnership with KDDI means we will give users access to Xayn for free, while the corporate — such as KDDI — is the actual customer but gives our search engine away for free.”

The core features of Xayn include personalized search results; a personalized feed of the entire internet, which learns from their Tinder-like swipes, without collecting or sharing personal data; and an ad-free experience.

Naoki Kamimeada, partner at Global Brain Corporation said: “The market for private online search is growing, but Xayn is head and shoulders above everyone else because of the way they’re re-thinking how finding information online should be.”

Kazuhiko Chuman, head of KDDI Open Innovation Fund, said: “This European discovery engine uniquely combines efficient AI with a privacy-protecting focus and a smooth user experience. At KDDI, we’re constantly on the lookout for companies that can shape the future with their expertise and technology. That’s why it was a perfect match for us.”

In addition to the three co-founders (Leif-Nissen Lundbæk, chief executive officer, Professor Michael Huth, chief research officer, and Felix Hahmann, chief operations officer), Dr Daniel von Heyl will come on board as chief financial officer. Frank Pepermans will take on the role of chief technology officer and Michael Briggs will join as chief growth officer.

Powered by WPeMatico

The Chinese government’s crackdown on its domestic technology industry continues, with Tencent under fresh pressure despite the company’s efforts to follow changing regulatory expectations.

News broke over the weekend that Beijing filed a civil suit against Tencent “over claims its messaging-app WeChat’s Youth Mode does not comply with laws protecting minors,” per the BBC. And NetEase, a major Chinese technology company, will delay the IPO of its music arm in Hong Kong. Why? Uncertain regulations, per Reuters.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The latest spate of bad news for China’s technology industry follows a raft of regulatory changes and actions by the nation’s government that have deleted an enormous quantity of equity value. After a period of relatively light-touch regulatory oversight, domestic Chinese technology companies have found themselves on defense after the Chinese Communist Party (CCP) came after their market power in antitrust terms — and some of their business operations from other perspectives. Sectors hit the hardest include fintech and edtech.

Gaming is also in the CCP crosshairs.

After state media criticized the gaming industry as providing the digital equivalent of drugs to the nation’s youth last week, shares of companies like Tencent and NetEase fell. Tencent owns Riot Games, makers of the popular League of Legends title. NetEase generated $2.3 billion in gaming revenue out of total revenues of $3.1 billion in its most recent quarter.

After state media criticized the gaming industry as providing the digital equivalent of drugs to the nation’s youth last week, shares of companies like Tencent and NetEase fell. Tencent owns Riot Games, makers of the popular League of Legends title. NetEase generated $2.3 billion in gaming revenue out of total revenues of $3.1 billion in its most recent quarter.

NetEase stock traded around $110 per share in late July. It’s now worth around $90 per share after expectations shifted in light of the gaming news, indicating that investors are concerned about its future performance. Tencent’s Hong Kong-listed stock has also fallen, from HK$775.50 to HK$461.60 this morning.

Tencent tried to head off regulatory pressure, announcing changes to how it controls access to its games after the government’s shot across the bow. The effort doesn’t appear to have worked. That Tencent is being sued by the government despite its publicly announced changes implies that its proposed curbs to youth gaming were either insufficient or perhaps moot from the beginning.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and me here.

It’s going to be a busy week, with a Samsung event and a host of earnings reports that we’ll have to pay attention to. But more important there are a few stories still dominating the news cycle:

All that and we also riffed on the Siemens-Sqills deal, Cornerstone OnDemand going private and Delivery Hero buying a piece of Deliveroo.

And, for added flavor and fun, Canopy Servicing just raised a $15 million Series A, while Siga OT Solutions raised a $8.1 million Series B.

All that, and we got to talk stocks! Hugs and love from the Equity crew — chat Wednesday!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Canopy Servicing announced this morning it recently closed a $15 million Series A. The startup sells software to fintechs and others, allowing customers to create loan programs and service the resulting products.

The company raised a $3.5 million seed round in 2020. Canaan led its Series A, with participation from Homebrew, Foundation and BoxGroup, among others. Per Canopy, its valuation grew by 5x from its seed round to its Series A.

The company has raised $18.5 million to date.

So far this reads much like any other post announcing a new startup funding round, kicking off with an array of information concerning the round and who chipped into the transaction. Next, we’d probably note the competitors, growth and what investors in the company in question have to say about their recent purchase. This morning, however, I want to riff a bit on the future of fintech and how the financial tech stack of the future may be built.

TechCrunch chatted with Canopy CEO Matt Bivons last week. He has an interesting take on where fintech is headed. Let’s discuss it and work through what Canopy does.

As with many startups, Canopy was built to scratch an itch. Bivons had run into issues regarding loan servicing in prior jobs. He went on to found a startup that aimed to build a student credit card. But after working on that project, Bivons and co-founder Will Hanson pivoted the company to a B2B-focused concern building loan servicing technology.

Behind the decision was market research undertaken by the Canopy crew that uncovered that a great number of fintech startups wanted to get into the credit market. That makes sense; credit products can provide far more attractive economics to fintech startups than, say, checking and savings accounts. Knowing that loan servicing was a bear and a half to manage, Canopy decided to focus on it.

Bivons framed Canopy as a modern API for loan servicing that can be used to create and manage loans at any point in their lifecycle. He noted that what the startup is doing is akin to what several successful fintech companies have done, namely taking a piece of the fintech world and making it better for developers.

This is where Bivons’ view of the future of fintech products comes into play. According to the CEO, in the future, companies will not buy a monolithic financial technology stack. Instead, he thinks, they will buy the best API for each slice of the fintech world that they need to implement. This matters because we could argue that Canopy is targeting too small a product space. Not that its market isn’t large — debt and its servicing are massive problem spaces — but seeing a company find a niche to focus on makes more sense when its leaders expect focused fintech products to win out over large bundles of services.

Bivons added that much of the fintech focus of the last five years has been on debit, citing Chime, Step and Greenlight as examples. The next decade, he said, is going to focus on credit products. That would be good news for Canopy.

Canopy co-founders via the company. CTO Will Hanson (left) and CEO Matt Bivons (right).

Critically, and for the finance nerds out there, Bivons told TechCrunch that its loan servicing technology does not require the company to take on any credit risk, and that it has gross margins of around 90%. I never trust a too-round number, but the figure indicates that what Canopy has built could grow into an attractive business.

Today, Canopy is a traditional SaaS, though Bivons said that it wants to move toward usage-based pricing in time. Its service costs around 50 cents per account per month, or around $6 per year in its current form. Today, around 40% of Canopy’s customers are seed and Series A-scale startups, though Bivons noted that it is moving up the customer size chart over time.

The resulting growth is impressive. Canopy’s customer count grew 4.5x from February to May of 2021. Of course, Canopy is a young company, so its overall customer base could not have been massive at the start of the year. Still, that’s the sort of growth that makes investors sit up and pay attention, making the Canopy Series A somewhat unsurprising.

Fintech growth doesn’t seem to be slackening much, meaning that the market for what Canopy is selling should expand. Provided that its view that best-of-breed, more particular fintech products will beat larger stacks in the market, it could have an interesting trajectory ahead of it. And now that it has raised its Series A, we can start to annoy it with more concrete questions about its growth from here on out.

Powered by WPeMatico

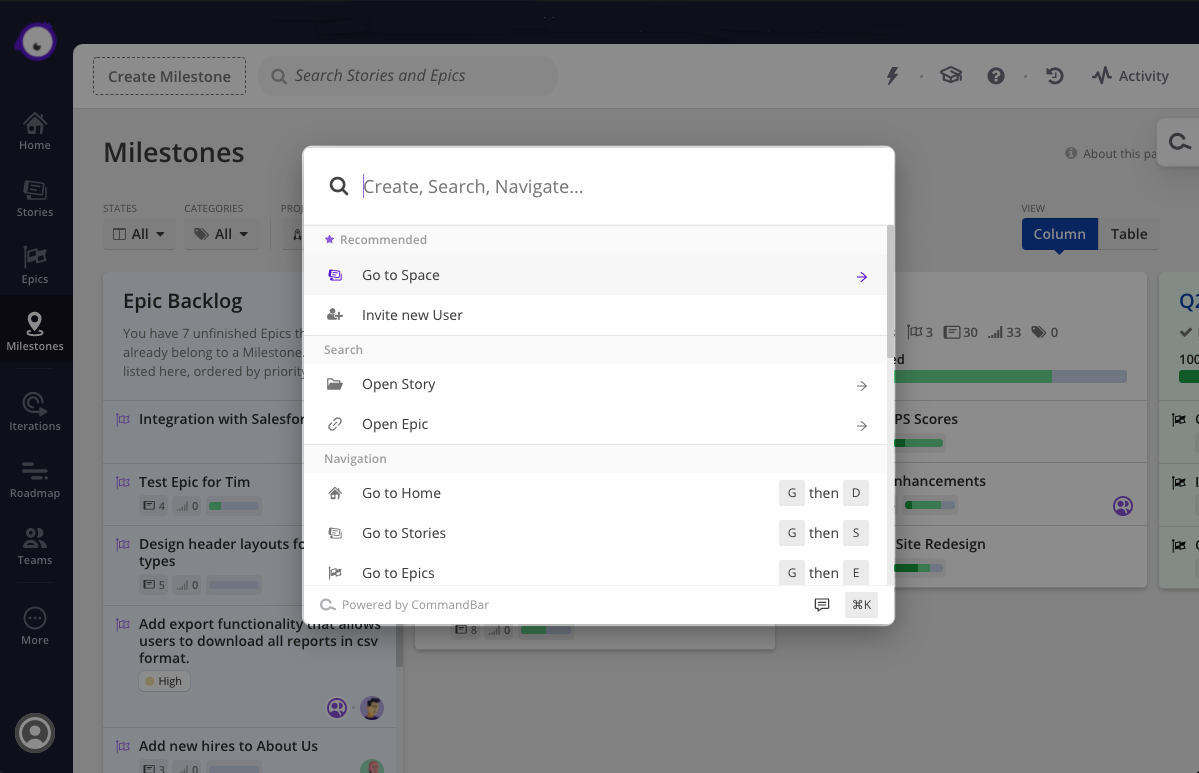

James Evans, Richard Freling and Vinay Ayyala, co-founders at CommandBar, were working on a software product when they hit a wall while trying to access certain functionalities within the software.

That’s when the lightbulb moment happened and, in 2020, the team shifted to building an embeddable search widget to make software easier to use.

“We thought this paradigm feels like it could be useful, but it is hard to build well, so we built it,” Evans told TechCrunch.

On Monday, CommandBar emerged from beta and announced its $4.8 million seed round, led by Thrive Capital, with participation from Y Combinator, BoxGroup and a group of angel investors including, AngelList’s Naval Ravikant, Worklife Ventures’ Brianne Kimmel, StitchFix president Mike Smith and others.

CommandBar’s business-to-business tool, referred to as “command k,” was designed to make software simpler and faster to use. The technology is a search interface that sits on top of web-based apps so that users can access functionalities by searching simple keywords. It can also be used to boost new users with recommended prompts like referrals.

CommandBar in Clubhouse. Image Credits: CommandBar

Companies integrate CommandBar by pasting in a line of code and using configuration tools to quickly add commands relevant to their apps. The product was purposefully designed as low-code so that product and customer success teams can add configurations without relying on engineering support, Evans said.

Initially, it was a difficult sell: One of the more challenging parts in the early days of the company was helping customers and investors understand what CommandBar was doing.

“It was hard to describe over the phone, we had to try to get people on Zoom so they could see it,” he said. “It is easier now to sell the product because they can see it being used in an app. That is where many new users come from.”

CommandBar is already being used by companies like Clubhouse.io, Canix and Stacker that are serving hundreds of thousands of users. The most common use case for CommandBar so far is onboarding new software users.

He intends to use the new funding to grow the team, hiring across engineering, sales and marketing. The beta testing was successful in receiving good feedback from the early customers, and Evans wants to reflect that in new products and functionalities that will come out later this year.

Vince Hankes, an investor at Thrive Capital, was introduced to CommandBar through one of its pre-seed investors.

His interest is in B2B software companies and applications, and one of the things that became obvious to him while looking into the space was the natural tension between the simplicity and functionality of apps.

Apps are sometimes hard for even a power user to navigate, he said, but CommandBar makes something as simple as resetting a password easier by being able to search for that term and go right to that page if it is configured that way by the company.

“The types of companies interested in their product are impressive,” Hankes said. “We began to see demand from a broad range of companies that weren’t obvious. In fact, they are using CommandBar as a tool for deeper customer engagement.”

Powered by WPeMatico

Assembling a startup team is harder than assembling 10 IKEA dressers, and the stakes are much, much higher.

Starting with the assumption that 90% of startups will fail and the most successful ones take an average of six years to IPO, founders must make careful decisions about whom they invite to join the core team.

Will that stellar engineer become a great CTO? Should your product person be opinionated or a team player? Are you even the best choice for CEO?

ThoughtSpot CEO Sudheesh Nair shared some of his thoughts about building a sturdy leadership team and drafted a thorough checklist for entrepreneurs who are putting a crew together. His initial advice?

“Investors love founder-CEOs, and founders are often fantastic candidates for this role. But not everyone can do it well, and more importantly, not everyone wants to.”

In a related article, Gregg Adkin, VP and managing director at Dell Technologies Capital, shared the framework he’s developed for helping founders set up their board.

Choosing the right mix of people can impact everything from fundraising to hiring: “Investors often ask founders about their board [because] it says a lot about their character, their judgment and their willingness to be challenged,” he writes.

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Miranda Halpern spoke to Amsterdam-based coach Ward van Gasteren for our latest growth marketing interview, which is free to read.

In their discussion, van Gasteren addressed misconceptions about growth hacking, the mistakes most startups are likely to make, and the distinctions he draws between growth hacking and growth marketing:

“Growth hacking is great to kickstart growth, test new opportunities and see what tactics work,” he tells us.

“Marketers should be there to continue where the growth hackers left off: Build out those strategies, maintain customer engagement, and keep tactics fresh and relevant.”

Thanks very much for reading Extra Crunch this week; I hope you have a great weekend.

Walter Thompson

Senior Editor, TechCrunch

Image Credits: sureeporn / Getty Images

In his first column since returning to TechCrunch, reporter Ryan Lawler considered the potential ripples Square’s purchase of Afterpay may send across the pond of buy now, pay later startups.

For commentary and perspective, he interviewed:

The investors he spoke to agreed that deferring payments helps drive e-commerce, “but scale matters and long-term margins look slim for BNPL startups,” reports Ryan.

Image Credits: Ivan Bajic (opens in a new window) / Getty Images

Businesses have been deploying AI solutions for 20 years, but few have achieved the outstanding gains in efficiency and profitability promised when the technology first appeared.

But there’s a burgeoning new generation of enterprise AI, Eshwar Belani, an operating partner at Symphony AI, writes in a guest column.

“Companies on the leading edge of AI innovation have advanced to the next generation, which will define the coming decade of big data, analytics and automation — Enterprise AI 2.0.”

Image Credits: Joan Cros Garcia-Corbis (opens in a new window) / Getty Images

Over the next 18 months, one technologist says the increased adoption of embodied artificial intelligence will open a path to superintelligence — incredibly powerful software that dwarfs anything the human mind could produce.

“All the crazy Boston Dynamics videos of robots jumping, dancing, balancing and running are examples of embodied AI,” says Chris Nicholson, founder and CEO of Pathmind, which uses deep reinforcement learning to optimize industrial operations and supply chains.

“The field is moving fast and, in this revolution, you can dance.”

Image Credits: Nigel Sussman (opens in a new window)

The Exchange looks at the valuations of public insurtech companies and considers what that means for startups — but from a slightly different perspective.

“We’d typically riff on the new values of public neoinsurance companies and use that data to work our way into a guess concerning what the price declines might mean for related startups,” Alex Wilhelm writes. “Taking public-market data and using it to better understand private markets is pretty much the national pastime of this column.

“Not today.”

Image Credits: Anastassiia (opens in a new window) / Getty Images

The fact that the globe is awash in venture capital should not be news to readers of this newsletter.

For founders, it means more than just fat checks, Kunal Lunawat, the co-founder and managing partner of Agya Ventures, writes in a guest column.

“Founders would be well served to go back to the basics and focus on the principles of fundraising when determining who sits on their cap table.”

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm checks in on results from Starling Bank and Monzo to see what the neobanks’ most recent financial figures say about the state of neobanks overall.

“Although some neobanks are managing to clean up their ledgers and work toward profits — or reach profitability — not all are in the black,” he notes.

But among those that are?

“At least a portion of the neobanking world is financially stable enough to consider public offerings.”

Image Credits: MicroStockHub (opens in a new window)/ Getty Images

The red-hot venture capital market may give founders lots of investors to choose from, but the most important thing (if you can be choosy) is being able to trust and rely on your investors, Ripple Ventures’ Matt Cohen and True’s Tony Conrad write in a guest column.

“This … new dynamic is forcing founders to be extremely selective about exactly who is sitting around their mentorship table,” they write.

“It’s simply not possible to have numerous deep and meaningful relationships to extract maximum value at the early stage from seasoned investors.”

Image Credits: A-Digit (opens in a new window) / Getty Images

Assembling a board of directors is not merely about finding individuals who can aid your early-stage journey, Gregg Adkin, the vice president and managing director at Dell Technologies Capital, writes in a guest column.

The composition of the board can also impact your fundraising.

“Investors often ask founders about their board [because] it says a lot about their character, their judgment and their willingness to be challenged,” he writes.

Adkins offers a framework he calls “SPIFS” — for strategy, people, image, finance and systems for compliance — to aid founders in setting up a board.

Image Credits: Nigel Sussman (opens in a new window)

In the wake of Deliveroo’s plans to abandon the Spanish market after the country passed legislation requiring companies dependent on gig workers to hire employees, Alex Wilhelm wondered about the battle for smaller markets and whether third place is sufficient.

“One company exiting a market is not a big deal, but we were curious about Deliveroo’s comments regarding the need for market leadership — or something close to it — to warrant continued investment,” he writes for The Exchange.

“Is this the common reality for startups battling for market position, no matter if those markets are cities or countries?”

Powered by WPeMatico

With most popular online video games, there’s a huge gap between being a good player and a great one. A casual player might be able to hold their own against other casual players, only for a random pro to wander by and chew through everyone like they’re somehow playing with a different set of rules.

Could an AI-driven voice in your ear help close that gap, if only a bit? SenpAI.GG, a company out of Y Combinator’s latest batch, thinks so.

Much of that aforementioned gap boils down to practice, muscle memory and — let’s face it — natural ability. But as a game gets older/bigger/more complex, the best players tend to have a wealth of one resource that’s oh-so-crucial, if not oh-so-fun to gather: information.

Which guns do the most damage at this range? Which character is best suited to counter that character on this map? Hell, what changed in that “minor update” that flashed across your screen as you were booting up the game? Wait, why is my favorite weapon suddenly so much harder to control?

Staying on top of all this information as players discover new tactics and updates shift the “meta” is a challenge in its own right. It usually involves lots of Twitch streams, lots of digging around Reddit threads and lots of poring over patch notes.

SenpAI.GG is looking to surface more of that information automatically and help new players get good, faster. Their desktop client presents you with information it thinks can help, post-game analysis on your strategies, plus in-game audio cues for the things you might not be great at tracking yet.

It currently supports a handful of games — League of Legends, Valorant and Teamfight Tactics — with the info it provides varying from game to game. In LoL, for example, it’ll look at both teams’ selected champions and try to recommend the one you could pick to help most; in Valorant, meanwhile, it can give you an audio heads-up that one of your teammates is running low on health (before said teammate starts yelling at you to heal them), when you’ve forgotten to reload or how long you’ve got before the Spike (read: game-ending bomb) explodes.

SenpAI.GG’s in-game overlay providing League of Legends insights. Image Credits: SenpAI.GG

Just as important as the information it provides is the information it won’t provide. In my chat with him, SenpAI.GG founder Olcay Yilmazcoban seemed very aware that there’s a hard-to-define line here where “assistant” blurs into “cheating tool” — but the company follows certain rules to stay on the right side of things and prevent their players from getting banned.

They won’t, for example, ever take action on a player’s behalf — they might fire an audio cue to say “hey, you should heal that teammate,” but they won’t press the button for you. They’ll only generate their real-time insights from what’s on your screen — not anything hidden within the running process. They also won’t do things like reveal an enemy’s location just because your teammate is also running the app and can see them. Think “good player standing over your shoulder,” not “wall hack.” The company says that they’re always within each game developer’s competitive fairness guidelines, and only work with approved/provided APIs.

It’s a good idea because it’s one that, arguably, never gets old. With each new game they support, they’ve got a new potential audience to serve. Meanwhile, it’s not as if the old games/insights will expire — a game’s big ol’ book-of-stuff-you-need-to-know tends to only get bigger and more complex as a game ages and the patches pile up. There are games I’ve been playing for years where I’d still love a voice assistant that says “Oh hey, the recoil on the gun you just picked up has gotten way more intense since the last time you played.” SenpAI.GG isn’t there yet, but there’s a ton of natural room for growth.

Yilmazcoban tells me that they currently have over 400,000 active users, with a team of 11 people working on it. The base app is free, with plans to offer advanced features for a couple bucks a month.

Powered by WPeMatico

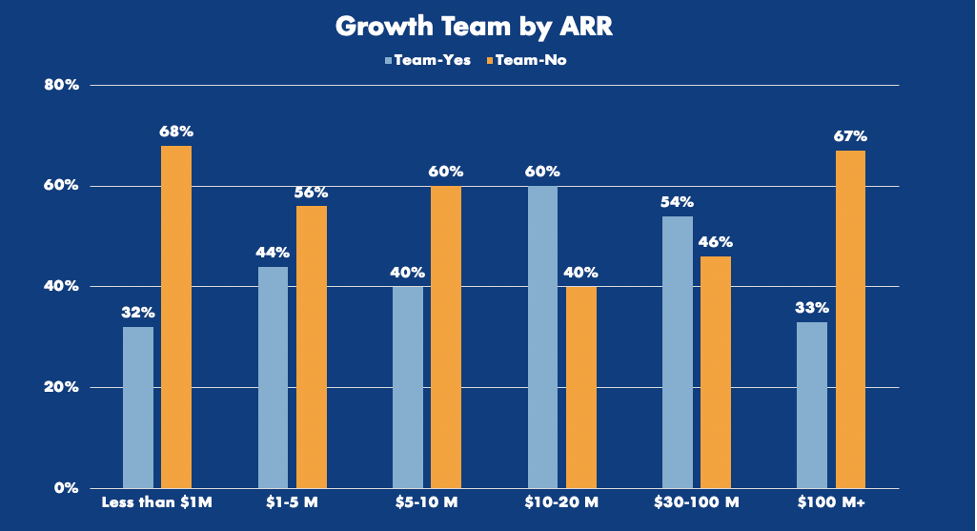

Everyone at an organization should own growth, right? Turns out when everyone owns something, no one does. As a result, growth teams can cause an enormous amount of friction in an organization when introduced.

Growth teams are twice as likely to appear among businesses growing their ARR by 100% or more annually. What’s more, they also seem to be more common after product-market fit has been achieved — usually after a company has reached about $5 million to $10 million in revenue.

Image Credits: OpenView Partners

I’m not here to sell you on why you need a growth team, but I will point out that product-led businesses with a growth team see dramatic results — double the median free-to-paid conversion rate.

Image Credits: OpenView Partners

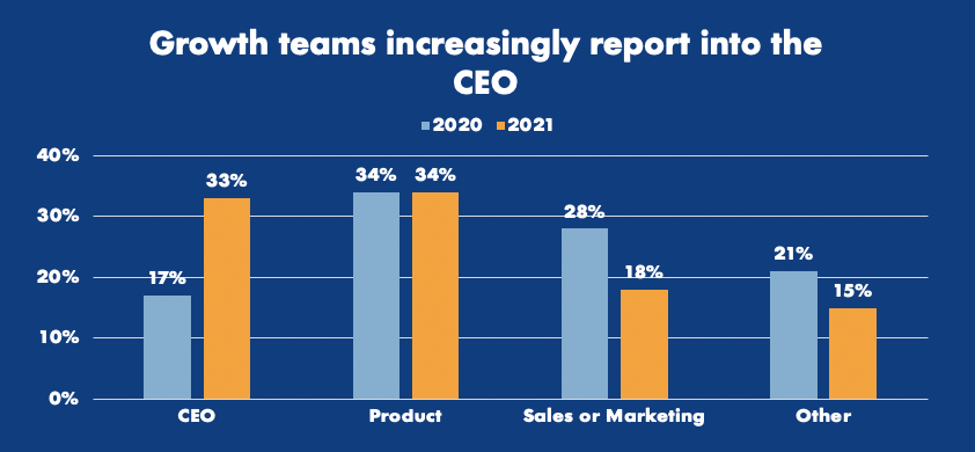

According to responses from product benchmarks surveys, growth teams have transitioned dramatically from reporting to marketing and sales to reporting directly to the CEO.

Some of the early writing on growth teams says that they can be structured individually as their own standalone team or as a SWAT model, where experts from various other departments in the organization converge on a regular cadence to solve for growth.

Image Credits: OpenView Partners

My experience, and the data I’ve collected from business-user focused software companies, has led me to the conclusion that growth teams in business software should not be structured as “SWAT” teams, with cross-functional leadership coming together to think critically about growth problems facing the business. I find that if problems don’t have a real owner, they’re not going to get solved. Growth issues are no different and are often deprioritized unless it’s someone’s job to think about them.

Becoming product-led isn’t something that happens overnight, and hiring someone will not be a silver bullet for your software.

I put early growth hires into a few simple buckets. You’ve got:

Product-minded growth experts: These folks are all about optimizing the user experience, reducing friction and expanding usage. They’re usually pretty analytical and might have product, data or MarketingOps backgrounds.

Powered by WPeMatico

Venture capitalists are chatting this week about a recent piece from The Information titled “The End of Venture Capital as We Know It.” As with nearly everything you read, the article in question is a bit more nuanced than its headline. Its author, Sam Lessin, makes some pretty good points. But I don’t fully agree with his conclusions, and want to talk about why.

This will be fun, and, because it’s Friday, both relaxed and cordial. (For fun, here’s a long-ass podcast I participated in with Lessin last year.)

Lessin notes that venture capitalists once made risky wagers on companies that often withered away. Higher-than-average investment risk meant that returns from winning bets had to be very lucrative, or else the venture model would have failed.

Thus, venture capitalists sold their capital dearly to founders. The prices that venture capitalists have historically paid for startup equity in high-growth tech upstarts make IPO pops appear de minimis; it’s the VCs who make out like bandits when a tech company floats, not the bankers. The Wall Street crew just gets a final lap at the milk saucer.

Over time, however, things changed. Founders could lean on AWS instead of having to spend equity capital on server racks and colocation. The process of building software and taking it to market became better understood by more people.

Even more, recurring fees overtook the traditional method of selling software for a one-time price. This made the revenues of software companies less like those of video game companies, driven by episodic releases and dependent on the market’s reception of the next version of any particular product.

As SaaS took over, software revenues kept their lucrative gross margin profile but became both longer-lasting and more dependable. They got better. And easier to forecast to boot.

So, prices went up for software companies — public and private.

Another result of the revolution in both software construction and distribution — higher-level programming languages, smartphones, app stores, SaaS and, today, on-demand pricing coupled to API delivery — was that more money could pile into the companies busy writing code. Lower risk meant that other forms of capital found startup investing — super-late stage to begin with, but increasingly earlier in the startup lifecycle — not just possible, but rather attractive.

With more capital varieties taking interest in private tech companies thanks in part to reduced risk, pricing changed. Or, as Lessin puts it, thanks to better market ability to metricize startup opportunity and risk, “investors across the board [now] price [startups] more or less the same way.”

You can see where this is going: If that’s the case, then the model of selling expensive capital for huge upside becomes a bit soggy. If there is less risk, then venture capitalists can’t charge as much for their capital. Their return profile might change, with cheaper and more plentiful money chasing deals, leading to higher prices and lower returns.

The result of all of the above is Lessin’s lede: “All signs seem to indicate that by 2022, for the first time, nontraditional tech investors — including hedge funds, mutual funds and the like — will invest more in private tech companies than traditional Silicon Valley-style venture capitalists will.”

Capital crowding into the parts of finance once reserved for the high priests of venture means that the VCs of the world are finding themselves often fighting for deals with all sorts of new, and wealthier, players.

The result of this, per Lessin, is that venture “firms that grew up around software and internet investing and consider themselves venture capitalists” must “enter the bigger pond as a fairly small fish, or go find another small pond.”

The obvious critique of Lessin’s argument is one that he makes himself, namely that what he is discussing is not as relevant to seed investing. As Lessin puts it, his argument’s impact on seed investing is “far less clear.”

Agreed. Sure, it’s the end of venture capital as we know it. But it’s not the end of venture capital, because if capitalism is going to continue, there’s always going to need to be risky-ass shit for VCs to bet on at the bottom.

The factors that made later-stage SaaS investing something that even idiots can make a few dollars doing become scarce the earlier one looks in the startup world. Investing in areas other than software compounds this effect; if you try to treat biotech startups as less risky than before simply because public clouds exist, you are going to fuck up.

So the Lessin argument matters less in seed-stage and earlier investing than it does in the later stages of startup backing, and doubly less when it comes to earlier investing in non-software companies.

While it’s a little-known fact, some venture capitalists still invest in startups that are not software-focused. Sure, nearly every startup involves code, but you can make a lot of money in a lot of ways by building startups, especially tech startups. The figuring-out of SaaS investing does not mean that investing in marketplaces, for example, has enjoyed a similar decline in risk.

So, the VCs-are-dead concept is less true for seed and non-software startups.

Is Lessin correct, then, that the game really has changed for middle- and late-stage software investing? Of course it has, but I think that he takes the concept of less risky, private-market software investing in the wrong direction.

First, even if private-market investing in software has a lower risk profile than before, it’s not zero. Many software startups will fail or stall out and sell for a modest sum at best. As many in today’s market as before? Probably not, but still some.

This means that the act of picking still matters; we can vamp as long as we’d like about how venture capitalists are going to have to pay more competitive prices for deals, but VCs could retain an edge in startup selection. This can limit downside, but may also do quite a lot more.

Anshu Sharma of Skyflow — and formerly of Salesforce and Storm Ventures, where I first met him — made an argument about this particular point earlier this week with which I am sympathetic.

Sharma thinks, and I agree, that venture winners are getting bigger. Recall that a billion-dollar private company was once a rare thing. Now they are built daily. And the biggest software companies aren’t worth the few hundred billion dollars that Microsoft was largely valued at between 1998 and 2019. Today they are worth several trillion dollars.

More simply, a more attractive software market in terms of risk and value creation means that outliers are even more outlier-y than before. This means that venture capitalists that pick well, and, yes, go earlier than they once did, can still generate bonkers returns. Perhaps even more so than before.

This is what I am hearing about certain funds regarding their present-day performance. If Lessin’s point held up as strongly as he states it, I reckon that we’d see declining rates of return at top VCs. We’re not, at least based on what I am hearing. (Feel free to tell me if I am wrong.)

So yes, venture capital is changing, and the larger funds really are looking more and more like entirely different sorts of capital managers than the VCs of yore. Capitalism is happening to venture capital, changing it as the world of money itself evolves. Services were one way that VCs tried to differentiate from one another, and probably from non-venture capital sources, though that was discussed less when The Services Wars were taking off.

But even the rapid-fire Tiger can’t invest in every company, and not all its bets will pay out. You might decide that you’d be better off putting capital into a slightly smaller fund with a slightly more measured cadence of dealmaking, allowing selection at the hand of fund managers that you trust to allocate your funds among other pooled capital to bet for you. So that you might earn better-than-average returns.

You know, the venture model.

Powered by WPeMatico

V2Food is one of many new contenders in the alternative protein space, founded in Australia but now setting its sights on Europe, Asia and beyond. It has a few key advantages over the competition, and with €45 million in new funding it may be finding its way to plates in the Eurozone soon.

The company has seen strong uptake in its home market, and the first goal is to be No. 1 in Australia, said CEO and founder Nick Hazell, formerly of MasterFoods and PepsiCo R&D. But in the meantime they’ll be expanding their presence in Asia, where partner Burger King has launched a Whopper with their patty, and in Europe, where the product’s minimal suspicious elements come into play.

Currently v2Food makes plant-based ground beef and patties, sausages and a ready-made Bolognese sauce. Obviously they have strong competition in those categories, which are sort of the opening play of most alternative protein companies. But v2Food has a leg up on many of them in two ways.

First, v2Food products are made, or at least can be made, using “any standard meat production facility.” That’s a big plus for scaling and a minus for cost, since economies of scale are already in play. The processes for creating and mixing the plant-derived and other artificial substances that make up alternative proteins in general aren’t always amenable to existing infrastructure. This also opens the door to partnerships with existing meat companies that might have balked at having to switch processes. (Incidentally, Hazell noted that what they’re aiming for isn’t so much about replacing traditional meats so much as growing the market in a new direction, a philosophy those companies may appreciate.)

Second, as the press release announcing the fundraise puts it, “v2food products do not contain GMOs, preservatives, colors or flavorings. This makes it an ideal product for the European market, where the many large competitors have been unable to enter the market due to strict regulation.” It’s also a soft advantage for winning over in-store buyers vacillating between two plant-based options; who hasn’t on occasion ended up going for the one with fewer ingredients that proudly touts its lack of preservatives and such? The alt-protein buying demographic is likely especially sensitive to this consideration.

The €45 million round is a “B Plus,” led by European impact fund Astanor, with participation from Huaxing Growth Capitol Fund, Main Sequence and ABC World Asia. The money is going toward both R&D and scaling.

“This funding is an important step towards v2food’s goal of transforming the way the world produces food,” said Hazell. “It’s imperative that we scale quickly because these global issues need immediate solutions.”

To that end a large portion will go toward simply creating enough product to meet demand. They’re also doubling R&D spend to both accelerate new products and improve the existing ones. And rather than import the necessary ingredients to Australia, they’re exploring the possibility of building a local manufacturing facility there. With luck and a bit of plant-based elbow grease, the region could become a net exporter, propping up the local economy as well as building up v2Food’s resilience and cutting costs.

The Europe expansion is still a twinkle in the company’s (and Astanor’s) eye, for even with its simplicity and non-GMO origins, it’s not trivial to launch a new product in the European market.

Powered by WPeMatico