Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

As far as pandemic-proof businesses go, a startup for barbershops isn’t exactly the first thing that comes to mind — unless you raised millions just days before barbershops were shut down across the country.

Dave Salvant and Songe LaRon, co-founders of New York-based Squire, a back-end barbershop management tool for independent businesses they launched in 2016, raised a $34 million Series B led by CRV in early March (after raising $8 million in a Series A round led by Trinity Ventures in 2018). Days later, “everything went to zero,” LaRon recalls of their customer base: All barbershops closed.

The cash quickly went from an opportunistic raise to needed capital. Squire waived all subscription fees, created a site for information called www.helpbarbershops.com and launched a way for patrons to buy online gift cards for their favorite shops. One barbershop sold more than $30,000 in just a few days.

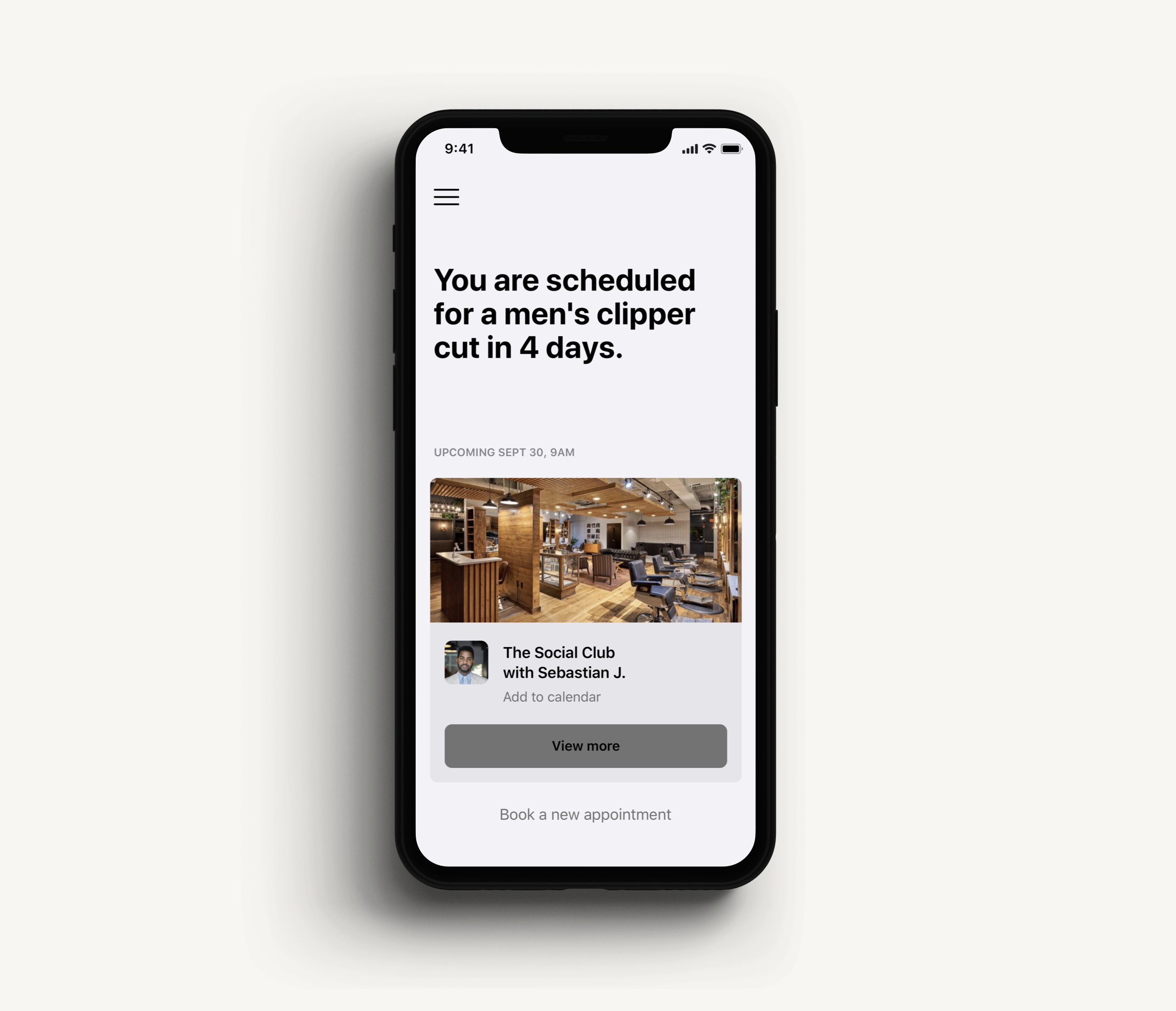

After weathering a hard few months, Squire is now enjoying high demand from barbershops preparing to reopen. The company provides cashless payment, a way to make appointments and is experimenting with a virtual waiting room, all features that barbershops post-pandemic are considering. It is currently live in 45 cities.

During shelter-in-place, some of us have been forced to cut our own hair, as shown by virtual haircuts done over Zoom and even a VC-hosted haircut workshop. But a DIY session won’t replace the intimacy of a barbershop.

Barbershops have long served as gathering places for Black and African American communities as a place to chat, be vulnerable and complain.

In recent years, the culture has moved more into mainstream conversation. Today, there is an entire talk show series, produced by LeBron James, where guests chat while getting a cut. In Atlanta, there’s a singular Atlanta barbershop that serves as an informal gathering ground for the city’s top politicians.

“We learned it resonated with men from all walks of life, all races and ethnicities and was really kind of a universal experience. So we saw an opportunity for a tech company,” LaRon said.

Salvant and LaRon thought of barbershops as places of comfort long before they saw them as a place of business.

“Barbers are part-time therapists for guys,” LaRon said in an interview with TechCrunch.

Salvant and LaRon, friends and then-students at Columbia who were living in Harlem, saw barbershops grow in cultural relevance while the technology behind them remained largely untouched. Long wait times, cash-only and scheduling woes continued to be problems that they themselves faced every time they got their hair cut.

Squire lets businesses schedule appointments, offer loyalty programs and install contactless and cashless payment. The team claims that barbershop operations are more complex than many other types of small businesses because there are multiple parties transacting, plus customers might check out different services from different barbers all within one service. That’s where Squire comes in — to be a point of sale to manage those confusing transactions.

Image Credits: Squire

“We don’t want to replace that relationship a guy had with the barber,” said Salvant. “We just wanted to take away all the annoying things about it.”

Squire makes money by charging a monthly fee based on size and needs of the barbershop, ranging from $30 to $250 per month.

A threat to Squire’s success are small and medium business payment infrastructure companies like Square. The co-founders were confident, noting that Squire is the only venture-backed business that exclusively tailors itself to barbershops, and thus will be the best solution for those businesses. Los Angeles-based Boulevard raised money in November for its salon and spa management software.

But Squire thinks barbershop subculture is niche enough that salon technology doesn’t do the job. Barbers want to partner with businesses that are as passionate as they are.

“They don’t look at it as a job, they look at it as a life calling,” LaRon said.

The high bar is precisely why a healthy chunk of Squire’s early days were defined by LaRon and Salvant sitting in barbershop chairs and asking a lot of questions. In fact, Salvant says he got his hair cut by nearly 600 different barbers.

Songe LaRon and Dave Salvant, the co-founders of Squire. Image Credits: Squire

“Part of them trusting you and you trust them happens if you sit down and get a haircut,” Salvant said. By and large, the feedback the co-founder got from barbers was that they needed a solution for the entire shop, as opposed to Squire’s original product aimed at a customer or individual barber. It gave them the faith to go for a vertical solution versus assuming a horizontal solution such as Square would do the job.

Reid Christian, an investor at Charles River Ventures (CRV) who was part of the Series B, said that he knew Squire would be a success when he experienced the product at Rust Belt Barbering in Buffalo, New York. Christian compared Squire to a “Venmo-like experience” with transactions. He estimates billions of dollars in men’s grooming spend.

When shops broadly reopen, Squire is in a good, timely spot to be adopted by the masses. For the co-founders, the incoming wave of interest was affirmed a long time ago.

Last year, the duo attended the Connecticut Barber Expo. It was an aha moment, as they witnessed over 15,000 make the pilgrimage over to Connecticut to learn about the industry.

“Most people don’t know about it, most people wouldn’t believe it until they saw it,” Salvant said. “It serves as a reminder how powerful it is.”

Powered by WPeMatico

We’re less than a month away from launching TC Early Stage 2020, our interactive online bootcamp, that runs July 21-22. Don’t miss out on more than 50 expert-led workshops focused on the core subjects every early-stage startup founder needs to ace.

But hold up — today is your last chance to score an early-bird deal. Buy your pass before the clock strikes 11:59 pm (PDT), and you’ll save $50.

Early founders — from pre-seed through Series A — tend to have more questions than answers as they strive to build their startups. That’s where TC Early Stage comes in. Get answers to your questions from a battalion of credible, knowledgeable experts across the startup spectrum.

Is your pitch deck anemic? Does your tech stack stack up? How should you approach a VC? How do you protect your users? Those and a zillion other questions can keep you tossing and turning. This is your chance to learn from the pros and get answers you can put into practice now.

Each session can accommodate around 100 people, so be sure to sign up quickly — especially if you have topic-specific questions you want addressed. Session seats are available first come first serve, so don’t delay. The good news is that ticket holders receive exclusive access to videos of all sessions — on-demand after the event.

Bonus: You also have access to all the Main Stage interviews and CrunchMatch, our AI-powered networking platform — famous for relieving stress and increasing productivity.

Take a peek at just some of the interactive sessions and experts we have waiting for you at TC Early Stage.

You still have a month to prepare for TC Early Stage 2020, but only a few hours left to keep $50 in your pocket. Don’t miss out — buy your pass before prices increase tonight at 11:59 p.m. (PDT).

Is your company interested in sponsoring TC Early Stage? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Housing has been constructed for millennia, and while clearly our modern abodes are ever so slightly better than the elk tents we used to live in, the construction techniques behind housing today haven’t progressed all that much. What has progressed are prices — it’s more expensive than ever to build a modern unit, and that’s just for housing — head over to commercial real estate and the numbers don’t look much better.

For Martin Diz and his team, that’s a problem. Diz is not exactly a lifelong builder — in fact, he was building proverbial rockets as an aerospace engineering PhD researcher several years ago. As he was talking to his roommate back then, who was studying structural engineering, he realized that some of the techniques that his roommate’s field was trying to pioneer had already been discovered by the aerospace folks decades ago.

His roommate was trying to simulate an earthquake to model how the tremors would affect objects like a table inside a building. As Diz recalled, he said “Hey dude, did you know that in aerospace engineering, we did the same thing for the space station 50 years ago? … I learned this in grad school, you know, in our basic course because it’s a very old technique.”

Diz is legitimately a nice chap, and totally not the kind of aerospace engineer who goes around talking about how aerospace solved everything a century ago (okay, maybe just a tad of that). But the interaction and followup conversation got him thinking about what aerospace as a field had solved, and whether some of those techniques could be used in other domains.

Diz and his roommate kept talking over the years, and eventually, the two formed Tango Builder. Tango’s main premise is to bring more sophisticated engineering techniques to construction, improving performance and quality while lowering costs. It’s part of the current YC batch, and previously raised a small seed round, which included participation from Tracy Young, co-founder and CEO of PlanGrid.

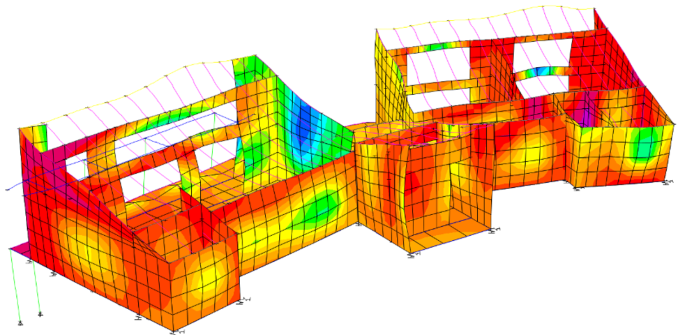

The two, plus one employee, have already worked on a handful of projects, with some early promising results. Tango helped to design a hospital for COVID-19 patients in Ecuador that saw total savings of $1 million by lowering structural costs by a third. They consulted on the creation of a justice center in Mexico, and were able to reduce the required steel in the project by 40%. And they used their platform to optimize wall thickness in a masonry home to bring total cost down by 15%. All numbers are reported by the company and have not been independently verified.

A look at Tango’s masonry home project. Photo from Tango Builder.

A look at Tango’s masonry home project. Photo from Tango Builder.

There is a heavy focus on structural integrity (as there should be in construction), but Tango particularly shines around seismic modeling. While earthquakes are perhaps most pronounced in places like California and Mexico, both of which suffered major tremors this past week, earthquakes are a lingering threat throughout the world, and buildings need to be designed to handle them even if they are rare.

Diz and his team want to give designers better tools to model what happens in different scenarios while understanding the trade-offs of various building materials and designs. “You’re building with steel stock, but it’s much more expensive now, so it’s up to the user or the owner to decide which of the paths he wants to take,” he said. Safety is always important, but how much steel do you place in a building that might see an earthquake once a century? That’s what Tango wants to help answer.

Beyond improving structural modeling, Tango’s big ambition is to find additional efficiencies in the construction process by helping everyone involved with construction work together through a better workflow. “Each person has benefits from the platform, the architect will get the approvals … faster, the engineer can focus on the creative side of things, the contractor” can bid earlier knowing what design is coming, Diz explained. Saving time in all these processes ultimately translates directly to a project’s bottom line.

It’s very early days of course, with just Diz, his co-founder Juan Aleman, and one employee “working extremely hard.” The hope though is that melding some aerospace engineering techniques with a much more robust and technical platform will help push construction to better quality while saving costs as well. After all, aerospace did all this a century ago.

Powered by WPeMatico

In a move that highlights how open the American IPO window may be at the moment, China-based Agora priced its public offering at $20 per share last night, ahead of its $16 to $18 proposed price range. (Update: As noted here, the company has a second HQ in California.)

At $20 per share, the 17.5 million shares sold in its debut raised $350 million, a huge haul for a company that reported around 10% of that figure in Q1 2020 revenue. Provided that your humble servant is doing his Class A to ADS share conversion calculations correctly, Agora is worth about $2 billion at its IPO price.

Agora raised well over $100 million while a private company, backed by GGV Capital, Coatue and others, according to Crunchbase data.

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

Agora is an API-powered company that allows customers to embed real-time video and voice abilities in their applications; appropriately, the company’s ticker symbol in America will be “API.”

With an annual run rate of $142.2 million, a $2 billion valuation gives Agora a run-rate multiple of around 14x. That’s rich, but not stratospheric. Perhaps Agora wasn’t able to command a higher multiple due to its sub-70% margins (68.8% in Q1)?

With an annual run rate of $142.2 million, a $2 billion valuation gives Agora a run-rate multiple of around 14x. That’s rich, but not stratospheric. Perhaps Agora wasn’t able to command a higher multiple due to its sub-70% margins (68.8% in Q1)?

Agora’s financials make its IPO pricing a neat puzzle, so let’s pull apart the good and the bad to better understand why the market was willing to pay more than the company anticipated.

After that short exercise, we’ll make note of the current IPO climate, inclusive of what we learn from Agora. (Spoiler for unicorns out there: Things look good.)

We can’t calculate Agora’s enterprise value with confidence until we get updated filings. But taking into account the company’s pre-IPO cash and liabilities, its implied enterprise value/run rate is something around 13x. (That figure will dip if the company’s shares don’t rise after its debut, as its cash position rises from its share sale; more on enterprise values here.)

Powered by WPeMatico

The direct-to-consumer health insurer Oscar has raised another $225 million in its latest, late-stage round of funding as its vision of tech-enabled healthcare services to drive down consumer costs becomes more and more of a reality.

In an effort to prevent a patient’s potential exposure to the novel coronavirus, COVID-19, most healthcare practices are seeing patients remotely via virtual consultations, and more patients are embracing digital health services voluntarily, which reduces costs for insurers and potentially provides better access to basic healthcare needs. Indeed, Oscar now has a $2 billion revenue base to point to and now a fresh pile of cash from which to draw.

“Transforming the health insurance experience requires the creation of personalized, affordable experiences at scale,” said Mario Schlosser, the co-founder and chief executive of Oscar.

Oscar’s insurance customers have the distinction of being among the most active users of telemedicine among all insurance providers in the U.S., according to the company. Around 30% of patients with insurance plans from the company have used telemedical services, versus only 10% of the country as a whole.

The new late-stage funding for Oscar includes new investors Baillie Gifford and Coatue, two late-stage investor that typically come in before a public offering. Other previous investors, including Alphabet, General Catalyst, Khosla Ventures, Lakestar and Thrive Capital, also participated in the round.

With the new funding, Oscar was able to shrug off the latest criticisms and controversies that swirled around the company and its relationship with White House official Jared Kushner as the president prepared its response to the COVID-19 epidemic.

As the Atlantic reported, engineers at Oscar spent days building a standalone website that would ask Americans to self report their symptoms and, if at risk, direct them to a COVID-19 test location. The project was scrapped within days of its creation, according to the same report.

The company now offers its services in 15 states and 29 U.S. cities, with more than 420,000 members in individual, Medicare Advantage and small group products, the company said.

As Oscar gets more ballast on its balance sheet, it may be readying itself for a public offering. The insurer wouldn’t be the first new startup to test public investor appetite for new listings. Lemonade, which provides personal and home insurance, has already filed to go public.

Oscar’s investors and executives may be watching closely to see how that listing performs. Despite its anemic target, the public market response could signal that more startups in the insurance space could make lemonade from frothy market conditions — even as employment numbers and the broader national economy continue to suffer from pandemic-induced economic shocks.

Powered by WPeMatico

Salt Lake City’s Spiff has announced a $10 million round of funding to expand the sales and marketing efforts for its service that automates commission payments for sales people.

Some of the biggest names in startup tech are using the service to pay their sales force, including Brex, Workfront, Algolia and the publicly traded startup Qualys.

The idea at Spiff is to create a new software category around sales compensation management, and it’s gotten buy-in from investors at Norwest Venture Partners, Next World Ventures and Epic Ventures. Seed investors, including Kickstart Album Ventures, Pipeline Capital and Peterson Ventures, returned to invest in the company as well.

“Commissions are a major cause of anxiety for teams who don’t understand or trust their incentive plan and many waste hours every month correcting mistakes or arguing with finance, which hits bottom lines,” said Spiff chief executive, Jeron Paul. “Norwest’s investment will help us automate commission calculations so sales teams have one less thing to worry about in these challenging times.”

Paul, a serial entrepreneur whose most recent business, Capshare, was sold to Solium in 2017, has spent the better part of his professional career developing services businesses for enterprises.

“The world of sales compensation software is long overdue for a revamp,” said Sean Jacobsohn, partner at Norwest Venture Partners, in a statement. “With 85 percent of companies still calculating sales commissions manually in Google Sheets or Excel, I’m excited to partner with Spiff to help transform the way people think about sales compensation and provide sales teams with a deeper level of visibility into their commissions.”

Powered by WPeMatico

Karat is a new startup promising to build better banking products for the creators who make a living on YouTube, Instagram, Twitch and other online platforms. Today it’s unveiling its first product — the Karat Black Card.

The startup, which was part of accelerator Y Combinator’s Winter 2020 batch, is also announcing that it has raised $4.6 million in seed funding from Twitch co-founder Kevin Lin, SignalFire, YC, CRV and Coatue.

Co-founder and co-CEO Eric Wei knows the creator world well, thanks to his time as product manager for Instagram Live. (His co-founder Will Kim was previously an investor with seed fund Lucky Capital.) Wei told me that although many creators have significant incomes, banks rarely understand their business or offer them good terms when they need capital.

“Traditional banks care a lot about FICO [credit scores],” he said. “A lot of YouTubers, when they’re blowing up, they don’t have time to think: Let me make sure my FICO is awesome as well.”

At the same time, he argued that creators have become suspicious of potentially scammy financial offers, to the point that if you were to attend a pre-COVID VidCon and tried to give out $3,000, “The good creators will not take it, even if you tell them there are no strings behind it.”

Karat co-founders Will Kim and Eric Wei

With the Karat Black Card, the startup is giving creators a credit card that they can use for their business-related expenses. When creators are approved, they receive a $250 bonus that can be applied to any future purchases of electronics or equipment. The card also comes with custom designs, 2% to 5% cash back on purchases and it even offers advances on sponsorship payments.

Underlying it, Wei said Karat has developed an underwriting model that works for creators. Instead of looking at credit scores, Karat focuses on the size of a creator’s following, their current revenue and whether or not they’re “business savvy.”

“It’s not just the number of followers you have, but what platforms,” Wei added. “I would rather have 100,000 subscribers on YouTube than 1 million on TikTok, because on TikTok, it’s all algorithmically driven.”

Karat has already provided the card to an initial group of creators, including TheRussianBadger, TierZoo and Nas Daily. Wei said the model is working so far, with no defaults.

For now, the card is aimed at professional, full-time creators who have at least 100,000 followers. Wei estimated that that’s a potential customer base of 1 million creators. Eventually, he wants to provide those creators with more than a black card.

“We’re building a vertical financial and biz ops experience,” he said. “People in earlier stages, we do want to get to them eventually, but only after we feel like we’ve developed enough of an underwriting model.”

Powered by WPeMatico

Earlier today, insurtech unicorn Lemonade filed an S-1/A, providing context into how the former startup may price its IPO and what the company may be worth when it begins to trade.

According to its new filing, Lemonade expects its IPO to price at $23 to $26 per share. As the company intends to sell 11 million shares in its debut, the rental and home insurance-focused unicorn would raise between $253 million and $286 million at those prices.

Counting an additional 1.65 million shares that it will make available to its underwriting banks, the company’s fundraise grows to $291 million to $328.9 million. Including shares offered to underwriters, Lemonade’s implied valuation given its IPO price range runs from $1.30 billion to $1.47 billion.

That’s the news. Now, is that expected valuation interval strong, and, if not, what might it portend for other insurtech startups? Let’s talk about it.

TechCrunch is speaking with the CEOs of Hippo (homeowner’s insurance) and Root (car insurance) later today, so we’ll get their notes in quick order regarding how Lemonade’s IPO is shaping up, and if they are surprised by its pricing targets.

But even without external commentary, the pricing range that Lemonade is at least initially targeting is not terribly impressive. That said, it’s stronger than I anticipated.

Powered by WPeMatico

The world is rife with me-too startups, which makes it all the more refreshing when a founder comes along that manages to find a broken market that’s hiding in plain sight.

That’s what Mike Kennedy appears to be doing with Koala, a young outfit determined to update the stodgy world of property time-share management, wherein people acquire points or otherwise pay for a unit at a timeshare resort that they intend to regularly use or swap or rent out (or all three).

It’s a big and growing market. According to data published last year by EY, the U.S. timeshare industry grew nearly 7% between 2017 and 2018 to hit $10.2 billion in sales volume.

It’s a market that Kennedy became acquainted with first-hand as a sales executive at the Hilton Club in New York, which, at least in 2018, was among 1,580 timeshare resorts up and running, representing approximately 204,100 units, most of them with two bedrooms or more.

Despite this growth, timeshares don’t jump to travelers’ minds as readily as hotel rooms or Airbnb stays, and therein lies the opportunity.

Part of the problem, as Kennedy see it, is that timeshares are harder to rent out than they should be. If a timeshare owner wants to reserve a week outside of the week that he or she purchased, for example, that person has to go through an antiquated exchange system like RCI (owned by Wyndam) or Interval International (owned by Marriott). Kennedy, who spent 10 years with Hilton, says he saw a number of his customers grow frustrated over time with their inability to better control their units’ usage.

Powered by WPeMatico

Calling all early-stage startup founders. You have a mere 48 hours left to save on your ticket to engage with leading experts at TC Early Stage 2020 on July 21-22. No one’s born knowing how to build a successful startup, and this online event provides the essential building blocks you need to flatten your learning curve. Prices increase tomorrow, June 26 at 11:59 p.m. (PDT). Beat the deadline and buy your pass today.

We’ve tapped leading experts, gurus, maestros and mavens across the startup ecosystem for two days of workshops designed to give you actionable tips and advice on everything a startup founder needs to know. We’re talking information you can apply to your startup now; at the time you need it most.

You can choose from more than 50 presentations that address topics vital to startup success — from fundraising, tech stack and growth marketing to term sheet construction, recruitment, product management and PR. Hear from the experts and ask them questions — each session offers plenty of interaction.

Each session can accommodate about 100 people. If you have questions you want to ask in a given session, sign up quickly because seats are available on a first-come, first-serve basis. As a ticket holder you’ll have exclusive, on-demand access to all the session videos after the event.

Pro tip: If you run into a schedule conflict, you can drop a breakout session and choose another one.

Here’s a taste of what’s on offer at Early Stage 2020 — be sure to check out all the breakout sessions.

Tune in to TC Early Stage on July 21-22, squash your learning curve and keep your business moving forward. You have 48 hours left to save some dough. Buy your ticket before the price goes up on June 26 at 11:59 p.m. (PDT).

Is your company interested in sponsoring the TC Early Stage? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico